FX

US Dollar Gains Against The Euro, Drops Against The Yen And Yuan

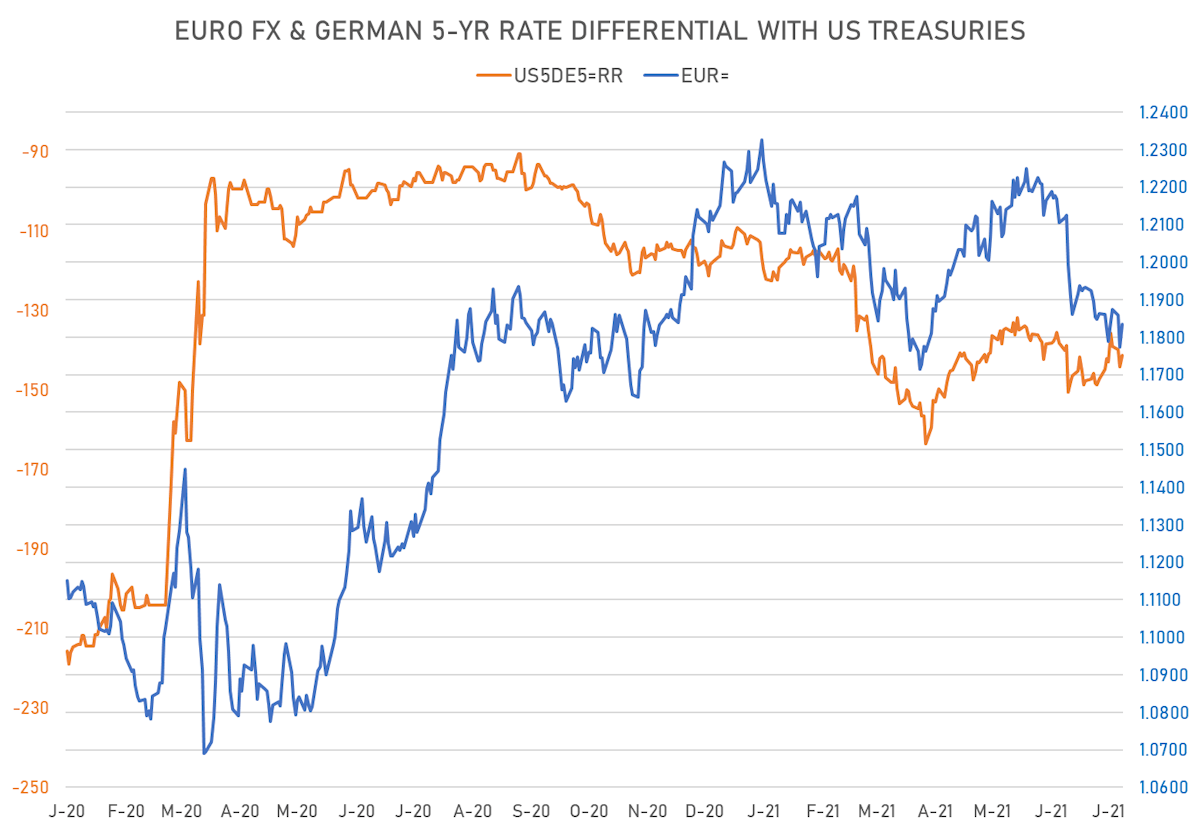

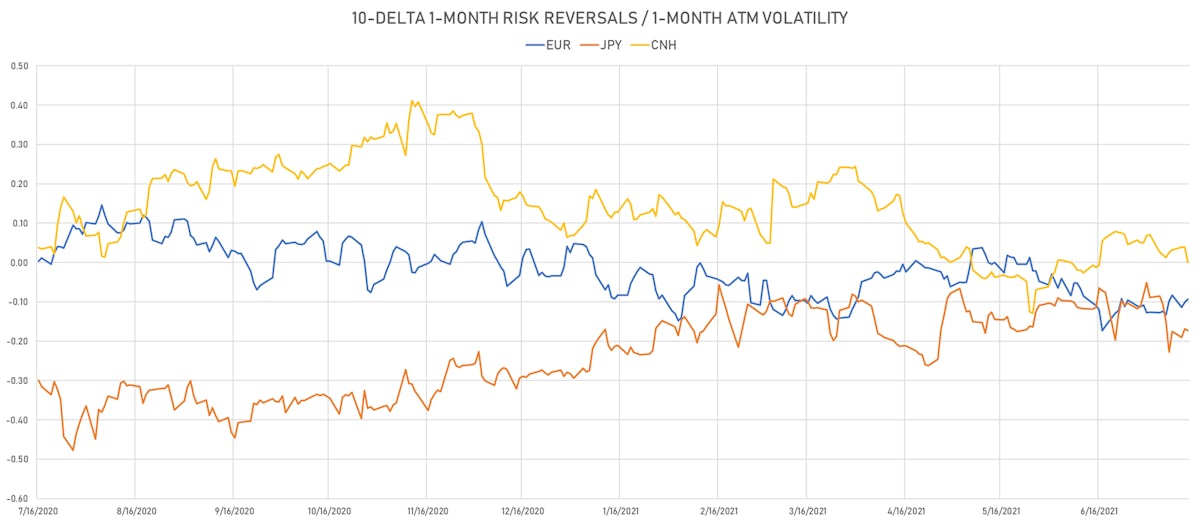

The euro has traded against moves in yields differentials (both real and nominal) in the past couple of days, with option implied volatilities showing that ECB governing