FX

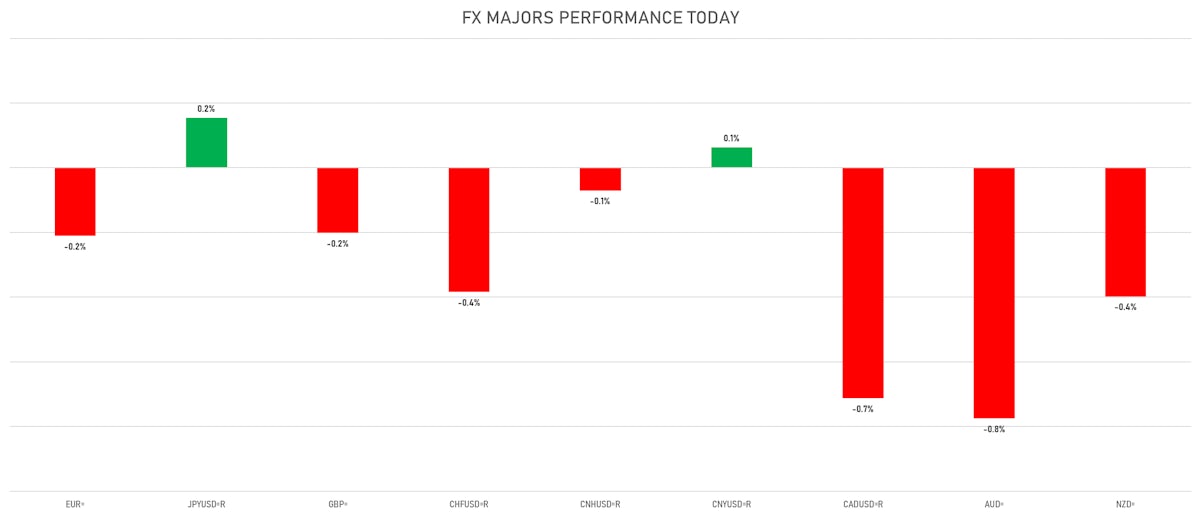

Major Currencies Down Today Against The Dollar, JPY The Exception

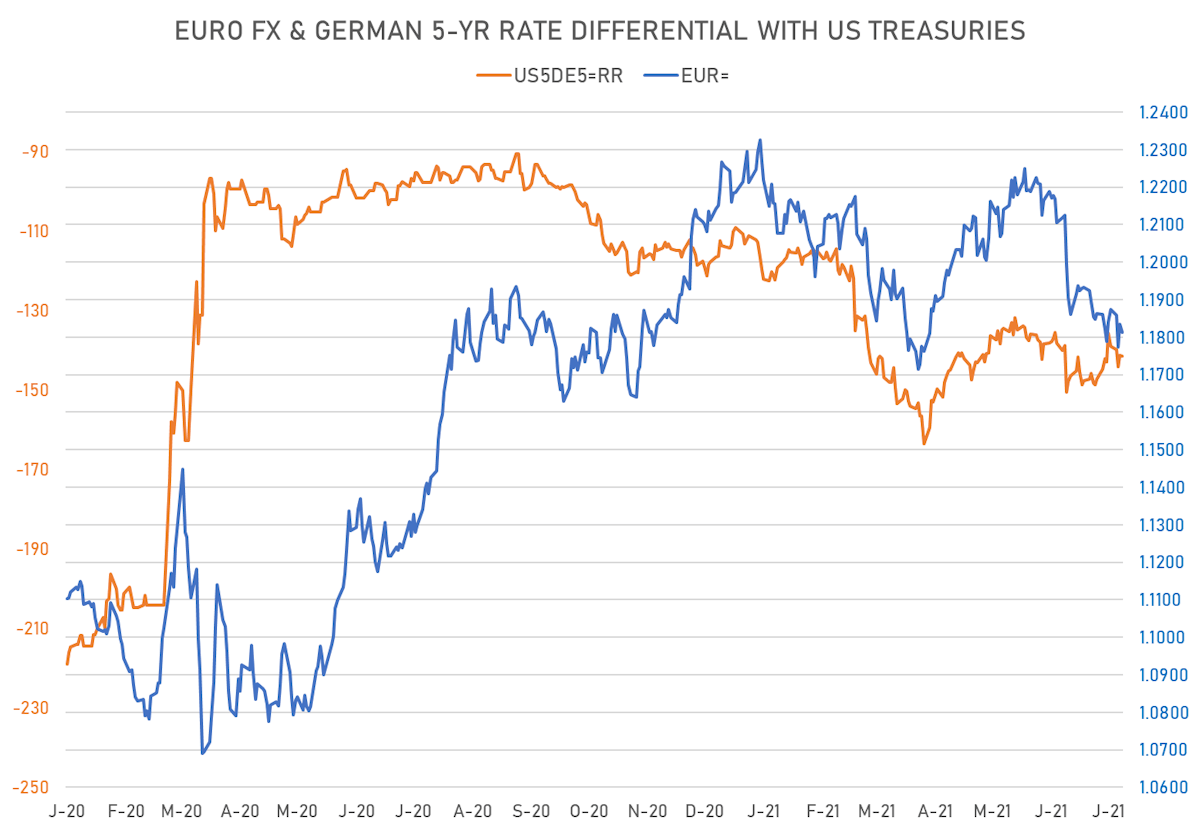

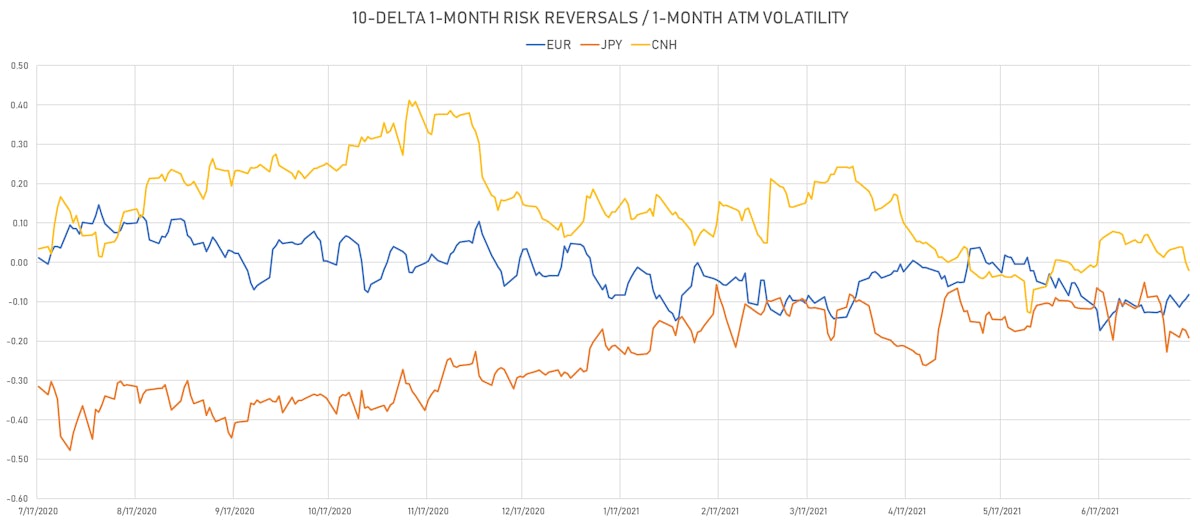

Recent moves in the euro are about nominal rates (rather than breakevens / real rates), as the market is more concerned about the potential paths of rate hikes than inflation at this point

Published ET

EURO 1-Month Implied Volatility Smile Only Slightly Skewed To The Downside | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

