FX

Euro, Yen Gain Against The US Dollar On Rates Differentials

Emerging markets currencies are broadly lower, credit spreads wider, on market doubts about the strength of the global economic rebound

Published ET

The Brazilian real has weakened over the last 2 weeks after 3 strong months | Source: Refinitiv

QUICK SUMMARY

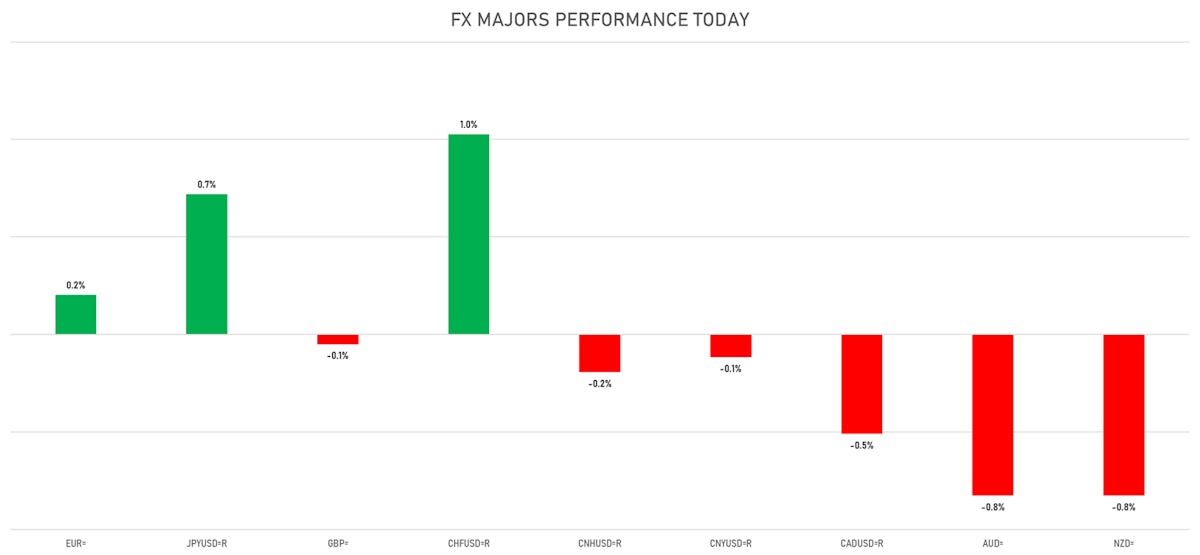

- The US Dollar Index is down -0.38% at 92.35 (YTD: +2.63%)

