FX

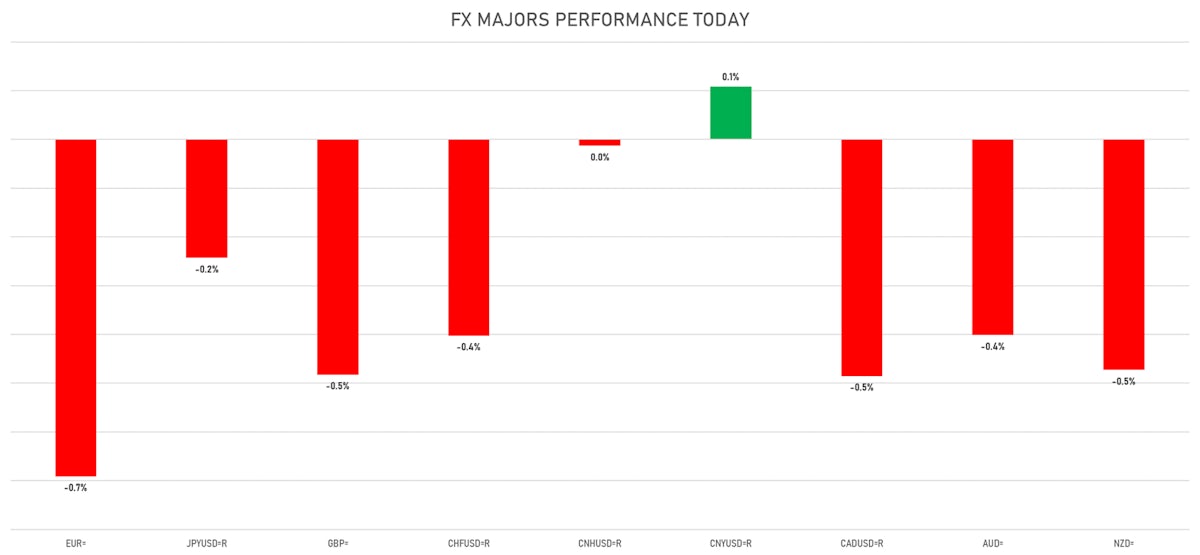

Major Currencies Fall Against The Dollar, With Hot CPI Print Pushing US Rates Higher

