FX

Dollar Index Rises With Widening Sovereign Rates Differentials

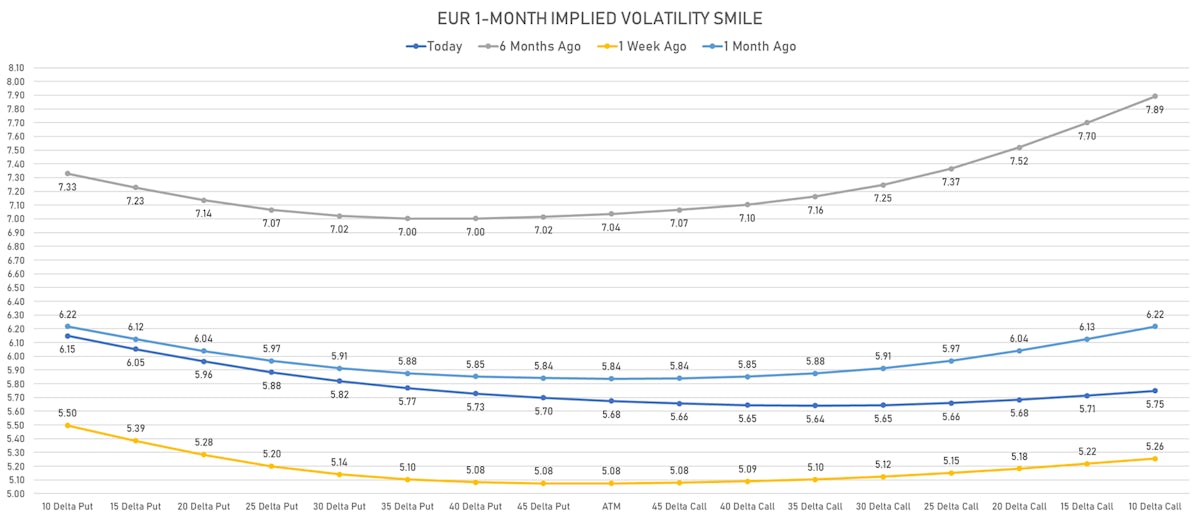

Implied volatilities point to more potential weakness in the euro and yen, but the hurdle is rising for US macro positive surprises and it will require terrific job numbers for dollar strength to continue unabated

Published ET

US Dollar Index & DB Currency Volatility Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

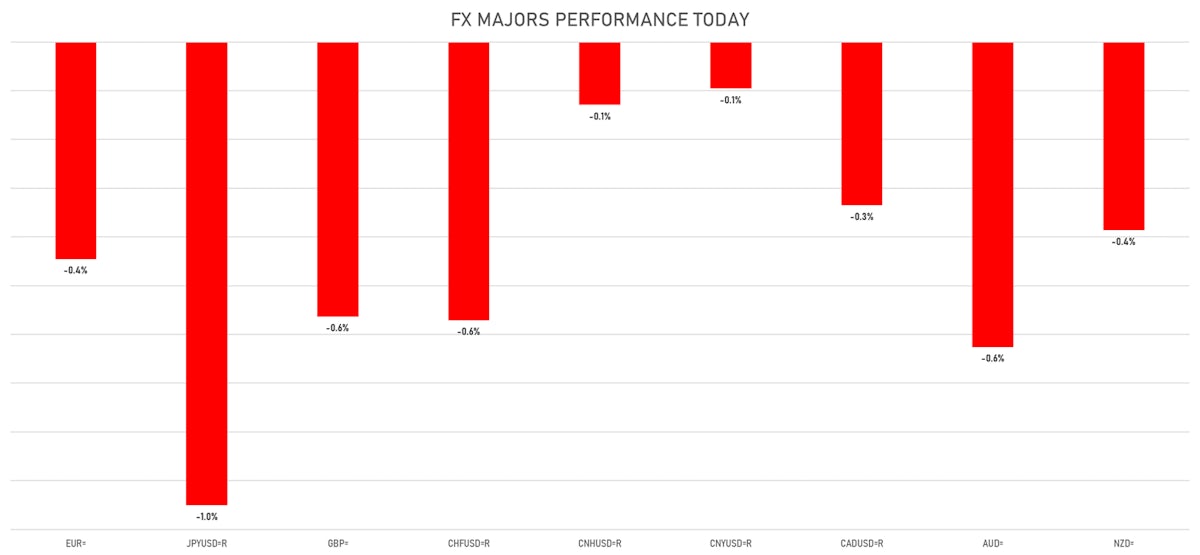

- The US Dollar Index is up 0.24% at 92.58 (YTD: +2.88%)

