FX

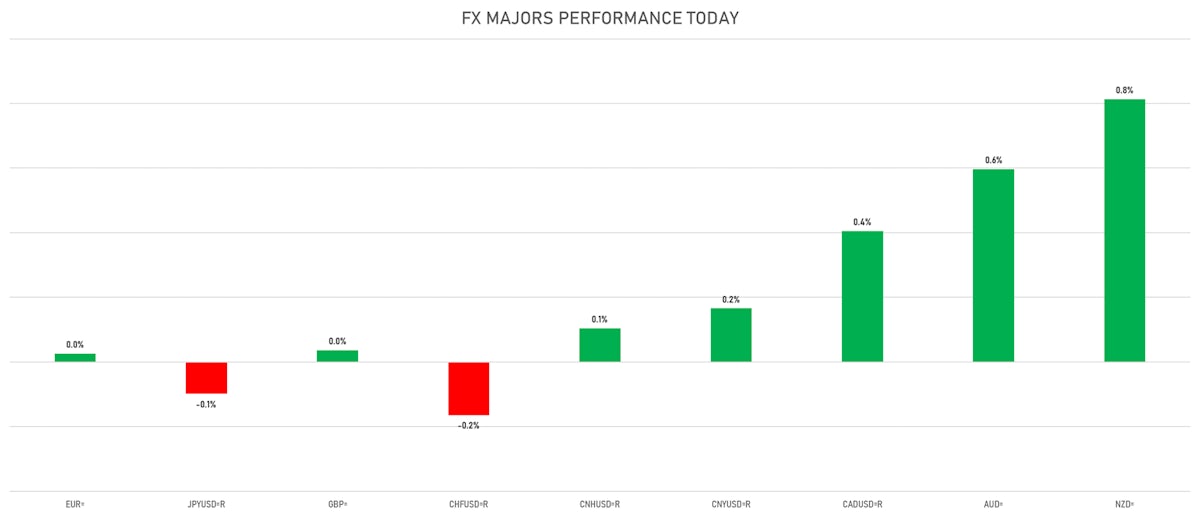

Euro, Yen Pretty Stable Today, While Antipodeans, Loony Recover Further

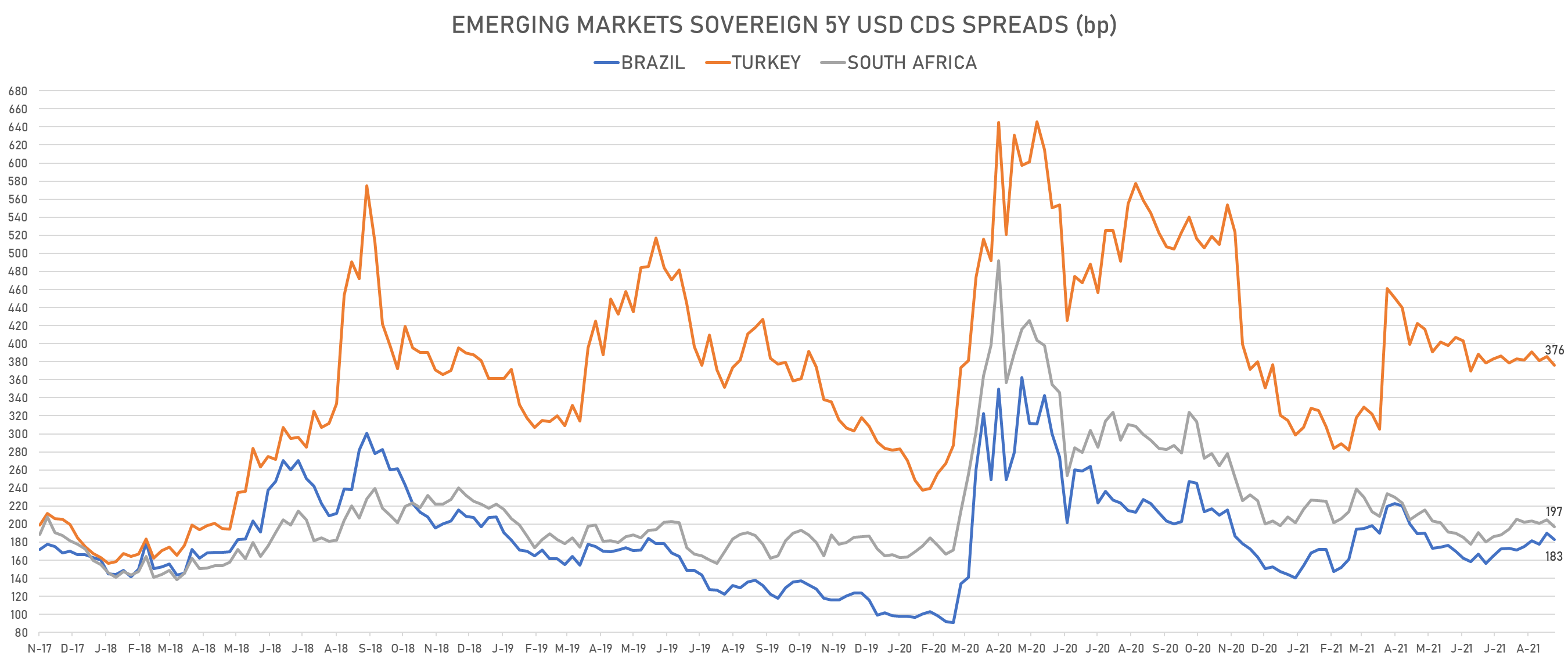

The broad rebound in commodities helped the Brazilian Real gain over 2%, along with a tightening of Brazilian sovereign CDS spreads

