FX

US Dollar Down Against Most Major Currencies On Soft Macro Data And Lower Real Yields

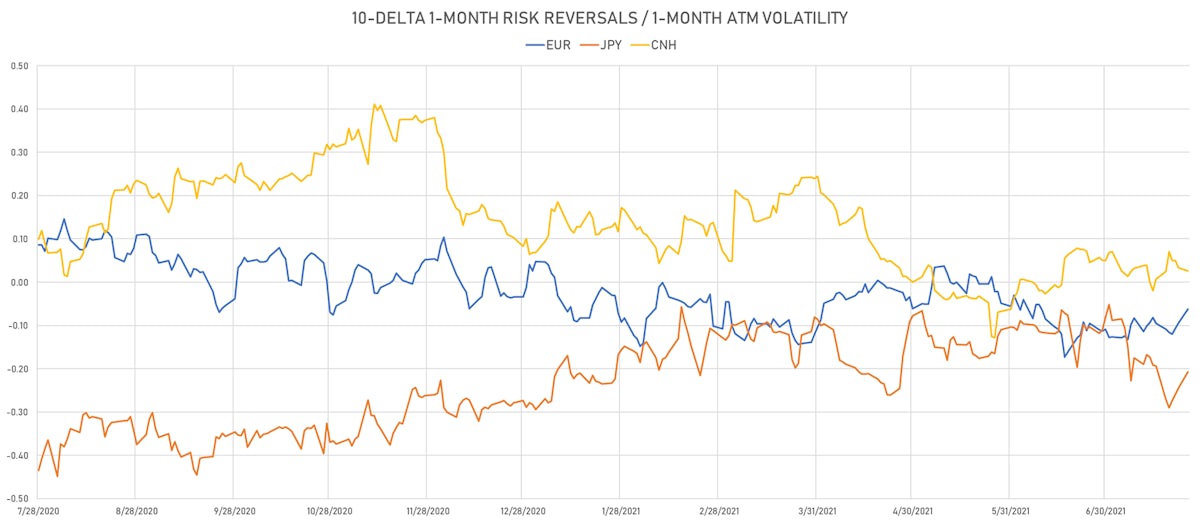

Risk reversals in options markets are not showing any clear direction, with currencies trading in a fairly tight range at the moment

Published ET

US Dollar in Euro And 10Y Real Rates Differential | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

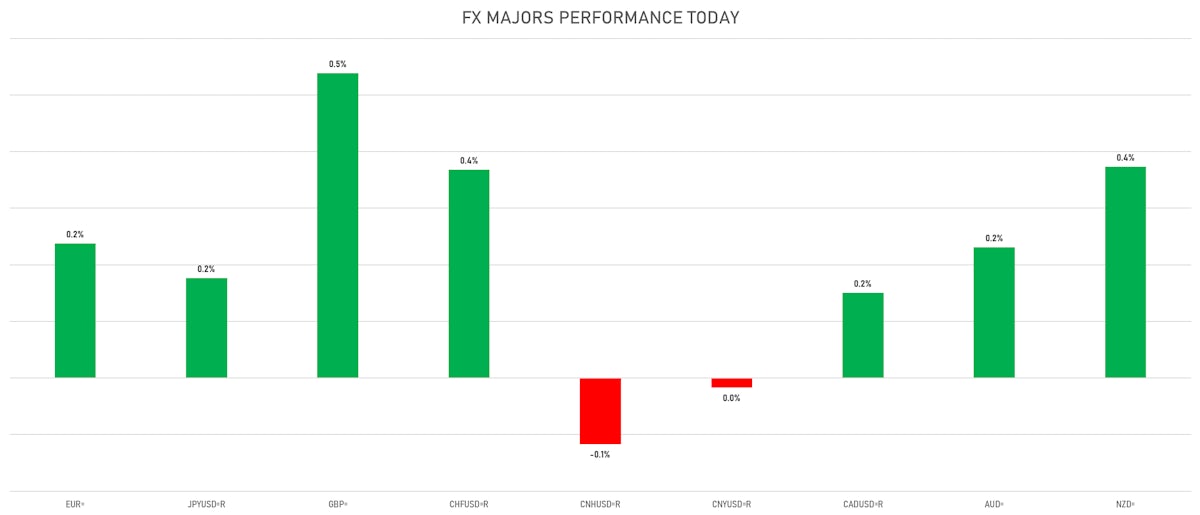

- The US Dollar Index is down -0.28% at 92.64 (YTD: +2.95%)

