FX

Very Little Movement In The Dollar Index As Markets Await NFP On Friday

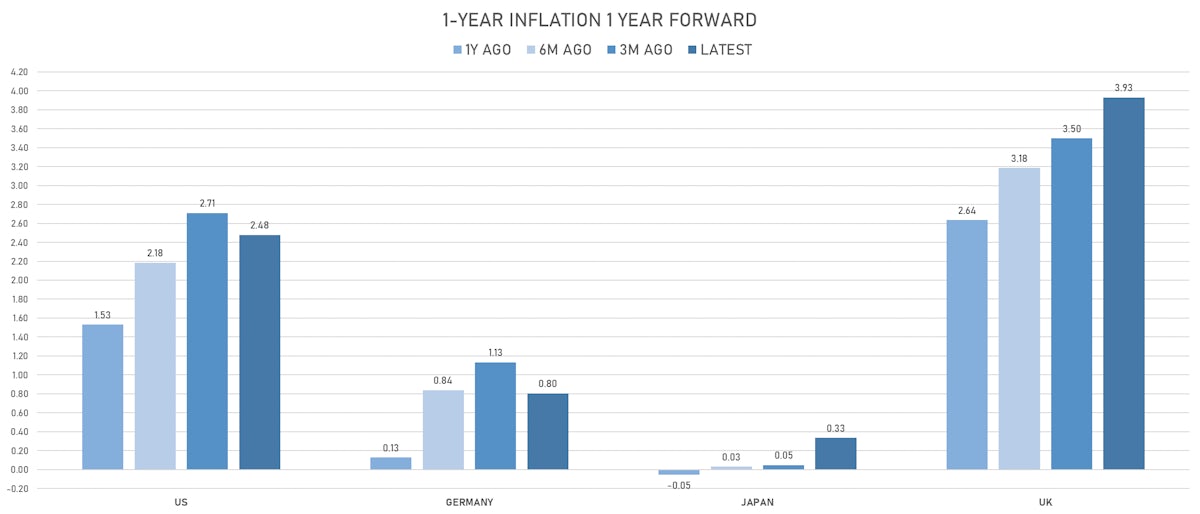

The Bank of England kept rates unchanged, although the UK is one of the countries where short-term inflation expectations have kept going up recently

Published ET

Global short-term inflation expectations | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

