FX

The Yen Rises Against The US Dollar, While The Euro Was Unchanged Today

Antipodean currencies were the best performers: the Kiwi dollar was up 1% with rate hikes expectations rising, following a larger than expected drop in the Q2 unemployment rate

Published ET

1-Year Inflation 1 Year Forward in the US, Germany, Japan, UK | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

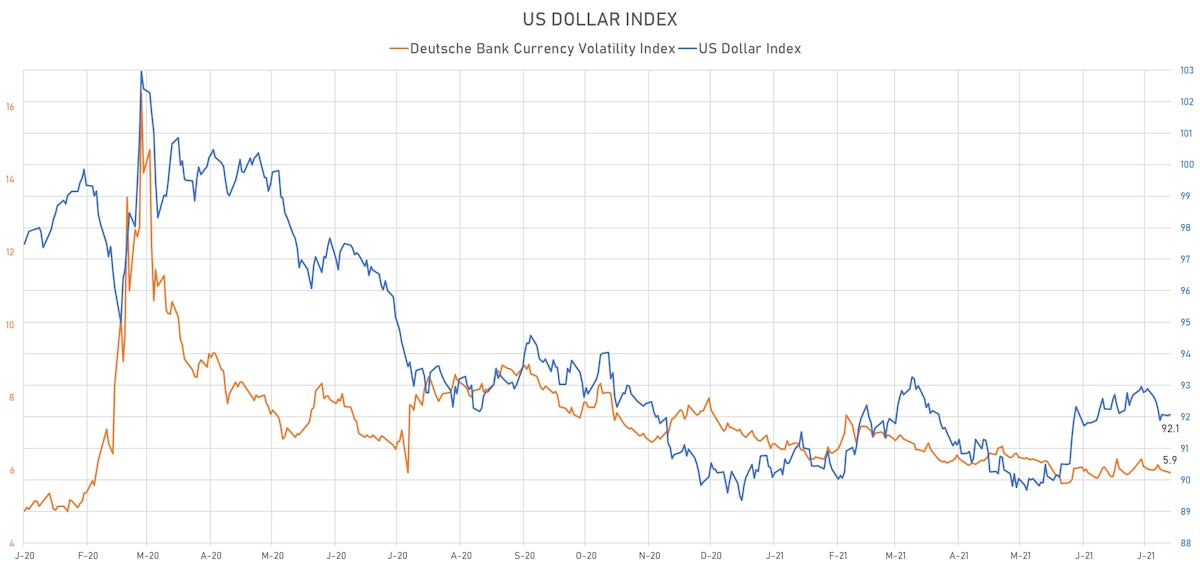

- The US Dollar Index is up 0.02% at 92.06 (YTD: +2.31%)

- Euro unchanged at 1.1867 (YTD: -2.8%)

- Yen up 0.30% at 108.99 (YTD: -5.3%)

- Onshore Yuan down 0.13% at 6.4700 (YTD: +0.9%)

- Swiss franc up 0.14% at 0.9035 (YTD: -2.1%)

- Sterling up 0.24% at 1.3915 (YTD: +1.8%)

- Canadian dollar down 0.16% at 1.2531 (YTD: +1.6%)

- Australian dollar up 0.52% at 0.7398 (YTD: -3.8%)

- NZ dollar up 1.13% at 0.7047 (YTD: -1.9%)

MACRO DATA RELEASES

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Jun 2021 (AU Bureau of Stat) at -6.70 %, below consensus estimate of -4.50 %

- Australia, Policy Rates, Cash Target Rate for Aug 2021 (RBA, Australia) at 0.10 %, in line with consensus estimate

- Brazil, Production, General industry, Change P/P for Jun 2021 (IBGE, Brazil) at 0.00 %, in line with consensus estimate

- Brazil, Production, General industry, Change Y/Y for Jun 2021 (IBGE, Brazil) at 12.00 %, above consensus estimate of 11.80 %