- Euro down 0.10% at 1.1843 (YTD: -3.0%)

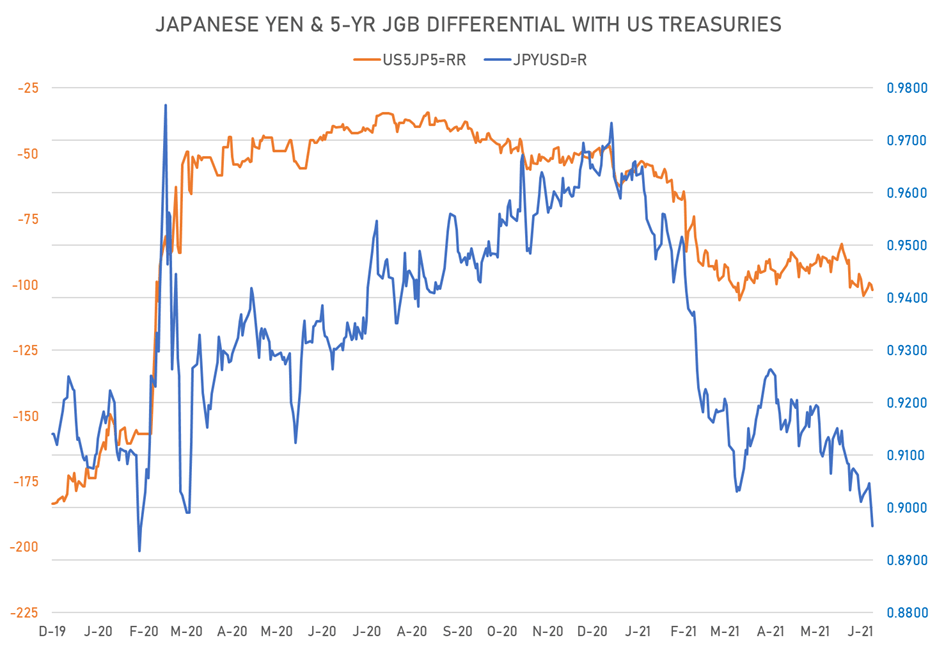

- Yen down 0.40% at 111.54 (YTD: -7.4%)

- Onshore Yuan down 0.19% at 6.4679 (YTD: +0.9%)

- Swiss franc down 0.12% at 0.9256 (YTD: -4.4%)

- Sterling down 0.47% at 1.3762 (YTD: +0.7%)

- Canadian dollar down 0.32% at 1.2434 (YTD: +2.4%)

- Australian dollar down 0.44% at 0.7465 (YTD: -3.0%)

- NZ dollar down 0.26% at 0.6964 (YTD: -3.1%)

MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for May 2021 (AU Bureau of Stat) at 9,681.00 Mln AUD, below consensus estimate of 10,000.00 Mln AUD

- Brazil, PMI, Manufacturing Sector for Jun 2021 (Markit Economics) at 56.40

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Jun 2021 (Markit Economics) at 51.30, below consensus estimate of 51.80

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Jun 2021 (Markit Economics) at 63.40, above consensus estimate of 63.10

- Euro Zone, Unemployment, Rate for May 2021 (Eurostat) at 7.90 %, below consensus estimate of 8.00 %

- France, PMI, Manufacturing Sector, Total, Final for Jun 2021 (Markit Economics) at 59.00, above consensus estimate of 58.60

- Germany, PMI, Manufacturing Sector, Total, Final for Jun 2021 (Markit Economics) at 65.10, above consensus estimate of 64.90

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Jun 2021 (Markit Economics) at 48.10, below consensus estimate of 49.50

- Indonesia, CPI, Change Y/Y for Jun 2021 (Statistics Indonesia) at 1.33 %, below consensus estimate of 1.41 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Jun 2021 (Markit Economics) at 53.50

- Italy, PMI, Manufacturing Sector for Jun 2021 (Markit Economics) at 62.20, in line with consensus estimate

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Jun 2021 (Markit Economics) at 52.40