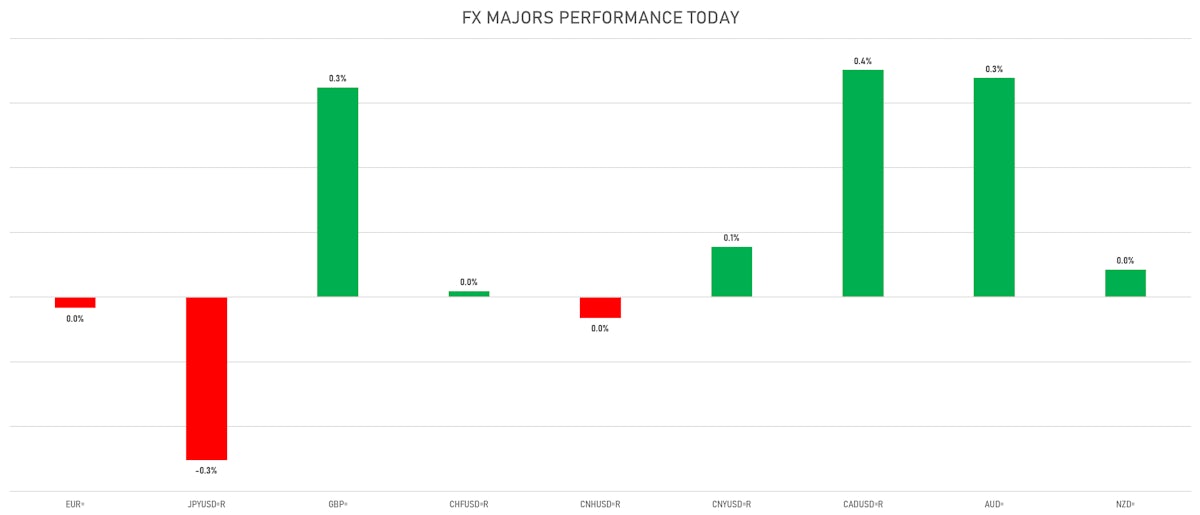

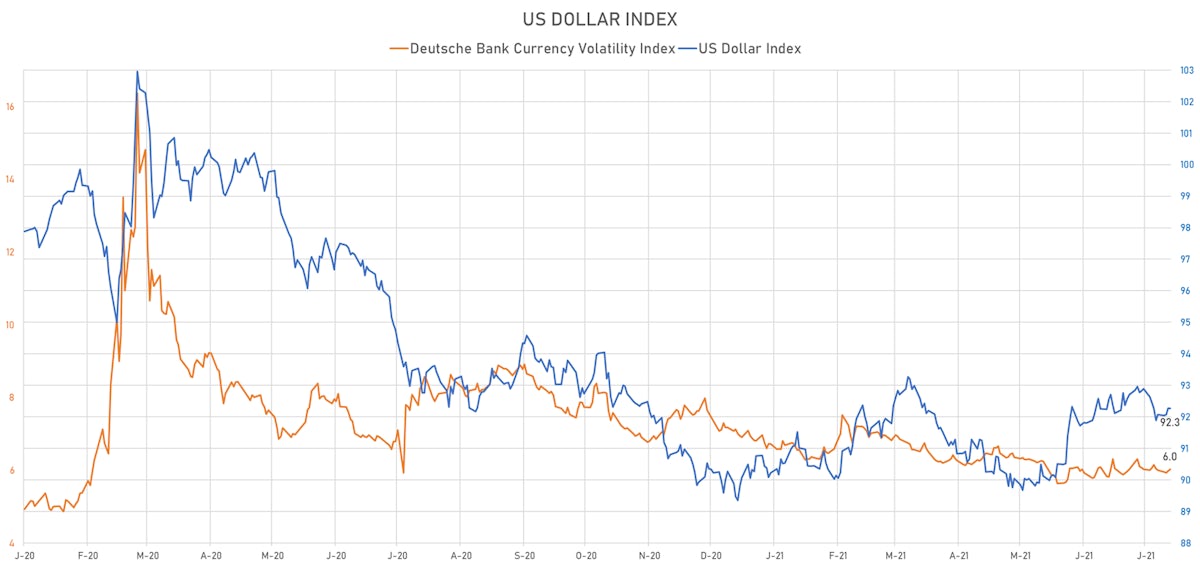

- The US Dollar Index was down -0.01% at 92.26 (YTD: +2.54%)

- Euro down 0.02% at 1.1833 (YTD: -3.1%)

- Yen down 0.25% at 109.77 (YTD: -5.9%)

- Onshore Yuan up 0.08% at 6.4608 (YTD: +1.0%)

- Swiss franc up 0.01% at 0.9062 (YTD: -2.4%)

- Sterling up 0.32% at 1.3930 (YTD: +1.9%)

- Canadian dollar up 0.35% at 1.2496 (YTD: +1.9%)

- Australian dollar up 0.34% at 0.7404 (YTD: -3.8%)

- NZ dollar up 0.04% at 0.7050 (YTD: -1.9%)

MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for Jun 2021 (AU Bureau of Stat) at 10,496.00 Mln AUD, above consensus estimate of 10,450.00 Mln AUD

- Canada, Trade Balance, Total, fob for Jun 2021 (CANSIM, Canada) at 3.23 Bln CAD, above consensus estimate of -0.68 Bln CAD

- Czech Republic, Policy Rates, Repo Rate (2 Week) for 06 Aug (Czech National Bank) at 0.75 %, in line with consensus estimate

- Egypt, Policy Rates, Overnight Deposit Rate for 09 Aug (Central Bank, Egypt) at 8.25 %, in line with consensus estimate

