FX

US Dollar Rises Against The Yen As The Games Begin In Tokyo

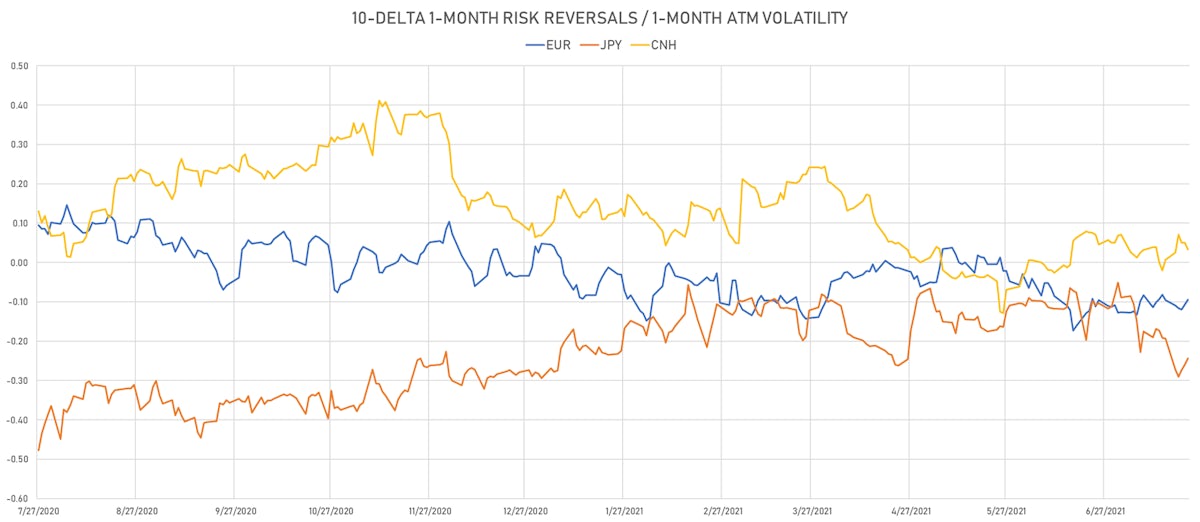

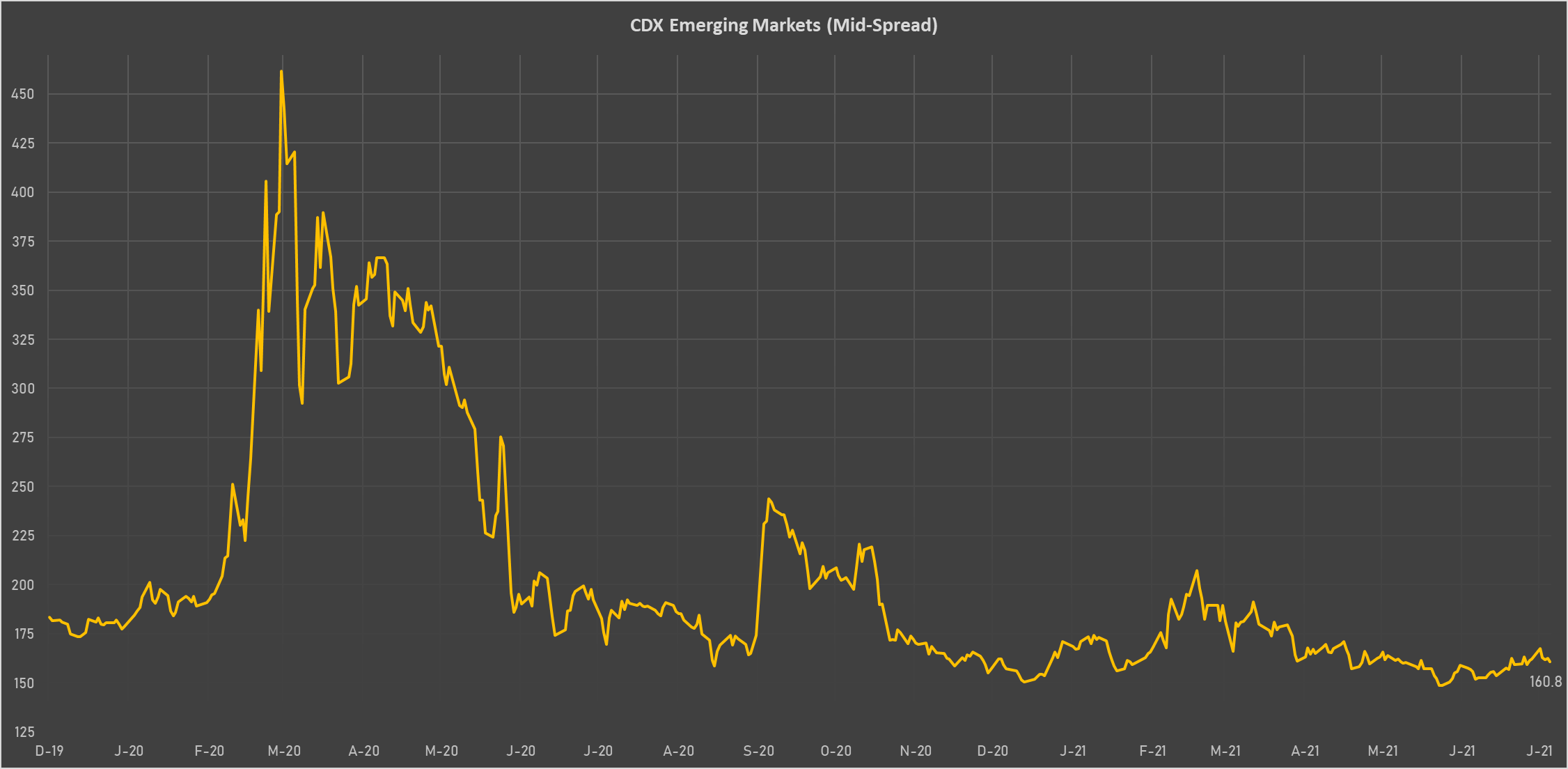

Emerging market currencies like the Russian Ruble and Brazilian Real looking increasingly attractive in terms of their rates differentials relative to volatility