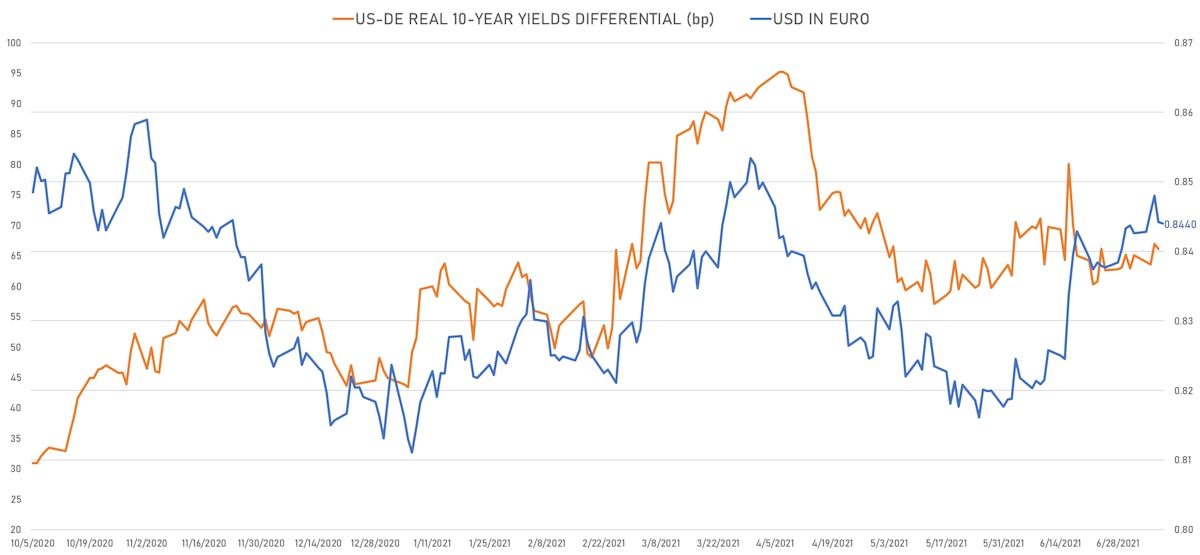

- Euro up 0.20% at 1.1846 (YTD: -3.0%)

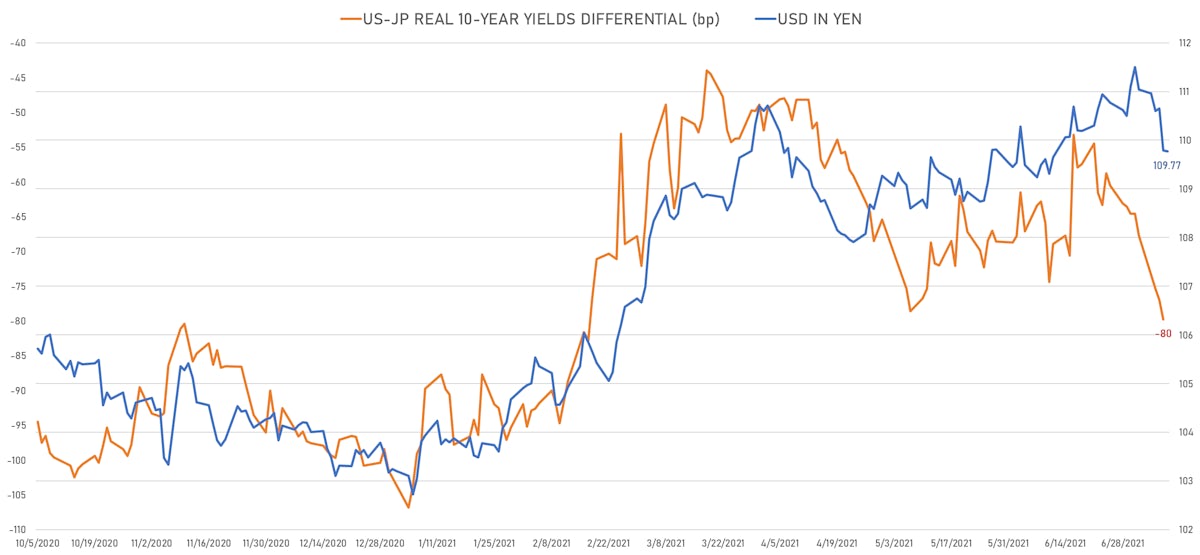

- Yen up 0.72% at 109.83 (YTD: -6.0%)

- Onshore Yuan down 0.12% at 6.4898 (YTD: +0.6%)

- Swiss franc up 1.03% at 0.9149 (YTD: -3.2%)

- Sterling down 0.05% at 1.3792 (YTD: +0.9%)

- Canadian dollar down 0.51% at 1.2528 (YTD: +1.7%)

- Australian dollar down 0.83% at 0.7435 (YTD: -3.4%)

- NZ dollar down 0.83% at 0.6952 (YTD: -3.2%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Jun 2021 (IBGE, Brazil) at 0.53 %, below consensus estimate of 0.59 %

- Brazil, CPI, Broad national index (IPCA), Change Y/Y for Jun 2021 (IBGE, Brazil) at 8.35 %, below consensus estimate of 8.40 %

