FX

US Dollar Essentially Unchanged Today, Despite Favorable Moves In Real Yields Differentials

Macro data in the UK was fairly strong, but the currency sold off half a percent: looking at differentials in forward rates with the USD, it looks like FX markets are less excited about BOE 2022 rate hikes expectations

Published ET

Differential between 1Y Rates 1Y Forward In USD and GBP vs GBP Exchange Rate | Source: Refinitiv

QUICK SUMMARY

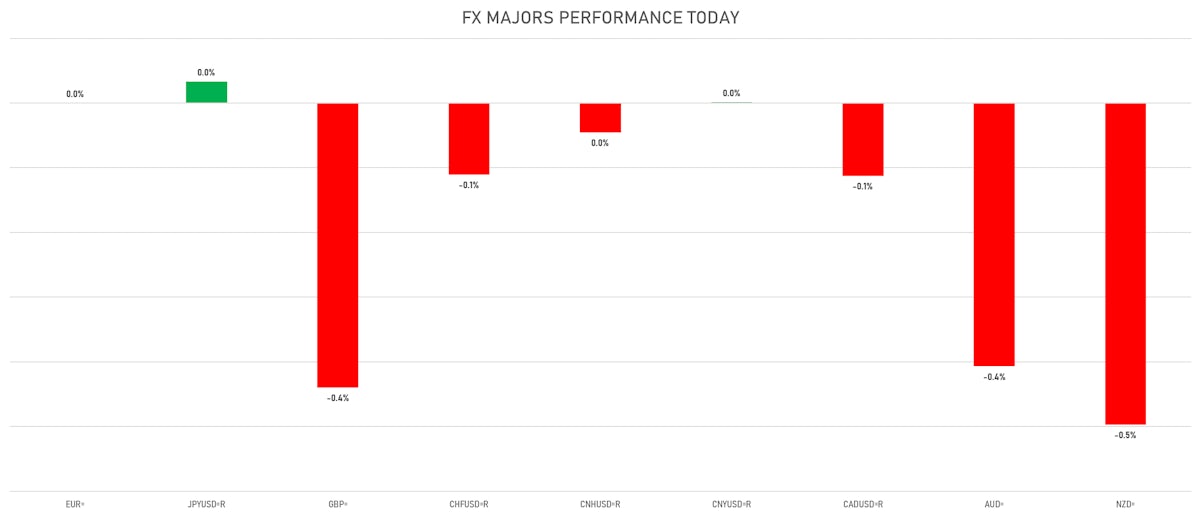

- The US Dollar Index is up 0.10% at 93.00 (YTD: +3.35%)

- Euro unchanged at 1.1737 (YTD: -3.9%)

- Yen up 0.03% at 110.38 (YTD: -6.4%)

- Onshore Yuan unchanged at 6.4782 (YTD: +0.7%)

- Swiss franc down 0.11% at 0.9231 (YTD: -4.1%)

- Sterling down 0.44% at 1.3811 (YTD: +1.0%)

- Canadian dollar down 0.11% at 1.2515 (YTD: +1.7%)

- Australian dollar down 0.41% at 0.7342 (YTD: -4.6%)

- NZ dollar down 0.50% at 0.7005 (YTD: -2.5%)

MACRO DATA RELEASES

- India, Production, Change Y/Y, Volume Index for Jun 2021 (MOSPI, India) at 13.60 %, above consensus estimate of 13.50 %

- Mexico, Policy Rates, Reference Rate (Overnight Lending Rate) for Aug 2021 (Banco de Mexico) at 4.50 %, in line with consensus estimate

- Peru, Policy Rates, Reference Interest Rate for Aug 2021 (Central Bank, Peru) at 0.50 %, above consensus estimate of 0.25 %

- Philippines, Policy Rates, Reverse Repo, O/N (Borrowing) Key Rate for 12 Aug (Bangko Sentral ng) at 2.00 %, in line with consensus estimate

- Serbia, Policy Rates, RS Benchmark Interest Rate, Change P/P for Aug 2021 (NBS, Serbia) at 1.00 %, in line with consensus estimate

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Aug 2021 (Central Bank, Turkey) at 17.50 %

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Aug 2021 (Central Bank, Turkey) at 19.00 %, in line with consensus estimate

- Turkey, Policy Rates, Late Liquidity Window Rate for Aug 2021 (Central Bank, Turkey) at 23.50 %