- Euro up 0.24% at 1.1799 (YTD: -3.4%)

- Yen up 0.18% at 110.37 (YTD: -6.4%)

- Onshore Yuan down 0.02% at 6.4825 (YTD: +0.7%)

- Swiss franc up 0.37% at 0.9159 (YTD: -3.3%)

- Sterling up 0.54% at 1.3819 (YTD: +1.1%)

- Canadian dollar up 0.15% at 1.2544 (YTD: +1.5%)

- Australian dollar up 0.23% at 0.7381 (YTD: -4.1%)

- NZ dollar up 0.37% at 0.6997 (YTD: -2.6%)

MACRO DATA RELEASES

- Belgium, All Sectors, Overall for Jul 2021 (NBB, Belgium) at 10.10

- Germany, Climate Germany (Incl.Services), Volume Index for Jul 2021 (Ifo, Univ. of Munich) at 100.80, below consensus estimate of 102.10

- Germany, Ifo Business Climate Germany Expectation (Incl.Services), Volume Index for Jul 2021 (Ifo, Univ. of Munich) at 101.20, below consensus estimate of 103.30

- Germany, Ifo Business Climate Germany Situation (Incl. services), Volume Index for Jul 2021 (Ifo, Univ. of Munich) at 100.40, below consensus estimate of 101.60

- Ghana, Policy Rates, Monetary Policy Rate, Methodology Break August 2015 for Jul 2021 (Bank of Ghana) at 13.50 %, in line with consensus estimate

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Flash for Jul 2021 (Markit Economics) at 52.20

- Kazakhstan, Policy Rates, Base Repo Rate for Jul 2021 (NBK, Kazakhstan) at 9.25 %

- Singapore, Production, Change P/P for Jun 2021 (Statistics Singapore) at -3.00 %, below consensus estimate of 0.30 %

- Singapore, Production, Change Y/Y for Jun 2021 (Statistics Singapore) at 27.50 %, above consensus estimate of 26.80 %

- South Korea, GDP, Total-adv, Change P/P for Q2 2021 (The Bank of Korea) at 0.70 %, in line with consensus estimate

- South Korea, GDP, Total-adv, Change Y/Y for Q2 2021 (The Bank of Korea) at 5.90 %, below consensus estimate of 6.00 %

- United States, New Home Sales for Jun 2021 (U.S. Census Bureau) at 0.68 Mln, below consensus estimate of 0.80 Mln

