FX

The US Dollar Follows Rates Down To End The Week

The euro sell-off may be overdone in the short term: some sell-side strategists point out that growth and rate hikes expectations are higher in the US than in Europe, leading to potentially greater disappointment in the US dollar if the delta variant caused a real growth slowdown

Published ET

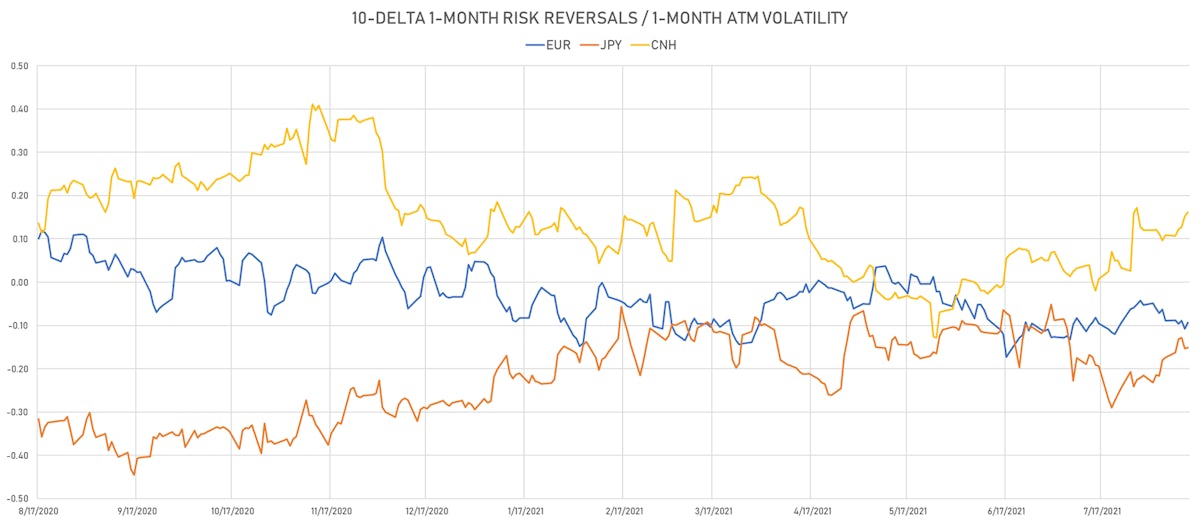

EUR/USD 1-Month Implied Volatility Smile Still Slightly Skewed To The Downside | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

