FX

US Dollar Edges Higher On Rates Rebound

The Canadian dollar did well today, and has had a meaningful beta to US equity markets lately, making it a cheaper potential proxy for bearish SPX bets

Published ET

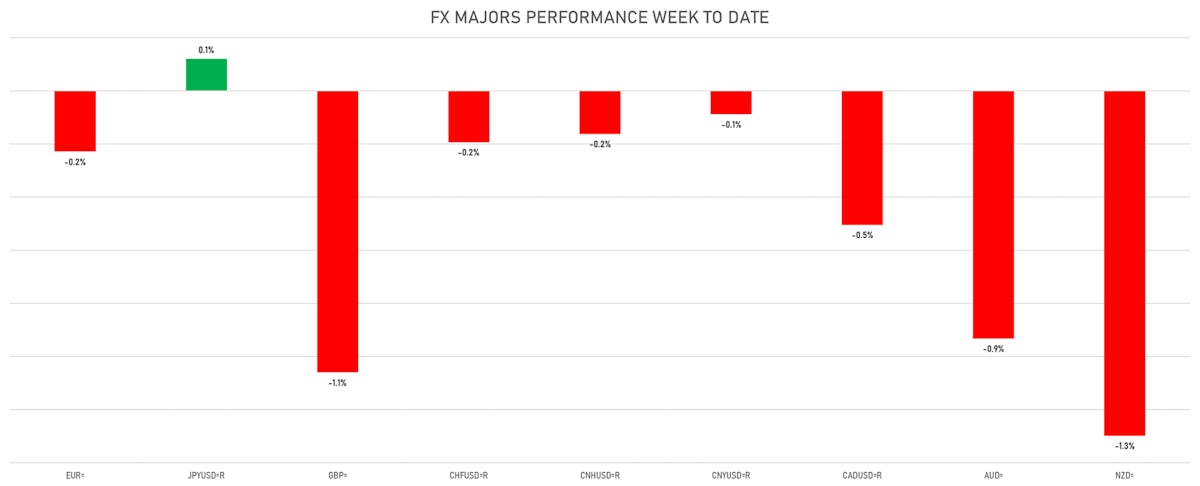

FX Majors Today | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.12% at 92.96 (YTD: +3.31%)

- Euro down 0.17% at 1.1778 (YTD: -3.6%)

- Yen down 0.42% at 109.91 (YTD: -6.1%)

- Onshore Yuan up 0.10% at 6.4845 (YTD: +0.7%)

- Swiss franc down 0.37% at 0.9213 (YTD: -3.9%)

- Sterling down 0.34% at 1.3626 (YTD: -0.3%)

- Canadian dollar up 0.59% at 1.2677 (YTD: +0.5%)

- Australian dollar down 0.12% at 0.7333 (YTD: -4.7%)

- NZ dollar down 0.37% at 0.6917 (YTD: -3.7%)

MACRO DATA RELEASES

- Czech Republic, Producer Prices, Change P/P, Price Index for Jun 2021 (CSU, Czech Rep) at 0.80 %, above consensus estimate of 0.70 %

- Czech Republic, Producer Prices, Change Y/Y, Price Index for Jun 2021 (CSU, Czech Rep) at 6.10 %, above consensus estimate of 5.90 %

- Germany, Producer Prices, Total industry, Change P/P, Price Index for Jun 2021 (Destatis) at 1.30 %, above consensus estimate of 1.10 %

- Germany, Producer Prices, Total industry, Change Y/Y, Price Index for Jun 2021 (Destatis) at 8.50 %, above consensus estimate of 8.40 %

- New Zealand, Milk Auction, Average Price, Constant Prices for W 20 Jul (GlobalDairy Trade) at US$ 3,839.00

- Poland, Producer Prices, Total industry, Change Y/Y for Jun 2021 (CSO, Poland) at 7.00 %, above consensus estimate of 6.80 %

- Poland, Production, Change Y/Y for Jun 2021 (CSO, Poland) at 18.40 %, below consensus estimate of 19.00 %

- Taiwan, Export Orders Received, Change Y/Y for Jun 2021 (MoEA, Taiwan) at 31.10 %, above consensus estimate of 29.45 %

- United States, Building Permits for Jun 2021 (U.S. Census Bureau) at 1.60 Mln, below consensus estimate of 1.70 Mln