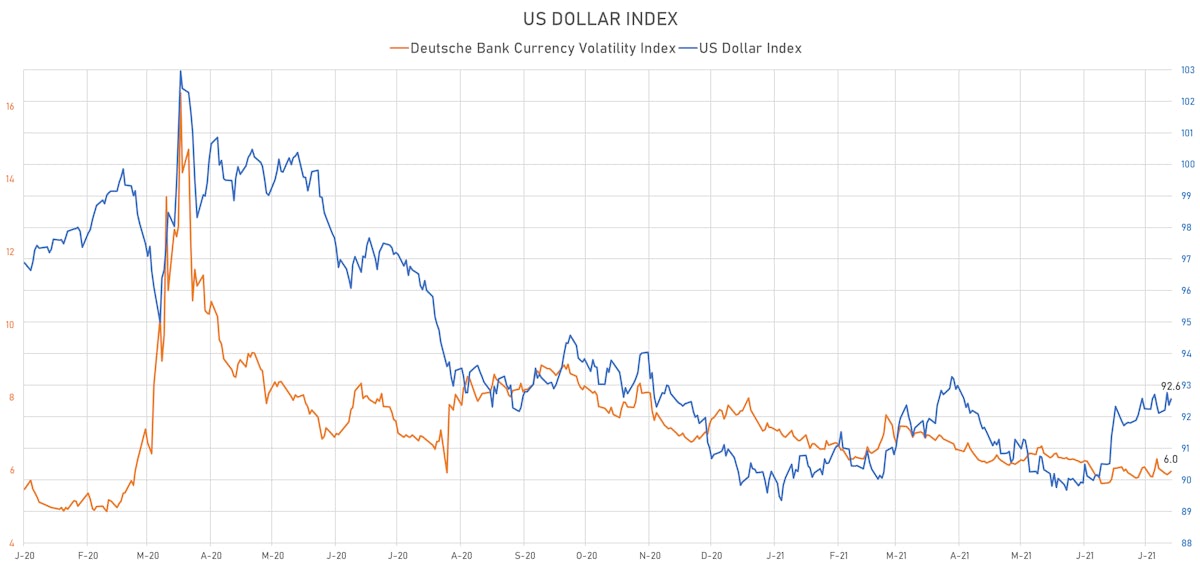

- The US Dollar Index is up 0.23% at 92.57 (YTD: +2.88%)

- Euro down 0.21% at 1.1810 (YTD: -3.3%)

- Yen up 0.15% at 109.79 (YTD: -5.9%)

- Onshore Yuan up 0.06% at 6.4569 (YTD: +1.0%)

- Swiss franc down 0.38% at 0.9177 (YTD: -3.6%)

- Sterling down 0.20% at 1.3828 (YTD: +1.1%)

- Canadian dollar down 0.71% at 1.2596 (YTD: +1.1%)

- Australian dollar down 0.78% at 0.7422 (YTD: -3.5%)

- NZ dollar down 0.40% at 0.7004 (YTD: -2.5%)

MACRO DATA RELEASES

- Australia, Employment, Absolute change for Jun 2021 (AU Bureau of Stat) at 29.10 k, below consensus estimate of 30.00 k

- Australia, Unemployment, Rate for Jun 2021 (AU Bureau of Stat) at 4.90 %, below consensus estimate of 5.00 %

- China (Mainland), GDP, Change Y/Y for Q2 2021 (NBS, China) at 7.90 %, below consensus estimate of 8.10 %

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Jun 2021 (NBS, China) at 12.60 %, above consensus estimate of 12.10 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Jun 2021 (NBS, China) at 12.10 %, above consensus estimate of 11.00 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Jun 2021 (ECB) at 869.05 Bln EUR

- Finland, Official reserve assets, Current Prices for Jun 2021 (Bank of Finland) at 11,239 Mln EUR

- Indonesia, Trade Balance, Current Prices for Jun 2021 (Statistics Indonesia) at 1.32 Bln USD, below consensus estimate of 2.23 Bln USD

