FX

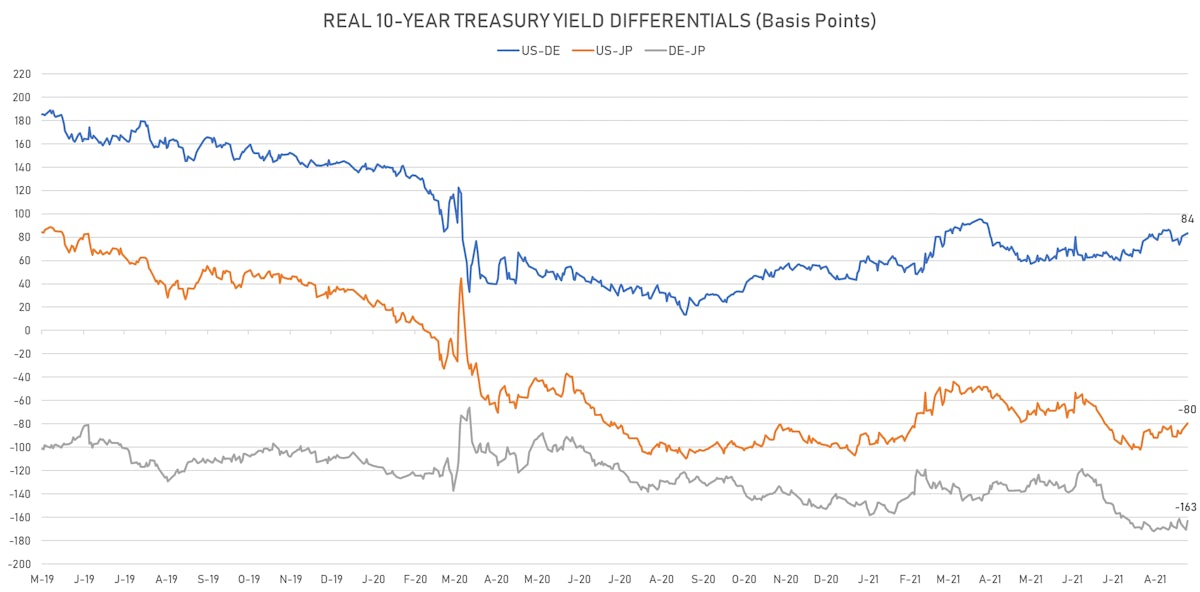

US Dollar Follows Real Rates Differentials Higher, With ECB Meeting On Thursday Main Event This Week

