FX

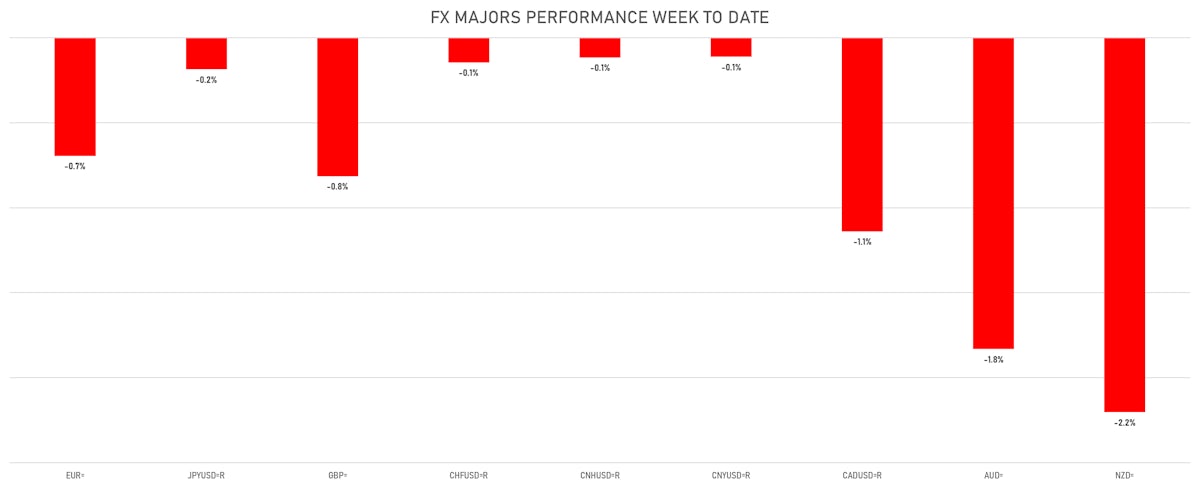

Little Movement In Major Currencies Today, Except For Antipodeans

The Kiwi dollar is now down more than 2% this week as the central bank kept rates unchanged, against market expectations of a 25bp rate hike

Published ET

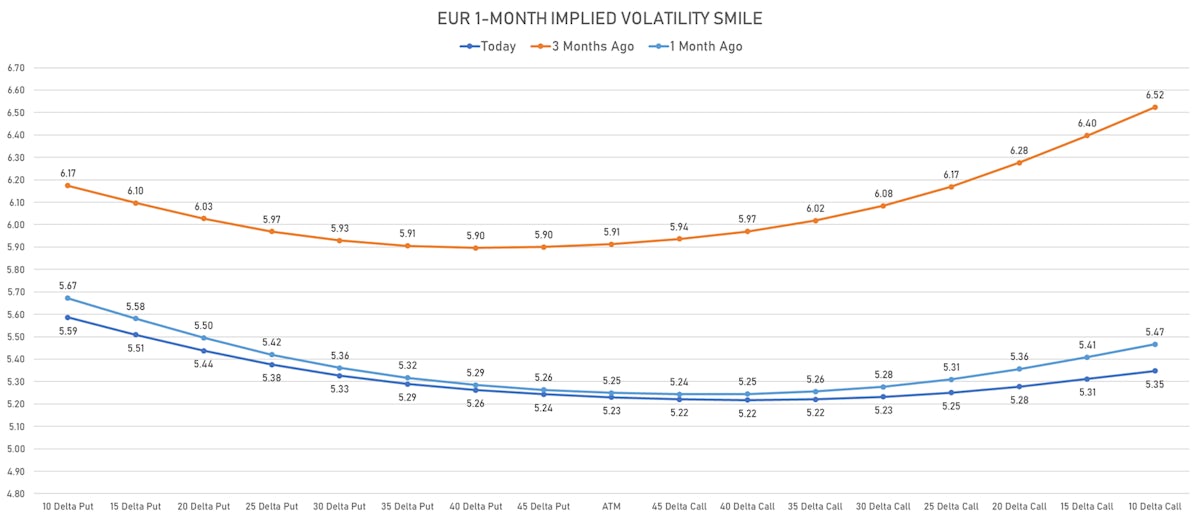

Very little directional bias priced into risk reversals | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.03% at 93.13 (YTD: +3.50%)

- Euro down 0.18% at 1.1687 (YTD: -4.3%)

- Yen down 0.35% at 109.97 (YTD: -6.1%)

- Onshore Yuan up 0.02% at 6.4841 (YTD: +0.7%)

