FX

US Dollar Index Unchanged, As Euro Rises Slightly, Yen Edges Down

Rates matter: moves in short rates differentials (US-JP 6-month rates 18-months forward) currently explain half of the variance in spot yen daily returns

Published ET

Correlation Between Moves In Short Forward Rates And Spot JPY | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

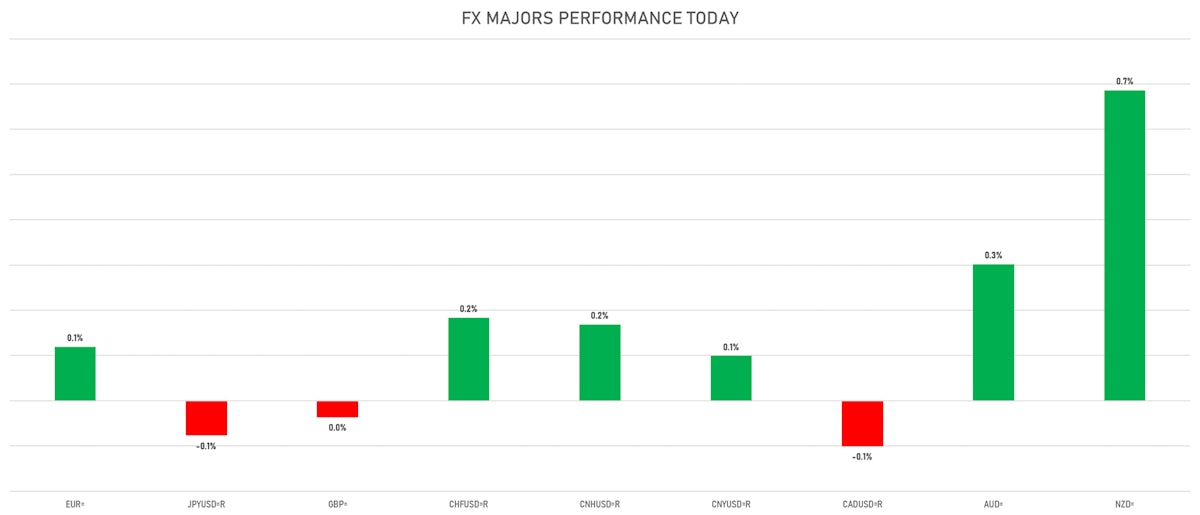

- The US Dollar Index is down -0.04% at 92.66 (YTD: +2.97%)

- Euro up 0.12% at 1.1809 (YTD: -3.3%)

- Yen down 0.08% at 110.00 (YTD: -6.1%)

- Onshore Yuan up 0.10% at 6.4604 (YTD: +1.0%)

- Swiss franc up 0.18% at 0.9153 (YTD: -3.3%)

- Sterling down 0.04% at 1.3753 (YTD: +0.6%)

- Canadian dollar down 0.10% at 1.2615 (YTD: +0.9%)

- Australian dollar up 0.30% at 0.7316 (YTD: -4.9%)

- NZ dollar up 0.69% at 0.7047 (YTD: -1.9%)

MACRO DATA RELEASES

- Australia, Current Account, Balance for Q2 2021 (AU Bureau of Stat) at 20.50 Bln AUD (vs 18.30 Bln AUD prior), below consensus estimate of 21.00 Bln AUD

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Jul 2021 (AU Bureau of Stat) at -8.60 % (vs -6.70 % prior), below consensus estimate of -5.00 %

- Australia, Net exports, Goods and Services, Total, Contributions to GDP Growth for Q2 2021 (AU Bureau of Stat) at -1.00 % (vs -0.60 % prior), in line with consensus estimate

- Canada, GDP, All industries, Change P/P for Jun 2021 (CANSIM, Canada) at 0.70 % (vs -0.30 % prior), in line with consensus estimate

