FX

US Dollar Rises Slightly, With Euro Down and Yen Largely Unchanged

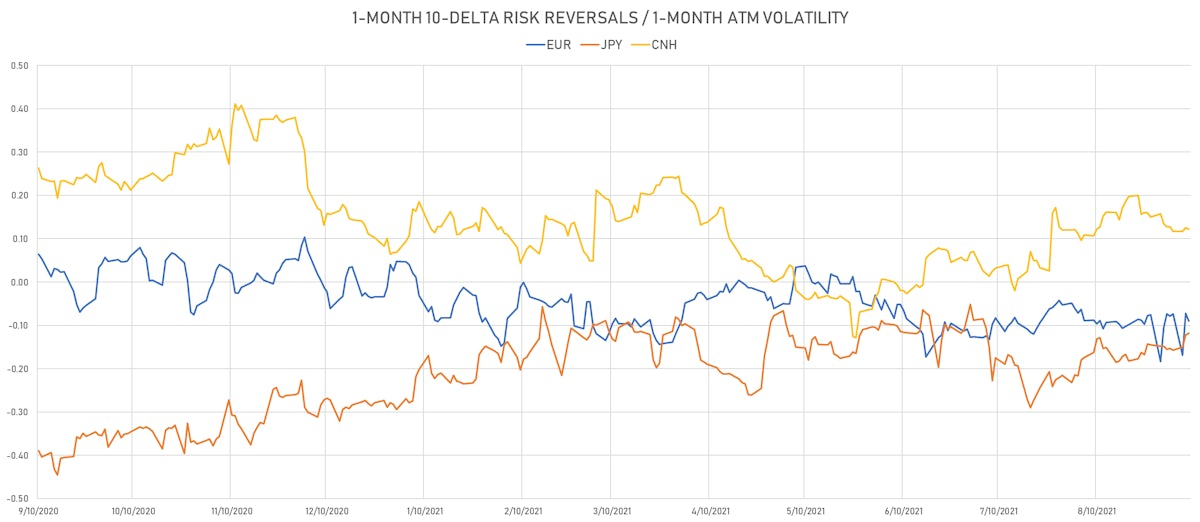

Despite a recent rebound in the euro against the dollar, implied volatilies are still moderately skewed to the downside