- Egypt, Policy Rates, Overnight Lending Rate for 09 Aug (Central Bank, Egypt) at 9.25 %, in line with consensus estimate

- Germany, New Orders, Manufacturing industry, Change P/P for Jun 2021 (Deutsche Bundesbank) at 4.10 %, above consensus estimate of 1.90 %

- Philippines, CPI, Total, inflation rate, Change Y/Y for Jul 2021 (PSA) at 4.00 %, above consensus estimate of 3.90 %

- Taiwan, CPI, Change Y/Y, Price Index for Jul 2021 (DGBAS, Taiwan) at 1.95 %, above consensus estimate of 1.81 %

- United Kingdom, Policy Rates, Bank Rate for Aug 2021 (Bank of England) at 0.10 %, in line with consensus estimate

- United Kingdom, Policy Rates, GB BOE QE Corporate Bond Purchases, Current Prices for Aug 2021 (Bank of England) at 20.00 Bln GBP, in line with consensus estimate

- United States, Jobless Claims, National, Initial for W 31 Jul (U.S. Dept. of Labor) at 385.00 k, above consensus estimate of 384.00 k

- United States, Trade Balance, Total, Goods and services for Jun 2021 (U.S. Census Bureau) at -75.70 Bln USD, below consensus estimate of -74.10 Bln USD

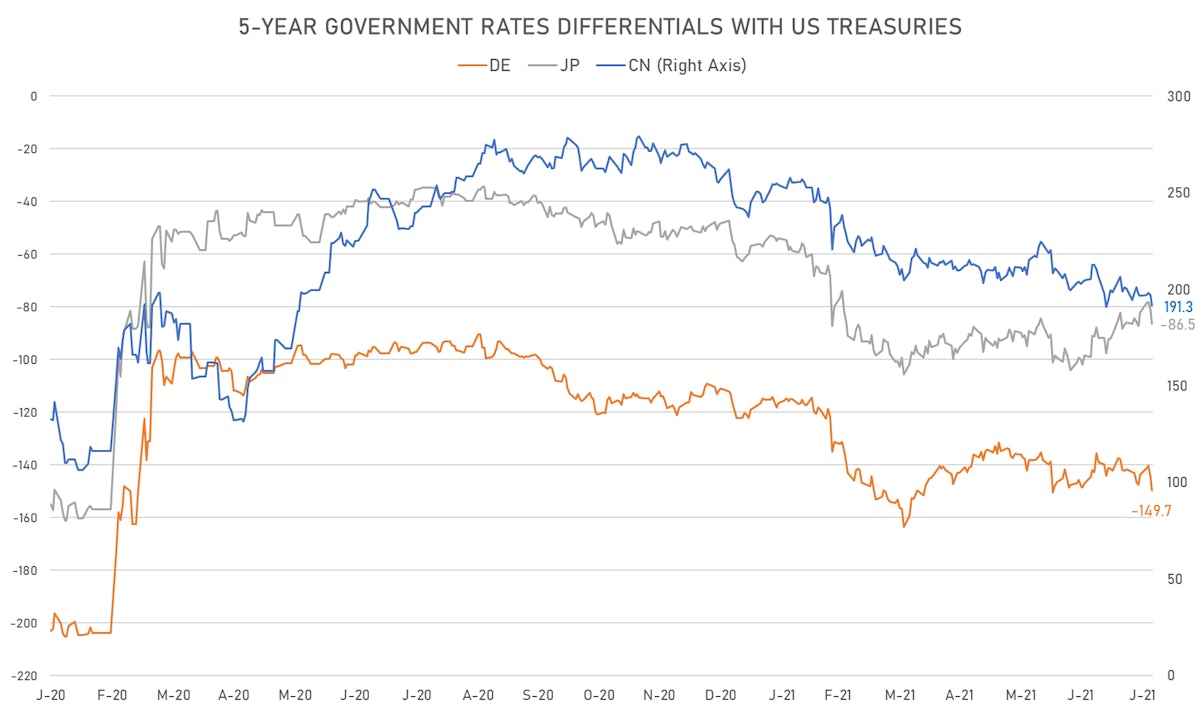

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.0 bp at 149.7 bp (YTD change: +38.6 bp)