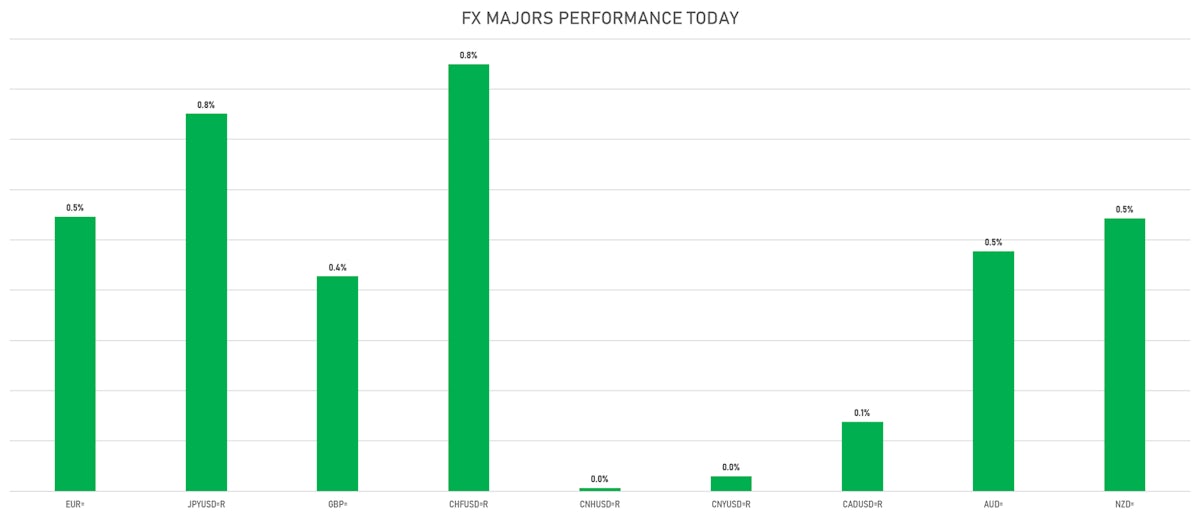

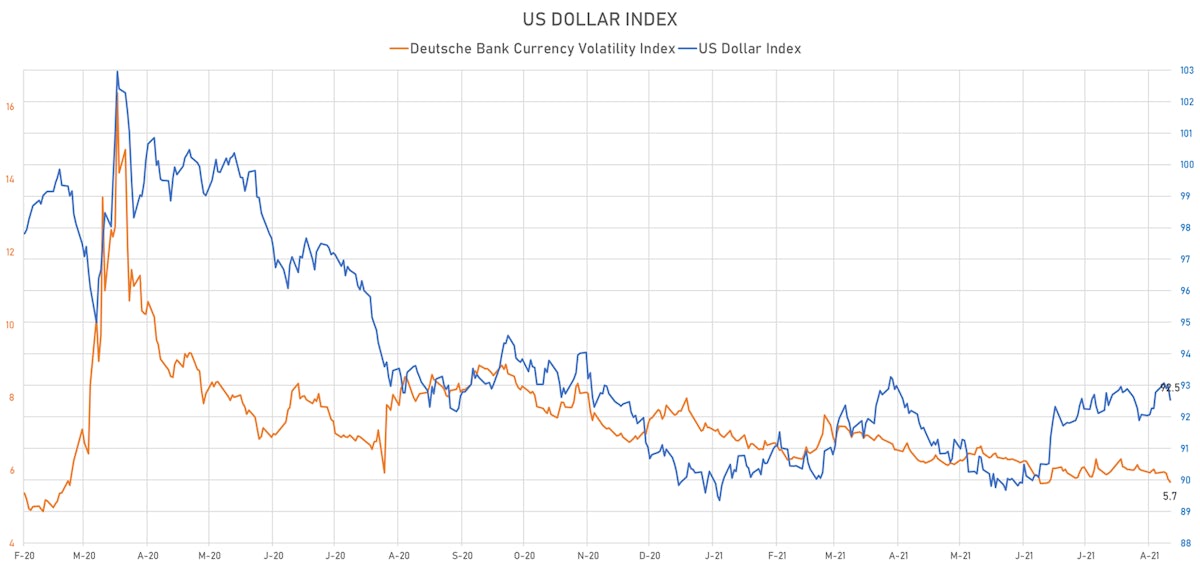

- The US Dollar Index is down -0.50% at 92.54 (YTD: +2.84%)

- Euro up 0.55% at 1.1791 (YTD: -3.5%)

- Yen up 0.75% at 109.57 (YTD: -5.8%)

- Onshore Yuan up 0.03% at 6.4768 (YTD: +0.8%)

- Swiss franc up 0.85% at 0.9154 (YTD: -3.3%)

- Sterling up 0.43% at 1.3863 (YTD: +1.4%)

- Canadian dollar up 0.14% at 1.2509 (YTD: +1.8%)

- Australian dollar up 0.48% at 0.7369 (YTD: -4.2%)

- NZ dollar up 0.54% at 0.7037 (YTD: -2.1%)

WEEKLY CFTC POSITIONING DATA FOR MANAGED MONEY ACCOUNTS

- ALL: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net short US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: increase in net long US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

MACRO DATA RELEASES

- Argentina, CPI, Total, Gran Buenos Aires, Change P/P for Jul 2021 (INDEC, Argentina) at 3.10 %

