FX

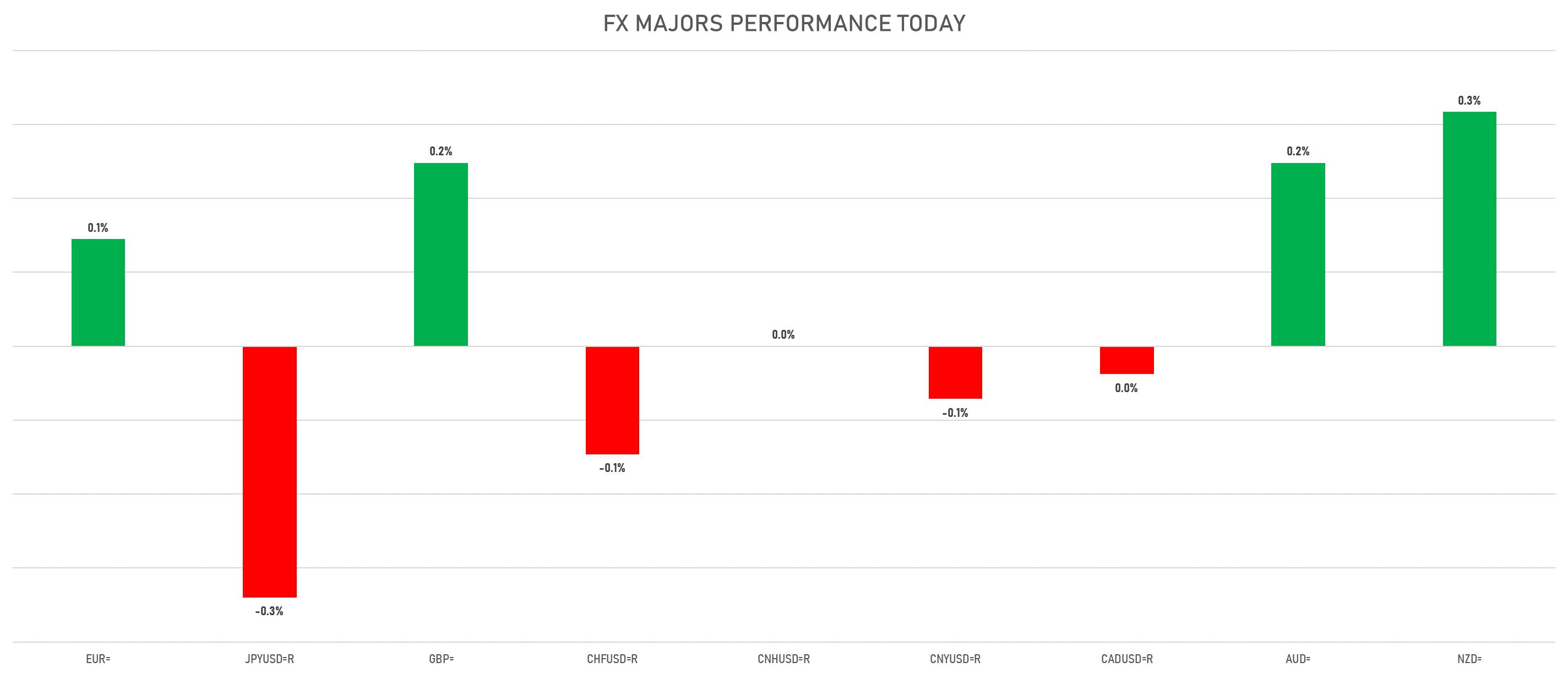

Major Currencies Mixed As The Dollar Index Closes Unchanged

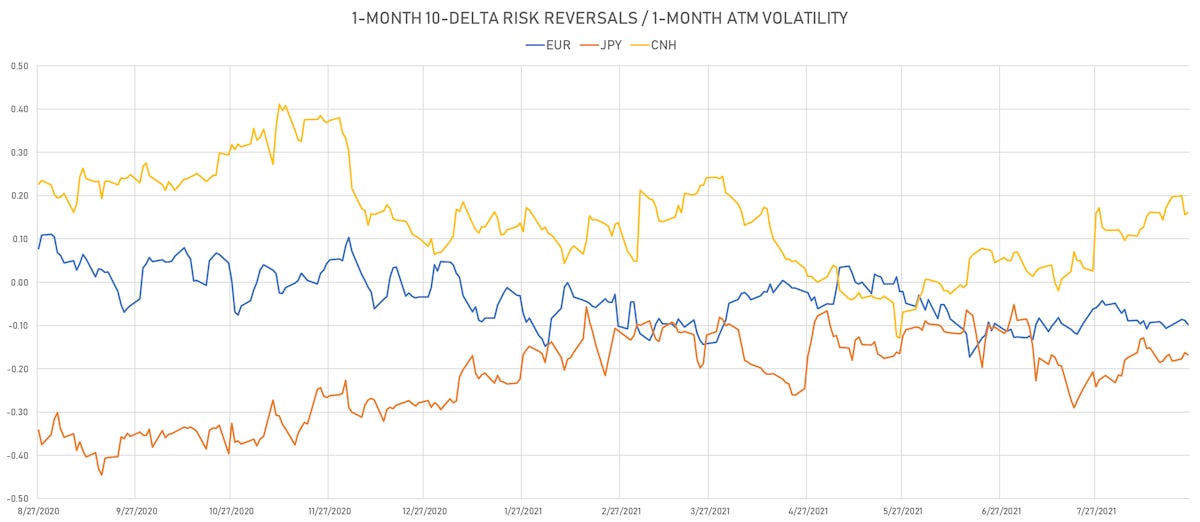

Real rates differentials are driving moves in the euro and yen, though it should be a quiet week, with nothing expected to come out of Powell's Jackson Hole speech on Friday

Published ET

US Dollar Index & Deutsche Bank Currency Volatility Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.04% at 92.83 (YTD: +3.17%)

- Euro up 0.14% at 1.1770 (YTD: -3.6%)

- Yen down 0.34% at 110.01 (YTD: -6.1%)

- Onshore Yuan down 0.07% at 6.4756 (YTD: +0.8%)

- Swiss franc down 0.15% at 0.9138 (YTD: -3.1%)

- Sterling up 0.25% at 1.3761 (YTD: +0.6%)

- Canadian dollar down 0.04% at 1.2591 (YTD: +1.1%)

- Australian dollar up 0.25% at 0.7275 (YTD: -5.4%)

- NZ dollar up 0.32% at 0.6970 (YTD: -3.0%)

MACRO DATA RELEASES

- Australia, Value of Construction, All types, Change P/P for Q2 2021 (AU Bureau of Stat) at 0.80 % (vs 2.40 % prior), below consensus estimate of 2.50 %

- Belgium, All Sectors, Overall for Aug 2021 (NBB, Belgium) at 7.60 (vs 10.10 prior)

- Brazil, CPI, Broad National - 15 (IPCA-15), Change Y/Y for Aug 2021 (IBGE, Brazil) at 9.30 % (vs 8.59 % prior), above consensus estimate of 9.24 %

- Brazil, CPI, Broad national - 15 (IPCA-15), Change P/P for Aug 2021 (IBGE, Brazil) at 0.89 % (vs 0.72 % prior), above consensus estimate of 0.82 %

- Brazil, Current Account, Balance, Current Prices for Jul 2021 (Central Bank, Brazil) at -1.58 Bln USD (vs 2.80 Bln USD prior), below consensus estimate of -0.65 Bln USD

- Brazil, Financial Account, Direct Investment, In Reporting Economy, Net incurrence of liabilities, Current Prices for Jul 2021 (Central Bank, Brazil) at 6.10 Bln USD (vs 0.17 Bln USD prior), above consensus estimate of 4.45 Bln USD

