FX

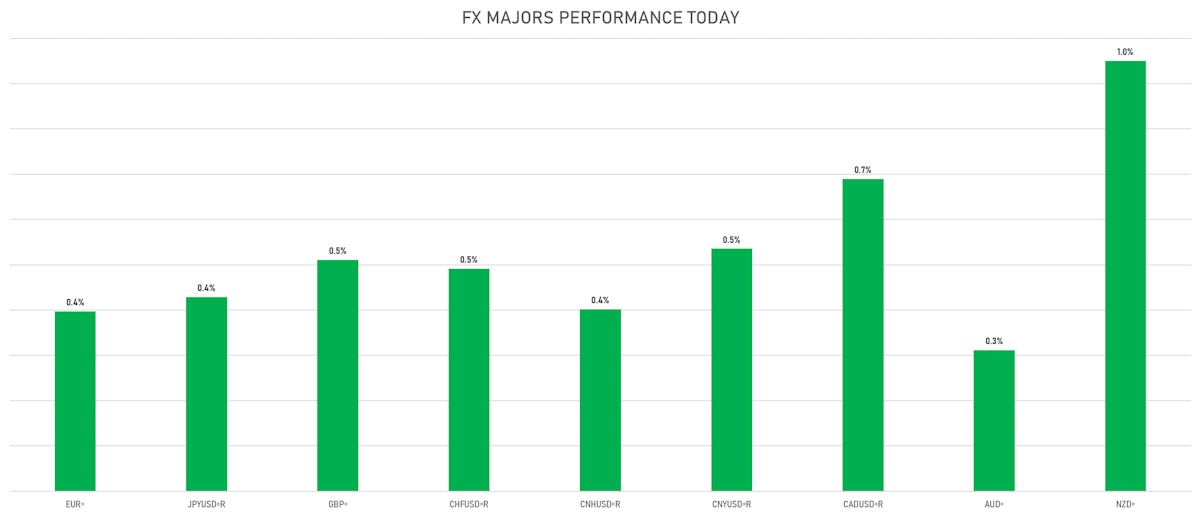

Major Currencies Have Jumped Against The US Dollar Since The FOMC Statement Yesterday

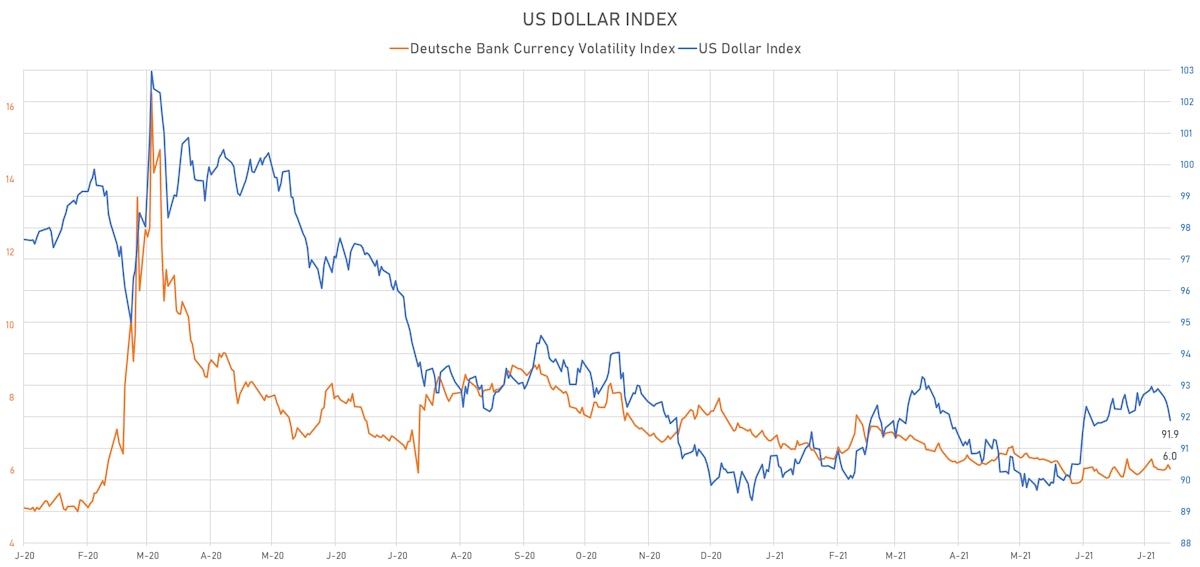

Moves in real and nominal rates differentials were positive for the dollar today, but negative speculative sentiment dominated flows

