FX

US Dollar Rises Against Major Currencies On Positive Real Rates Differentials

Technical analysts see the US dollar extending recent gains, with a double bottom in the charts indicating possible further strength

Published ET

US Dollar Index & Deutsche Bank Currency Volatility Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

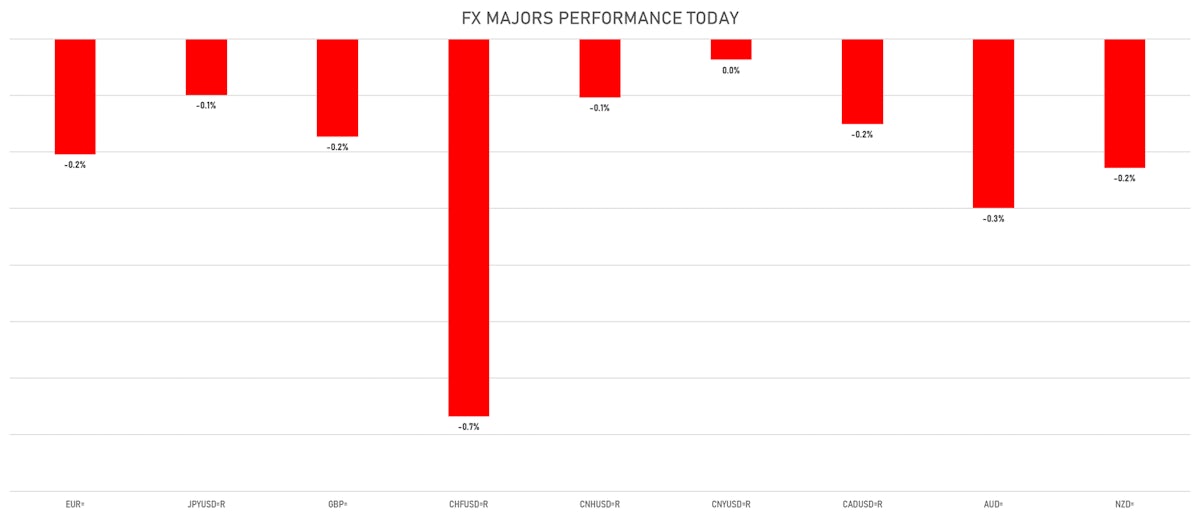

- The US Dollar Index is up 0.21% at 92.97 (YTD: +3.32%)

- Euro down 0.20% at 1.1736 (YTD: -3.9%)

- Yen down 0.10% at 110.38 (YTD: -6.4%)

- Onshore Yuan down 0.04% at 6.4857 (YTD: +0.6%)

- Swiss franc down 0.67% at 0.9202 (YTD: -3.9%)

- Sterling down 0.17% at 1.3847 (YTD: +1.3%)

- Canadian dollar down 0.15% at 1.2575 (YTD: +1.3%)

- Australian dollar down 0.30% at 0.7331 (YTD: -4.7%)

- NZ dollar down 0.23% at 0.6992 (YTD: -2.7%)

MACRO DATA RELEASES

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Jul 2021 (NBS, China) at 1.00 %, above consensus estimate of 0.80 %

- China (Mainland), CPI, Change P/P for Jul 2021 (NBS, China) at 0.30 %, above consensus estimate of 0.20 %

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Jul 2021 (NBS, China) at 9.00 %, above consensus estimate of 8.80 %

- Czech Republic, Unemployment, Rate for Jul 2021 (MPSV, Czech Republic) at 3.70 %, below consensus estimate of 3.80 %

- Euro Zone Investors sentiment for Aug 2021 (Sentix) at 22.20, below consensus estimate of 29.00

- Germany, Exports, Change P/P for Jun 2021 (Deutsche Bundesbank) at 1.30 %, above consensus estimate of 0.40 %

- Germany, Imports, Change P/P for Jun 2021 (Deutsche Bundesbank) at 0.60 %, above consensus estimate of 0.50 %

