FX

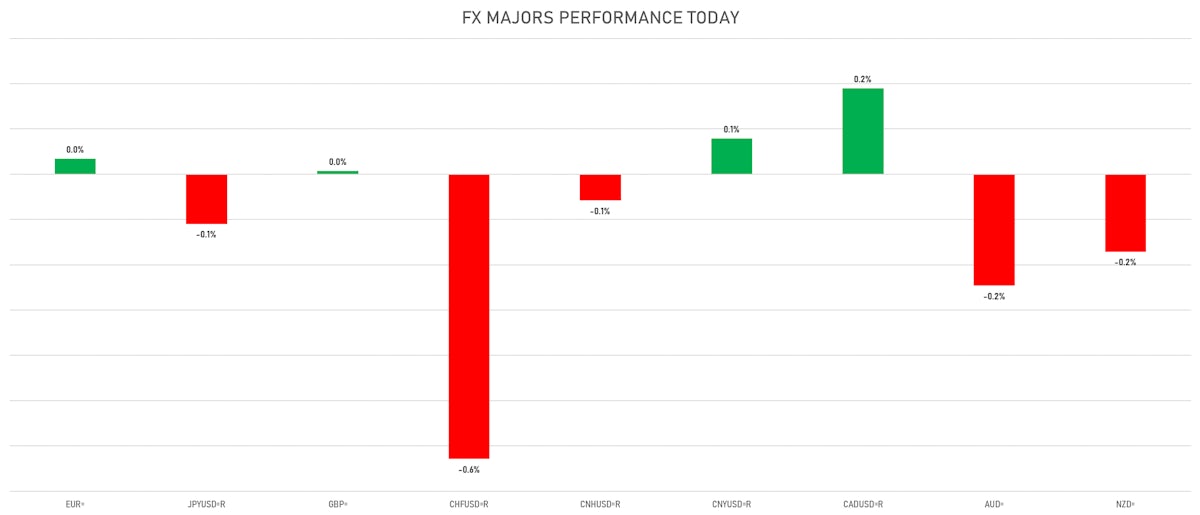

Major Currencies Mostly Unchanged Against The US Dollar

The Swiss Franc had a rough day as leading economic indicators for August came in well below market expectations

Published ET

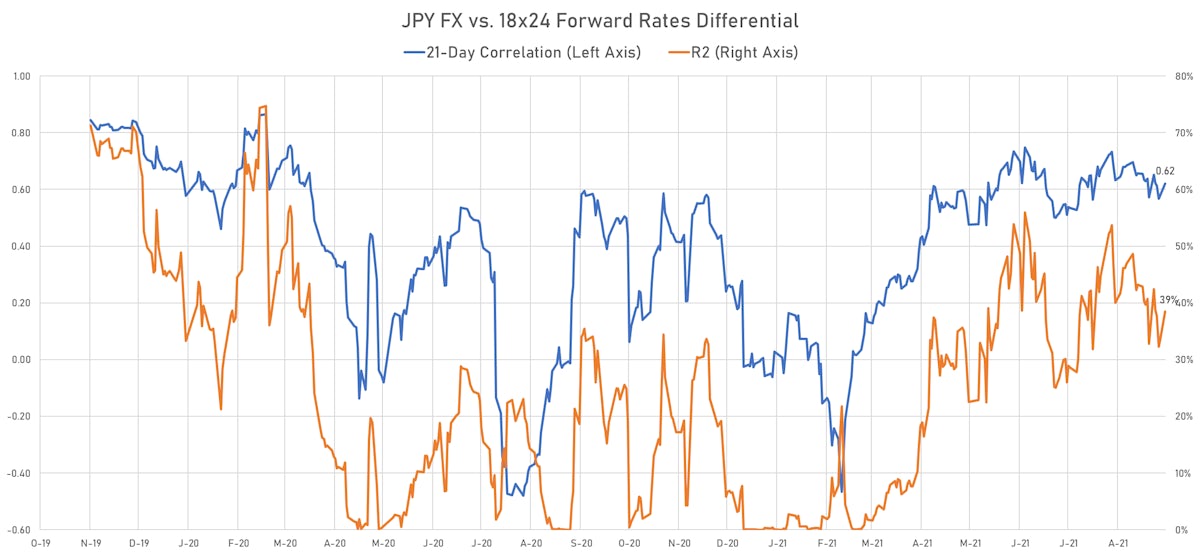

Spot JPY vs. US-JP 6-month rates differentials 18 months forward | Source: Refinitiv