- Italy, HICP, Final, Change P/P, Price Index for Jun 2021 (ISTAT, Italy) at 0.20 %, in line with consensus estimate

- Italy, HICP, Final, Change Y/Y, Price Index for Jun 2021 (ISTAT, Italy) at 1.30 %, ine line with consensus estimate

- New Zealand, CPI, Change P/P, Price Index for Q2 2021 (Statistics, NZ) at 1.30 %, above consensus estimate of 0.80 %

- Poland, CPI, Change P/P, Price Index for Jun 2021 (CSO, Poland) at 0.10 %

- Poland, CPI, Change Y/Y, Price Index for Jun 2021 (CSO, Poland) at 4.40 %

- South Korea, Policy Rates, Base Rate for Jul 2021 (The Bank of Korea) at 0.50 %, in line with consensus estimate

- United Kingdom, Unemployment, Claimant count, Absolute change for Jun 2021 (ONS, United Kingdom) at -114.80 k

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for May 2021 (ONS, United Kingdom) at 4.80 %, above consensus estimate of 4.70 %

- United States, Jobless Claims, National, Initial for W 10 Jul (U.S. Dept. of Labor) at 360.00 k, in line with consensus estimate

- United States, Philadelphia Fed, General business activity for Jul 2021 (FED, Philadelphia) at 21.90, below consensus estimate of 28.00

- United States, Production, Change P/P for Jun 2021 (FED, U.S.) at 0.40 %, below consensus estimate of 0.60 %

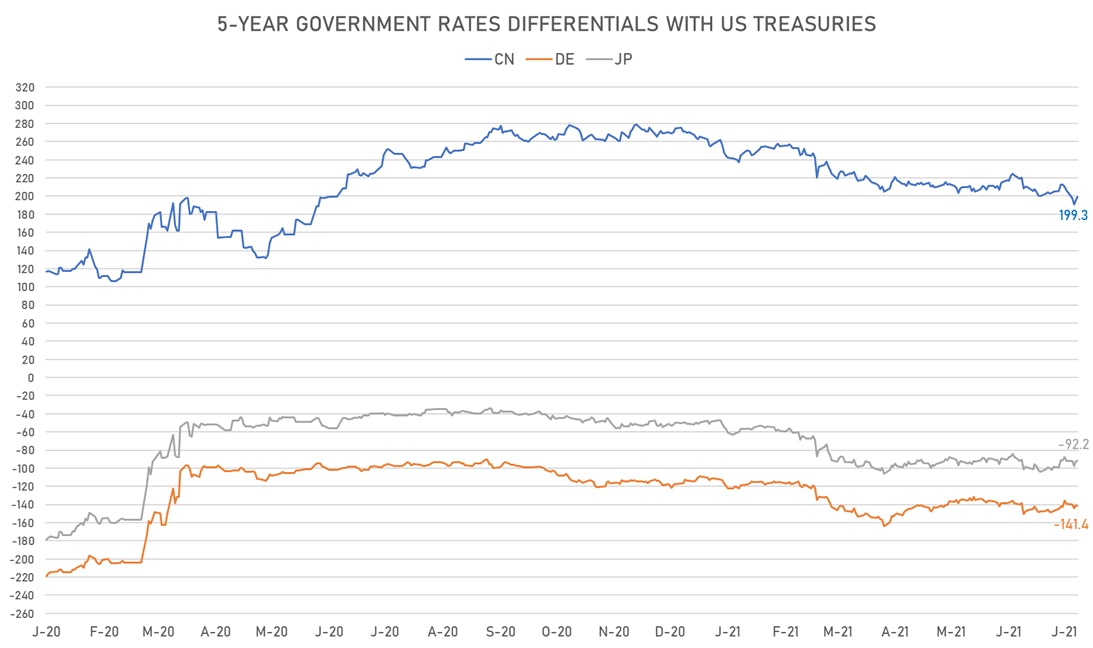

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 0.2 bp wider at -141.4 bp (YTD change: -30.3 bp), negative for the euro

