FX

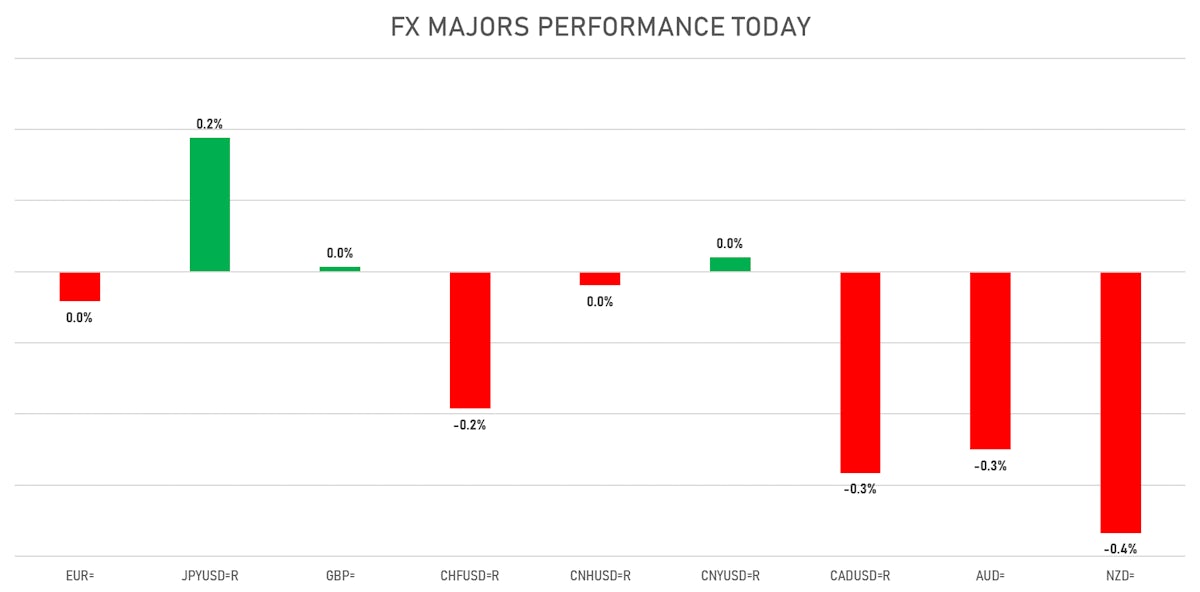

Mixed Performance For Major Currencies Today, US Dollar Index Closes Unchanged

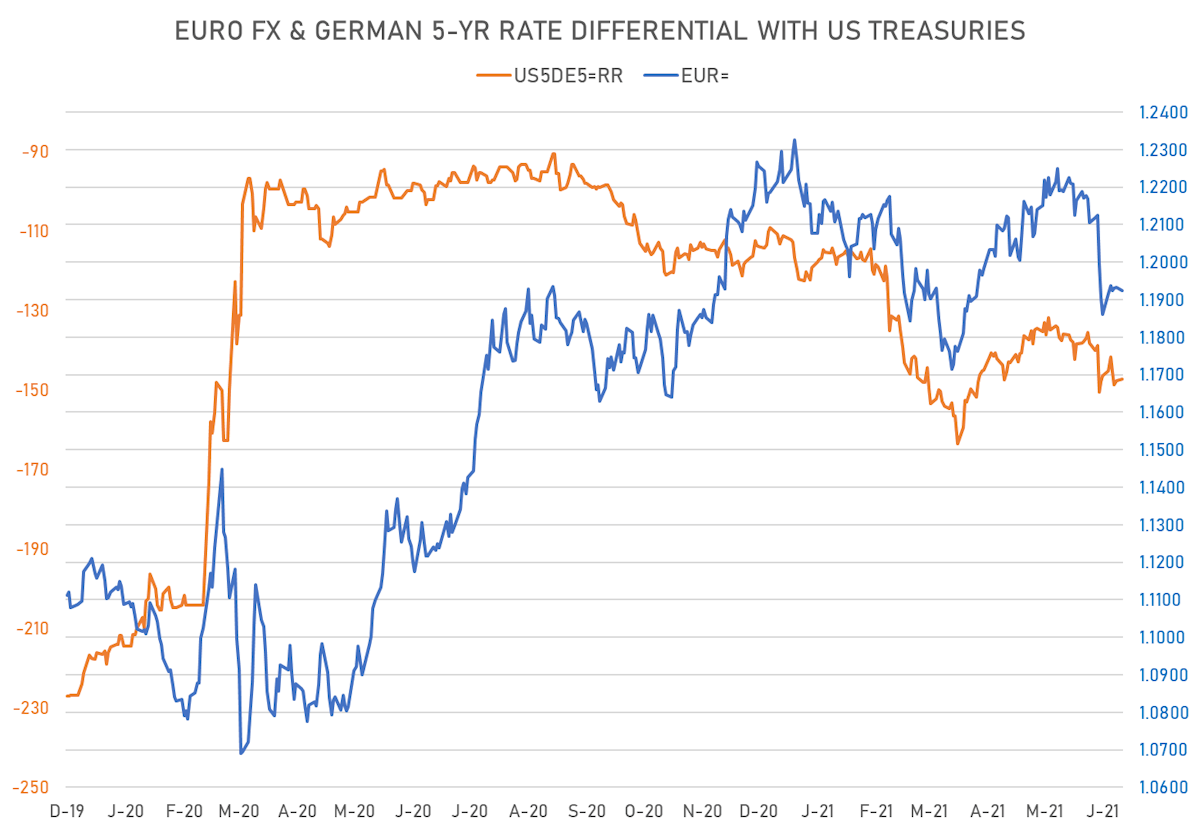

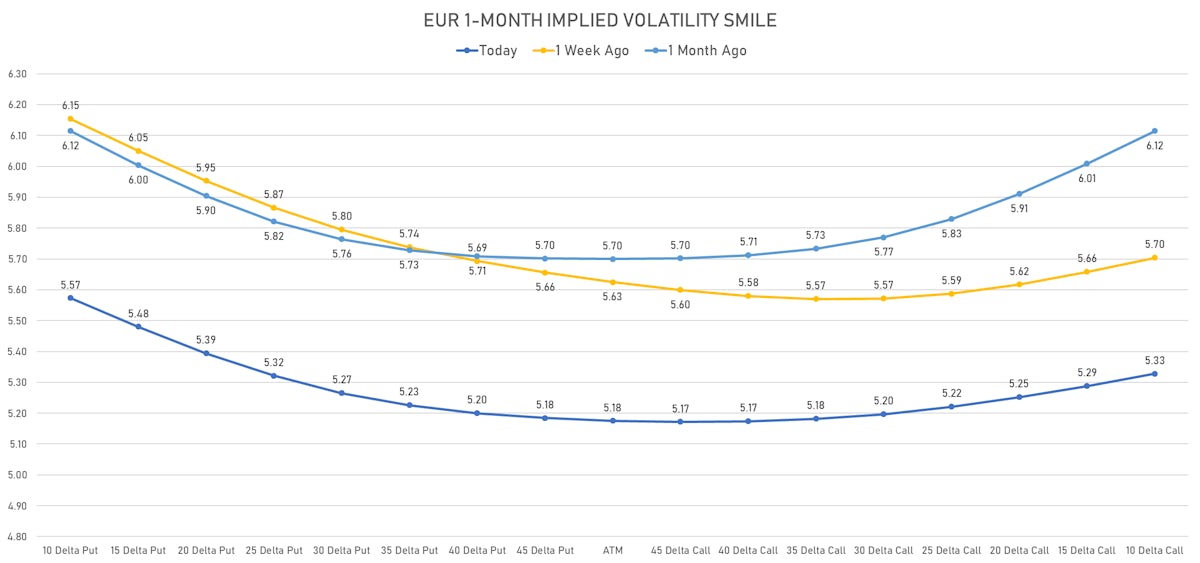

At-the-money implied volatilities up slightly today for the EUR and JPY; euro IV curve still skewed to the downside

Published ET

QUICK SUMMARY

- The US Dollar Index is up 0.04% at 91.89 (YTD: +2.17%)

- Euro down 0.04% at 1.1928 (YTD: -2.3%)

- Yen up 0.19% at 110.60 (YTD: -6.6%)

- Onshore Yuan up 0.02% at 6.4555 (YTD: +1.1%)

- Swiss franc down 0.19% at 0.9196 (YTD: -3.7%)

- Sterling up 0.01% at 1.3878 (YTD: +1.5%)

- Canadian dollar down 0.28% at 1.2330 (YTD: +3.3%)

- Australian dollar down 0.25% at 0.7567 (YTD: -1.7%)