- Germany, Climate Germany (Incl. Services), Volume Index for Aug 2021 (Ifo, Univ. of Munich) at 99.40 (vs 100.80 prior), below consensus estimate of 100.40

- Germany, Ifo Business Climate Germany Expectation (Incl. Services), Volume Index for Aug 2021 (Ifo, Univ. of Munich) at 97.50 (vs 101.20 prior), below consensus estimate of 100.00

- Germany, Ifo Business Climate Germany Situation (Incl. services), Volume Index for Aug 2021 (Ifo, Univ. of Munich) at 101.40 (vs 100.40 prior), above consensus estimate of 100.80

- Mexico, GDP, Change P/P for Q2 2021 (INEGI, Mexico) at 1.50 % (vs 1.50 % prior), below consensus estimate of 1.70 %

- Mexico, GDP, Change Y/Y for Q2 2021 (INEGI, Mexico) at 19.60 % (vs 19.70 % prior), below consensus estimate of 19.80 %

- Mexico, IGAE, Change Y/Y for Jun 2021 (INEGI, Mexico) at 13.30 % (vs 25.10 % prior), below consensus estimate of 13.90 %

- Russia, Production, IP Total , Change Y/Y for Jul 2021 (RosStat, Russia) at 6.80 % (vs 10.40 % prior), below consensus estimate of 8.20 %

- United States, Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.70 % (vs 0.50 % prior), above consensus estimate of 0.50 %

- United States, Manufacturers New Orders, Durable goods total, Change P/P for Jul 2021 (U.S. Census Bureau) at -0.10 % (vs 0.90 % prior), above consensus estimate of -0.30 %

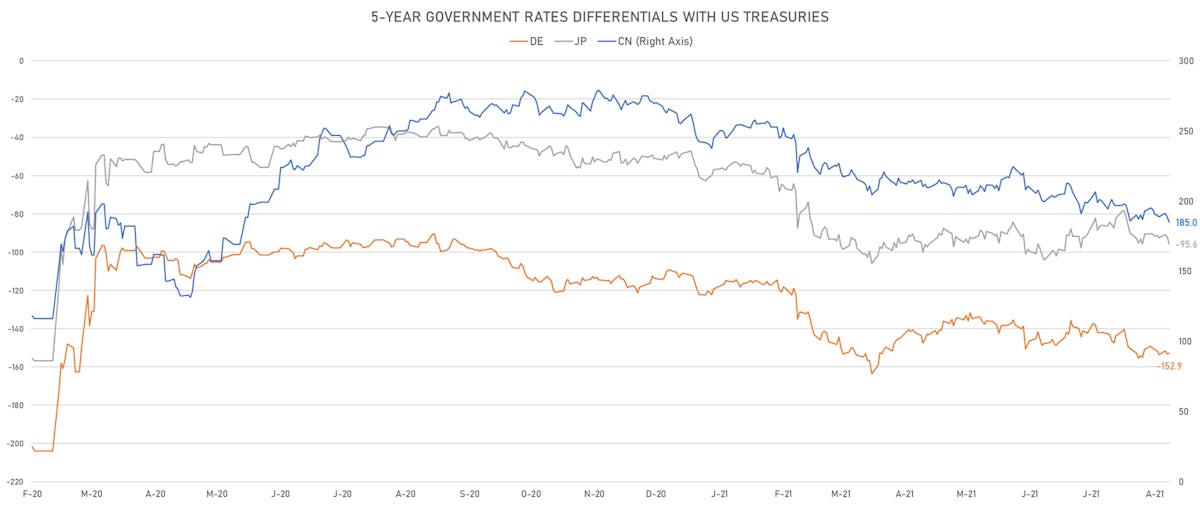

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.3 bp at 152.9 bp (YTD change: +41.9 bp)

- US-JAPAN: +3.4 bp at 95.6 bp (YTD change: +47.4 bp)

