FX

Moves In Rates Differentials Push The US Dollar Down Ahead Of Jackson Hole

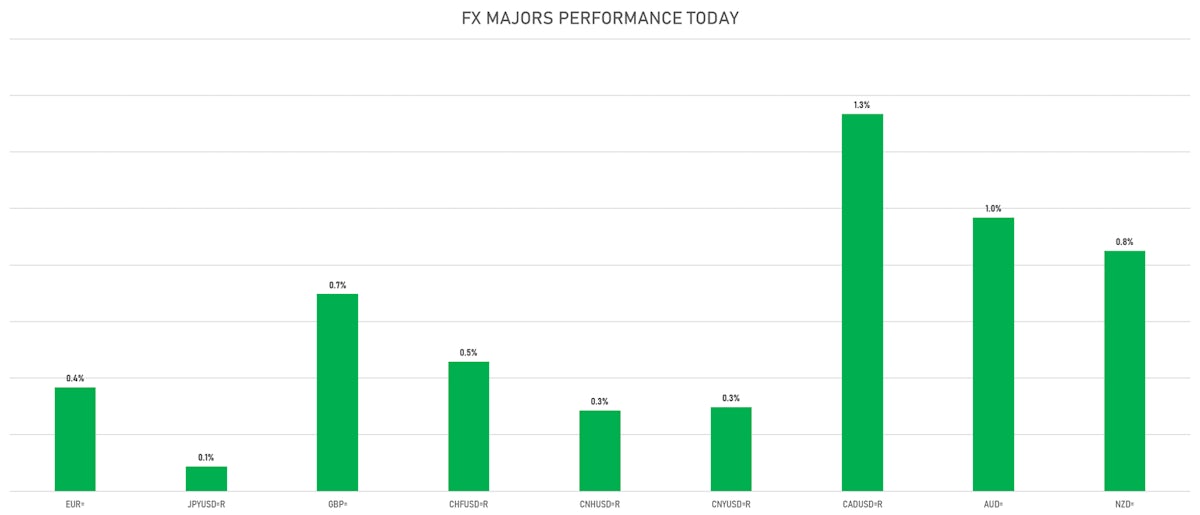

Good rebound in the currencies battered the most last week: CAD, AUD, NZD all up against the USD on Monday

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is down -0.55% at 92.97 (YTD: +3.32%)

- Euro up 0.37% at 1.1739 (YTD: -3.9%)

- Yen up 0.09% at 109.72 (YTD: -5.9%)

- Onshore Yuan up 0.30% at 6.4805 (YTD: +0.7%)

- Swiss franc up 0.46% at 0.9129 (YTD: -3.0%)

- Sterling up 0.70% at 1.3716 (YTD: +0.3%)

- Canadian dollar up 1.33% at 1.2656 (YTD: +0.6%)

- Australian dollar up 0.97% at 0.7203 (YTD: -6.4%)

- NZ dollar up 0.85% at 0.6883 (YTD: -4.2%)

MACRO DATA RELEASES

- Denmark, Consumer confidence indicator for Aug 2021 (statbank.dk) at 4.40 (vs 2.60 prior)

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Aug 2021 (DG ECFIN, France) at -5.30 (vs -4.40 prior), below consensus estimate of -5.00

- Euro Zone, PMI, Composite, Output, Flash for Aug 2021 (Markit Economics) at 59.50 (vs 60.20 prior), below consensus estimate of 59.70

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Aug 2021 (Markit Economics) at 61.50 (vs 62.80 prior), below consensus estimate of 62.00

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Aug 2021 (Markit Economics) at 59.70 (vs 59.80 prior), below consensus estimate of 59.80

- France, PMI, Composite, Output, Flash for Aug 2021 (Markit Economics) at 55.90 (vs 56.60 prior), below consensus estimate of 56.50

- France, PMI, Manufacturing Sector, Total, Flash for Aug 2021 (Markit/CDAF, France) at 57.30 (vs 58.00 prior), in line with consensus estimate

- France, PMI, Services Sector, Business Activity, Flash for Aug 2021 (Markit/CDAF, France) at 56.40 (vs 56.80 prior), below consensus estimate of 57.00

- Germany, PMI, Composite, Output, Flash for Aug 2021 (Markit Economics) at 60.60 (vs 62.40 prior), below consensus estimate of 62.20