- NZ dollar down 0.37% at 0.7046 (YTD: -1.9%)

MACRO DATA RELEASES

- Austria, Markit PMI, Business Surveys, PMI, Manufacturing Sector, Total for Jun 2021 (Markit Economics) at 67.00

- Colombia, Policy Rates, Intervention Rate for Jun 2021 (Cent Bank, Colombia) at 1.75%, in line with consensus estimate

- Germany, Import Prices, Change P/P, Price Index for May 2021 (Destatis) at 1.70 %, above consensus estimate of 1.50 %

- Germany, Import Prices, Change Y/Y, Price Index for May 2021 (Destatis) at 11.80 %, above consensus estimate of 11.30 %

- Japan, Labour Market n.i.e, Active opening rate for May 2021 (JILPT, Japan) at 1.09 , above consensus estimate of 1.08

- Japan, Retail Sales, Change Y/Y for May 2021 (METI, Japan) at 8.20 %, above consensus estimate of 7.90 %

- Japan, Unemployment, Rate for May 2021 (MIC, Japan) at 3.00%, above consensus estimate of 2.90 %

- Norway, Retail Sales, Change P/P for May 2021 (Statistics Norway) at 5.80 %

- Sweden, Retail Sales, Total excluding petrol stations, Change P/P for May 2021 (SCB, Sweden) at 2.30 %

- Sweden, Retail Sales, Total excluding petrol stations, Change Y/Y for May 2021 (SCB, Sweden) at 10.30 %

- Thailand, Production, Value Added, Manufacturing, total, Change Y/Y for May 2021 (OIE, Thailand) at 25.84 %, above consensus estimate of 19.55 %