- Argentina, CPI, Total, Gran Buenos Aires, Change Y/Y for Jul 2021 (INDEC, Argentina) at 50.40 %

- Brazil, Central Bank Economic Activity Index (IBC-Br), Change P/P for Jun 2021 (Central Bank, Brazil) at 1.14 %, above consensus estimate of 0.40 %

- Czech Republic, Current Account, Balance, Current Prices for Jun 2021 (Czech National Bank) at -12.84 Bln CZK, below consensus estimate of -3.00 Bln CZK

- France, HICP, Change Y/Y, Price Index for Jul 2021 (INSEE, France) at 1.50 %, below consensus estimate of 1.60 %

- France, HICP, Final, Change P/P, Price Index for Jul 2021 (INSEE, France) at 0.10 %, in line with consensus estimate

- Poland, CPI, Change P/P, Price Index for Jul 2021 (CSO, Poland) at 0.40 %

- Poland, CPI, Change Y/Y, Price Index for Jul 2021 (CSO, Poland) at 5.00 %

- Poland, Current Account, Balance, Current Prices for Jun 2021 (Central Bank, Poland) at 281.00 Mln EUR, below consensus estimate of 436.00 Mln EUR

- Poland, GDP, Total (flash estimate), Change Y/Y for Q2 2021 (CSO, Poland) at 10.90 %, below consensus estimate of 11.00 %

- Russia, GDP, Total-prelim, Change Y/Y for Q2 2021 (RosStat, Russia) at 10.30 %

- Slovakia, CPI, Change P/P for Jul 2021 (Stat Office of SR) at 0.50 %, below consensus estimate of 0.60 %

- Slovakia, CPI, Change Y/Y for Jul 2021 (Stat Office of SR) at 3.30 %, in line with consensus estimate

- Slovakia, CPI, Core CPI, Change P/P for Jul 2021 (Stat Office of SR) at 0.50 %, below consensus estimate of 0.70 %

- Slovakia, CPI, Core CPI, Change Y/Y for Jul 2021 (Stat Office of SR) at 3.90 %, in line with consensus estimate

- Spain, CPI, All Items, Change Y/Y, Price Index for Jul 2021 (INE, Spain) at 2.90 %, in line with consensus estimate

- Spain, CPI, All Items, Total, Final, Change P/P, Price Index for Jul 2021 (INE, Spain) at -0.80 %, below consensus estimate of -0.70 %

- Spain, HICP, Total, Final, Change P/P, Price Index for Jul 2021 (INE, Spain) at -1.20 %, in line with consensus estimate

- Spain, HICP, Total, Final, Change Y/Y, Price Index for Jul 2021 (INE, Spain) at 2.90 %, in line with consensus estimate

- Sweden, CPI, All Items, Change P/P, Price Index for Jul 2021 (SCB, Sweden) at 0.30 %, in line with consensus estimate

- Sweden, CPI, All Items, Change Y/Y, Price Index for Jul 2021 (SCB, Sweden) at 1.40 %, above consensus estimate of 1.30 %

- Sweden, CPI, Underlying inflation CPIF, Change P/P, Price Index for Jul 2021 (SCB, Sweden) at 0.30 %, above consensus estimate of 0.20 %

- Sweden, CPI, Underlying inflation CPIF, Change Y/Y, Price Index for Jul 2021 (SCB, Sweden) at 1.70 %, above consensus estimate of 1.60 %

- Taiwan, GDP, Growth rate, Change Y/Y for Q2 2021 (DGBAS, Taiwan) at 7.43 %

- Turkey, Current Account, Balance, Current Prices for Jun 2021 (Central Bank, Turkey) at -1.13 Bln USD, below consensus estimate of -1.10 Bln USD

- United States, Import Prices, All commodities, Change P/P, Price Index for Jul 2021 (BLS, U.S Dep. Of Lab) at 0.30 %, below consensus estimate of 0.60 %

