FX

The US Dollar Rose Against Most Major Currencies Today, Though JPY Remains Driven By Real Yields Differentials

US Fed presidents pointing to a mid-2022 end for tapering lifted US short rates and drove the euro down today

Published ET

The Euro spot rate vs the spread between USD and EUR 1-Year forward 1-Year money market rates | Source: Refinitiv

QUICK SUMMARY

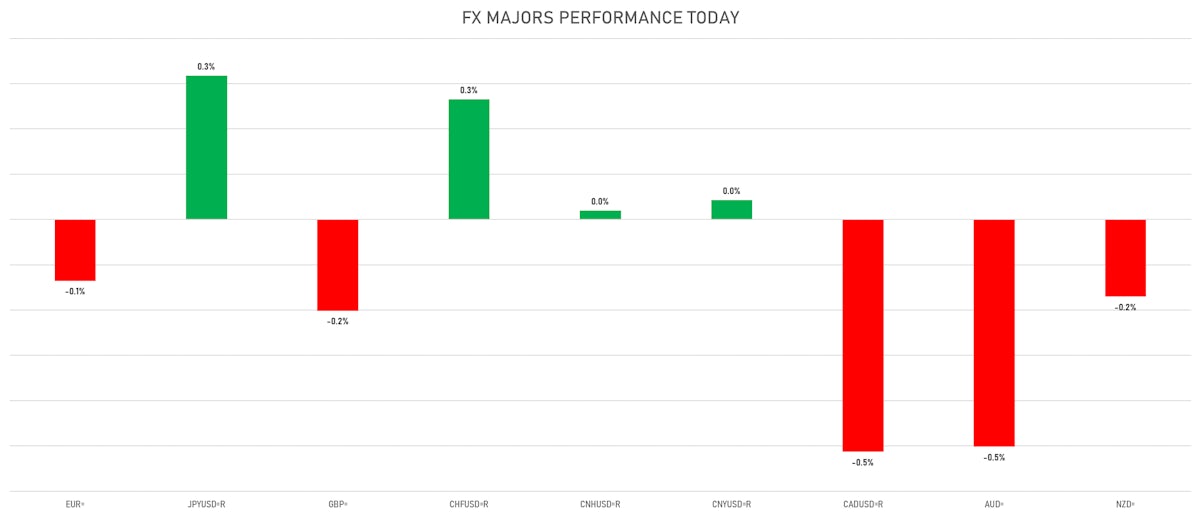

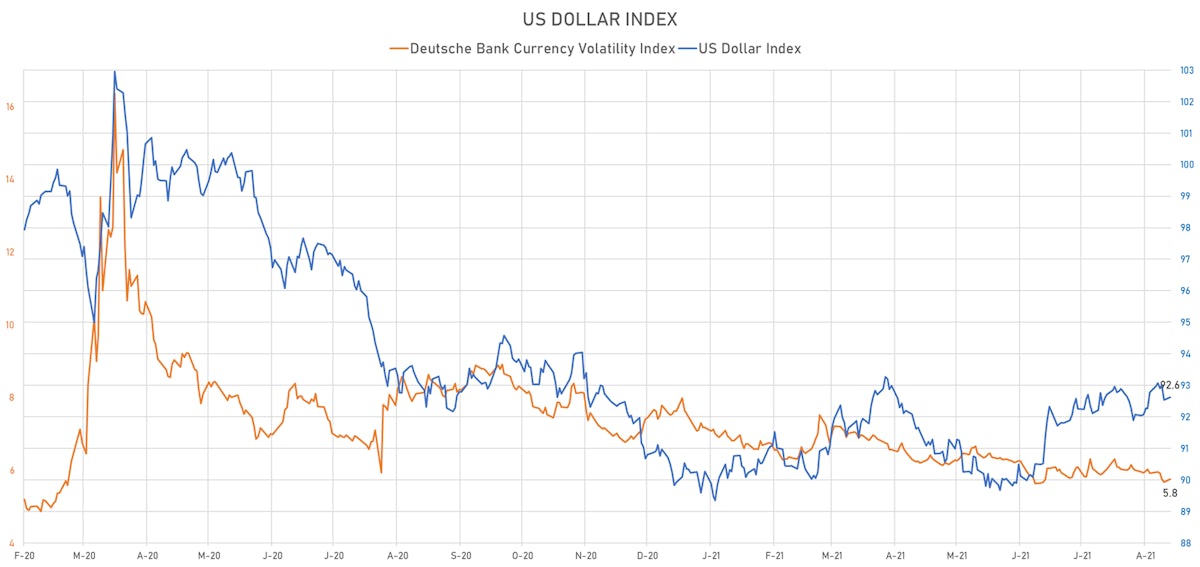

- The US Dollar Index is up 0.09% at 92.62 (YTD: +2.93%)