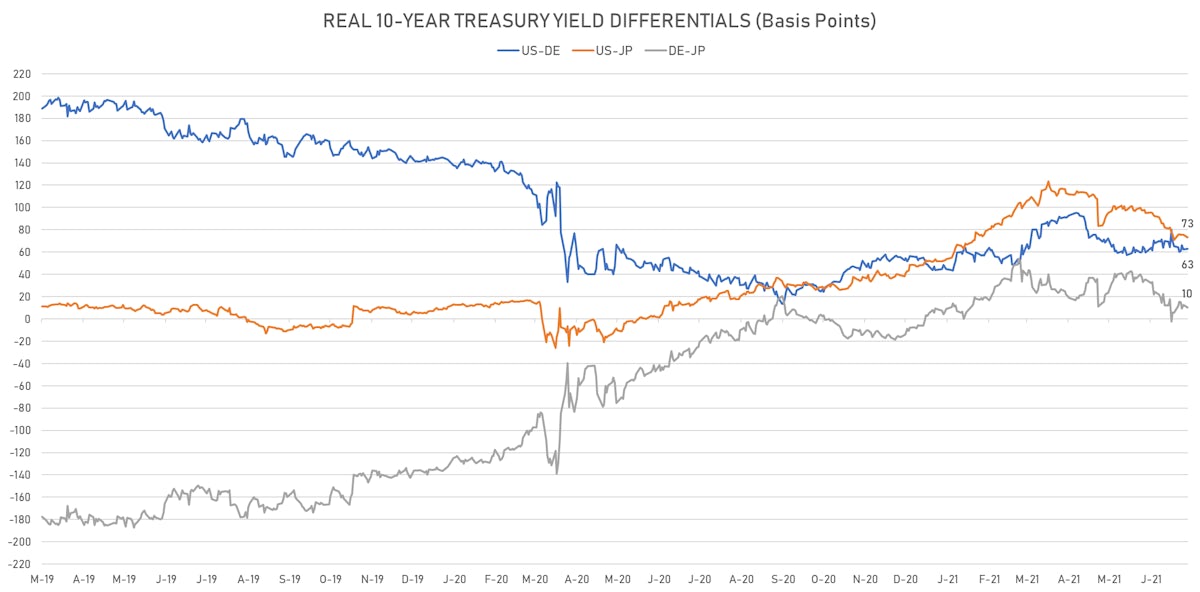

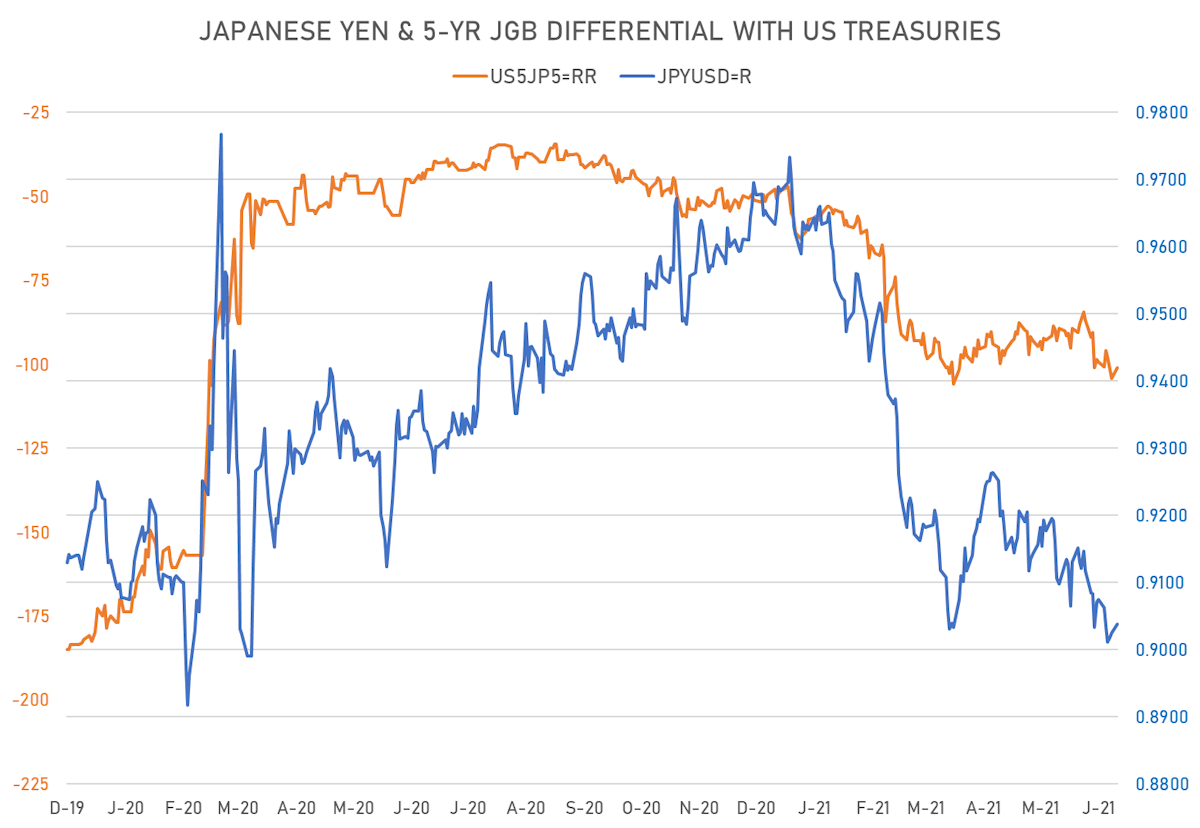

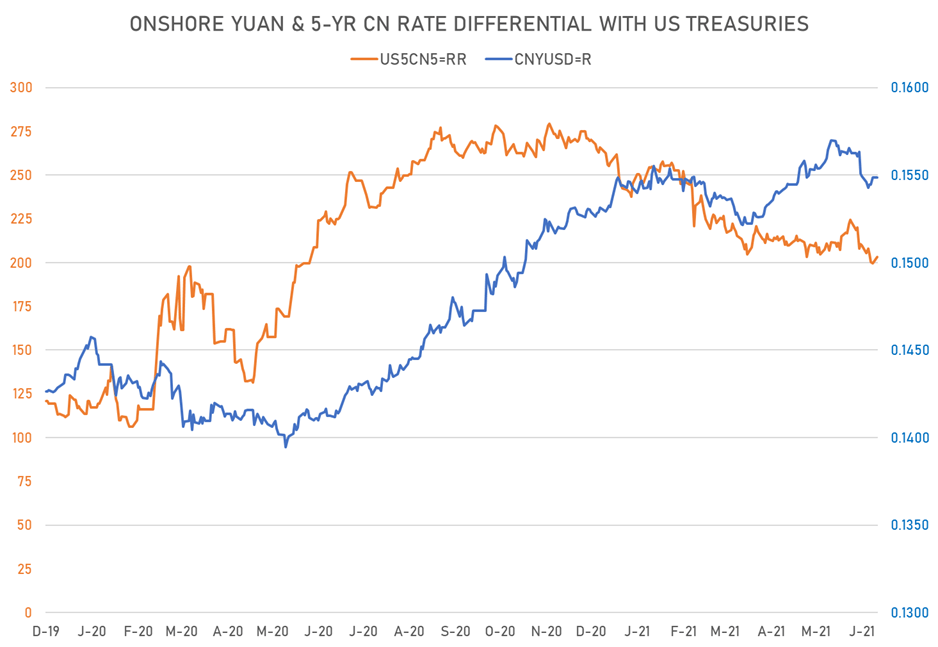

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 0.5 bp tighter at -147.2 bp (YTD change: -36.1 bp)

