FX

Broad Fall For The Dollar On Lower US Short Rates And Real Yields

It's game on for pro-cyclical EM carry currencies (like the Russian Rouble) as markets interpreted Powell's prudent speech as positive for risky assets

Published ET

US Dollar Index Intraday | Source: Refinitiv

QUICK SUMMARY

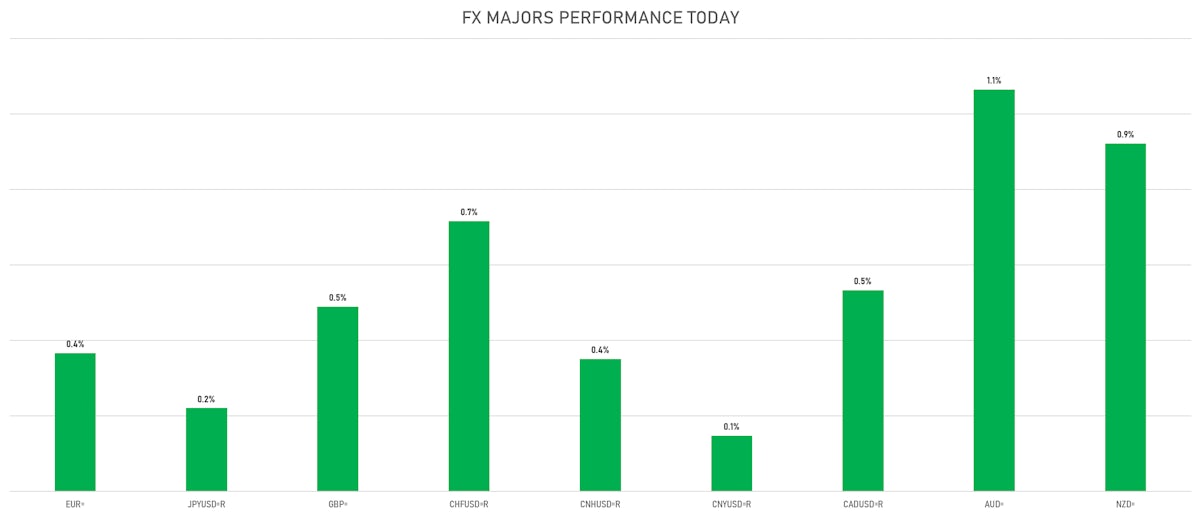

- The US Dollar Index is down -0.38% at 92.68 (YTD: +3.00%)

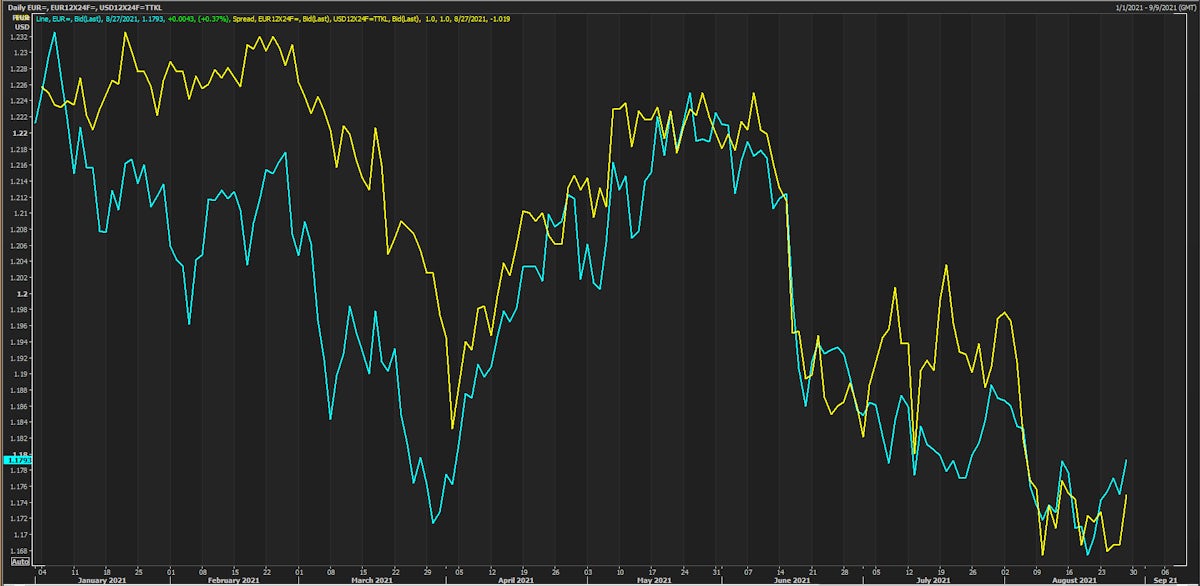

- Euro up 0.37% at 1.1793 (YTD: -3.4%)

