FX

US Dollar Edged Up On A Very Quiet Summer Friday

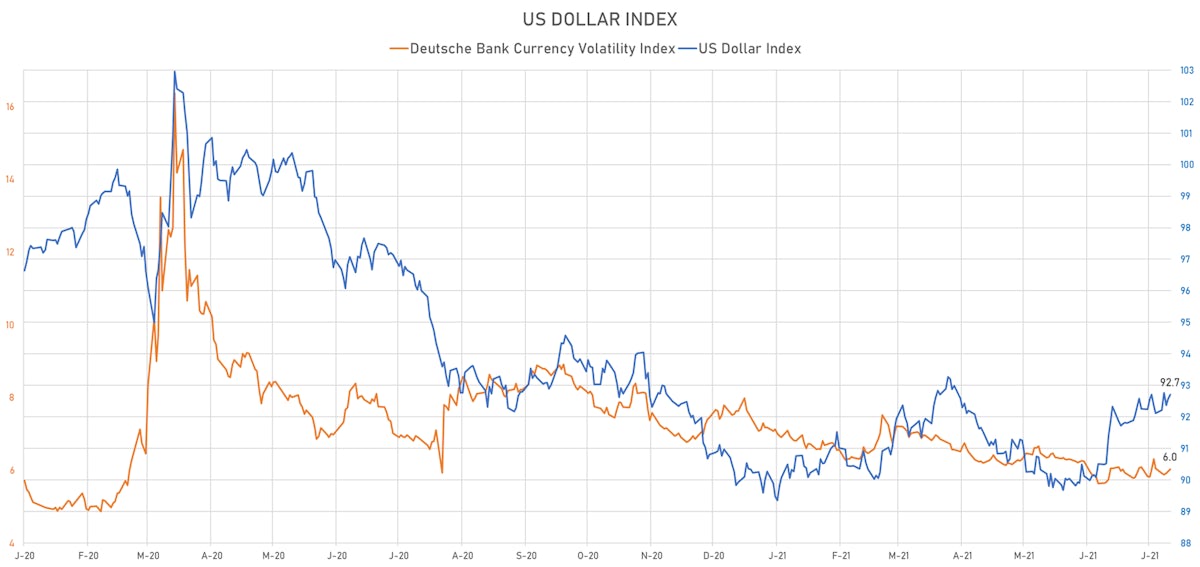

The focus of currency markets on uncertain global growth and changing monetary policies should be positive for the dollar until more clarity emerges about the relative paths of rates

