FX

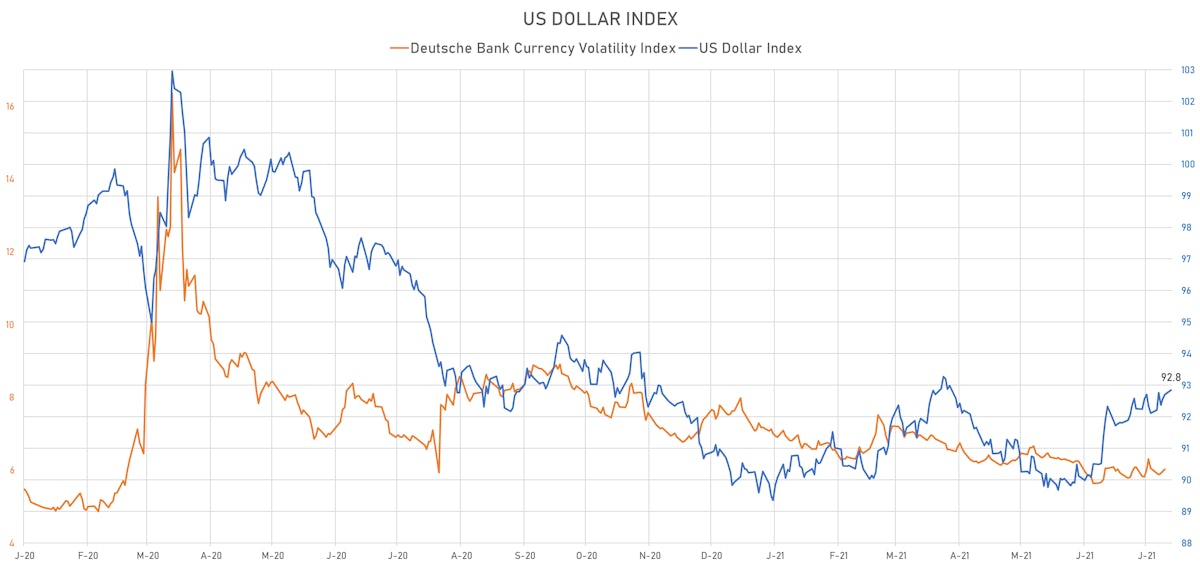

Broad Rise Of The US Dollar Despite Fall In Rates

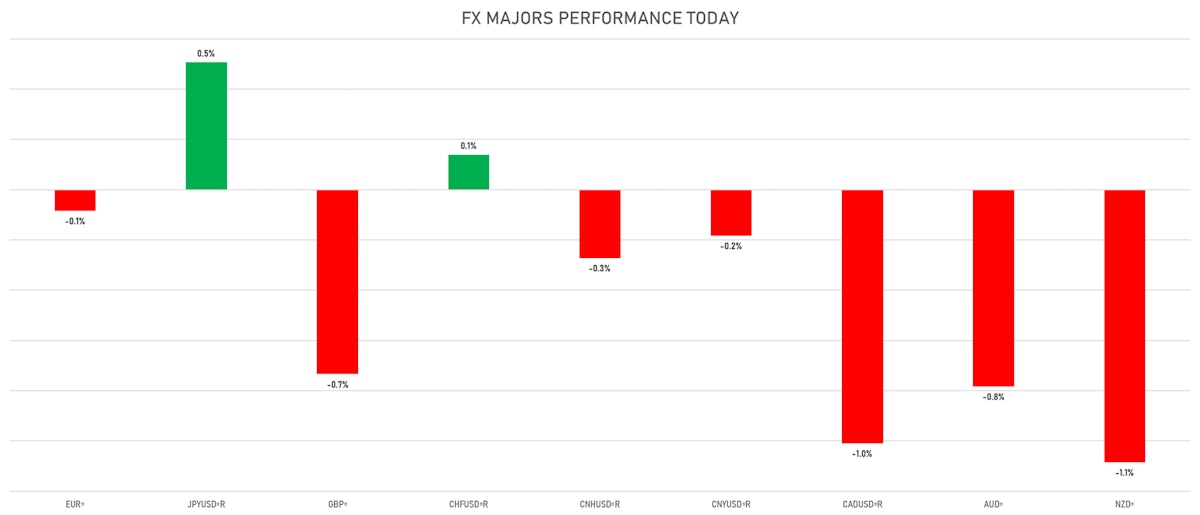

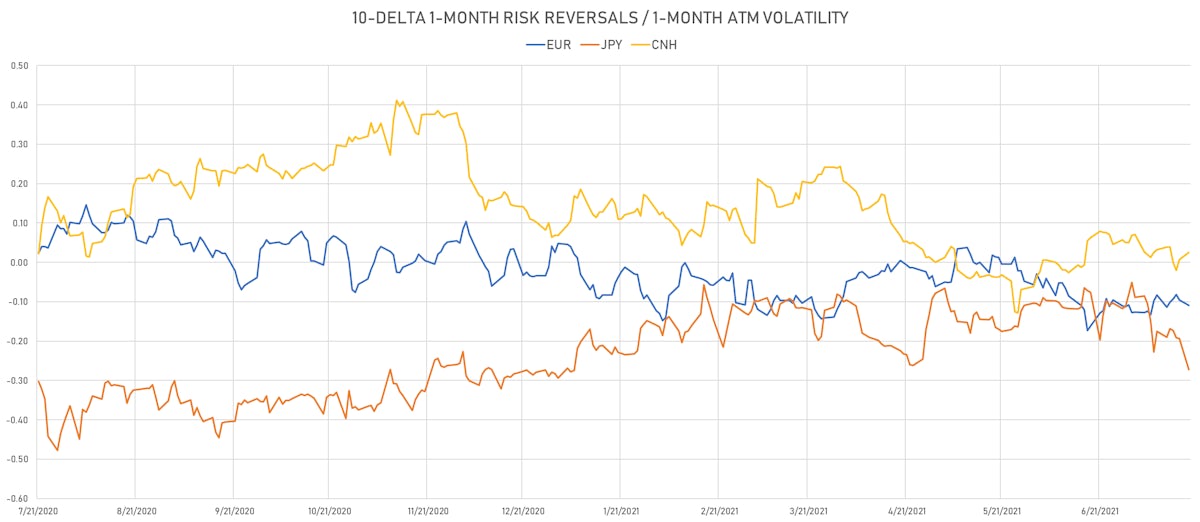

The Japanese Yen was the lone winner among major currencies, with 1-month risk reversals showing some speculative expectation of further gains

Published ET

US Dollar Index Intraday Prices | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is up 0.16% at 92.85 (YTD: +3.19%)

- Euro down 0.08% at 1.1796 (YTD: -3.4%)

- Yen up 0.50% at 109.50 (YTD: -5.7%)

- Onshore Yuan down 0.18% at 6.4893 (YTD: +0.6%)

- Swiss franc up 0.12% at 0.9184 (YTD: -3.6%)

- Sterling down 0.73% at 1.3671 (YTD: 0.0%)

- Canadian dollar down 1.05% at 1.2743 (YTD: -0.1%)

- Australian dollar down 0.80% at 0.7343 (YTD: -4.6%)

- NZ dollar down 1.06% at 0.6934 (YTD: -3.5%)

MACRO DATA RELEASES

- Japan, CPI, Nationwide, All Items, Change Y/Y for Jun 2021 (MIC, Japan) at 0.20 %

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Jun 2021 (MIC, Japan) at 0.20 %, in line with consensus estimate

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Jun 2021 (CSO, Poland) at 2.80 %, above consensus estimate of 2.70 %

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Jun 2021 (CSO, Poland) at 9.80 %, above consensus estimate of 9.30 %

- United States, NAHB/Wells Fargo Housing Market Index for Jul 2021 (NAHB, United States) at 80.00, below consensus estimate of 82.00