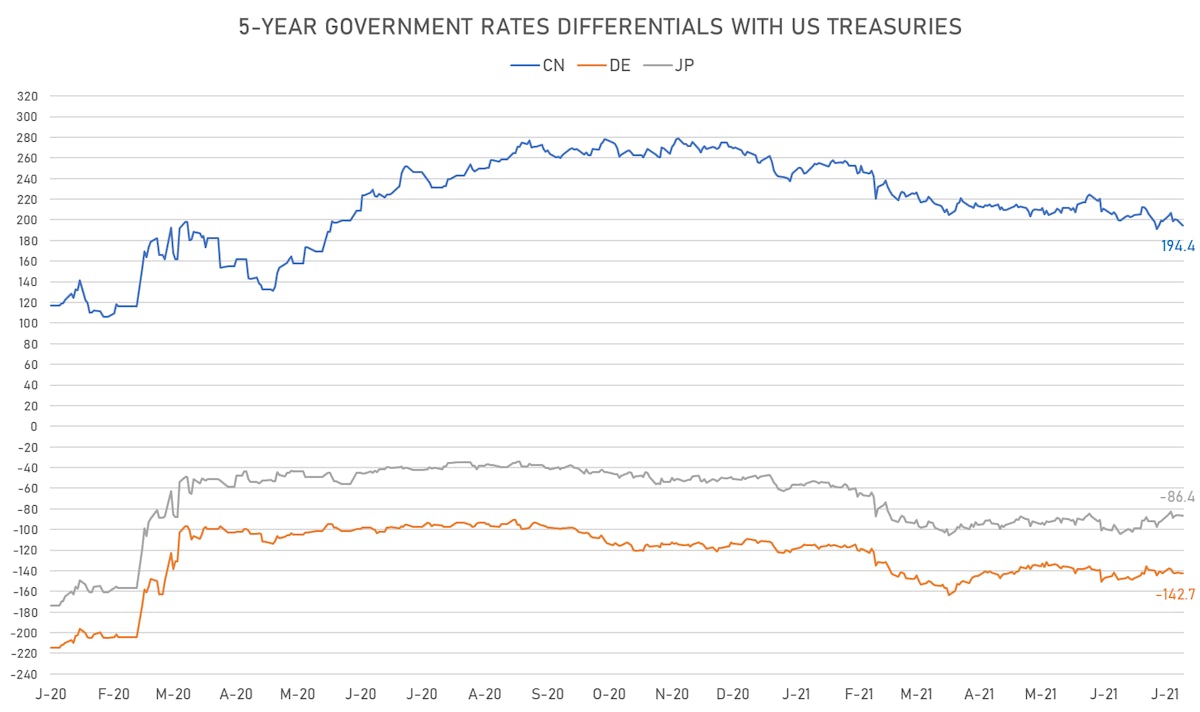

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.9 bp at 142.7 bp (YTD change: +31.6 bp)

- US-JAPAN: +0.4 bp at 86.4 bp (YTD change: +38.1 bp)

- US-CHINA: +5.8 bp at -194.4 bp (YTD change: +62.7 bp)

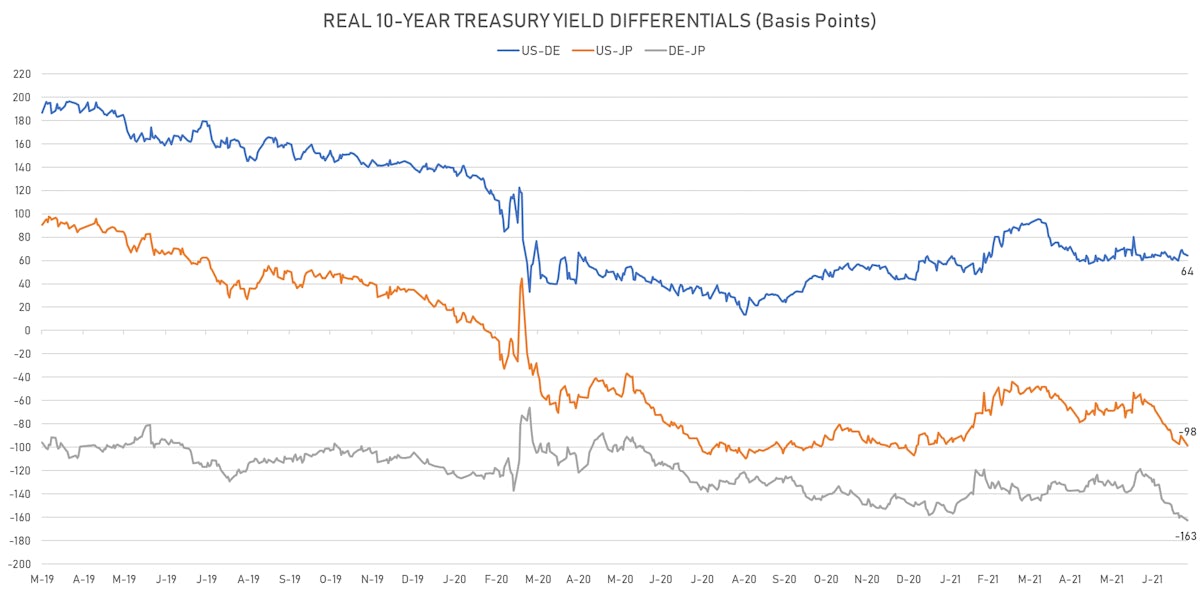

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.0 bp at 64.3 bp (YTD change: +18.2bp)

