FX

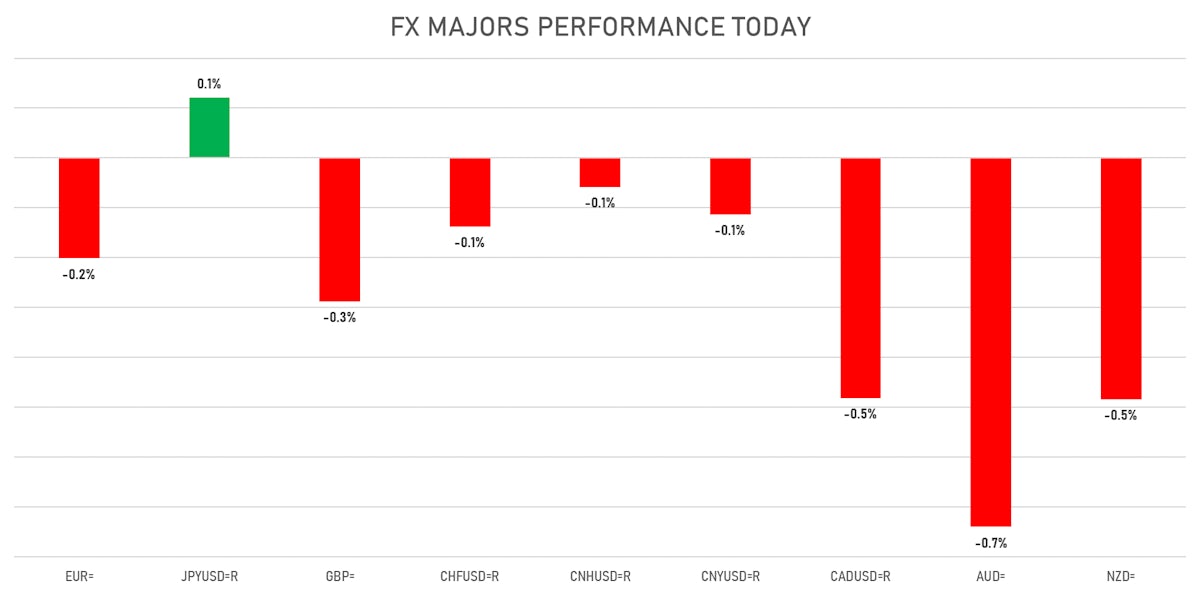

Dollar Index Up As Most Major Currencies Fall, With JPY The Exception Today

Antipodean currencies fell hard as lockdowns in Australian capitals are increasing odds of RBA dovish surprises at next week's monetary policy meeting