council next week (22 July) is seen as a key event risk (1-week 25-delta put IV > 1-month 25-delta put IV)

Published ET

Japanese Yen vs 10Y US-JP Real Rates Differential | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

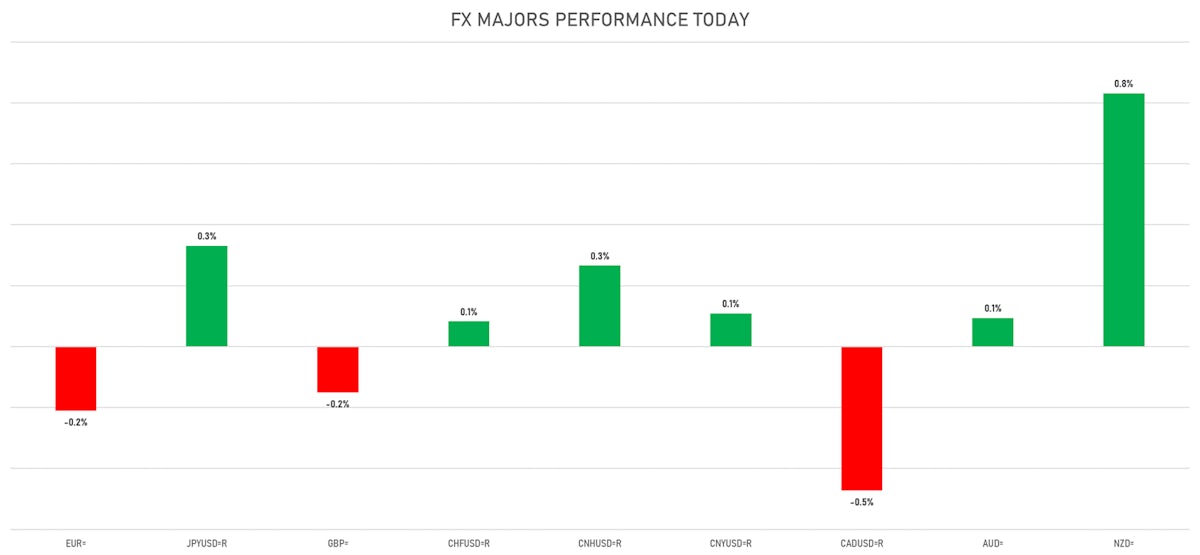

- The US Dollar Index is down -0.44% at 92.36 (YTD: +2.65%)