Published ET

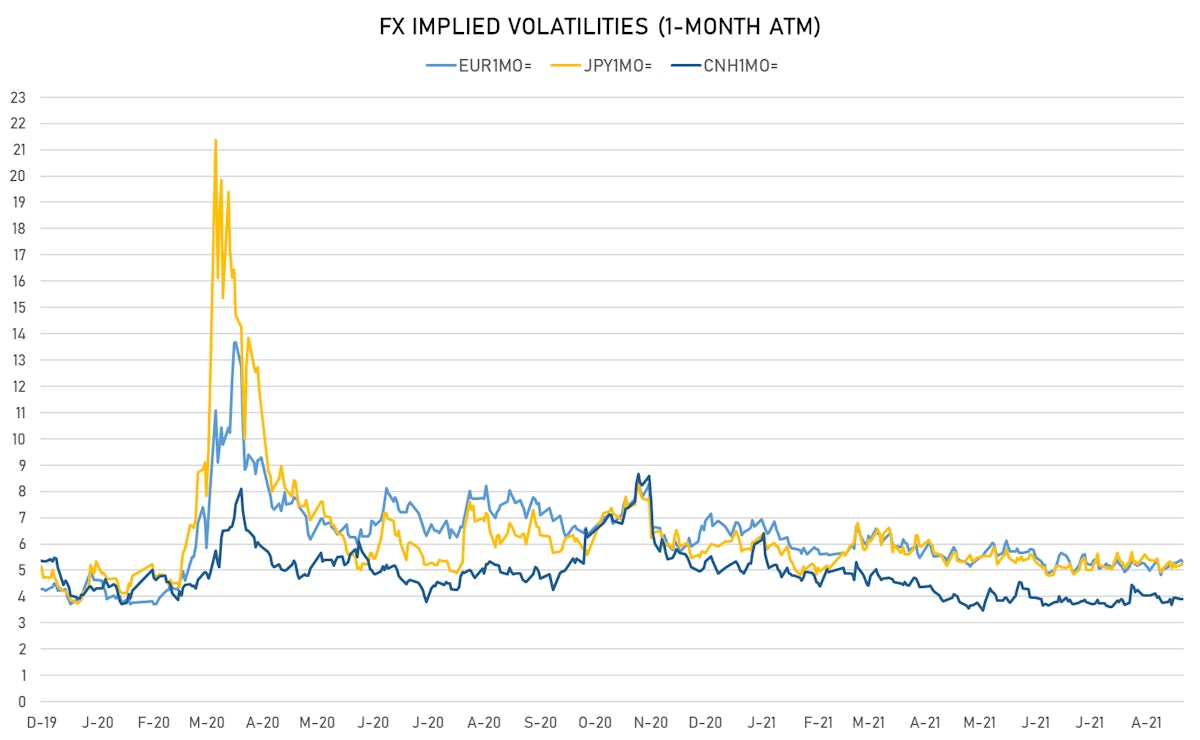

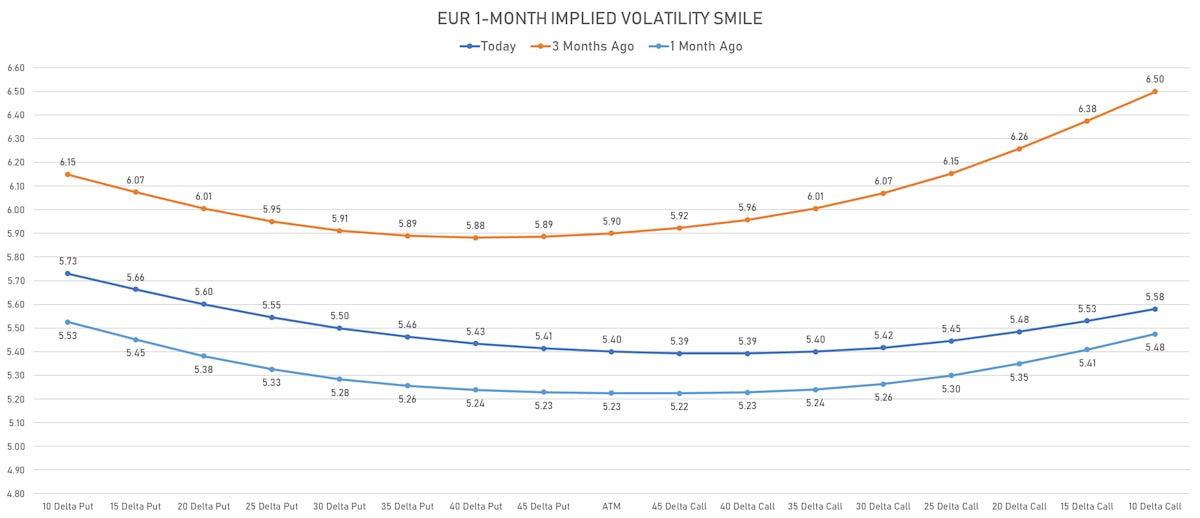

Euro 1-month options prices are still slightly skewed to the downside | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.10% at 92.87 (YTD: +3.21%)

- Euro up 0.03% at 1.1746 (YTD: -3.8%)

- Yen down 0.10% at 109.79 (YTD: -6.0%)

- Onshore Yuan up 0.17% at 6.4710 (YTD: +0.9%)

- Swiss franc down 0.16% at 0.9140 (YTD: -3.1%)

- Sterling up 0.04% at 1.3722 (YTD: +0.4%)

- Canadian dollar up 0.40% at 1.2597 (YTD: +1.1%)

- Australian dollar up 0.60% at 0.7251 (YTD: -5.8%)

- NZ dollar up 0.81% at 0.6946 (YTD: -3.3%)

GLOBAL MACRO DATA RELEASES

- Germany, GDP, Detailed, Change P/P for Q2 2021 (Destatis) at 1.60 % (vs 1.50 % prior), above consensus estimate of 1.50 %

- Germany, GDP, Detailed, Change Y/Y for Q2 2021 (Destatis) at 9.80 % (vs 9.60 % prior), above consensus estimate of 9.60 %

- Hungary, Policy Rates, Base Rate for Aug 2021 (Cent. Bank, Hungary) at 1.50 % (vs 1.20 % prior), in line with consensus estimate

- New Zealand, Exports, Total, FOB, Current Prices for Jul 2021 (Statistics, NZ) at 5.75 Bln NZD (vs 5.95 Bln NZD prior)

- New Zealand, Imports, Total, CIF, Current Prices for Jul 2021 (Statistics, NZ) at 6.16 Bln NZD (vs 5.69 Bln NZD prior)

