FX

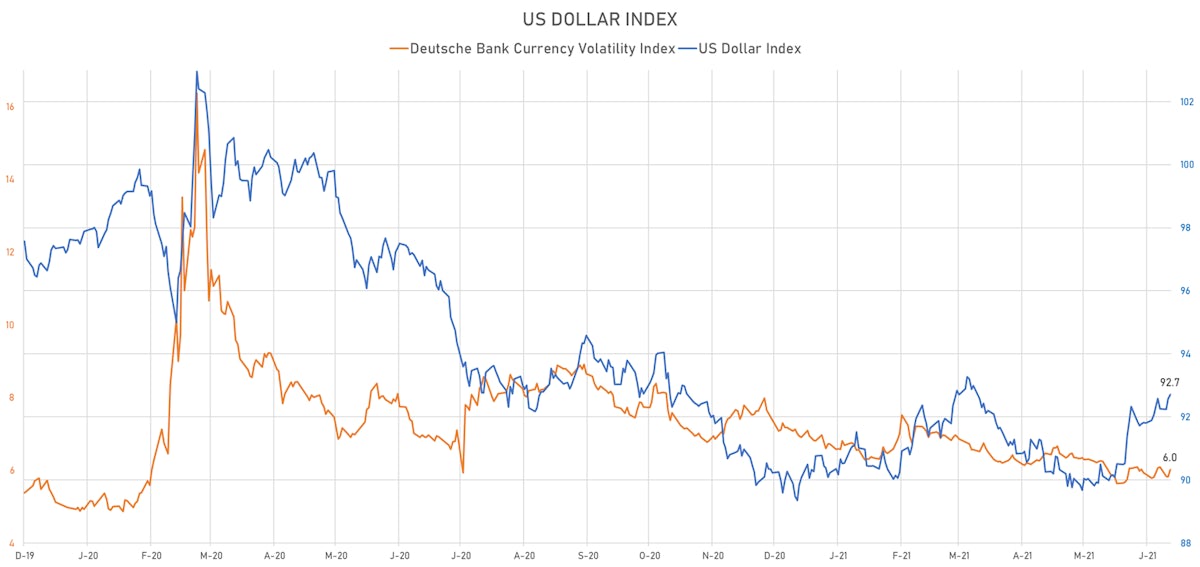

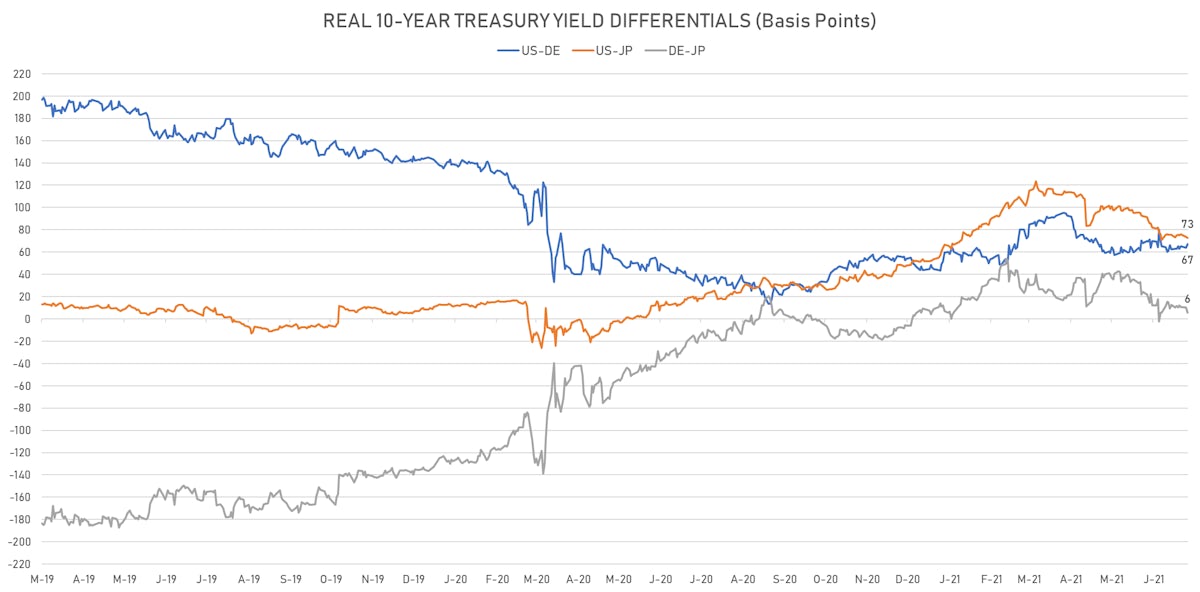

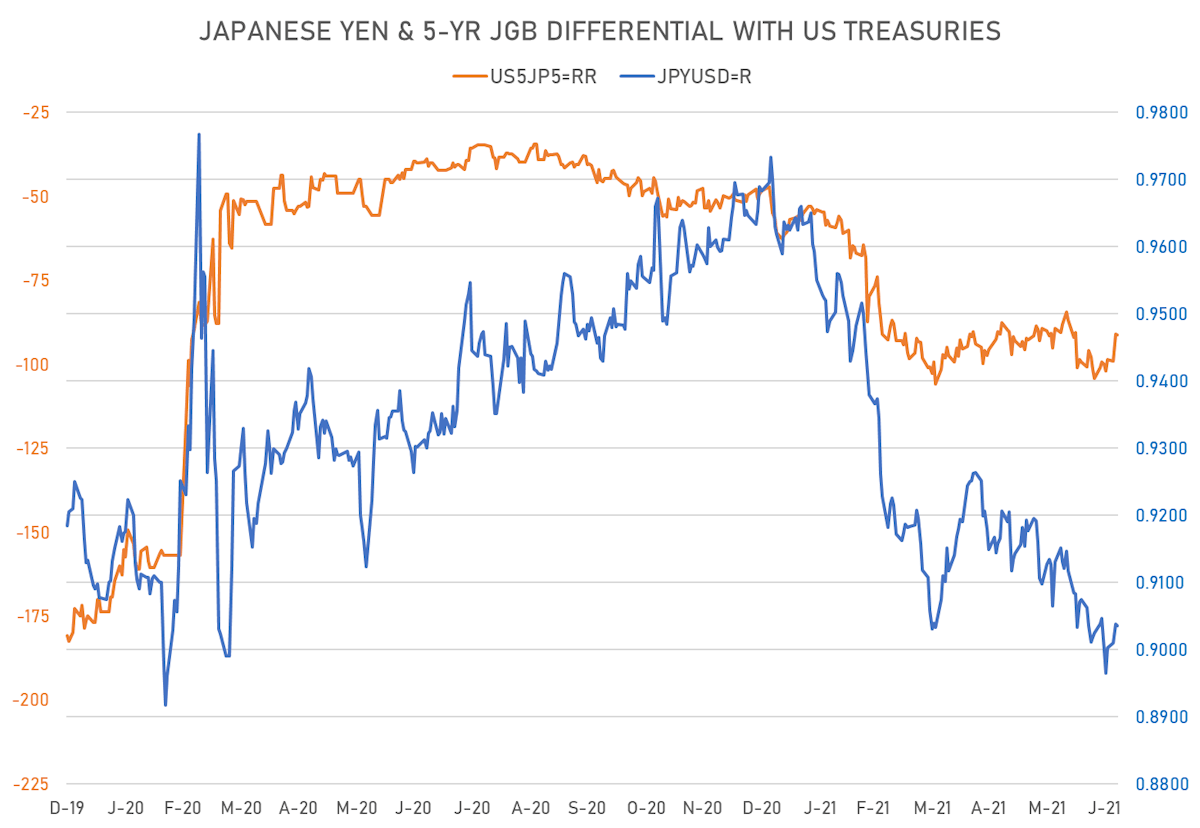

US Dollar Follows Real Yields Differentials, Up Against The Euro, Down Against The Yen

The Japanese yen rise this week may not last, as Dow Jones reports that "the government is considering declaring a state of emergency in Tokyo again to prevent a spread of coronavirus cases"