- US-JAPAN: +5.2 bp at 86.5 bp (YTD change: +38.2 bp)

- US-CHINA: +5.6 bp at -191.3 bp (YTD change: +65.8 bp)

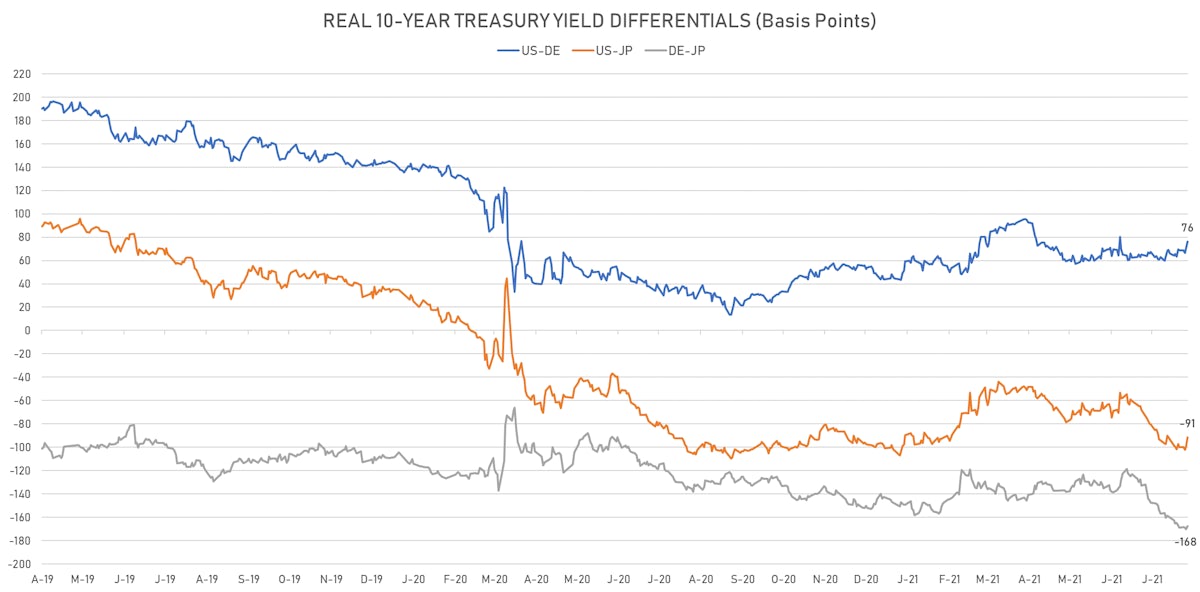

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.5 bp at 76.2 bp (YTD change: +30.1bp)

- US-JAPAN: +8.1 bp at -91.4 bp (YTD change: +10.1bp)

- JAPAN-GERMANY: -2.6 bp at 167.6 bp (YTD change: +20.0bp)

