FX

The US Dollar Rises Broadly Against Major Currencies With Higher Real Rates

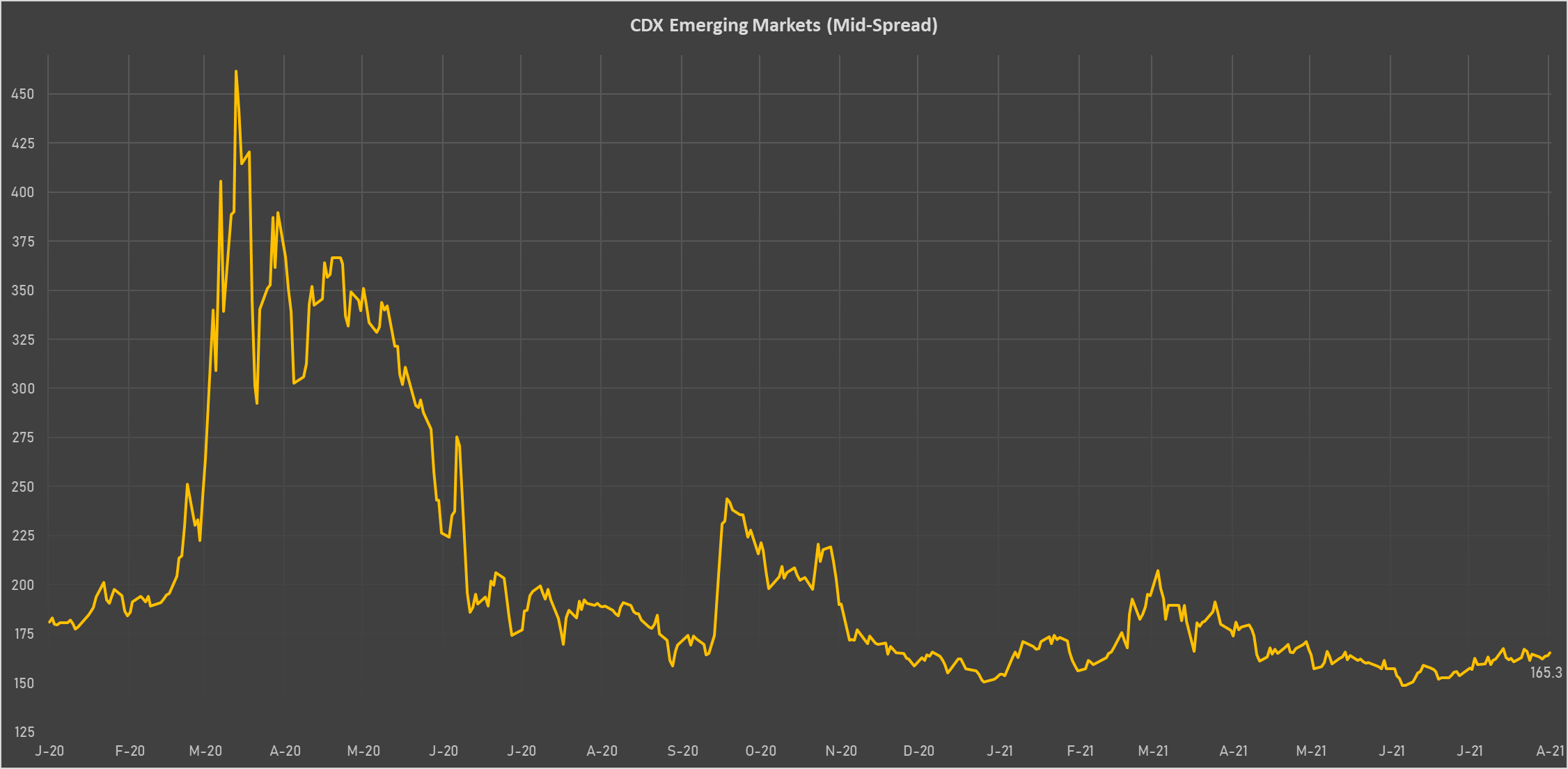

Many emerging market credit spreads widened, with currencies like the Chilean Peso, Turkish Lira, Philippines Peso weakening close to 2% today

