FX

US Dollar Ends Day Higher After Conflicting Macro Data From ADP, ISM

The latest Reuters sell-side forecasts show an expected strengthening of the euro towards 1.2060 in 6 months, weakening of the yen towards 110.30 and strengthening of the CNY at 6.4455

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

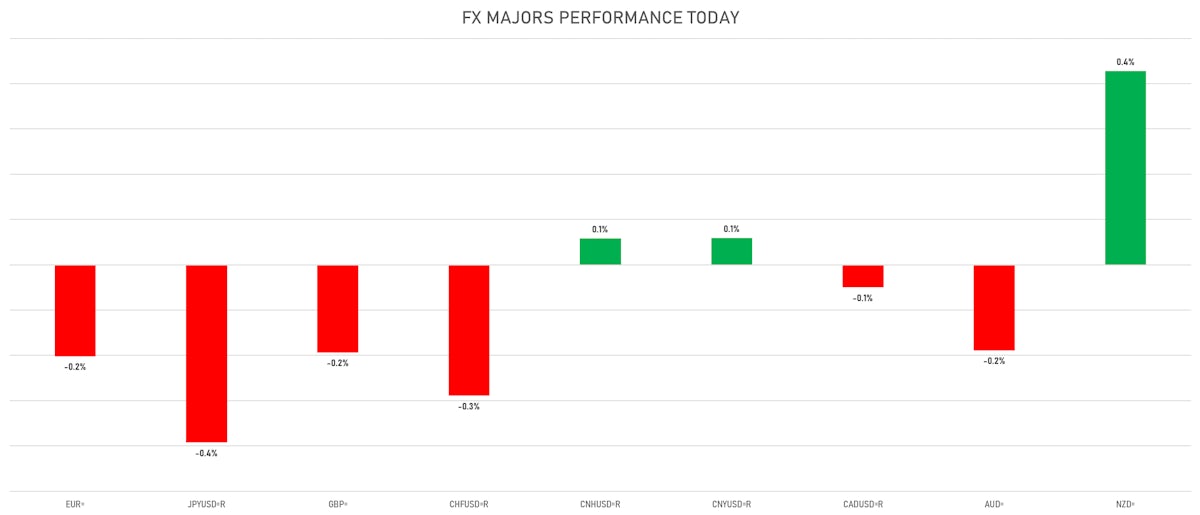

- The US Dollar Index is up 0.23% at 92.27 (YTD: +2.55%)

- Euro down 0.20% at 1.1836 (YTD: -3.1%)

- Yen down 0.39% at 109.49 (YTD: -5.7%)

- Onshore Yuan up 0.06% at 6.4655 (YTD: +0.9%)

- Swiss franc down 0.29% at 0.9065 (YTD: -2.3%)

- Sterling down 0.19% at 1.3887 (YTD: +1.6%)

- Canadian dollar down 0.05% at 1.2545 (YTD: +1.5%)

- Australian dollar down 0.19% at 0.7380 (YTD: -4.1%)

- NZ dollar up 0.43% at 0.7044 (YTD: -2.0%)

MACRO DATA RELEASES

- Australia, Retail Sales, Change P/P for Q2 2021 (AU Bureau of Stat) at 0.80 %, below consensus estimate of 0.90 %

- Australia, Retail Sales, Total, Final, Change P/P for Jun 2021 (AU Bureau of Stat) at -1.80 %, in line with consensus estimate

- Brazil, PMI, Composite, Output, Total for Jul 2021 (Markit Economics) at 55.20

- Brazil, PMI, Services Sector, Business Activity for Jul 2021 (Markit Economics) at 54.40

- Brazil, Policy Rates, SELIC Target Rate for 04 Aug (Central Bank, Brazil) at 5.25 %, in line with consensus

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for Jul 2021 (Markit Economics) at 54.90

- Euro Zone, PMI, Composite, Output, Final for Jul 2021 (Markit Economics) at 60.20, below consensus estimate of 60.60

- Euro Zone, PMI, Services Sector, Business Activity, Final for Jul 2021 (Markit Economics) at 59.80, below consensus estimate of 60.40

- France, PMI, Composite, Output, Final for Jul 2021 (Markit/CDAF, France) at 56.60, below consensus estimate of 56.80

- France, PMI, Services Sector, Business Activity, Final for Jul 2021 (Markit Economics) at 56.80, below consensus estimate of 57.00

- Germany, PMI, Composite, Output, Final for Jul 2021 (Markit Economics) at 62.40, below consensus estimate of 62.50