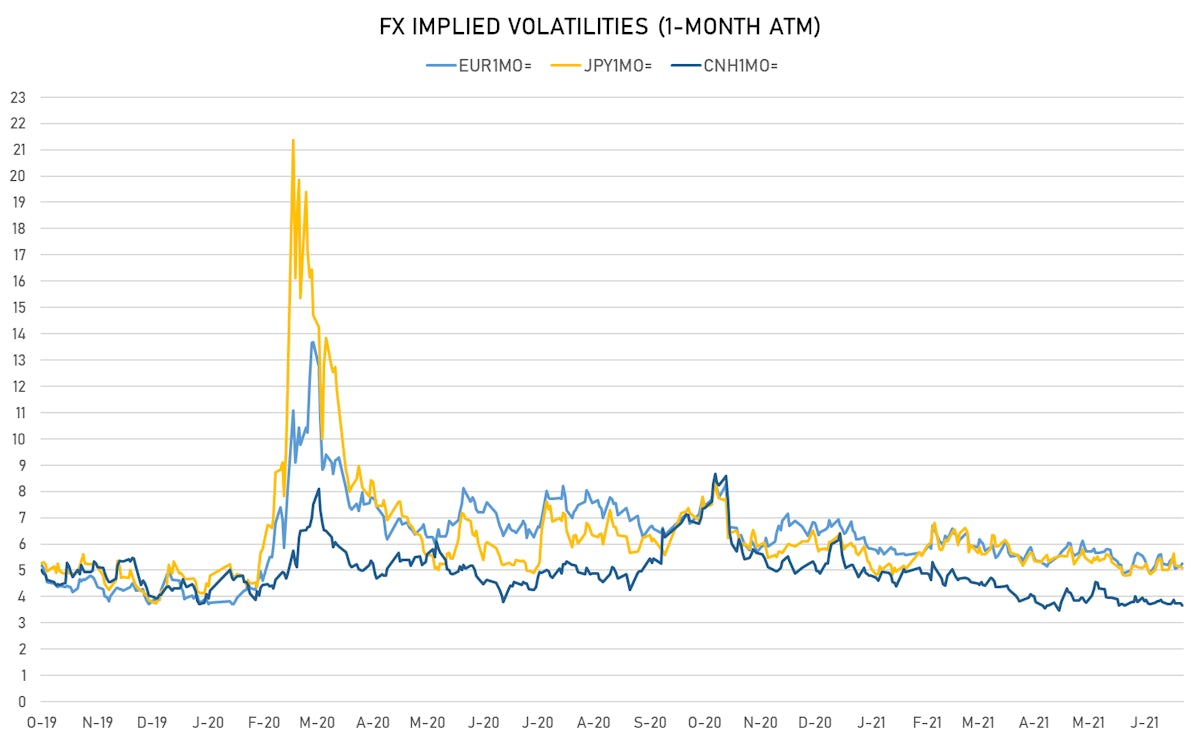

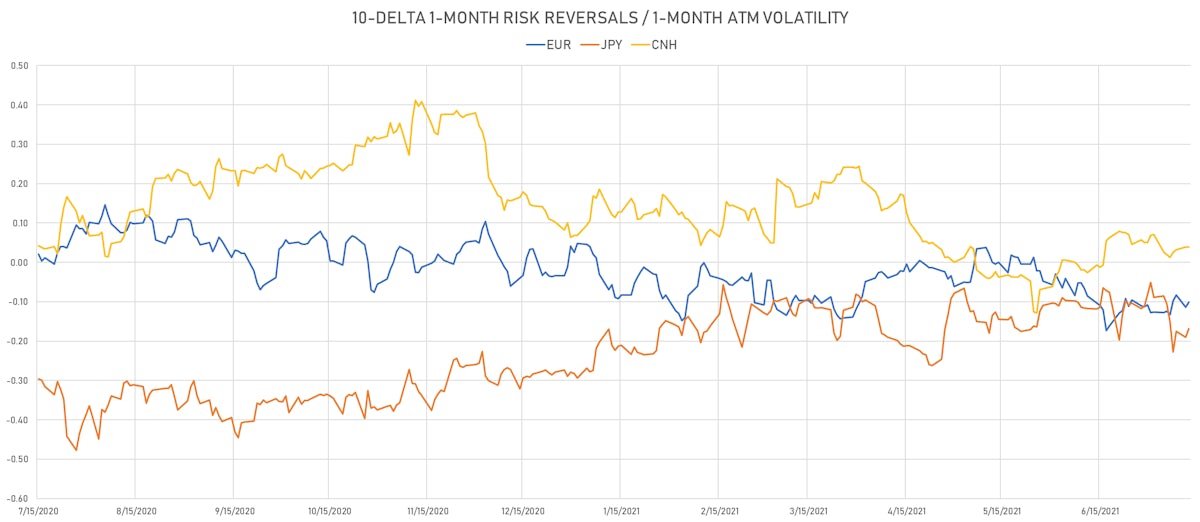

Volatility remains muted and risk reversals don't show any clear appetite for strong directional positioning at current levels