- Canada, GDP, Total at market prices, annualized, Change P/P for Q2 2021 (CANSIM, Canada) at -1.10 % (vs 5.60 % prior), below consensus estimate of 2.50 %

- China (Mainland), PMI, Manufacturing Sector for Aug 2021 (NBS, China) at 50.10 (vs 50.40 prior), below consensus estimate of 50.20

- Denmark, GDP, Total, chain linked-prelim, Change P/P for Q2 2021 (statbank.dk) at 2.30 % (vs -1.00 % prior)

- Denmark, GDP, Total, chain linked-prelim, Change Y/Y for Q2 2021 (statbank.dk) at 8.50 % (vs -0.80 % prior)

- Denmark, Unemployment, Rate, Net for Jul 2021 (statbank.dk) at 3.30 % (vs 3.30 % prior)

- Euro Zone, CPI, Change Y/Y for Aug 2021 (Eurostat) at 3.00 % (vs 2.20 % prior), above consensus estimate of 2.70 %

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Aug 2021 (Eurostat) at 1.60 % (vs 0.90 % prior), above consensus estimate of 1.40 %

- France, GDP, Total growth, Change P/P for Q2 2021 (INSEE, France) at 1.10 % (vs 0.90 % prior), above consensus estimate of 0.90 %

- France, HICP, Flash, Change Y/Y, Price Index for Aug 2021 (INSEE, France) at 2.40 % (vs 1.50 % prior), above consensus estimate of 2.10 %

- Germany, Unemployment, Change, Absolute change for Aug 2021 (Deutsche Bundesbank) at -53.00 k (vs -91.00 k prior), below consensus estimate of -40.00 k

- Germany, Unemployment, Rate, Registered for Aug 2021 (Deutsche Bundesbank) at 5.50 % (vs 5.70 % prior), below consensus estimate of 5.60 %

- India, GDP, At basic price, Change Y/Y for Q1 2021 (CSO, India) at 20.10 % (vs 1.60 % prior), above consensus estimate of 20.00 %

- Italy, GDP, Final, Change P/P for Q2 2021 (ISTAT, Italy) at 2.70 % (vs 2.70 % prior), in line with consensus estimate

- Italy, GDP, Final, Change Y/Y for Q2 2021 (ISTAT, Italy) at 17.30 % (vs 17.30 % prior), in line with consensus estimate

- Italy, HICP, Preliminary, Change P/P, Price Index for Aug 2021 (ISTAT, Italy) at 0.30 % (vs -1.00 % prior), above consensus estimate of -0.30 %

- Italy, HICP, Preliminary, Change Y/Y, Price Index for Aug 2021 (ISTAT, Italy) at 2.60 % (vs 1.00 % prior), above consensus estimate of 2.00 %

- Portugal, GDP, Change P/P for Q2 2021 (INE, Portugal) at 4.90 % (vs 4.90 % prior)

- Switzerland, Reserves, Official reserve assets, Current Prices for Jul 2021 (Swiss National Bank) at 984,002.78 Mln CHF (vs 1,002,153.31 Mln CHF prior)

- United States, Conference Board, Consumer confidence for Aug 2021 (The Conference Board) at 113.80 (vs 129.10 prior), below consensus estimate of 124.00