- Germany, PMI, Services Sector, Business Activity, Final for Jul 2021 (Markit Economics) at 61.80, below consensus estimate of 62.20

- India, IHS Markit, PMI, Services Sector, Business Activity for Jul 2021 (Markit Economics) at 45.40, below consensus estimate of 49.00

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Jul 2021 (Markit Economics) at 47.40

- Mauritius, Policy Rates, Key Repo Rate for Q2 2021 (Bank of Mauritius) at 1.85 %

- Russia, PMI, Services Sector, Business Activity for Jul 2021 (Markit Economics) at 53.50

- Thailand, Policy Rates, 1-Day Repurchase Rate (Key Policy Rate) for 04 Aug (Bank of Thailand) at 0.50 %, in line with consensus

- United Kingdom, Reserves, Gross, Government, Current Prices for Jul 2021 (HM Treasury) at US$ 178.1 bn

- United States, ISM Non-manufacturing, NMI/PMI for Jul 2021 (ISM, United States) at 64.10, above consensus estimate of 60.50

- United States, PMI, Composite, Output, Final for Jul 2021 (Markit Economics) at 59.90

- United States, PMI, Services Sector, Business Activity, Final for Jul 2021 (Markit Economics) at 59.90

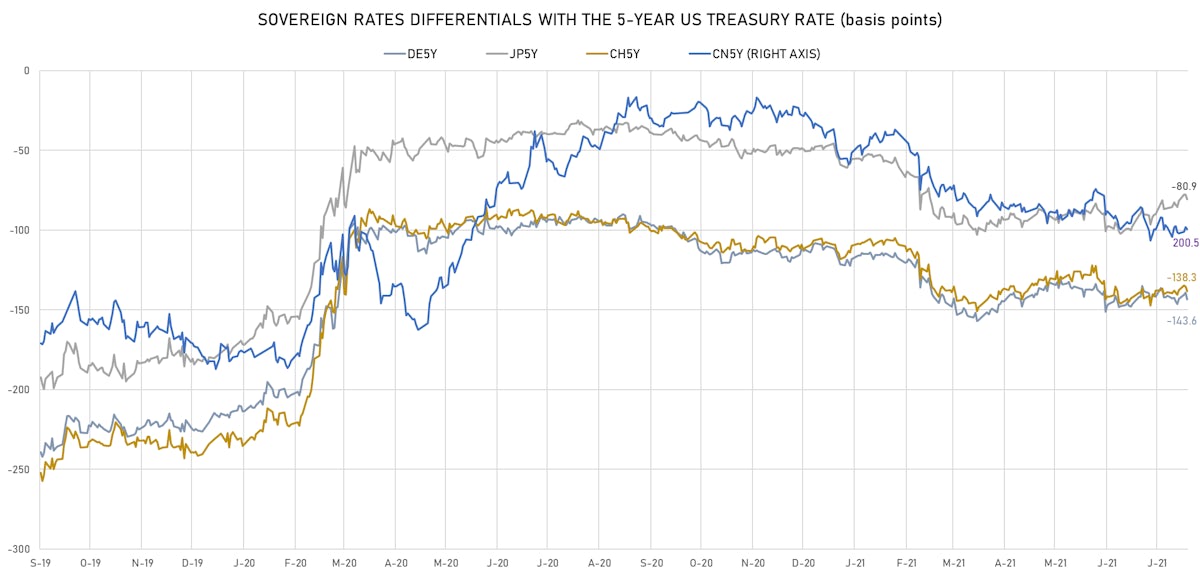

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.3 bp at 144.7 bp (YTD change: +33.6 bp)

- US-JAPAN: +3.0 bp at 81.3 bp (YTD change: +33.0 bp)

- US-CHINA: +1.0 bp at -197.0 bp (YTD change: +60.2 bp)