- New Zealand, Trade Balance, Current Prices for Jul 2021 (Statistics, NZ) at -402.00 Mln NZD (vs 261.00 Mln NZD prior)

- New Zealand, Trade Balance, Current Prices for Jul 2021 (Statistics, NZ) at -1.10 Bln NZD (vs -0.25 Bln NZD prior)

- Poland, Unemployment, Rate for Jul 2021 (CSO, Poland) at 5.80 % (vs 5.90 % prior), below consensus estimate of 5.80 %

- Thailand, Imports, Total, customs basis, Change Y/Y for Jul 2021 (Bank of Thailand) at 45.94 % (vs 53.75 % prior), above consensus estimate of 43.00 %

- United Kingdom, CBI Distributive Trades, Retailing, Volume of sales, balance for Aug 2021 (CBI, UK) at 60.00 (vs 23.00 prior), above consensus estimate of 20.00

- United States, New Home Sales for Jul 2021 (U.S. Census Bureau) at 0.71 Mln (vs 0.68 Mln prior), above consensus estimate of 0.70 Mln

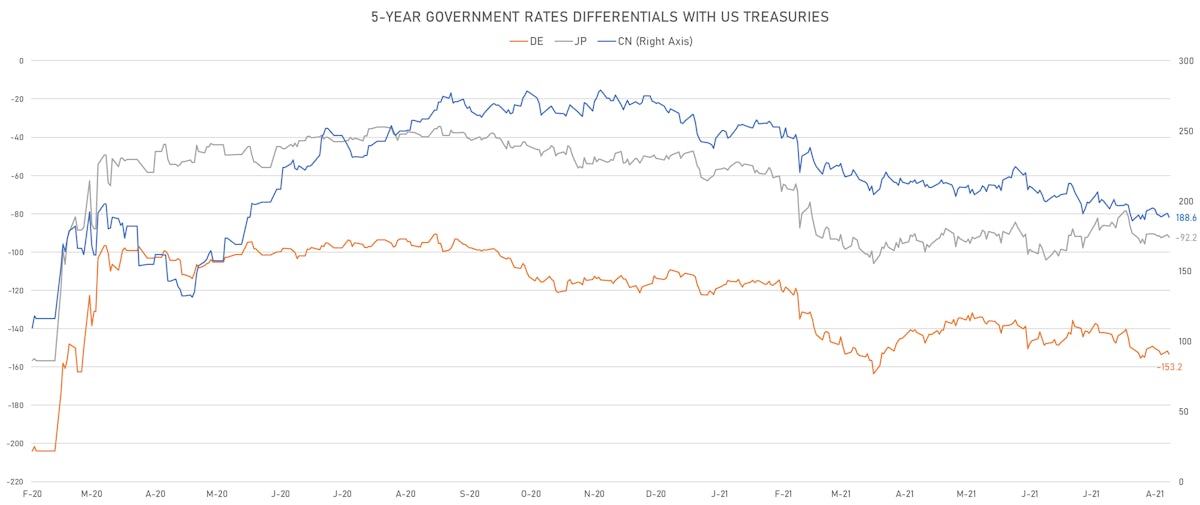

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.6 bp at 153.2 bp (YTD change: +42.1 bp)

- US-JAPAN: +1.5 bp at 92.2 bp (YTD change: +43.9 bp)

- US-CHINA: +2.8 bp at -188.6 bp (YTD change: +68.5 bp)