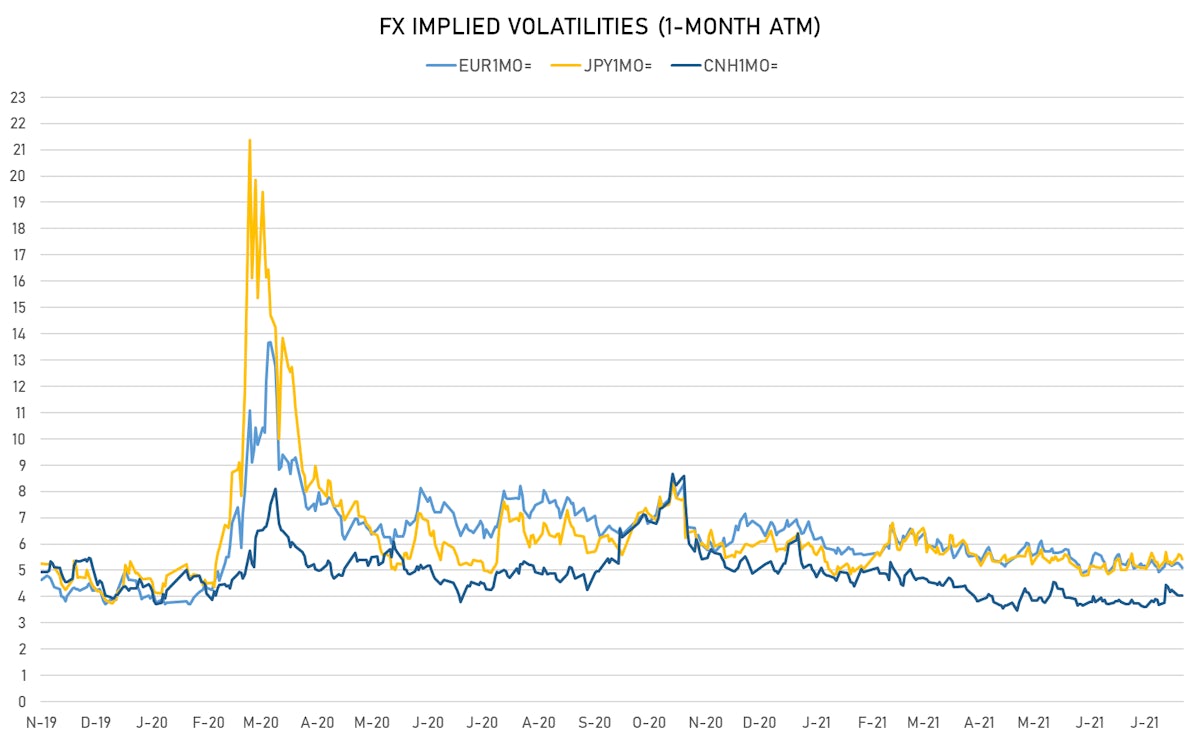

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.03, up 0.05 (YTD: -1.14)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.10, down -0.1 (YTD: -1.6)

- Japanese Yen 1M ATM IV currently at 5.43, down -0.1 (YTD: -0.7)

- Offshore Yuan 1M ATM IV unchanged at 4.04 (YTD: -1.9)