- Germany, Trade Balance for Jun 2021 (Deutsche Bundesbank) at 13.60 Bln EUR, above consensus estimate of 13.40 Bln EUR

- Greece, CPI, Change Y/Y, Price Index for Jul 2021 (ELSTAT, Greece) at 1.40 %

- Greece, HICP, Change Y/Y, Price Index for Jul 2021 (ELSTAT, Greece) at -1.30 %

- Ireland, Unemployment, Rate, ILO for Jul 2021 (CSO, Ireland) at 6.50 %

- Japan, Current Account, Balance, Current Prices for Jun 2021 (BOJ/MOF Japan) at 905.10 Bln JPY, above consensus estimate of 779.80 Bln JPY

- Latvia, CPI, Change P/P for Jul 2021 (Statistics, Latvia) at 0.40 %

- Latvia, CPI, Change Y/Y for Jul 2021 (Statistics, Latvia) at 2.80 %

- Lithuania, CPI, Change P/P for Jul 2021 (Statistics Lithuania) at 0.70 %

- Lithuania, CPI, Change Y/Y, Price Index for Jul 2021 (Statistics Lithuania) at 4.70 %

- Malaysia, Production, Total industry, Change Y/Y for Jun 2021 (Statistics, Malaysia) at 1.40 %, above consensus estimate of -0.30 %

- Mexico, CPI, Change P/P, Price Index for Jul 2021 (INEGI, Mexico) at 0.59 %, above consensus estimate of 0.55 %

- Mexico, CPI, Change Y/Y, Price Index for Jul 2021 (INEGI, Mexico) at 5.81 %, above consensus estimate of 5.77 %

- Mexico, CPI, Core CPI, Change P/P, Price Index for Jul 2021 (INEGI, Mexico) at 0.48 %, in line with consensus estimate

- New Zealand, Electronic card transactions, Retail industry, Change P/P for Jul 2021 (Statistics, NZ) at 0.60 %

- New Zealand, Electronic card transactions, Retail industry, Change Y/Y for Jul 2021 (Statistics, NZ) at 4.70 %

- Norway, Production, Manufacturing, Change P/P for Jun 2021 (Statistics Norway) at 0.70 %

- Slovakia, Trade Balance, Total, FOB, Current Prices for Jun 2021 (Stat Office of SR) at 296.70 Mln EUR, above consensus estimate of 178.30 Mln EUR

- Switzerland, Unemployment, Rate for Jul 2021 (SECO, Switzerland) at 3.00 %, in line with consensus estimate

- Taiwan, Exports, Change Y/Y for Jul 2021 (MoF, Taiwan) at 34.70 %, above consensus estimate of 29.50 %

- Taiwan, Imports, Change Y/Y for Jul 2021 (MoF, Taiwan) at 41.00 %, above consensus estimate of 35.00 %

- Taiwan, Trade Balance, Current Prices for Jul 2021 (MoF, Taiwan) at 5.90 Bln USD, above consensus estimate of 5.18 Bln USD

- United States, Labour Market n.i.e, JOLTS Job Openings for Jun 2021 (BLS, U.S Dep. Of Lab) at 10.07 Mln, above consensus estimate of 9.28 Mln