Published ET

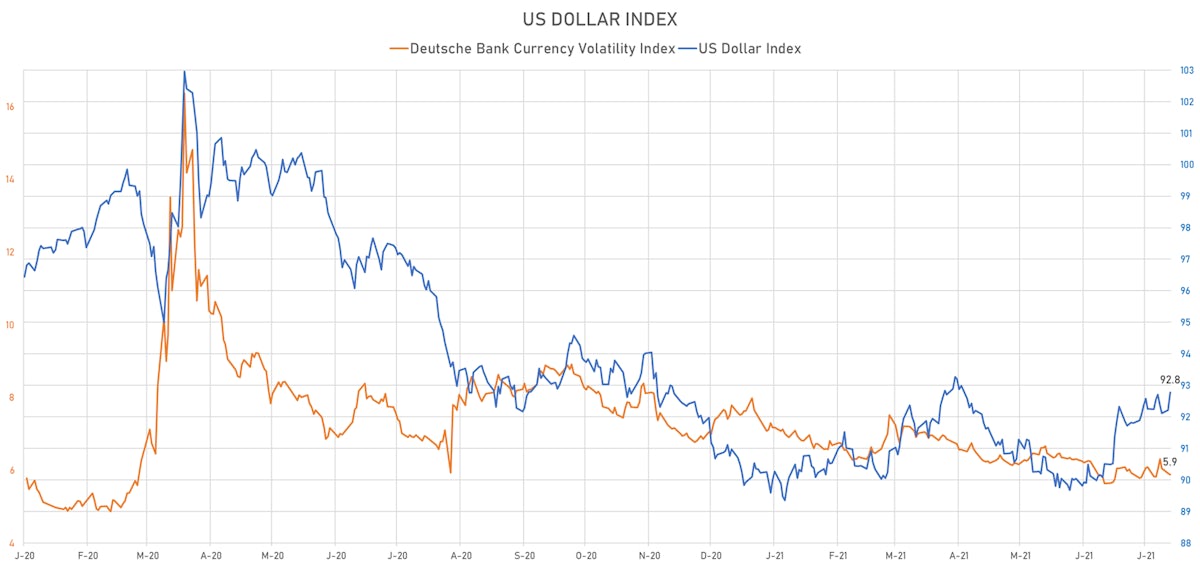

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is up 0.61% at 92.78 (YTD: +3.11%)

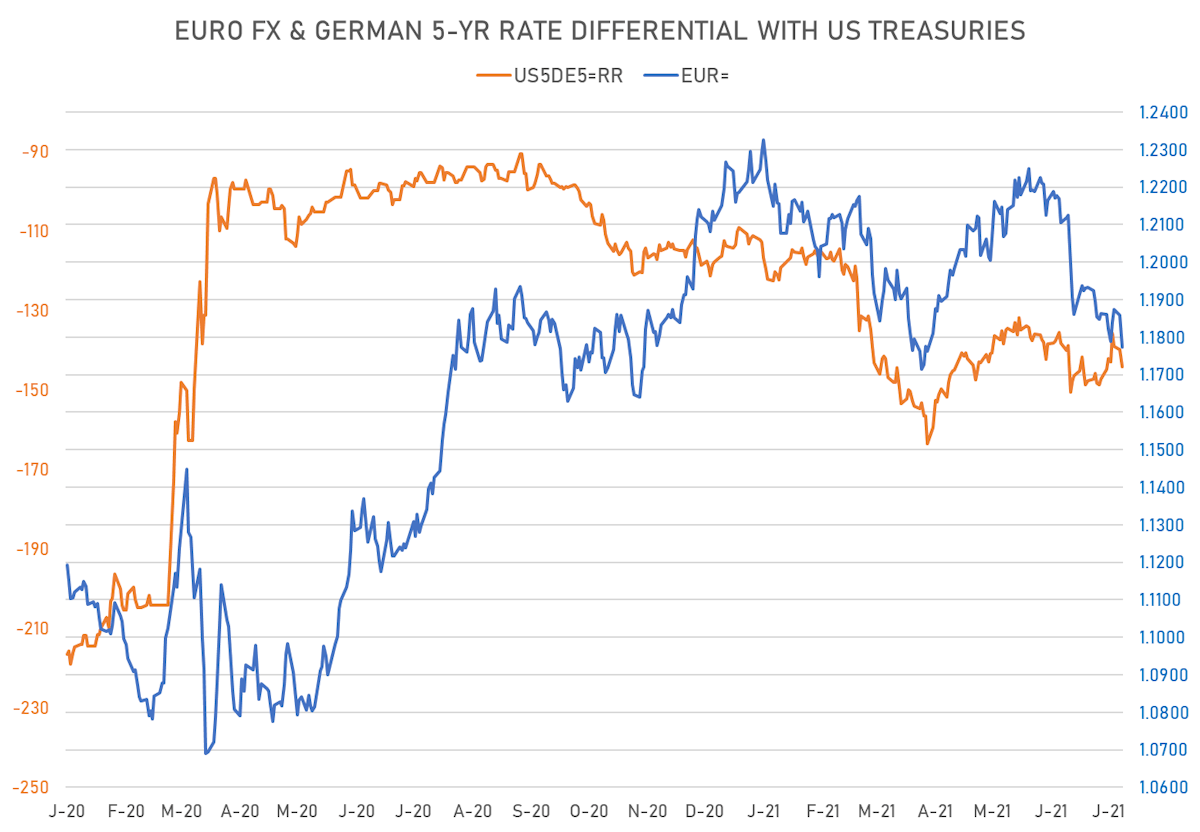

- Euro down 0.69% at 1.1777 (YTD: -3.6%)

- Yen down 0.24% at 110.61 (YTD: -6.7%)

- Onshore Yuan up 0.11% at 6.4685 (YTD: +0.9%)

- Swiss franc down 0.40% at 0.9182 (YTD: -3.6%)

- Sterling down 0.48% at 1.3813 (YTD: +1.0%)

- Canadian dollar down 0.49% at 1.2512 (YTD: +1.8%)

- Australian dollar down 0.40% at 0.7445 (YTD: -3.2%)