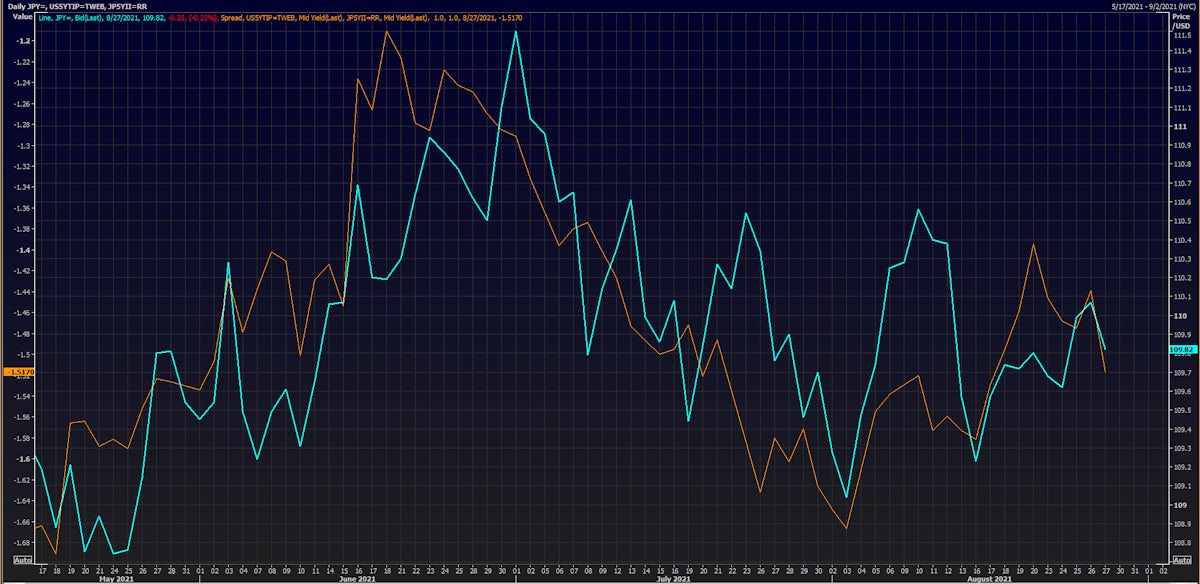

- Yen up 0.22% at 109.82 (YTD: -6.0%)

- Onshore Yuan up 0.15% at 6.4711 (YTD: +0.9%)

- Swiss franc up 0.72% at 0.9111 (YTD: -2.9%)

- Sterling up 0.49% at 1.3766 (YTD: +0.7%)

- Canadian dollar up 0.53% at 1.2614 (YTD: +0.9%)

- Australian dollar up 1.06% at 0.7311 (YTD: -5.0%)

- NZ dollar up 0.92% at 0.7011 (YTD: -2.4%)

MACRO DATA RELEASES

- Australia, Retail Sales, Total, Final, Change P/P for Jul 2021 (AU Bureau of Stat) at -2.70 %, below consensus estimate of -2.30 %

- Austria, Markit PMI, Business Surveys, PMI, Manufacturing Sector, Total for Aug 2021 (Markit Economics) at 61.80 (vs 63.90 prior)

- Canada, Industrial Product Prices, (NAPCS), Industrial product price index, Change P/P, Price Index for Jul 2021 (CANSIM, Canada) at -0.40 %, below consensus estimate of 0.10 %

- France, Consumer confidence, overall for Aug 2021 (INSEE, France) at 99.00 (vs 101.00 prior), below consensus estimate of 100.00

- Germany, Import Prices, Change P/P, Price Index for Jul 2021 (Destatis) at 2.20 % (vs 1.60 % prior), above consensus estimate of 0.80 %

- Germany, Import Prices, Change Y/Y, Price Index for Jul 2021 (Destatis) at 15.00 % (vs 12.90 % prior), above consensus estimate of 13.70 %

- Italy, Consumer confidence for Aug 2021 (ISTAT, Italy) at 116.20 (vs 116.60 prior), above consensus estimate of 116.10

- Malaysia, Exports, Total, free on board, Change Y/Y for Jul 2021 (Statistics, Malaysia) at 5.00 % (vs 27.20 % prior), below consensus estimate of 9.70 %

- Malaysia, Imports, Total, cost insurance freight, Change Y/Y for Jul 2021 (Statistics, Malaysia) at 24.00 % (vs 32.10 % prior), above consensus estimate of 19.40 %