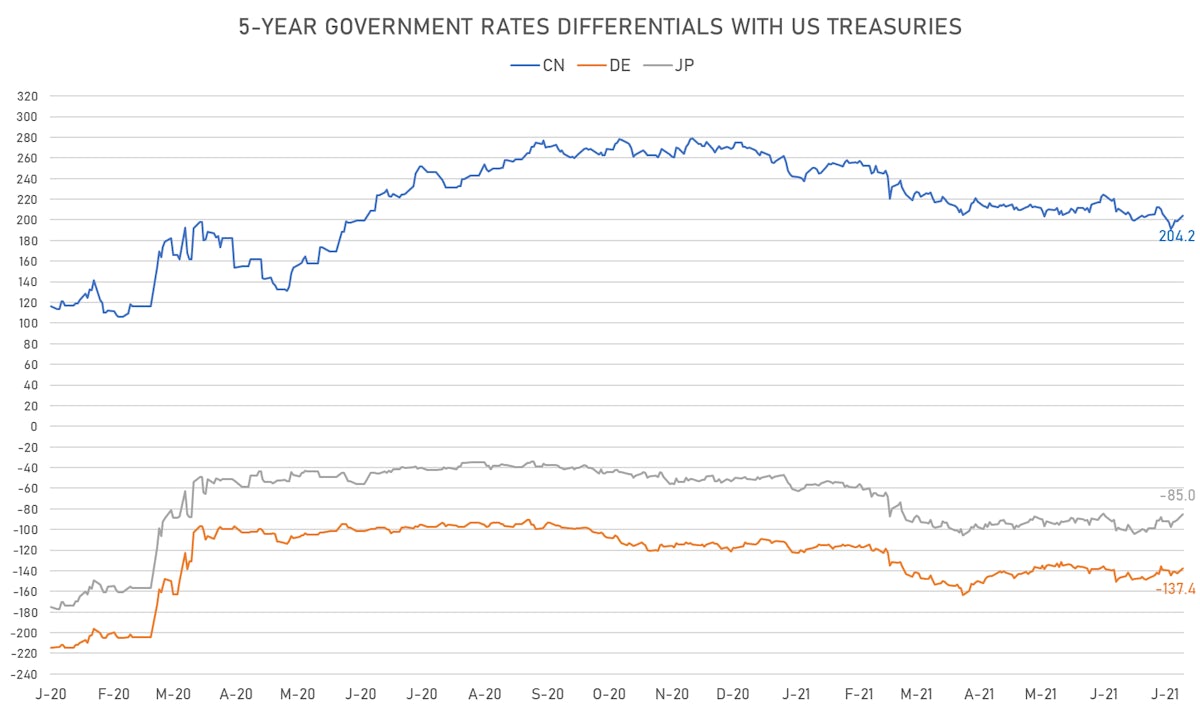

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.0 bp at 137.4 bp (YTD change: +26.3 bp)

- US-JAPAN: -5.7 bp at 85.0 bp (YTD change: +36.7 bp)

- US-CHINA: -5.6 bp at -204.2 bp (YTD change: +53.0 bp)

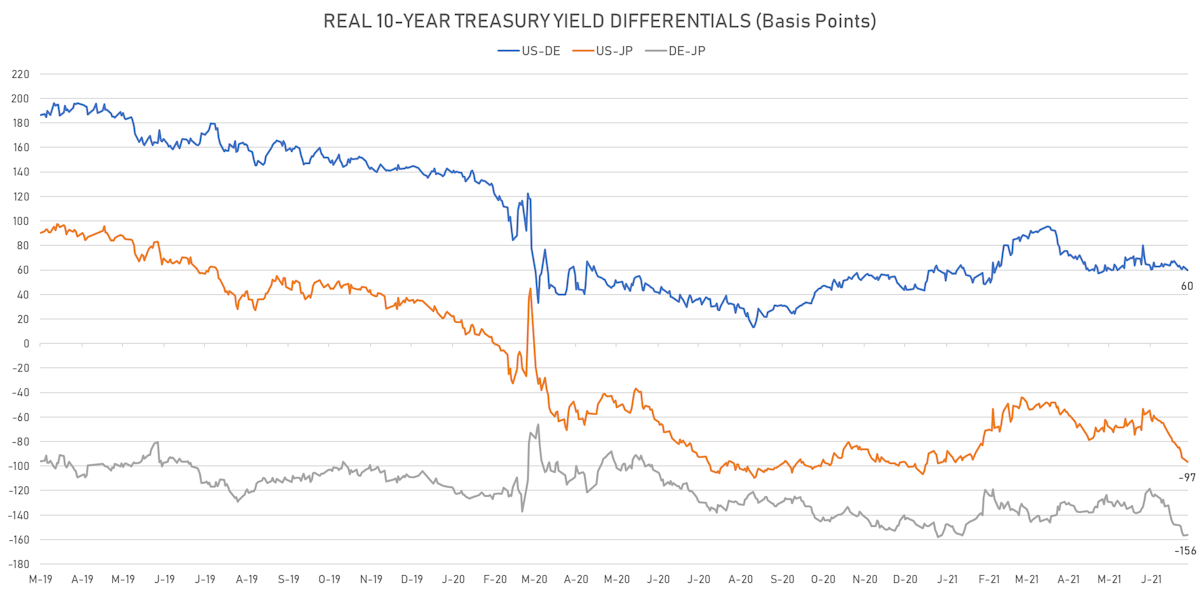

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.2 bp at 59.6 bp (YTD change: +13.5bp)

- US-JAPAN: -2.7 bp at -96.6 bp (YTD change: +4.9bp)

- JAPAN-GERMANY: -0.5 bp at 156.2 bp (YTD change: +8.6bp)