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

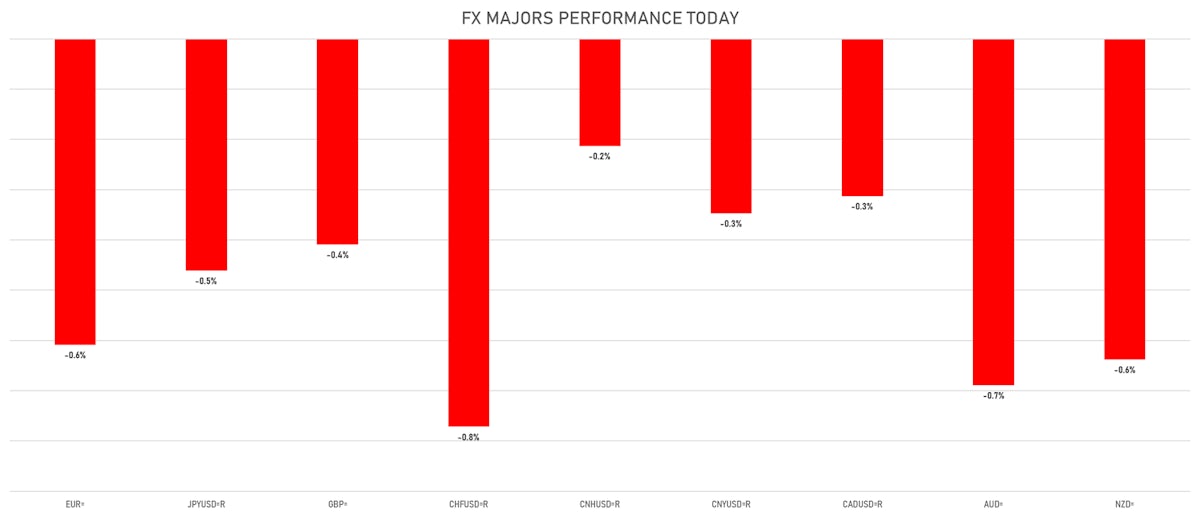

- The US Dollar Index is up 0.56% at 92.78 (YTD: +3.11%)

- Euro down 0.61% at 1.1760 (YTD: -3.7%)

- Yen down 0.46% at 110.25 (YTD: -6.4%)

- Onshore Yuan down 0.35% at 6.4825 (YTD: +0.7%)

- Swiss franc down 0.77% at 0.9144 (YTD: -3.2%)

- Sterling down 0.41% at 1.3871 (YTD: +1.4%)

- Canadian dollar down 0.31% at 1.2546 (YTD: +1.5%)

- Australian dollar down 0.69% at 0.7353 (YTD: -4.4%)

- NZ dollar down 0.64% at 0.7008 (YTD: -2.5%)

MACRO DATA RELEASES

- Canada, Employment, Absolute change for Jul 2021 (CANSIM, Canada) at 94.00 k, below consensus estimate of 177.50 k

- Canada, Unemployment, Rate for Jul 2021 (CANSIM, Canada) at 7.50 %, above consensus estimate of 7.40 %

- France, Reserve Assets, Current Prices for Jul 2021 (MINEFI, France) at 190,654.00 Mln EUR

- Germany, Production, Total industry including construction, Change P/P for Jun 2021 (Destatis) at -1.30 %, below consensus estimate of 0.50 %

- India, Policy Rates, Cash Reserve Ratio for 06 Aug (RBI) at 4.00 %, in line with consensus estimate

- India, Policy Rates, Repo Rate for 06 Aug (RBI) at 4.00 %, in line with consensus estimate

- India, Policy Rates, Reverse Repo Rate for 06 Aug (RBI) at 3.35 %, in line with consensus estimate

- New Zealand, Reserve Assets, Current Prices for Jul 2021 (RBNZ) at 17,599.00 Mln NZD

- Romania, Policy Rates, Policy Rate for 06 Aug (Cent. Bank, Romania) at 1.25 %, in line with consensus estimate

- Russia, CPI, Change P/P for Jul 2021 (RosStat, Russia) at 0.30 %, below consensus estimate of 0.40 %

- Russia, CPI, Change Y/Y for Jul 2021 (RosStat, Russia) at 6.50 %, below consensus estimate of 6.60 %

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Jul 2021 (SA Reserve Bank) at 54.46 Bln USD

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Jul 2021 (SA Reserve Bank) at 51.65 Bln USD

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Jul 2021 (Swiss National Bank) at 923,240.00 Mln CHF

- United Kingdom, House Prices, Halifax, UK, Change P/P for Jul 2021 at 0.40 %

- United States, Employment, Nonfarm payroll, total, Absolute change for Jul 2021 (BLS, U.S Dep. Of Lab) at 943 k, above consensus estimate of 870 k