Published ET

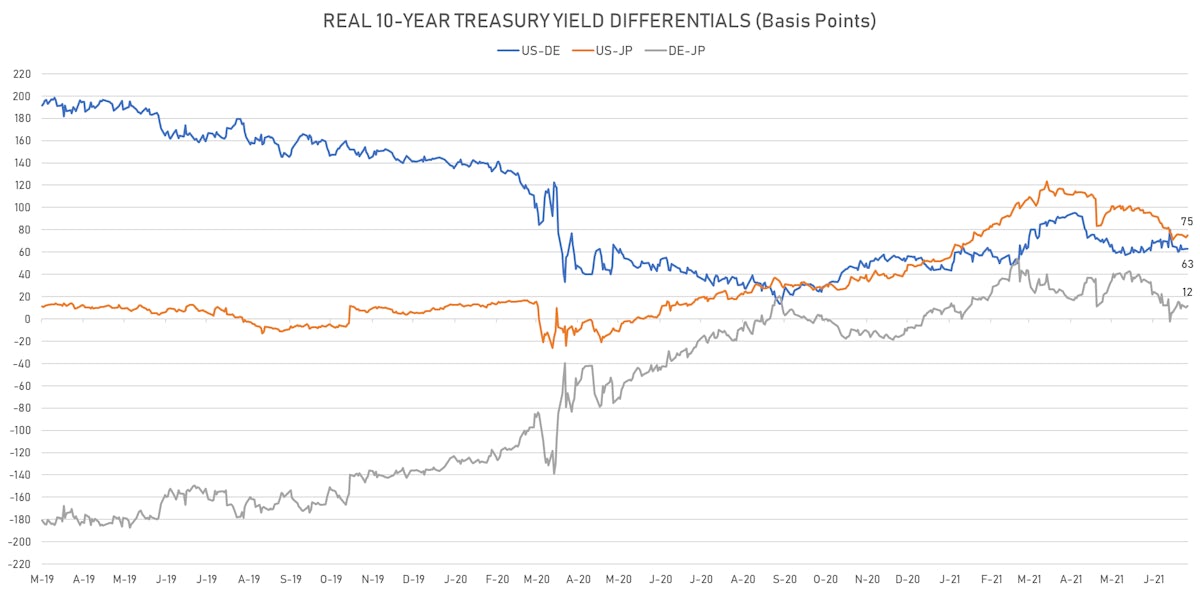

10-Year Real Rates Differentials | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.18% at 92.05 (YTD: +2.35%)

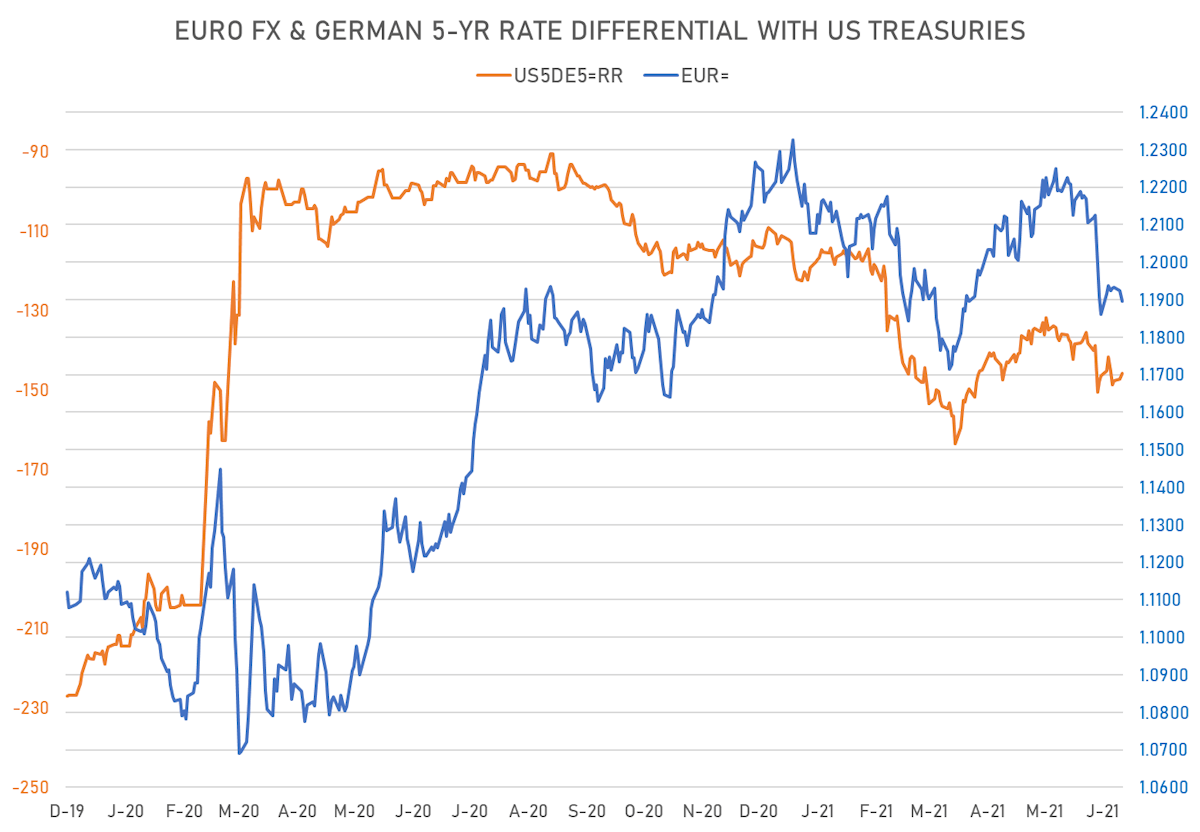

- Euro down 0.20% at 1.1900 (YTD: -2.6%)

