FX

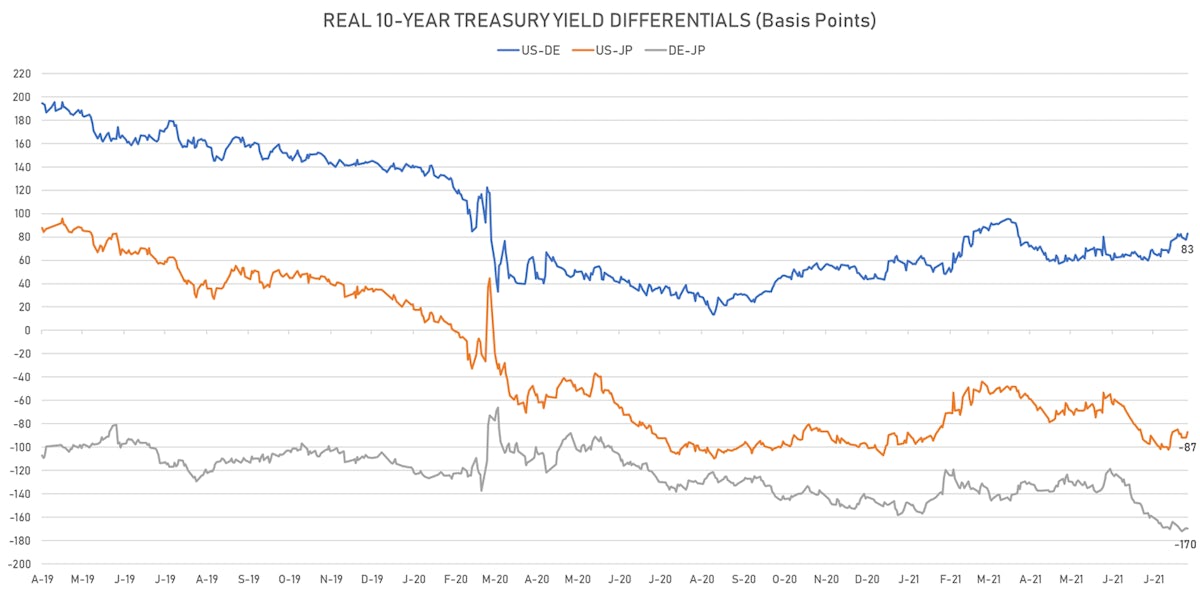

Broad Rise In The US Dollar Following Moves In Real Rates Differentials

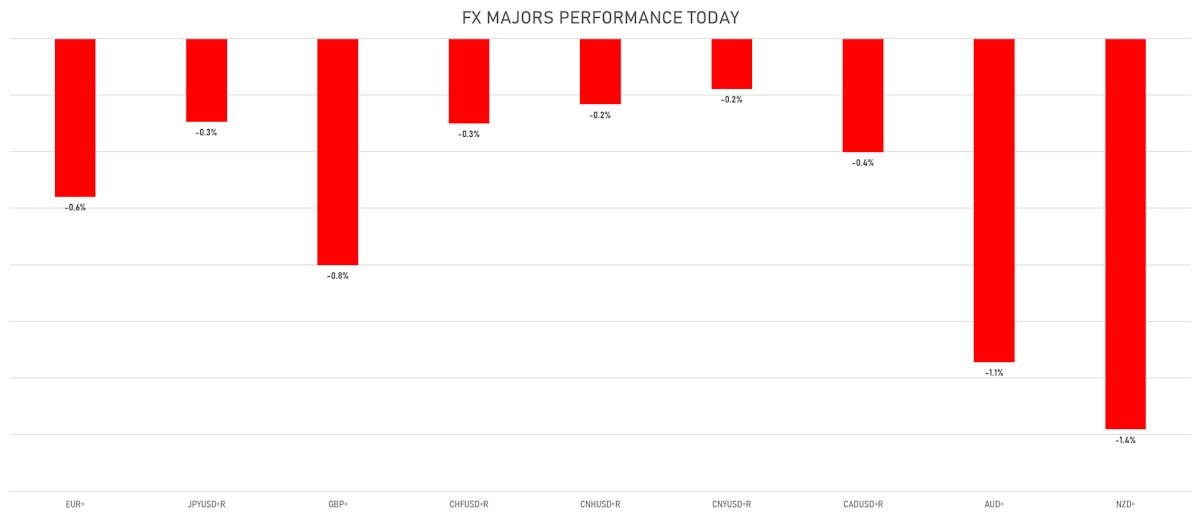

Antipodean currencies were hit the hardest today, as local lockdowns are pushing markets to dial down rate hikes expectations