- United States, Housing Starts for Jun 2021 (U.S. Census Bureau) at 1.64 Mln, above consensus estimate of 1.59 Mln

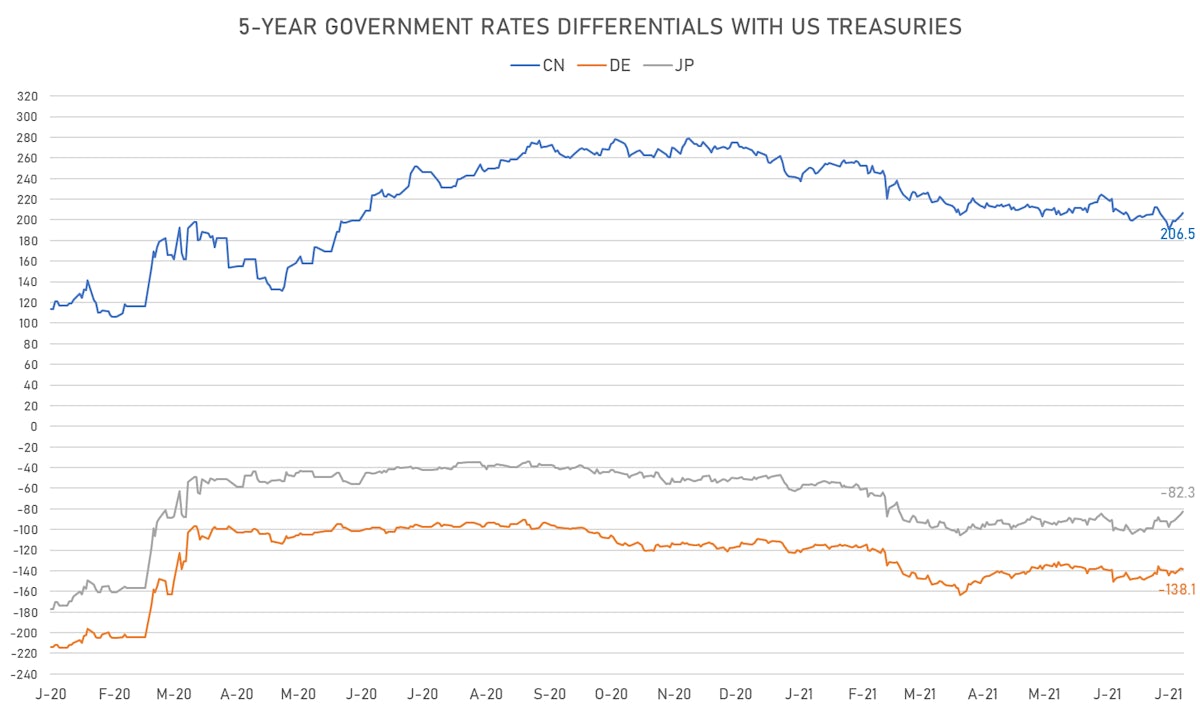

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.8 bp at 138.1 bp (YTD change: +27.0 bp)

- US-JAPAN: -2.7 bp at 82.3 bp (YTD change: +34.0 bp)

- US-CHINA: -2.3 bp at -206.5 bp (YTD change: +50.6 bp)