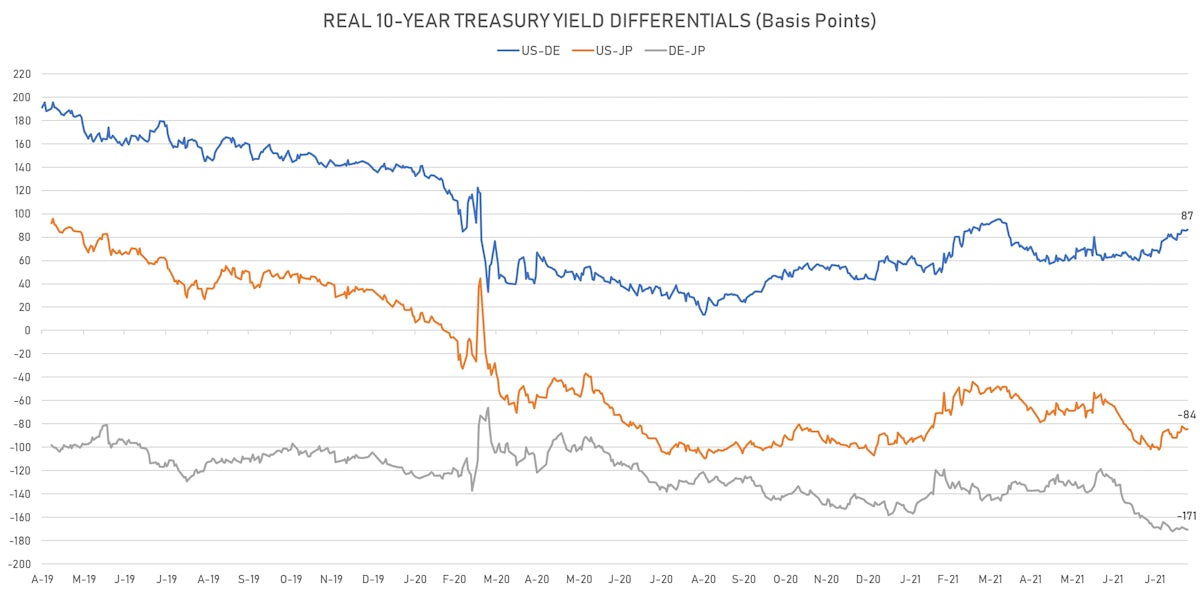

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.1 bp at 86.5 bp (YTD change: +40.4bp)

- US-JAPAN: +0.7 bp at -84.1 bp (YTD change: +17.4bp)

- JAPAN-GERMANY: +0.4 bp at 170.6 bp (YTD change: +23.0bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.94, down -0.02 (YTD: -1.23)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.33, down -0.1 (YTD: -1.4)

- Japanese Yen 1M ATM IV unchanged at 5.25 (YTD: -0.9)

- Offshore Yuan 1M ATM IV unchanged at 3.90 (YTD: -2.1)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Bahrain (rated B+): down 2.6 basis points to 250 bp (1Y range: 159-330bp)

- Argentina (rated CCC): down 21.1 basis points to 1,893 bp (1Y range: 1,049-1,971bp)

- Turkey (rated BB-): down 5.5 basis points to 376 bp (1Y range: 282-570bp)

- Panama (rated BBB-): down 1.2 basis points to 74 bp (1Y range: 44-95bp)

- Colombia (rated BB+): down 3.5 basis points to 139 bp (1Y range: 83-164bp)

- Brazil (rated BB-): down 4.6 basis points to 183 bp (1Y range: 141-252bp)

- Russia (rated BBB): down 2.1 basis points to 82 bp (1Y range: 72-129bp)

- South Africa (rated BB-): down 5.2 basis points to 197 bp (1Y range: 178-328bp)

- Mexico (rated BBB-): down 2.8 basis points to 91 bp (1Y range: 79-164bp)

- Chile (rated A-): down 2.2 basis points to 65 bp (1Y range: 43-75bp)

LARGEST FX MOVES TODAY

- Brazilian Real up 2.6% (YTD: -1.0%)

- Jamaican Dollar up 1.9% (YTD: -6.3%)

- Vanuatu Vatu up 1.1% (YTD: -2.4%)

- Thai Baht up 0.9% (YTD: -8.8%)

- Swazi Lilangeni up 0.9% (YTD: -2.0%)

- Lesotho Loti up 0.9% (YTD: -2.0%)

- South Africa Rand up 0.8% (YTD: -2.0%)

- Namibian Dollar up 0.8% (YTD: -2.0%)

- Cfa Franc Beac down 3.2% (YTD: -4.2%)

- Haiti Gourde down 4.0% (YTD: -26.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.8%

- Mozambique metical up 15.4%

- Argentine Peso down 13.6%

- Ethiopian Birr down 13.8%

- Haiti Gourde down 26.8%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%