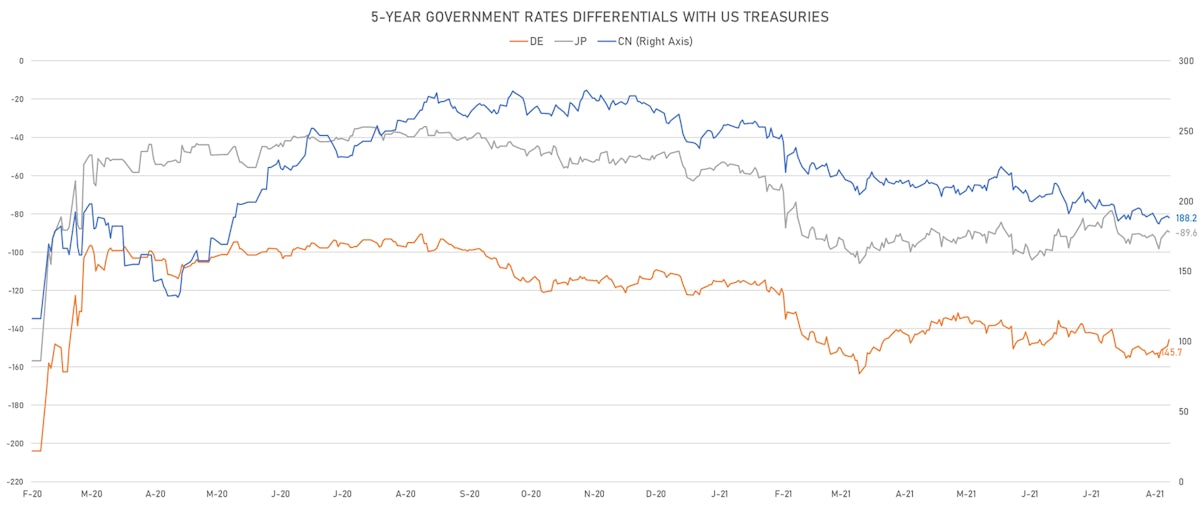

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.6 bp at 145.7 bp (YTD change: +34.6 bp)

- US-JAPAN: +0.7 bp at 89.6 bp (YTD change: +41.3 bp)

- US-CHINA: +1.3 bp at -188.2 bp (YTD change: +69.0 bp)

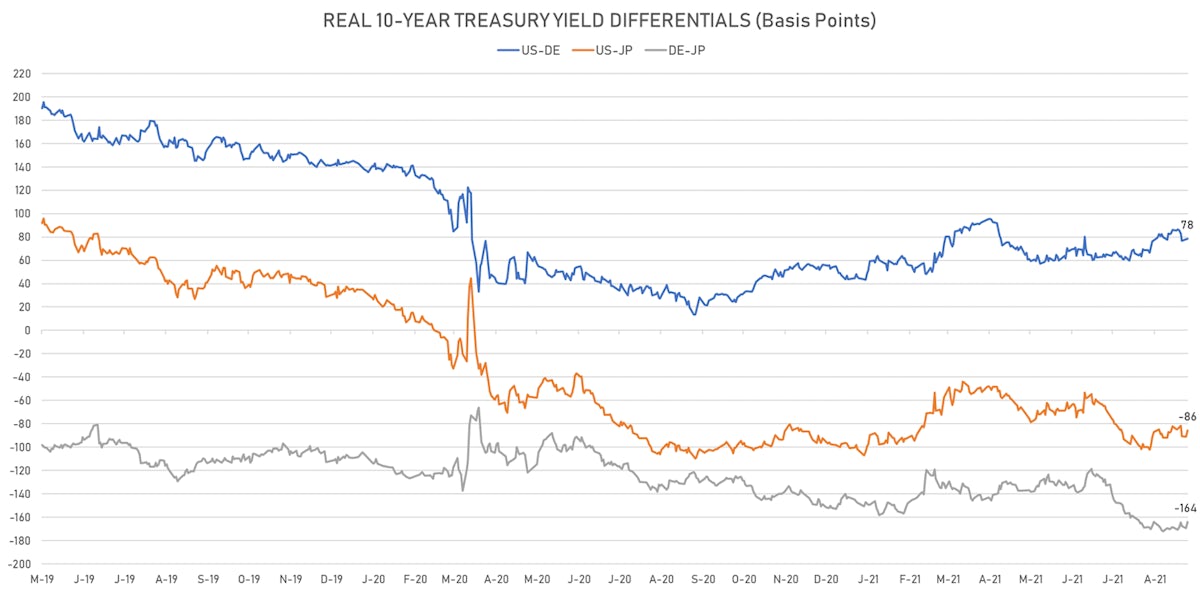

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.4 bp at 78.4 bp (YTD change: +32.3bp)