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is down -0.42% at 91.88 (YTD: +2.11%)

- Euro up 0.40% at 1.1889 (YTD: -2.7%)

- Yen up 0.43% at 109.45 (YTD: -5.6%)

- Onshore Yuan up 0.54% at 6.4562 (YTD: +1.1%)

- Swiss franc up 0.49% at 0.9058 (YTD: -2.2%)

- Sterling up 0.51% at 1.3969 (YTD: +2.2%)

- Canadian dollar up 0.69% at 1.2443 (YTD: +2.3%)

- Australian dollar up 0.31% at 0.7399 (YTD: -3.8%)

- NZ dollar up 0.95% at 0.7013 (YTD: -2.4%)

MACRO DATA RELEASES

- Belgium, GDP, Change P/P for Q2 2021 (NBB, Belgium) at 1.40 %, below consensus estimate of 1.50 %

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Jul 2021 (FGV, Brazil) at 0.78 %, below consensus estimate of 0.90 %

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Jul 2021 (DG ECFIN, France) at -4.40, in line with consensus estimate

- Germany, CPI, Flash, Change Y/Y, Price Index for Jul 2021 (Destatis) at 3.80 %, above consensus estimate of 3.30 %

- Germany, HICP, Flash, Change Y/Y, Price Index for Jul 2021 (Destatis) at 3.10 %, above consensus estimate of 2.90 %

- Germany, Unemployment, Change, Absolute change for Jul 2021 (Deutsche Bundesbank) at -91k, below consensus estimate of -28k

- Germany, Unemployment, Rate, Registered for Jul 2021 (Deutsche Bundesbank) at 5.70 %, below consensus estimate of 5.80 %

- Japan, Labour Market n.i.e, Active opening rate for Jun 2021 at 1.13%, above consensus estimate of 1.10%

- Japan, Production, Mining and manufacturing, preliminary, Change P/P for Jun 2021 (METI, Japan) at 6.20 %, above consensus estimate of 5.00 %

- Japan, Unemployment, Rate for Jun 2021 (MIC, Japan) at 2.90 %, below consensus estimate of 3.00 %

- Sweden, GDP, GDP at market prices, Change Y/Y for Q2 2021 (SCB, Sweden) at 10.00 %

- Sweden, GDP, Total at market prices, Change P/P for Q2 2021 (SCB, Sweden) at 0.90 %, above consensus estimate of 0.70 %

- United States, GDP, Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.50 %, below consensus estimate of 8.50 %

- United States, Jobless Claims, National, Initial for W 24 Jul (U.S. Dept. of Labor) at 400k, above consensus estimate of 380k