Published ET

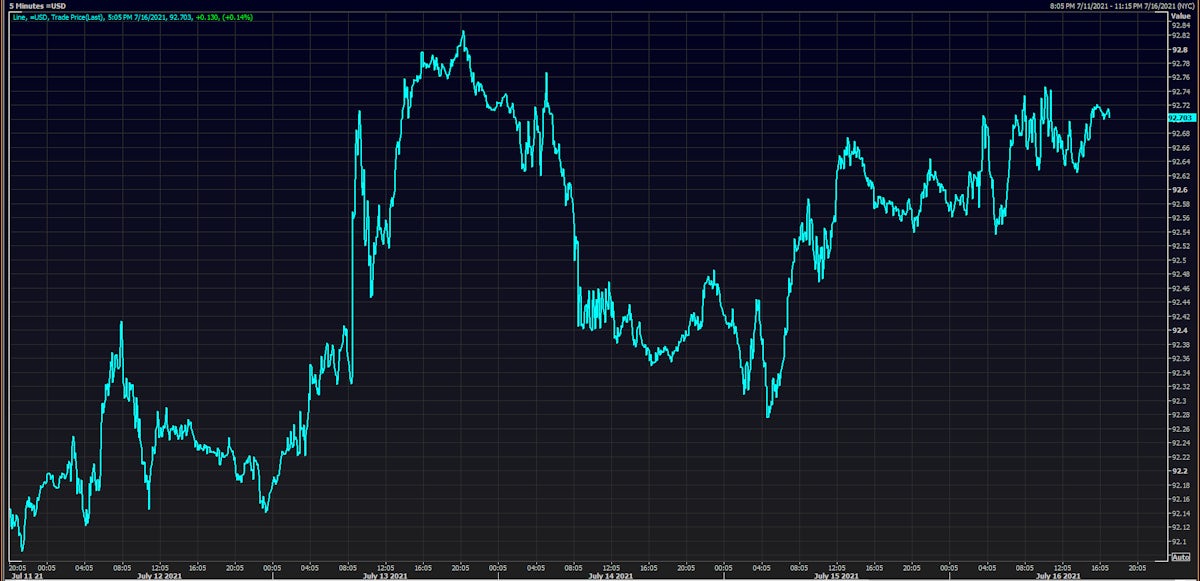

US Dollar Index This Week | Source: Refinitiv

QUICK SUMMARY

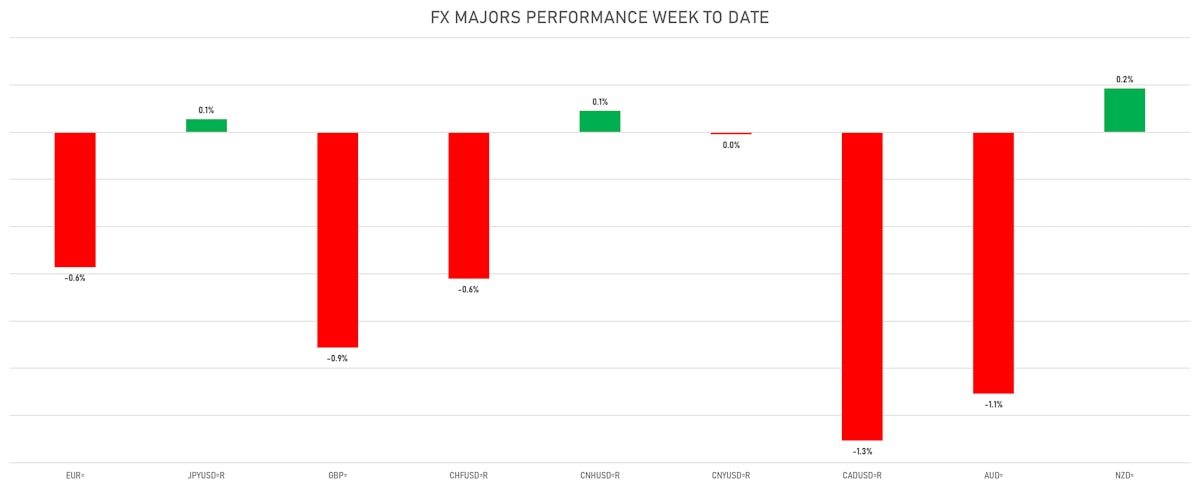

- The US Dollar Index is up 0.14% at 92.70 (YTD: +3.03%)