- US-JAPAN: +5.5 bp at -85.6 bp (YTD change: +15.9bp)

- JAPAN-GERMANY: -5.1 bp at 164.0 bp (YTD change: +16.4bp)

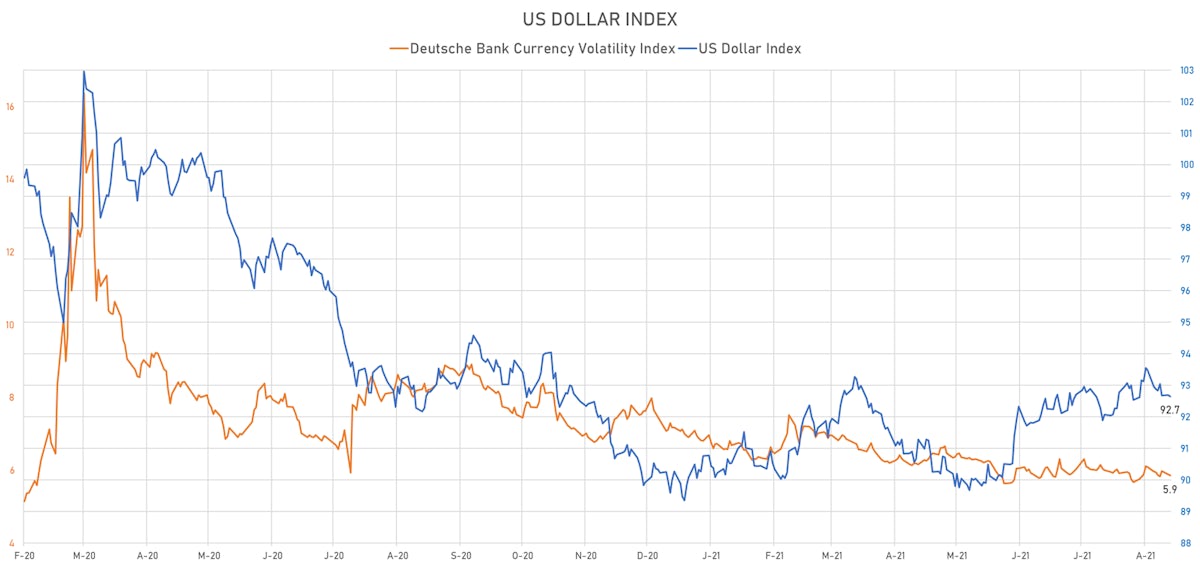

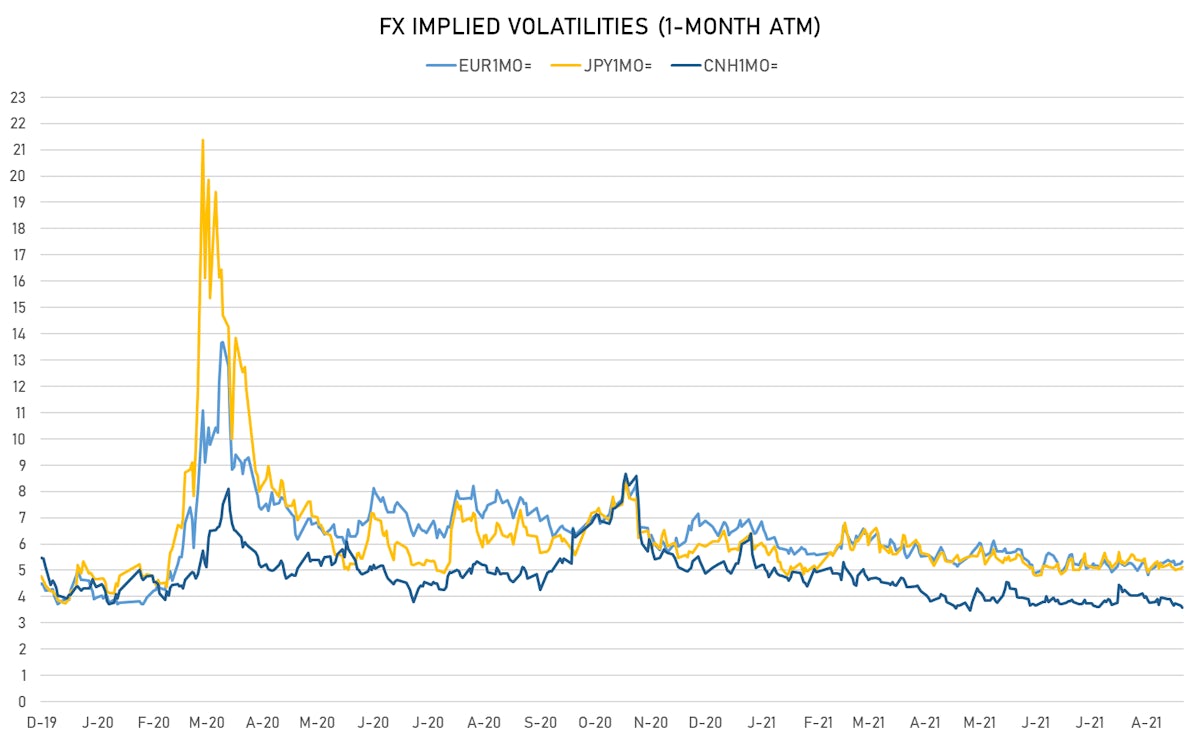

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.85, down -0.12 (YTD: -1.32)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.35, up 0.1 (YTD: -1.3)

- Japanese Yen 1M ATM IV currently at 5.11, up 0.0 (YTD: -1.0)

- Offshore Yuan 1M ATM IV currently at 3.58, down -0.1 (YTD: -2.4)