- NZ dollar down 0.47% at 0.6946 (YTD: -3.3%)

MACRO DATA RELEASES

- China (Mainland), Exports, Change Y/Y for Jun 2021 (China Customs) at 32.20 %, above consensus estimate of 23.10 %

- China (Mainland), Imports, Change Y/Y for Jun 2021 (China Customs) at 36.70 %, above consensus estimate of 30.00 %

- China (Mainland), Trade Balance, Current Prices for Jun 2021 (China Customs) at 51.53 Bln USD, above consensus estimate of 44.20 Bln USD

- Czech Republic, CPI, Change P/P, Price Index for Jun 2021 (CSU, Czech Rep) at 0.50 %, above consensus estimate of 0.40 %

- Czech Republic, CPI, Change Y/Y, Price Index for Jun 2021 (CSU, Czech Rep) at 2.80 %, above consensus estimate of 2.70 %

- France, HICP, Change Y/Y, Price Index for Jun 2021 (INSEE, France) at 1.90 %, in line with consensus estimate

- France, HICP, Final, Change P/P, Price Index for Jun 2021 (INSEE, France) at 0.20 %, in line with consensus estimate

- Germany, CPI, Final, Change P/P, Price Index for Jun 2021 (Destatis) at 0.40 %, in line with consensus estimate

- Germany, CPI, Final, Change Y/Y, Price Index for Jun 2021 (Destatis) at 2.30 %, in line with consensus estimate

- Germany, HICP, Final, Change P/P, Price Index for Jun 2021 (Destatis) at 0.40 %, in line with consensus estimate

- Germany, HICP, Final, Change Y/Y, Price Index for Jun 2021 (Destatis) at 2.10%, in line with consensus estimate

- Romania, CPI, All Items, Change Y/Y, Price Index for Jun 2021 (NIS, Romania) at 3.94 %, above consensus estimate of 3.70 %

- South Africa, Mining Production YY, Change Y/Y for May 2021 (Statistics, SA) at 21.90 %, below consensus estimate of 32.80 %

- United States, CPI - All Urban Samples: All Items, Change Y/Y for Jun 2021 (BLS, U.S Dep. Of Lab) at 5.40 %, above consensus estimate of 4.90 %

- United States, CPI, All items less food and energy, Change Y/Y, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 4.50 %, above consensus estimate of 4.00 %

- United States, CPI, All items, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 0.90 %, above consensus estimate of 0.50 %

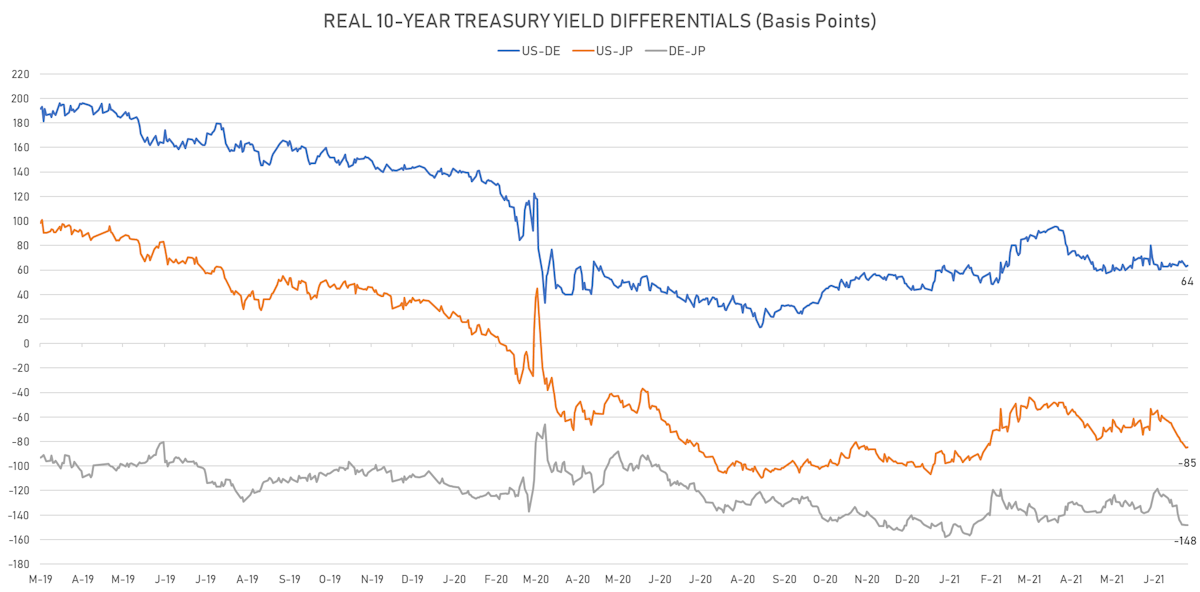

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 4.4 bp wider at -144.2 bp (YTD change: -33.1 bp), negative for the euro