- Swiss franc down 0.44% at 0.9186 (YTD: -3.6%)

- Sterling down 0.05% at 1.3732 (YTD: +0.4%)

- Canadian dollar down 0.33% at 1.2675 (YTD: +0.5%)

- Australian dollar down 0.48% at 0.7214 (YTD: -6.2%)

- NZ dollar down 1.08% at 0.6848 (YTD: -4.7%)

MACRO DATA RELEASES

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change P/P for Q2 2021 (AU Bureau of Stat) at 0.40 %, below consensus estimate of 0.60 %

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change Y/Y for Q2 2021 (AU Bureau of Stat) at 1.70 %, below consensus estimate of 1.90 %

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Jul 2021 (CANSIM, Canada) at 0.60 %

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Jul 2021 (CANSIM, Canada) at 3.30 %

- Chile, GDP, Change Y/Y for Q2 2021 (Central Bank, Chile) at 18.10 %, above consensus estimate of 17.40 %

- Euro Zone, CPI, Change P/P, Price Index for Jul 2021 (Eurostat) at -0.10 %, in line with consensus estimate

- Euro Zone, CPI, Change Y/Y for Jul 2021 (Eurostat) at 2.20 %, in line with consensus estimate

- Indonesia, Trade Balance, Current Prices for Jul 2021 (Statistics Indonesia) at 2.59 Bln USD, above consensus estimate of 2.27 Bln USD

- Namibia, Policy Rates, Bank Rate for Aug 2021 (Bank of Namibia) at 3.75 %

- New Zealand, Policy Rates, Official Cash Rate (OCR) for 18 Aug (RBNZ) at 0.25 %, below consensus estimate of 0.50 %

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for Jul 2021 (Statistics, SA) at 4.60 %, in line with consensus estimate

- United Kingdom, CPI, All items (CPI), Change Y/Y for Jul 2021 (ONS, United Kingdom) at 2.00 %, below consensus estimate of 2.30 %

- United States, Housing Starts for Jul 2021 (U.S. Census Bureau) at 1.53 Mln, below consensus estimate of 1.60 Mln

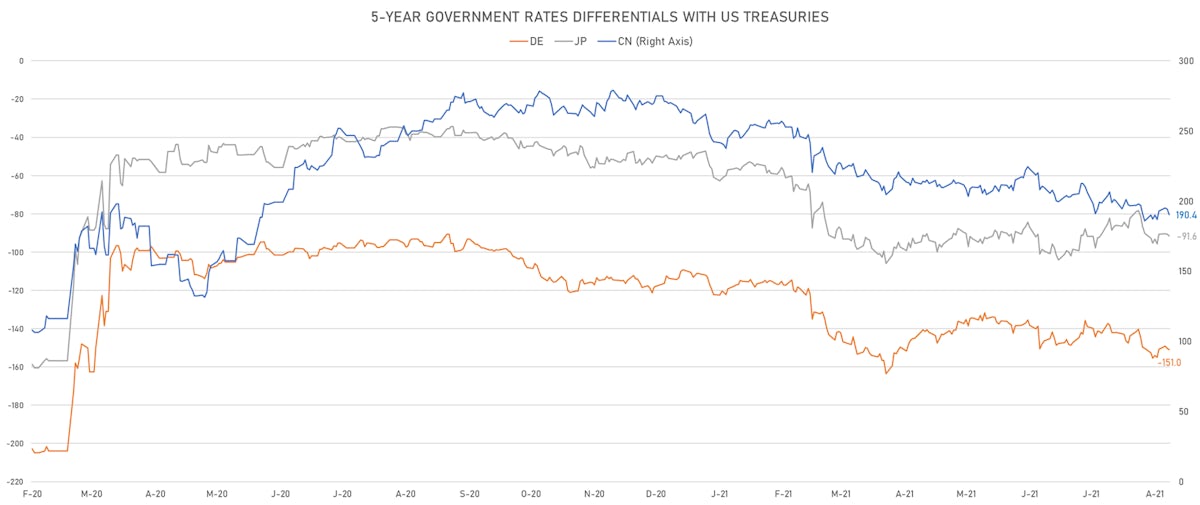

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.5 bp at 151.0 bp (YTD change: +39.9 bp)

- US-JAPAN: +1.1 bp at 91.6 bp (YTD change: +43.3 bp)

- US-CHINA: +3.8 bp at -190.4 bp (YTD change: +66.8 bp)