- Norway, Retail Sales, Change P/P for Jul 2021 (Statistics Norway) at -3.10 % (vs -0.10 % prior)

- Sweden, KI, Consumer confidence indicator for Aug 2021 (NIER, Sweden) at 108.60 (vs 106.50 prior)

- Sweden, Overall Sentiment for Aug 2021 (NIER, Sweden) at 121.10 (vs 122.40 prior)

- Sweden, Retail Sales, Total excluding petrol stations, Change P/P for Jul 2021 (SCB, Sweden) at -1.20 % (vs -0.30 % prior)

- Sweden, Retail Sales, Total excluding petrol stations, Change Y/Y for Jul 2021 (SCB, Sweden) at 5.40 % (vs 8.50 % prior)

- United States, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 1.10 % (vs 0.10 % prior), above consensus estimate of 0.20 %

- United States, Personal Consumption Expenditure, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 1.00 % prior), in line with consensus estimate

- United States, Personal Consumption Expenditure, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at -0.10 % (vs 0.50 % prior)

- United States, Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 0.40 % prior), in line with consensus estimate

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Aug 2021 (UMICH, Survey) at 70.30 (vs 70.20 prior), below consensus estimate of 70.70

WEEKLY CFTC MANAGED MONEY DATA

- ALL CURRENCIES: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduced their net short US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net long US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.9 bp at 151.3 bp (YTD change: +40.2 bp)

- US-JAPAN: -5.5 bp at 92.8 bp (YTD change: +44.5 bp)

- US-CHINA: -3.4 bp at -187.1 bp (YTD change: +70.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -6.2 bp at 76.7 bp (YTD change: +30.6bp)

- US-JAPAN: -9.1 bp at -90.6 bp (YTD change: +10.9bp)

- JAPAN-GERMANY: +2.9 bp at 167.3 bp (YTD change: +19.7bp)

The yen moves align with the 5Y real rates differential, while the euro moves with the 1Y forward 1Y rates differential