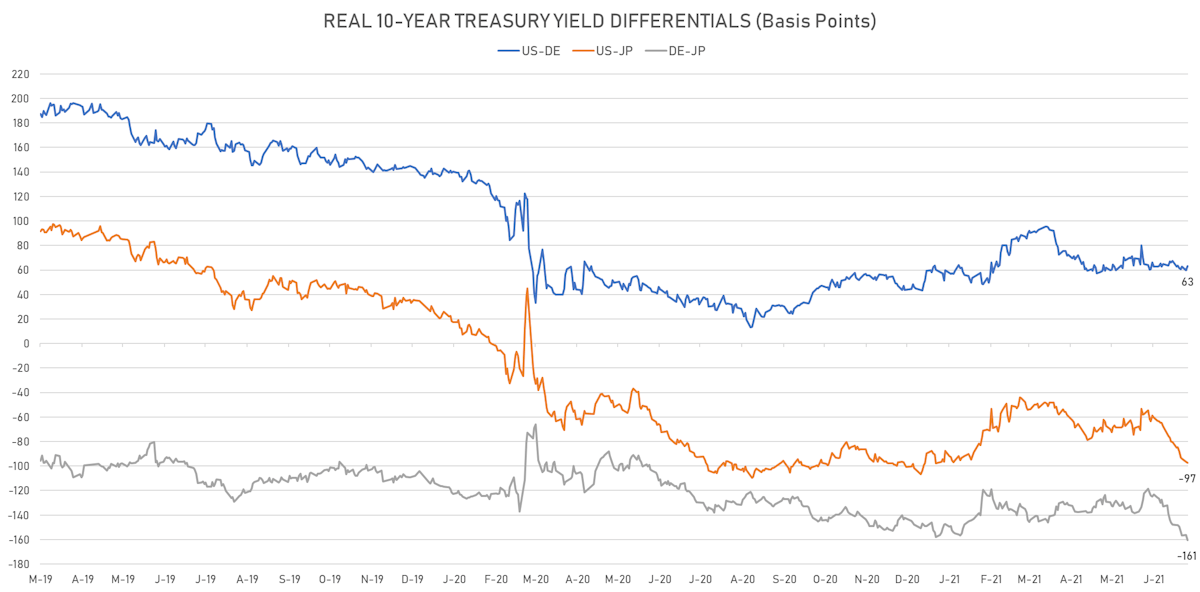

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.6 bp at 63.2 bp (YTD change: +17.1bp)

- US-JAPAN: -0.7 bp at -97.3 bp (YTD change: +4.2bp)

- JAPAN-GERMANY: +4.3 bp at 160.5 bp (YTD change: +12.9bp)