- Euro down 0.21% at 1.1834 (YTD: -3.1%)

- Yen up 0.33% at 109.96 (YTD: -6.1%)

- Onshore Yuan up 0.11% at 6.4688 (YTD: +0.9%)

- Swiss franc up 0.08% at 0.9145 (YTD: -3.2%)

- Sterling down 0.15% at 1.3859 (YTD: +1.4%)

- Canadian dollar down 0.47% at 1.2513 (YTD: +1.8%)

- Australian dollar up 0.09% at 0.7482 (YTD: -2.8%)

- NZ dollar up 0.83% at 0.7037 (YTD: -2.1%)

MACRO DATA RELEASES

- Canada, Policy Rates, Overnight Target Rate for 14 Jul (Bank of Canada) at 0.25 %, in line with consensus estimate

- Chile, Policy Rates, Monetary Policy Interest Rate for Jul 2021 (Central Bank, Chile) at 0.75 %, in line with consensus estimate

- India, Wholesale Prices, Change Y/Y, Price Index for Jun 2021 (Econ Adviser, India) at 12.07 %, below consensus estimate of 12.23 %

- New Zealand, Policy Rates, Official Cash Rate (OCR) for 14 Jul (RBNZ) at 0.25 %, in line with consensus estimate

- Singapore, GDP, Change Y/Y for Q2 2021 (Statistics Singapore) at 14.30 %, above consensus estimate of 14.20 %

- Sweden, CPI, All Items, Change P/P, Price Index for Jun 2021 (SCB, Sweden) at 0.10 %, in line with consensus estimate

- Sweden, CPI, All Items, Change Y/Y, Price Index for Jun 2021 (SCB, Sweden) at 1.30 %, in line with consensus estimate

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Jul 2021 (Central Bank, Turkey) at 17.50 %

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Jul 2021 (Central Bank, Turkey) at 19.00 %, in line with consensus estimate

- Turkey, Policy Rates, Late Liquidity Window Rate for Jul 2021 (Central Bank, Turkey) at 23.50 %

- Turkey, Policy Rates, Overnight Lending Rate for Jul 2021 (Central Bank, Turkey) at 20.50 %

- United Kingdom, CPI, All items (CPI), Change Y/Y for Jun 2021 (ONS, United Kingdom) at 2.50%, above consensus estimate of 2.20%

