FX

Not A Lot Of FX Volatility Today, But The Euro Strengthens Against The Dollar On Favorable Rates Differentials

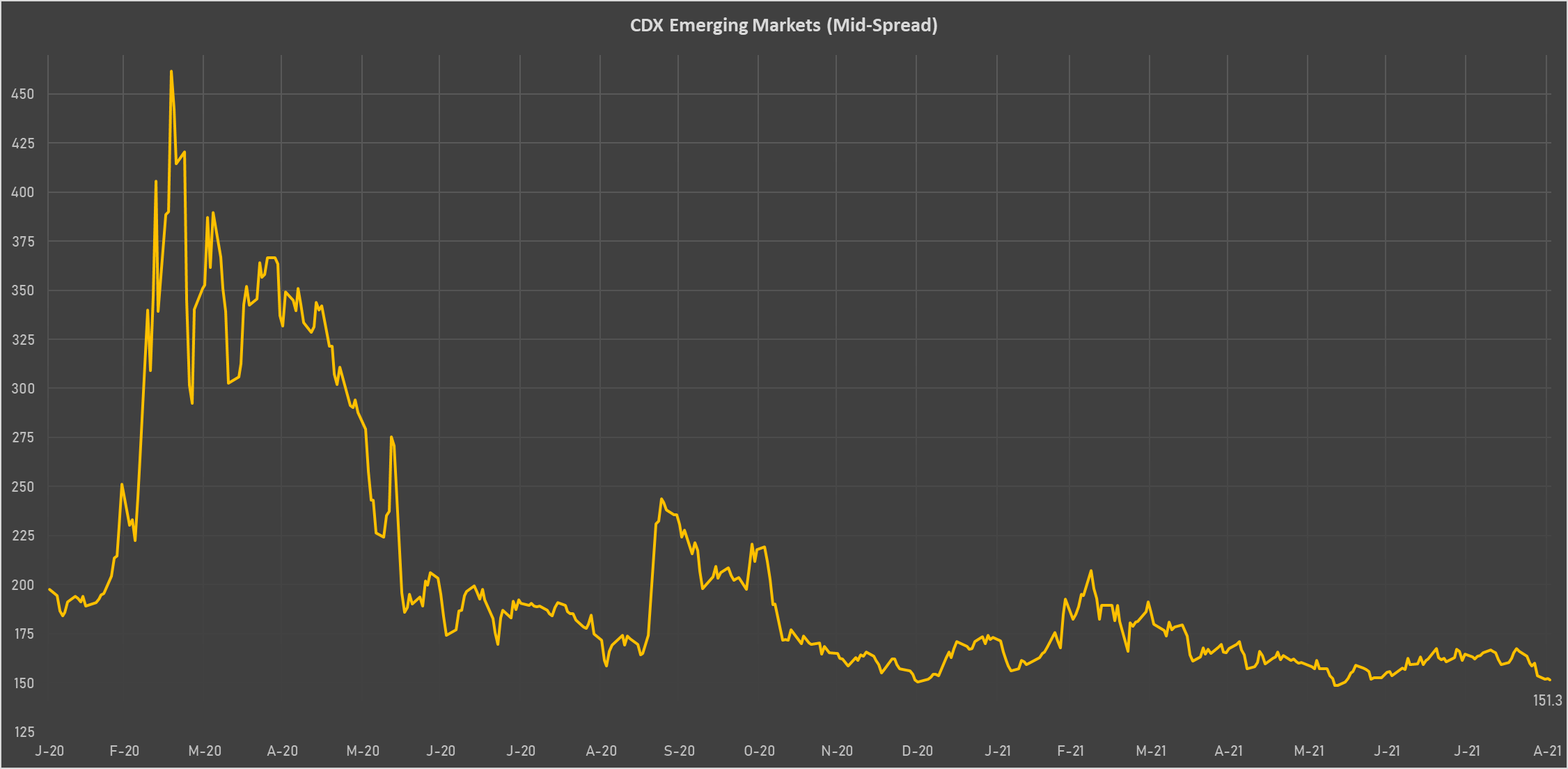

Pro-cyclical commodities currencies (like the AUD) did well, EM credit spreads kept tightening and currencies strengthening against the USD (RUB, ZAR, TRY)