Published ET

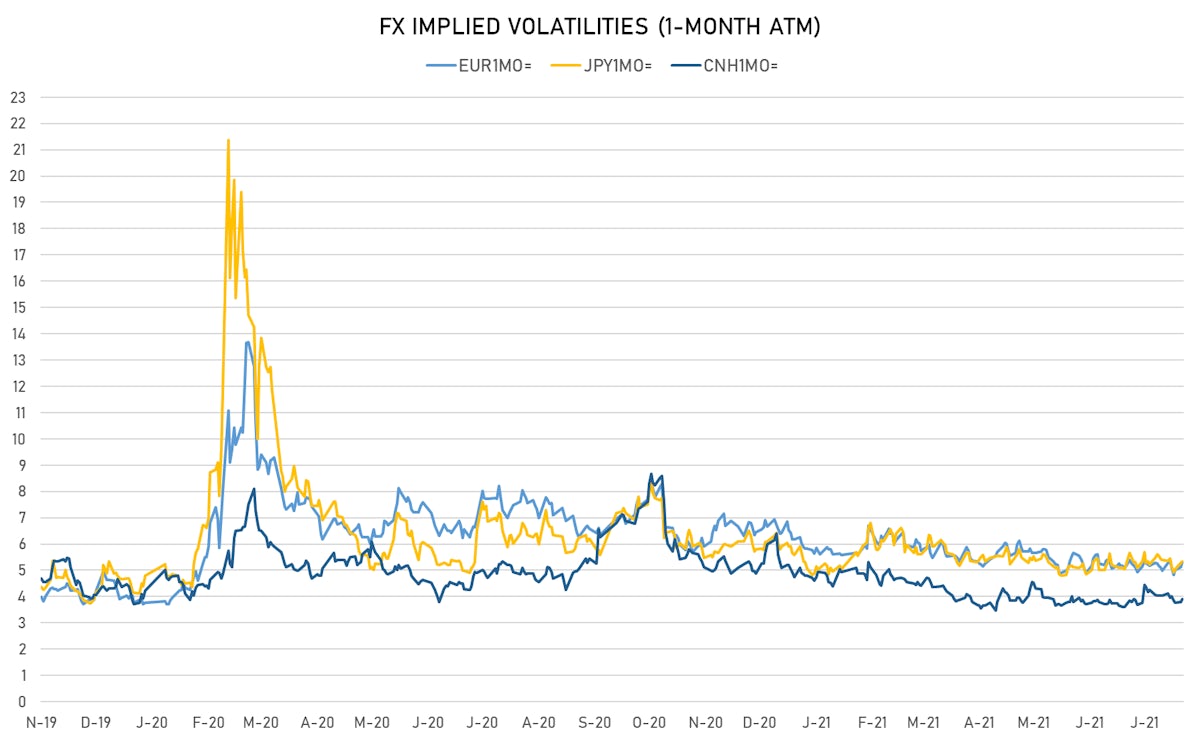

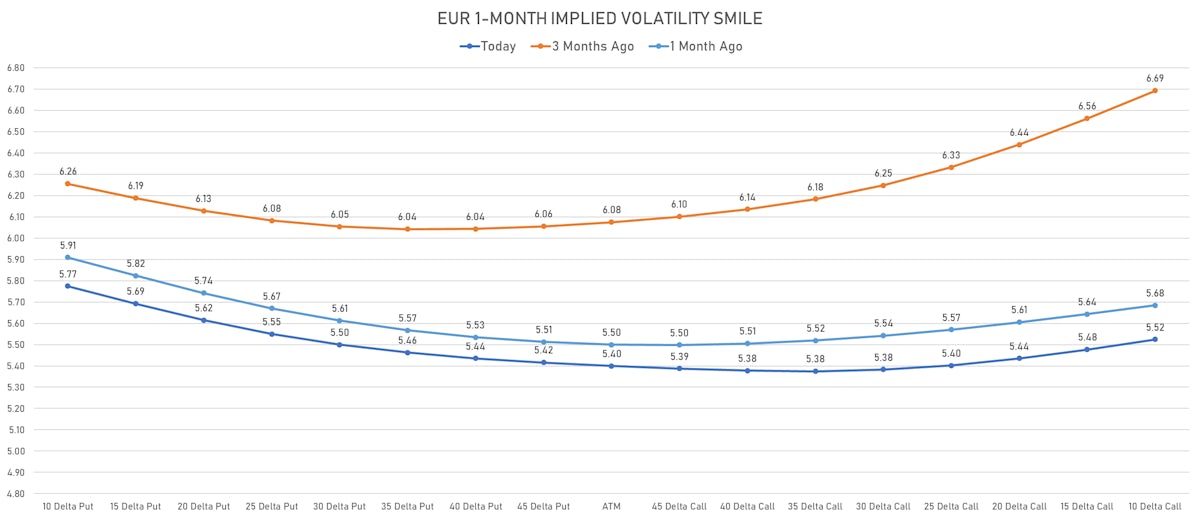

Euro 1-month option prices remain skewed to the downside | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.59% at 93.16 (YTD: +3.54%)