- United States, University of Michigan, Total-prelim, Volume Index for Aug 2021 (UMICH, Survey) at 70.20, below consensus estimate of 81.20

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.3 bp at 150.7 bp (YTD change: +39.7 bp)

- US-JAPAN: -5.2 bp at 90.6 bp (YTD change: +42.4 bp)

- US-CHINA: -5.9 bp at -192.8 bp (YTD change: +64.4 bp)

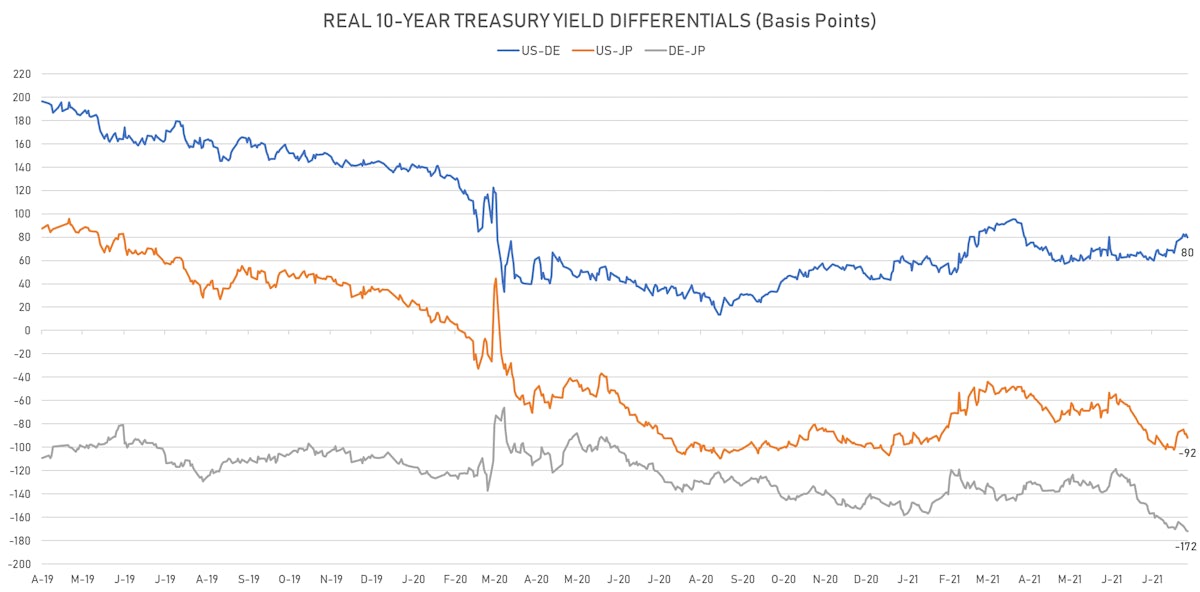

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.7 bp at 80.0 bp (YTD change: +33.9bp)

- US-JAPAN: -3.6 bp at -91.8 bp (YTD change: +9.7bp)

- JAPAN-GERMANY: +0.9 bp at 171.8 bp (YTD change: +24.2bp)