Published ET

Euro spot vs German-US 1Y Forward 1Y Rates Differential | Source: Refinitiv

QUICK SUMMARY

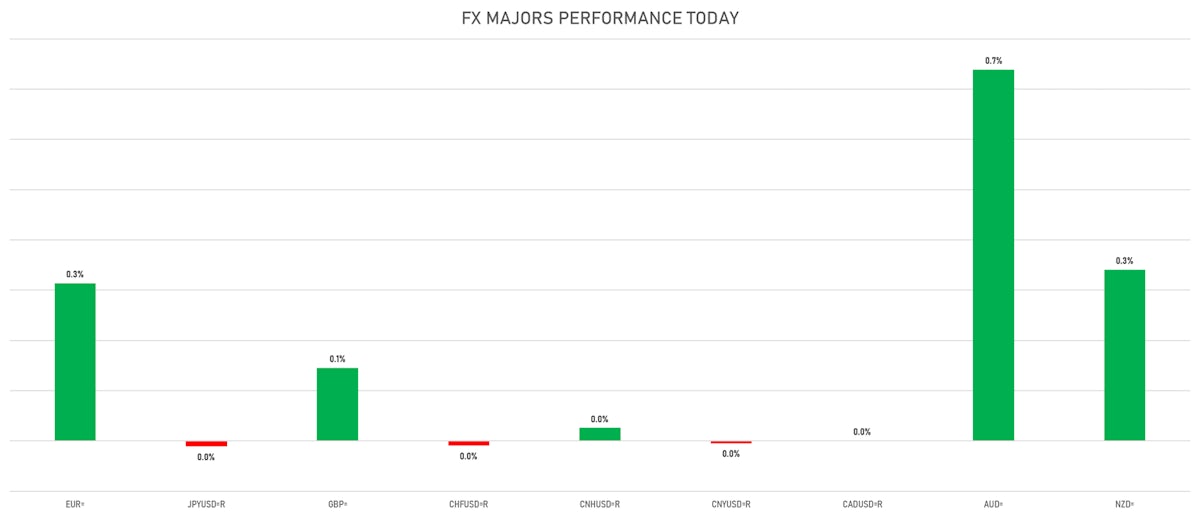

- The US Dollar Index is down -0.17% at 92.50 (YTD: +2.80%)

- Euro up 0.28% at 1.1840 (YTD: -3.1%)

- Yen up 0.01% at 110.02 (YTD: -6.1%)

- Onshore Yuan unchanged at 6.4586 (YTD: +1.0%)

- Swiss franc down 0.03% at 0.9156 (YTD: -3.3%)

- Sterling up 0.12% at 1.3770 (YTD: +0.7%)

- Canadian dollar down 0.03% at 1.2620 (YTD: +0.9%)

- Australian dollar up 0.72% at 0.7368 (YTD: -4.2%)

- NZ dollar up 0.33% at 0.7067 (YTD: -1.6%)

MACRO DATA RELEASES

- Australia, GDP, Change P/P for Q2 2021 (AU Bureau of Stat) at 0.70 % (vs 1.80 % prior), above consensus estimate of 0.50 %

- Australia, GDP, Change Y/Y for Q2 2021 (AU Bureau of Stat) at 9.60 % (vs 1.10 % prior), above consensus estimate of 9.20 %

- Brazil, GDP, Market prices, chain-weighted, Change P/P for Q2 2021 (IBGE, Brazil) at -0.10 % (vs 1.20 % prior), below consensus estimate of 0.20 %

- Brazil, GDP, Market prices, chain-weighted, Change Y/Y for Q2 2021 (IBGE, Brazil) at 12.40 % (vs 1.00 % prior), below consensus estimate of 12.80 %