Published ET

Euro 1-Month Options Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

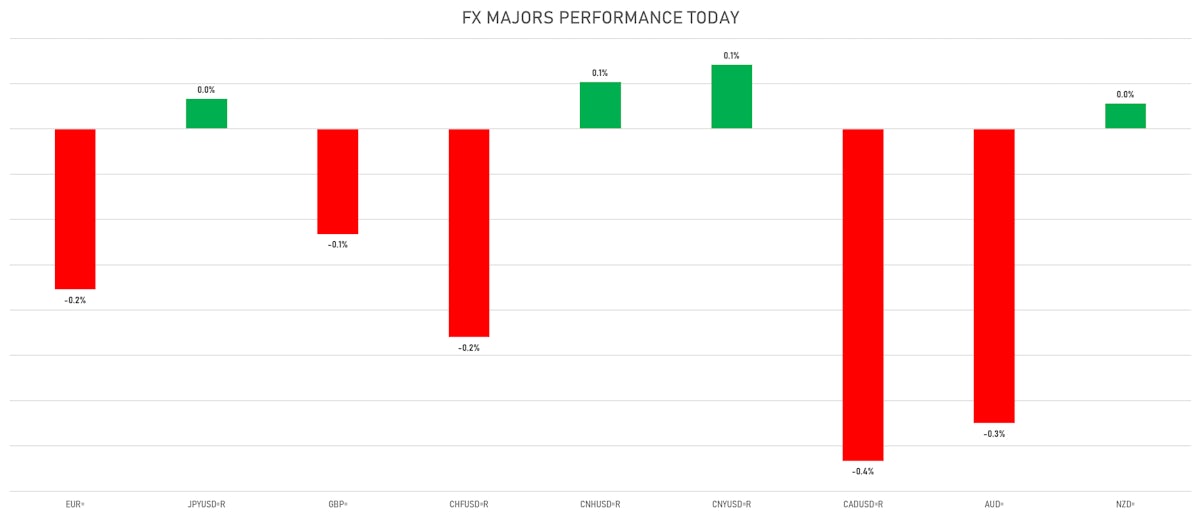

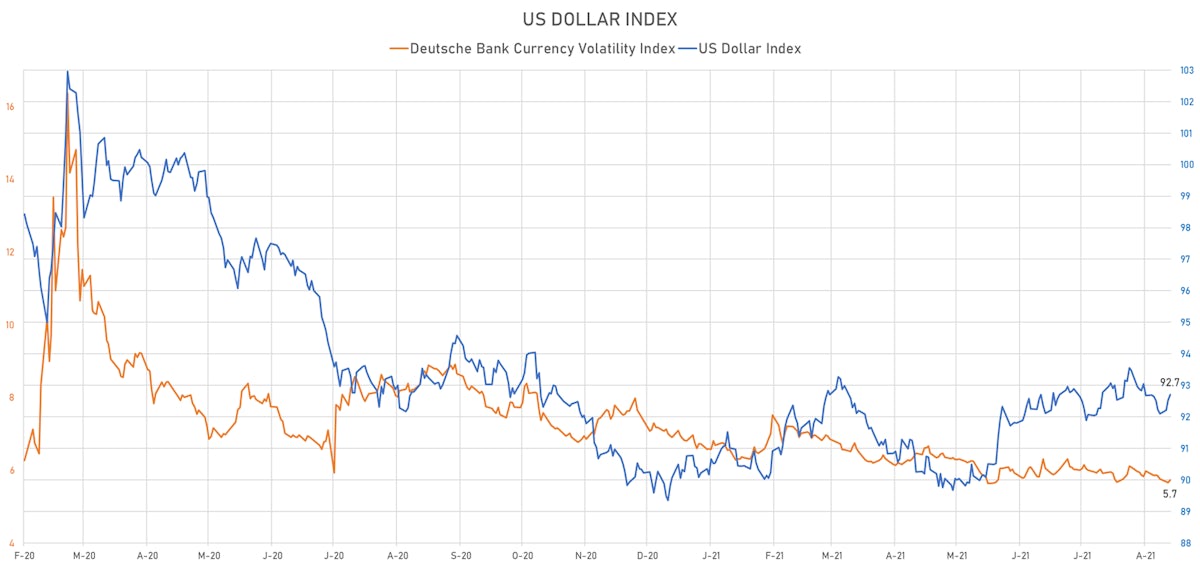

- The US Dollar Index is up 0.19% at 92.70 (YTD: +3.02%)

- Euro down 0.18% at 1.1818 (YTD: -3.2%)

- Yen up 0.03% at 110.23 (YTD: -6.3%)

- Onshore Yuan up 0.07% at 6.4612 (YTD: +1.0%)

- Swiss franc down 0.23% at 0.9219 (YTD: -4.0%)

- Sterling down 0.12% at 1.3766 (YTD: +0.7%)

- Canadian dollar down 0.37% at 1.2691 (YTD: +0.4%)

- Australian dollar down 0.32% at 0.7361 (YTD: -4.3%)

- NZ dollar up 0.03% at 0.7099 (YTD: -1.2%)

MACRO DATA RELEASES

- Canada, PMI, Composite for Aug 2021 (Richard Ivey) at 63.80 (vs 59.80 prior)

- Canada, PMI, Composite for Aug 2021 (Richard Ivey) at 66.00 (vs 56.40 prior)

- Canada, Policy Rates, Overnight Target Rate for 08 Sep (Bank of Canada) at 0.25 % (vs 0.25 % prior), in line with the consensus estimate

- Chile, CPI, Change P/P, Price Index for Aug 2021 (INE, Chile) at 0.40 % (vs 0.80 % prior), in line with the consensus estimate

- Hungary, CPI, All Items, Change Y/Y, Price Index for Aug 2021 (HCSO, Hungary) at 4.90 % (vs 4.60 % prior), above consensus estimate of 4.70 %

- Hungary, Trade Balance, Preliminary, Current Prices for Jul 2021 (HCSO, Hungary) at -193.00 Mln EUR (vs 629.00 Mln EUR prior), below consensus estimate of 185.00 Mln EUR