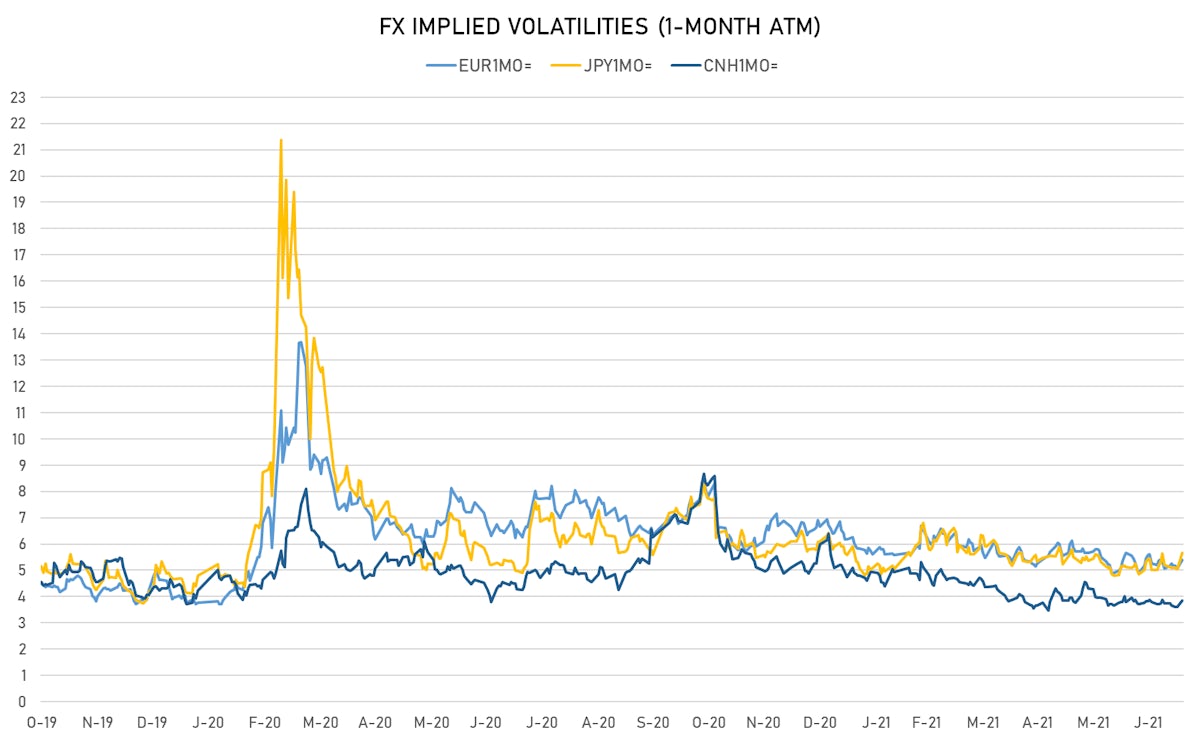

IMPLIED VOLATILITIES TODAY

- Euro 1-Month At-The-Money Implied Volatility currently at 5.40, up 0.3 (YTD: -1.3)

- Japanese Yen 1M ATM IV currently at 5.67, up 0.6 (YTD: -0.4)

- Offshore Yuan 1M ATM IV currently at 3.86, up 0.3 (YTD: -2.1)