Published ET

QUICK SUMMARY

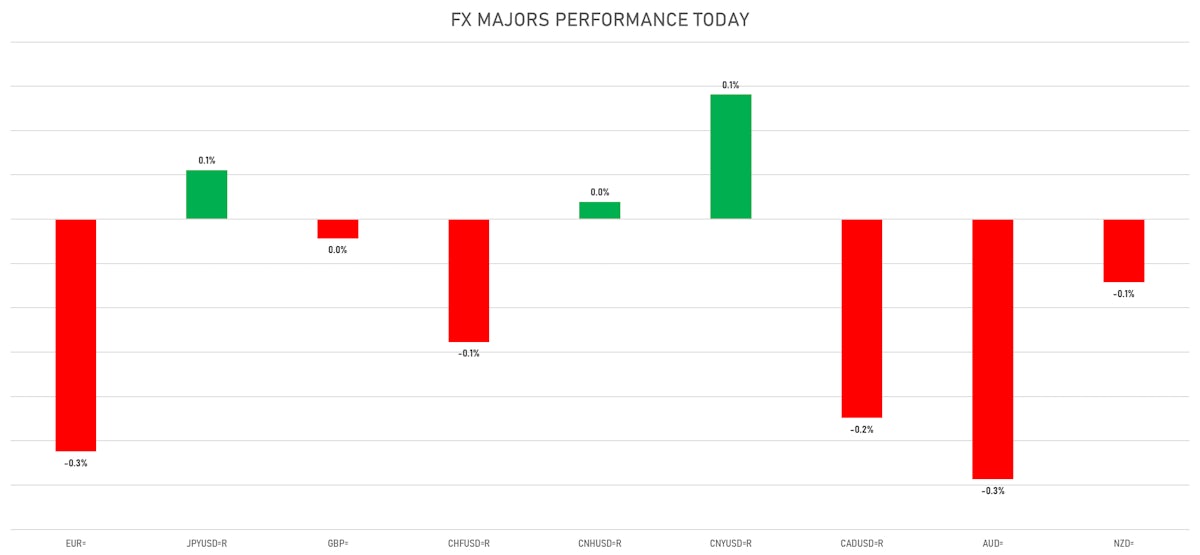

- The US Dollar Index is up 0.15% at 92.70 (YTD: +3.02%)

- Euro down 0.26% at 1.1791 (YTD: -3.5%)

- Yen up 0.06% at 110.55 (YTD: -6.6%)

- Onshore Yuan up 0.14% at 6.4718 (YTD: +0.8%)

- Swiss franc down 0.14% at 0.9255 (YTD: -4.3%)

- Sterling down 0.02% at 1.3796 (YTD: +0.9%)

- Canadian dollar down 0.22% at 1.2489 (YTD: +1.9%)

- Australian dollar down 0.29% at 0.7475 (YTD: -2.8%)

- NZ dollar down 0.07% at 0.7005 (YTD: -2.5%)

MACRO DATA RELEASES

- Brazil, Retail Sales, Change Y/Y for May 2021 (IBGE, Brazil) at 16.00 %, below consensus estimate of 16.50 %

- France, Reserve Assets, Current Prices for Jun 2021 (MINEFI, France) at 18,6242.00 Mln EUR

- Germany, Production, Total industry including construction, Change P/P for May 2021 (Destatis) at -0.30 %, below consensus estimate of 0.50 %

- Japan, Current Account, Balance, Current Prices for May 2021 (BOJ/MOF Japan) at 1,979.70 Bln JPY, above consensus estimate of 1,820.40 Bln JPY

- New Zealand, Reserve Assets, Current Prices for Jun 2021 (RBNZ) at 19,977.00 Mln NZD

- Romania, Policy Rates, Policy Rate for 07 Jul (Cent. Bank, Romania) at 1.25 %, in line with consensus estimate

- Russia, CPI, Change P/P for Jun 2021 (RosStat, Russia) at 0.70%, above consensus estimate of 0.50 %

- Russia, CPI, Change Y/Y for Jun 2021 (RosStat, Russia) at 6.50%, above consensus estimate of 6.30 %

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Jun 2021 (SA Reserve Bank) at 54.47 Bln USD

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Jun 2021 (SA Reserve Bank) at 51.37 Bln USD

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Jun 2021 (Swiss National Bank) at 941,125.00 Mln CHF

- Taiwan, CPI, Change Y/Y, Price Index for Jun 2021 (DGBAS, Taiwan) at 1.89 %, below consensus estimate of 2.30 %

- United Kingdom, House Prices, Halifax, UK, Change P/P for Jun 2021 at -0.50 % (May data +1.2%)