- Latvia, CPI, Change P/P for Aug 2021 (Statistics, Latvia) at 0.40 % (vs 0.40 % prior)

- Latvia, CPI, Change Y/Y for Aug 2021 (Statistics, Latvia) at 3.70 % (vs 2.80 % prior)

- Lithuania, CPI, Change P/P for Aug 2021 (Statistics Lithuania) at 0.40 % (vs 0.70 % prior)

- Lithuania, CPI, Change Y/Y, Price Index for Aug 2021 (Statistics Lithuania) at 5.30 % (vs 4.70 % prior)

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for Aug 2021 (Central Bank, Poland) at 0.10 % (vs 0.10 % prior), in line with the consensus estimate

- Russia, CPI, Change P/P for Aug 2021 (RosStat, Russia) at 0.20 % (vs 0.30 % prior), above consensus estimate of 0.10 %

- Russia, CPI, Change Y/Y for Aug 2021 (RosStat, Russia) at 6.70 % (vs 6.50 % prior), above consensus estimate of 6.60 %

- Slovakia, Trade Balance, Total, FOB, Current Prices for Jul 2021 (Stat Office of SR) at -10.70 Mln EUR (vs 296.70 Mln EUR prior), below consensus estimate of 175.60 Mln EUR

- Sweden, Industrial Production , Change Y/Y for Jul 2021 (SCB, Sweden) at 13.30 % (vs 16.70 % prior)

- Sweden, Industrial Production, Change M/M, Volume Index for Jul 2021 (SCB, Sweden) at 1.20 % (vs 1.90 % prior)

- Sweden, Private Sector Production, Change M/M, Volume Index for Jul 2021 (SCB, Sweden) at 2.00 % (vs 0.80 % prior)

- Sweden, Private Sector Production, Change Y/Y for Jul 2021 (SCB, Sweden) at 10.50 % (vs 10.50 % prior)

- United Kingdom, RICS Housing Market, Price, England and Wales for Aug 2021 (RICS, United Kingdom) at 73.00 (vs 79.00 prior), below consensus estimate of 75.00

- United States, Consumer credit, total, Absolute change for Jul 2021 (FED, U.S.) at 17.00 Bln USD (vs 37.69 Bln USD prior), below consensus estimate of 25.00 Bln USD

- United States, JOLTS Job Openings for Jul 2021 (BLS, U.S Dep. Of Lab) at 10.93 Mln (vs 10.07 Mln prior), above consensus estimate of 10.00 Mln

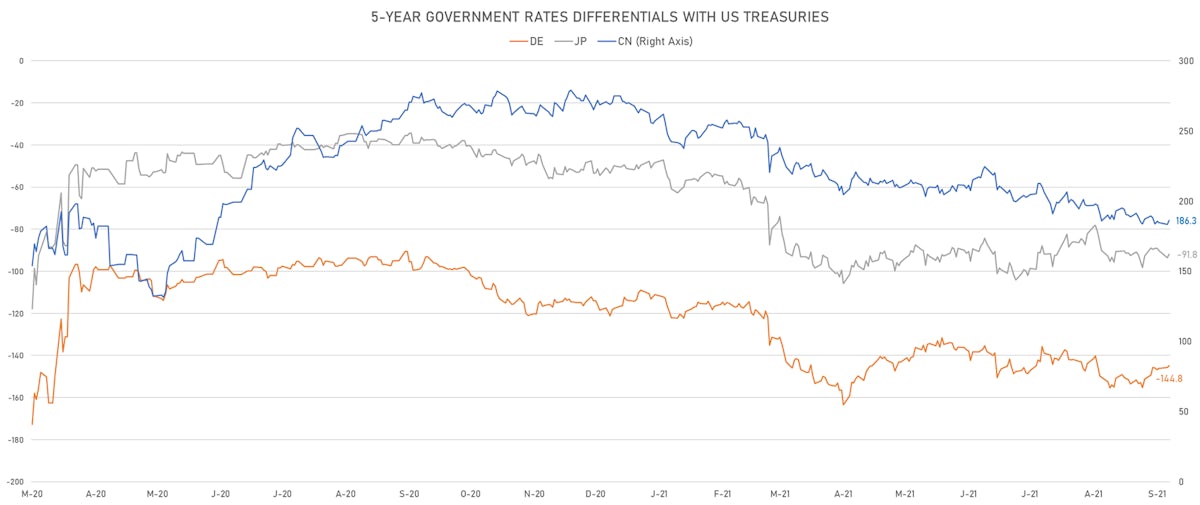

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.9 bp at 144.8 bp (YTD change: +33.7 bp)