KEY GLOBAL RATES DIFFERENTIALS

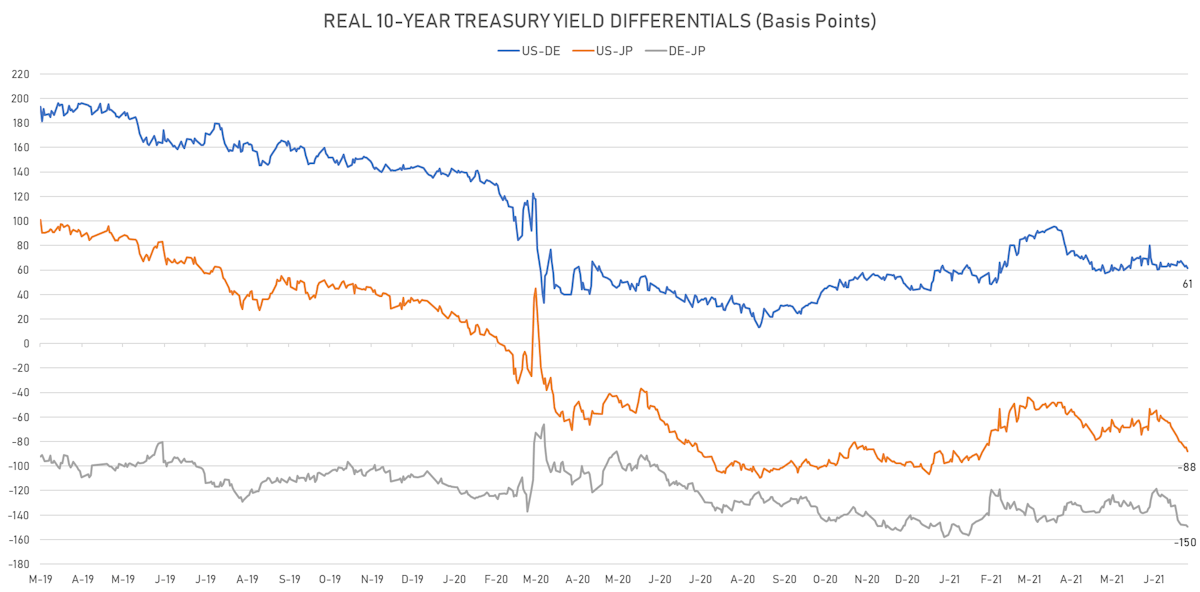

- 5Y German-US interest rates differential 2.9 bp tighter at -141.3 bp (YTD change: -30.2 bp), positive for the euro