KEY GLOBAL RATES DIFFERENTIALS

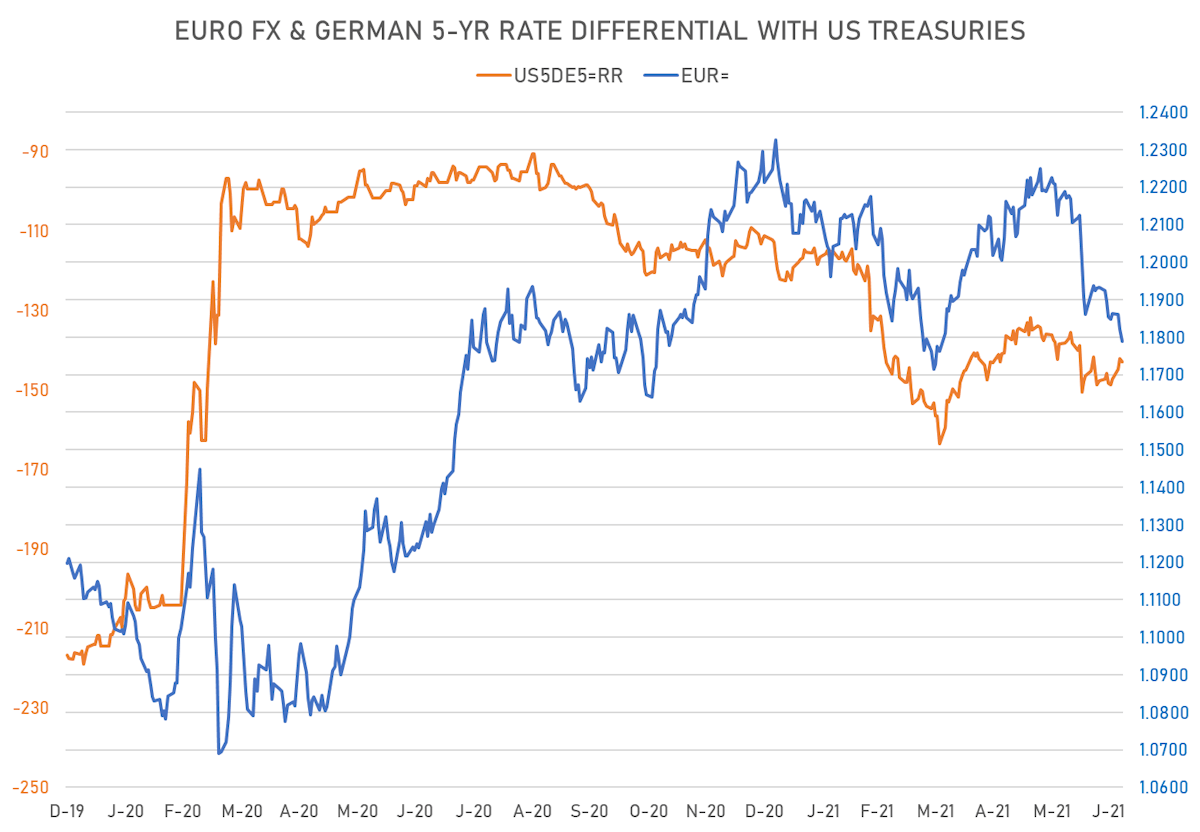

- 5Y German-US interest rates differential 0.9 bp wider at -142.9 bp (YTD change: -31.8 bp), negative for the euro

- 5Y Japan-US interest rates differential 0.2 bp wider at -91.2 bp (YTD change: -42.9 bp), negative for the yen