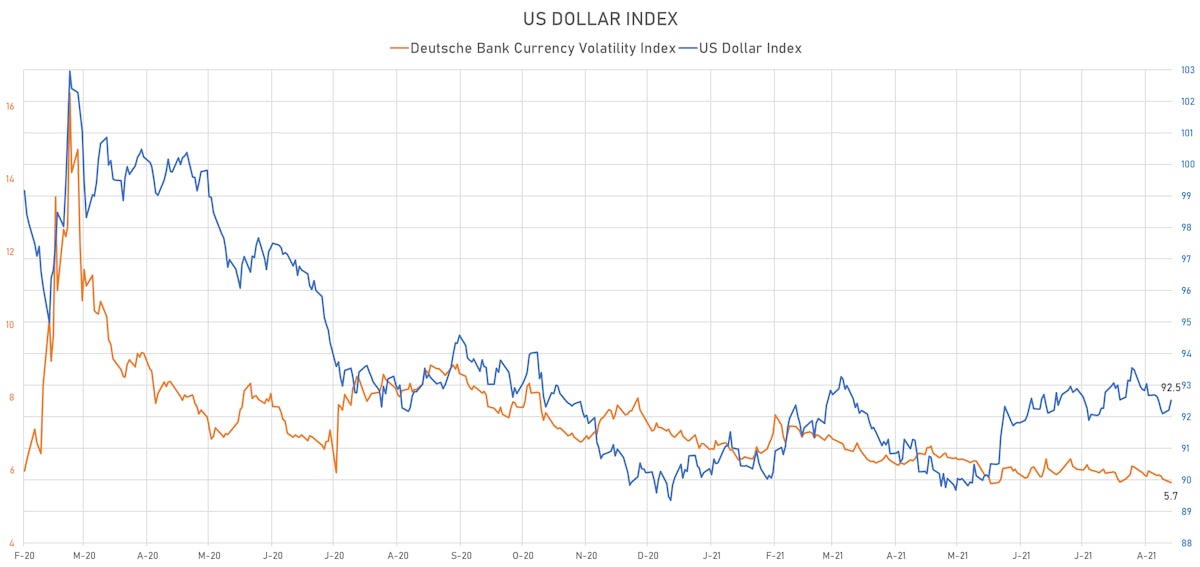

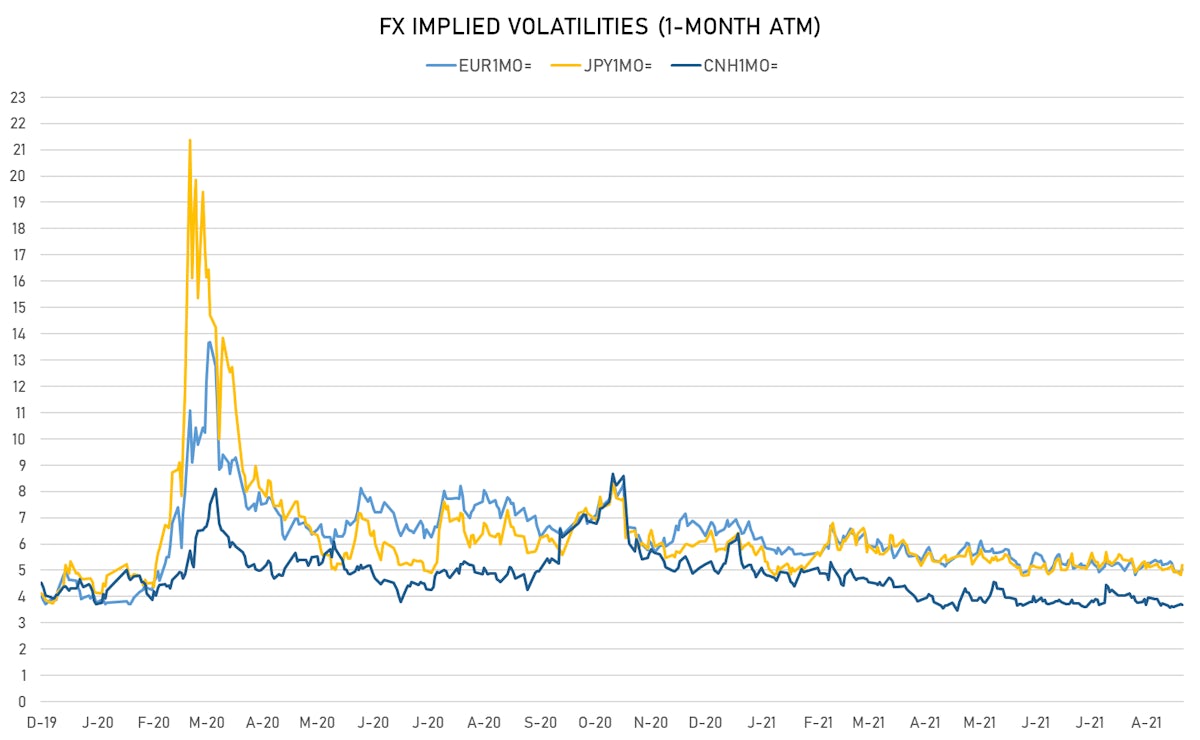

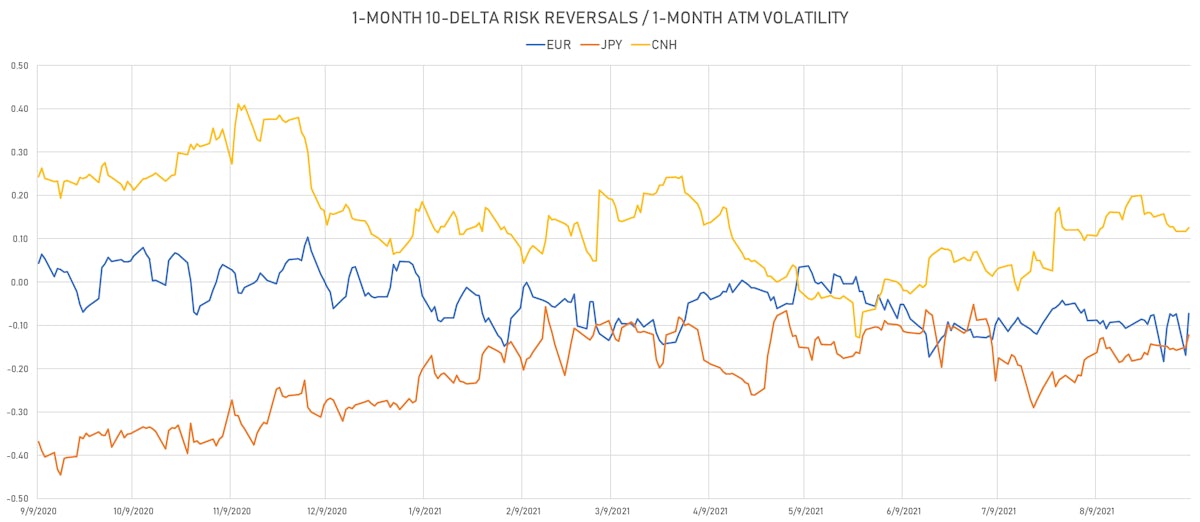

FX options implied volatilities are low and trending lower, with very little short-term directional skew in risk reversals at the moment

Published ET