- Mexico, PMI, Manufacturing Sector for Jun 2021 (Markit Economics) at 48.80

- Russia, PMI, Manufacturing Sector for Jun 2021 (Markit Economics) at 49.20

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Jun 2021 (Markit Economics) at 53.90

- Sweden, Policy Rates, Repo Rate (Effective Dates) for 07 Jul (Sveriges Riksbank) at 0.00 %, below consensus estimate

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Jun 2021 (Markit Economics) at 51.30

- United Kingdom, PMI, Manufacturing Sector for Jun 2021 (Markit Economics) at 63.90, below consensus estimate of 64.20

- United States, ISM Manufacturing, PMI total for Jun 2021 (ISM, United States) at 60.60, below consensus estimate of 61.00

- United States, Jobless Claims, National, Initial for W 26 Jun (U.S. Dept. of Labor) at 364.00k, below consensus estimate of 390.00 k

- United States, PMI, Manufacturing Sector, Total, Final for Jun 2021 (Markit Economics) at 62.10

KEY GLOBAL RATES DIFFERENTIALS

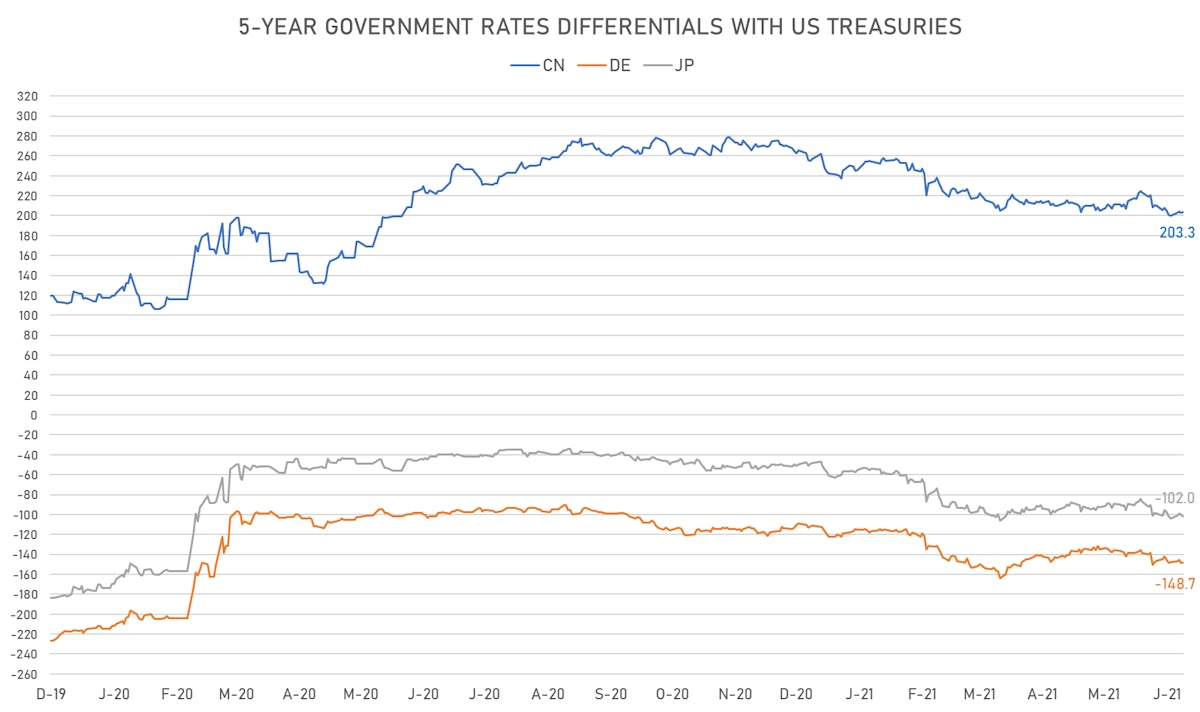

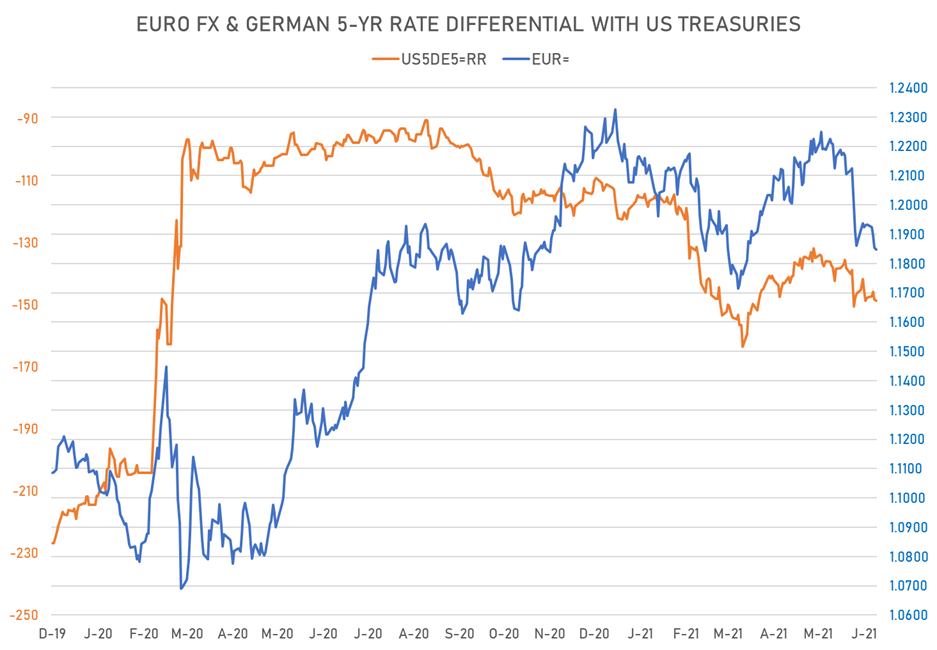

- 5Y German-US interest rates differential 0.5 bp wider at -148.7 bp (YTD change: -37.6 bp), negative for the euro

- 5Y Japan-US interest rates differential 2.0 bp wider at -102.0 bp (YTD change: -53.7 bp), negative for the yen

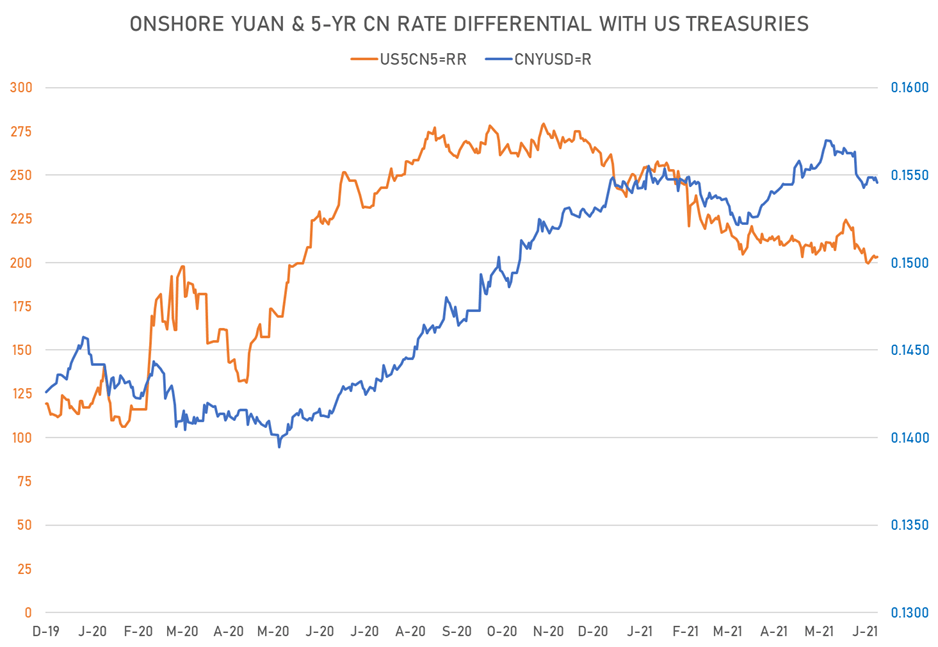

- 5Y China-US interest rates differential 0.6 bp wider at 203.3 bp (YTD change: -53.8 bp), positive for the yuan