- United States, Unemployment, Rate for Jul 2021 (BLS, U.S Dep. Of Lab) at 5.40 %, below consensus estimate of 5.70 %

WEEKLY CFTC DATA

- ALL: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduced their net short US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

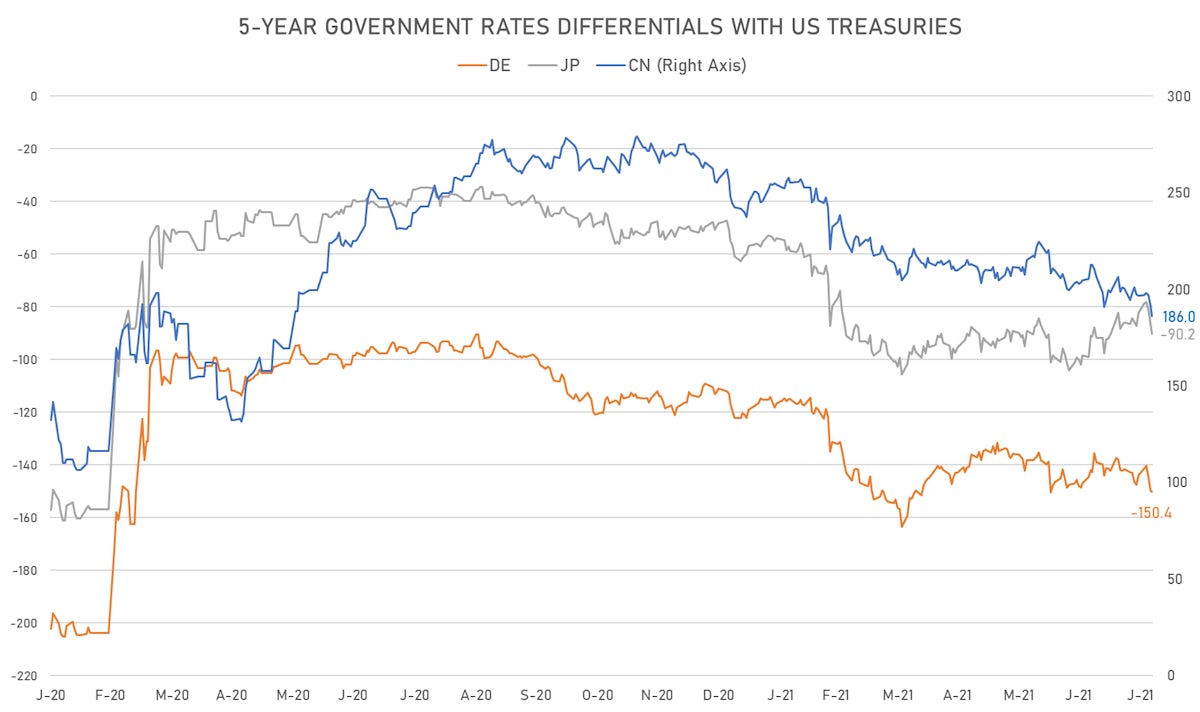

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.7 bp at 150.4 bp (YTD change: +39.3 bp)

- US-JAPAN: +3.7 bp at 90.2 bp (YTD change: +41.9 bp)

- US-CHINA: +5.3 bp at -186.0 bp (YTD change: +71.1 bp)