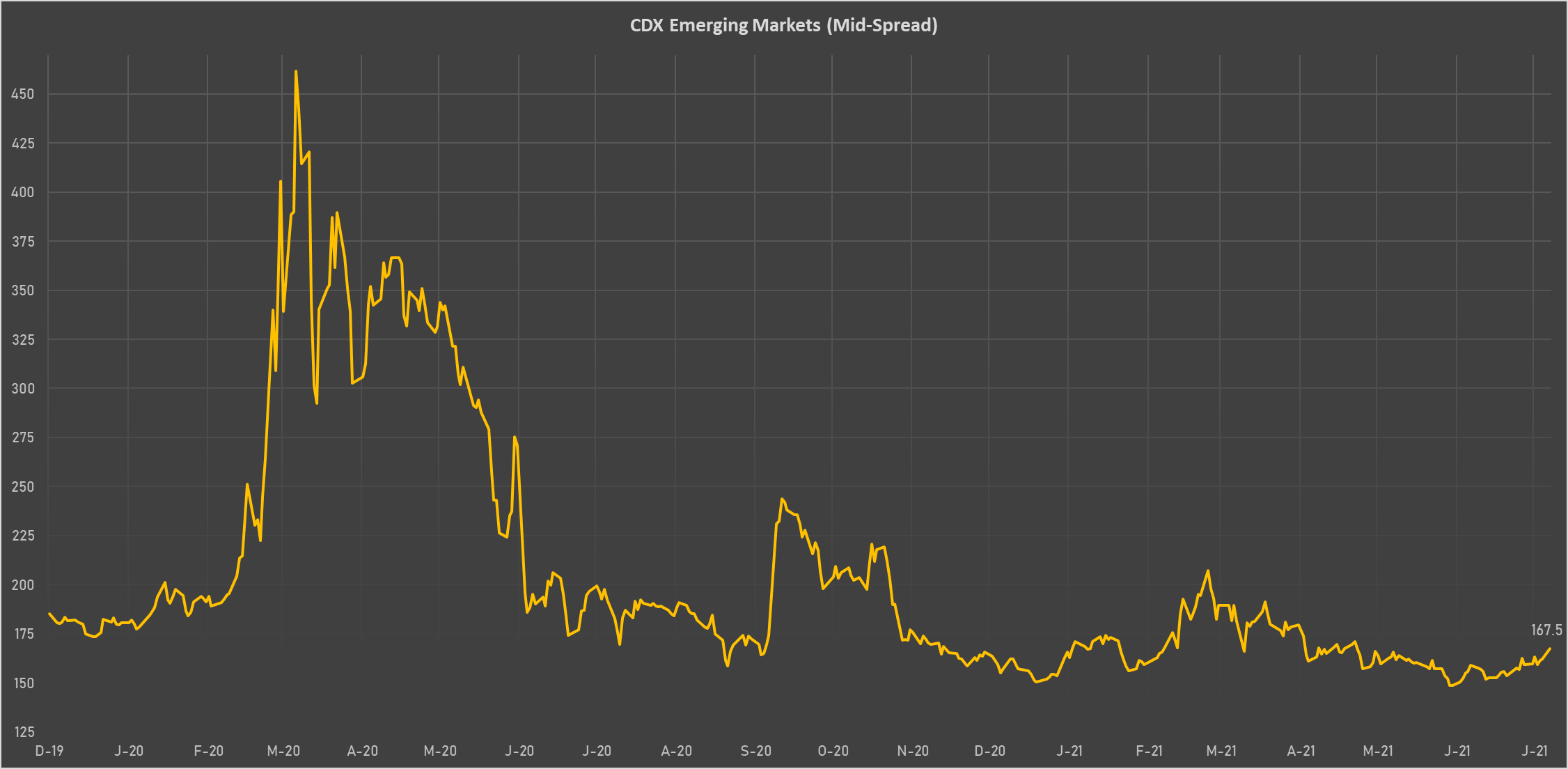

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Mexico (rated BBB-): up 5.2 basis points to 98 bp (1Y range: 79-164bp)

- Russia (rated BBB): up 3.8 basis points to 89 bp (1Y range: 72-129bp)

- United Arab Emirates (rated AA-): up 2.5 basis points to 63 bp (1Y range: 50-63bp)

- Panama (rated BBB-): up 2.5 basis points to 70 bp (1Y range: 44-95bp)

- South Africa (rated BB-): up 7.1 basis points to 205 bp (1Y range: 178-328bp)

- Indonesia (rated BBB): up 2.7 basis points to 79 bp (1Y range: 66-123bp)

- Colombia (rated BB+): up 5.1 basis points to 149 bp (1Y range: 83-164bp)

- Peru (rated BBB+): up 2.8 basis points to 85 bp (1Y range: 52-98bp)

- Government of Chile (rated A-): up 2.0 basis points to 66 bp (1Y range: 43-75bp)

- Bahrain (rated B+): up 7.2 basis points to 236 bp (1Y range: 159-335bp)

LARGEST FX MOVES TODAY

- Malagasy Ariary up 3.8% (YTD: +3.8%)

- Surinamese dollar up 3.4% (YTD: -30.3%)

- Qatari Riyal up 1.8% (YTD: 0.0%)

- New Zealand $ down 1.1% (YTD: -3.5%)

- Philippine Peso down 1.1% (YTD: -5.7%)

- Norwegian Krone down 1.2% (YTD: -4.1%)

- Peru Sol down 1.4% (YTD: -8.7%)

- CFA Franc BCEAO down 1.5% (YTD: -5.2%)

- Brazilian Real down 2.6% (YTD: -1.1%)

- Seychelles rupee down 3.3% (YTD: +40.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 40.8%

- Mozambique metical up 15.4%

- Ethiopian Birr down 11.1%

- Argentine Peso down 12.7%

- Turkish Lira down 13.5%

- Haiti Gourde down 22.2%

- Surinamese dollar down 30.3%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Sudanese Pound down 87.6%