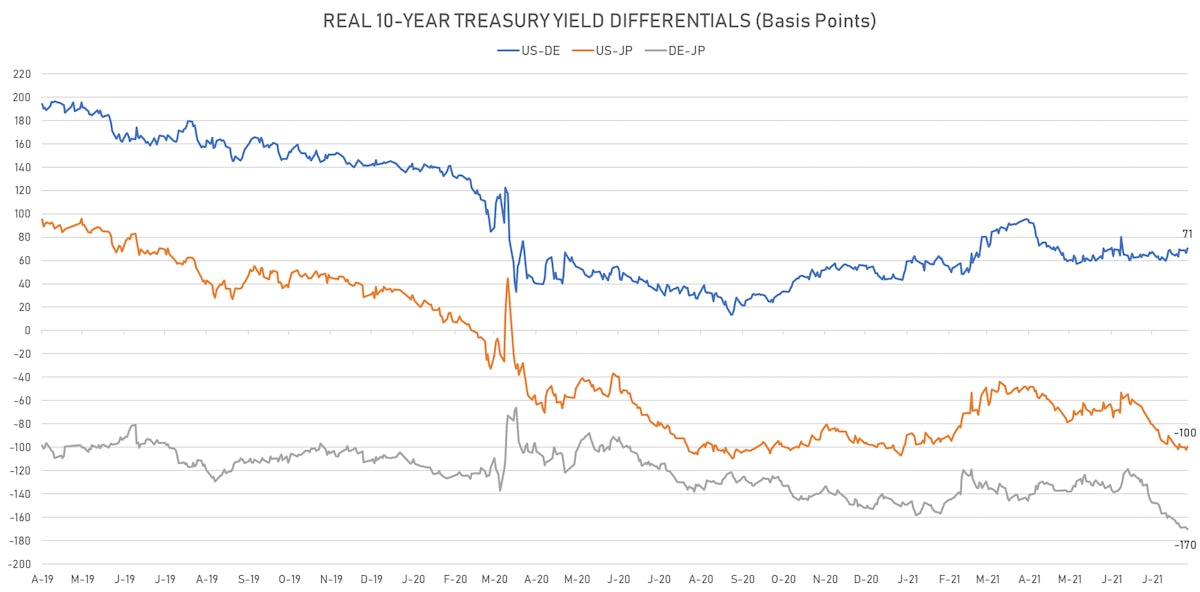

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.0 bp at 70.7 bp (YTD change: +24.6bp)

- US-JAPAN: +2.4 bp at -99.5 bp (YTD change: +2.0bp)

- JAPAN-GERMANY: +1.6 bp at 170.2 bp (YTD change: +22.6bp)

