FX

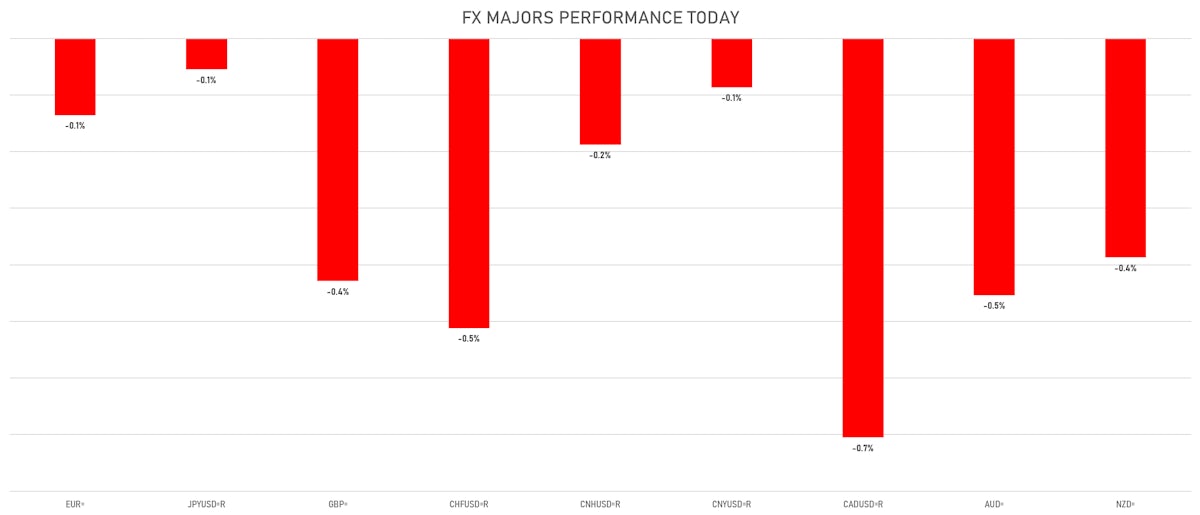

Broad Fall In Major Currencies Against The US Dollar

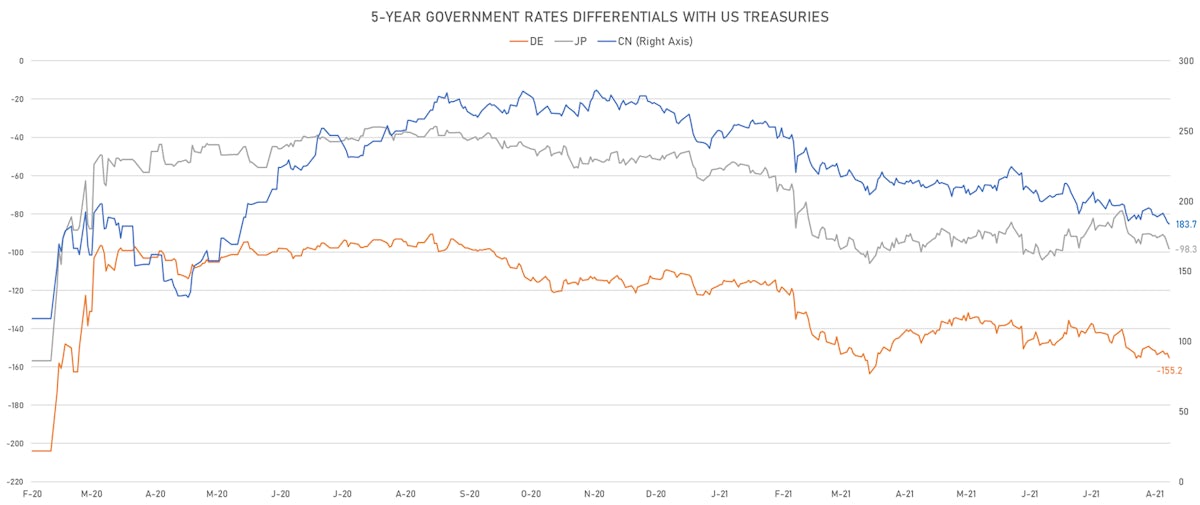

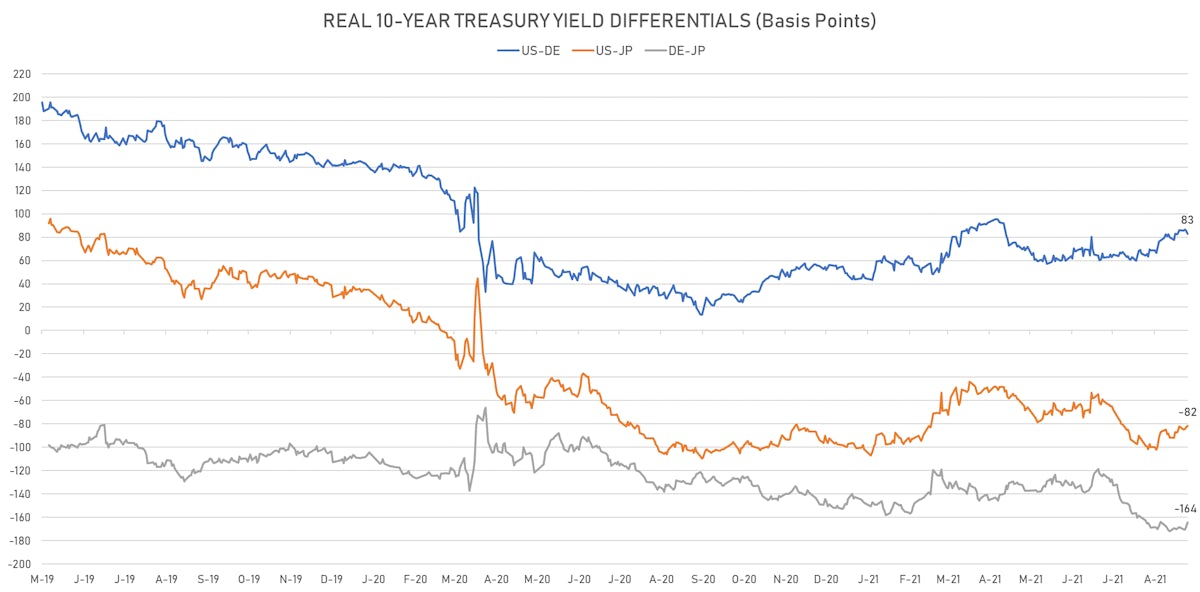

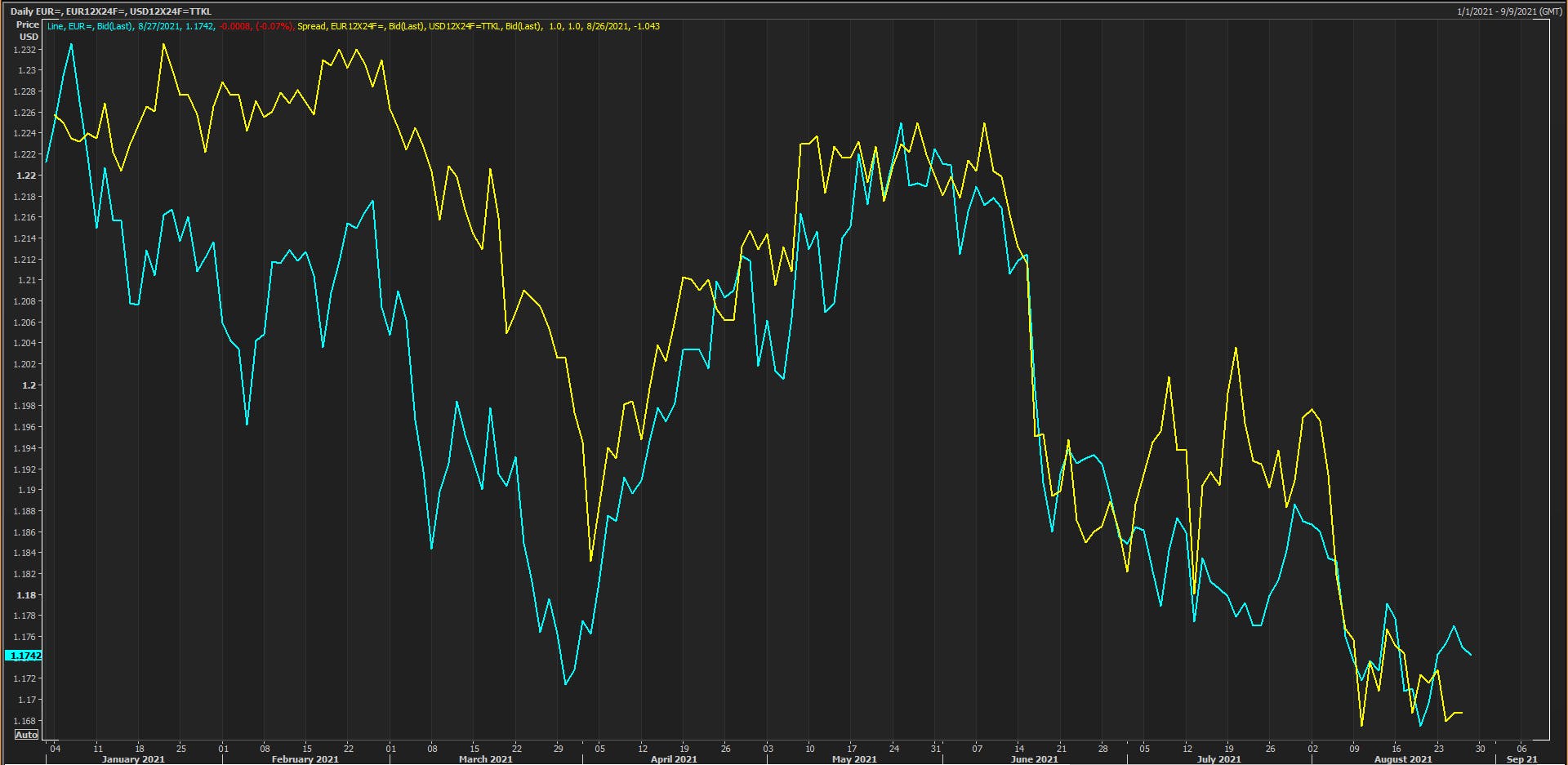

The Japanese Yen is moving in sync with real rates differentials, whereas the euro is aligned more directly with the spread in short-term forward rates, with the expectation of diverging policies for the Fed & ECB weighing on the EUR

Published ET

JPY and US-JP 5-Year Real Yields Differentials | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is up 0.23% at 93.04 (YTD: +3.40%)