QUICK SUMMARY

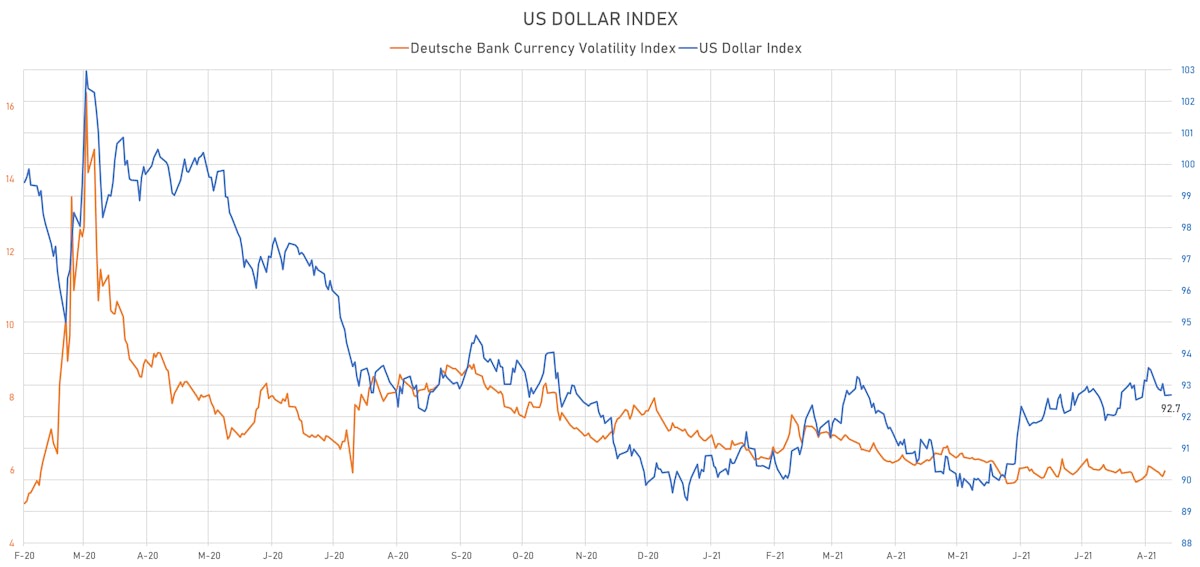

- The US Dollar Index is up 0.01% at 92.69 (YTD: +3.01%)

- Euro up 0.03% at 1.1797 (YTD: -3.4%)

- Yen down 0.11% at 109.97 (YTD: -6.1%)

- Onshore Yuan up 0.08% at 6.4658 (YTD: +0.9%)

- Swiss Franc down 0.63% at 0.9172 (YTD: -3.5%)

- Sterling up 0.01% at 1.3758 (YTD: +0.6%)

- Canadian dollar up 0.19% at 1.2602 (YTD: +1.0%)

- Australian dollar down 0.25% at 0.7293 (YTD: -5.2%)

- NZ dollar down 0.17% at 0.6999 (YTD: -2.6%)

MACRO DATA RELEASES

- Australia, Inventories, Change P/P for Q2 2021 (AU Bureau of Stat) at 0.20 % (vs 2.10 % prior), below consensus estimate of 1.30 %

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Aug 2021 (FGV, Brazil) at 0.66 % (vs 0.78 % prior), below consensus estimate of 0.91 %

- Canada, Current Account, Balance for Q2 2021 (Statistics Canada) at 3.58 Bln CAD (vs 1.18 Bln CAD prior), above consensus estimate of 1.85 Bln CAD

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Aug 2021 (DG ECFIN, France) at -5.30 (vs -5.30 prior), in line with consensus estimate

- Euro Zone, Business climate indicator for Aug 2021 (DG ECFIN, France) at 1.75 (vs 1.90 prior)