- Euro down 0.56% at 1.1711 (YTD: -4.1%)

- Yen down 0.30% at 109.56 (YTD: -5.8%)

- Onshore Yuan down 0.18% at 6.4854 (YTD: +0.6%)

- Swiss franc down 0.30% at 0.9147 (YTD: -3.2%)

- Sterling down 0.80% at 1.3739 (YTD: +0.5%)

- Canadian dollar down 0.40% at 1.2622 (YTD: +0.9%)

- Australian dollar down 1.14% at 0.7253 (YTD: -5.7%)

- NZ dollar down 1.38% at 0.6920 (YTD: -3.7%)

MACRO DATA RELEASES

- Canada, Housing Starts, All areas for Jul 2021 (CMHC, Canada) at 272.20 k

- Colombia, GDP, Change Y/Y for Q2 2021 (DANE, Colombia) at 17.60 %, above consensus estimate of 15.60 %

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q2 2021 (Eurostat) at 2.00 %, in line with consensus estimate

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q2 2021 (Eurostat) at 13.60 %, below consensus estimate of 13.70 %

- Japan, Exports, Change Y/Y for Jul 2021 (MoF, Japan) at 37.00 %, below consensus estimate of 39.00 %

- Japan, Imports, Change Y/Y for Jul 2021 (MoF, Japan) at 28.50 %, below consensus estimate of 35.10 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Jun 2021 (Cabinet Office, JP) at -1.50 %, above consensus estimate of -2.80 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Jun 2021 (Cabinet Office, JP) at 18.60 %, above consensus estimate of 15.80 %

- Japan, Trade Balance, Current Prices for Jul 2021 (MoF, Japan) at 441.00 Bln JPY, above consensus estimate of 202.30 Bln JPY

- Netherlands, GDP, Total, Flash, Change P/P for Q2 2021 (CBS - NL) at 3.10 %, above consensus estimate of 1.60 %

- New Zealand, Milk Auction, Average Price, Constant Prices for W 17 Aug (Global Dairy Trade) at 3,827.00 USD

- United Kingdom, Unemployment, Claimant count, Absolute change for Jul 2021 (ONS, United Kingdom) at -7.80 k

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Jun 2021 (ONS, United Kingdom) at 4.70 %, below consensus estimate of 4.80 %

- United States, Production, Change P/P for Jul 2021 (FED, U.S.) at 0.90 %, above consensus estimate of 0.50 %

- United States, Retail Sales, Total including food services, Change P/P for Jul 2021 (U.S. Census Bureau) at -1.10 %, below consensus estimate of -0.30 %

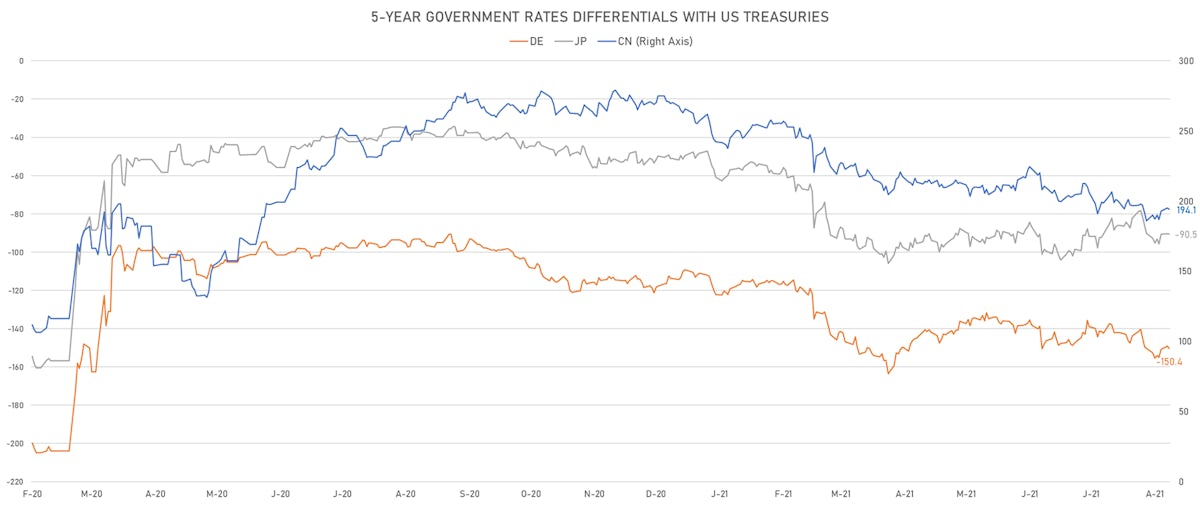

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.3 bp at 150.4 bp (YTD change: +39.3 bp)