VOLATILITIES

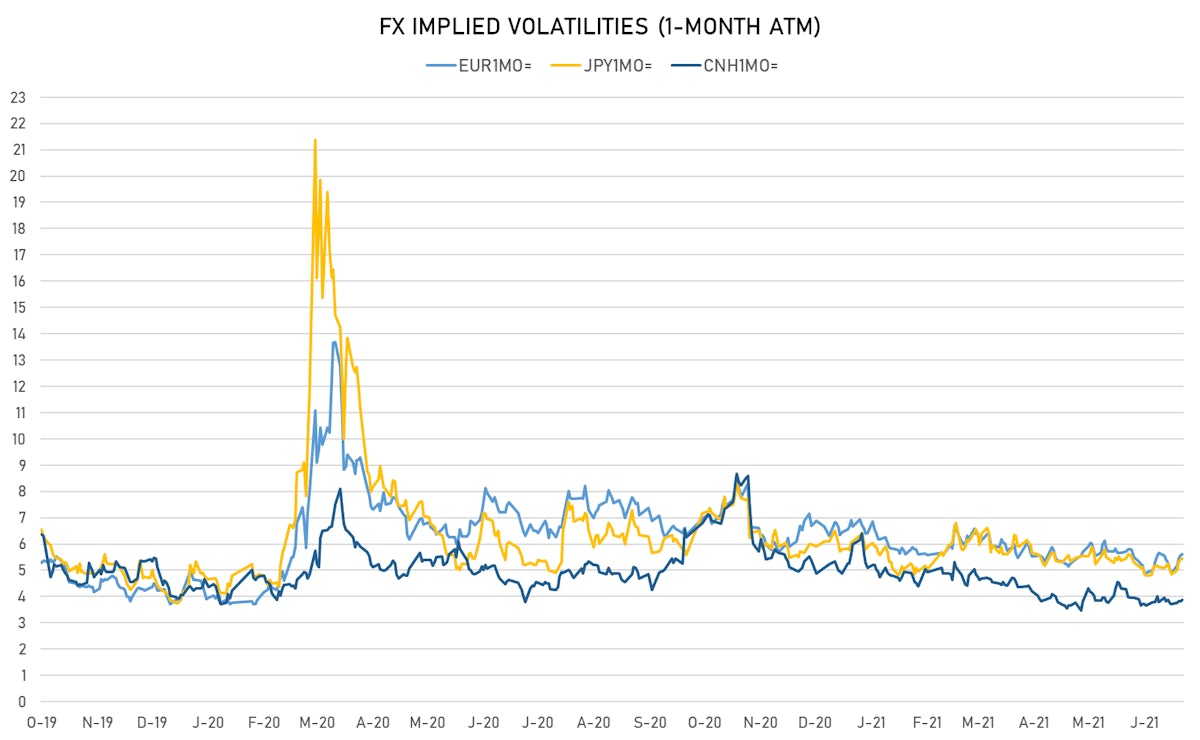

- Deutsche Bank USD Currency Volatility Index currently at 6.06, up 0.12 on the day (YTD: -1.11)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.60, unchanged today (YTD: -1.1)

- Japanese Yen 1M ATM IV currently at 5.45, unchanged (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.89, up 0.1 on the day (YTD: -2.1)