- Germany, PMI, Manufacturing Sector, Total, Flash for Aug 2021 (Markit Economics) at 62.70 (vs 65.90 prior), below consensus estimate of 65.00

- Germany, PMI, Services Sector, Business Activity, Flash for Aug 2021 (Markit Economics) at 61.50 (vs 61.80 prior), above consensus estimate of 61.00

- Israel, Policy Rates, Bank of Israel Headline Rate for Aug 2021 (Bank of Israel) at 0.10 % (vs 0.10 % prior), in line with consensus estimate

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Flash for Aug 2021 (Markit Economics) at 52.40 (vs 53.00 prior)

- United Kingdom, Markit/CIPS PMI, Composite, Flash for Aug 2021 (Markit Economics) at 55.30 (vs 59.20 prior), below consensus estimate of 58.40

- United Kingdom, Markit/CIPS PMI, Manufacturing Flash for Aug 2021 (Markit Economics) at 60.10 (vs 60.40 prior), above consensus estimate of 59.50

- United Kingdom, Markit/CIPS PMI, Services, Flash for Aug 2021 (Markit Economics) at 55.50 (vs 59.60 prior), below consensus estimate of 59.00

- United States, Existing-Home Sales, Single-Family and Condos, total for Jul 2021 (NAR, United States) at 5.99 Mln (vs 5.86 Mln prior), above consensus estimate of 5.83 Mln

- United States, PMI, Composite, Output, Flash for Aug 2021 (Markit Economics) at 55.40 (vs 59.90 prior), below consensus estimate of 58.30

- United States, PMI, Manufacturing Sector, Total, Flash for Aug 2021 (Markit Economics) at 61.20 (vs 63.40 prior), below consensus estimate of 62.50

- United States, PMI, Services Sector, Business Activity, Flash for Aug 2021 (Markit Economics) at 55.20 (vs 59.90 prior), below consensus estimate of 59.50

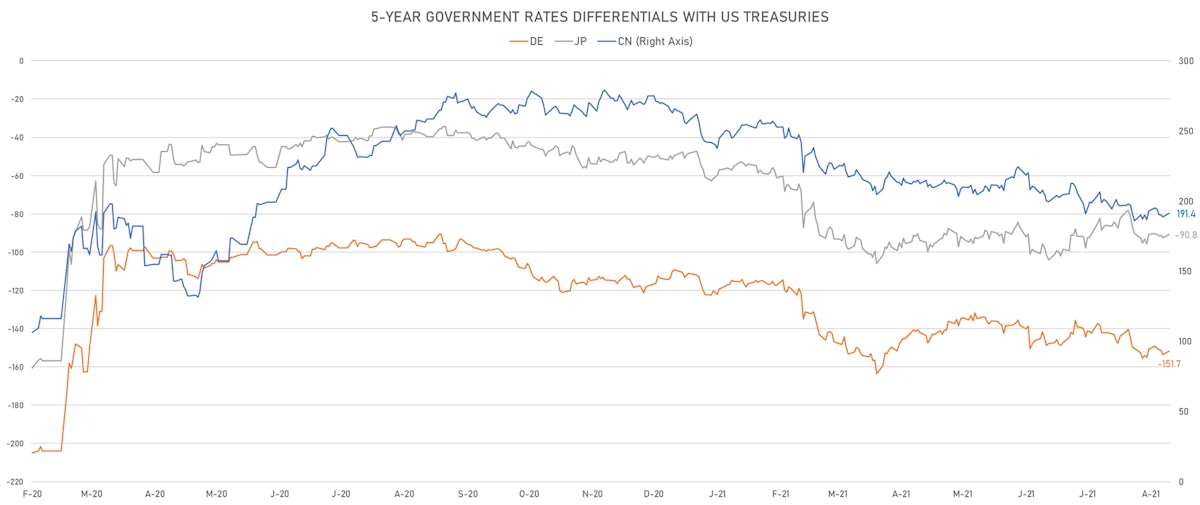

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.8 bp at 151.7 bp (YTD change: +40.6 bp)

- US-JAPAN: -1.8 bp at 90.8 bp (YTD change: +42.5 bp)

- US-CHINA: -2.5 bp at -191.4 bp (YTD change: +65.8 bp)