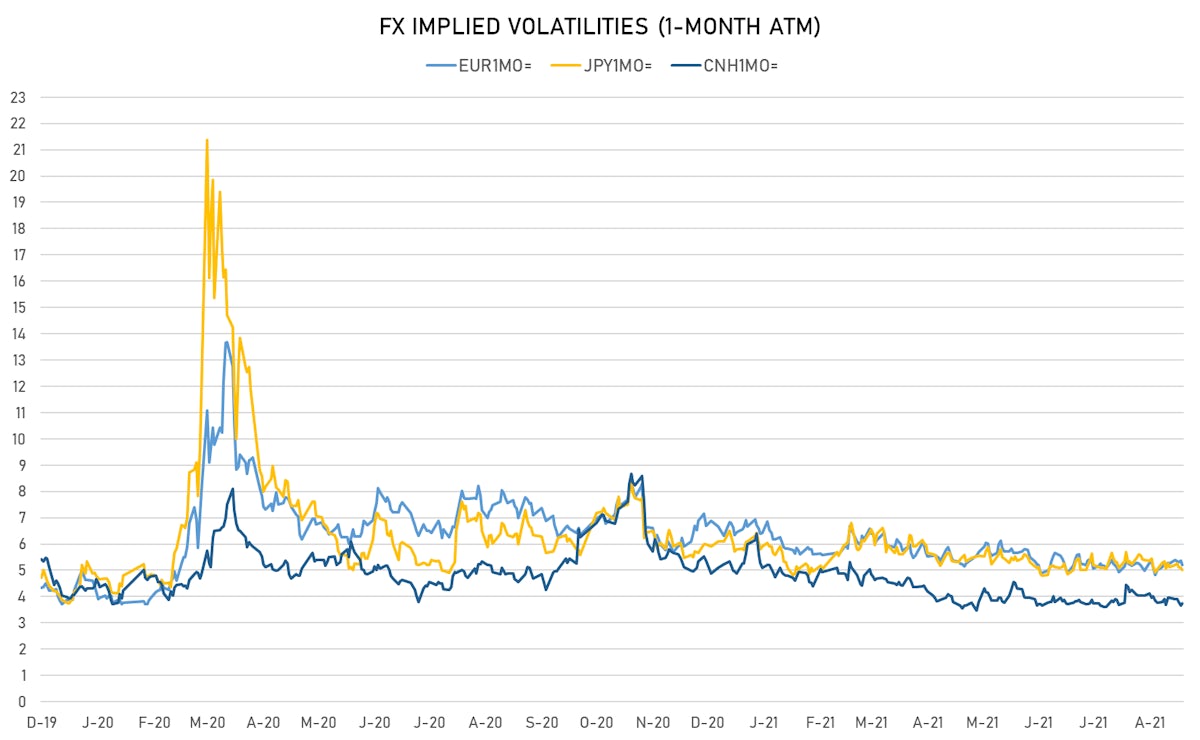

VOLATILITIES TODAY

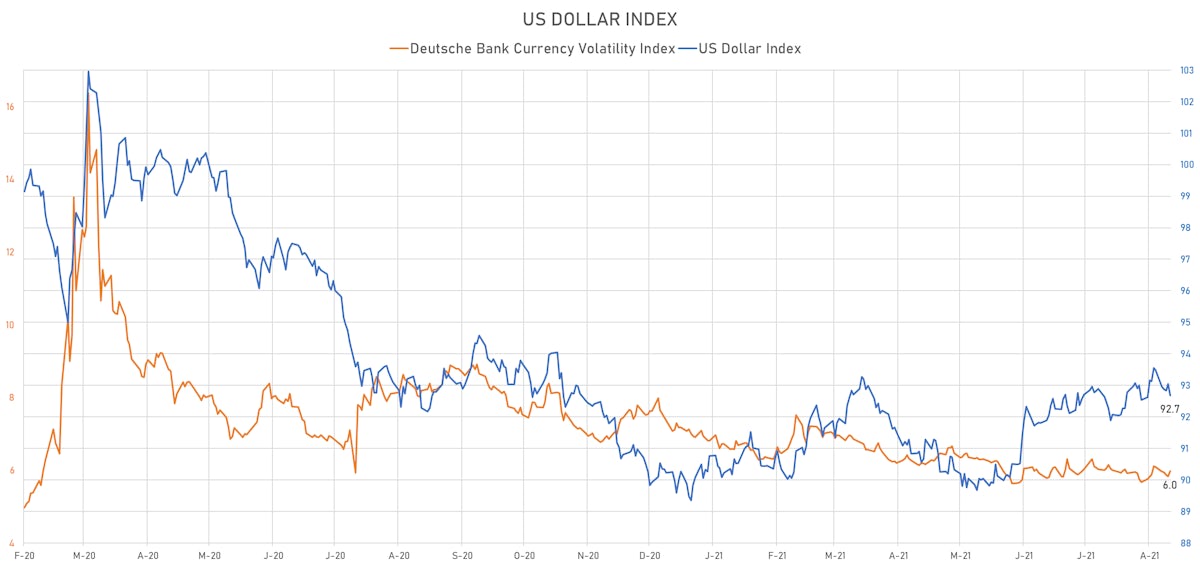

- Deutsche Bank USD Currency Volatility Index currently at 5.97, up 0.14 (YTD: -1.20)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.20, down -0.2 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.03, down -0.1 (YTD: -1.1)

- Offshore Yuan 1M ATM IV currently at 3.74, up 0.1 (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Morocco (rated BB+): up 1.0 basis points to 93 bp (1Y range: 84-127bp)

- Turkey (rated BB-): down 4.2 basis points to 368 bp (1Y range: 282-570bp)

- Russia (rated BBB): down 1.0 basis points to 79 bp (1Y range: 72-129bp)

- South Africa (rated BB-): down 3.3 basis points to 191 bp (1Y range: 178-328bp)

- Peru (rated BBB+): down 1.9 basis points to 85 bp (1Y range: 52-101bp)

- Colombia (rated BB+): down 3.3 basis points to 134 bp (1Y range: 83-164bp)

- Brazil (rated BB-): down 5.0 basis points to 176 bp (1Y range: 141-252bp)

- Panama (rated BBB-): down 2.3 basis points to 70 bp (1Y range: 44-95bp)

- Mexico (rated BBB-): down 4.2 basis points to 85 bp (1Y range: 79-164bp)

- Chile (rated A-): down 4.4 basis points to 59 bp (1Y range: 43-75bp)

LARGEST FX MOVES TODAY

- Malagasy Ariary up 3.2% (YTD: +3.2%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Jamaican Dollar up 1.9% (YTD: -5.7%)

- Namibian Dollar up 1.5% (YTD: -0.3%)

- Swazi Lilangeni up 1.5% (YTD: -0.3%)

- Lesotho Loti up 1.5% (YTD: -0.2%)

- Qatari Riyal down 1.5% (YTD: -1.5%)

- Fiji Dollar down 2.0% (YTD: -3.1%)

- Nicaragua Cordoba down 2.5% (YTD: -2.9%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 49.6%

- Mozambique metical up 17.0%

- Ethiopian Birr down 13.8%

- Argentine Peso down 13.8%

- Haiti Gourde down 25.6%

- Surinamese dollar down 33.5%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.6%