- Chile, CPI, Change P/P, Price Index for Jun 2021 (INE, Chile) at 0.10 %, below consensus estimate of 0.30 %

- Czech Republic, Retail Sales, Retail trade (incl. retail sale of automotive fuel), Change Y/Y for May 2021 (CSU, Czech Rep) at 8.10 %, above consensus estimate of 4.50 %

- Germany, Exports, Change P/P for May 2021 (Deutsche Bundesbank) at 0.30 %, below consensus estimate of 0.60 %

- Germany, Imports, Change P/P for May 2021 (Deutsche Bundesbank) at 3.40 %, above consensus estimate of 0.40 %

- Germany, Trade Balance for May 2021 (Deutsche Bundesbank) at 12.60 Bln EUR, below consensus estimate of 15.40 Bln EUR

- Hungary, CPI, All Items, Change Y/Y, Price Index for Jun 2021 (HCSO, Hungary) at 5.30 %, above consensus estimate of 4.90 %

- Latvia, CPI, Change P/P for Jun 2021 (Statistics, Latvia) at 0.30 %

- Latvia, CPI, Change Y/Y for Jun 2021 (Statistics, Latvia) at 2.70 %

- Malaysia, Policy Rates, Overnight Policy Rate for 08 Jul (BNM, Malaysia) at 1.75 %, in line with consensus estimate

- Mexico, CPI, Change P/P, Price Index for Jun 2021 (INEGI, Mexico) at 0.53 %, above consensus estimate of 0.51 %

- Mexico, CPI, Change Y/Y, Price Index for Jun 2021 (INEGI, Mexico) at 5.88 %, above consensus estimate of 5.86 %

- Mexico, CPI, Core CPI, Change P/P, Price Index for Jun 2021 (INEGI, Mexico) at 0.57 %, above consensus estimate of 0.56 %

- Netherlands, CPI, All items, Change Y/Y for Jun 2021 (CBS - NL) at 2.00 %, above consensus estimate of 1.90 %

- Peru, Policy Rates, Reference Interest Rate for Jul 2021 (Central Bank, Peru) at 0.25 %, in line with consensus estimate

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for Jul 2021 (Central Bank, Poland) at 0.10 %, in line with consensus estimate

- Serbia, Policy Rates, RS Benchmark Interest Rate, Change P/P for Jul 2021 (NBS, Serbia) at 1.00 %, in line with consensus estimate

- Switzerland, Unemployment, Rate for Jun 2021 (SECO, Switzerland) at 3.10 %, above consensus estimate of 2.90 %

- United States, Consumer credit, total, Absolute change for May 2021 (FED, U.S.) at 35.28 Bln USD, above consensus estimate of 18.40 Bln USD

- United States, Jobless Claims, National, Continued for W 26 Jun (U.S. Dept. of Labor) at 3.34 Mln, in line with consensus estimate

- United States, Jobless Claims, National, Initial for W 03 Jul (U.S. Dept. of Labor) at 373.00 k, above consensus estimate of 350.00 k