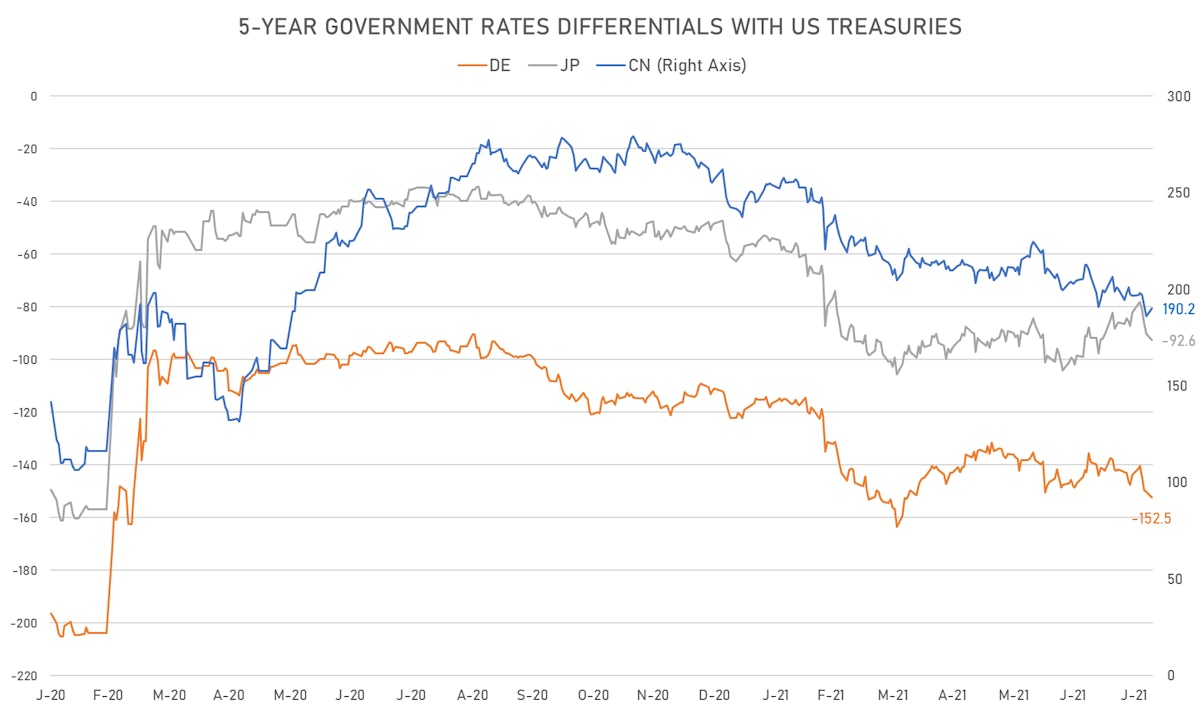

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.1 bp at 152.5 bp (YTD change: +41.5 bp)

- US-JAPAN: +2.4 bp at 92.6 bp (YTD change: +44.4 bp)

- US-CHINA: -4.2 bp at -190.2 bp (YTD change: +67.0 bp)