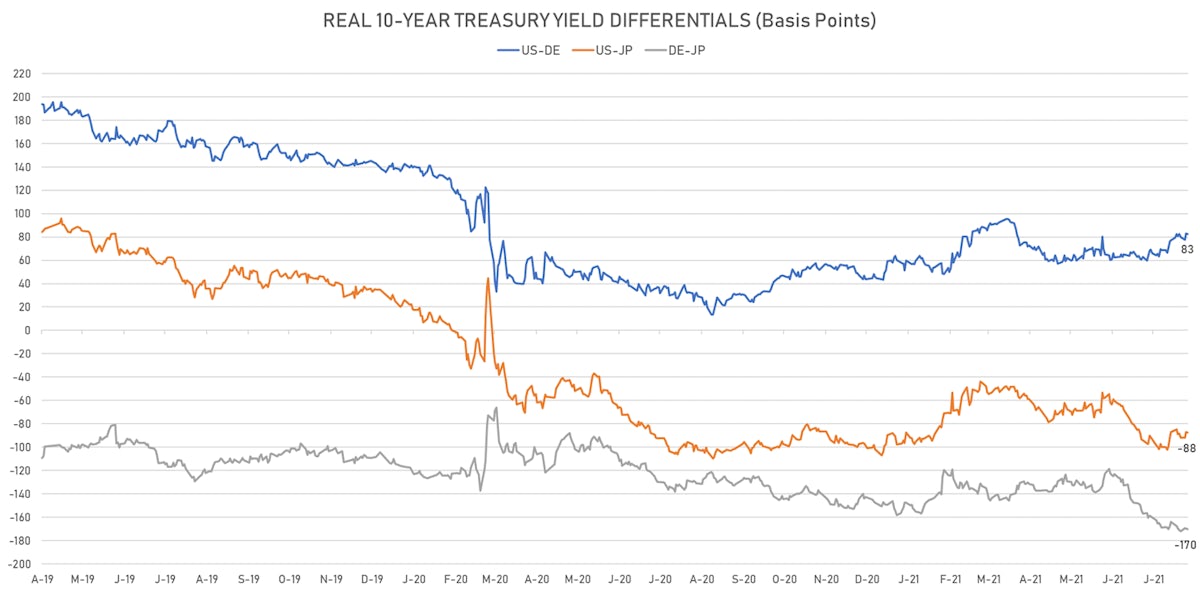

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.3 bp at 82.6 bp (YTD change: +36.5bp)

- US-JAPAN: -0.6 bp at -87.5 bp (YTD change: +14.0bp)

- JAPAN-GERMANY: +0.3 bp at 170.1 bp (YTD change: +22.5bp)