- Brazil, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 53.60 (vs 56.70 prior)

- Canada, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 57.20 (vs 56.20 prior)

- Chile, Policy Rates, Monetary Policy Interest Rate for Aug 2021 (Central Bank, Chile) at 1.50 % (vs 0.75 % prior), above consensus estimate of 1.25 %

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Aug 2021 (Markit Economics) at 49.20 (vs 50.30 prior), below consensus estimate of 50.20

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Aug 2021 (Markit Economics) at 61.40 (vs 61.50 prior), below consensus estimate of 61.50

- Euro Zone, Unemployment, Rate for Jul 2021 (Eurostat) at 7.60 % (vs 7.70 % prior), in line with consensus estimate

- France, PMI, Manufacturing Sector, Total, Final for Aug 2021 (Markit Economics) at 57.50 (vs 57.30 prior), above consensus estimate of 57.30

- Germany, PMI, Manufacturing Sector, Total, Final for Aug 2021 (Markit Economics) at 62.60 (vs 62.70 prior), below consensus estimate of 62.70

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Aug 2021 (Markit Economics) at 52.30 (vs 55.30 prior), below consensus estimate of 55.00

- Indonesia, CPI, Change Y/Y for Aug 2021 (Statistics Indonesia) at 1.59 % (vs 1.52 % prior), below consensus estimate of 1.60 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Aug 2021 (Markit Economics) at 43.70 (vs 40.10 prior)

- Italy, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 60.90 (vs 60.30 prior), above consensus estimate of 60.10

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Aug 2021 (Markit Economics) at 52.70 (vs 52.40 prior)

- Mexico, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 47.10 (vs 49.60 prior)

- Russia, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 46.50 (vs 47.50 prior)

- Russia, Unemployment, Rate for Jul 2021 (RosStat, Russia) at 4.50 % (vs 4.80 % prior), below consensus estimate of 4.70 %

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Aug 2021 (Markit Economics) at 51.20 (vs 53.00 prior)

- Turkey, Gross Domestic Product (%YOY), Change Y/Y for Q2 2021 (TURKSTAT) at 21.70 % (vs 7.00 % prior), in line with consensus estimate

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Aug 2021 (Markit Economics) at 54.10 (vs 54.00 prior)

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Aug 2021 (Nationwide, UK) at 2.10 % (vs -0.50 % prior), above consensus estimate of 0.20 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Aug 2021 (Nationwide, UK) at 11.00 % (vs 10.50 % prior), above consensus estimate of 8.60 %

- United Kingdom, PMI, Manufacturing Sector for Aug 2021 (Markit Economics) at 60.30 (vs 60.10 prior), above consensus estimate of 60.10

- United States, ISM Manufacturing, PMI total for Aug 2021 (ISM, United States) at 59.90 (vs 59.50 prior), above consensus estimate of 58.60

- United States, PMI, Manufacturing Sector, Total, Final for Aug 2021 (Markit Economics) at 61.10 (vs 61.20 prior)

- Zambia, Policy Rates, BOZ Policy Rate for Sep 2021 (Bank of Zambia) at 8.50 % (vs 8.50 % prior)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.3 bp at 146.0 bp (YTD change: +34.9 bp)

- US-JAPAN: -0.5 bp at 89.1 bp (YTD change: +40.8 bp)

- US-CHINA: +4.3 bp at -183.8 bp (YTD change: +73.3 bp)