Published ET

Russian Rouble And 5-Year Rates Differentials With the US | Source: Refinitiv

QUICK SUMMARY

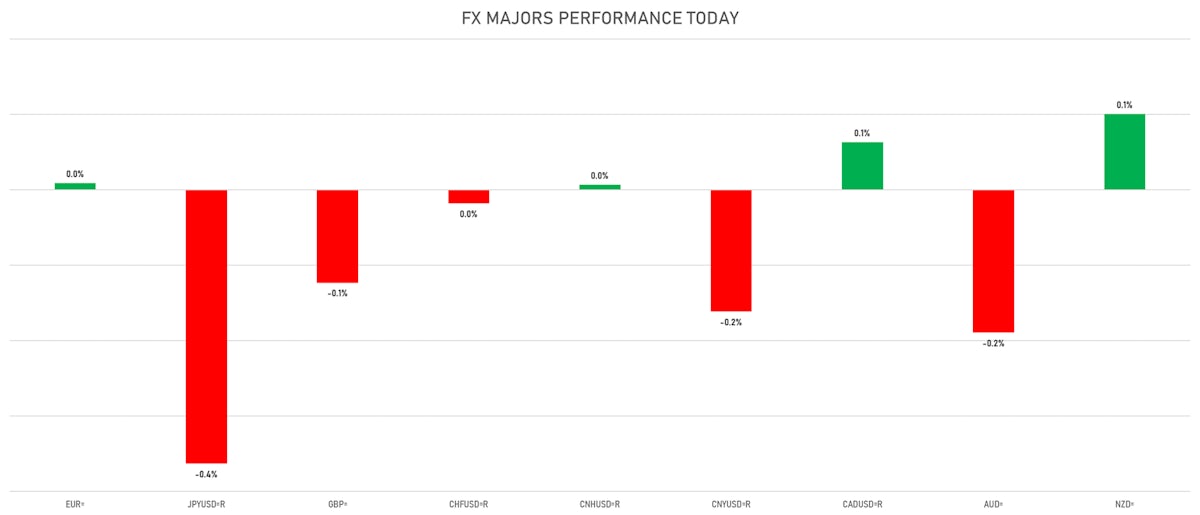

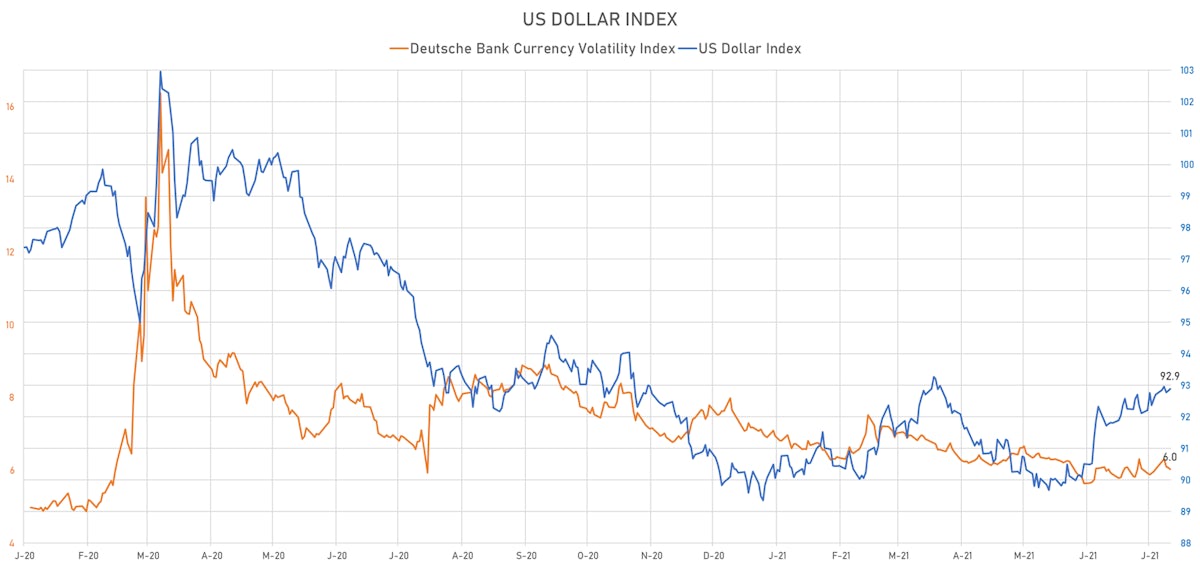

- The US Dollar Index is up 0.07% at 92.89 (YTD: +3.24%)

- Euro up 0.01% at 1.1771 (YTD: -3.6%)

- Yen down 0.36% at 110.54 (YTD: -6.6%)

- Onshore Yuan down 0.16% at 6.4808 (YTD: +0.7%)

- Swiss franc down 0.02% at 0.9190 (YTD: -3.7%)

- Sterling down 0.12% at 1.3746 (YTD: +0.5%)

- Canadian dollar up 0.06% at 1.2556 (YTD: +1.4%)

- Australian dollar down 0.19% at 0.7364 (YTD: -4.3%)

- NZ dollar up 0.10% at 0.6971 (YTD: -3.0%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national - 15 (IPCA-15), Change P/P for Jul 2021 (IBGE, Brazil) at 0.72 %, above consensus estimate of 0.64 %

- Canada, Retail Sales, Change P/P for May 2021 (CANSIM, Canada) at -2.10 %, above consensus estimate of -3.00 %

- Euro Zone, PMI, Composite, Output, Flash for Jul 2021 (Markit Economics) at 60.60, above consensus estimate of 60.00

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Jul 2021 (Markit Economics) at 62.60, above consensus estimate of 62.50

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Jul 2021 (Markit Economics) at 60.40, above consensus estimate of 59.50

- France, PMI, Composite, Output, Flash for Jul 2021 (Markit Economics) at 56.80, below consensus estimate of 58.50

- France, PMI, Manufacturing Sector, Total, Flash for Jul 2021 (Markit/CDAF, France) at 58.10, below consensus estimate of 58.40

- France, PMI, Services Sector, Business Activity, Flash for Jul 2021 (Markit/CDAF, France) at 57.00, below consensus estimate of 58.70