- Yen up 0.12% at 110.50 (YTD: -6.5%)

- Onshore Yuan down 0.11% at 6.4635 (YTD: +1.0%)

- Swiss franc down 0.14% at 0.9209 (YTD: -3.9%)

- Sterling down 0.29% at 1.3843 (YTD: +1.2%)

- Canadian dollar down 0.48% at 1.2395 (YTD: +2.7%)

- Australian dollar down 0.74% at 0.7511 (YTD: -2.4%)

- NZ dollar down 0.48% at 0.6990 (YTD: -2.7%)

MACRO DATA RELEASES

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Jun 2021 (FGV, Brazil) at 0.60 %, below consensus estimate of 1.01 %

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Jun 2021 (DG ECFIN, France) at -3.30, in line with the consensus estimate

- Euro Zone, Business climate indicator for Jun 2021 (DG ECFIN, France) at 1.71

- Euro Zone, Economic Sentiment, Economic Sentiment Indicator (ESI), Overall for Jun 2021 (DG ECFIN, France) at 117.90, above consensus estimate of 116.50

- Euro Zone, Manufacturing Sector, Confidence indicator for Jun 2021 (DG ECFIN, France) at 12.70, above consensus estimate of 12.30

- Euro Zone, Service Sector, Confidence indicator, Balance for Jun 2021 (DG ECFIN, France) at 17.90, above consensus estimate of 14.80

- France, Consumer confidence, overall for Jun 2021 (INSEE, France) at 102.00, above consensus estimate of 100.00

- Germany, CPI, Flash, Change P/P, Price Index for Jun 2021 (Destatis) at 0.40 %, in line with consensus estimate

- Germany, CPI, Flash, Change Y/Y, Price Index for Jun 2021 (Destatis) at 2.30 %, in line with consensus estimate

- Germany, HICP, Flash, Change P/P, Price Index for Jun 2021 (Destatis) at 0.40 %, in line with consensus estimate

- Germany, HICP, Flash, Change Y/Y, Price Index for Jun 2021 (Destatis) at 2.10 %, in line with consensus estimate

- South Korea, Production, Total industry, Change P/P for May 2021 (KOSTAT - Korea) at -0.70%, below consensus estimate of 0.80 %

- South Korea, Production, Total industry, Change Y/Y for May 2021 (KOSTAT - Korea) at 15.60%, below consensus estimate of 16.10 %

- Spain, HICP, Change Y/Y, Price Index for Jun 2021 (INE, Spain) at 2.40 %, in line with consensus estimate

- Spain, Retail Sales, Turnover, Change Y/Y for May 2021 (INE, Spain) at 19.60 %

- Sweden, KI, Consumer confidence indicator for Jun 2021 (NIER, Sweden) at 109.40

- Sweden, Overall Sentiment for Jun 2021 (NIER, Sweden) at 119.80

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Jun 2021 (Nationwide, UK) at 0.70 %, in line with consensus estimate

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Jun 2021 (Nationwide, UK) at 13.40 %, below consensus estimate of 13.70 %

- United Kingdom, Net lending to individuals, secured on dwellings for May 2021 (Bank of England) at 6.58 Bln GBP, above consensus estimate of 4.58 Bln GBP

- United Kingdom, Number of loans approved for house purchase total for May 2021 (Bank of England) at 87.55 k, above consensus estimate of 85.90 k

- United Kingdom, changes (excluding the Student Loans Company) unsecured lending to individuals for May 2021 (Bank of England) at 0.28 Bln GBP, above consensus estimate of 0.24 Bln GBP

- United States, Conference Board, Consumer confidence for Jun 2021 (The Conference Board) at 127.30, above consensus estimate of 119.00