- Euro down 0.14% at 1.1775 (YTD: -3.6%)

- Yen up 0.32% at 109.24 (YTD: -5.5%)

- Onshore Yuan up 0.04% at 6.4742 (YTD: +0.8%)

- Swiss franc up 0.27% at 0.9124 (YTD: -3.1%)

- Sterling down 0.20% at 1.3835 (YTD: +1.2%)

- Canadian dollar down 0.51% at 1.2577 (YTD: +1.2%)

- Australian dollar down 0.50% at 0.7332 (YTD: -4.7%)

- NZ dollar down 0.17% at 0.7025 (YTD: -2.2%)

MACRO DATA RELEASES

- Canada, Manufacturers Shipments, Change P/P for Jun 2021 (CANSIM, Canada) at 2.10 %, in line with consensus estimate

- Canada, Wholesale Trade, Sales, all trade groups, Change P/P for Jun 2021 (CANSIM, Canada) at -0.80 %, above consensus estimate of -1.80 %

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Jul 2021 (NBS, China) at 10.30 %, below consensus estimate of 11.30 %

- China (Mainland), Production, Value added, industry, Change Y/Y for Jul 2021 (NBS, China) at 6.40 %, below consensus estimate of 7.80 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Jul 2021 (NBS, China) at 8.50 %, below consensus estimate of 11.50 %

- Czech Republic, Producer Prices, Change P/P, Price Index for Jul 2021 (CSU, Czech Rep) at 1.60 %, above consensus estimate of 0.70 %

- Czech Republic, Producer Prices, Change Y/Y, Price Index for Jul 2021 (CSU, Czech Rep) at 7.80 %, above consensus estimate of 6.70 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Jul 2021 (ECB) at 888.49 Bln EUR

- Finland, Official reserve assets, Current Prices for Jul 2021 (Bank of Finland) at 11,415.00 Mln EUR

- India, Wholesale Prices, Change Y/Y, Price Index for Jul 2021 (Econ Adviser, India) at 11.16 %, below consensus estimate of 11.30 %

- Peru, GDP, Change Y/Y for Jun 2021 (INEI, Peru) at 23.45 %

- Poland, Core CPI, Excluding food and energy prices, Change Y/Y, Price Index for Jul 2021 (Central Bank, Poland) at 3.70 %, above consensus estimate of 3.60 %

- Thailand, GDP, Change P/P for Q2 2021 (NESDB, Thailand) at 0.40 %

- Thailand, GDP, Change Y/Y for Q2 2021 (NESDB, Thailand) at 7.50 %, above consensus estimate of 6.40 %

- Uganda, Policy Rates, Central Bank Rate for 16 Aug (Bank of Uganda) at 6.50 %

- United States, New York Fed, General Business Condition for Aug 2021 (FED, NY) at 18.30, below consensus estimate of 29.00