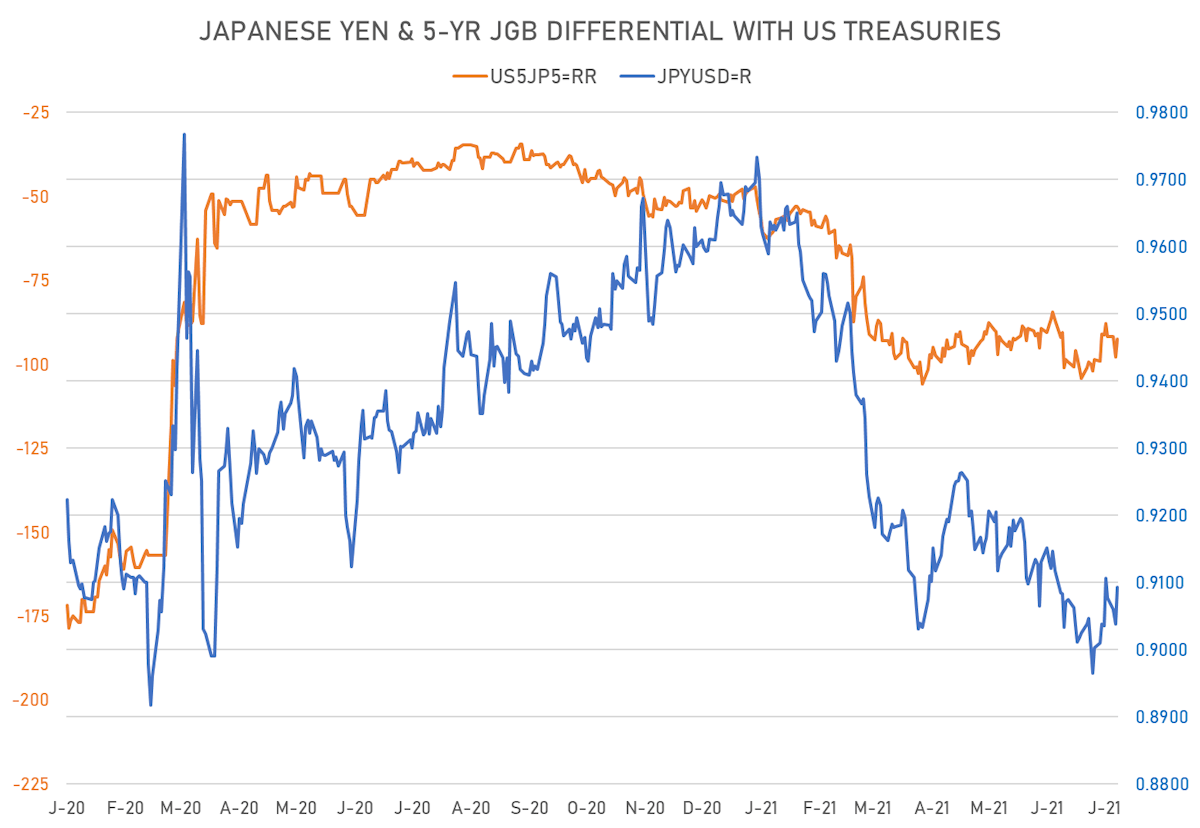

- 5Y Japan-US interest rates differential 5.3 bp tighter at -92.5 bp (YTD change: -44.2 bp), positive for the yen