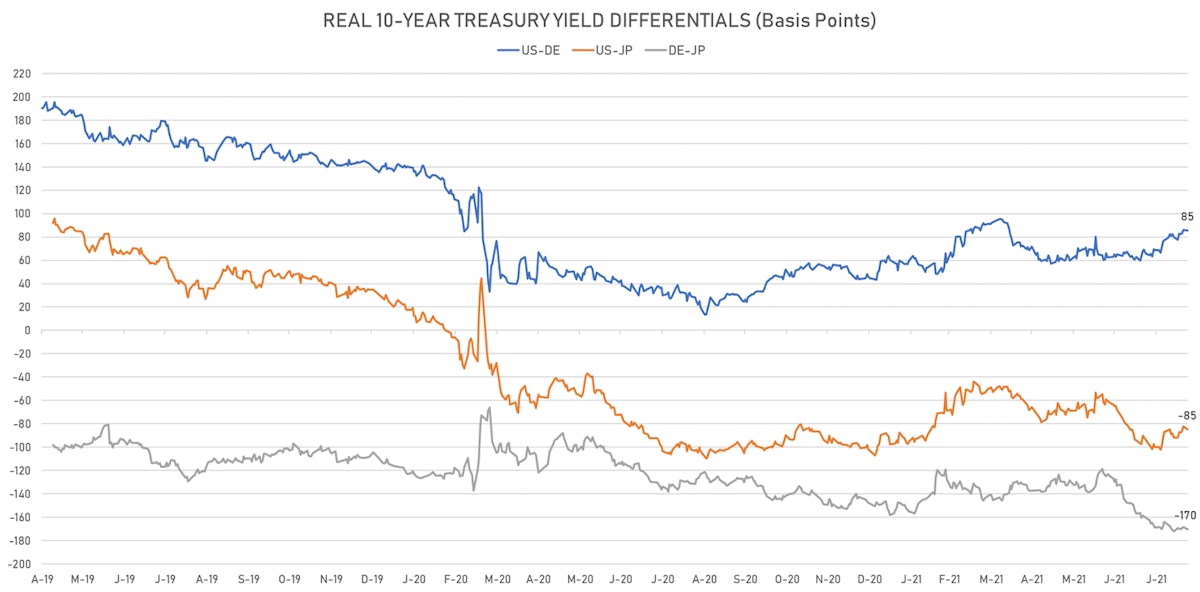

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.6 bp at 85.4 bp (YTD change: +39.3bp)

- US-JAPAN: -2.6 bp at -84.8 bp (YTD change: +16.7bp)

- JAPAN-GERMANY: +2.0 bp at 170.2 bp (YTD change: +22.6bp)