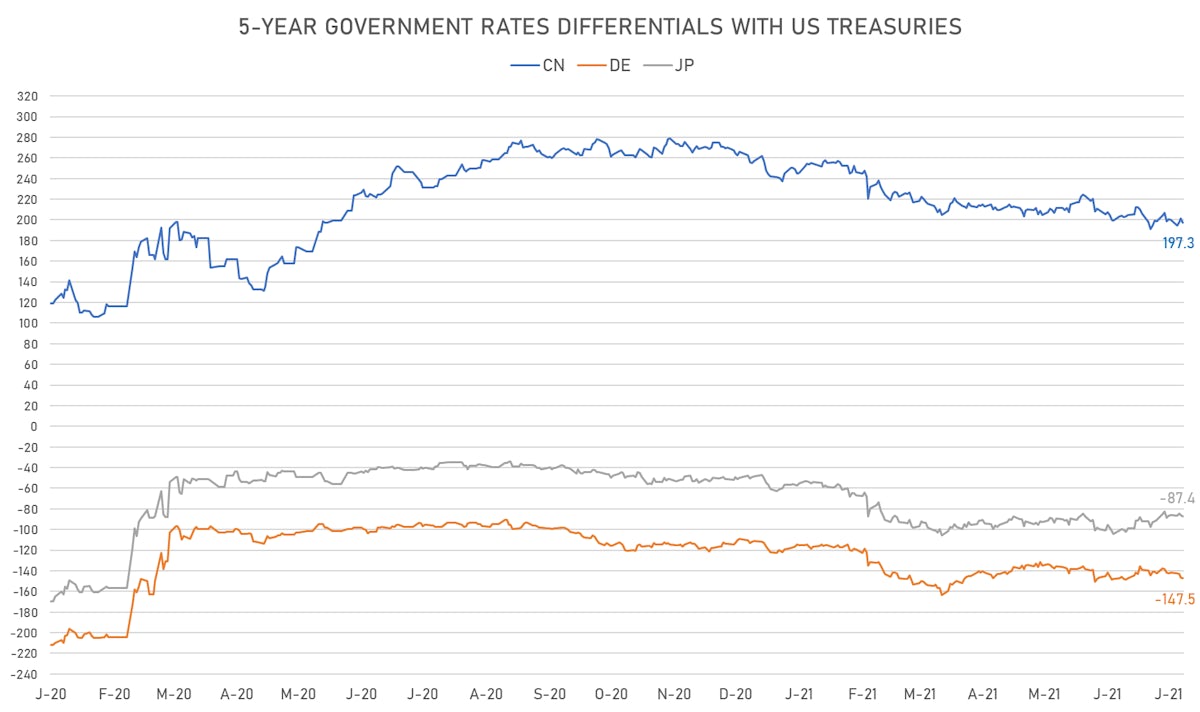

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.1 bp at 147.5 bp (YTD change: +36.4 bp)

- US-JAPAN: +1.8 bp at 87.4 bp (YTD change: +39.1 bp)

- US-CHINA: +3.8 bp at -197.3 bp (YTD change: +59.8 bp)

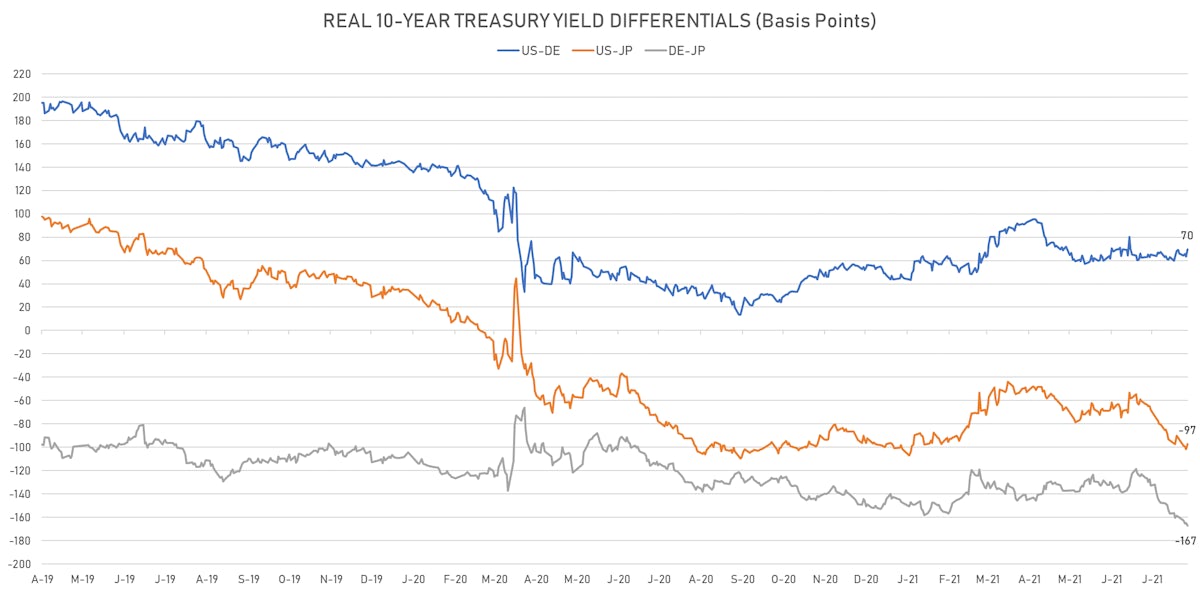

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.2 bp at 69.5 bp (YTD change: +23.4bp)

- US-JAPAN: +4.3 bp at -97.4 bp (YTD change: +4.1bp)

- JAPAN-GERMANY: +1.9 bp at 166.9 bp (YTD change: +19.3bp)