EURO Spot vs. EUR-USD Forward Rates Differential | Source: Refinitiv

QUICK SUMMARY

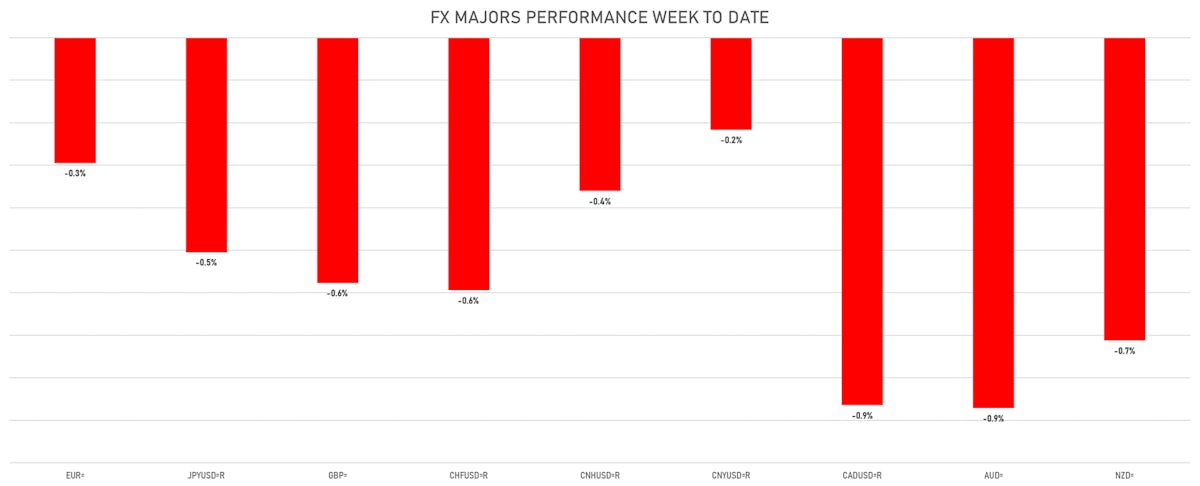

- The US Dollar Index is up 0.34% at 92.52 (YTD: +2.83%)

- Euro down 0.18% at 1.1847 (YTD: -3.0%)

- Yen down 0.41% at 110.26 (YTD: -6.4%)

- Onshore Yuan down 0.07% at 6.4662 (YTD: +0.9%)