- Canada, PMI, Manufacturing Sector for Jul 2021 (Markit Economics) at 56.20

- New Zealand, Labor Cost, Ordinary time wage rates, Private sector, Change P/P, Price Index for Q2 2021 (Statistics, NZ) at 0.90 %, above consensus estimate of 0.60 %

- New Zealand, Labor Cost, Ordinary time wage rates, Private sector, Change Y/Y for Q2 2021 (Statistics, NZ) at 2.20 %, above consensus estimate of 2.00 %

- New Zealand, Milk Auction, Average Price, Constant Prices for W 03 Aug (Global Dairy Trade) at 3,784.00 USD

- New Zealand, Unemployment, Rate for Q2 2021 (Statistics, NZ) at 4.00 %, below consensus estimate of 4.50 %

- Saudi Arabia, IHS Markit, PMI, Composite, Output, IHS Markit PMI for Jul 2021 (Markit Economics) at 55.80

- Turkey, CPI, Change P/P, Price Index for Jul 2021 (TURKSTAT) at 1.80 %, above consensus estimate of 1.54 %

- United States, Manufacturers New Orders, Total manufacturing, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.50 %, above consensus estimate of 1.00 %

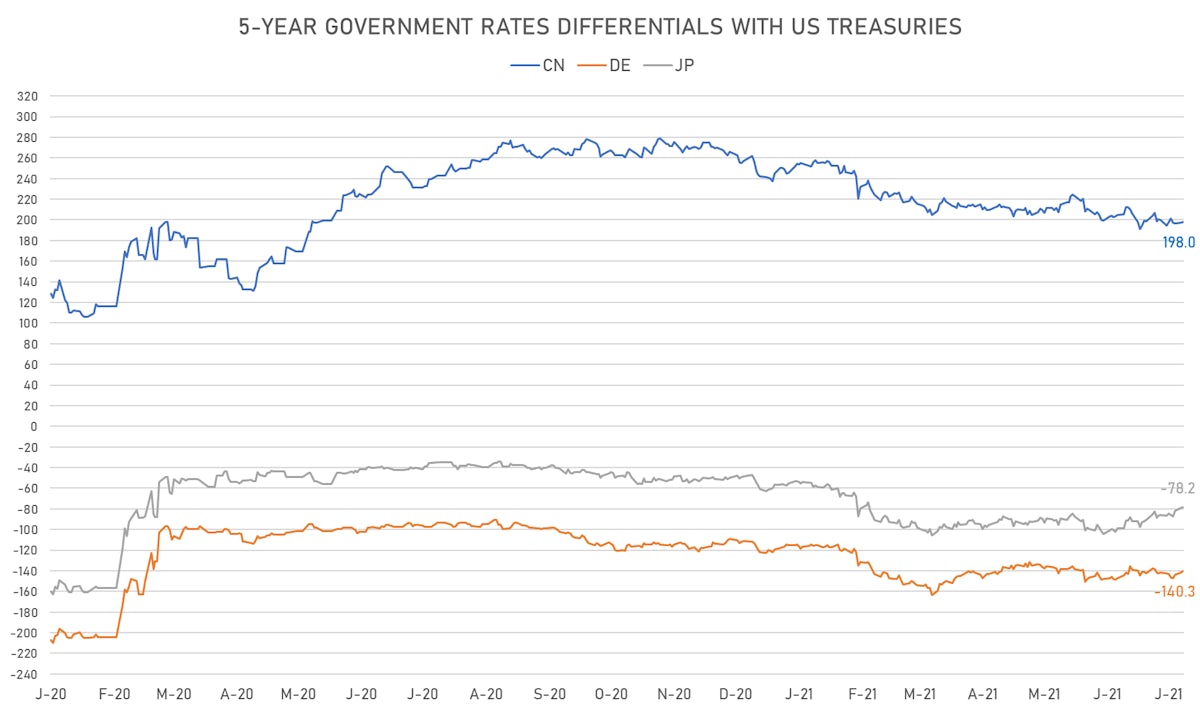

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.2 bp at 140.3 bp (YTD change: +29.3 bp)