- US-CHINA: +3.6 bp at -185.0 bp (YTD change: +72.2 bp)

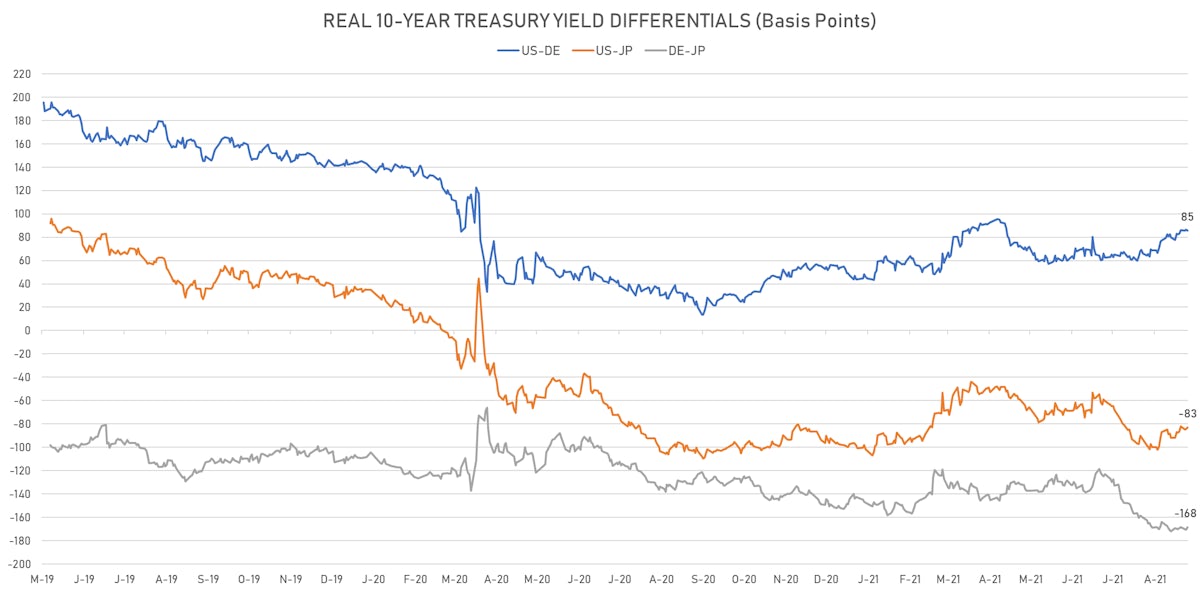

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.1 bp at 85.4 bp (YTD change: +39.3bp)

- US-JAPAN: +1.3 bp at -82.8 bp (YTD change: +18.7bp)

- JAPAN-GERMANY: -2.4 bp at 168.2 bp (YTD change: +20.6bp)