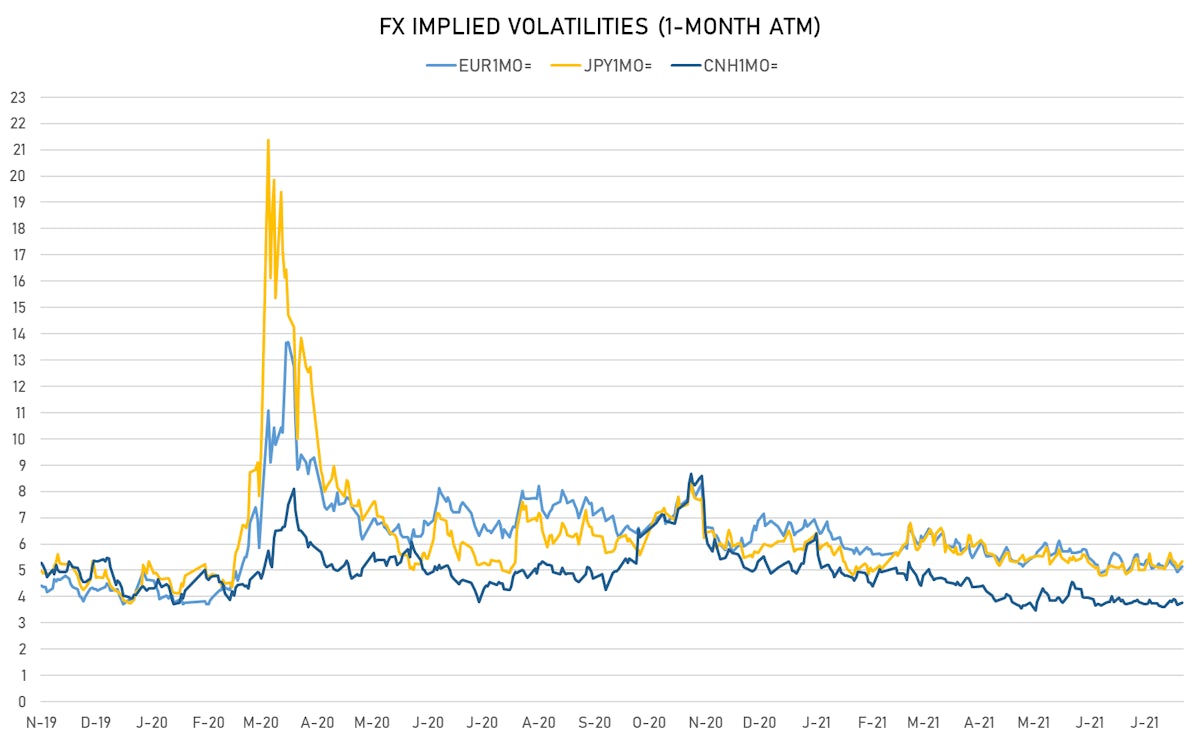

VOLATILITIES TODAY

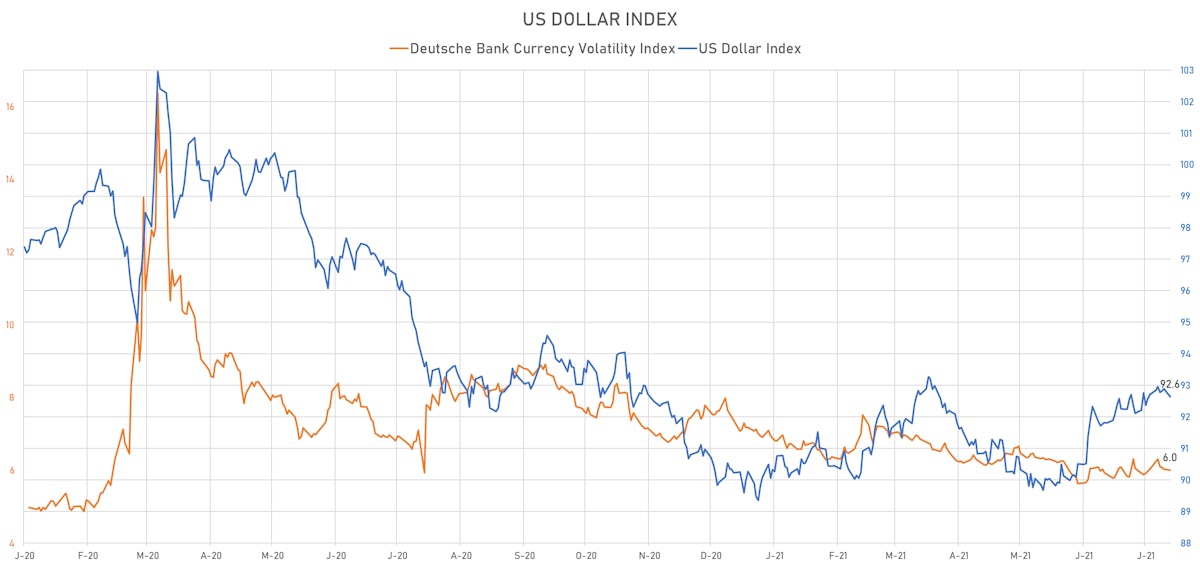

- Deutsche Bank USD Currency Volatility Index currently at 6.00, down -0.02 (YTD: -1.17)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.14, up 0.2 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.34, up 0.2 (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 3.76, up 0.1 (YTD: -2.2)