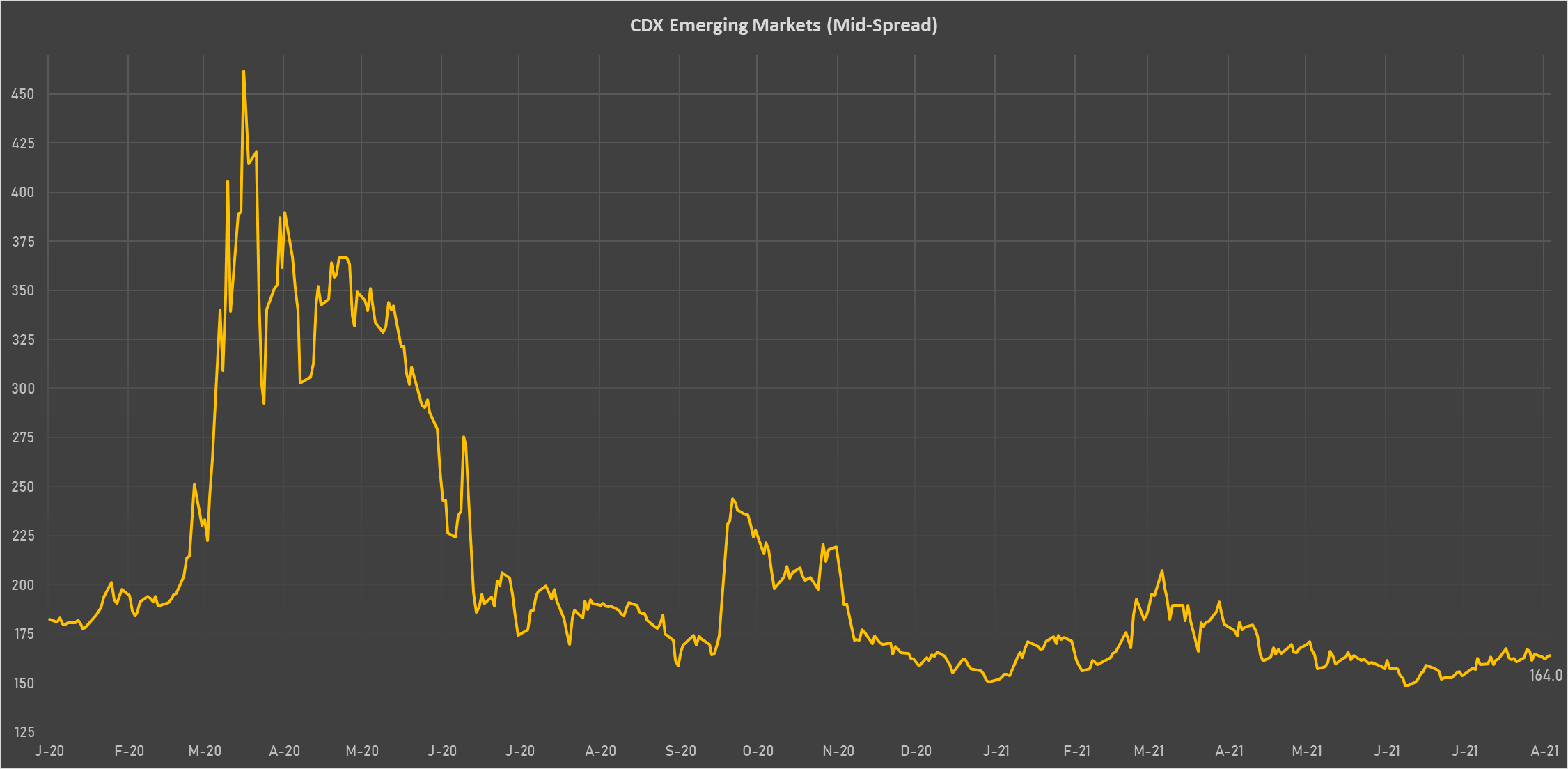

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Turkey (rated BB-): up 3.2 basis points to 385 bp (1Y range: 282-597bp)

- Brazil (rated BB-): up 1.4 basis points to 181 bp (1Y range: 141-252bp)

- South Africa (rated BB-): up 1.3 basis points to 200 bp (1Y range: 178-328bp)

- Panama (rated BBB-): up 0.3 basis points to 72 bp (1Y range: 44-95bp)

- Vietnam (rated BB): down 0.7 basis points to 108 bp (1Y range: 90-150bp)

- Argentina (rated CCC): down 14.6 basis points to 1,945 bp (1Y range: 1,049-1,968bp)

- Saudi Arabia (rated A): down 0.4 basis points to 54 bp (1Y range: 52-101bp)

- Oman (rated BB-): down 3.6 basis points to 236 bp (1Y range: 223-452bp)

- Bahrain (rated B+): down 4.9 basis points to 241 bp (1Y range: 159-330bp)

- Egypt (rated B+): down 14.1 basis points to 331 bp (1Y range: 283-422bp)

LARGEST FX MOVES TODAY

- Cape Verde Escudo down 0.9% (YTD: 0.0%)

- Pakistani rupee down 1.0% (YTD: -2.4%)

- Philippine Peso down 1.2% (YTD: -4.6%)

- South Africa Rand down 1.3% (YTD: +1.3%)

- Turkish Lira down 1.3% (YTD: -12.8%)

- Namibian Dollar down 1.4% (YTD: +1.3%)

- Swazi Lilangeni down 1.4% (YTD: +1.2%)

- Lesotho Loti down 1.5% (YTD: +1.2%)

- Ethiopian Birr down 1.9% (YTD: -12.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 47.4%

- Mozambique metical up 15.4%

- Ethiopian Birr down 12.8%

- Argentine Peso down 13.2%

- Haiti Gourde down 24.6%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%