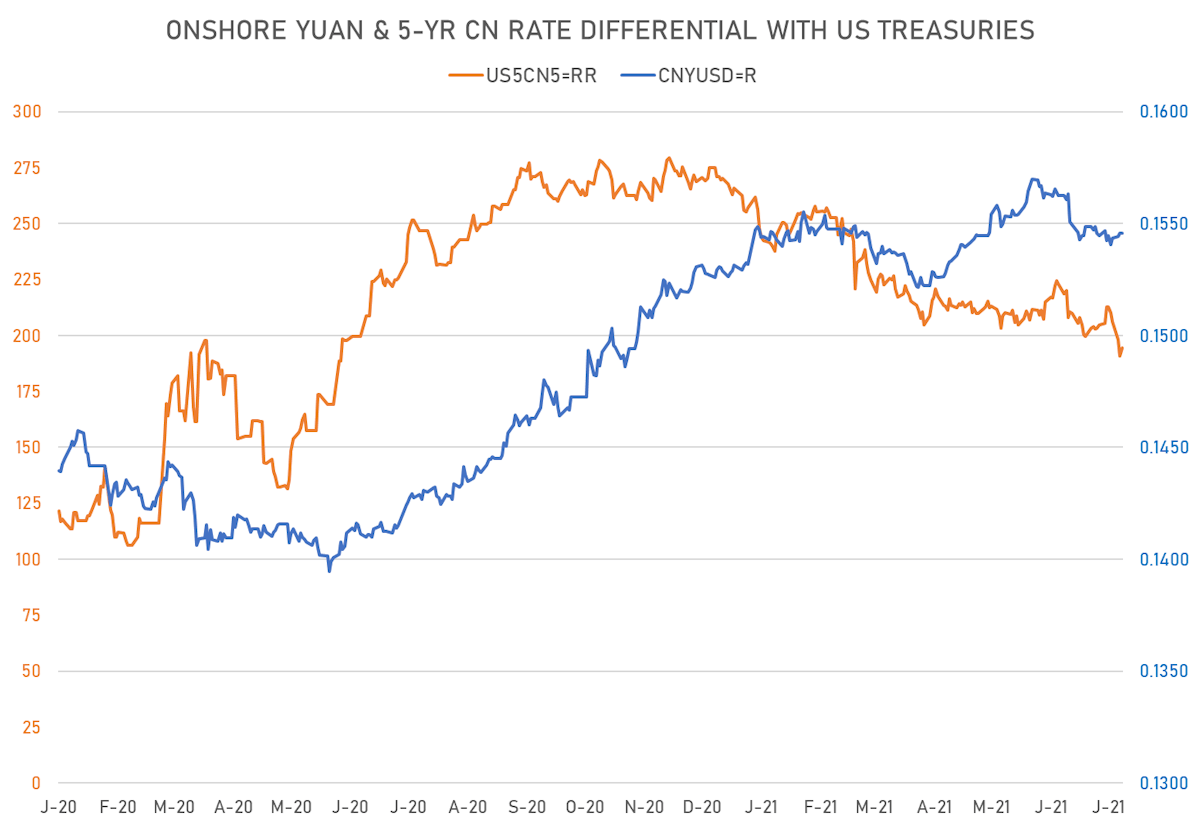

- 5Y China-US interest rates differential 3.4 bp wider at 194.4 bp (YTD change: -62.8 bp), positive for the yuan