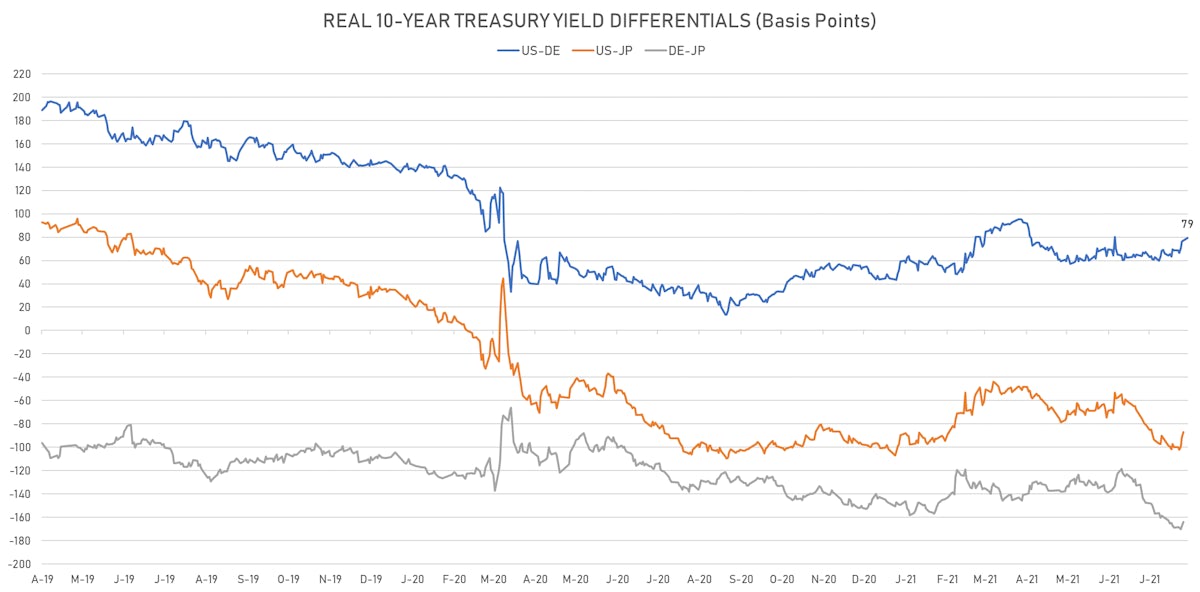

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.3 bp at 79.3 bp (YTD change: +33.2bp)

- US-JAPAN: +4.3 bp at -87.1 bp (YTD change: +14.4bp)

- JAPAN-GERMANY: -3.5 bp at 164.1 bp (YTD change: +16.5bp)

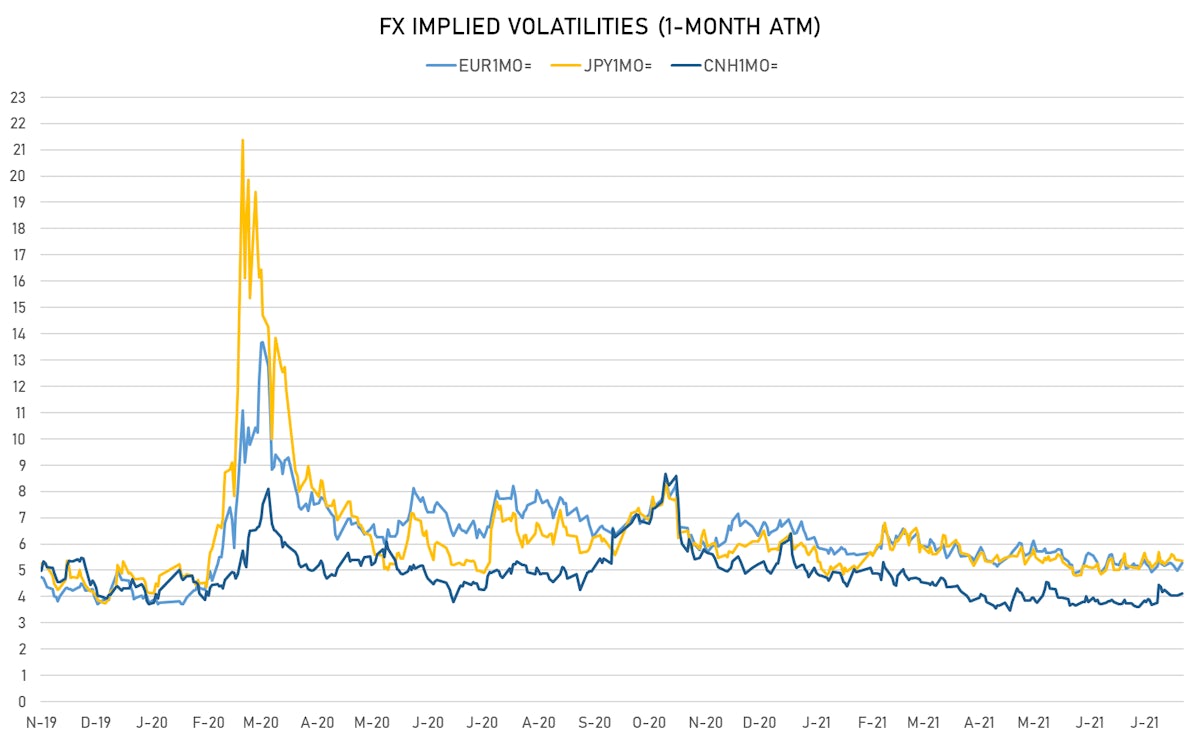

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.98, up 0.06 (YTD: -1.19)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.28, up 0.3 (YTD: -1.4)