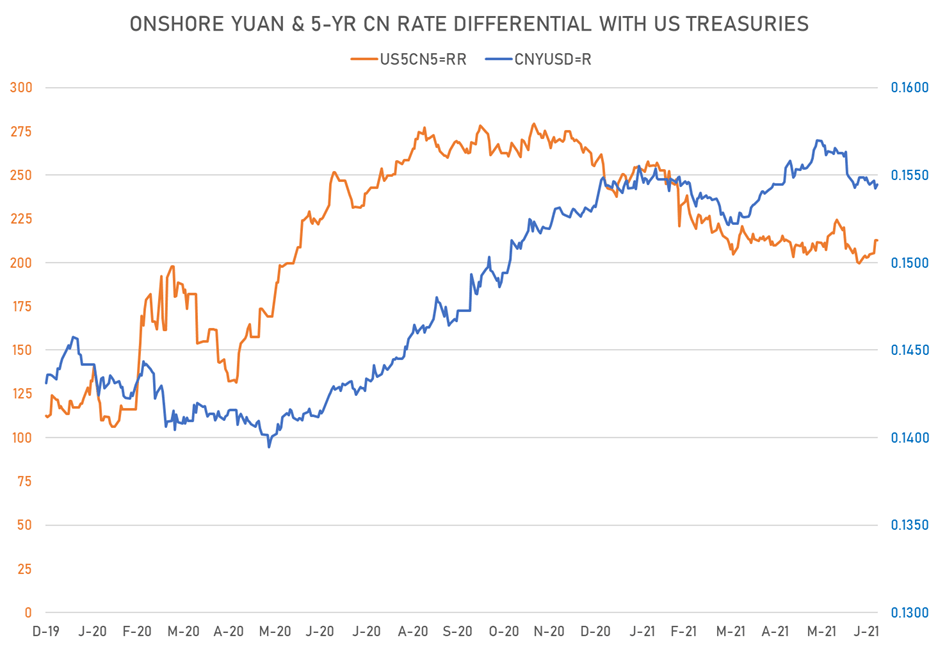

- 5Y China-US interest rates differential unchanged at 212.6 bp (YTD change: -44.5 bp)

VOLATILITIES

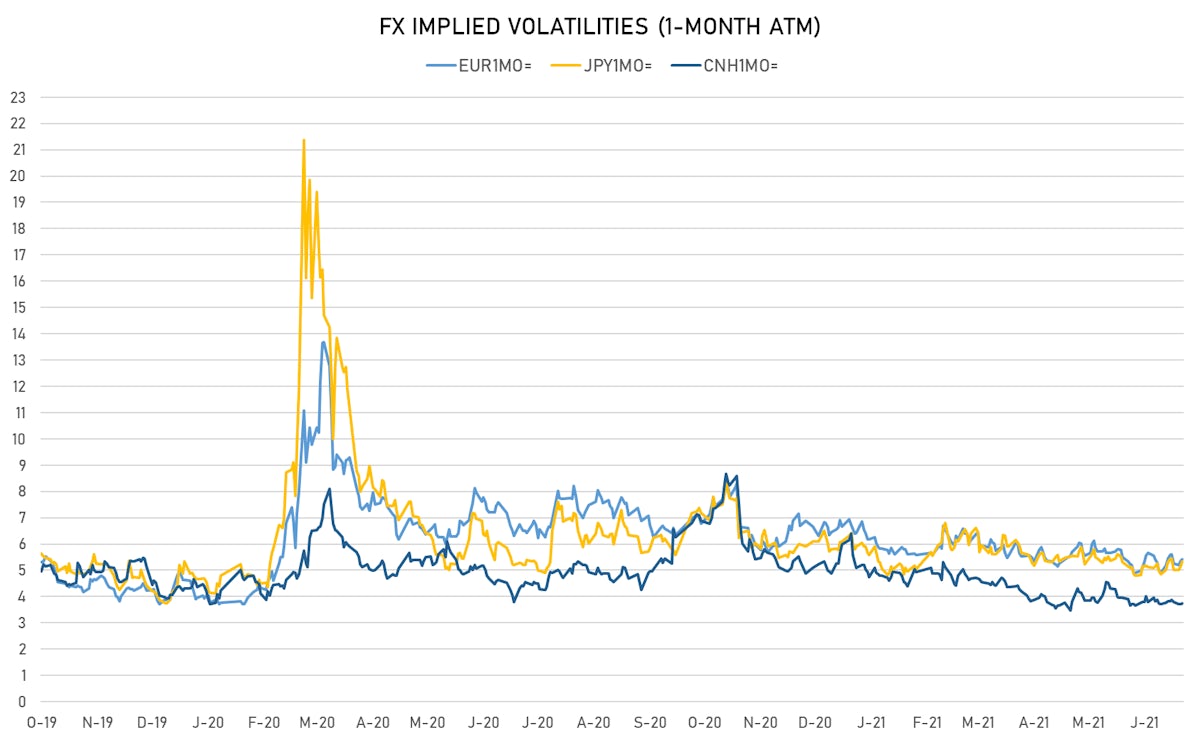

- Deutsche Bank USD Currency Volatility Index currently at 6.01, up 0.19 on the day (YTD: -1.16)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.41 (YTD: -1.3)