- Euro down 0.14% at 1.1754 (YTD: -3.8%)

- Yen down 0.06% at 110.04 (YTD: -6.2%)

- Onshore Yuan down 0.09% at 6.4809 (YTD: +0.7%)

- Swiss franc down 0.51% at 0.9177 (YTD: -3.6%)

- Sterling down 0.43% at 1.3700 (YTD: +0.2%)

- Canadian dollar down 0.71% at 1.2678 (YTD: +0.4%)

- Australian dollar down 0.45% at 0.7240 (YTD: -5.9%)

- NZ dollar down 0.39% at 0.6945 (YTD: -3.3%)

Euro spot vs. 1Y Forward 1Y Rates Differentials

GLOBAL MACRO DATA RELEASES

- Australia, Private New Capital Expenditure, All industries, Change P/P for Q2 2021 (AU Bureau of Stat) at 4.40 % (vs 6.30 % prior), above consensus estimate of 2.50 %

- Australia, Private New Capital Expenditure, Buildings and structures, Change P/P for Q2 2021 (AU Bureau of Stat) at 4.60 % (vs 3.80 % prior)

- Australia, Private New Capital Expenditure, Equipment, plant and machinery, Change P/P for Q2 2021 (AU Bureau of Stat) at 4.30 % (vs 9.10 % prior)

- Euro Zone, Money Supply, M3, Change Y/Y for Jul 2021 (ECB) at 7.60 % (vs 8.30 % prior), below consensus estimate of 7.70 %