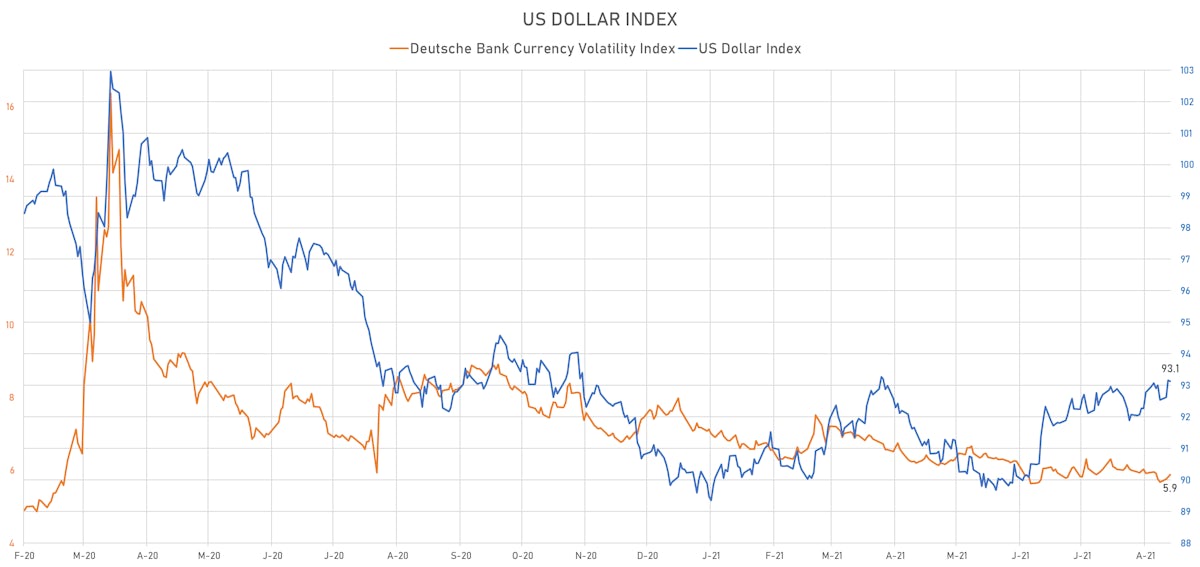

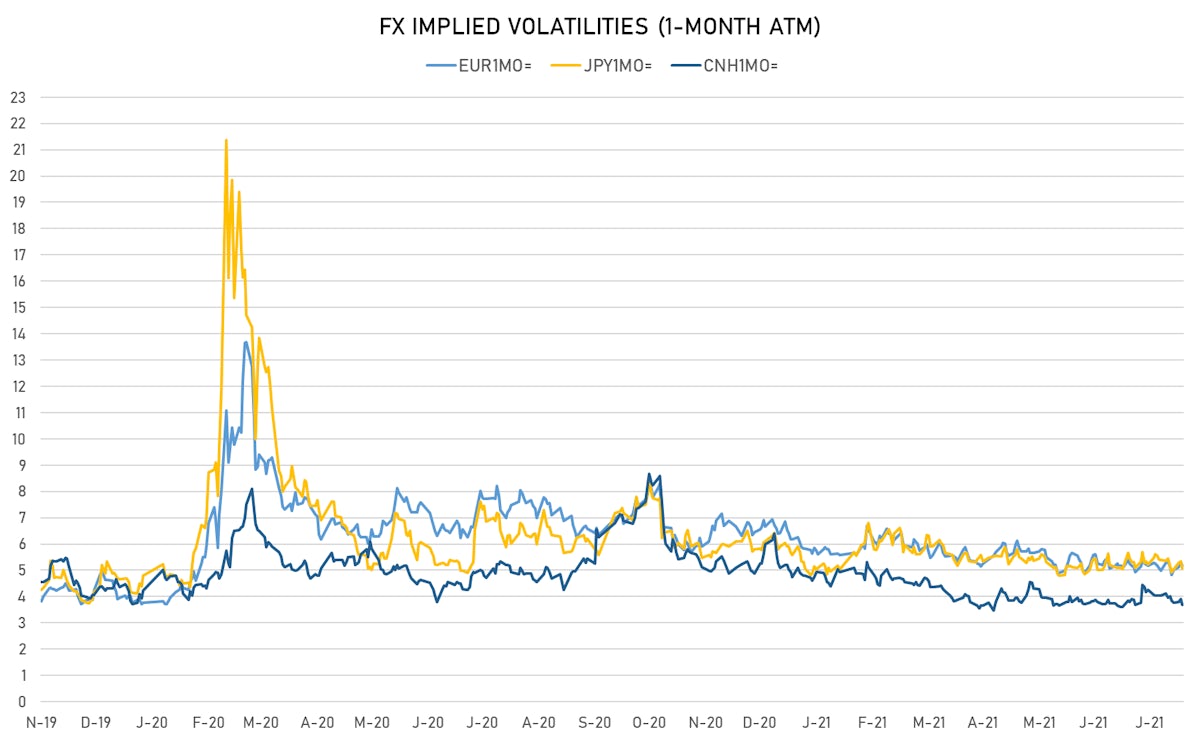

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.88, up 0.13 (YTD: -1.29)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.18, down -0.1 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.08, down -0.3 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.68, down -0.2 (YTD: -2.3)