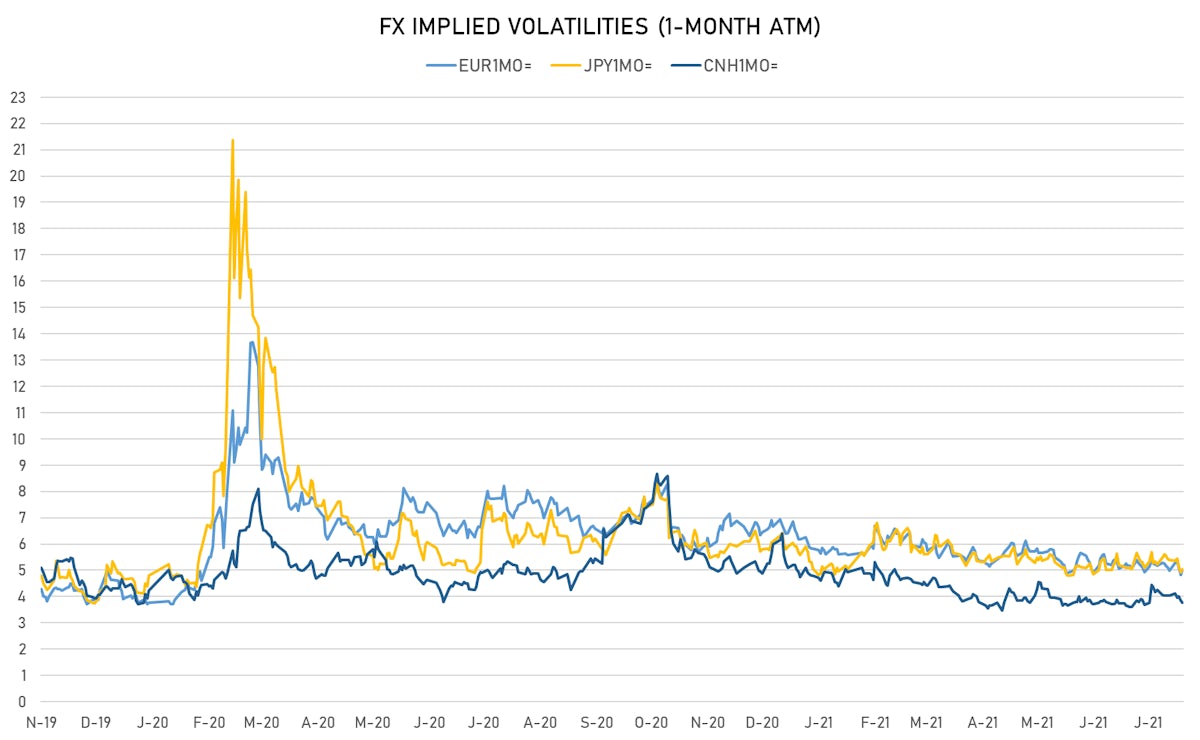

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.67, down -0.09 (YTD: -1.50)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.03, up 0.2 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 5.04, up 0.1 (YTD: -1.1)

- Offshore Yuan 1M ATM IV currently at 3.76, down -0.1 (YTD: -2.2)