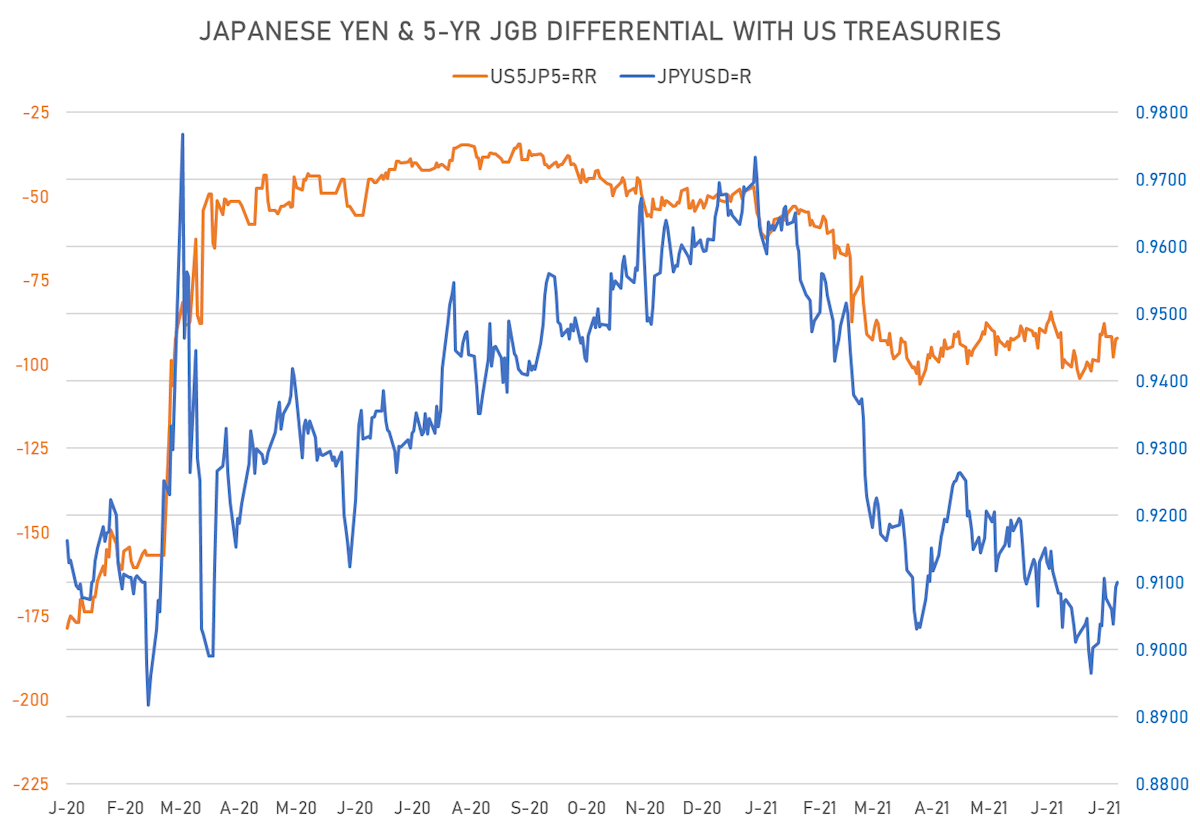

- 5Y Japan-US interest rates differential 0.3 bp tighter at -92.2 bp (YTD change: -43.9 bp), positive for the yen