- Euro Zone, Economic Sentiment, Economic Sentiment Indicator (ESI), Overall for Aug 2021 (DG ECFIN, France) at 117.50 (vs 119.00 prior), below consensus estimate of 117.90

- Euro Zone, Manufacturing Sector, Confidence indicator for Aug 2021 (DG ECFIN, France) at 13.70 (vs 14.60 prior), above consensus estimate of 13.40

- Euro Zone, Service Sector, Confidence indicator, Balance for Aug 2021 (DG ECFIN, France) at 16.80 (vs 19.30 prior), below consensus estimate of 18.80

- Germany, CPI, Flash, Change P/P, Price Index for Aug 2021 (Destatis) at 0.00 % (vs 0.90 % prior), below consensus estimate of 0.10 %

- Germany, CPI, Flash, Change Y/Y, Price Index for Aug 2021 (Destatis) at 3.90 % (vs 3.80 % prior), in line with consensus estimate

- Germany, HICP, Flash, Change P/P, Price Index for Aug 2021 (Destatis) at 0.10 % (vs 0.50 % prior), in line with consensus estimate

- Germany, HICP, Flash, Change Y/Y, Price Index for Aug 2021 (Destatis) at 3.40 % (vs 3.10 % prior), in line with consensus estimate

- Japan, Labour Market n.i.e, Active opening rate for Jul 2021 at 1.15 (vs 1.13 prior), above consensus estimate of 1.12

- Japan, Production, Mining and manufacturing, preliminary, Change P/P for Jul 2021 (METI, Japan) at -1.50 % (vs 6.50 % prior), above consensus estimate of -2.50 %

- Japan, Unemployment, Rate for Jul 2021 (MIC, Japan) at 2.80 % (vs 2.90 % prior), below consensus estimate of 2.90 %

- South Korea, Production, Total industry, Change P/P for Jul 2021 (KOSTAT - Korea) at 0.40 % (vs 2.20 % prior), above consensus estimate of -0.10 %

- South Korea, Production, Total industry, Change Y/Y for Jul 2021 (KOSTAT - Korea) at 7.90 % (vs 11.90 % prior), above consensus estimate of 7.00 %

- Spain, HICP, Change Y/Y, Price Index for Aug 2021 (INE, Spain) at 3.30 % (vs 2.90 % prior), above consensus estimate of 2.90 %

- Spain, Retail Sales, Turnover, Change Y/Y for Jul 2021 (INE, Spain) at 0.10 % (vs 1.40 % prior)

- Switzerland, KOF composite leading indicator for Aug 2021 (KOF, Switzerland) at 113.50 (vs 129.80 prior), below consensus estimate of 125.00

- Thailand, Production, Value Added, Manufacturing, total, Change Y/Y for Jul 2021 (OIE, Thailand) at 5.12 % (vs 17.58 % prior), below consensus estimate of 11.00 %

- United States, Pending Home Sales, United States, Change P/P for Jul 2021 (NAR, United States) at -1.80 % (vs -1.90 % prior), below consensus estimate of 0.40 %