- France, Business Sentiment, Composite business climate, manufacturing industry for Aug 2021 (INSEE, France) at 110.00 (vs 110.00 prior), above consensus estimate of 109.00

- Germany, GfK Consumer climate indicator for Sep 2021 (GfK Group) at -1.20 (vs -0.30 prior), below consensus estimate of -0.70

- Japan, CPI, Tokyo, All Items, General, Change Y/Y for Aug 2021 (MIC, Japan) at -0.40 % (vs -0.10 % prior)

- Japan, CPI, Tokyo, All Items, Less fresh food, Change Y/Y for Aug 2021 (MIC, Japan) at 0.00 % (vs 0.10 % prior), above consensus estimate of -0.20 %

- Nigeria, GDP, Growth rate, Change Y/Y for Q2 2021 (NBS, Nigeria) at 5.01 % (vs 0.51 % prior)

- Singapore, Production, Change P/P for Jul 2021 (Statistics Singapore) at -2.60 % (vs -3.00 % prior), below consensus estimate of -0.30 %

- Singapore, Production, Change Y/Y for Jul 2021 (Statistics Singapore) at 16.30 % (vs 27.50 % prior), below consensus estimate of 20.20 %

- South Africa, Producer Prices, Manufactured goods, Total, Change P/P, Price Index for Jul 2021 (Statistics, SA) at 0.70 % (vs 0.80 % prior), above consensus estimate of 0.60 %

- South Africa, Producer Prices, Manufactured goods, Total, Change Y/Y, Price Index for Jul 2021 (Statistics, SA) at 7.10 % (vs 7.70 % prior), above consensus estimate of 7.00 %

- South Korea, Policy Rates, Base Rate for Aug 2021 (The Bank of Korea) at 0.75 % (vs 0.50 % prior), in line with consensus estimate

- Sweden, Unemployment, Rate, Total (SCB), 15-74 years for Jul 2021 (SCB, Sweden) at 8.00 % (vs 10.30 % prior)

- United States, GDP, Total-2nd Estimate, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.60 % (vs 6.50 % prior), below consensus estimate of 6.70 %

- United States, Implicit Price Deflator, GDP, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.20 % (vs 6.10 % prior), above consensus estimate of 6.00 %

- United States, Jobless Claims, National, Continued for W 14 Aug (U.S. Dept. of Labor) at 2.86 Mln (vs 2.82 Mln prior), above consensus estimate of 2.79 Mln

- United States, Jobless Claims, National, Initial for W 21 Aug (U.S. Dept. of Labor) at 353.00 k (vs 348.00 k prior), above consensus estimate of 350.00 k

- United States, Personal Consumption Expenditure, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.10 % (vs 6.10 % prior), in line with consensus estimate

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.3 bp at 155.2 bp (YTD change: +44.1 bp)

- US-JAPAN: +2.7 bp at 98.3 bp (YTD change: +50.0 bp)

- US-CHINA: +1.3 bp at -183.7 bp (YTD change: +73.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.5 bp at 82.9 bp (YTD change: +36.8bp)

- US-JAPAN: +1.3 bp at -81.5 bp (YTD change: +20.0bp)

- JAPAN-GERMANY: -3.8 bp at 164.4 bp (YTD change: +16.8bp)