- US-JAPAN: -1.8 bp at 91.8 bp (YTD change: +43.5 bp)

- US-CHINA: -3.0 bp at -186.3 bp (YTD change: +70.8 bp)

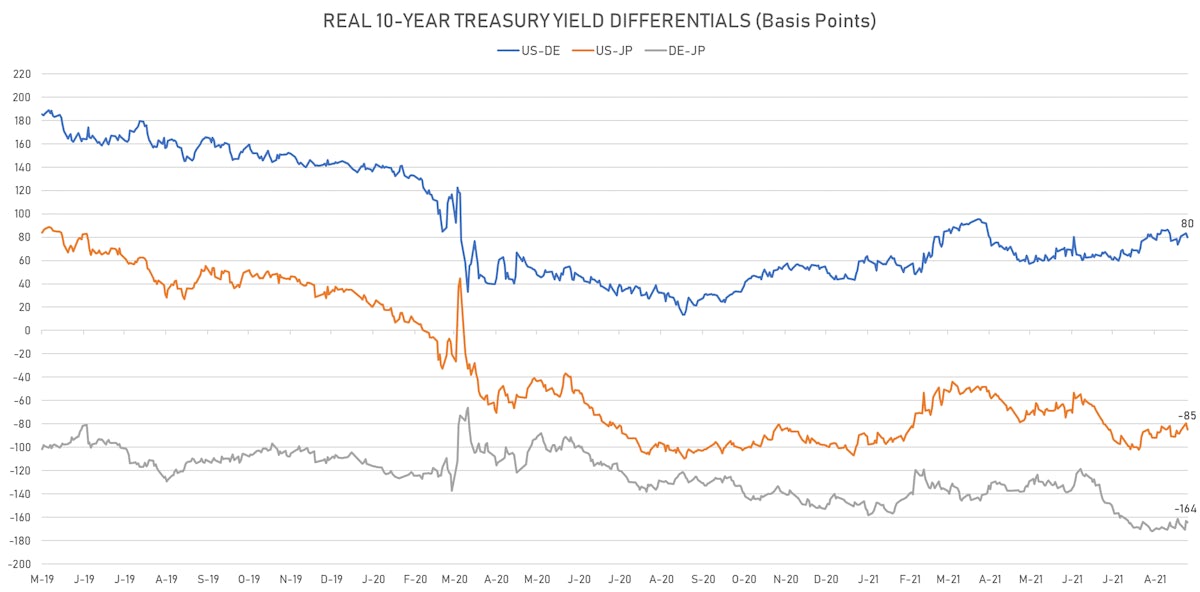

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.8 bp at 79.8 bp (YTD change: +33.7bp)

- US-JAPAN: -5.1 bp at -84.6 bp (YTD change: +16.9bp)

- JAPAN-GERMANY: +1.3 bp at 164.4 bp (YTD change: +16.8bp)