- Germany, PMI, Composite, Output, Flash for Jul 2021 (Markit Economics) at 62.50, above consensus estimate of 60.80

- Germany, PMI, Manufacturing Sector, Total, Flash for Jul 2021 (Markit Economics) at 65.60, above consensus estimate of 64.20

- Germany, PMI, Services Sector, Business Activity, Flash for Jul 2021 (Markit Economics) at 62.20, above consensus estimate of 59.10

- Russia, Policy Rates, Central bank key rate for Jul 2021 (Central Bank, Russia) at 6.50% (up 1%), in line with consensus estimate

- United Kingdom, Markit/CIPS PMI, Composite, Flash for Jul 2021 (Markit Economics) at 57.70, below consensus estimate of 61.70

- United Kingdom, Markit/CIPS PMI, Manufacturing Flash for Jul 2021 (Markit Economics) at 60.40, below consensus estimate of 62.50

- United Kingdom, Markit/CIPS PMI, Services, Flash for Jul 2021 (Markit Economics) at 57.80, below consensus estimate of 62.00

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for Jun 2021 (ONS, United Kingdom) at 9.70 %, above consensus estimate of 9.60 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for Jun 2021 (ONS, United Kingdom) at 0.30%, below consensus estimate of 0.60 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for Jun 2021 (ONS, United Kingdom) at 0.50%, above consensus estimate of 0.40 %

- United States, PMI, Composite, Output, Flash for Jul 2021 (Markit Economics) at 59.70

- United States, PMI, Manufacturing Sector, Total, Flash for Jul 2021 (Markit Economics) at 63.10, above consensus estimate of 62.00

- United States, PMI, Services Sector, Business Activity, Flash for Jul 2021 (Markit Economics) at 59.80, below consensus estimate of 64.80

WEEKLY CFTC DATA

- ALL: increase in net short US$ positioning

- G10: increase in net short US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net short US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

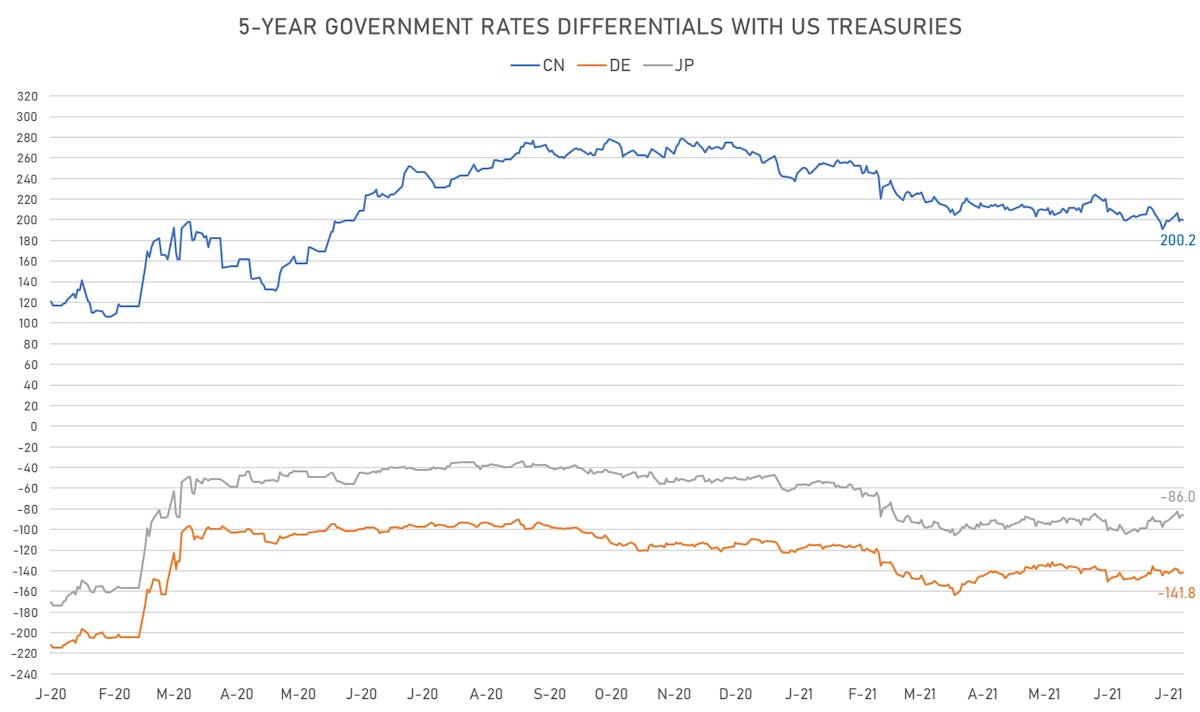

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.4 bp at 141.8 bp (YTD change: +30.8 bp)