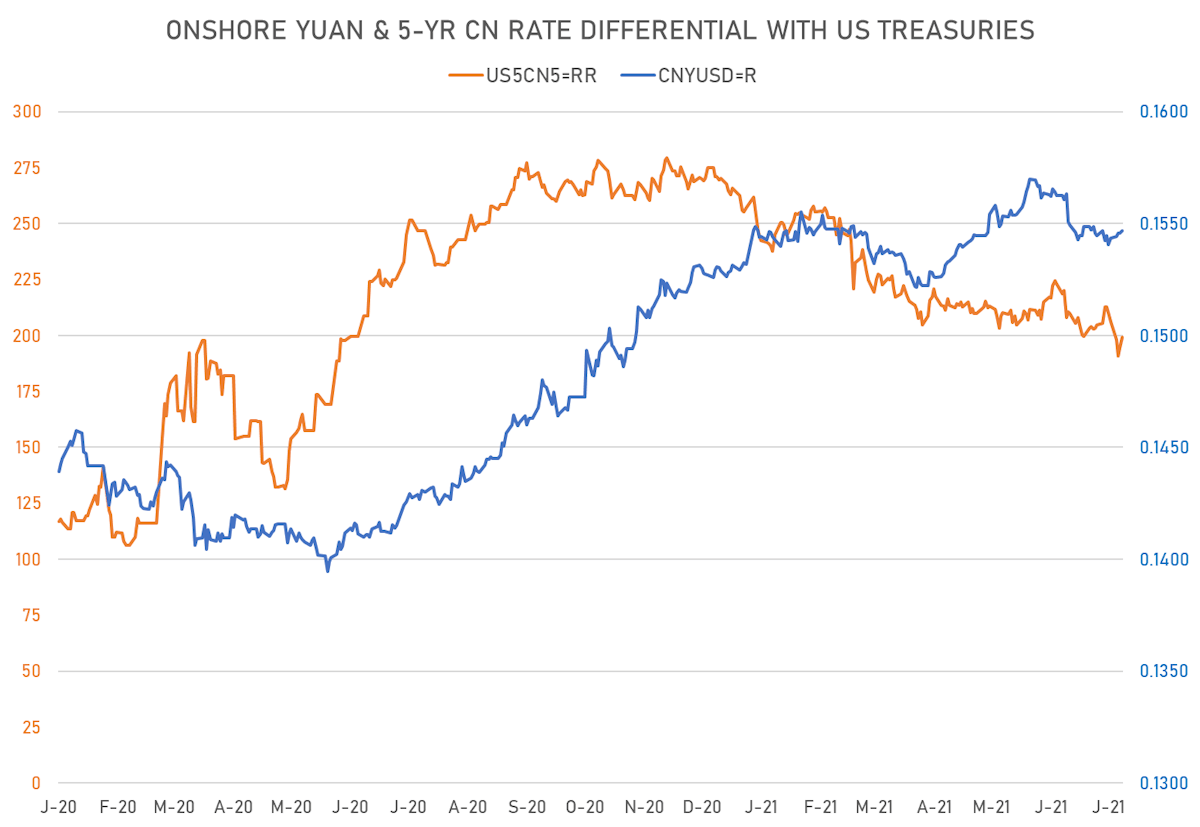

- 5Y China-US interest rates differential 5.0 bp wider at 199.3 bp (YTD change: -57.8 bp), positive for the yuan

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.96, up 0.04 (YTD: -1.21)