- United States, House Prices, S&P Case-Shiller, Composite-20, Change P/P for Apr 2021 (Standard & Poor's) at 1.60 %, below consensus estimate of 1.70 %

- United States, House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Apr 2021 (Standard & Poor's) at 14.90 %, above consensus estimate of 14.50 %

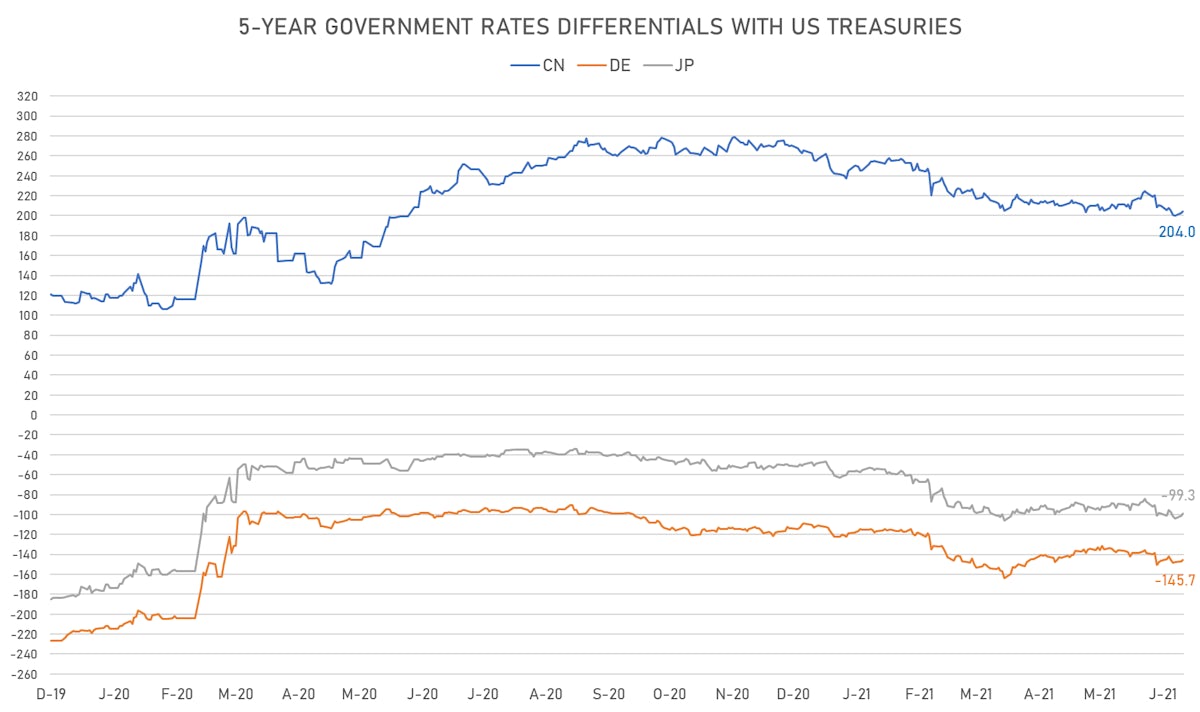

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 1.5 bp tighter at -145.7 bp (YTD change: -34.6 bp), positive for the euro