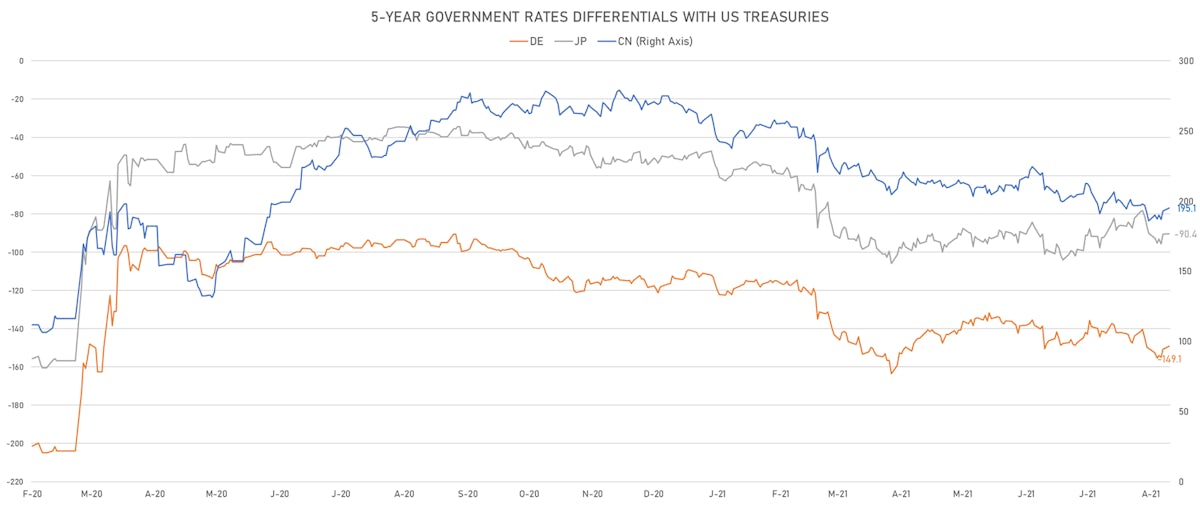

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.6 bp at 149.1 bp (YTD change: +38.0 bp)

- US-JAPAN: -0.3 bp at 90.4 bp (YTD change: +42.1 bp)

- US-CHINA: -2.3 bp at -195.1 bp (YTD change: +62.0 bp)

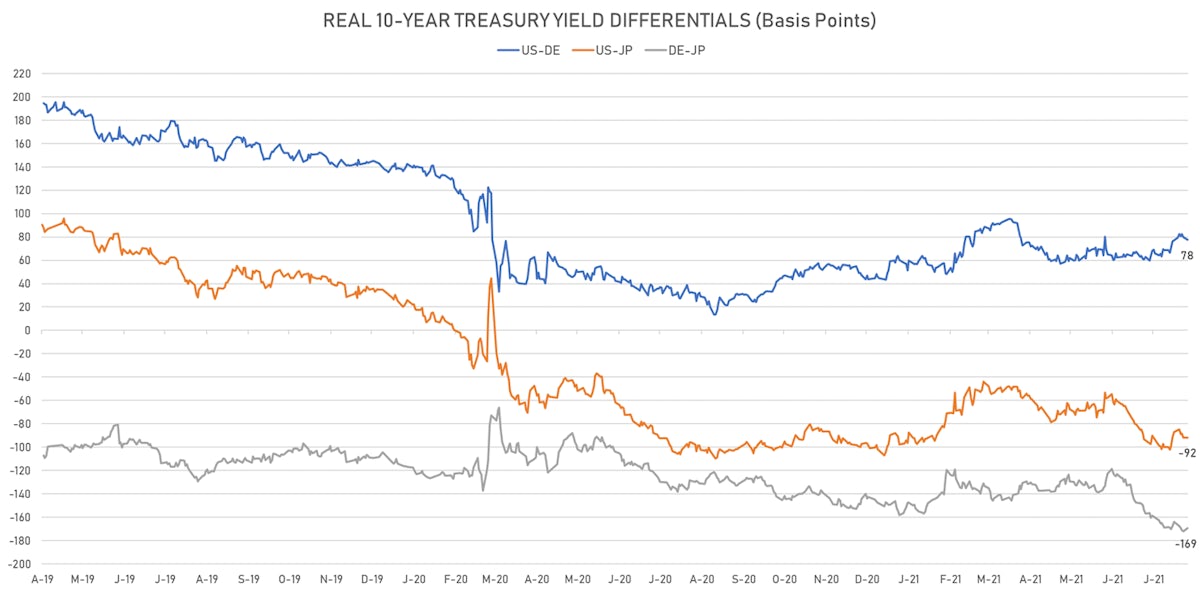

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.4 bp at 77.6 bp (YTD change: +31.5bp)

- US-JAPAN: +0.1 bp at -91.7 bp (YTD change: +9.8bp)

- JAPAN-GERMANY: -2.5 bp at 169.3 bp (YTD change: +21.7bp)