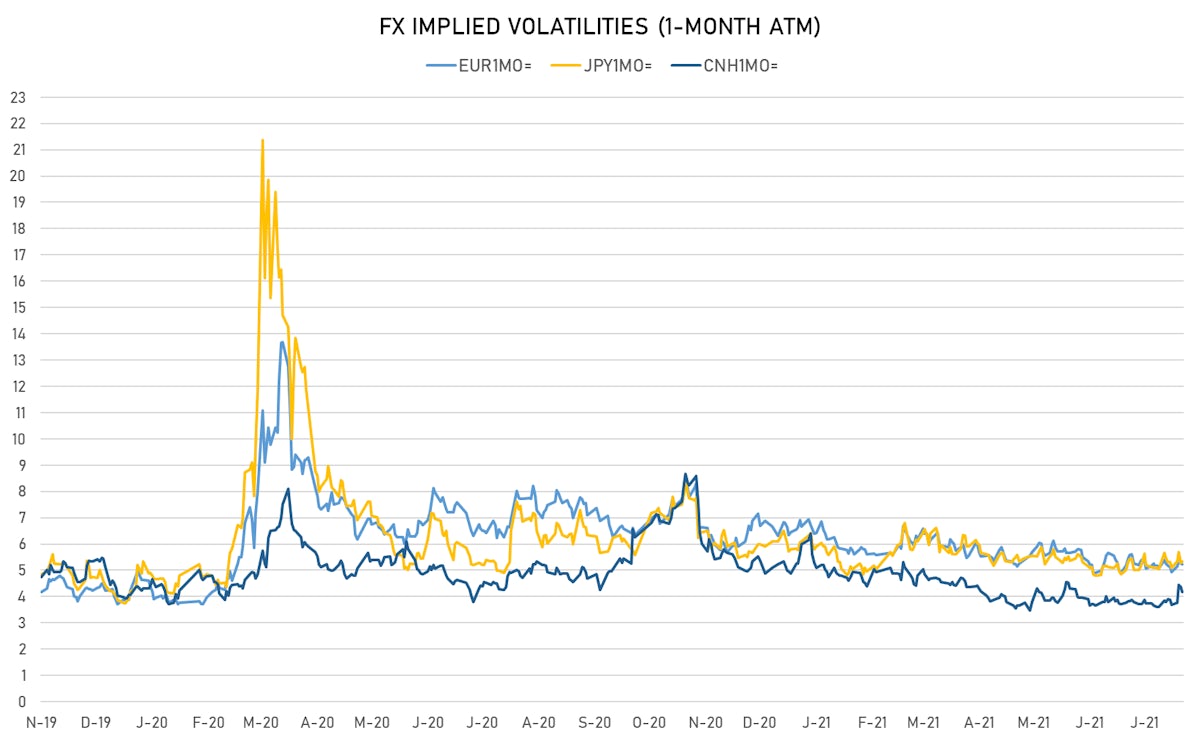

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.04, down -0.11 (YTD: -1.13)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.23 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.34, up 0.1 (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 4.18, down -0.2 (YTD: -1.8)