- US-JAPAN: +0.1 bp at 90.5 bp (YTD change: +42.2 bp)

- US-CHINA: +1.0 bp at -194.1 bp (YTD change: +63.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.3 bp at 82.9 bp (YTD change: +36.8bp)

- US-JAPAN: +4.8 bp at -86.9 bp (YTD change: +14.6bp)

- JAPAN-GERMANY: +0.5 bp at 169.8 bp (YTD change: +22.2bp)

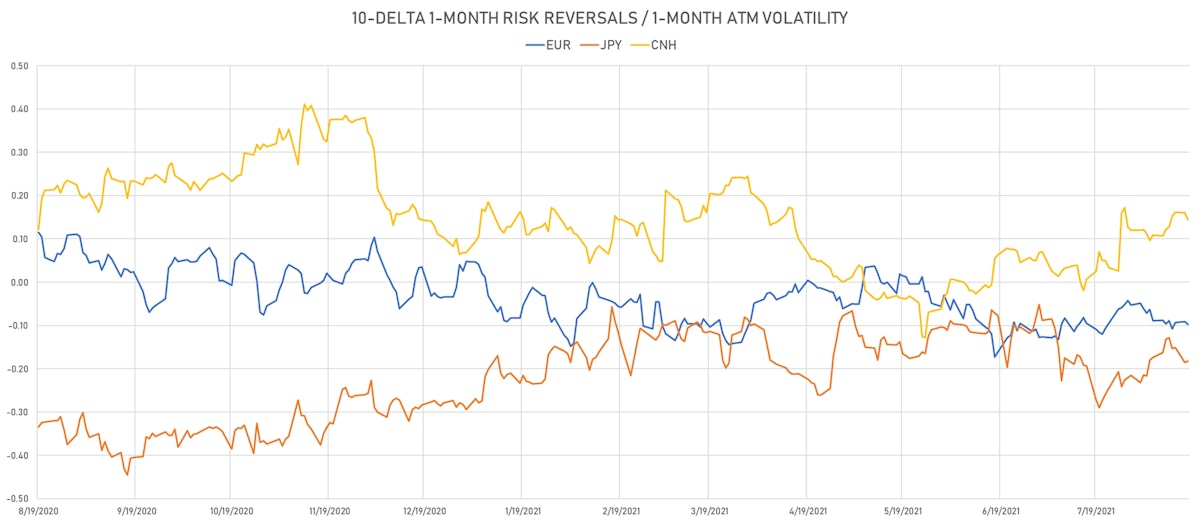

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.75, up 0.08 (YTD: -1.42)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.30, up 0.2 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.35, up 0.1 (YTD: -0.8)

- Offshore Yuan 1M ATM IV currently at 3.90, up 0.1 (YTD: -2.1)