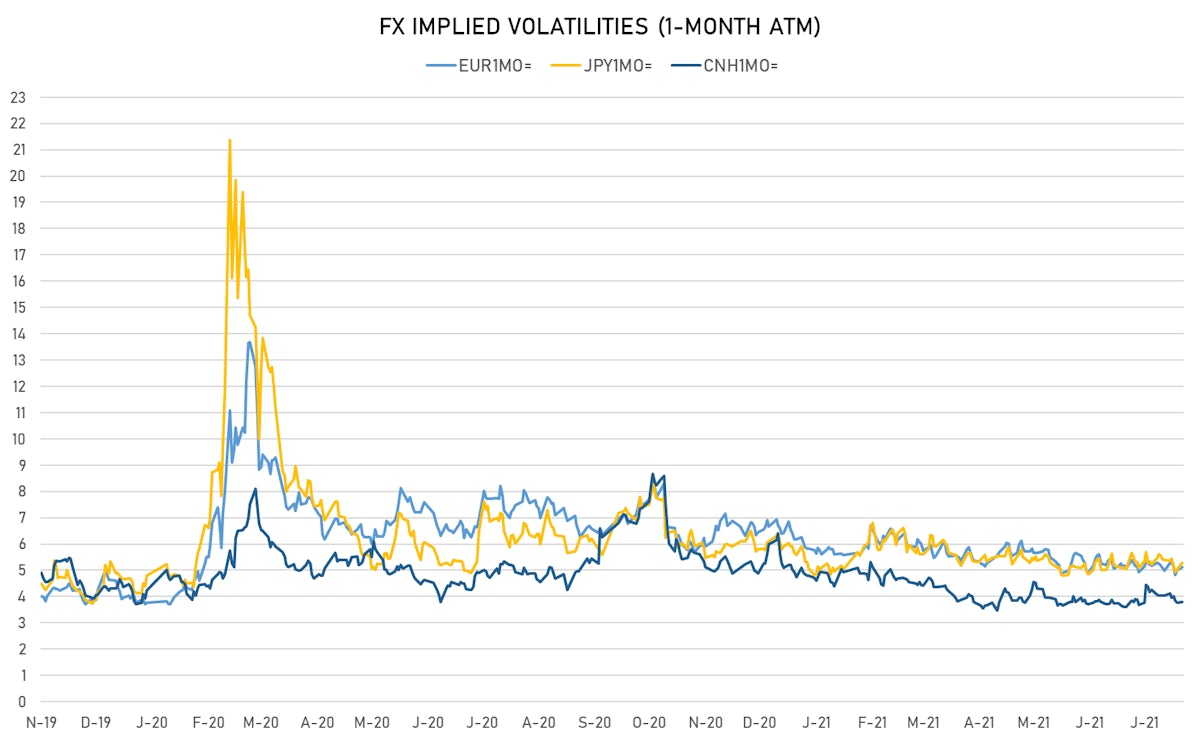

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.75, up 0.08 (YTD: -1.42)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.13, up 0.1 (YTD: -1.6)

- Japanese Yen 1M ATM IV currently at 5.28, up 0.2 (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 3.80, up 0.0 (YTD: -2.2)