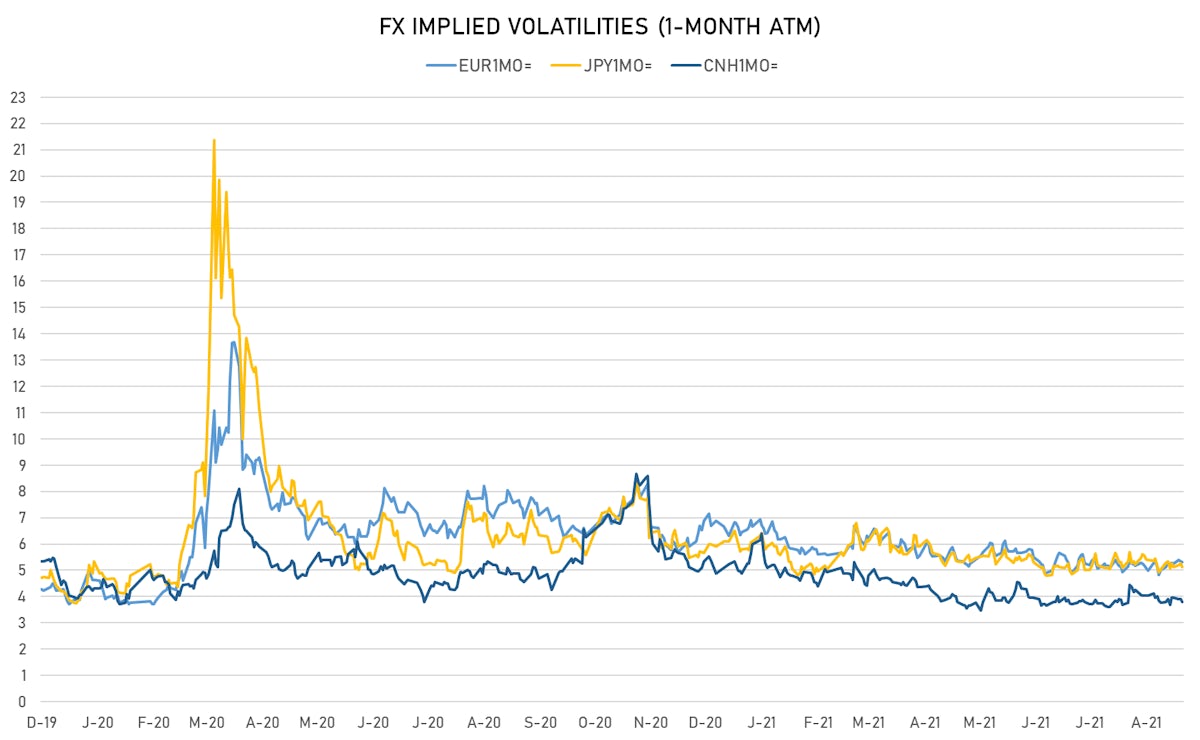

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.86, down -0.08 (YTD: -1.31)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.30 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.13, down -0.1 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.80, down -0.1 (YTD: -2.2)