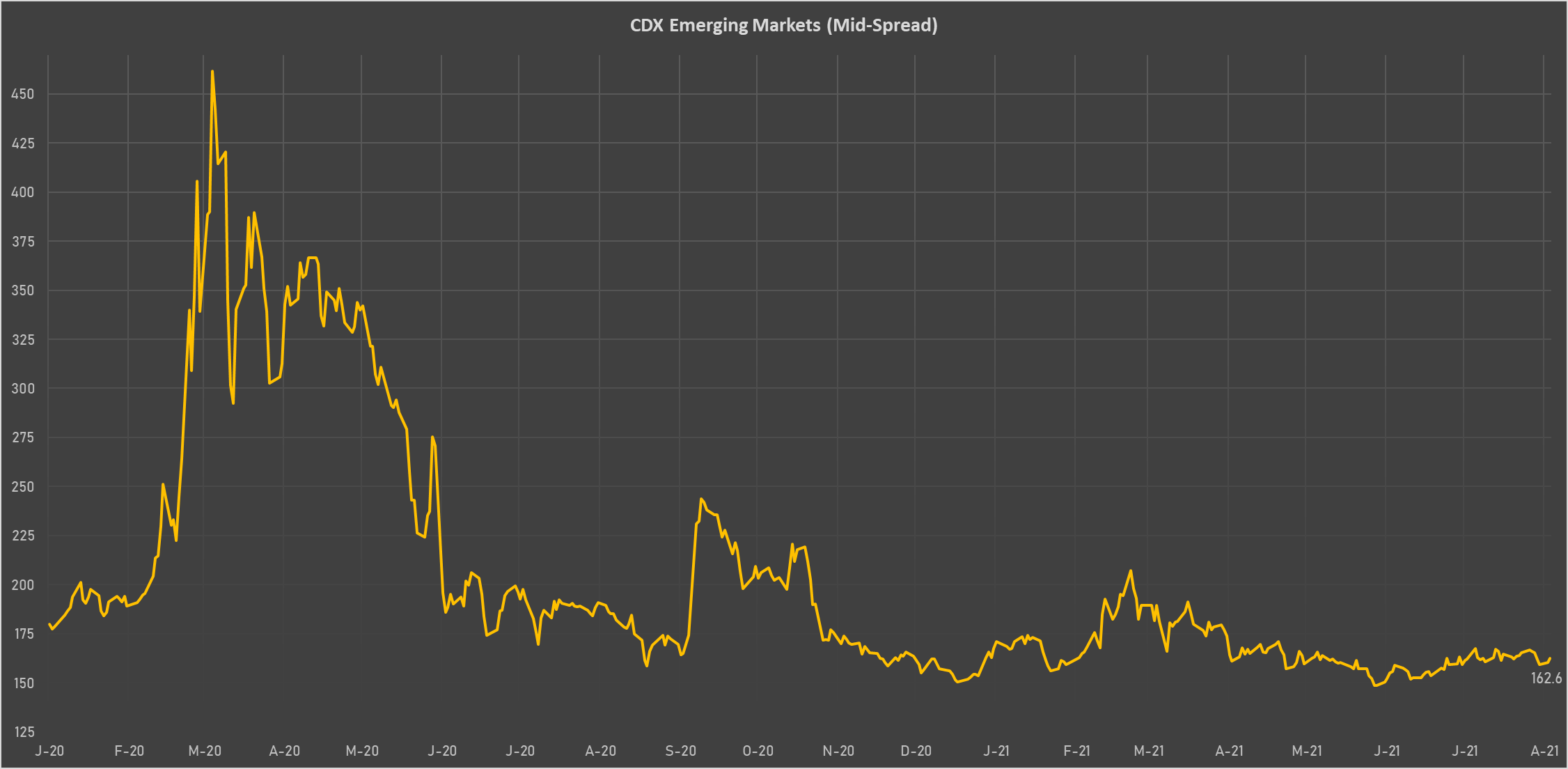

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Mexico (rated BBB-): up 1.3 basis points to 91 bp (1Y range: 79-164bp)

- Peru (rated BBB+): up 1.3 basis points to 91 bp (1Y range: 52-101bp)

- Panama (rated BBB-): up 1.0 basis points to 74 bp (1Y range: 44-95bp)

- Brazil (rated BB-): up 2.2 basis points to 181 bp (1Y range: 141-252bp)

- Government of Chile (rated A-): up 0.6 basis points to 68 bp (1Y range: 43-75bp)

- Colombia (rated BB+): up 1.1 basis points to 142 bp (1Y range: 83-164bp)

- South Africa (rated BB-): up 1.5 basis points to 203 bp (1Y range: 178-328bp)

- Russia (rated BBB): up 0.4 basis points to 85 bp (1Y range: 72-129bp)

- Vietnam (rated BB): up 0.3 basis points to 103 bp (1Y range: 90-137bp)

- Morocco (rated BB+): down 0.5 basis points to 93 bp (1Y range: 84-127bp)

LARGEST FX MOVES TODAY

- Barbados Dollar up 1.5% (YTD: +1.5%)

- Belize Dollar up 1.2% (YTD: +1.2%)

- Cape Verde Escudo down 0.9% (YTD: -0.9%)

- Colombian Peso down 1.0% (YTD: -11.7%)

- Haiti Gourde down 1.0% (YTD: -25.4%)

- North Macedonian denar down 1.0% (YTD: -4.5%)

- Korean Won down 1.1% (YTD: -7.7%)

- Australian Dollar down 1.1% (YTD: -5.7%)

- Swedish Krona down 1.2% (YTD: -5.9%)

- New Zealand $ down 1.4% (YTD: -3.7%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 52.1%

- Mozambique metical up 15.4%

- Ethiopian Birr down 12.8%

- Argentine Peso down 13.5%

- Haiti Gourde down 25.4%

- Surinamese dollar down 33.3%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%