- Turkey, Policy Rates, Overnight Lending Rate for Aug 2021 (Central Bank, Turkey) at 20.50 %

- Uganda, Policy Rates, Central Bank Rate for 16 Aug (Bank of Uganda) at 6.50 %

- United Kingdom, GDP Estimated YY, Change Y/Y for Jun 2021 (ONS, United Kingdom) at 15.20 %, above consensus estimate of 14.90 %

- United Kingdom, GDP Estimated, Change M/M for Jun 2021 (ONS, United Kingdom) at 1.00 %, above consensus estimate of 0.80 %

- United Kingdom, GDP estimate 3m/3m for Jun 2021 (ONS, United Kingdom) at 4.80 %, in line with consensus estimate

- United Kingdom, GDP, Total, at market prices, Change P/P for Q2 2021 (ONS, United Kingdom) at 4.80 %, in line with consensus estimate

- United Kingdom, GDP, Total, at market prices, Change Y/Y for Q2 2021 (ONS, United Kingdom) at 22.20 %, above consensus estimate of 22.10 %

- United Kingdom, Production, Manufacturing, Change P/P for Jun 2021 (ONS, United Kingdom) at 0.20 %, below consensus estimate of 0.40 %

- United States, Jobless Claims, National, Initial for W 07 Aug (U.S. Dept. of Labor) at 375.00 k, in line with consensus estimate

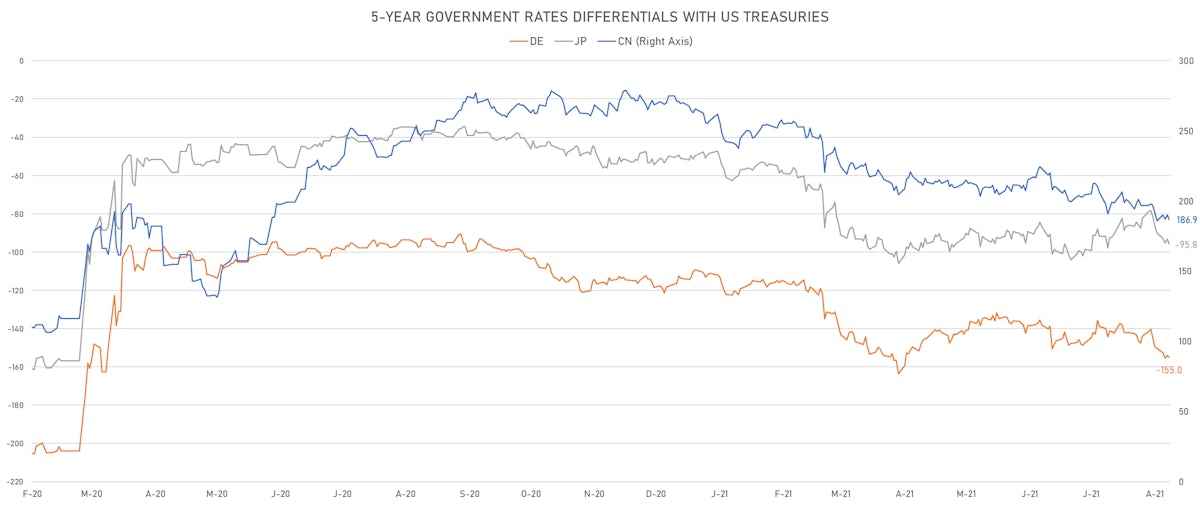

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.0 bp at 155.0 bp (YTD change: +43.9 bp)

- US-JAPAN: +2.5 bp at 95.8 bp (YTD change: +47.5 bp)

- US-CHINA: +3.1 bp at -186.9 bp (YTD change: +70.2 bp)