- US-JAPAN: -0.6 bp at 78.2 bp (YTD change: +30.0 bp)

- US-CHINA: -0.9 bp at -198.0 bp (YTD change: +59.2 bp)

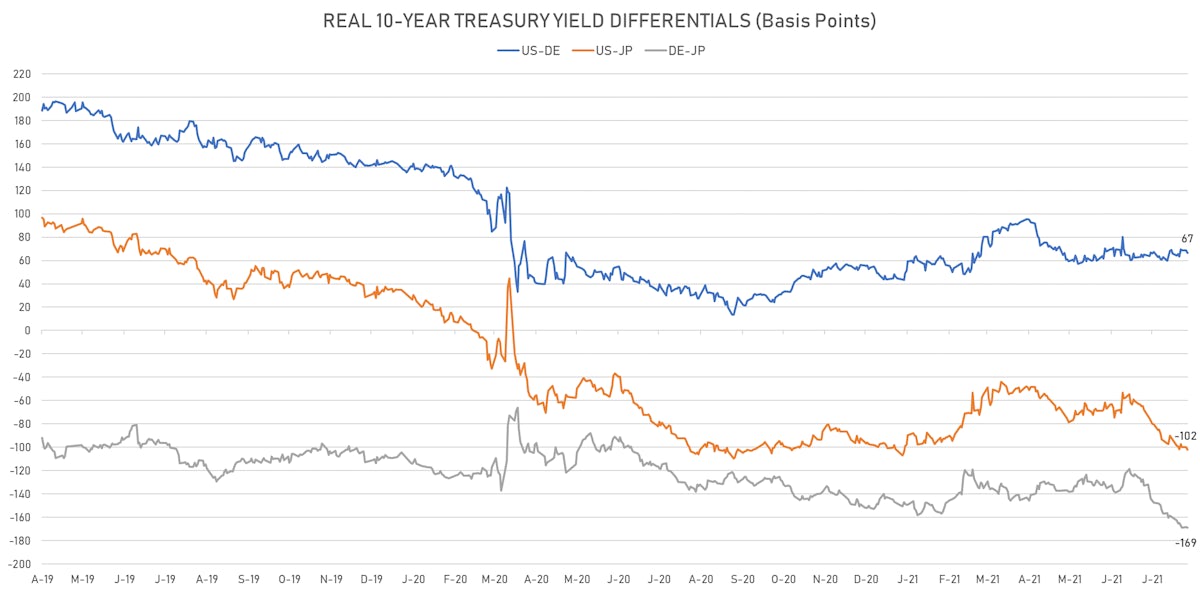

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.9 bp at 66.7 bp (YTD change: +20.6bp)

- US-JAPAN: -2.0 bp at -101.9 bp (YTD change: -0.4bp)

- JAPAN-GERMANY: +0.1 bp at 168.6 bp (YTD change: +21.0bp)