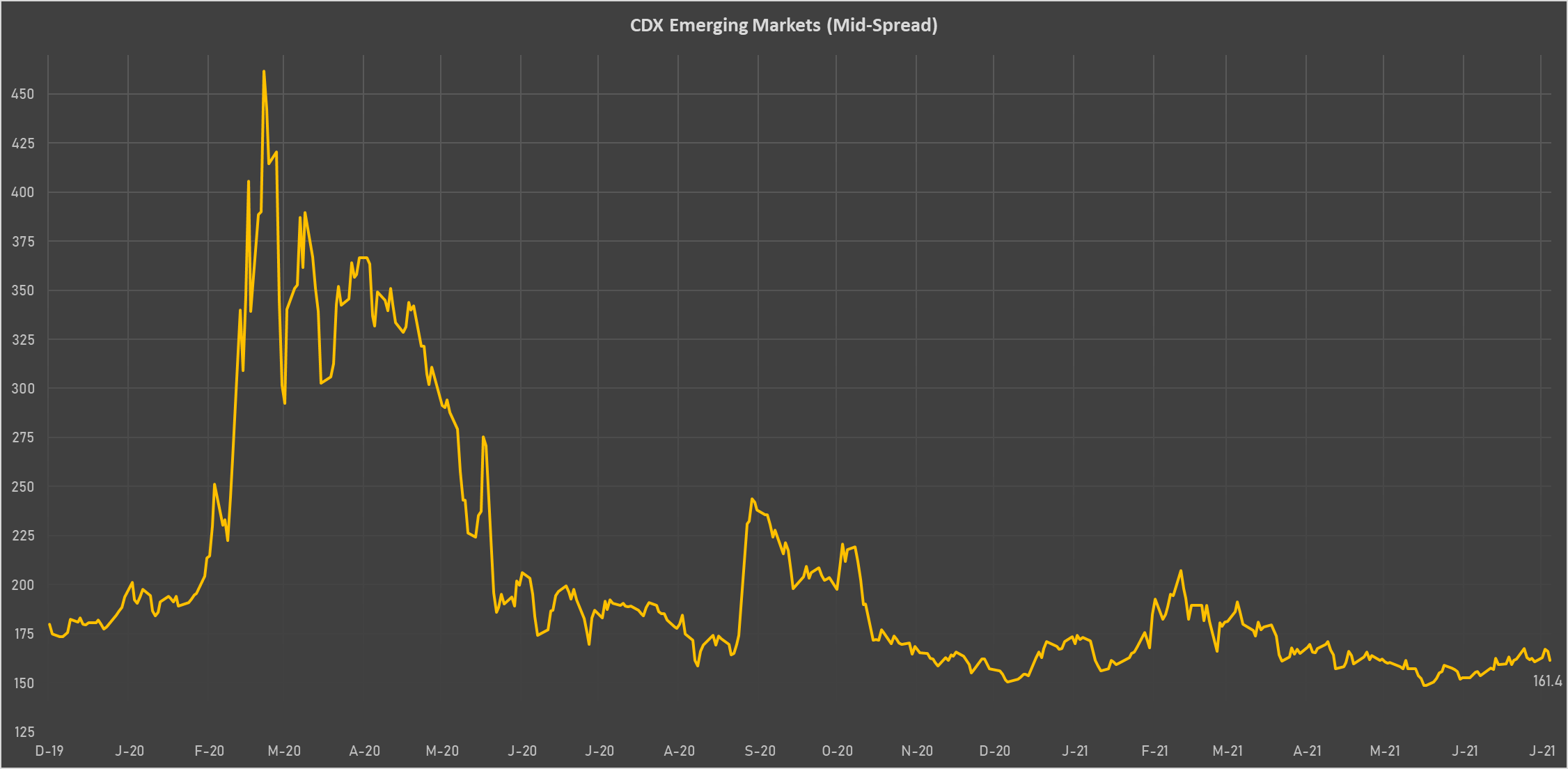

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Peru (rated BBB+): up 5.5 basis points to 95 bp (1Y range: 52-98bp)

- Indonesia (rated BBB): down 2.0 basis points to 80 bp (1Y range: 66-118bp)

- Bahrain (rated B+): down 7.3 basis points to 240 bp (1Y range: 159-330bp)

- Russia (rated BBB): down 2.6 basis points to 85 bp (1Y range: 72-129bp)

- Saudi Arabia (rated A): down 1.7 basis points to 55 bp (1Y range: 52-101bp)

- South Africa (rated BB-): down 6.5 basis points to 200 bp (1Y range: 178-328bp)

- Egypt (rated B+): down 11.6 basis points to 339 bp (1Y range: 283-424bp)

- Mexico (rated BBB-): down 3.6 basis points to 94 bp (1Y range: 79-164bp)

- Colombia (rated BB+): down 6.5 basis points to 146 bp (1Y range: 83-164bp)

- Oman (rated BB-): down 13.7 basis points to 231 bp (1Y range: 223-466bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 4.1% (YTD: +0.2%)

- Colombian Peso up 2.2% (YTD: -11.0%)

- Iceland Krona up 1.9% (YTD: +3.2%)

- Brazilian Real up 1.7% (YTD: +2.2%)

- Botswana Pula up 1.7% (YTD: -1.8%)

- Norwegian Krone up 1.7% (YTD: -1.8%)

- Lesotho Loti up 1.5% (YTD: +0.9%)

- Czech Koruna up 1.5% (YTD: +0.2%)

- South Africa Rand up 1.5% (YTD: +0.9%)