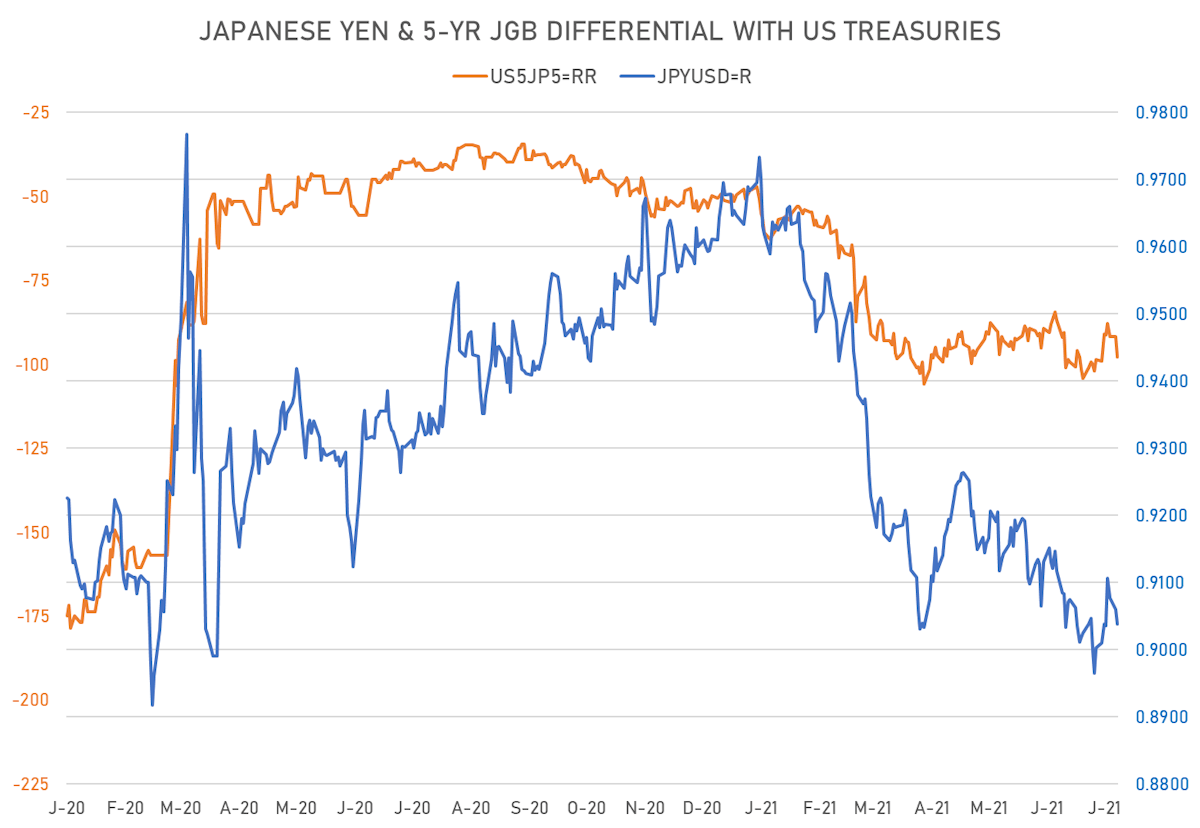

- 5Y Japan-US interest rates differential 6.0 bp wider at -97.8 bp (YTD change: -49.5 bp), negative for the yen