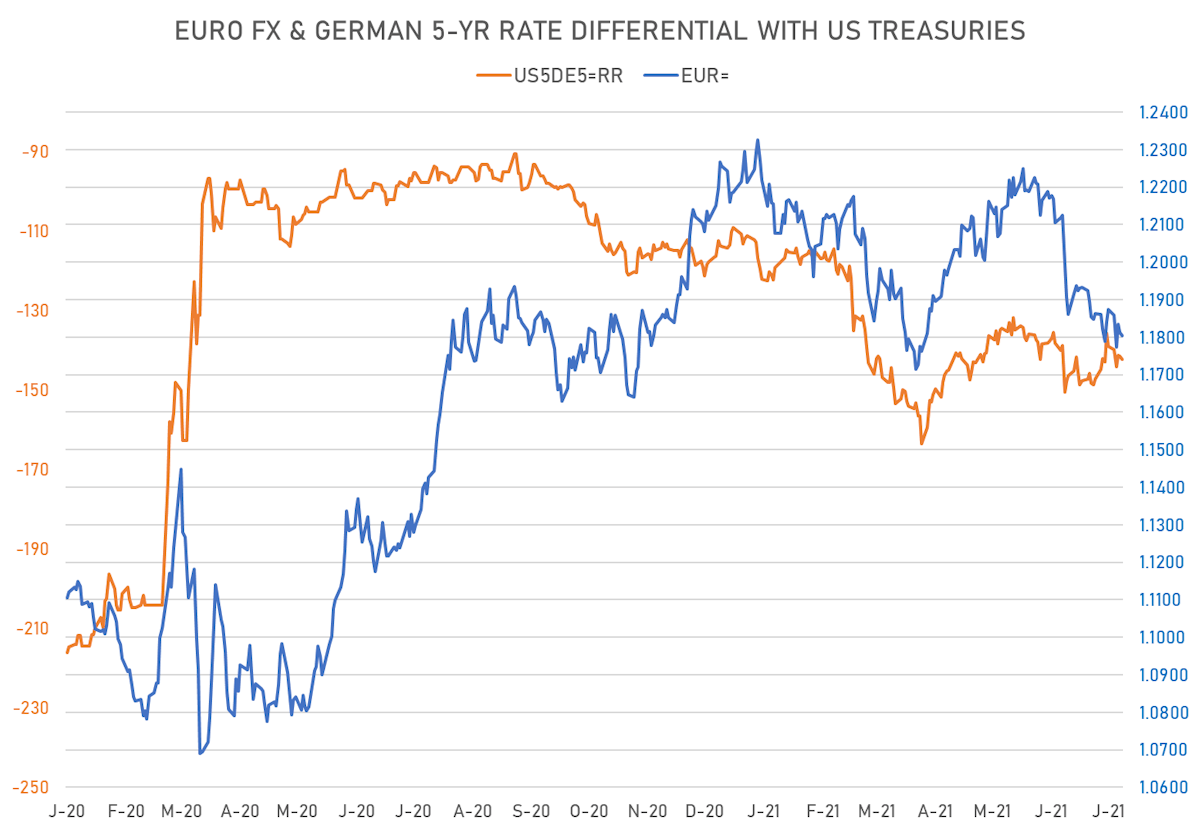

- Euro down 0.06% at 1.1805 (YTD: -3.3%)

- Yen down 0.20% at 110.08 (YTD: -6.2%)

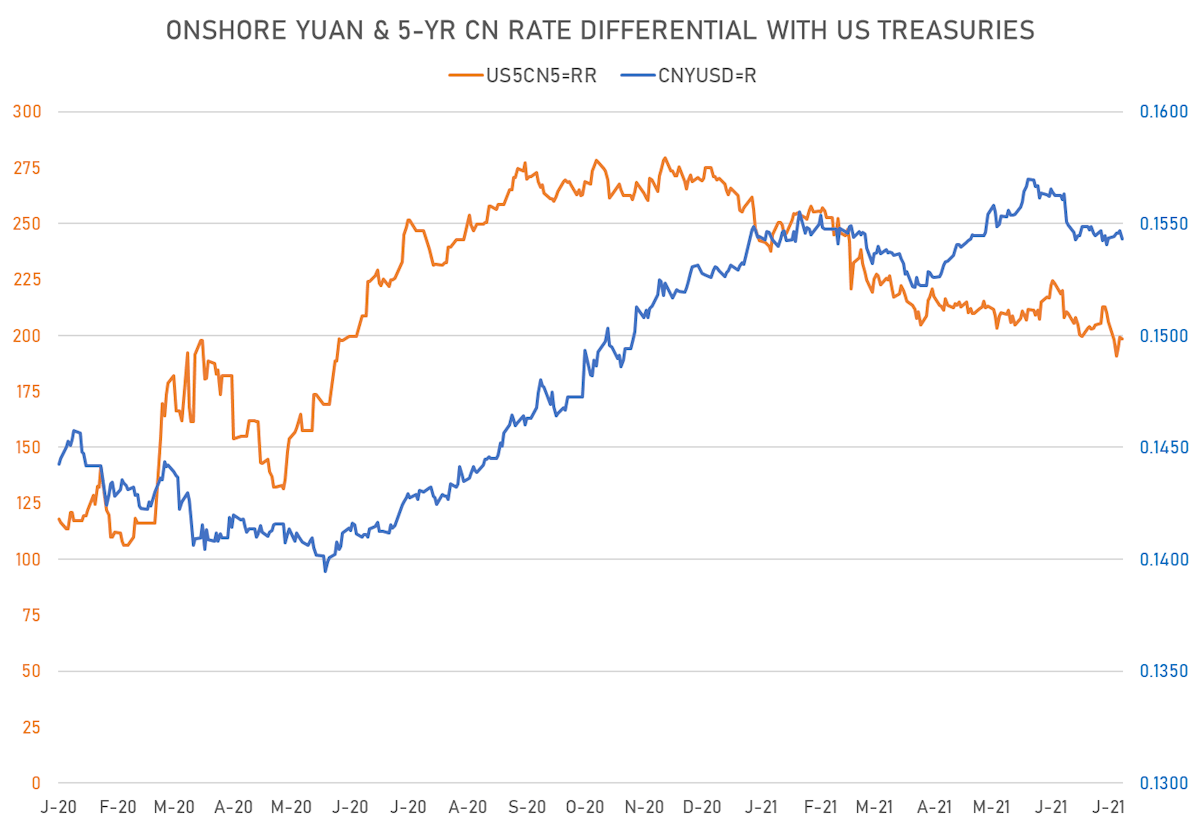

- Onshore Yuan down 0.23% at 6.4785 (YTD: +0.8%)