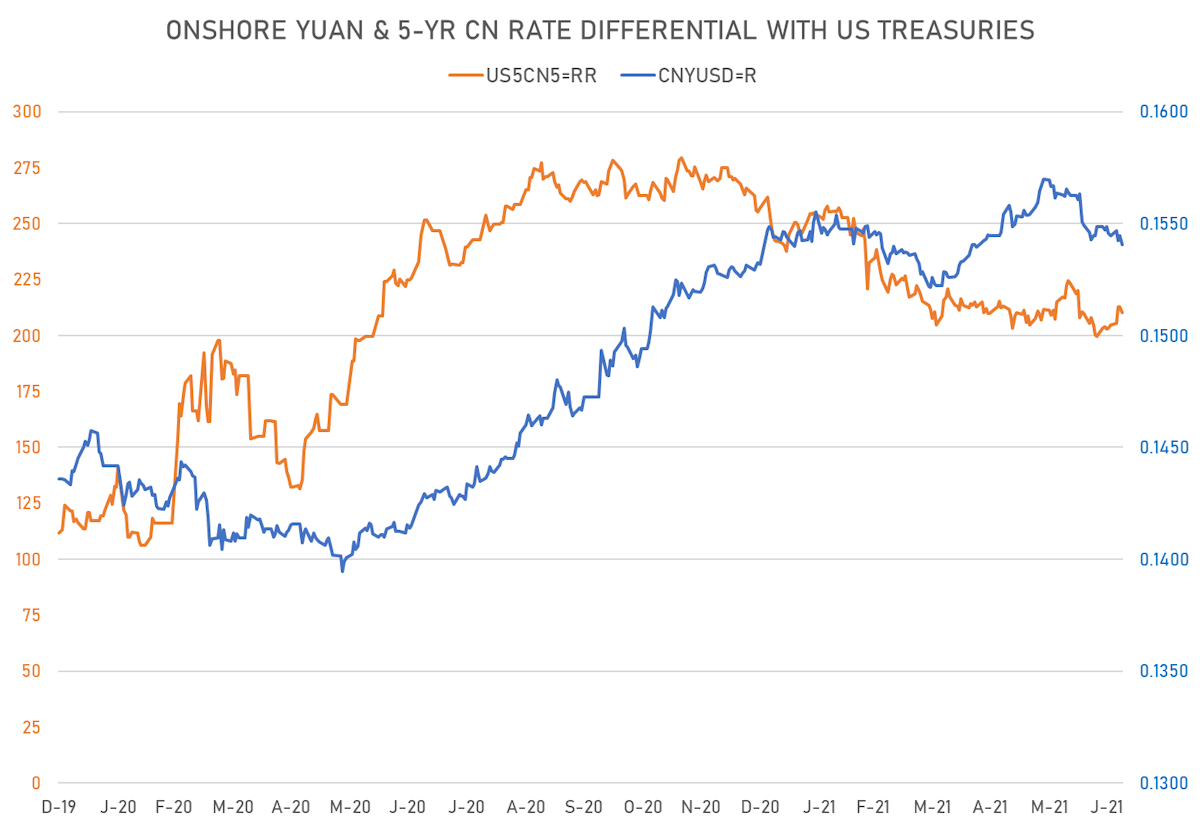

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 7.2 bp tighter at -135.7 bp (YTD change: -24.6 bp), positive for the euro

- 5Y Japan-US interest rates differential 3.3 bp tighter at -87.9 bp (YTD change: -39.6 bp), positive for the yen

- 5Y China-US interest rates differential 2.3 bp tighter at 210.3 bp (YTD change: -46.8 bp), negative for the yuan