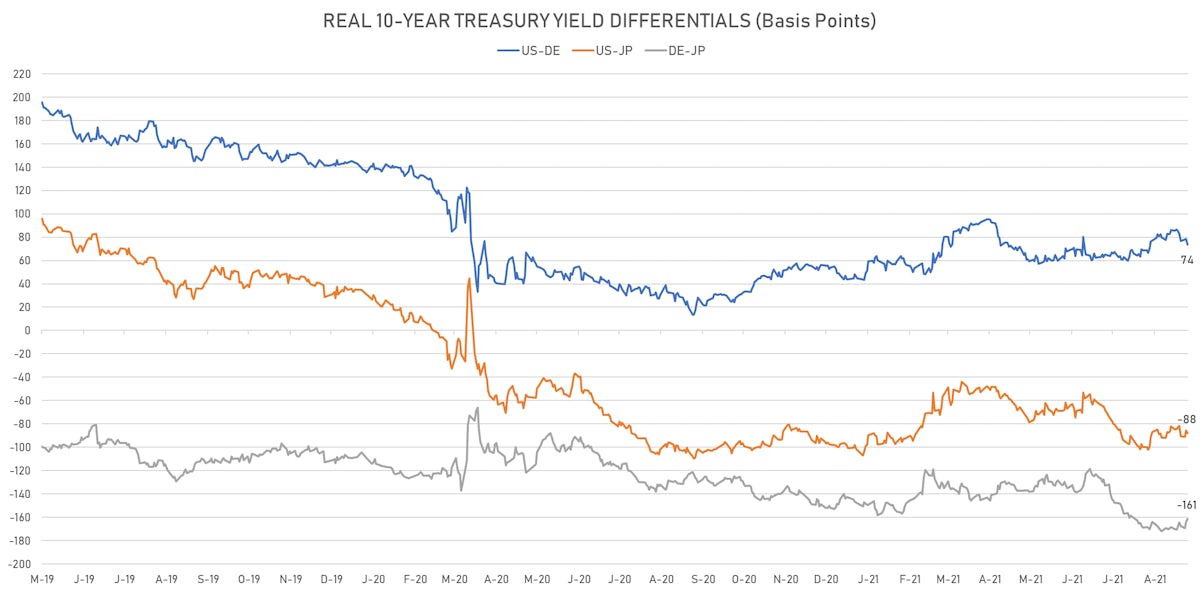

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.7 bp at 73.7 bp (YTD change: +27.6bp)

- US-JAPAN: -2.1 bp at -87.7 bp (YTD change: +13.8bp)

- JAPAN-GERMANY: -2.6 bp at 161.4 bp (YTD change: +13.8bp)