- Swiss franc down 0.19% at 0.9194 (YTD: -3.7%)

- Sterling down 0.40% at 1.3772 (YTD: +0.7%)

- Canadian dollar down 0.15% at 1.2611 (YTD: +1.0%)

- Australian dollar down 0.34% at 0.7402 (YTD: -3.8%)

- NZ dollar up 0.39% at 0.7008 (YTD: -2.5%)

WEEKLY CFTC POSITIONING DATA

- ALL CURRENCIES: increase in net short US$ positioning

- G10: increase in net short US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduced their net short US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

MACRO DATA RELEASES

- Austria, HICP, Change P/P, Price Index for Jun 2021 (Statistics Austria) at 0.20 %

- Austria, HICP, Change Y/Y for Jun 2021 (Statistics Austria) at 2.80 %

- Canada, Housing Starts, All areas for Jun 2021 (CMHC, Canada) at 282.10 k, above consensus estimate of 270.00 k

- Canada, Wholesale Trade, Sales, all trade groups, Change P/P for May 2021 (CANSIM, Canada) at 0.50 %, below consensus estimate of 1.10 %

- Euro Zone, CPI, Change P/P, Price Index for Jun 2021 (Eurostat) at 0.30 %, in line with consensus estimate

- Euro Zone, CPI, Change Y/Y for Jun 2021 (Eurostat) at 1.90 %, in line with consensus estimate

- Euro Zone, CPI, Total excluding energy, food, alcohol and tobacco, Change Y/Y for Jun 2021 (Eurostat) at 0.90 %, in line with consensus estimate

- Euro Zone, HICP, Overall index excluding energy, food, alcohol and tobacco, Change P/P for Jun 2021 (Eurostat) at 0.30 %, in line with consensus estimate

- Japan, Policy Rates, Bank Of Japan Policy Rate Balance for 16 Jul (Bank of Japan) at -0.10 %, in line with consensus estimate

- Nigeria, CPI, Change Y/Y for Jun 2021 (NBS, Nigeria) at 17.75 %

- Nigeria, CPI, Food, Change Y/Y, Price Index for Jun 2021 (NBS, Nigeria) at 21.83 %

- Poland, Core CPI, Excluding food and energy prices, Change Y/Y, Price Index for Jun 2021 (Central Bank, Poland) at 3.50 %, below consensus estimate of 3.60 %

- Russia, Producer Prices, Change P/P for Jun 2021 (RosStat, Russia) at 2.90 %

- Singapore, Exports, Domestic non-oil, Change Y/Y for Jun 2021 (Statistics Singapore) at 15.90 %, above consensus estimate of 9.70 %

- Singapore, Exports, Non-oil domestic exports, Change P/P for Jun 2021 (Statistics Singapore) at 6.00 %, above consensus estimate of 2.10 %

- Slovakia, HICP, Change P/P, Price Index for Jun 2021 (Stat Office of SR) at 0.40 %, in line with consensus estimate

- Slovakia, HICP, Change Y/Y, Price Index for Jun 2021 (Stat Office of SR) at 2.50 %, above consensus estimate of 2.40 %

- United States, Overall, Total business inventories, Change P/P for May 2021 (U.S. Census Bureau) at 0.50 %, in line with consensus estimate

- United States, Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.10 %, above consensus estimate of 0.40 %

- United States, Retail Sales, Total including food services, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.60 %, above consensus estimate of -0.40 %

- United States, Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.30 %, above consensus estimate of 0.40 %

- United States, University of Michigan, Total-prelim, Volume Index for Jul 2021 (UMICH, Survey) at 80.80, below consensus estimate of 86.50

KEY GLOBAL RATES DIFFERENTIALS

- 5Y German-US interest rates differential 0.9 bp wider at -142.4 bp (YTD change: -31.3 bp), negative for the euro

- 5Y Japan-US interest rates differential 1.6 bp tighter at -90.7 bp (YTD change: -42.4 bp), positive for the yen

- 5Y China-US interest rates differential 0.8 bp tighter at 198.6 bp (YTD change: -58.6 bp), negative for the yuan