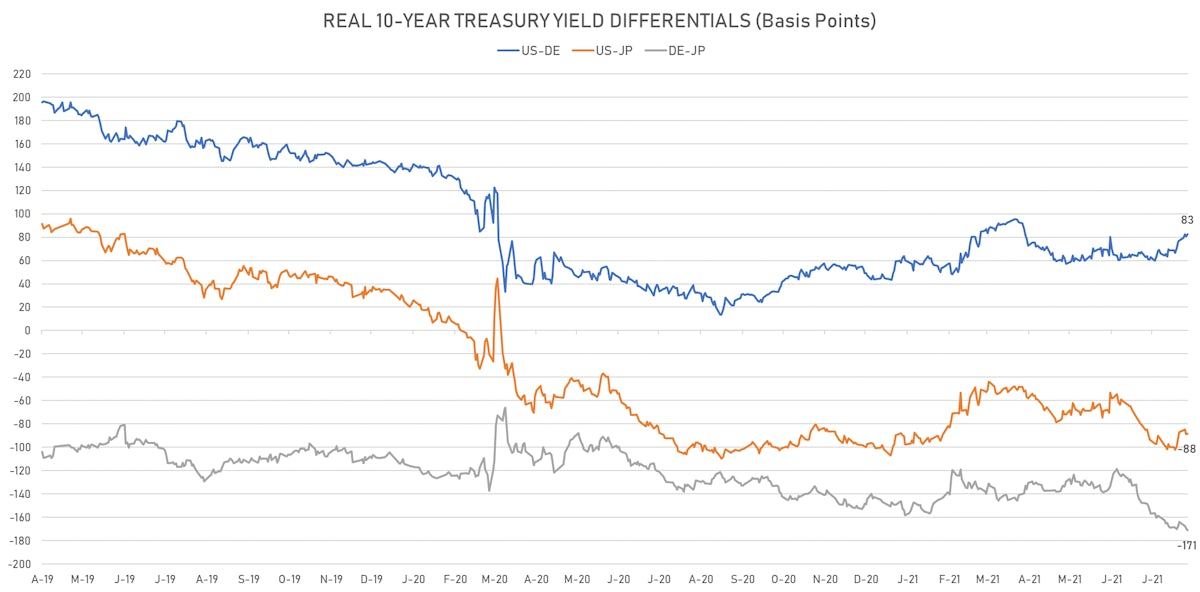

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.0 bp at 82.7 bp (YTD change: +36.6bp)

- US-JAPAN: +0.5 bp at -88.2 bp (YTD change: +13.3bp)

- JAPAN-GERMANY: +1.5 bp at 170.9 bp (YTD change: +23.3bp)