VOLATILITIES TODAY

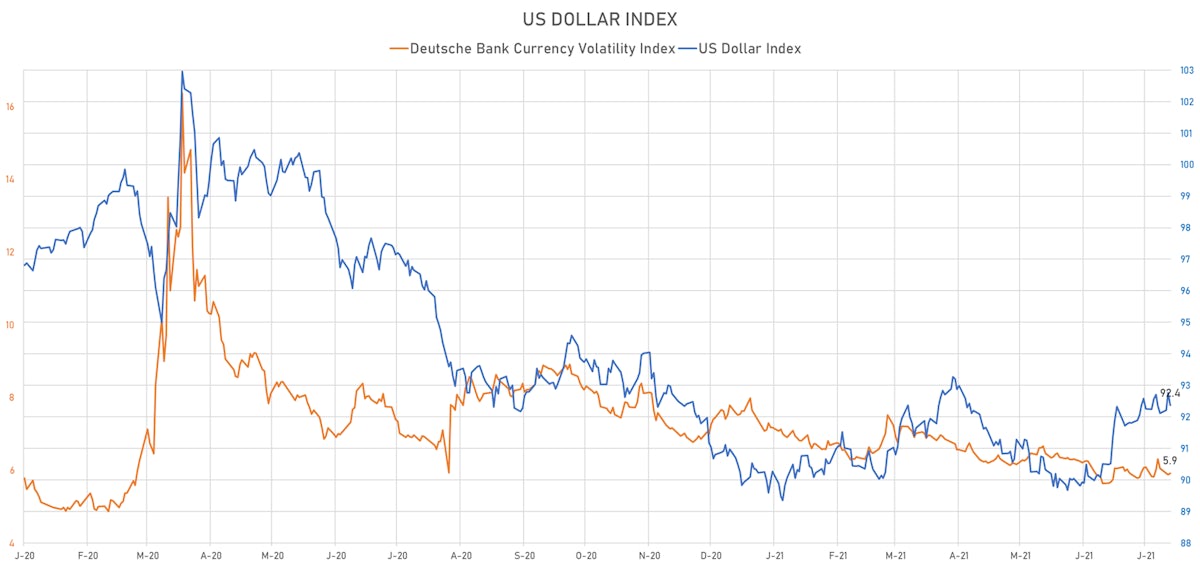

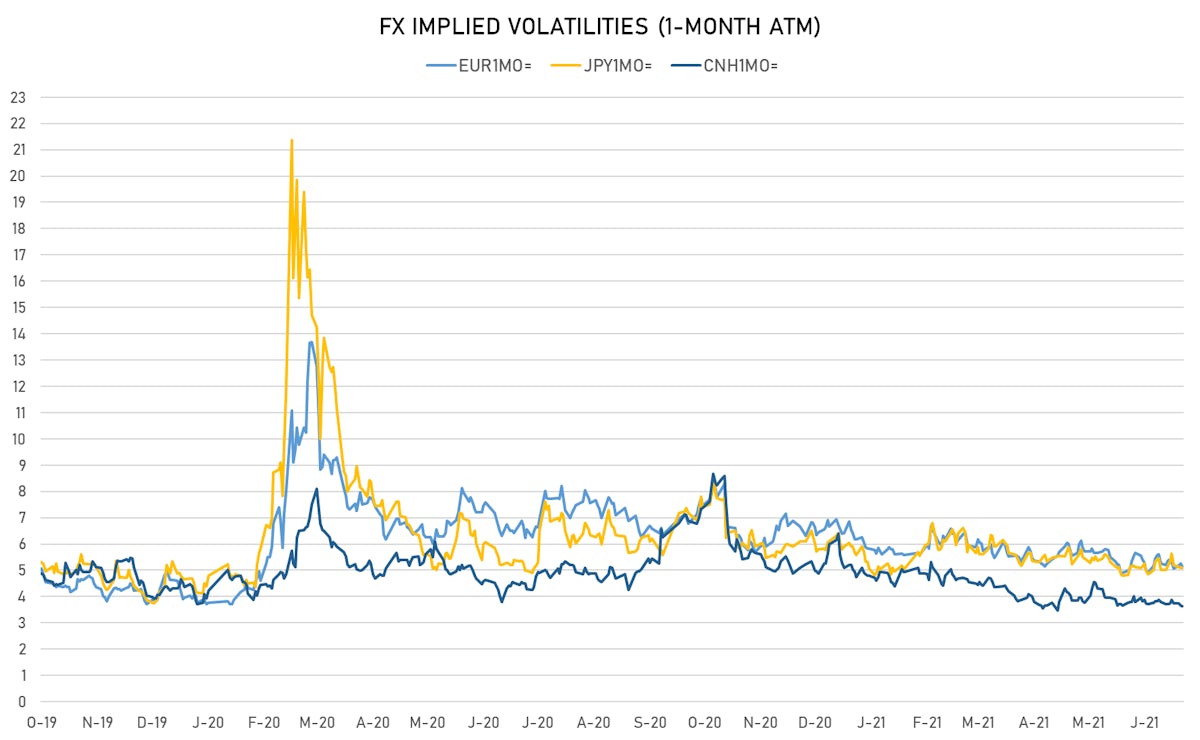

- Deutsche Bank USD Currency Volatility Index currently at 5.92, up 0.04 (YTD: -1.25)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.15, down -0.1 (YTD: -1.5)

- Japanese Yen 1M ATM IV unchanged at 5.10 (YTD: -1.0)

- Offshore Yuan 1M ATM IV unchanged at 3.63 (YTD: -2.4)