- Swiss franc down 0.45% at 0.9192 (YTD: -3.7%)

- Sterling down 0.35% at 1.3785 (YTD: +0.8%)

- Canadian dollar down 0.80% at 1.2638 (YTD: +0.8%)

- Australian dollar down 0.62% at 0.7393 (YTD: -3.9%)

- NZ dollar down 0.39% at 0.7109 (YTD: -1.1%)

MACRO DATA RELEASES

- Australia, Policy Rates, Cash Target Rate for Sep 2021 (RBA, Australia) at 0.10 % (vs 0.10 % prior), in line with consensus estimate

- China (Mainland), Exports, Change Y/Y for Aug 2021 (China Customs) at 25.60 % (vs 19.30 % prior), above consensus estimate of 17.10 %

- China (Mainland), Imports, Change Y/Y for Aug 2021 (China Customs) at 33.10 % (vs 28.10 % prior), above consensus estimate of 26.80 %

- China (Mainland), Trade Balance, Current Prices for Aug 2021 (China Customs) at 58.34 Bln USD (vs 56.59 Bln USD prior), above consensus estimate of 51.05 Bln USD

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q2 2021 (Eurostat) at 2.20 % (vs 2.00 % prior), above consensus estimate of 2.00 %

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q2 2021 (Eurostat) at 14.30 % (vs 13.60 % prior), above consensus estimate of 13.60 %

- France, Reserve Assets, Current Prices for Aug 2021 (MINEFI, France) at 213,930.00 Mln EUR (vs 190,654.00 Mln EUR prior)

- Germany, Production, Total industry including construction, Change P/P for Jul 2021 (Destatis) at 1.00 % (vs -1.30 % prior), above consensus estimate of 0.90 %

- Germany, ZEW, Current Economic Situation, Germany, balance for Sep 2021 (ZEW, Germany) at 31.90 (vs 29.30 prior), below consensus estimate of 34.00

- Germany, ZEW, Economic Expectations, Germany, balance for Sep 2021 (ZEW, Germany) at 26.50 (vs 40.40 prior), below consensus estimate of 30.00

- New Zealand, Milk Auction, Average Price, Constant Prices for W 07 Sep (GlobalDairy Trade) at 3,927.00 USD (vs 3,827.00 USD prior)

- New Zealand, Reserve Assets, Current Prices for Aug 2021 (RBNZ) at 22,622.00 Mln NZD (vs 17,599.00 Mln NZD prior)

- Philippines, CPI, Total, inflation rate, Change Y/Y for Aug 2021 (PSA) at 4.90 % (vs 4.00 % prior), above consensus estimate of 4.40 %

- South Africa, GDP, Total, at market prices, Change Y/Y for Q2 2021 (Statistics, SA) at 19.30 % (vs -3.20 % prior), above consensus estimate of 17.50 %

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Aug 2021 (SA Reserve Bank) at 58.41 Bln USD (vs 54.46 Bln USD prior)

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Aug 2021 (SA Reserve Bank) at 55.67 Bln USD (vs 51.65 Bln USD prior)

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Aug 2021 (Swiss National Bank) at 929,292.00 Mln CHF (vs 923,240.00 Mln CHF prior)

- Taiwan, CPI, Change Y/Y, Price Index for Aug 2021 (DGBAS, Taiwan) at 2.36 % (vs 1.95 % prior), above consensus estimate of 1.90 %

- United Kingdom, House Prices, Halifax, UK, Change P/P for Aug 2021 at 0.70 % (vs 0.40 % prior)