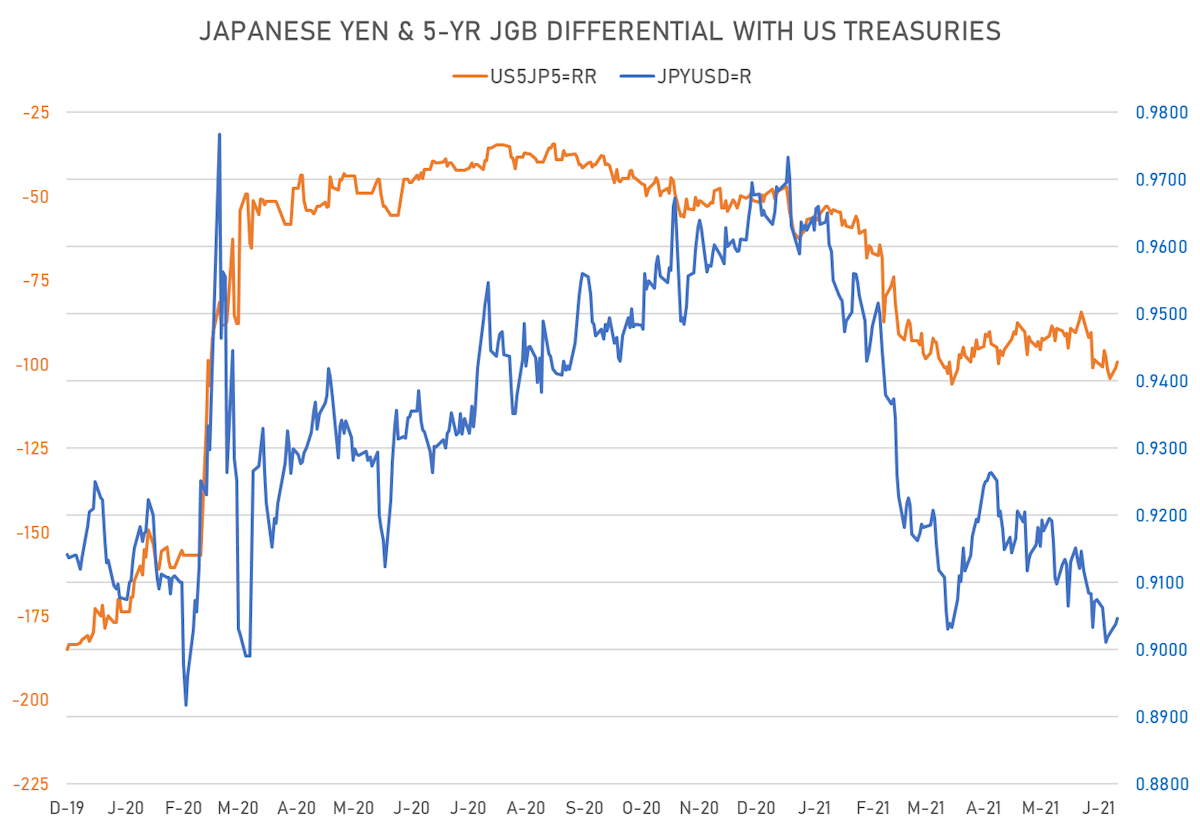

- 5Y Japan-US interest rates differential 1.8 bp tighter at -99.3 bp (YTD change: -51.0 bp), positive for the yen