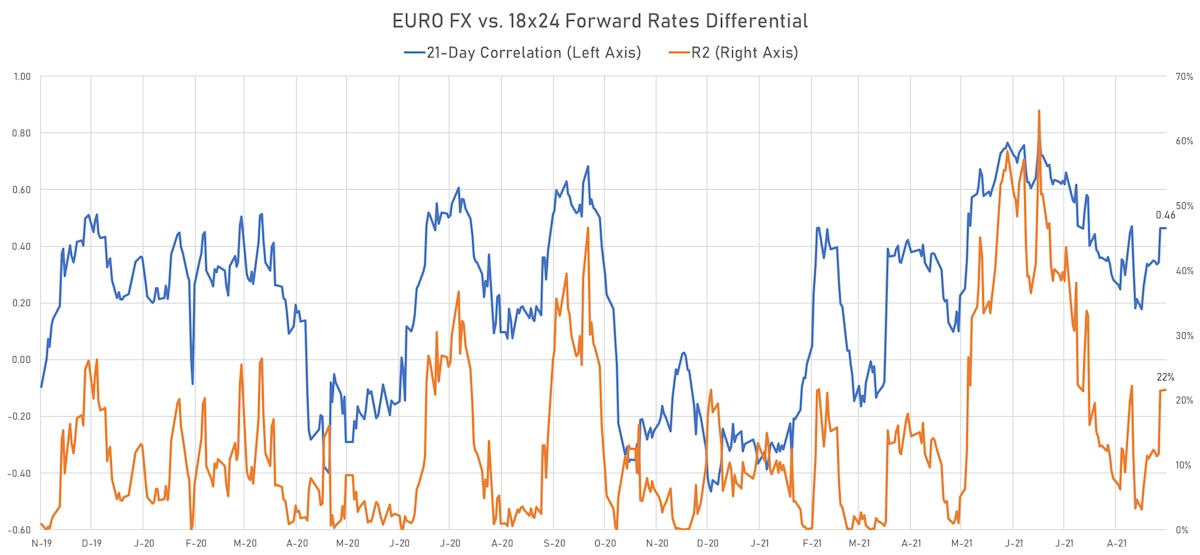

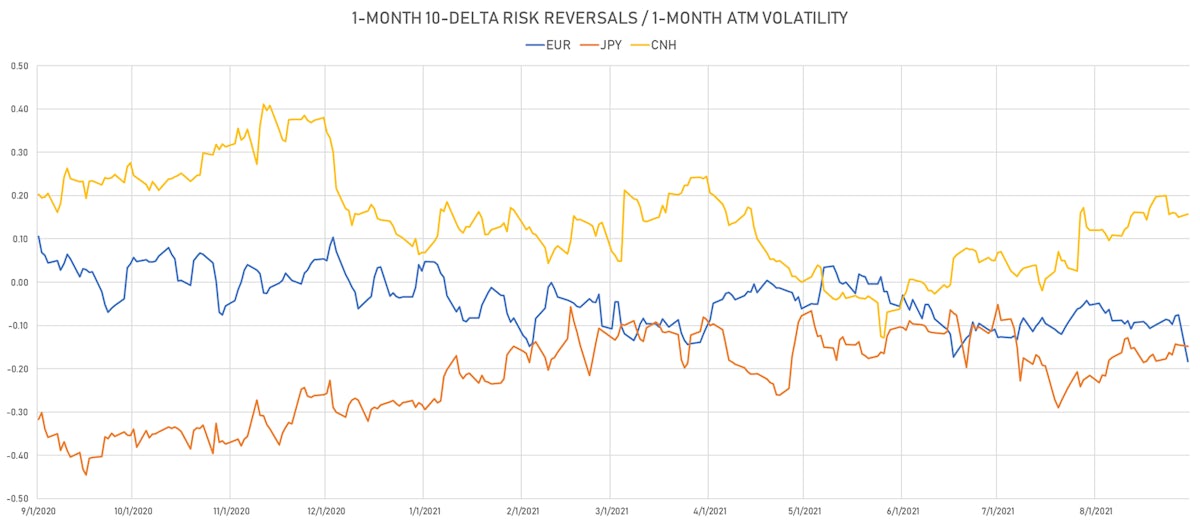

With the current uncertainty around monetary policies in the US and Europe, FX daily returns have significant correlations with moves in short-term interest rates differentials, in particular 18 months forward (see charts below)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.1 bp at 149.3 bp (YTD change: +38.2 bp)

- US-JAPAN: -4.0 bp at 88.9 bp (YTD change: +40.6 bp)

- US-CHINA: -2.4 bp at -189.5 bp (YTD change: +67.7 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.3 bp at 78.0 bp (YTD change: +31.9bp)

- US-JAPAN: -0.5 bp at -91.1 bp (YTD change: +10.4bp)

- JAPAN-GERMANY: +1.8 bp at 169.1 bp (YTD change: +21.5bp)