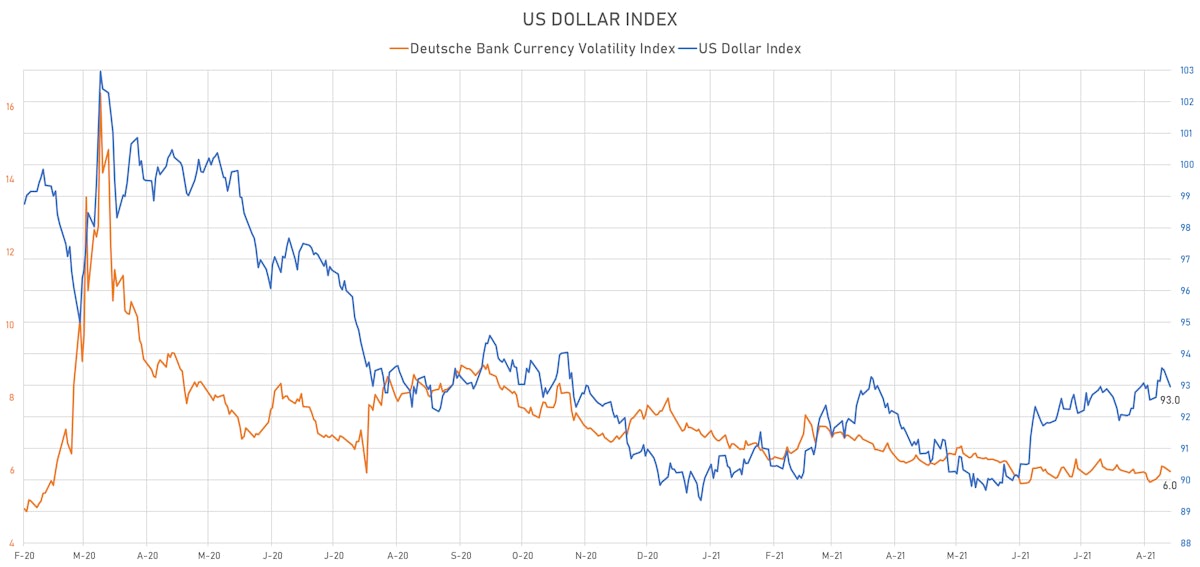

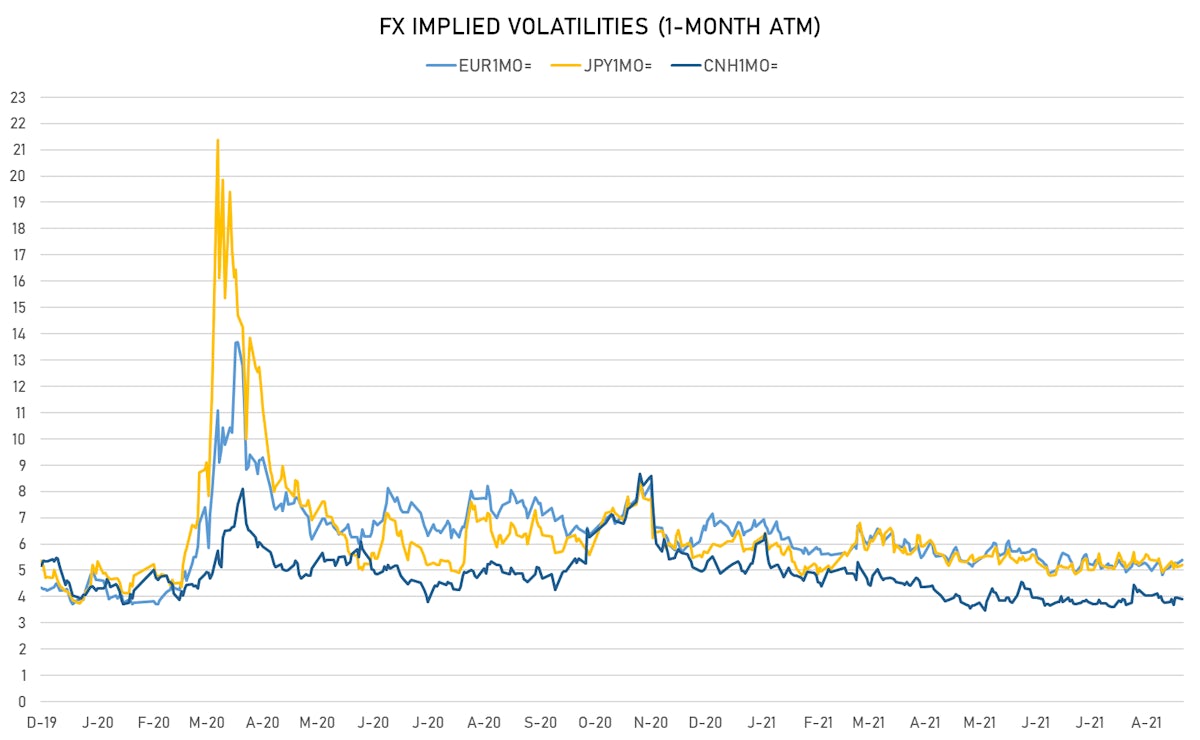

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.96, down -0.13 (YTD: -1.21)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.40, up 0.2 (YTD: -1.3)

- Japanese Yen 1M ATM IV currently at 5.20, up 0.1 (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.90, down -0.1 (YTD: -2.1)