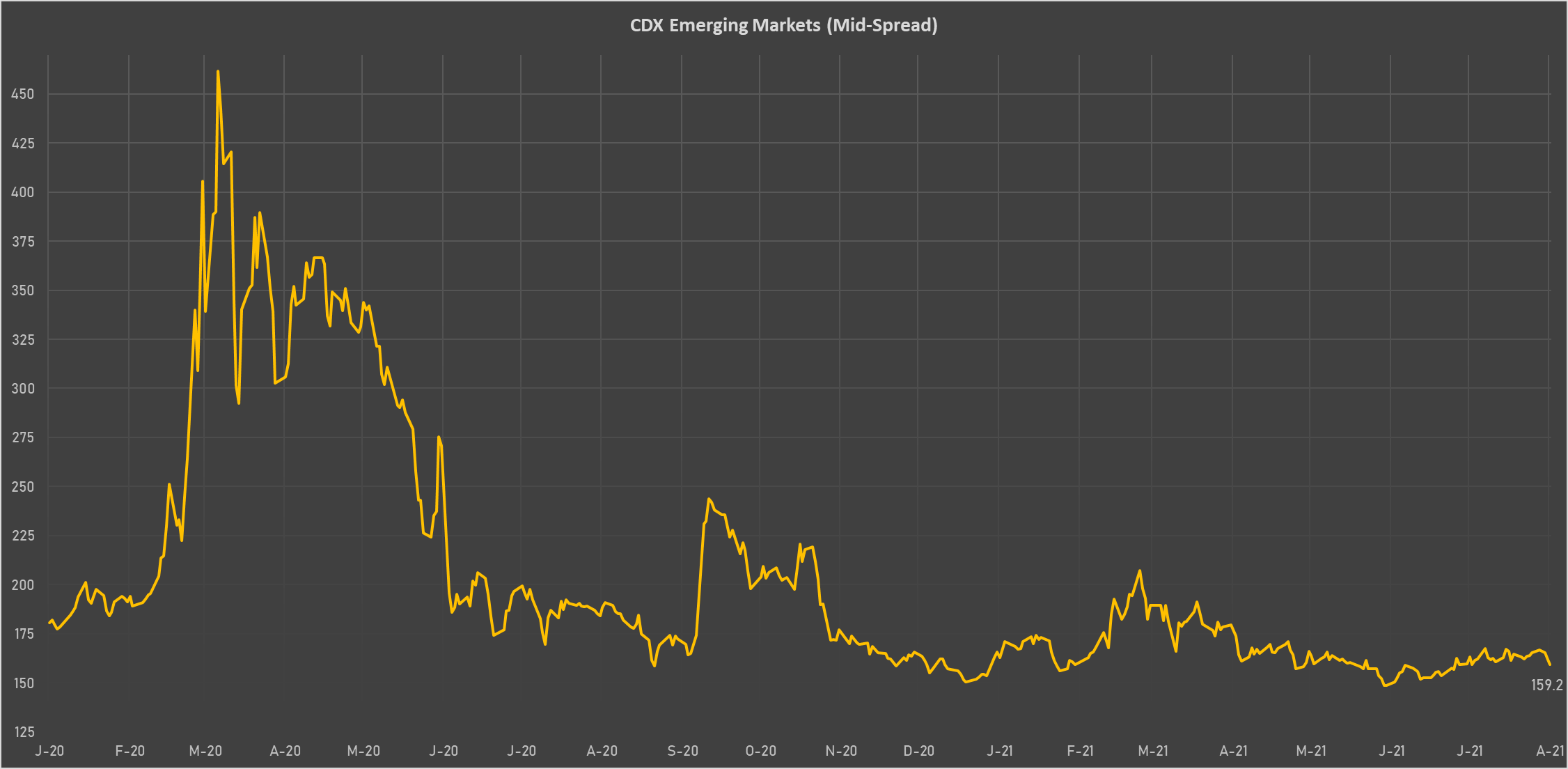

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 34.5 basis points to 1,900 bp (1Y range: 1,049-1,971bp)

- South Africa (rated BB-): down 1.3 basis points to 201 bp (1Y range: 178-328bp)

- Government of Chile (rated A-): down 0.6 basis points to 66 bp (1Y range: 43-75bp)

- Saudi Arabia (rated A): down 0.6 basis points to 54 bp (1Y range: 52-101bp)

- Mexico (rated BBB-): down 1.3 basis points to 90 bp (1Y range: 79-164bp)

- Turkey (rated BB-): down 5.8 basis points to 381 bp (1Y range: 282-570bp)

- Vietnam (rated BB): down 1.7 basis points to 103 bp (1Y range: 90-137bp)

- Indonesia (rated BBB): down 1.3 basis points to 74 bp (1Y range: 66-118bp)

- Colombia (rated BB+): down 2.9 basis points to 141 bp (1Y range: 83-164bp)

- Peru (rated BBB+): down 4.5 basis points to 90 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 2.9% (YTD: -23.2%)

- Colombian Peso up 2.6% (YTD: -10.8%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Moldovan Leu up 1.6% (YTD: -2.4%)

- Mozambique metical up 1.6% (YTD: +17.2%)

- Cambodia Riel up 1.2% (YTD: -0.8%)

- Rwanda Franc up 1.2% (YTD: -0.3%)

- Nicaragua Cordoba down 2.4% (YTD: -2.8%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 61.0%

- Mozambique metical up 17.2%

- Ethiopian Birr down 12.8%

- Argentine Peso down 13.4%

- Haiti Gourde down 23.2%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%