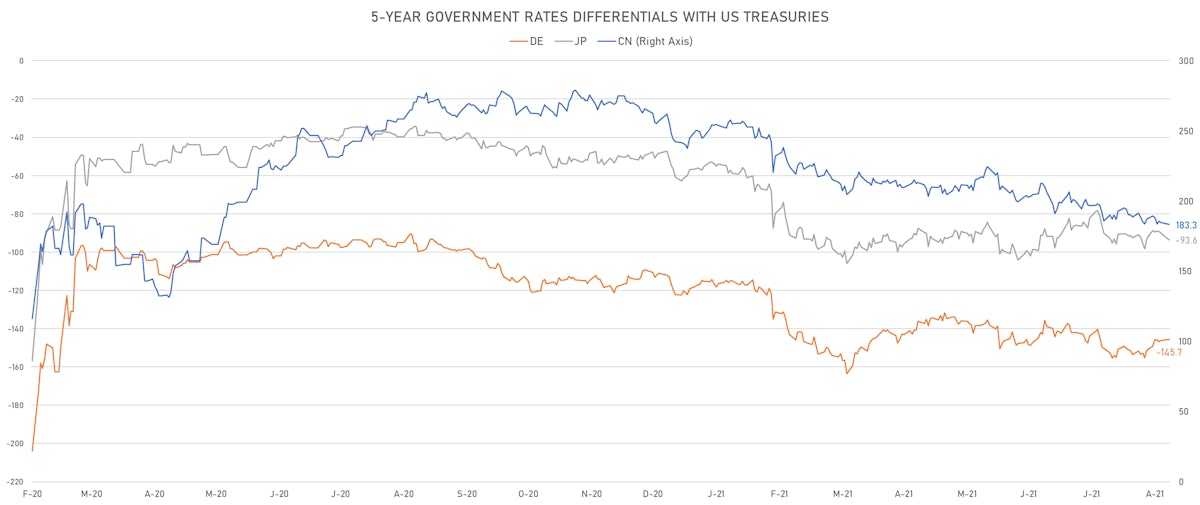

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.4 bp at 145.7 bp (YTD change: +34.6 bp)

- US-JAPAN: +3.3 bp at 93.6 bp (YTD change: +45.3 bp)

- US-CHINA: +1.3 bp at -183.3 bp (YTD change: +73.8 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.2 bp at 83.6 bp (YTD change: +37.5bp)

- US-JAPAN: +5.3 bp at -79.5 bp (YTD change: +22.0bp)

- JAPAN-GERMANY: -7.5 bp at 163.1 bp (YTD change: +15.5bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.66, down -0.02 (YTD: -1.51)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.05, up 0.1 (YTD: -1.6)

- Japanese Yen 1M ATM IV currently at 5.20, up 0.4 (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.68, down -0.1 (YTD: -2.3)