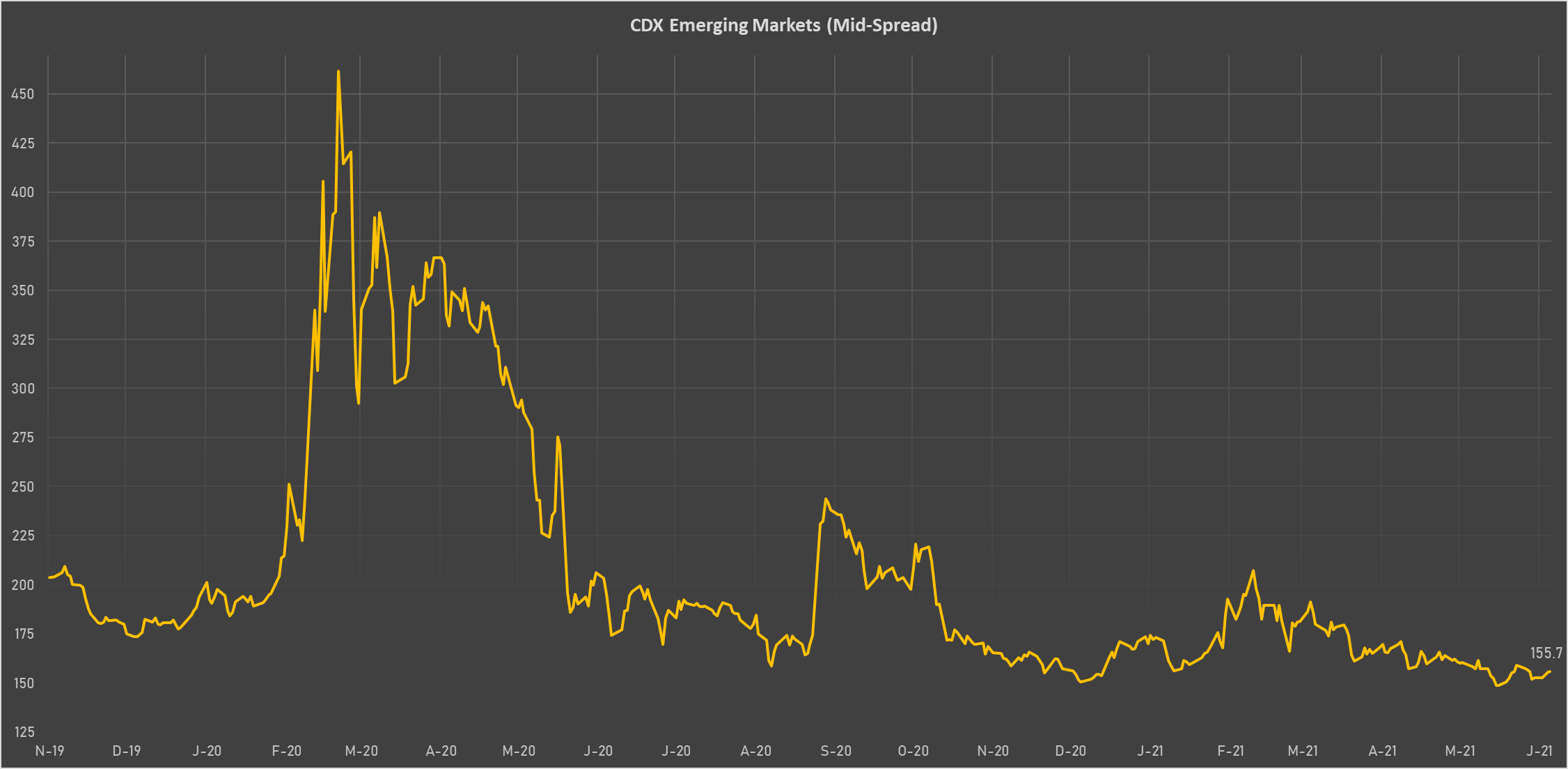

NOTABLE MOVES IN SOVEREIGN CDS

- Oman (rated BB-): up 7.0 basis points to 230 bp (1Y range: 223-485bp)

- Bahrain (rated B+): up 3.4 basis points to 195 bp (1Y range: 172-347bp)

- Saudi Arabia (rated A): up 0.7 basis points to 53 bp (1Y range: 52-101bp)

- Egypt (rated B+): up 3.5 basis points to 322 bp (1Y range: 283-437bp)

- South Africa (rated BB-): up 1.9 basis points to 187 bp (1Y range: 178-328bp)

- Russia (rated BBB): up 0.7 basis points to 82 bp (1Y range: 72-129bp)

- Brazil (rated BB-): up 1.1 basis points to 166 bp (1Y range: 141-252bp)

- Peru (rated BBB+): down 0.7 basis points to 80 bp (1Y range: 52-98bp)

- United Arab Emirates (rated AA-): down 1.0 basis points to 57 bp (1Y range: 50-62bp)

- Government of Chile (rated A-): down 1.3 basis points to 56 bp (1Y range: 43-76bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 3.2% (YTD: -19.7%)

- Jamaican Dollar up 2.0% (YTD: -4.3%)

- Cape Verde Escudo down 0.9% (YTD: 0.0%)

- Russian Rouble down 1.0% (YTD: +0.9%)

- Philippine Peso down 1.1% (YTD: -2.4%)

- Surinamesedollar down 1.2% (YTD: -32.7%)

- Honduras Lempira down 1.4% (YTD: -0.5%)

- Brazilian Real down 1.8% (YTD: +2.9%)

- Chilean Peso down 2.0% (YTD: -4.1%)

- Venezuela Bolivar down 3.2% (YTD: -66.7%)