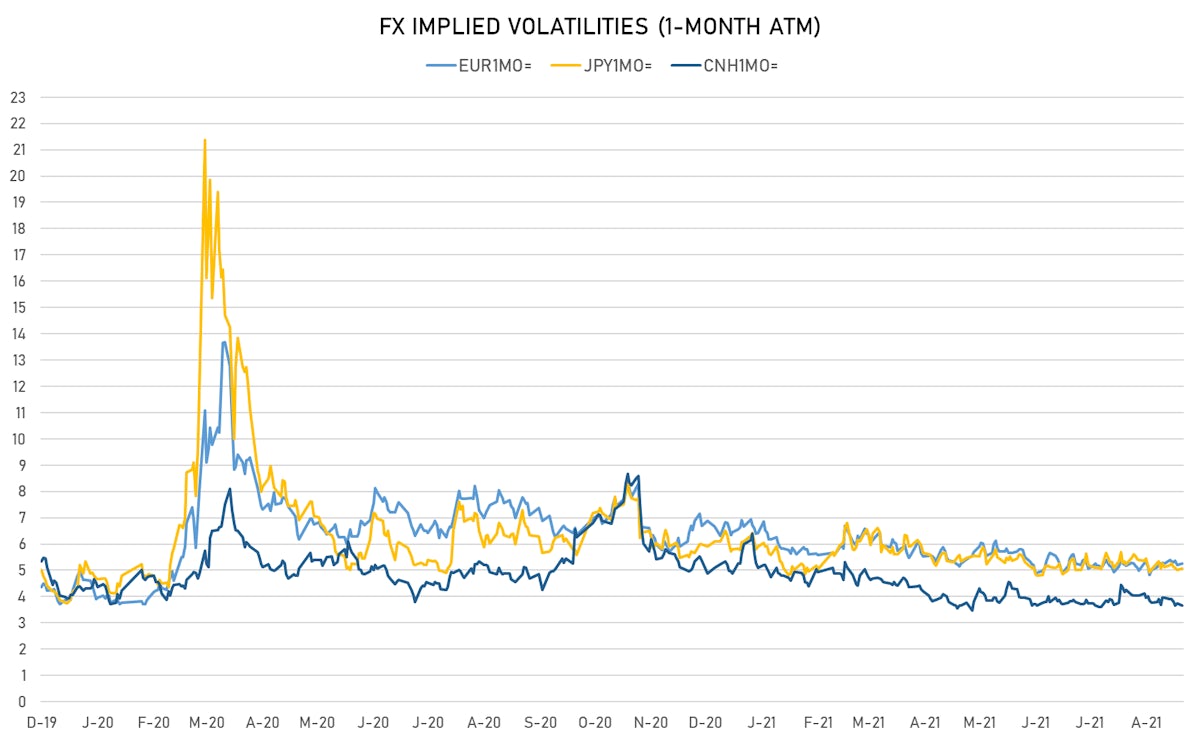

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.97, up 0.14 (YTD: -1.20)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.26, up 0.1 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.08, up 0.0 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.65, down -0.1 (YTD: -2.3)