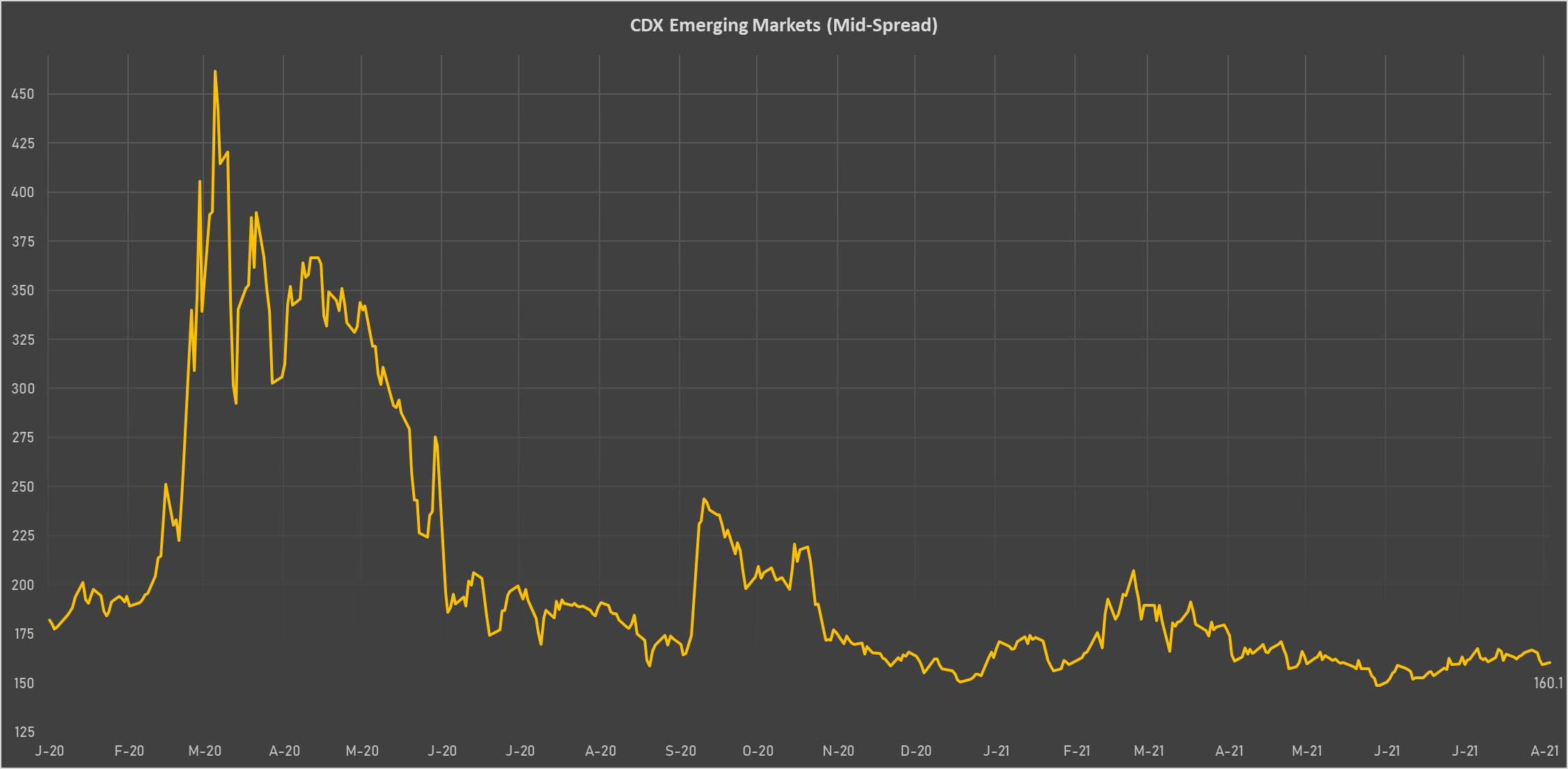

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 53.4 basis points to 1,927 bp (1Y range: 1,049-1,971bp)

- Egypt (rated B+): up 4.9 basis points to 341 bp (1Y range: 283-422bp)

- Panama (rated BBB-): down 0.4 basis points to 74 bp (1Y range: 44-95bp)

- Turkey (rated BB-): down 4.7 basis points to 382 bp (1Y range: 282-570bp)

- Saudi Arabia (rated A): down 0.7 basis points to 53 bp (1Y range: 52-101bp)

- Mexico (rated BBB-): down 1.5 basis points to 90 bp (1Y range: 79-164bp)

- Indonesia (rated BBB): down 1.3 basis points to 74 bp (1Y range: 66-118bp)

- Vietnam (rated BB): down 2.2 basis points to 103 bp (1Y range: 90-137bp)

- Colombia (rated BB+): down 3.1 basis points to 141 bp (1Y range: 83-164bp)

- Peru (rated BBB+): down 4.6 basis points to 90 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Vanuatu Vatu up 0.8% (YTD: -2.7%)

- Swazi Lilangeni down 0.8% (YTD: -1.0%)

- South Africa Rand down 0.8% (YTD: -1.0%)

- Lesotho Loti down 0.8% (YTD: -1.0%)

- Chilean Peso down 1.4% (YTD: -9.7%)

- Qatari Riyal down 1.8% (YTD: -1.8%)

- Haiti Gourde down 1.8% (YTD: -24.6%)

- Malagasy Ariary down 3.9% (YTD: 0.0%)

- Afghani down 6.1% (YTD: -10.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 59.3%

- Mozambique metical up 15.4%

- Ethiopian Bir down 12.8%

- Argentine Peso down 13.3%

- Haiti Gourde down 24.6%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%