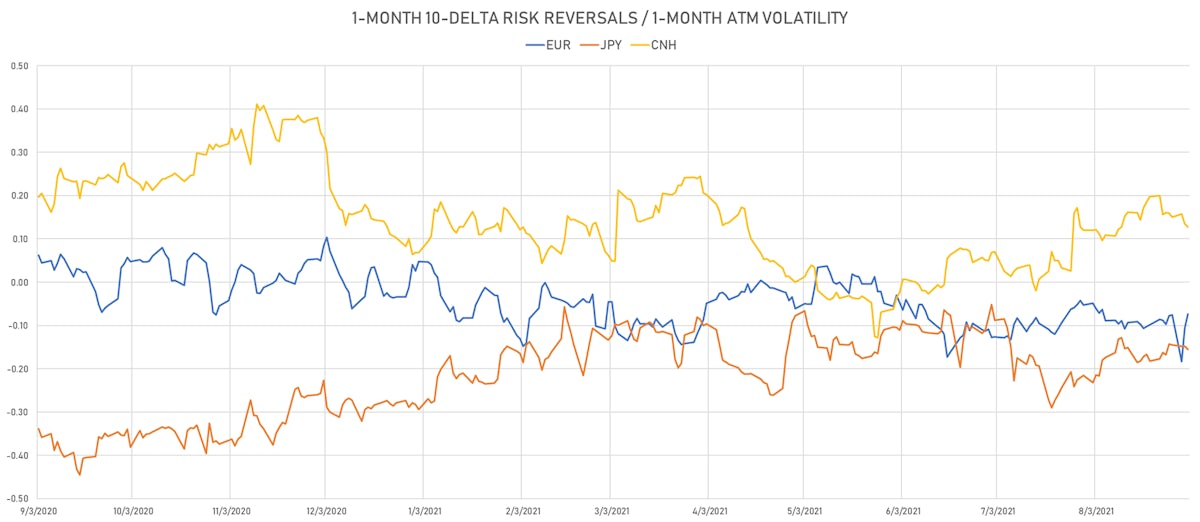

VOLATILITIES TODAY

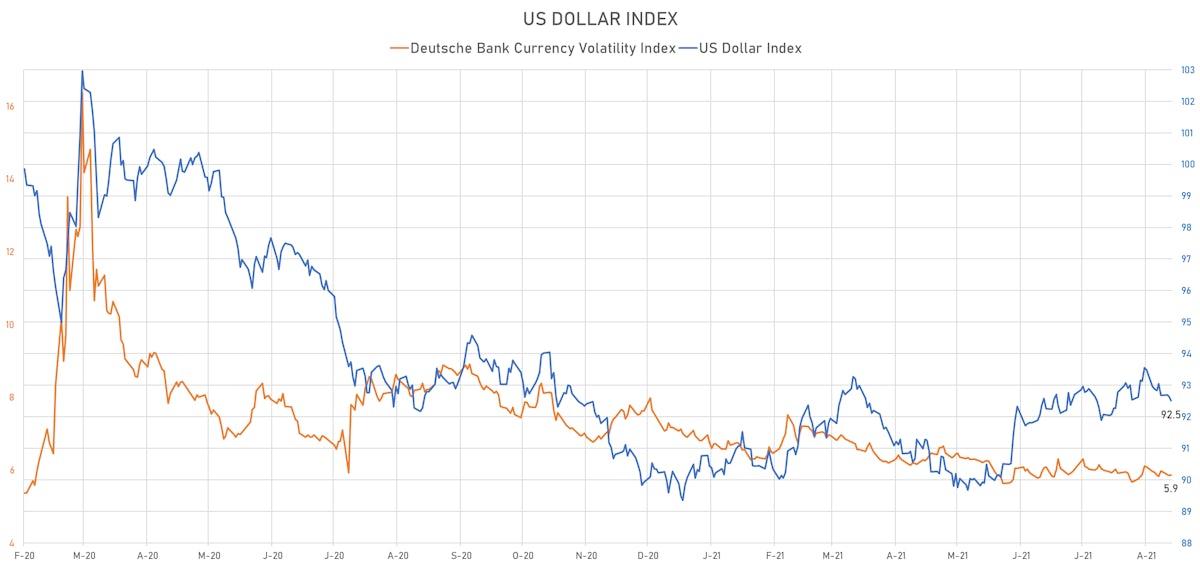

- Deutsche Bank USD Currency Volatility Index currently at 5.87, up 0.02 (YTD: -1.30)