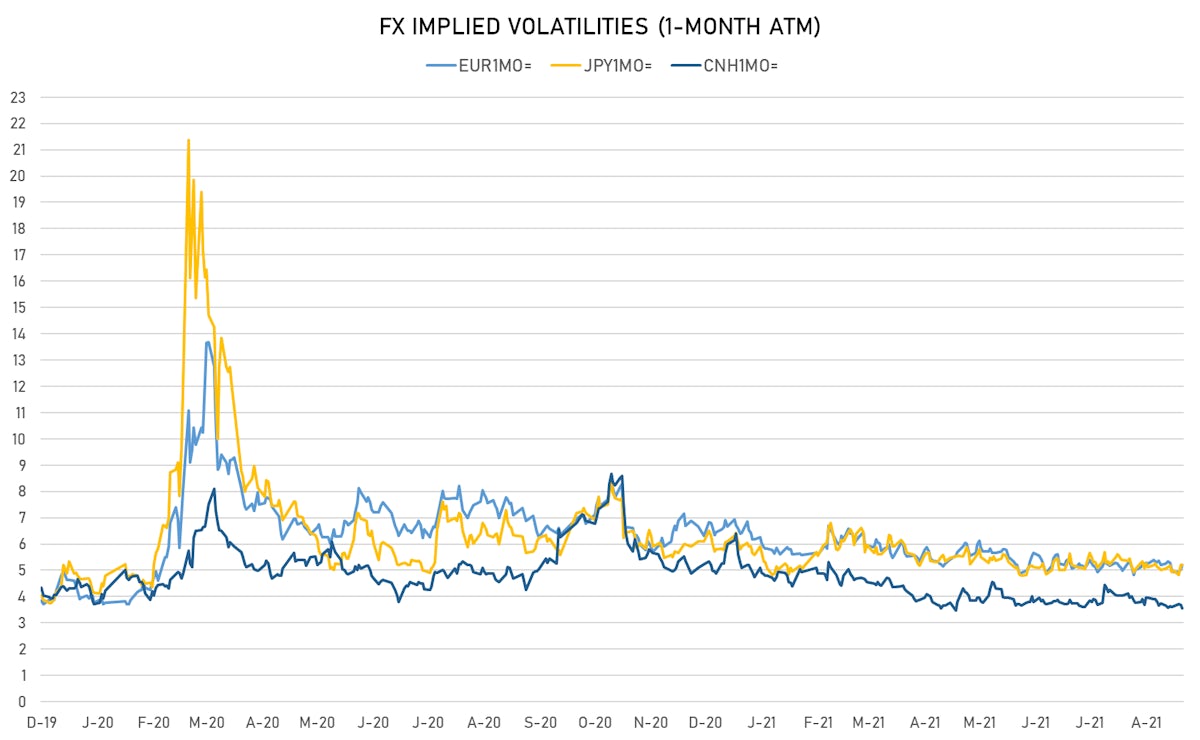

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.73, up 0.07 (YTD: -1.44)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.20, up 0.2 (YTD: -1.5)

- Japanese Yen 1M ATM IV unchanged at 5.20 (YTD: -0.9)

- Offshore Yuan 1M ATM IV currently at 3.56, down -0.1 (YTD: -2.4)