- 5Y Japan-US interest rates differential 3.1 bp tighter at -101.1 bp (YTD change: -52.8 bp)

- 5Y China-US interest rates differential 3.5 bp wider at 203.1 bp (YTD change: -54.0 bp)

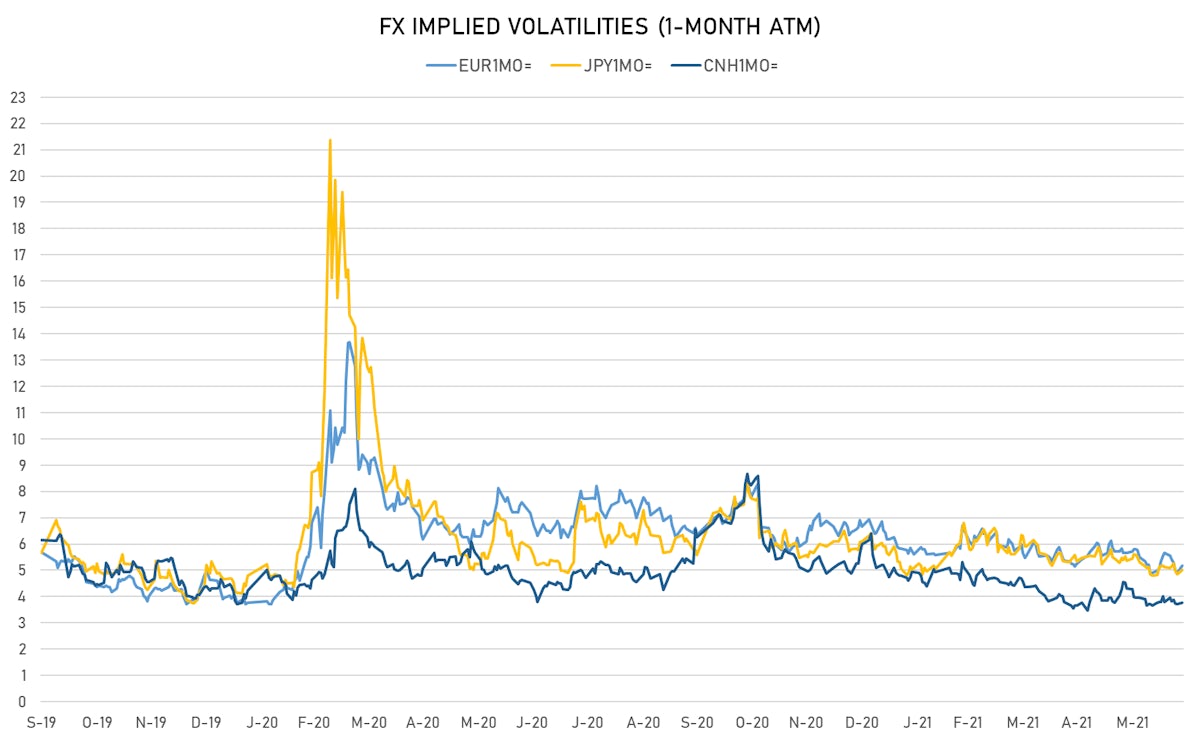

VOLATILITIES

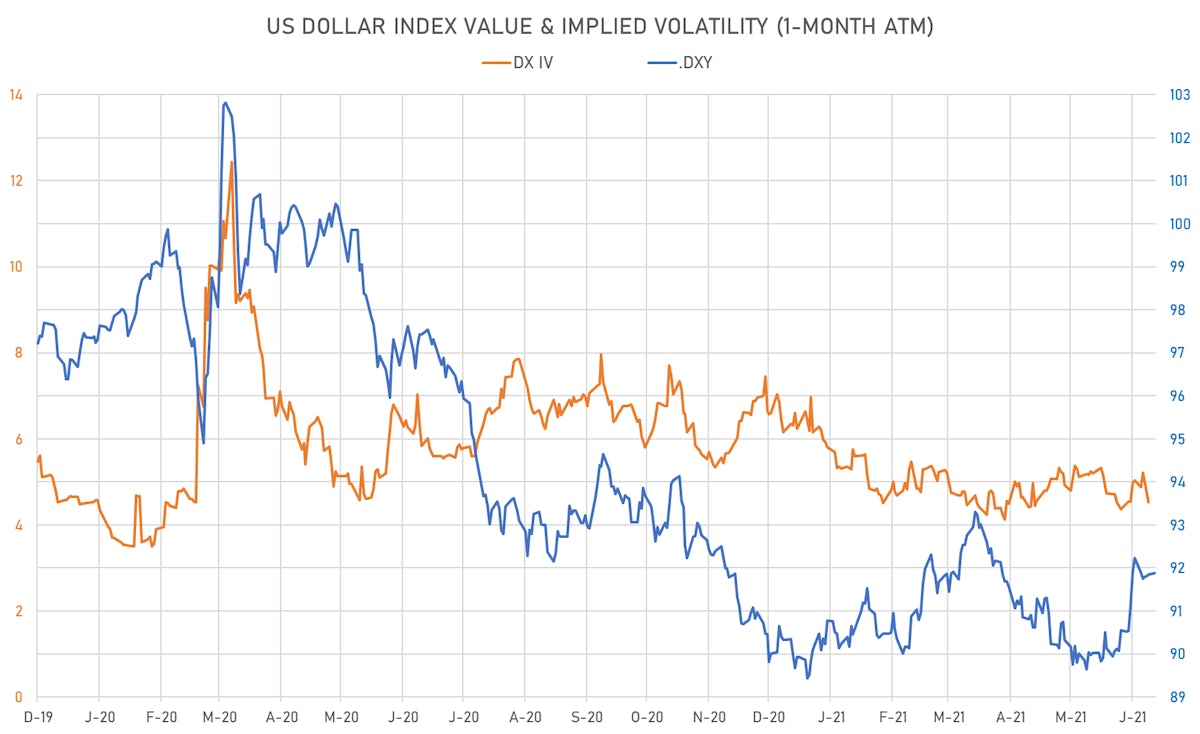

- Deutsche Bank USD Currency Volatility Index currently at 5.78, down -0.11 on the day (YTD: -1.39)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.18, up 0.3 on the day (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.00, up 0.2 on the day (YTD: -1.1)

- Offshore Yuan 1M ATM IV currently at 3.78, up 0.1 on the day (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS

- Morocco (rated BB+): up 3.2 basis points to 87 bp (1Y range: 84-127bp)

- Argentina (rated CCC): up 54.6 basis points to 1,907 bp (1Y range: 1,049-1,968bp)

- Indonesia (rated BBB): down 0.8 basis points to 73 bp (1Y range: 66-132bp)