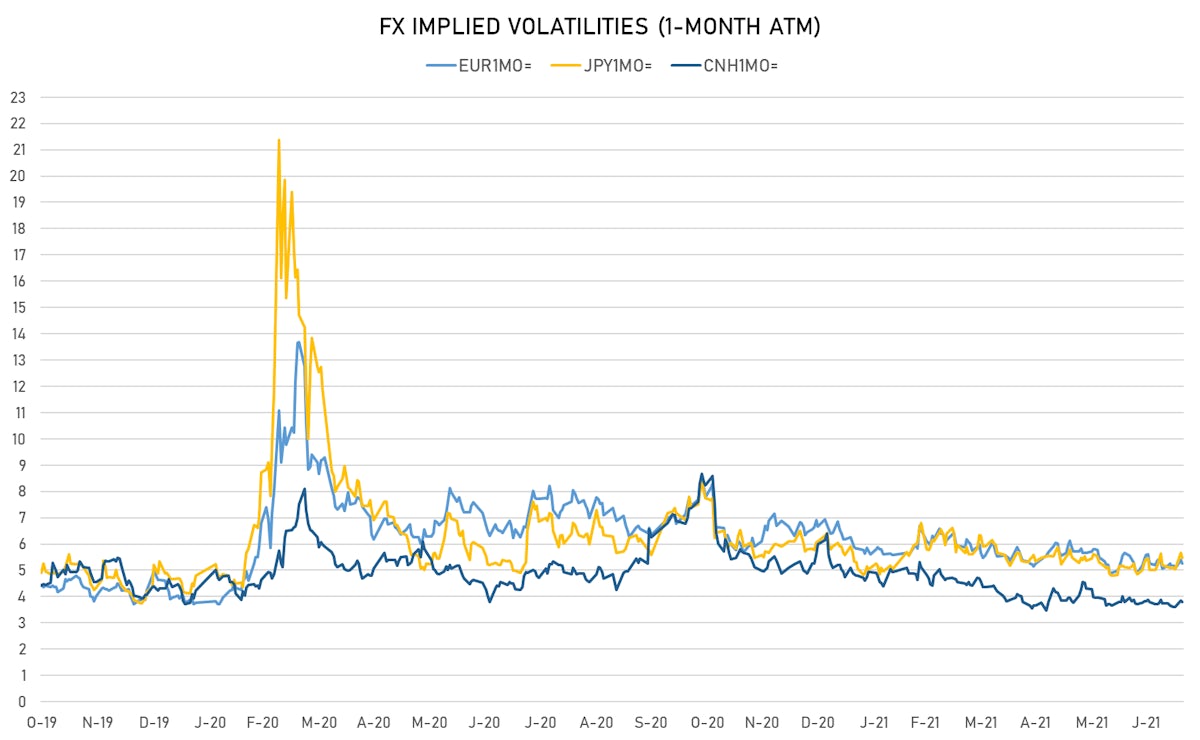

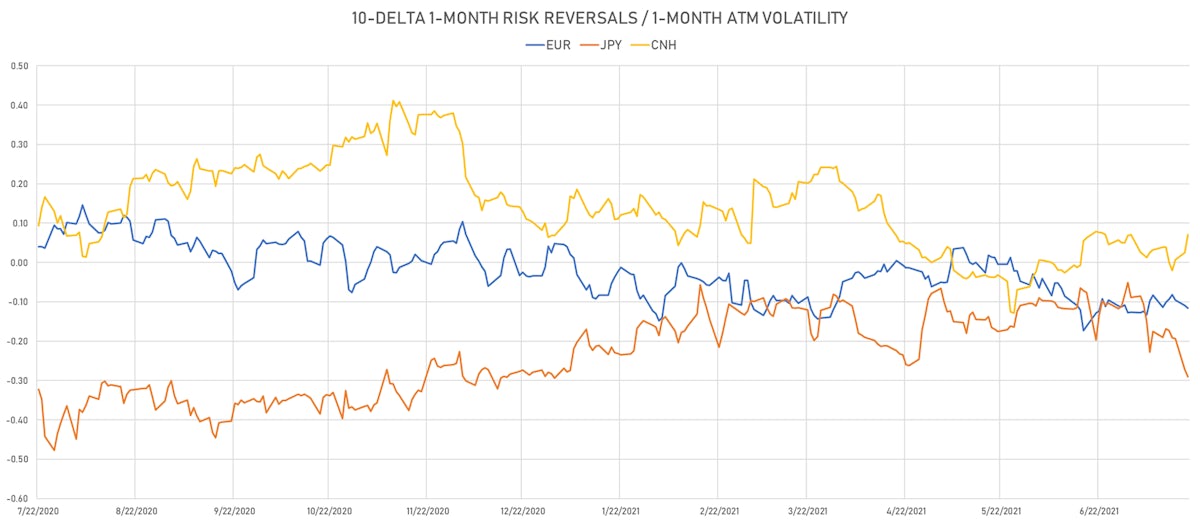

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.30, up 0.28 (YTD: -0.87)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.25, down -0.2 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.48, down -0.2 (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.80, down -0.1 (YTD: -2.2)