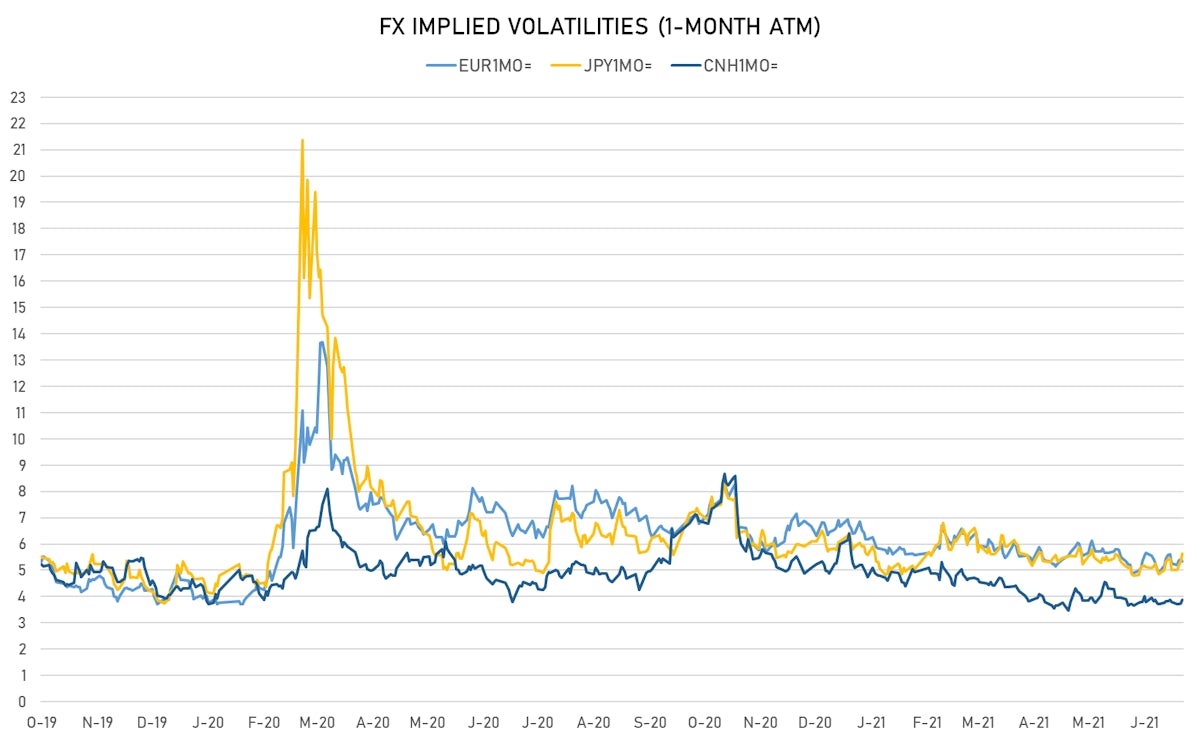

VOLATILITIES

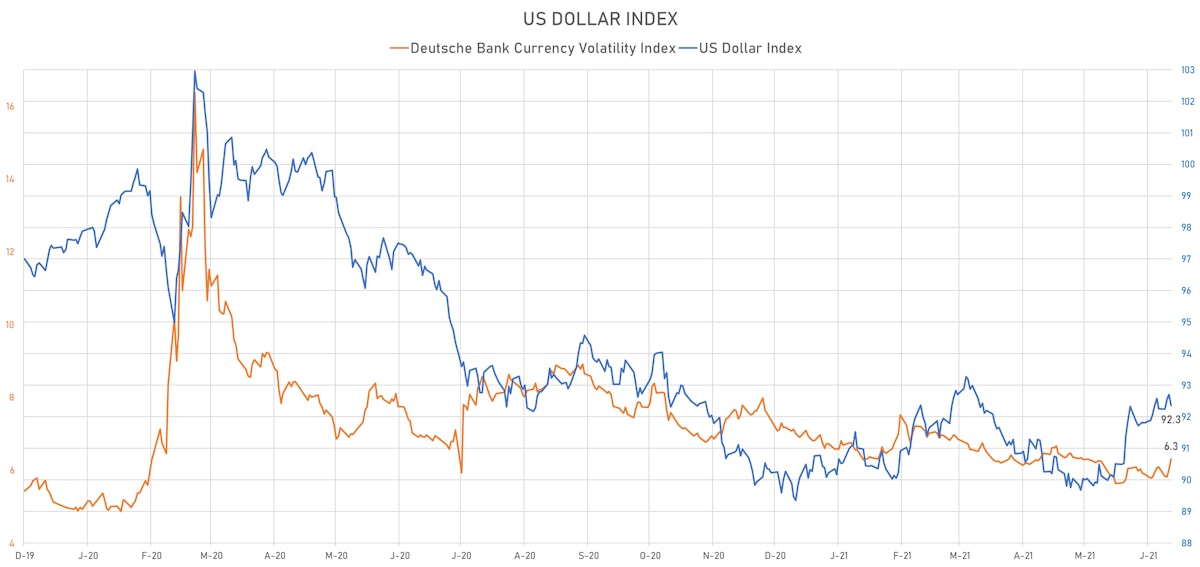

- Deutsche Bank USD Currency Volatility Index currently at 6.31, up 0.30 on the day (YTD: -0.86)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.35, down -0.1 on the day (YTD: -1.3)