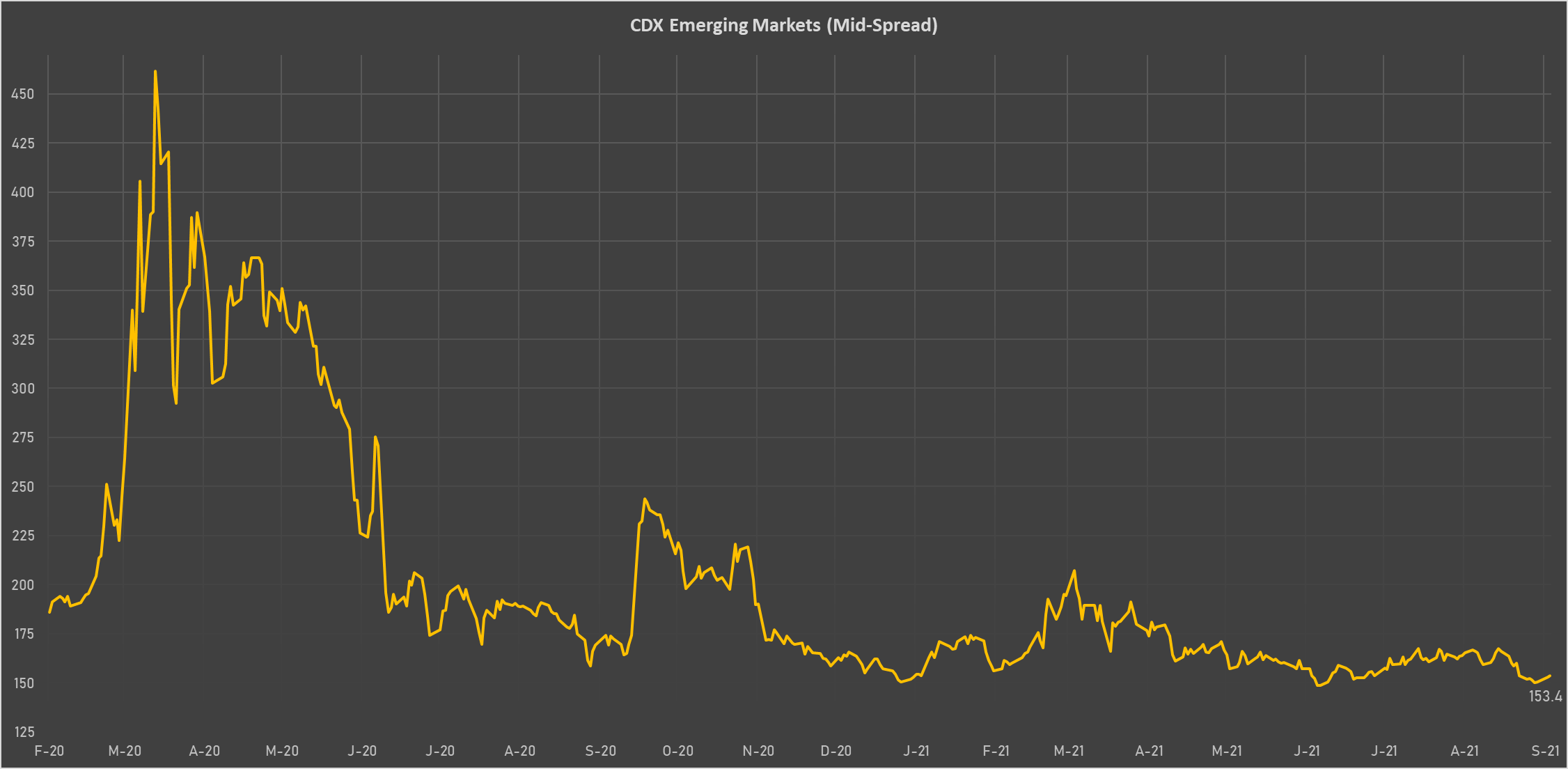

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Brazil (rated BB-): up 4.0 basis points to 175 bp (1Y range: 141-252bp)

- Chile (rated A-): up 0.8 basis points to 63 bp (1Y range: 43-75bp)

- Peru (rated BBB+): up 0.9 basis points to 84 bp (1Y range: 52-101bp)

- Nigeria (rated B): up 3.5 basis points to 333 bp (1Y range: 331-383bp)

- Ethiopia (rated CCC): up 4.0 basis points to 384 bp (1Y range: 382-442bp)

- Lebanon (rated CC): up 32.5 basis points to 3,197 bp (1Y range: 3,179-3,683bp)

- Kenya (rated B+): up 4.0 basis points to 394 bp (1Y range: 392-454bp)

- Senegal (rated ): up 3.5 basis points to 355 bp (1Y range: 353-409bp)

- Ecuador (rated WD): up 1.5 basis points to 157 bp (1Y range: 156-181bp)

- Pakistan (rated B-): up 3.5 basis points to 366 bp (1Y range: 362-512bp)

LARGEST FX MOVES TODAY

- Ghanaian Cedi up 1.3% (YTD: -3.3%)

- Sri Lanka Rupee down 0.8% (YTD: -7.7%)

- Cambodia Riel down 0.8% (YTD: -0.8%)

- Canadian Dollar down 0.9% (YTD: +0.4%)

- Turkish Lira down 0.9% (YTD: -12.2%)

- Cape Verde Escudo down 0.9% (YTD: 0.0%)

- Sierra Leon Leon down 0.9% (YTD: -3.6%)

- Chilean Peso down 1.0% (YTD: -9.8%)

- Haiti Gourde down 1.3% (YTD: -27.0%)

- Tonga Pa'anga down 1.5% (YTD: +1.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 66.7%

- Mozambique metical up 15.4%

- Argentine Peso down 14.2%

- Ethiopian Birr down 15.2%

- Haiti Gourde down 27.0%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%