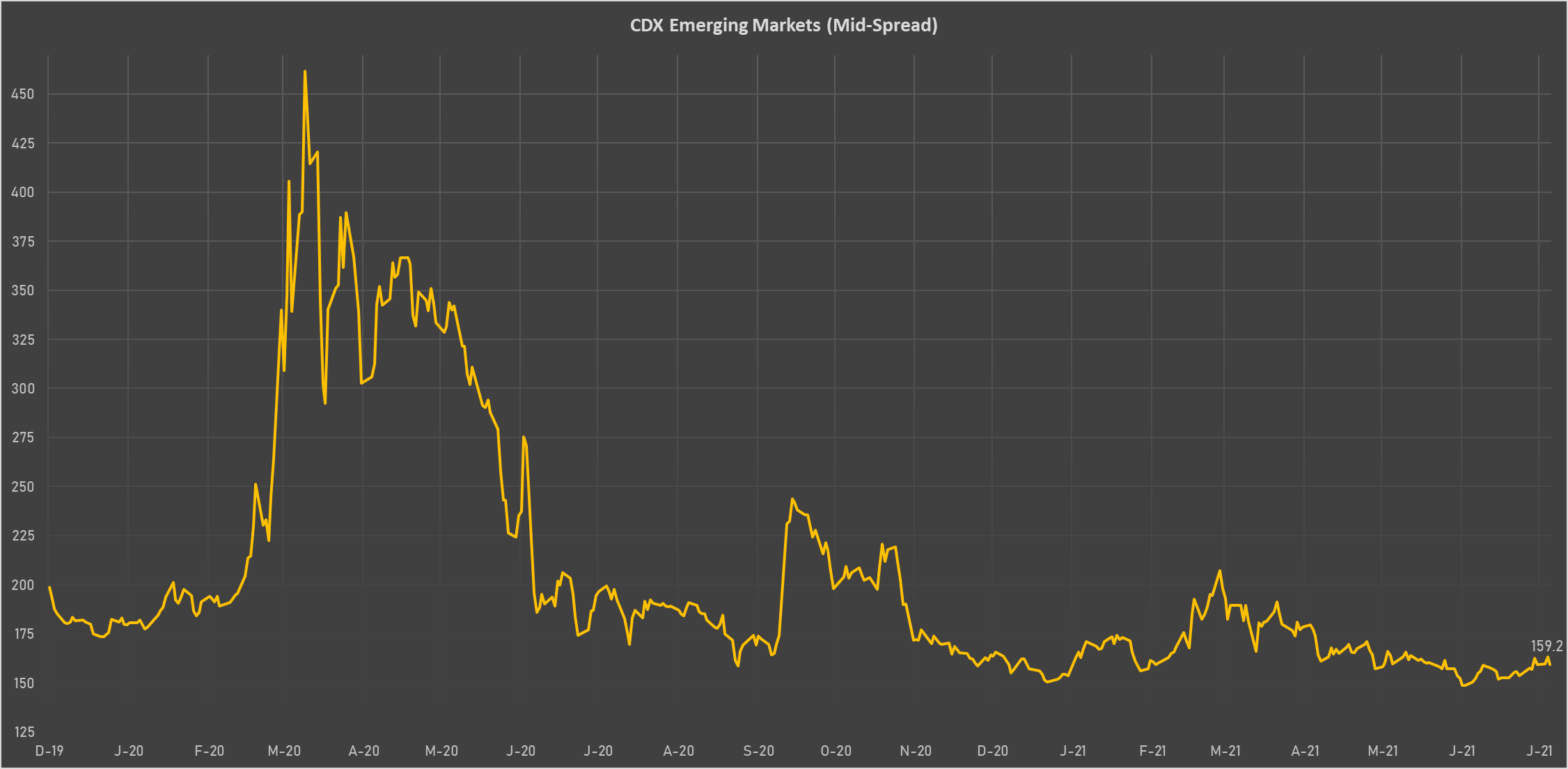

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Vietnam (rated BB): up 0.8 basis points to 108 bp (1Y range: 90-167bp)

- Argentina (rated CCC): down 8.3 basis points to 1,920 bp (1Y range: 1,049-1,968bp)

- Panama (rated BBB-): down 0.7 basis points to 67 bp (1Y range: 44-98bp)

- Russia (rated BBB): down 0.9 basis points to 85 bp (1Y range: 72-129bp)

- Turkey (rated BB-): down 4.8 basis points to 384 bp (1Y range: 282-597bp)

- South Africa (rated BB-): down 2.5 basis points to 195 bp (1Y range: 178-328bp)

- Brazil (rated BB-): down 3.2 basis points to 173 bp (1Y range: 141-252bp)

- Peru (rated BBB+): down 1.6 basis points to 81 bp (1Y range: 52-98bp)

- Mexico (rated BBB-): down 2.0 basis points to 93 bp (1Y range: 79-164bp)

- Saudi Arabia (rated A): down 5.3 basis points to 56 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 17.0% (YTD: +45.6%)

- Afghani up 2.0% (YTD: -3.1%)

- Brazilian Real up 2.0% (YTD: +2.4%)

- Mauritania ouguiya up 1.8% (YTD: +1.8%)

- Congo Franc up 1.2% (YTD: -0.8%)

- Armenian Dram up 1.1% (YTD: +5.7%)

- Mauritius Rupee down 1.3% (YTD: -8.0%)

- Tunisian Dinar down 1.7% (YTD: -3.7%)

- Qatari Riyal down 1.8% (YTD: -1.8%)

- Venezuela Bolivar down 3.3% (YTD: -67.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 45.6%

- Mozambique metical up 15.4%

- Argentine Peso down 12.6%

- Turkish Lira down 13.4%

- Haiti Gourde down 22.8%

- Surinamese dollar down 32.8%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 67.8%

- Libyan Dinar down 70.4%

- Sudanese Pound down 87.6%