- Panama (rated BBB-): down 1.0 basis points to 64 bp (1Y range: 44-112bp)

- Saudi Arabia (rated A): down 0.9 basis points to 53 bp (1Y range: 53-105bp)

- Mexico (rated BBB-): down 2.3 basis points to 92 bp (1Y range: 79-164bp)

- Oman (rated BB-): down 6.4 basis points to 234 bp (1Y range: 226-485bp)

- Colombia (rated BBB-): down 4.5 basis points to 133 bp (1Y range: 83-164bp)

- Government of Chile (rated A-): down 2.0 basis points to 59 bp (1Y range: 43-84bp)

- Peru (rated BBB+): down 3.1 basis points to 82 bp (1Y range: 52-98bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 3.4% (YTD: +47.9%)

- Peru Sol up 2.5% (YTD: -6.9%)

- Vanuatu Vatu up 1.6% (YTD: -2.0%)

- Barbados Dollar up 1.5% (YTD: +1.5%)

- Bosnian Mark up 1.5% (YTD: -2.8%)

- Belize Dollar up 1.2% (YTD: +1.2%)

- Congo Franc down 1.6% (YTD: -2.2%)

- Qatari Riyal down 1.9% (YTD: -1.9%)

- CFA Franc BEAC down 2.9% (YTD: -2.5%)

- Mauritius Rupee down 3.7% (YTD: -6.8%)