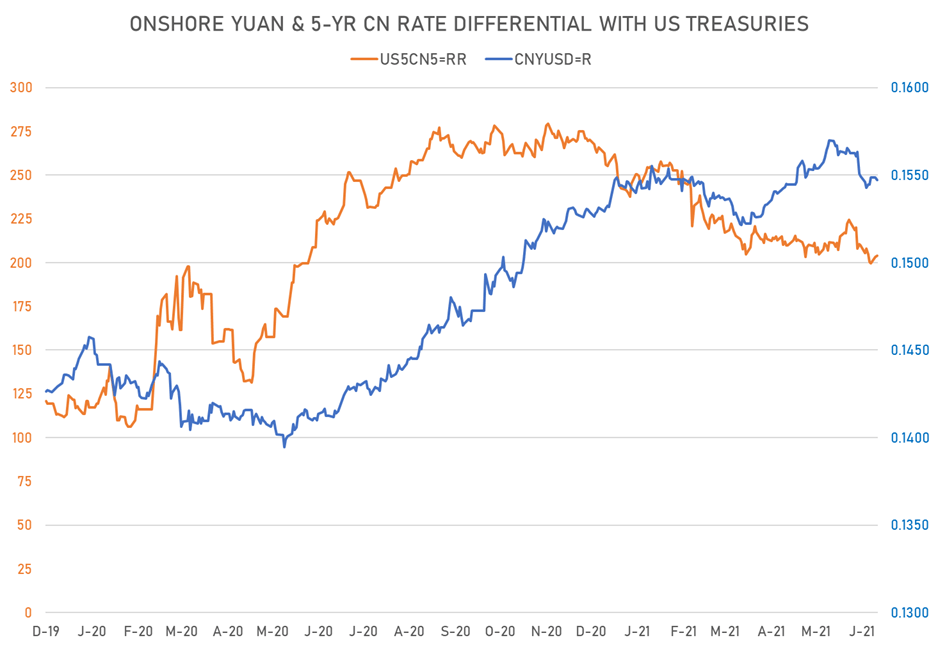

- 5Y China-US interest rates differential 0.9 bp wider at 204.0 bp (YTD change: -53.1 bp), positive for the yuan