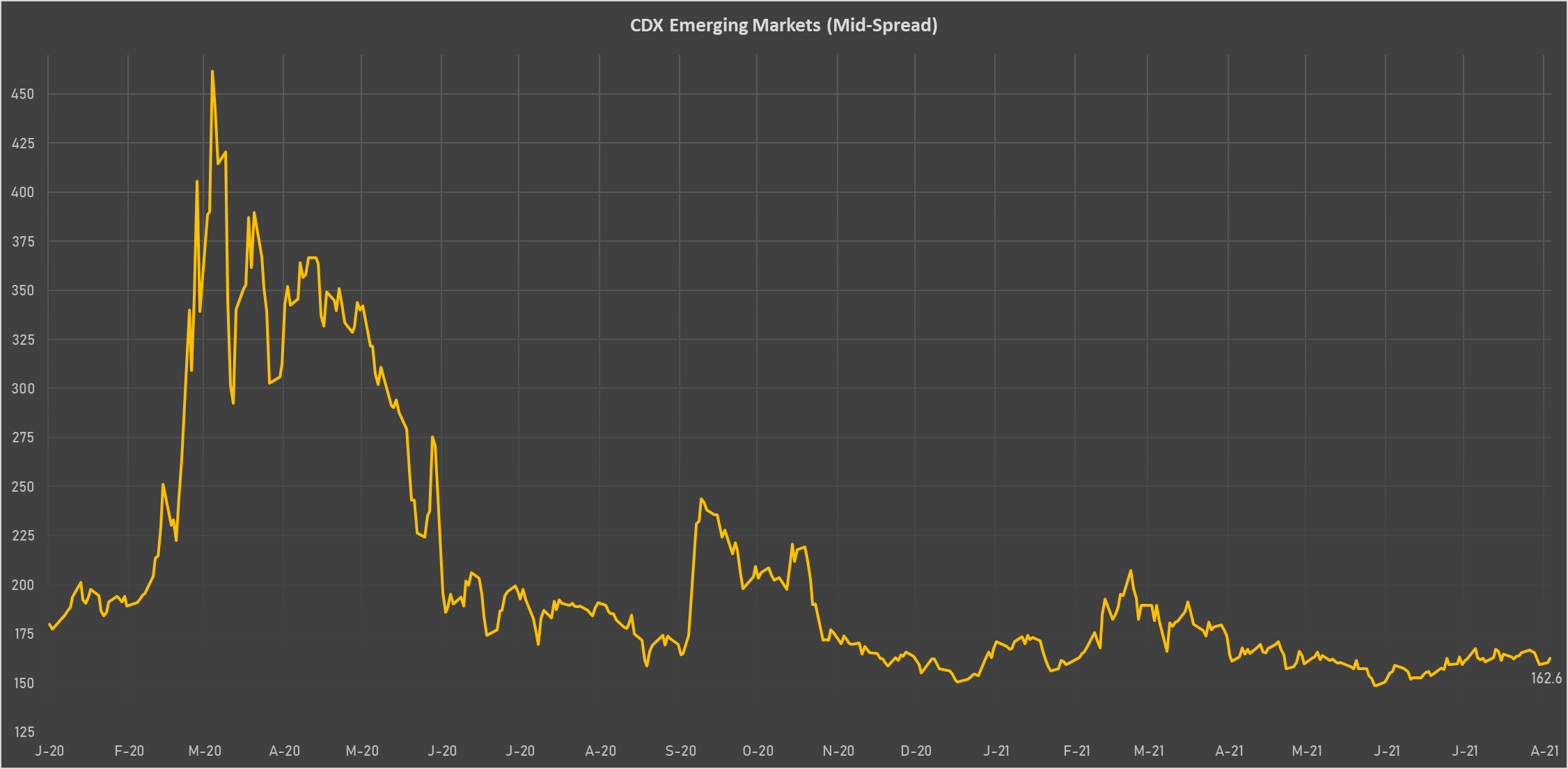

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Brazil (rated BB-): up 2.6 basis points to 186 bp (1Y range: 141-252bp)

- Egypt (rated B+): up 3.4 basis points to 344 bp (1Y range: 283-422bp)

- Colombia (rated BB+): up 0.9 basis points to 143 bp (1Y range: 83-164bp)

- Turkey (rated BB-): up 2.2 basis points to 385 bp (1Y range: 282-570bp)

- South Africa (rated BB-): up 1.0 basis points to 204 bp (1Y range: 178-328bp)

- Panama (rated BBB-): down 0.5 basis points to 75 bp (1Y range: 44-95bp)

- Vietnam (rated BB): down 0.7 basis points to 102 bp (1Y range: 90-137bp)

- Indonesia (rated BBB): down 0.7 basis points to 73 bp (1Y range: 66-118bp)

- Government of Chile (rated A-): down 0.7 basis points to 67 bp (1Y range: 43-75bp)

- Peru (rated BBB+): down 1.3 basis points to 90 bp (1Y range: 52-101bp)

LARGEST FX MOVES TODAY

- Malawi Kwacha up 0.8% (YTD: -4.7%)

- Cambodia Riel up 0.8% (YTD: -0.8%)

- Mauritius Rupee down 0.9% (YTD: -7.2%)

- Vanuatu Vatu down 0.9% (YTD: -3.6%)

- New Zealand $ down 1.1% (YTD: -4.7%)

- Ethiopian Birr down 1.1% (YTD: -13.8%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Samoa Tala down 1.2% (YTD: -2.7%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Brazilian Real down 1.6% (YTD: -3.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 65.8%

- Mozambique metical up 15.4%

- Argentine Peso down 13.5%

- Ethiopian Birr down 13.8%

- Haiti Gourde down 25.4%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%