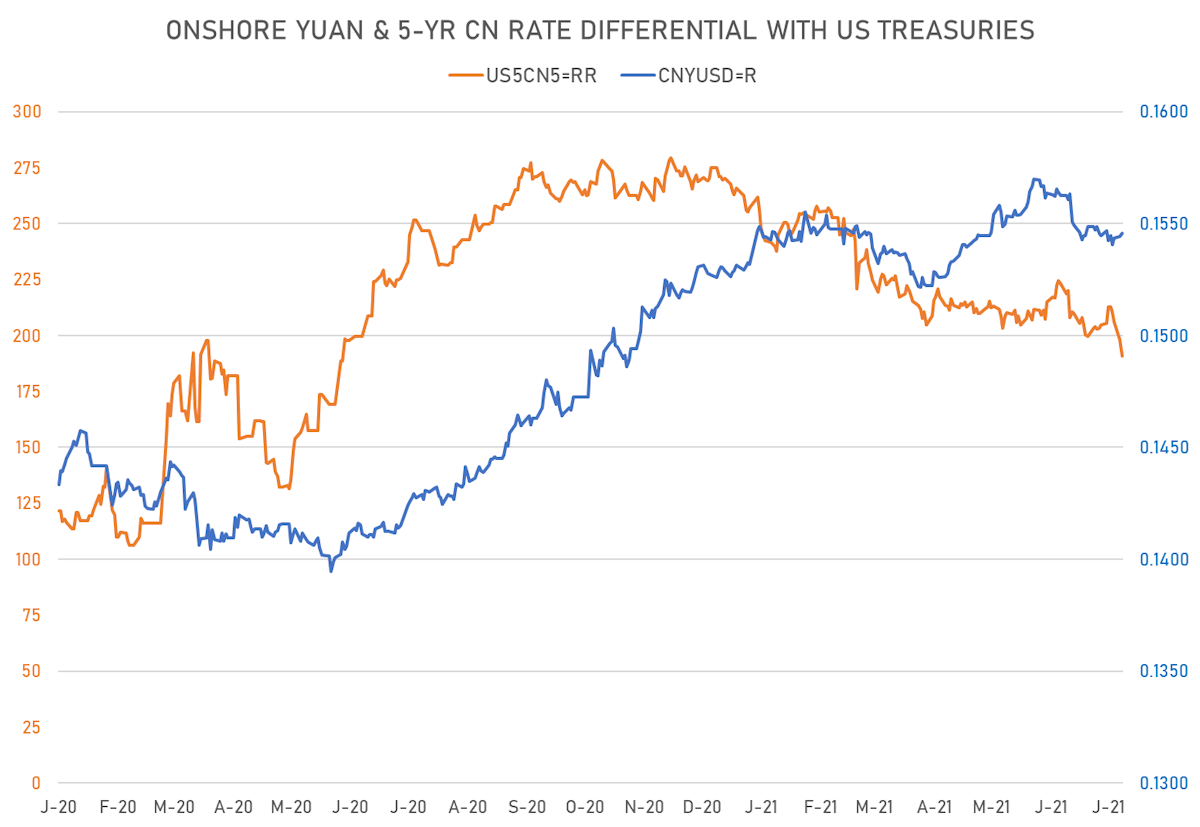

- 5Y China-US interest rates differential 7.0 bp tighter at 190.9 bp (YTD change: -66.2 bp), negative for the yuan

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.88, down -0.04 (YTD: -1.29)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.25, up 0.1 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.10, unchanged (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.65, down -0.1 (YTD: -2.3)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Saudi Arabia (rated A): up 5.0 basis points to 61 bp (1Y range: 52-101bp)

- Government of Chile (rated A-): up 2.9 basis points to 63 bp (1Y range: 43-75bp)

- Colombia (rated BB+): up 6.1 basis points to 144 bp (1Y range: 83-164bp)

- Peru (rated BBB+): up 2.3 basis points to 83 bp (1Y range: 52-98bp)

- South Africa (rated BB-): up 5.5 basis points to 198 bp (1Y range: 178-328bp)

- Mexico (rated BBB-): up 2.3 basis points to 94 bp (1Y range: 79-164bp)

- Panama (rated BBB-): up 1.6 basis points to 67 bp (1Y range: 44-98bp)

- Bahrain (rated B+): up 3.9 basis points to 230 bp (1Y range: 159-347bp)

- Brazil (rated BB-): up 2.0 basis points to 176 bp (1Y range: 141-252bp)

- Oman (rated BB-): down 3.4 basis points to 251 bp (1Y range: 223-485bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 20.2% (YTD: +49.5%)

- Mauritania ouguiya up 1.8% (YTD: +1.8%)

- Mauritius Rupee down 1.3% (YTD: -8.0%)

- Polish Zloty down 1.4% (YTD: -4.0%)

- Qatari Riyal down 1.7% (YTD: -1.7%)

- Tunisian Dinar down 2.1% (YTD: -4.2%)

- South Africa Rand down 2.1% (YTD: -0.2%)

- Lesotho Loti down 2.1% (YTD: -0.2%)

- Swaziland Lilageni down 2.2% (YTD: -0.2%)

- Namibian Dollar down 2.2% (YTD: -0.2%)