- Japanese Yen 1M ATM IV unchanged at 5.38 (YTD: -0.7)

- Offshore Yuan 1M ATM IV currently at 4.13, up 0.1 (YTD: -1.9)

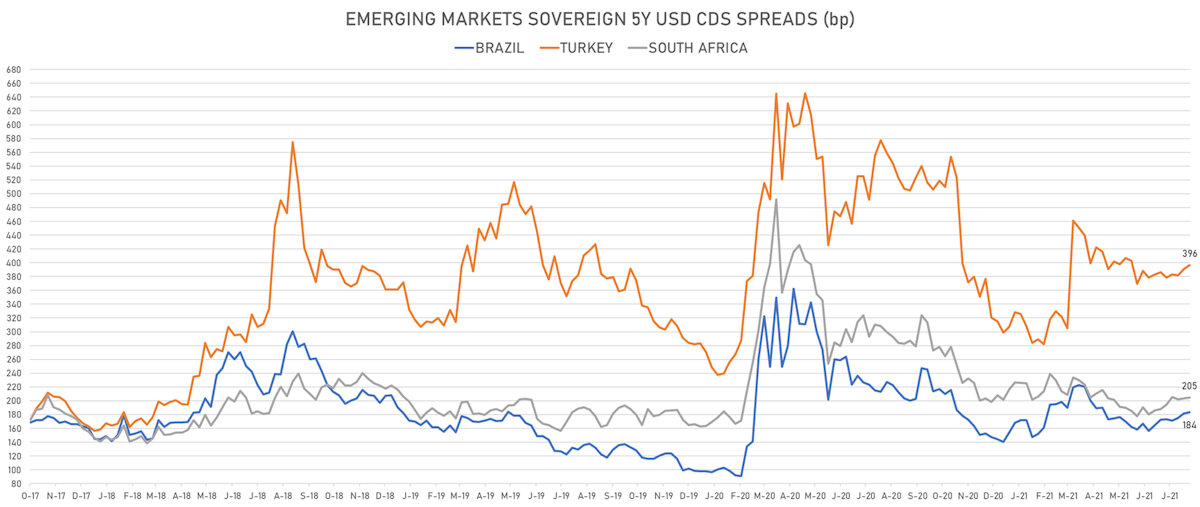

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Turkey (rated BB-): up 11.5 basis points to 396 bp (1Y range: 282-570bp)

- South Africa (rated BB-): up 5.0 basis points to 205 bp (1Y range: 178-328bp)

- Brazil (rated BB-): up 4.0 basis points to 184 bp (1Y range: 141-252bp)

- Russia (rated BBB): up 1.1 basis points to 86 bp (1Y range: 72-129bp)

- Panama (rated BBB-): up 0.9 basis points to 73 bp (1Y range: 44-95bp)

- Colombia (rated BB+): up 1.6 basis points to 145 bp (1Y range: 83-164bp)

- Argentina (rated CCC): up 20.7 basis points to 1,962 bp (1Y range: 1,049-1,968bp)

- Saudi Arabia (rated A): up 0.6 basis points to 55 bp (1Y range: 52-101bp)

- Egypt (rated B+): up 3.1 basis points to 334 bp (1Y range: 283-422bp)

- Indonesia (rated BBB): down 0.9 basis points to 78 bp (1Y range: 66-118bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 2.0% (YTD: -24.6%)

- Mauritius Rupee up 1.3% (YTD: -6.8%)

- Lesotho Loti down 1.0% (YTD: -0.6%)

- Botswana Pula down 1.0% (YTD: -3.5%)

- Swazi Lilangeni down 1.0% (YTD: -0.6%)

- Namibian Dollar down 1.4% (YTD: -1.0%)

- South Africa Rand down 1.4% (YTD: -0.7%)

- Fiji Dollar down 1.5% (YTD: -2.5%)

- Afghani down 1.6% (YTD: -4.9%)