- Japanese Yen 1M ATM IV currently at 5.33, up 0.2 on the day (YTD: -0.8)

- Offshore Yuan 1M ATM IV unchanged at 3.74 (YTD: -2.2)

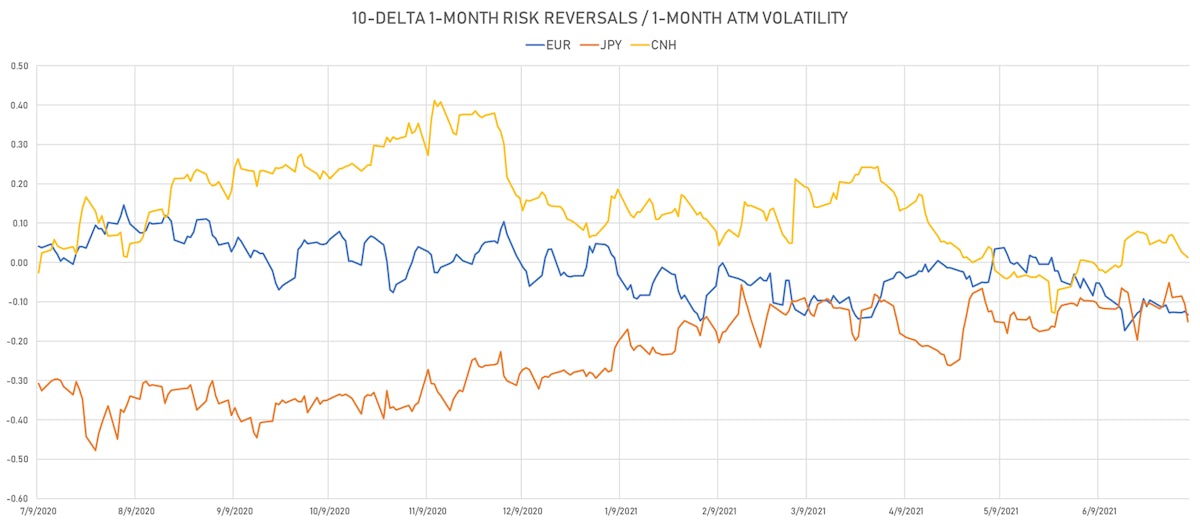

- Risk reversals showing speculative appetite for yen appreciation against the USD

NOTABLE MOVES IN SOVEREIGN CDS

- Russia (rated BBB): up 1.0 basis points to 84 bp (1Y range: 72-129bp)

- Indonesia (rated BBB): up 0.8 basis points to 75 bp (1Y range: 66-126bp)

- Brazil (rated BB-): up 1.3 basis points to 170 bp (1Y range: 141-252bp)

- Oman (rated BB-): up 1.7 basis points to 241 bp (1Y range: 223-485bp)

- Vietnam (rated BB): up 0.8 basis points to 105 bp (1Y range: 90-167bp)

- Saudi Arabia (rated A): down 0.3 basis points to 55 bp (1Y range: 52-101bp)

- Government of Chile (rated A-): down 0.3 basis points to 57 bp (1Y range: 43-75bp)

- Mexico (rated BBB-): down 0.5 basis points to 92 bp (1Y range: 79-164bp)

- South Africa (rated BB-): down 1.4 basis points to 189 bp (1Y range: 178-328bp)

- Colombia (rated BB+): down 1.5 basis points to 137 bp (1Y range: 83-164bp)

LARGEST FX MOVES TODAY

- Malagasy Ariary up 3.1% (YTD: +3.1%)

- Seychelles rupee up 3.0% (YTD: +51.2%)

- Jamaican Dollar down 1.5% (YTD: -6.0%)

- Russian Rouble down 1.6% (YTD: -0.8%)

- Chilean Peso down 1.8% (YTD: -5.1%)

- Norwegian Krone down 1.8% (YTD: -1.7%)

- Hungarian Forint down 2.0% (YTD: -1.8%)

- Colombian Peso down 2.4% (YTD: -10.6%)

- Afghani down 2.7% (YTD: -5.7%)

- Brazilian Real down 2.7% (YTD: -0.7%)