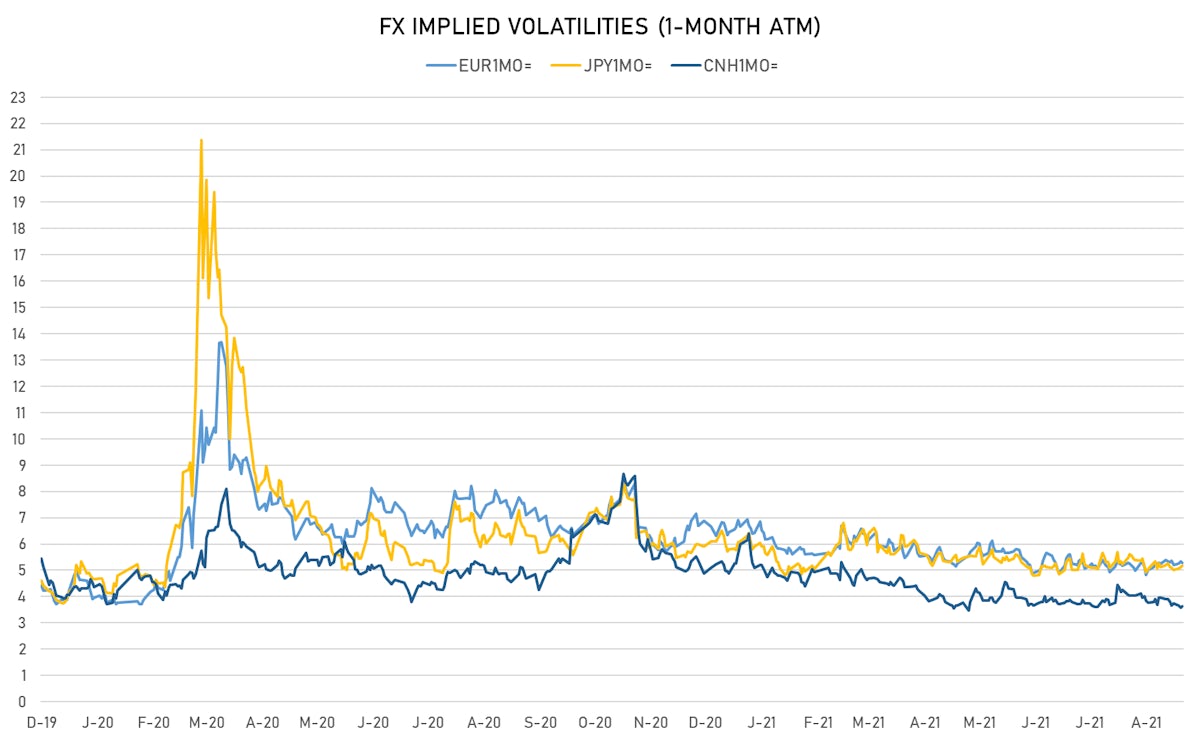

- Euro 1-Month At-The-Money Implied Volatility currently at 5.29, down -0.1 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.18, up 0.1 (YTD: -0.9)

- Offshore Yuan 1M ATM IV unchanged at 3.63 (YTD: -2.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Pakistan (rated B-): down 3.0 basis points to 367 bp (1Y range: 362-512bp)

- Senegal (rated ): down 3.0 basis points to 356 bp (1Y range: 355-409bp)

- South Africa (rated BB-): down 1.8 basis points to 184 bp (1Y range: 178-328bp)

- Argentina (rated CCC): down 18.6 basis points to 1,865 bp (1Y range: 1,049-1,971bp)

- Vietnam (rated BB): down 1.2 basis points to 94 bp (1Y range: 90-137bp)

- Bahrain (rated B+): down 3.9 basis points to 240 bp (1Y range: 159-330bp)

- Indonesia (rated BBB): down 1.1 basis points to 66 bp (1Y range: 66-118bp)

- Egypt (rated B+): down 8.3 basis points to 336 bp (1Y range: 283-422bp)

- Morocco (rated BB+): down 3.5 basis points to 90 bp (1Y range: 84-127bp)

- Oman (rated BB-): down 10.6 basis points to 231 bp (1Y range: 223-452bp)

LARGEST FX MOVES TODAY

- Mauritius Rupee up 1.7% (YTD: -6.4%)

- Russian Rouble up 0.7% (YTD: +1.6%)

- South Africa Rand up 0.7% (YTD: +2.1%)

- Samoa Tala up 0.7% (YTD: -1.5%)

- Australian Dollar up 0.7% (YTD: -4.2%)

- Pacific Franc up 0.6% (YTD: -3.2%)

- Hungarian Forint up 0.6% (YTD: +1.1%)

- Polish Zloty up 0.6% (YTD: -1.9%)

- Brazilian Real down 0.7% (YTD: +0.1%)

- Philippine Peso down 0.7% (YTD: -4.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 64.9%

- Mozambique metical up 15.4%

- Ethiopian Birr down 13.8%

- Argentine Peso down 14.0%

- Haiti Gourde down 25.4%

- Surinamese dollar down 33.5%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%