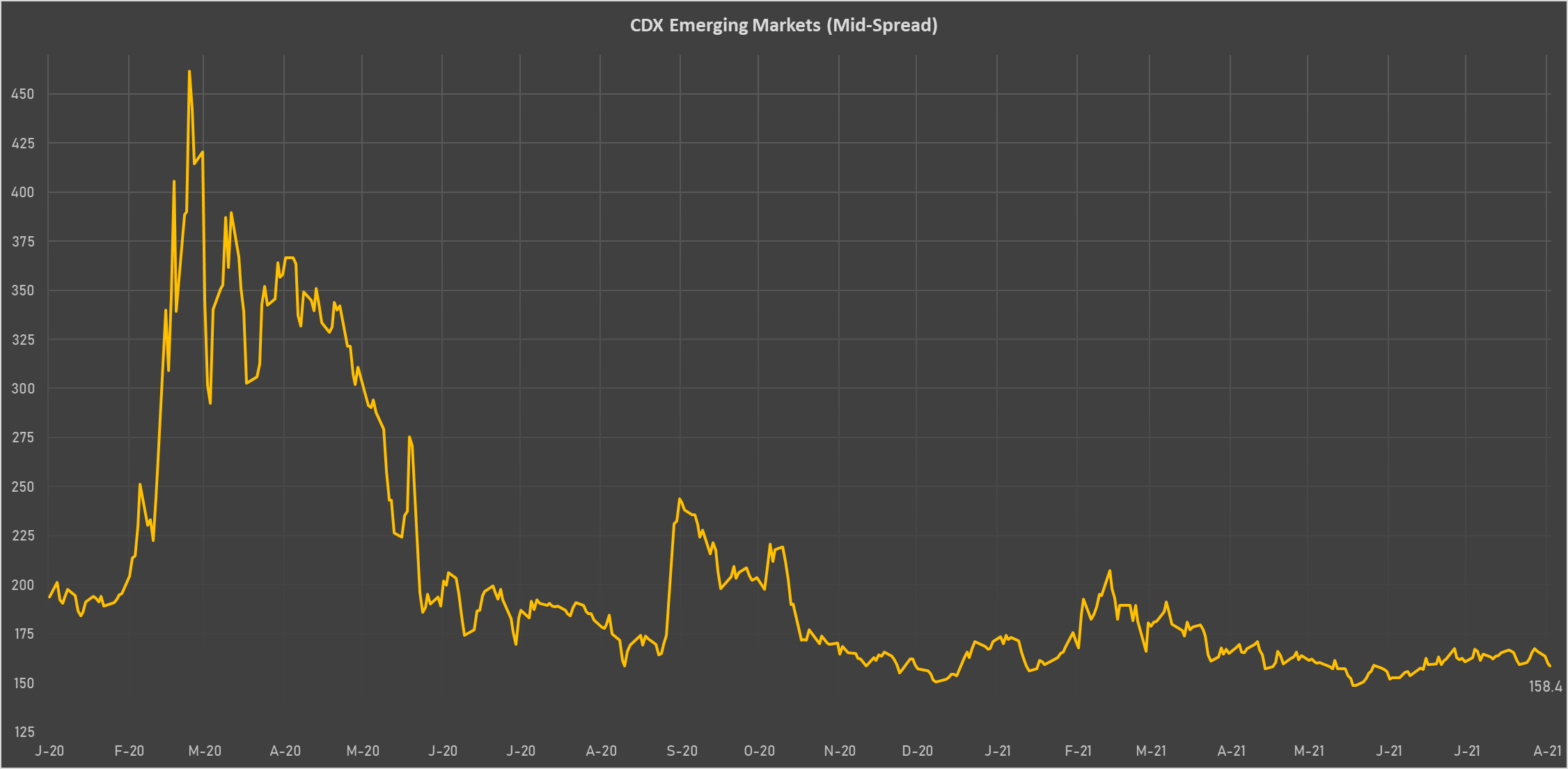

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): up 3.9 basis points to 344 bp (1Y range: 283-422bp)

- Brazil (rated BB-): down 1.9 basis points to 181 bp (1Y range: 141-252bp)

- Chile (rated A-): down 0.7 basis points to 64 bp (1Y range: 43-75bp)

- Russia (rated BBB): down 1.0 basis points to 81 bp (1Y range: 72-129bp)

- Mexico (rated BBB-): down 1.1 basis points to 90 bp (1Y range: 79-164bp)

- Colombia (rated BB+): down 2.4 basis points to 137 bp (1Y range: 83-164bp)

- South Africa (rated BB-): down 3.7 basis points to 193 bp (1Y range: 178-328bp)

- Saudi Arabia (rated A): down 1.2 basis points to 52 bp (1Y range: 52-101bp)

- Peru (rated BBB+): down 2.2 basis points to 87 bp (1Y range: 52-101bp)

- Panama (rated BBB-): down 1.9 basis points to 73 bp (1Y range: 44-95bp)

LARGEST FX MOVES TODAY

- Brazilian Real up 3.2% (YTD: -0.4%) in the last couple of days

- Philippine Peso up 2.6% (YTD: -1.8%)

- Jamaican Dollar up 2.0% (YTD: -6.2%)

- Qatari Riyal up 1.7% (YTD: 0.0%)

- Thai Baht up 1.4% (YTD: -8.4%)

- Iceland Krona up 1.3% (YTD: +1.2%)

- Vanuatu Vatu up 1.2% (YTD: -2.3%)

- New Zealand $ up 1.2% (YTD: -3.0%)

- CFA Franc BEAC down 3.1% (YTD: -4.1%)

- Haiti Gourde down 3.5% (YTD: -26.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 60.7%

- Mozambique metical up 15.4%

- Argentine Peso down 13.8%

- Ethiopian Birr down 13.8%

- Haiti Gourde down 26.5%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%