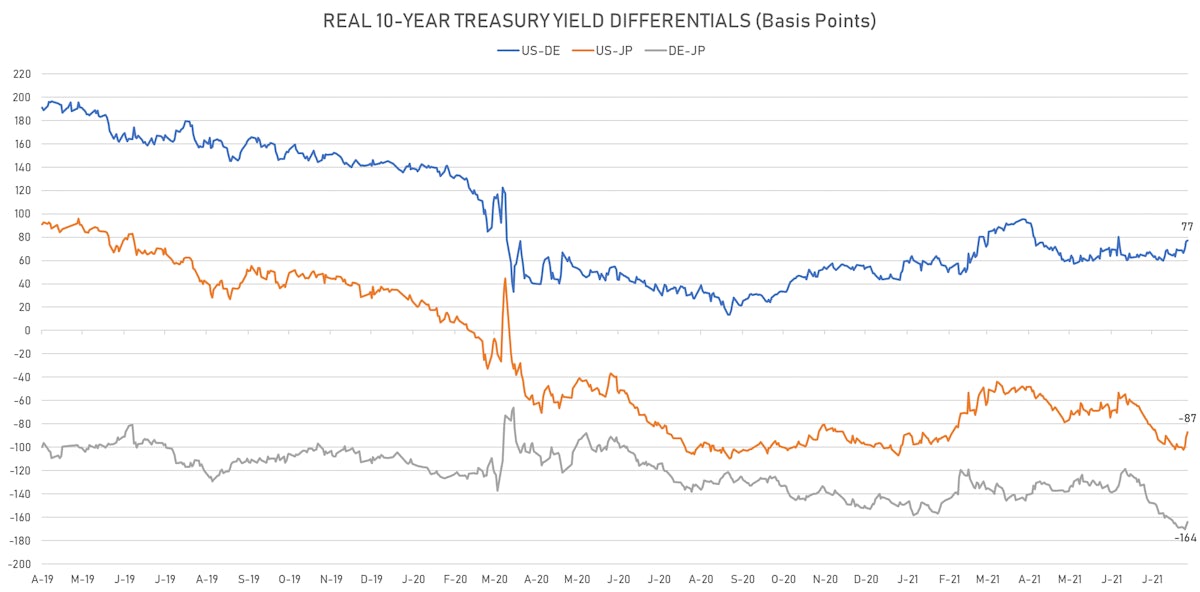

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.8 bp at 77.0 bp (YTD change: +30.9bp)

- US-JAPAN: +4.3 bp at -87.1 bp (YTD change: +14.4bp)

- JAPAN-GERMANY: -3.5 bp at 164.1 bp (YTD change: +16.5bp)