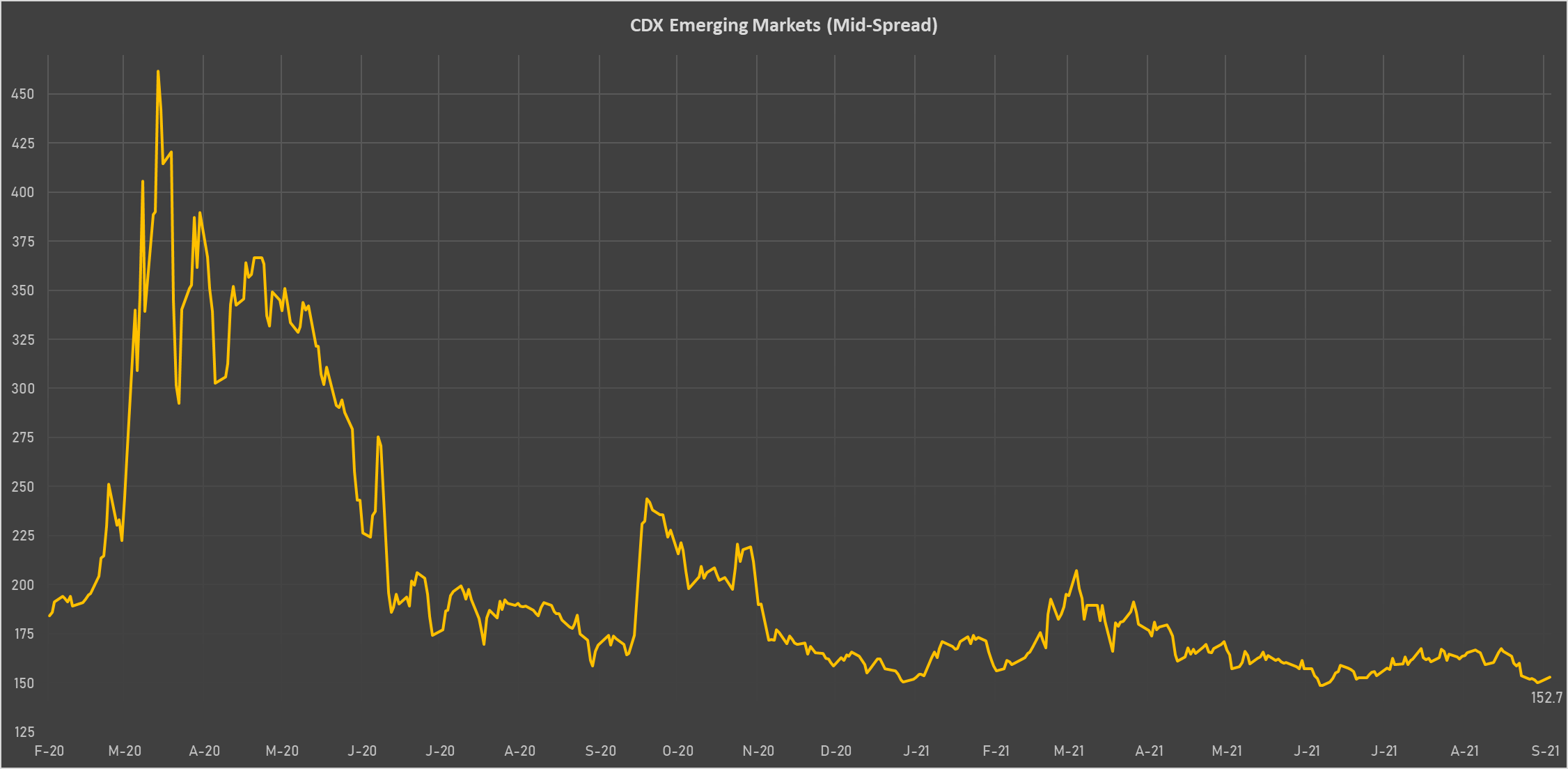

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Chile (rated A-): up 1.7 basis points to 63 bp (1Y range: 43-75bp)

- Peru (rated BBB+): up 1.1 basis points to 84 bp (1Y range: 52-101bp)

- Mexico (rated BBB-): up 1.1 basis points to 84 bp (1Y range: 79-164bp)

- Egypt (rated B+): up 4.0 basis points to 337 bp (1Y range: 283-422bp)

- Panama (rated BBB-): up 0.8 basis points to 67 bp (1Y range: 44-95bp)

- Colombia (rated BB+): up 1.4 basis points to 131 bp (1Y range: 83-164bp)

- Ecuador (rated WD): up 1.0 basis points to 157 bp (1Y range: 156-181bp)

- Kenya (rated B+): up 2.5 basis points to 394 bp (1Y range: 392-454bp)

- Nigeria (rated B): up 2.0 basis points to 333 bp (1Y range: 331-383bp)

- Turkey (rated BB-): down 2.2 basis points to 364 bp (1Y range: 282-570bp)

LARGEST FX MOVES TODAY

- Ghanaian Cedi up 1.3% (YTD: -2.1%)

- Sri Lanka Rupee down 0.8% (YTD: -8.2%)

- Cambodia Riel down 0.8% (YTD: -1.2%)

- Canadian Dollar down 0.9% (YTD: +0.8%)

- Turkish Lira down 0.9% (YTD: -10.9%)

- Cape Verde Escudo down 0.9% (YTD: 0.0%)

- Sierra Leon Leon down 0.9% (YTD: -3.6%)

- Chilean Peso down 1.0% (YTD: -9.0%)

- Haiti Gourde down 1.3% (YTD: -26.4%)

- Tonga Pa'anga down 1.5% (YTD: +2.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 66.4%

- Mozambique metical up 15.4%

- Argentine Peso down 14.2%

- Ethiopian Birr down 15.2%

- Haiti Gourde down 26.4%

- Surinamese dollar down 33.4%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.3%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%