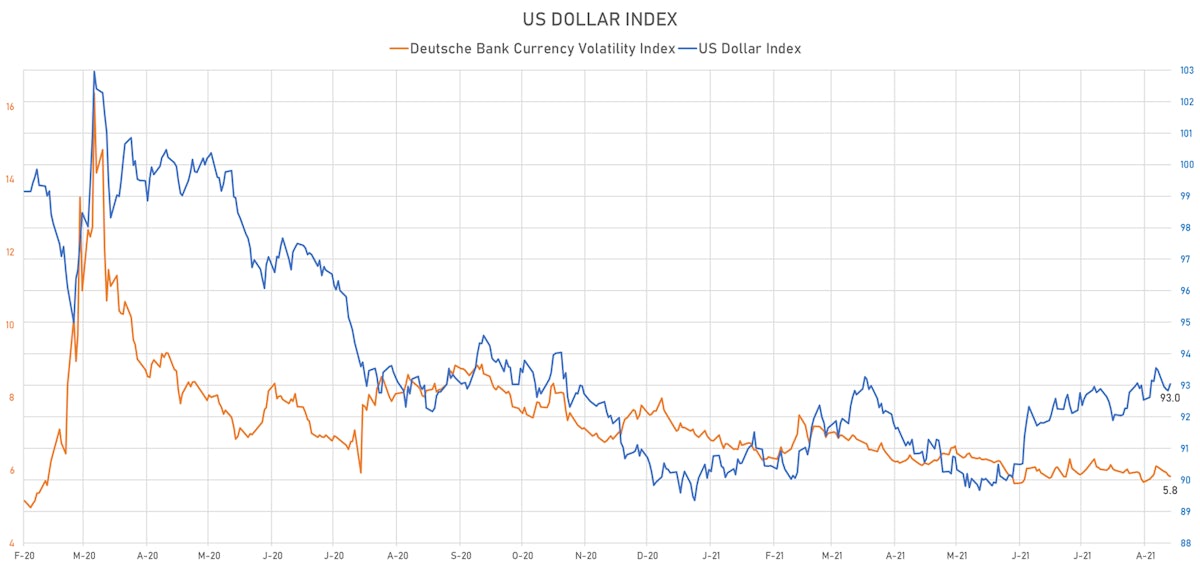

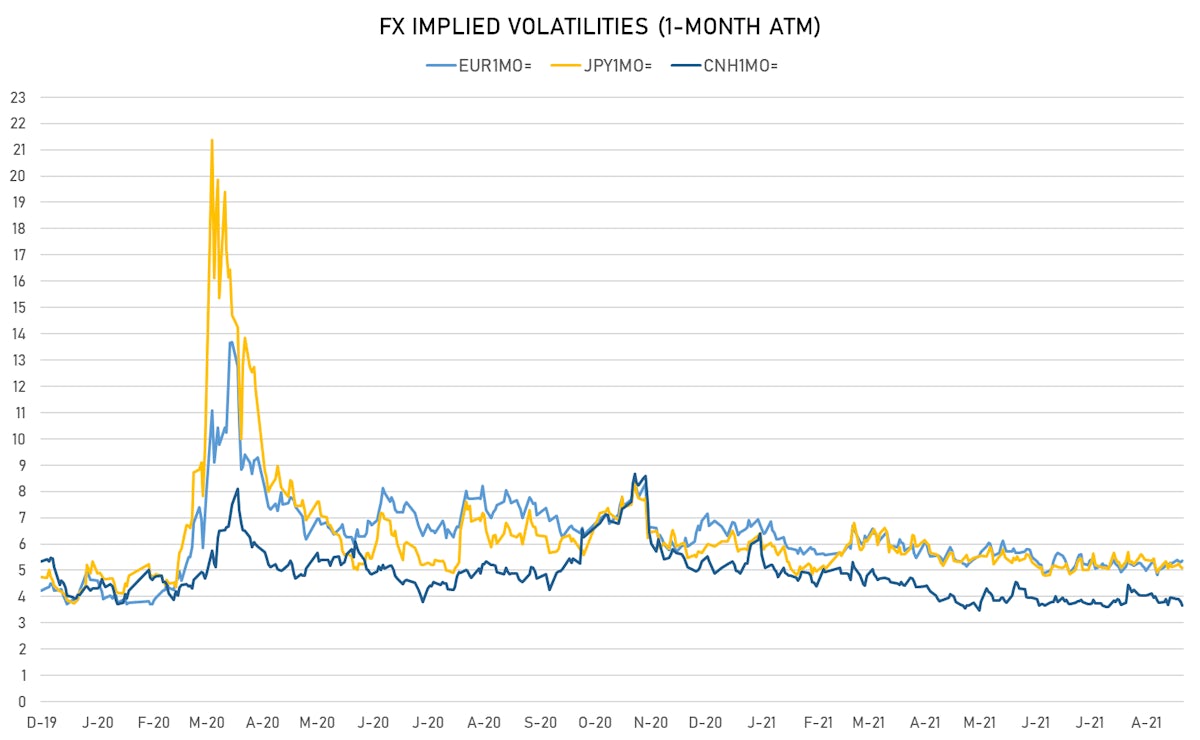

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.83, down -0.03 (YTD: -1.34)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.38, up 0.1 (YTD: -1.3)