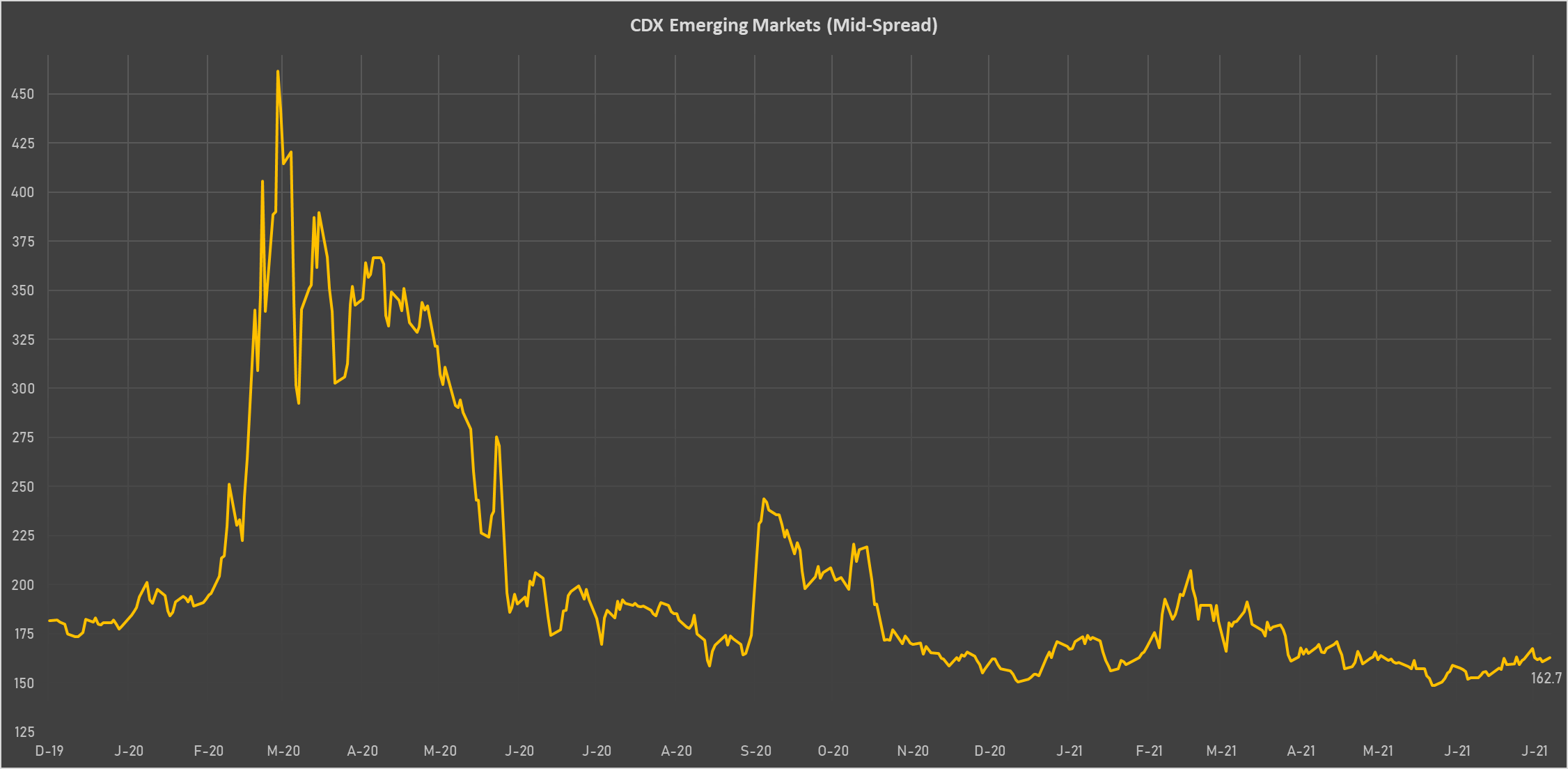

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Oman (rated BB-): up 6.4 basis points to 238 bp (1Y range: 223-466bp)

- Government of Chile (rated A-): up 0.9 basis points to 64 bp (1Y range: 43-75bp)

- Colombia (rated BB+): up 1.6 basis points to 147 bp (1Y range: 83-164bp)

- Panama (rated BBB-): up 0.7 basis points to 68 bp (1Y range: 44-95bp)

- Bahrain (rated B+): up 2.1 basis points to 239 bp (1Y range: 159-330bp)

- Vietnam (rated BB): up 0.8 basis points to 109 bp (1Y range: 90-159bp)

- South Africa (rated BB-): up 1.1 basis points to 205 bp (1Y range: 178-328bp)

- Ecuador (rated WD): down 1.0 basis points to 166 bp (1Y range: 157-181bp)

- Argentina (rated CCC): down 16.7 basis points to 1,948 bp (1Y range: 1,049-1,968bp)

- Egypt (rated B+): down 7.2 basis points to 339 bp (1Y range: 283-424bp)

LARGEST FX MOVES TODAY

- Seychelles rupee up 1.9% (YTD: +44.2%)

- Vanuatu Vatu up 1.0% (YTD: -2.5%)

- Mauritius Rupee up 0.9% (YTD: -7.2%)

- Pacific Franc up 0.6% (YTD: -3.6%)

- Colombian Peso down 0.6% (YTD: -12.4%)

- Afghani down 0.8% (YTD: -3.8%)

- Ghanaian Cedi down 1.2% (YTD: -1.5%)

- Samoa Tala down 1.2% (YTD: -1.8%)

- CFA Franc BEAC down 3.2% (YTD: -3.8%)

- Venezuela Bolivar down 3.8% (YTD: -72.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 44.2%

- Mozambique metical up 15.4%

- Argentine Peso down 12.9%

- Turkish Lira down 13.2%

- Haiti Gourde down 24.6%

- Surinamese dollar down 33.6%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 72.2%

- Sudanese Pound down 87.6%