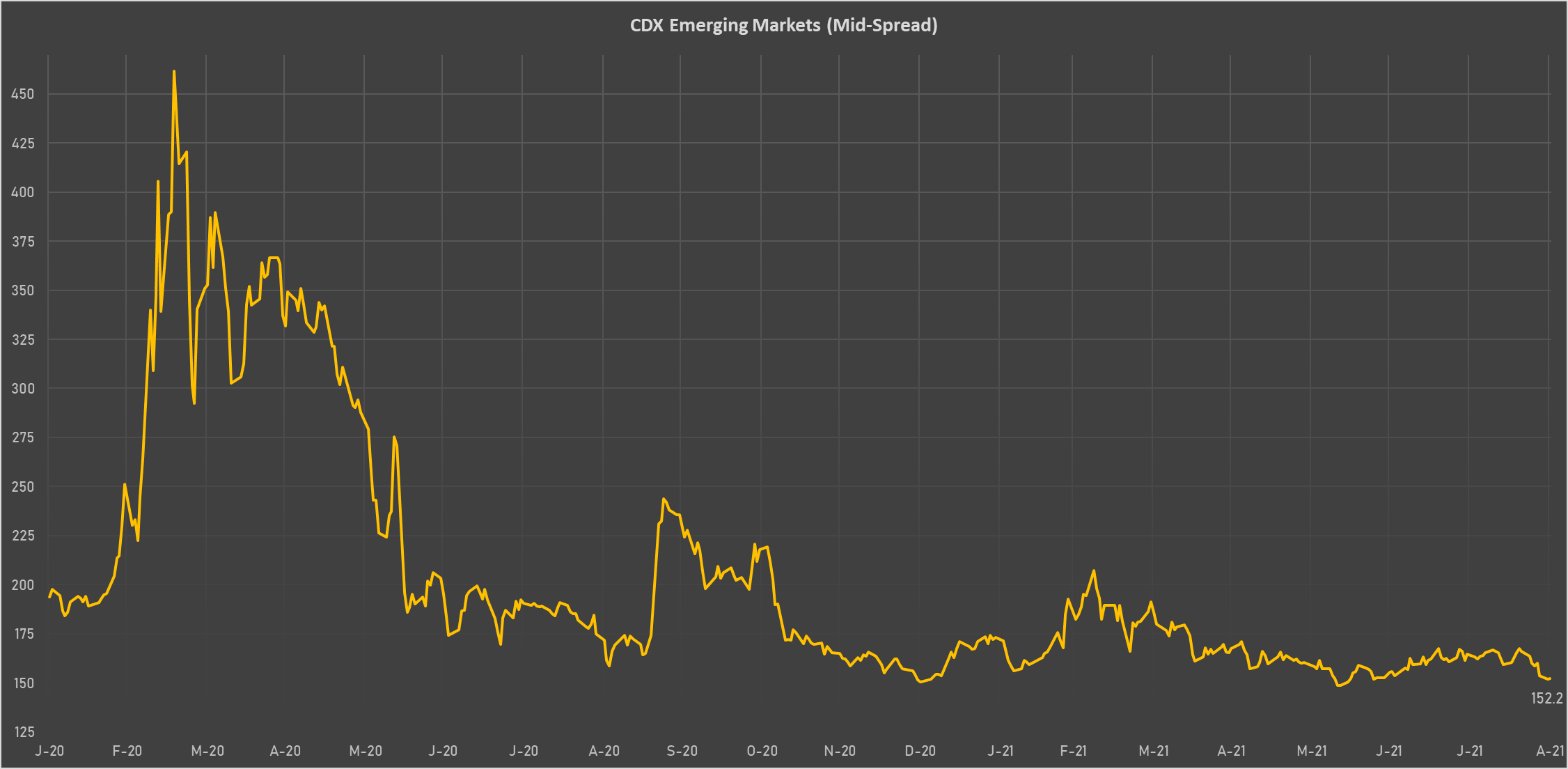

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Chile (rated A-): up 1.5 basis points to 61 bp (1Y range: 43-75bp)

- Brazil (rated BB-): up 2.5 basis points to 176 bp (1Y range: 141-252bp)

- Colombia (rated BB+): up 1.6 basis points to 132 bp (1Y range: 83-164bp)

- Mexico (rated BBB-): up 0.9 basis points to 85 bp (1Y range: 79-164bp)

- Ecuador (rated WD): down 1.5 basis points to 158 bp (1Y range: 157-181bp)

- Russia (rated BBB): down 1.1 basis points to 78 bp (1Y range: 72-129bp)

- Vietnam (rated BB): down 1.7 basis points to 95 bp (1Y range: 90-137bp)

- Bahrain (rated B+): down 5.4 basis points to 244 bp (1Y range: 159-330bp)

- South Africa (rated BB-): down 5.3 basis points to 185 bp (1Y range: 178-328bp)

- United Arab Emirates (rated AA-): down 2.5 basis points to 58 bp (1Y range: 50-63bp)

LARGEST FX MOVES TODAY

- Tajikistan Somoni up 1.4% (YTD: -0.1%)

- Colombian Peso up 1.3% (YTD: -9.1%)

- Chilean Peso up 1.2% (YTD: -8.1%)

- South Africa Rand up 1.0% (YTD: +1.1%)

- Lesotho Loti up 0.9% (YTD: +1.2%)

- Namibian Dollar up 0.9% (YTD: +1.1%)

- Polish Zloty up 0.9% (YTD: -2.5%)

- Swazi Lilangeni up 0.9% (YTD: +1.1%)

- Mauritius Rupee down 0.9% (YTD: -8.0%)

- Afghani down 1.0% (YTD: -13.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 64.8%

- Mozambique metical up 15.4%

- Ethiopian Birr down 13.8%

- Argentine Peso down 14.0%

- Haiti Gourde down 25.2%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%