- Japanese Yen 1M ATM IV unchanged at 5.10 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.65, down -0.2 (YTD: -2.3)

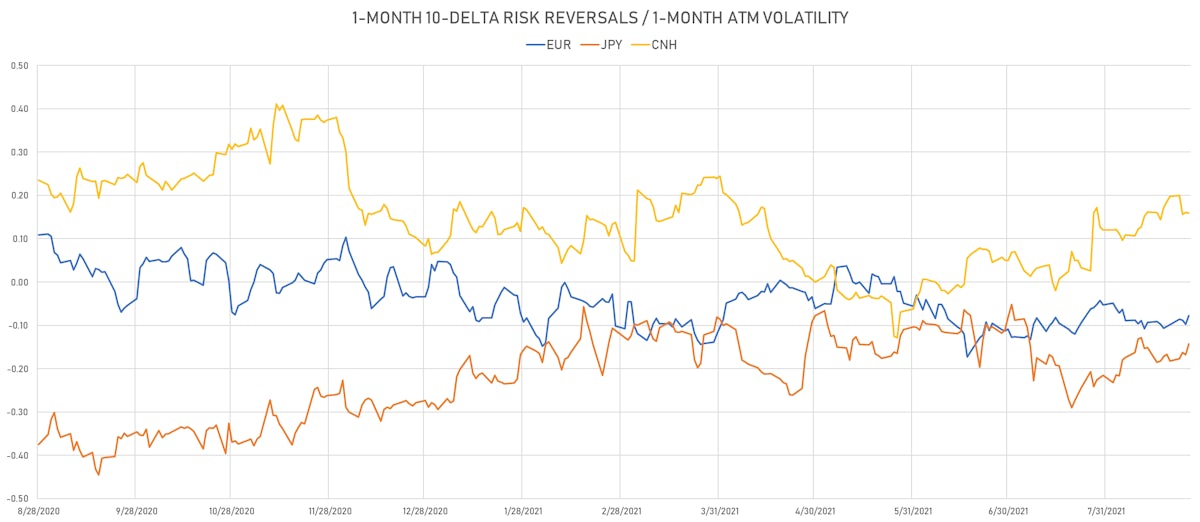

- Looking at 1-month risk reversals, there is little sense of spec directional bias, except a slight bearish tilt for the yen