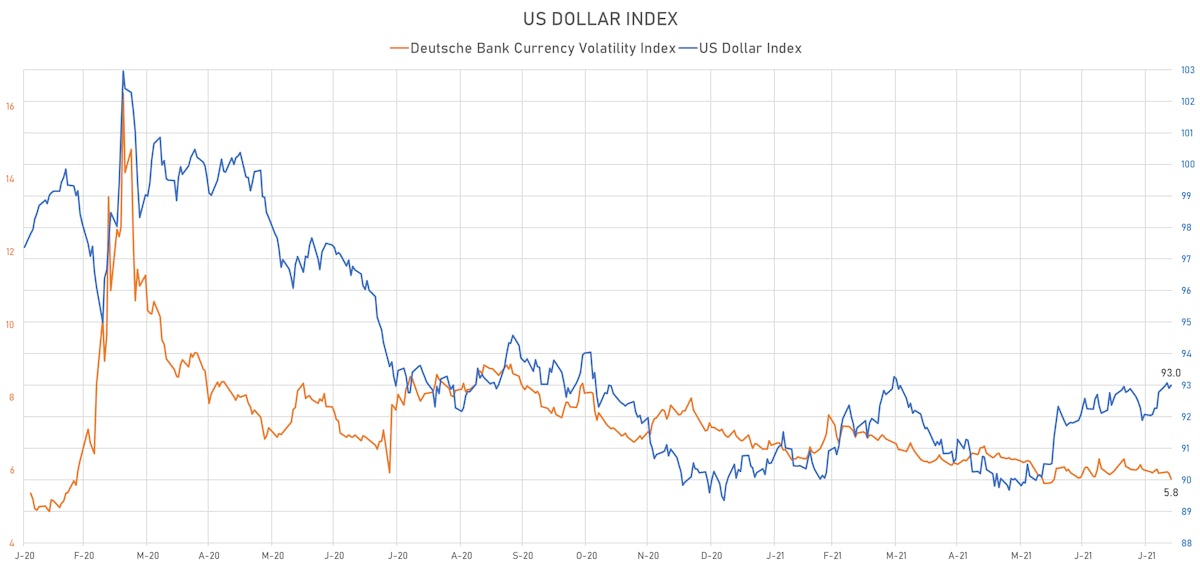

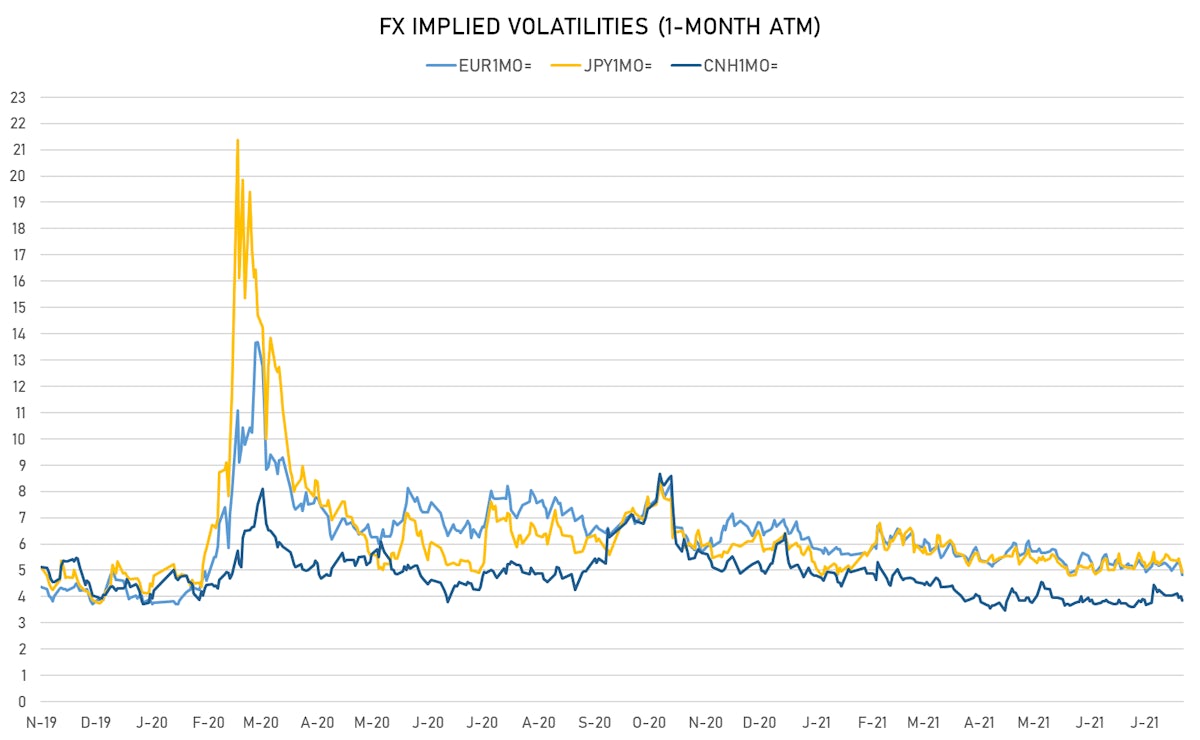

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.76, down -0.16 (YTD: -1.41)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.83, down -0.3 (YTD: -1.9)

- Japanese Yen 1M ATM IV currently at 4.94, down -0.2 (YTD: -1.2)

- Offshore Yuan 1M ATM IV currently at 3.85, down -0.2 (YTD: -2.1)