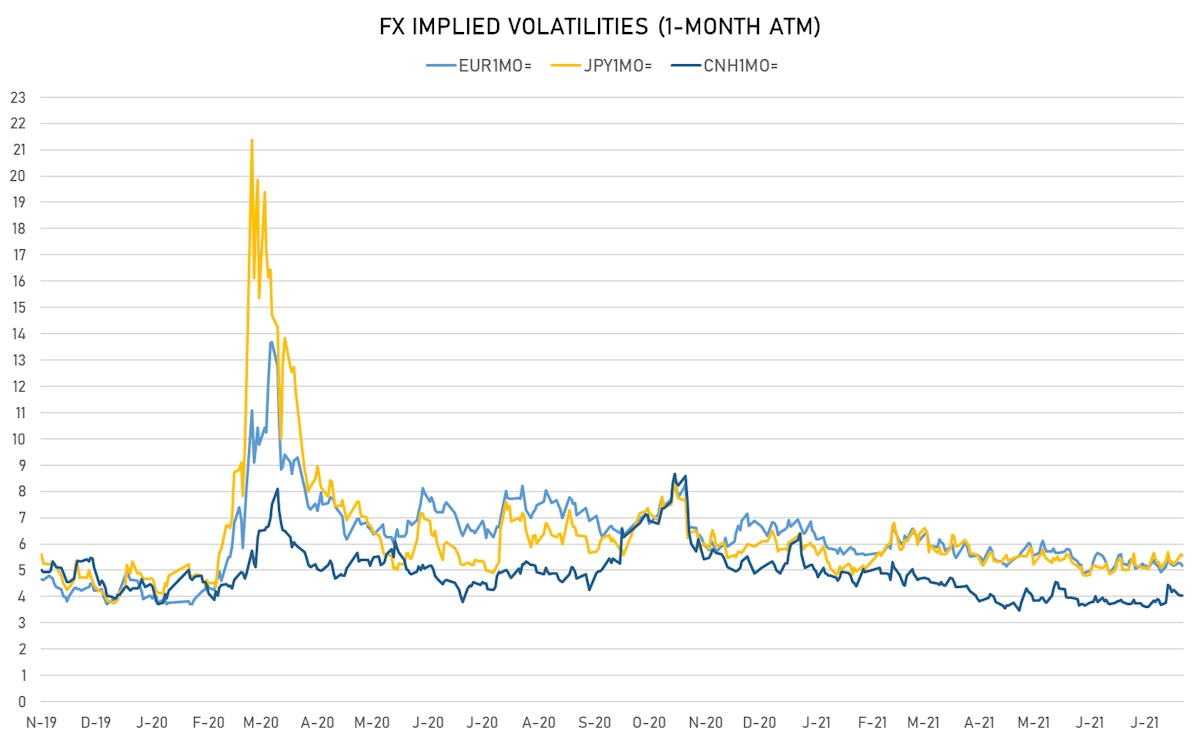

VOLATILITIES TODAY

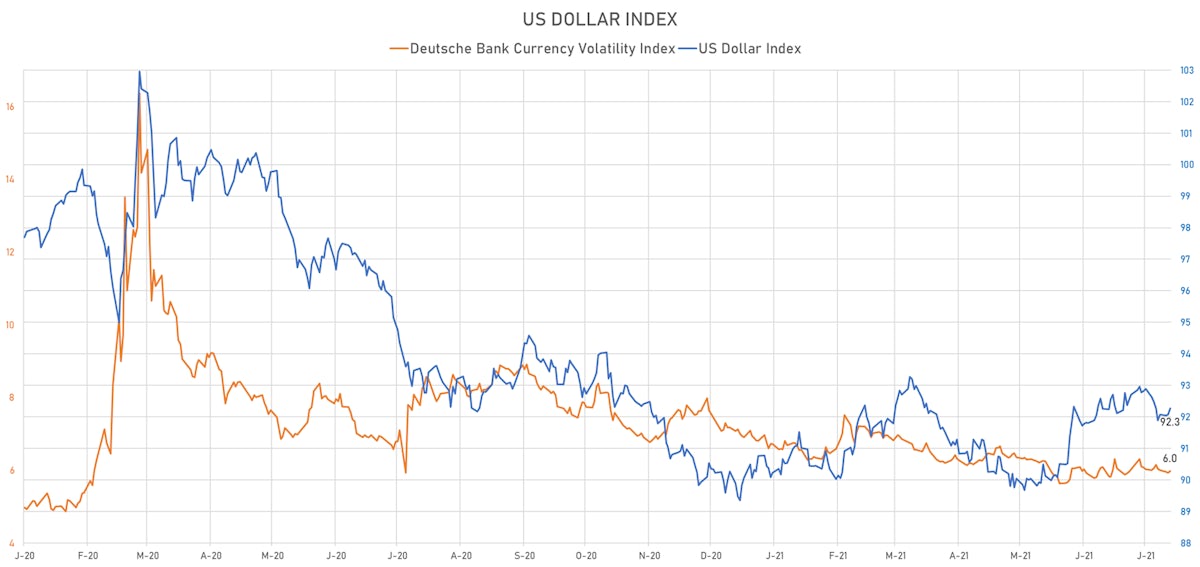

- Deutsche Bank USD Currency Volatility Index currently at 5.98, up 0.05 (YTD: -1.19)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.18, down -0.1 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.54, down -0.1 (YTD: -0.6)

- Offshore Yuan 1M ATM IV unchanged at 4.03 (YTD: -2.0)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Brazil (rated BB-): up 1.8 basis points to 178 bp (1Y range: 141-252bp)

- Panama (rated BBB-): up 0.7 basis points to 72 bp (1Y range: 44-95bp)

- Egypt (rated B+): up 2.7 basis points to 345 bp (1Y range: 283-424bp)

- Mexico (rated BBB-): up 0.7 basis points to 95 bp (1Y range: 79-164bp)

- Nigeria (rated B): down 1.5 basis points to 343 bp (1Y range: 333-383bp)

- Russia (rated BBB): down 0.8 basis points to 85 bp (1Y range: 72-129bp)

- South Africa (rated BB-): down 2.0 basis points to 198 bp (1Y range: 178-328bp)

- Indonesia (rated BBB): down 0.8 basis points to 79 bp (1Y range: 66-118bp)

- Saudi Arabia (rated A): down 0.6 basis points to 55 bp (1Y range: 52-101bp)

- Vietnam (rated BB): down 1.2 basis points to 109 bp (1Y range: 90-153bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 0.8% (YTD: -24.6%)

- Taiwan Dollar up 0.6% (YTD: +1.3%)

- Brazilian Real up 0.5% (YTD: +0.4%)

- Pakistani rupee down 0.5% (YTD: -1.9%)

- Peru Sol down 0.8% (YTD: -11.7%)

- Turkish Lira down 0.8% (YTD: -12.4%)

- Iceland Krona down 0.9% (YTD: +2.2%)

- Cape Verde Escudo down 0.9% (YTD: 0.0%)

- Ethiopian Birr down 1.9% (YTD: -12.8%)