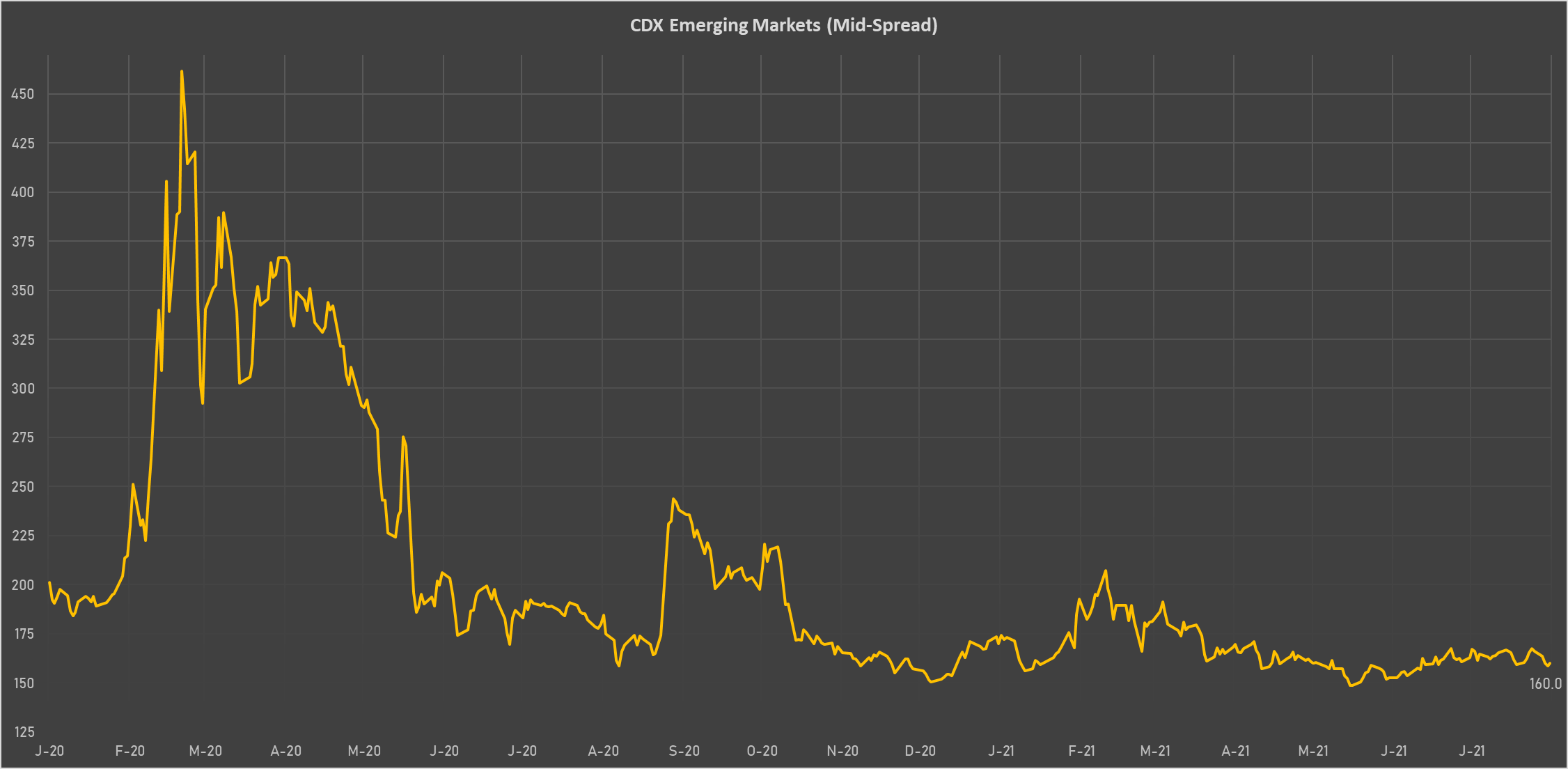

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Saudi Arabia (rated A): up 0.3 basis points to 52 bp (1Y range: 52-101bp)

- Egypt (rated B+): up 0.8 basis points to 344 bp (1Y range: 283-422bp)

- South Africa (rated BB-): up 0.4 basis points to 194 bp (1Y range: 178-328bp)

- Peru (rated BBB+): down 0.1 basis points to 87 bp (1Y range: 52-101bp)

- Vietnam (rated BB): down 0.2 basis points to 100 bp (1Y range: 90-137bp)

- Argentina (rated CCC): down 6.8 basis points to 1,892 bp (1Y range: 1,049-1,971bp)

- Chile (rated A-): down 0.3 basis points to 63 bp (1Y range: 43-75bp)

- Panama (rated BBB-): down 0.6 basis points to 72 bp (1Y range: 44-95bp)

- Morocco (rated BB+): down 0.9 basis points to 92 bp (1Y range: 84-127bp)

- Russia (rated BBB): down 1.0 basis points to 80 bp (1Y range: 72-129bp)

LARGEST FX MOVES TODAY

- Jamaican Dollar up 1.2% (YTD: -5.9%)

- Qatari Riyal up 1.2% (YTD: 0.0%)

- Uruguayan Peso up 1.0% (YTD: -0.4%)

- Botswana Pula up 1.0% (YTD: -3.6%)

- Vanuatu Vatu up 1.0% (YTD: -2.5%)

- Samoa Tala down 1.1% (YTD: -2.4%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Mauritius Rupee down 1.7% (YTD: -8.0%)

- Fiji Dollar down 1.7% (YTD: -3.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 65.7%

- Mozambique metical up 15.4%

- Argentine Peso down 13.8%

- Ethiopian Birr down 13.8%

- Haiti Gourde down 26.1%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%