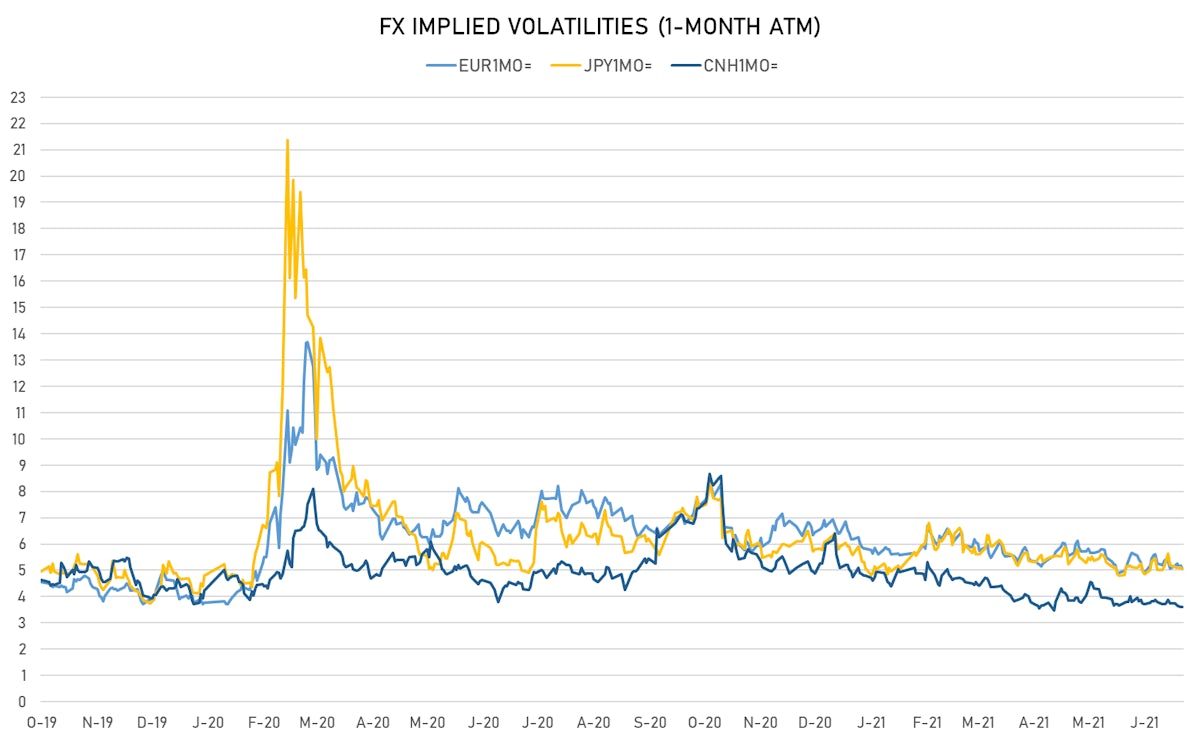

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.02, up 0.06 (YTD: -1.15)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.08, down -0.1 (YTD: -1.6)

- Japanese Yen 1M ATM IV unchanged at 5.05 (YTD: -1.1)

- Offshore Yuan 1M ATM IV unchanged at 3.60 (YTD: -2.4)