- Japanese Yen 1M ATM IV currently at 5.63, up 0.3 on the day (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 3.86, up 0.1 on the day (YTD: -2.1)

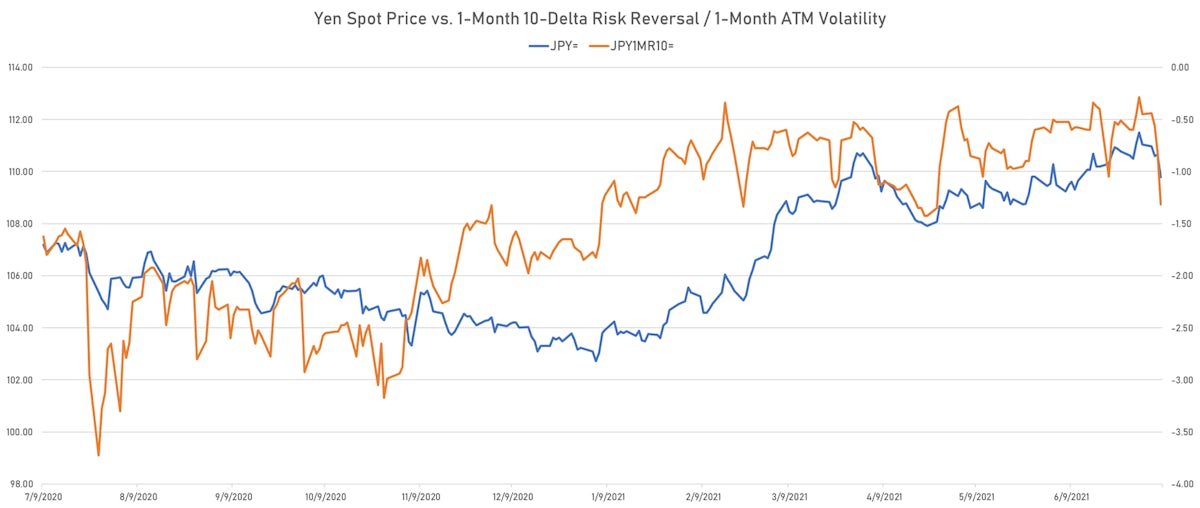

- Big move in 1-month 10-delta JPY risk reversal (see below), as specs positioned for further gains in the currency