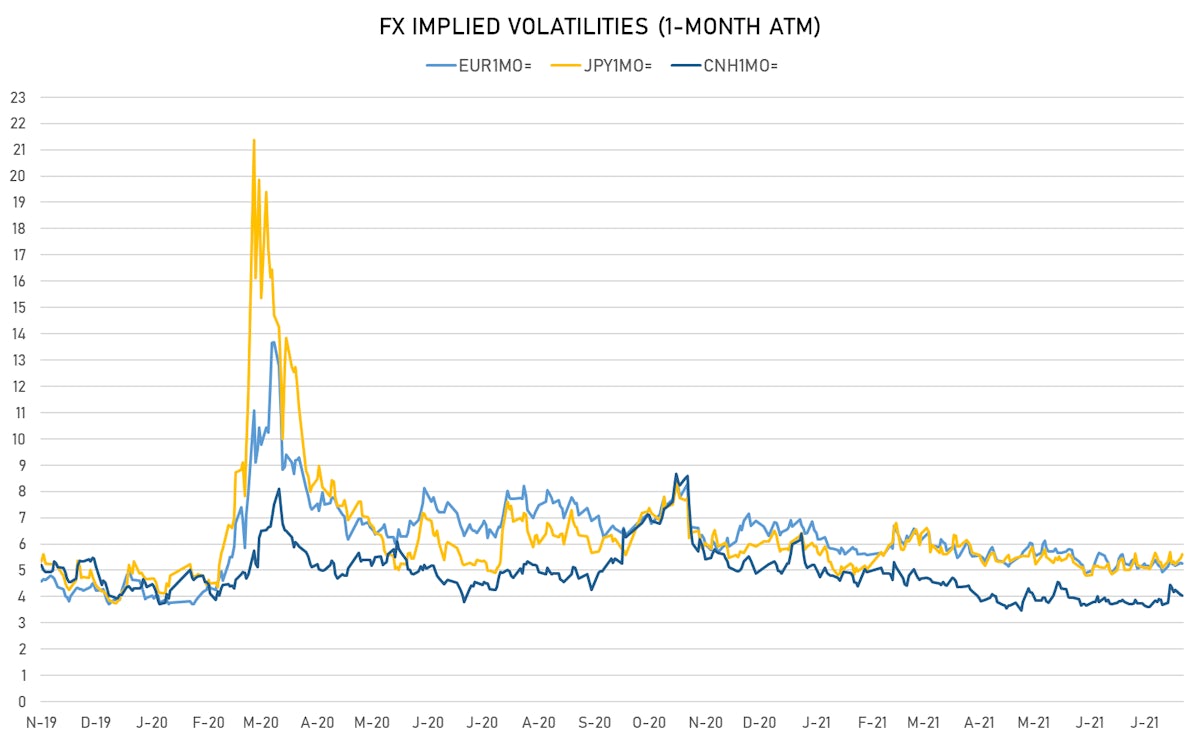

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.93, down -0.02 (YTD: -1.24)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.25 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.60, up 0.1 (YTD: -0.5)

- Offshore Yuan 1M ATM IV unchanged at 4.03 (YTD: -2.0)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): up 1.4 basis points to 86 bp (1Y range: 72-129bp)

- Saudi Arabia (rated A): up 0.6 basis points to 55 bp (1Y range: 52-101bp)

- Bahrain (rated B+): up 2.2 basis points to 246 bp (1Y range: 159-330bp)

- Turkey (rated BB-): up 3.2 basis points to 381 bp (1Y range: 282-597bp)

- Senegal (rated ): down 1.5 basis points to 368 bp (1Y range: 355-409bp)

- Nigeria (rated B): down 1.5 basis points to 345 bp (1Y range: 333-383bp)

- Government of Chile (rated A-): down 0.4 basis points to 69 bp (1Y range: 43-75bp)

- Mexico (rated BBB-): down 0.5 basis points to 94 bp (1Y range: 79-164bp)

- Oman (rated BB-): down 4.1 basis points to 239 bp (1Y range: 223-466bp)

- Peru (rated BBB+): down 3.7 basis points to 92 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Qatari Riyal up 2.3% (YTD: 0.0%)

- New Zealand $ up 1.1% (YTD: -1.9%)

- Lesotho Loti up 1.1% (YTD: +2.6%)

- Namibian Dollar up 1.0% (YTD: +2.6%)

- Swaziland Lilangeni up 1.0% (YTD: +2.6%)

- South Africa Rand up 1.0% (YTD: +2.6%)

- CFA Franc BEAC up 0.9% (YTD: -2.6%)

- Botswana Pula up 0.8% (YTD: -1.1%)

- Chilean Peso down 1.0% (YTD: -8.4%)

- Seychelles rupee down 1.1% (YTD: +45.4%)