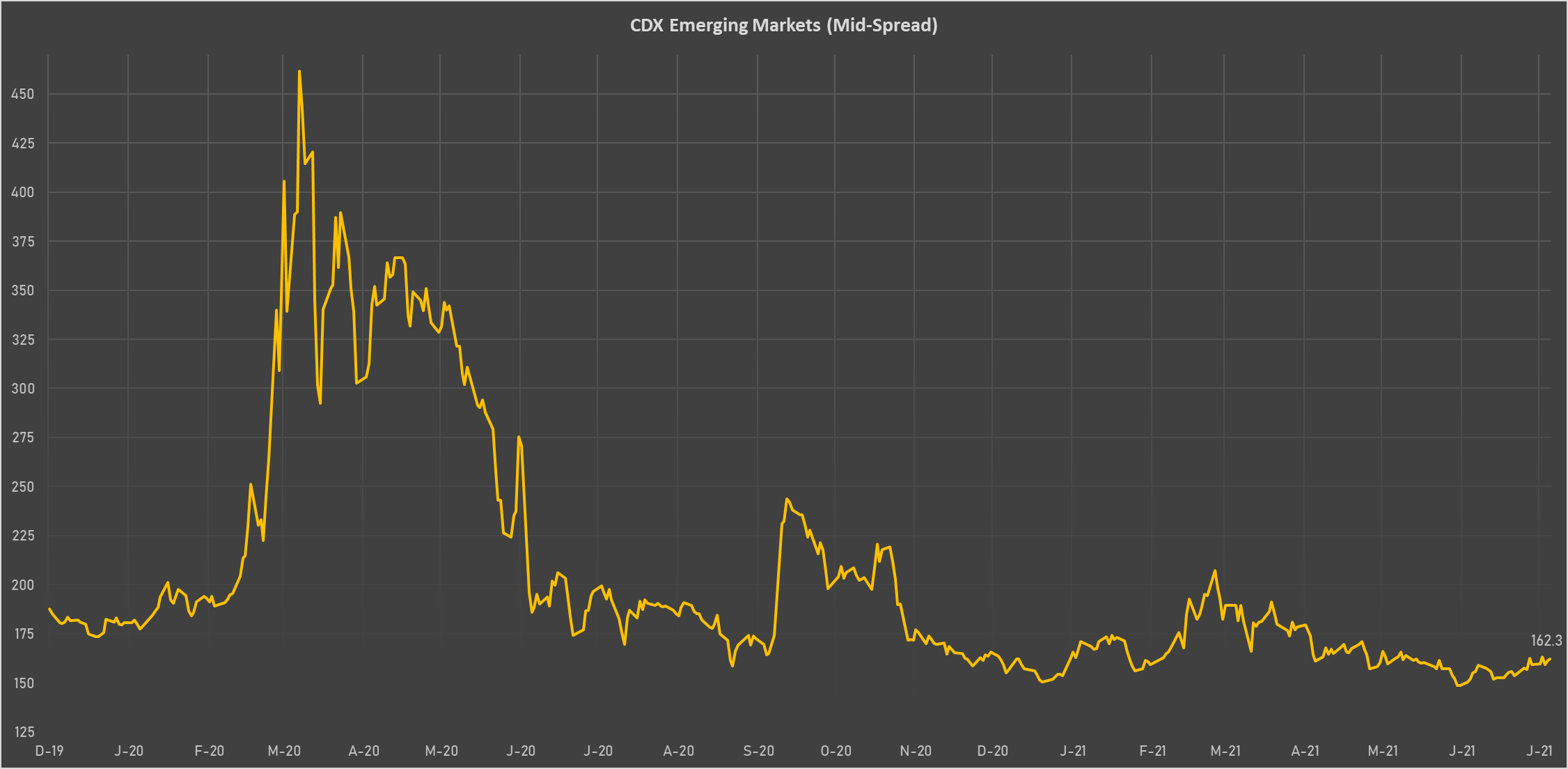

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Indonesia (rated BBB): up 0.6 basis points to 77 bp (1Y range: 66-126bp)

- Senegal (rated ): down 1.5 basis points to 371 bp (1Y range: 355-409bp)

- Russia (rated BBB): down 0.3 basis points to 85 bp (1Y range: 72-129bp)

- Nigeria (rated B): down 1.5 basis points to 347 bp (1Y range: 333-383bp)

- Turkey (rated BB-): down 2.6 basis points to 379 bp (1Y range: 282-597bp)

- Argentina (rated CCC): down 17.3 basis points to 1,907 bp (1Y range: 1,049-1,968bp)

- Saudi Arabia (rated A): down 0.6 basis points to 55 bp (1Y range: 52-101bp)

- Panama (rated BBB-): down 0.7 basis points to 67 bp (1Y range: 44-97bp)

- Colombia (rated BB+): down 1.8 basis points to 143 bp (1Y range: 83-164bp)

- South Africa (rated BB-): down 3.3 basis points to 194 bp (1Y range: 178-328bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 3.2% (YTD: -0.2%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Peru Sol up 1.6% (YTD: -7.4%)

- Mozambique metical up 1.6% (YTD: +17.3%)

- Rwanda Franc up 1.4% (YTD: -0.1%)

- Azerbaijan New Manat down 1.2% (YTD: -1.2%)

- Chilean Peso down 1.6% (YTD: -6.2%)

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

- Nicaragua Cordoba down 2.6% (YTD: -2.6%)

- Venezuela Bolivar down 3.4% (YTD: -68.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 22.9%

- Mozambique metical up 17.3%

- Argentine Peso down 12.6%

- Turkish Lira down 12.8%

- Haiti Gourde down 22.0%

- Surinamese dollar down 33.0%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 68.9%

- Libyan Dinar down 70.4%

- Sudanese Pound down 87.6%