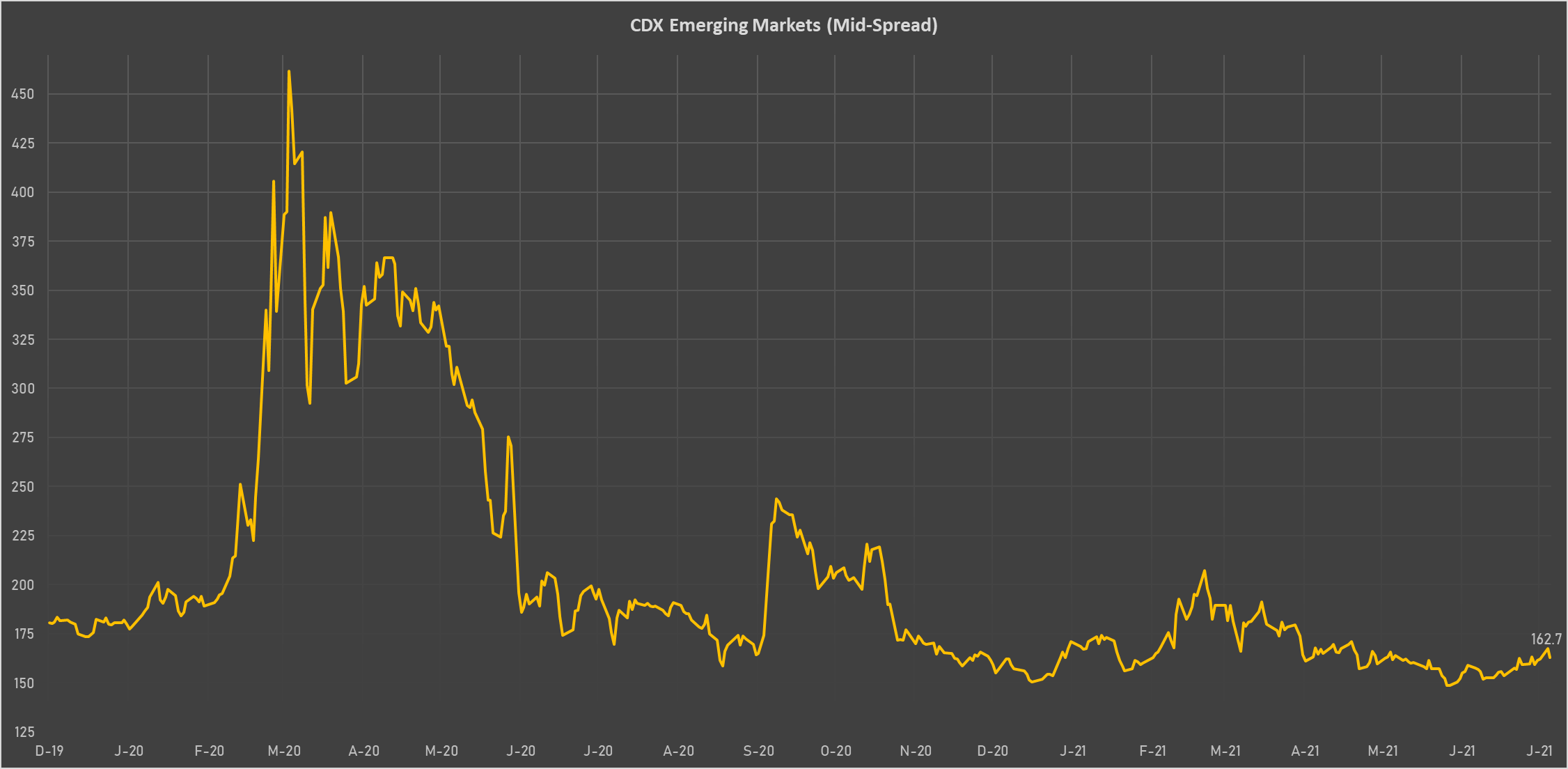

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Oman (rated BB-): up 9.5 basis points to 248 bp (1Y range: 223-485bp)

- Bahrain (rated B+): up 4.1 basis points to 240 bp (1Y range: 159-335bp)

- Nigeria (rated B): up 6.0 basis points to 362 bp (1Y range: 333-383bp)

- Lebanon (rated CC): up 57.0 basis points to 3,474 bp (1Y range: 3,196-3,683bp)

- Kenya (rated B+): up 7.0 basis points to 428 bp (1Y range: 394-454bp)

- Pakistan (rated B-): up 6.5 basis points to 398 bp (1Y range: 362-512bp)

- Mexico (rated BBB-): down 2.4 basis points to 96 bp (1Y range: 79-164bp)

- Peru (rated BBB+): down 2.6 basis points to 83 bp (1Y range: 52-98bp)

- Government of Chile (rated A-): down 2.2 basis points to 64 bp (1Y range: 43-75bp)

- Russia (rated BBB): down 3.2 basis points to 86 bp (1Y range: 72-129bp)

LARGEST FX MOVES TODAY

- CFA Franc BCEAO up 1.2% (YTD: -4.0%)

- Armenian Dram up 0.7% (YTD: +6.7%)

- Philippine Peso up 0.7% (YTD: -5.1%)

- Vanuatu Vatu down 0.7% (YTD: -2.9%)

- Iceland Krona down 0.8% (YTD: +2.3%)

- Falklands Pound down 0.8% (YTD: +0.0%)

- Gibraltar Pound down 0.8% (YTD: +0.0%)

- Haiti Gourde down 1.0% (YTD: -23.0%)

- Venezuela Bolivar down 3.6% (YTD: -70.0%)

- Seychelles rupee down 17.0% (YTD: +23.4%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 23.4%

- Mozambique metical up 15.4%

- Argentine Peso down 12.7%

- Turkish Lira down 13.3%

- Haiti Gourde down 23.0%

- Surinamese dollar down 30.5%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 70.0%

- Libyan Dinar down 70.4%

- Sudanese Pound down 87.6%