- US-JAPAN: -0.7 bp at 86.0 bp (YTD change: +37.8 bp)

- US-CHINA: +0.8 bp at -200.2 bp (YTD change: +57.0 bp)

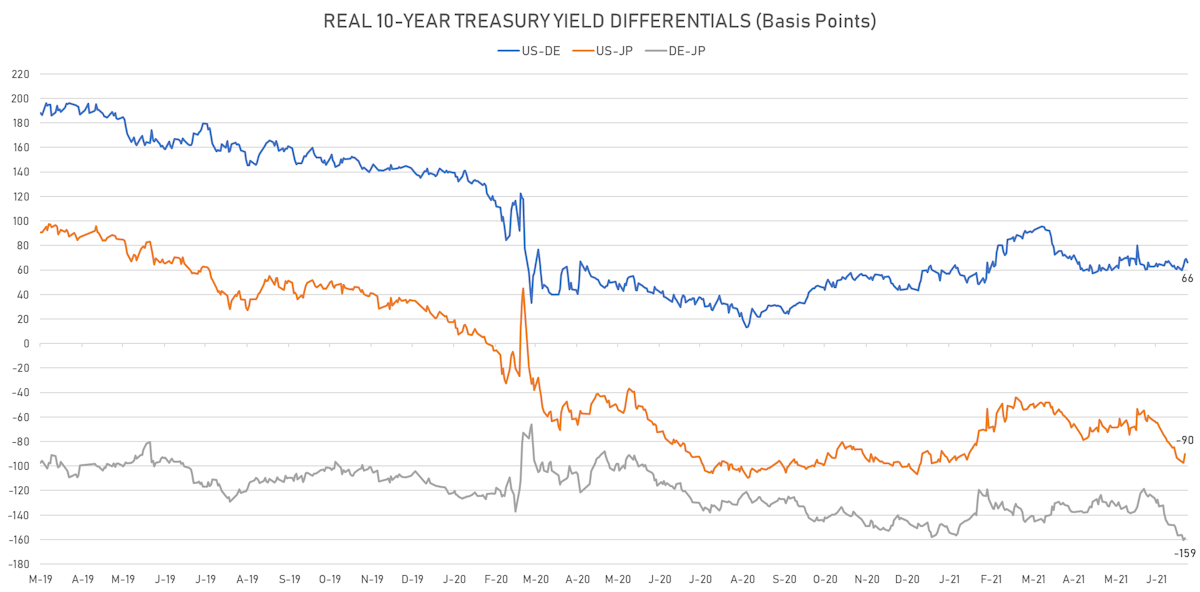

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.9 bp at 66.3 bp (YTD change: +20.2bp)