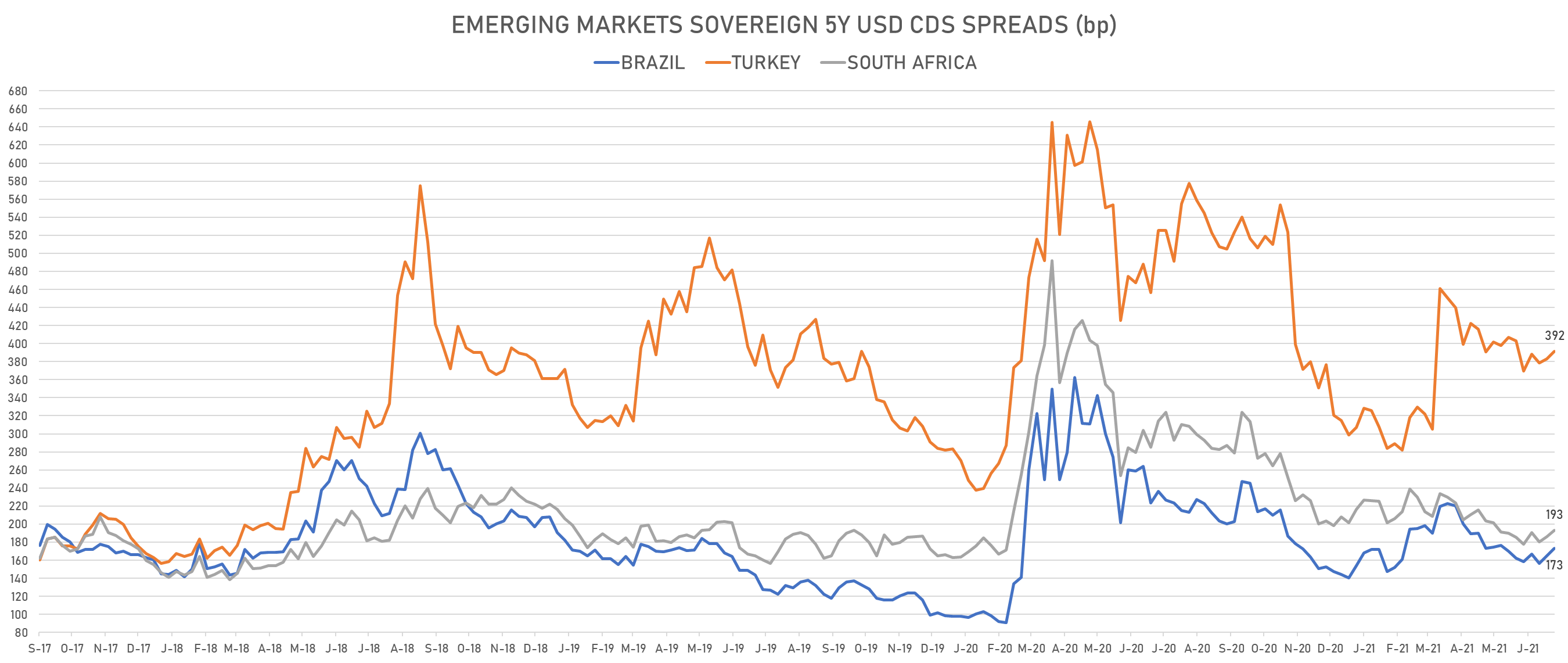

NOTABLE MOVES IN SOVEREIGN CDS

- United Arab Emirates (rated AA-): up 2.5 basis points to 60 bp (1Y range: 50-62bp)

- Saudi Arabia (rated A): up 1.9 basis points to 57 bp (1Y range: 52-101bp)

- Slovenia (rated A): up 1.5 basis points to 51 bp (1Y range: 47-55bp)

- Russia (rated BBB): up 2.6 basis points to 87 bp (1Y range: 72-129bp)

- Vietnam (rated BB): up 2.8 basis points to 108 bp (1Y range: 90-167bp)

- Government of Chile (rated A-): up 1.4 basis points to 58 bp (1Y range: 43-75bp)

- Indonesia (rated BBB): up 1.8 basis points to 77 bp (1Y range: 66-126bp)

- South Africa (rated BB-): up 4.2 basis points to 193 bp (1Y range: 178-328bp)

- Brazil (rated BB-): up 3.8 basis points to 174 bp (1Y range: 141-252bp)

- Kenya (rated B+): up 9.0 basis points to 420 bp (1Y range: 394-454bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 3.5% (YTD: -0.2%)

- Swiss Franc up 1.0% (YTD: -3.2%)

- Malagasy Ariary up 1.0% (YTD: +3.8%)

- Philippine Peso down 1.0% (YTD: -4.4%)

- Haiti Gourde down 1.0% (YTD: -23.0%)

- Brazilian Real down 1.2% (YTD: -1.3%)

- Seychelles rupee down 1.4% (YTD: +49.8%)

- Fiji Dollar down 1.5% (YTD: -2.3%)

- Jamaican Dollar down 1.5% (YTD: -6.6%)

- Colombian Peso down 1.6% (YTD: -10.8%)