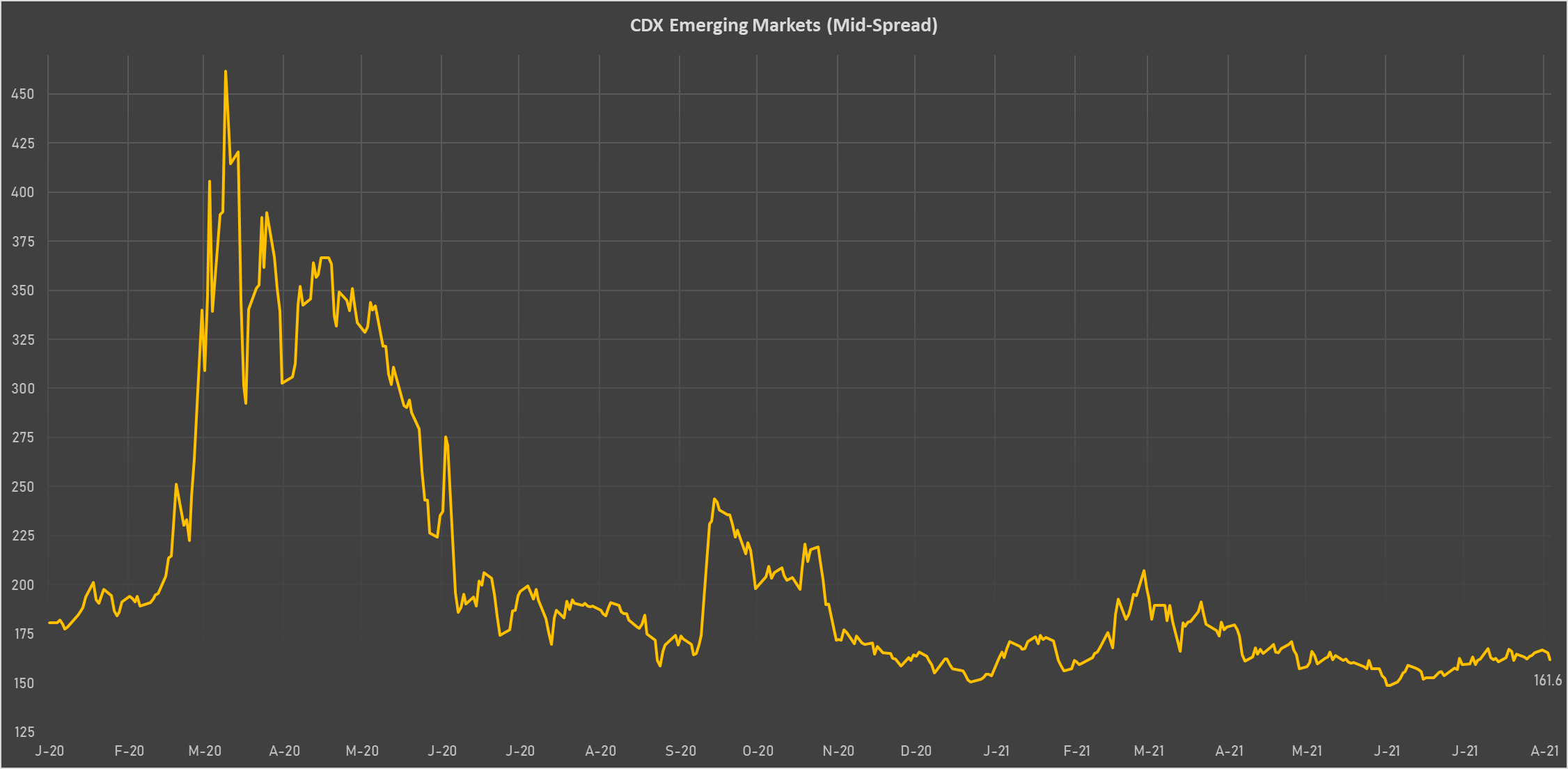

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Vietnam (rated BB): down 1.3 basis points to 105 bp (1Y range: 90-141bp)

- Russia (rated BBB): down 1.3 basis points to 85 bp (1Y range: 72-129bp)

- Indonesia (rated BBB): down 1.2 basis points to 75 bp (1Y range: 66-118bp)

- Government of Chile (rated A-): down 1.3 basis points to 67 bp (1Y range: 43-75bp)

- Peru (rated BBB+): down 1.8 basis points to 94 bp (1Y range: 52-101bp)

- Turkey (rated BB-): down 7.8 basis points to 387 bp (1Y range: 282-570bp)

- Colombia (rated BB+): down 3.3 basis points to 144 bp (1Y range: 83-164bp)

- Brazil (rated BB-): down 4.4 basis points to 179 bp (1Y range: 141-252bp)

- Mexico (rated BBB-): down 3.0 basis points to 91 bp (1Y range: 79-164bp)

- Argentina (rated CCC): down 61.5 basis points to 1,859 bp (1Y range: 1,049-1,971bp)

LARGEST FX MOVES TODAY

- Colombian Peso up 2.8% (YTD: -11.2%)

- Thai Baht up 1.1% (YTD: -9.2%)

- Moldovan Leu up 1.1% (YTD: -2.6%)

- Congo Franc up 1.0% (YTD: -0.8%)

- Seychelles rupee up 1.0% (YTD: +52.6%)

- Haiti Gourde down 0.9% (YTD: -25.3%)

- Mongolia Tugrik down 0.9% (YTD: +0.1%)

- Korean Won down 0.9% (YTD: -6.6%)

- CFA Franc BCEAO down 0.9% (YTD: -4.6%)

- Brazilian Real down 1.2% (YTD: -1.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 52.6%

- Mozambique metical up 15.4%

- Turkish Lira down 13.2%

- Argentine Peso down 13.4%

- Haiti Gourde down 25.3%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%