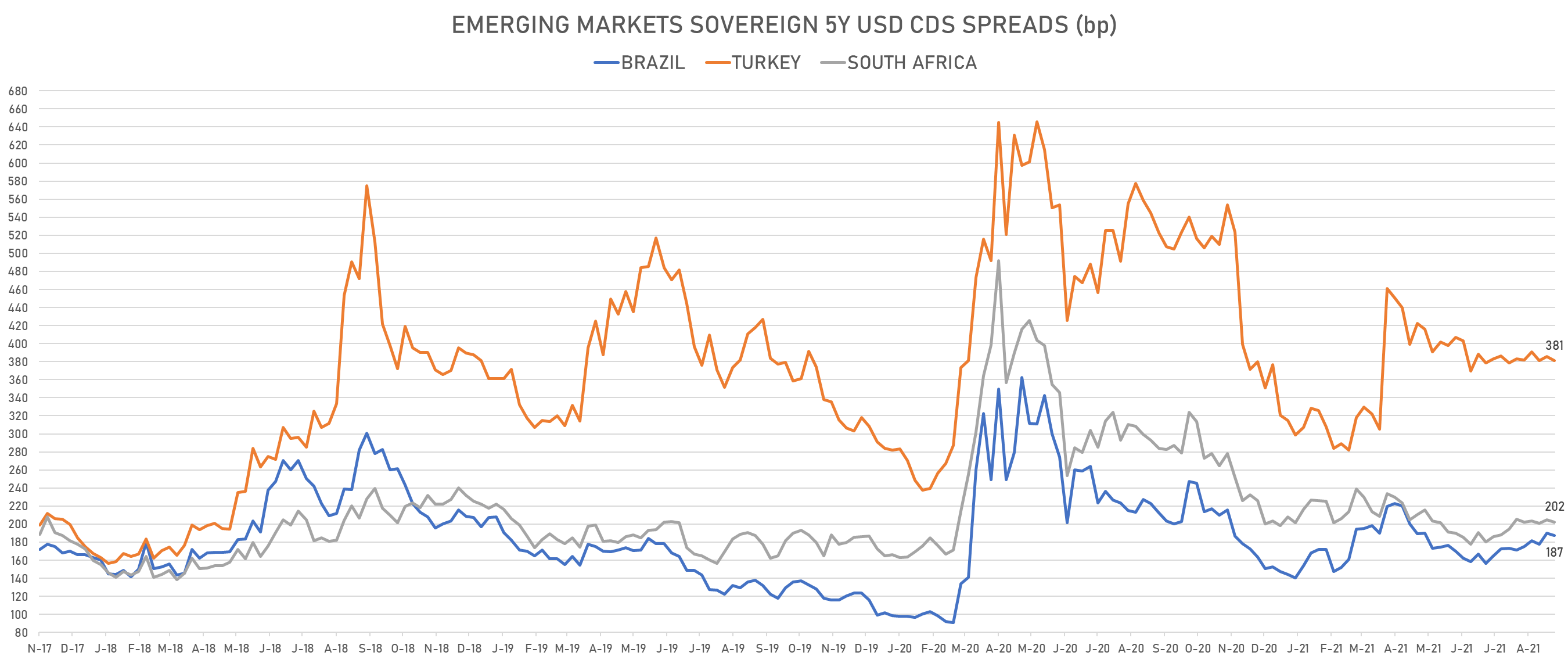

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Morocco (rated BB+): up 0.7 basis points to 94 bp (1Y range: 84-127bp)

- Indonesia (rated BBB): up 0.5 basis points to 73 bp (1Y range: 66-118bp)

- Peru (rated BBB+): down 1.0 basis points to 90 bp (1Y range: 52-101bp)

- Brazil (rated BB-): down 2.3 basis points to 187 bp (1Y range: 141-252bp)

- Chile (rated A-): down 1.1 basis points to 67 bp (1Y range: 43-75bp)

- Turkey (rated BB-): down 7.3 basis points to 381 bp (1Y range: 282-570bp)

- Saudi Arabia (rated A): down 1.2 basis points to 53 bp (1Y range: 52-101bp)

- Colombia (rated BB+): down 3.4 basis points to 143 bp (1Y range: 83-164bp)

- South Africa (rated BB-): down 5.8 basis points to 202 bp (1Y range: 178-328bp)

- Russia (rated BBB): down 2.6 basis points to 84 bp (1Y range: 72-129bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 3.1% (YTD: -23.8%)

- Jamaican Dollar up 1.4% (YTD: -6.7%)

- Canadian Dollar up 1.3% (YTD: +0.6%)

- Norwegian Krone up 1.1% (YTD: -3.8%)

- Swedish Krona up 1.0% (YTD: -5.5%)

- Australian Dollar up 1.0% (YTD: -6.4%)

- Cape Verde Escudo up 1.0% (YTD: 0.0%)

- South Africa Rand up 0.9% (YTD: -3.1%)

- Namibian Dollar up 0.9% (YTD: -3.1%)

- Swazi Lilangeni up 0.9% (YTD: -3.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 62.3%

- Mozambique metical up 15.4%

- Argentine Peso down 13.7%

- Ethiopian Birr down 13.8%

- Haiti Gourde down 23.8%

- Surinamese dollar down 34.2%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%