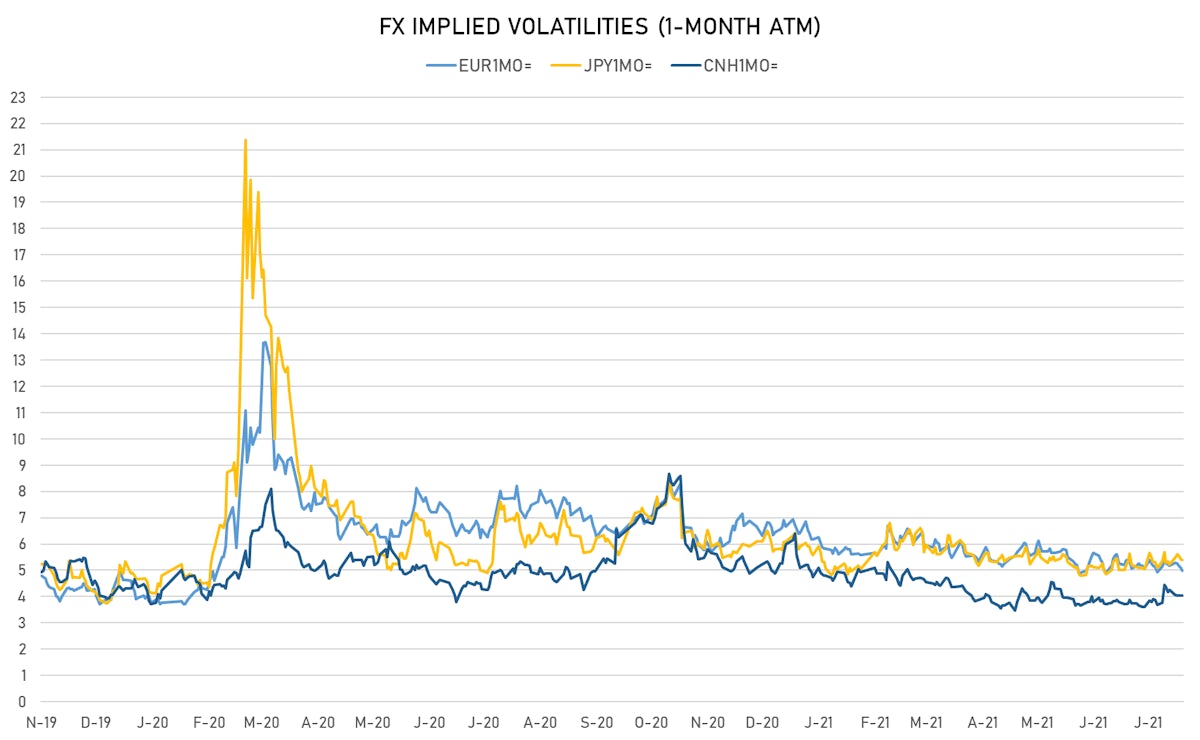

VOLATILITIES TODAY

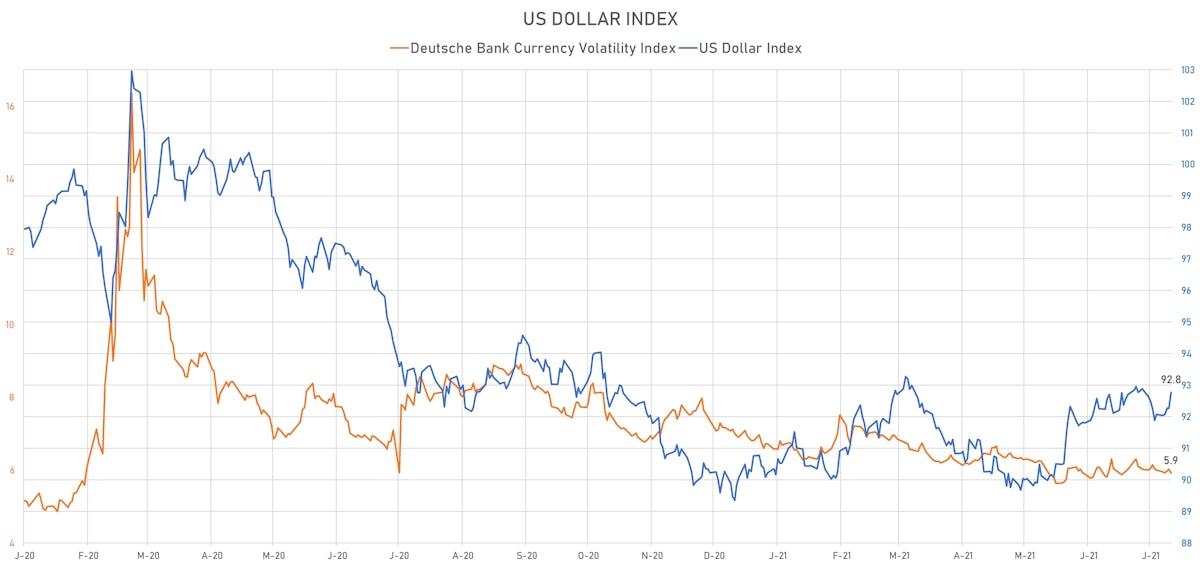

- Deutsche Bank USD Currency Volatility Index currently at 5.92, down -0.11 (YTD: -1.25)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.98, down -0.1 (YTD: -1.7)

- Japanese Yen 1M ATM IV unchanged at 5.39 (YTD: -0.7)

- Offshore Yuan 1M ATM IV unchanged at 4.05 (YTD: -1.9)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Oman (rated BB-): up 12.4 basis points to 248 bp (1Y range: 223-452bp)

- Egypt (rated B+): up 14.5 basis points to 346 bp (1Y range: 283-422bp)

- Bahrain (rated B+): up 4.7 basis points to 246 bp (1Y range: 159-330bp)

- South Africa (rated BB-): up 3.7 basis points to 203 bp (1Y range: 178-328bp)

- Turkey (rated BB-): up 5.7 basis points to 391 bp (1Y range: 282-597bp)

- Brazil (rated BB-): up 1.6 basis points to 182 bp (1Y range: 141-252bp)

- Malaysia (rated BBB+): up 0.2 basis points to 50 bp (1Y range: 33-57bp)

- Government of Chile (rated A-): down 0.5 basis points to 68 bp (1Y range: 43-75bp)

- Indonesia (rated BBB): down 0.7 basis points to 78 bp (1Y range: 66-118bp)

- Mexico (rated BBB-): down 0.9 basis points to 94 bp (1Y range: 79-164bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 2.9% (YTD: 0.0%)

- Aruba Florin up 2.2% (YTD: +2.2%)

- Lesotho Loti down 1.8% (YTD: +0.3%)

- Chilean Peso down 1.8% (YTD: -9.8%)

- Turkish Lira down 1.9% (YTD: -13.9%)

- Philippine Peso down 1.9% (YTD: -5.3%)

- Haiti Gourde down 2.0% (YTD: -26.1%)

- Nicaragua Cordoba down 2.3% (YTD: -2.7%)

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 34.7%

- Mozambique metical up 17.2%

- Colombian Peso down 13.6%

- Turkish Lira down 13.9%

- Haiti Gourde down 26.1%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%