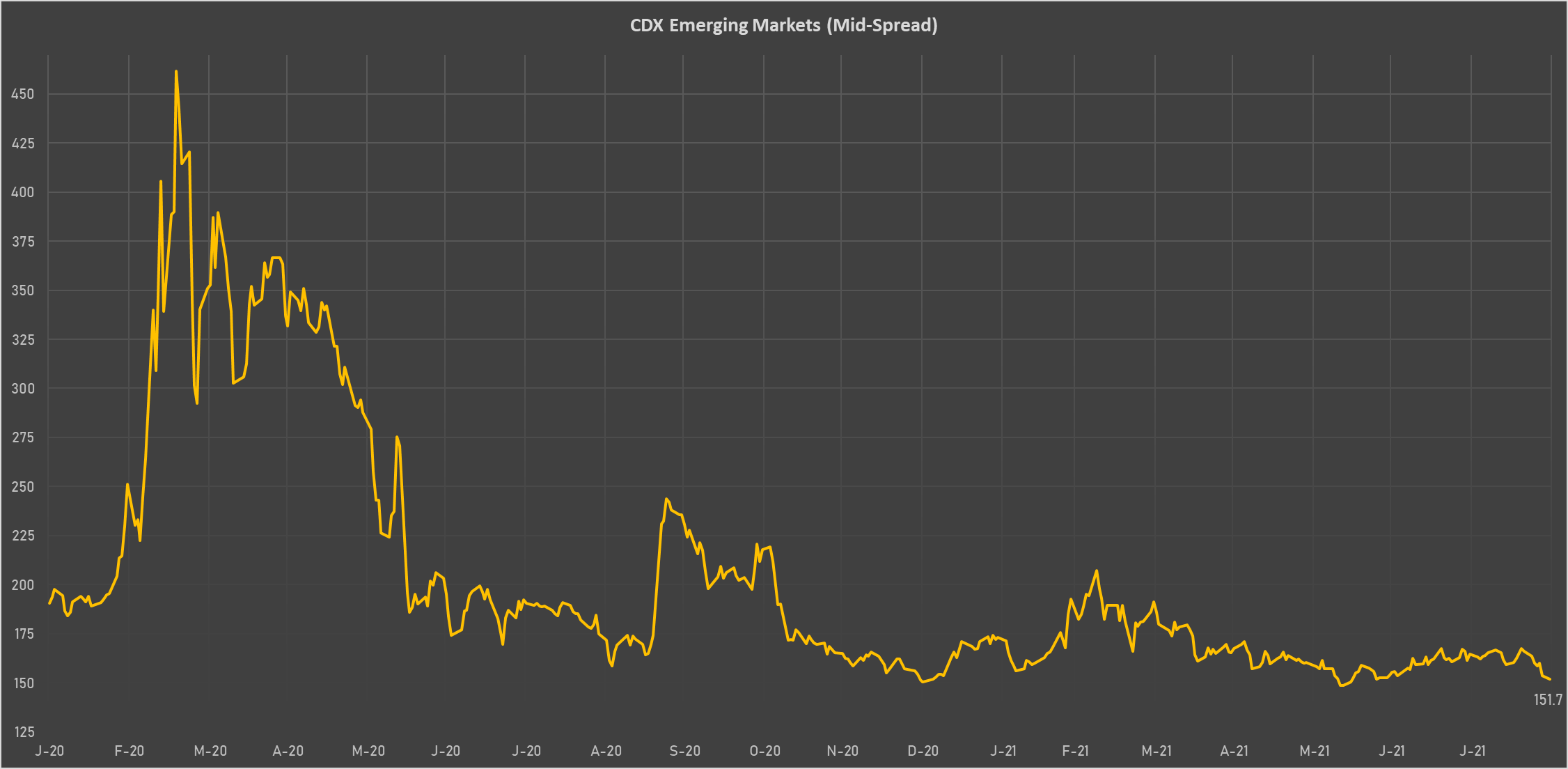

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Nigeria (rated B): down 1.5 basis points to 339 bp (1Y range: 333-383bp)

- Argentina (rated CCC): down 12.3 basis points to 1,868 bp (1Y range: 1,049-1,971bp)

- Vietnam (rated BB): down 3.5 basis points to 97 bp (1Y range: 90-137bp)

- Peru (rated BBB+): down 3.6 basis points to 83 bp (1Y range: 52-101bp)

- Brazil (rated BB-): down 8.1 basis points to 173 bp (1Y range: 141-252bp)

- Indonesia (rated BBB): down 3.6 basis points to 68 bp (1Y range: 66-118bp)

- Colombia (rated BB+): down 6.9 basis points to 130 bp (1Y range: 83-164bp)

- Panama (rated BBB-): down 4.0 basis points to 68 bp (1Y range: 44-95bp)

- Chile (rated A-): down 3.7 basis points to 59 bp (1Y range: 43-75bp)

- Mexico (rated BBB-): down 5.7 basis points to 84 bp (1Y range: 79-164bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 1.2% (YTD: -24.8%)

- Mongolia Tugrik up 0.9% (YTD: +1.1%)

- Pakistani rupee up 0.8% (YTD: -3.1%)

- Malaysian Ringgit up 0.8% (YTD: -3.2%)

- Jamaican Dollar up 0.8% (YTD: -5.6%)

- Namibian Dollar up 0.7% (YTD: +0.4%)

- Swazi Lilangeni up 0.7% (YTD: +0.4%)

- Botswana Pula up 0.7% (YTD: -2.6%)

- Ghanaian Cedi down 0.8% (YTD: -3.0%)

- Afghani down 2.1% (YTD: -12.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.5%

- Mozambique metical up 15.4%

- Ethiopian Birr down 13.8%

- Argentine Peso down 14.0%

- Haiti Gourde down 24.8%

- Surinamese dollar down 33.6%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%