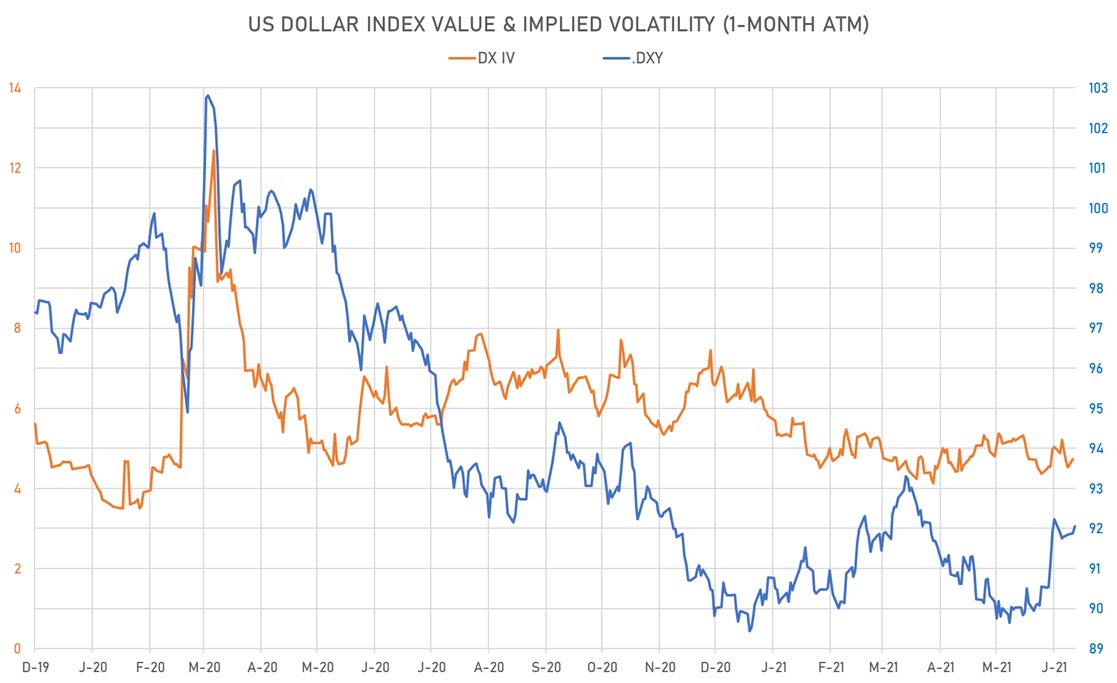

VOLATILITIES

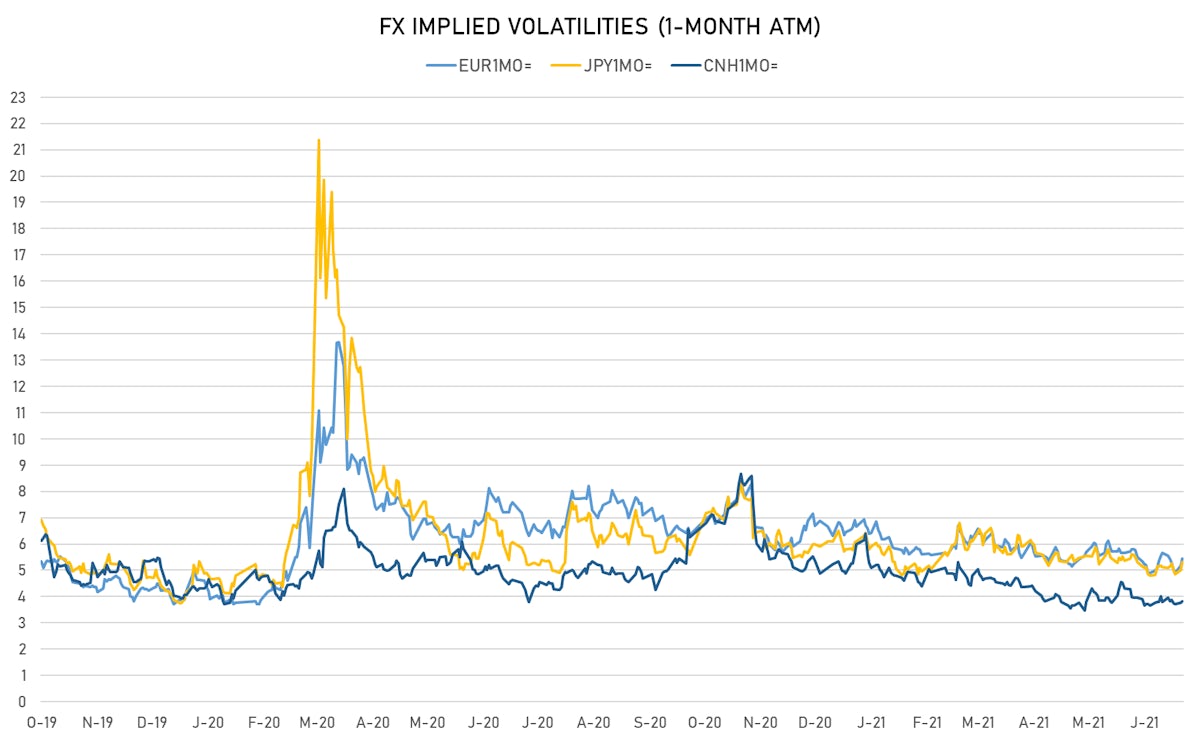

- Deutsche Bank USD Currency Volatility Index currently at 5.81, up 0.03 on the day (YTD: -1.36)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.45, up 0.3 on the day (YTD: -1.2)

- Japanese Yen 1M ATM IV currently at 5.30, up 0.3 on the day (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 3.83, up 0.1 on the day (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS

- Brazil (rated BB-): up 1.4 basis points to 160 bp (1Y range: 141-259bp)

- Colombia (rated BBB-): up 0.9 basis points to 134 bp (1Y range: 83-164bp)

- South Africa (rated BB-): up 1.1 basis points to 183 bp (1Y range: 178-328bp)

- Russia (rated BBB): up 0.4 basis points to 81 bp (1Y range: 72-129bp)

- Turkey (rated BB-): up 2.0 basis points to 380 bp (1Y range: 282-597bp)

- Vietnam (rated BB): down 0.5 basis points to 102 bp (1Y range: 90-174bp)

- Government of Chile (rated A-): down 0.4 basis points to 58 bp (1Y range: 43-84bp)

- Peru (rated BBB+): down 0.8 basis points to 81 bp (1Y range: 52-98bp)

- Egypt (rated B+): down 4.5 basis points to 323 bp (1Y range: 283-444bp)

- Saudi Arabia (rated A): down 1.1 basis points to 52 bp (1Y range: 53-105bp)

LARGEST FX MOVES TODAY

- Jamaican Dollar up 1.8% (YTD: -4.4%)

- Honduras Lempira up 1.2% (YTD: +1.0%)

- Chilean Peso up 1.0% (YTD: -2.3%)

- Australian Dollar down 0.7% (YTD: -2.4%)

- South Africa Rand down 0.7% (YTD: +2.4%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Colombian Peso down 1.7% (YTD: -9.1%)

- Malagasy Ariary down 3.4% (YTD: 0.0%)

- Seychelles rupee down 13.2% (YTD: +23.8%)