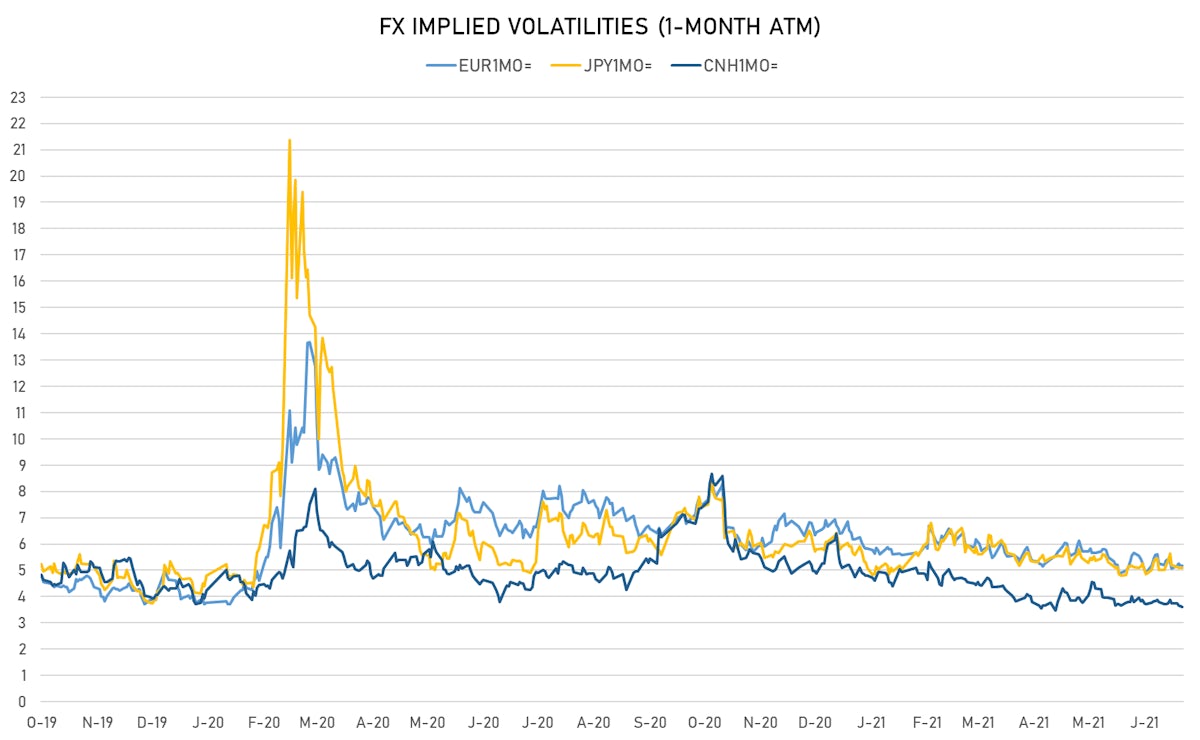

- Euro 1-Month At-The-Money Implied Volatility currently at 5.18, up 0.0 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.10, down 0.0 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.60, down 0.0 (YTD: -2.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Peru (rated BBB+): up 1.4 basis points to 82 bp (1Y range: 52-98bp)

- Government of Chile (rated A-): up 1.0 basis points to 64 bp (1Y range: 43-75bp)

- Panama (rated BBB-): up 0.9 basis points to 68 bp (1Y range: 44-97bp)

- South Africa (rated BB-): up 2.5 basis points to 198 bp (1Y range: 178-328bp)

- Pakistan (rated B-): down 4.5 basis points to 383 bp (1Y range: 362-512bp)

- Kenya (rated B+): down 5.0 basis points to 413 bp (1Y range: 394-454bp)

- Ecuador (rated WD): down 2.0 basis points to 164 bp (1Y range: 157-181bp)

- Ethiopia (rated CCC): down 5.0 basis points to 402 bp (1Y range: 383-442bp)

- Egypt (rated B+): down 4.9 basis points to 338 bp (1Y range: 283-437bp)

- Oman (rated BB-): down 13.0 basis points to 238 bp (1Y range: 223-485bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 18.1% (YTD: +46.9%)

- Afghani up 1.3% (YTD: -2.7%)

- Swaziland Lilageni up 1.1% (YTD: +0.8%)

- Namibian Dollar up 1.1% (YTD: +0.8%)

- Lesotho Loti up 1.1% (YTD: +0.9%)

- South Africa Rand up 1.1% (YTD: +0.8%)

- Haiti Gourde up 1.1% (YTD: -22.2%)

- Brazilian Real up 1.0% (YTD: +1.6%)

- Venezuela Bolivar down 3.3% (YTD: -67.8%)

- Malagasy Ariary down 4.9% (YTD: 0.0%)