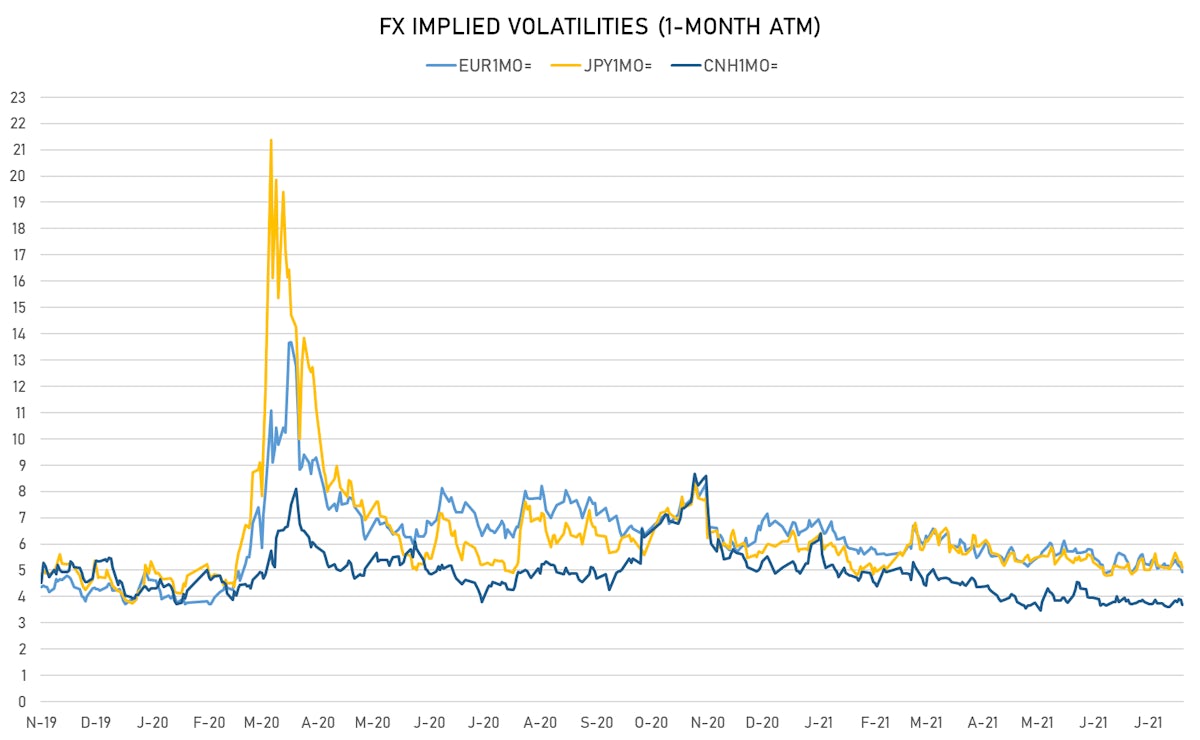

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.02, down -0.05 (YTD: -1.15)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.93, down -0.2 (YTD: -1.8)

- Japanese Yen 1M ATM IV currently at 5.10, down -0.2 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.69, down -0.2 (YTD: -2.3)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- South Africa (rated BB-): up 4.0 basis points to 204 bp (1Y range: 178-328bp)

- Government of Chile (rated A-): up 0.9 basis points to 64 bp (1Y range: 43-75bp)

- Lebanon (rated CC): down 29.5 basis points to 3,400 bp (1Y range: 3,196-3,683bp)

- Vietnam (rated BB): down 1.0 basis points to 108 bp (1Y range: 90-159bp)

- Pakistan (rated B-): down 3.5 basis points to 389 bp (1Y range: 362-512bp)

- Ecuador (rated WD): down 1.5 basis points to 167 bp (1Y range: 157-181bp)

- Indonesia (rated BBB): down 0.7 basis points to 79 bp (1Y range: 66-118bp)

- Nigeria (rated B): down 3.5 basis points to 354 bp (1Y range: 333-383bp)

- Bahrain (rated B+): down 4.4 basis points to 237 bp (1Y range: 159-330bp)

- Oman (rated BB-): down 16.1 basis points to 231 bp (1Y range: 223-466bp)

LARGEST FX MOVES TODAY

- Vanuatu Vatu up 1.3% (YTD: -1.6%)

- Sao Tome Dobra up 1.3% (YTD: +8.3%)

- St Helena Pound up 1.1% (YTD: +0.9%)

- Falklands Pound up 0.9% (YTD: +0.8%)

- Gibraltar Pound up 0.9% (YTD: +0.8%)

- Lesotho Loti down 0.8% (YTD: -0.1%)

- Surinamese dollar down 0.8% (YTD: -33.4%)

- Fiji Dollar down 0.9% (YTD: -2.4%)

- Haiti Gourde down 1.5% (YTD: -24.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 41.3%

- Mozambique metical up 15.4%

- Argentine Peso down 12.8%

- Turkish Lira down 13.2%

- Haiti Gourde down 24.2%

- Surinamese dollar down 33.4%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 71.1%

- Sudanese Pound down 87.6%