FX

Very Moderate Moves Across Major Currencies, Dollar Index Edges Up

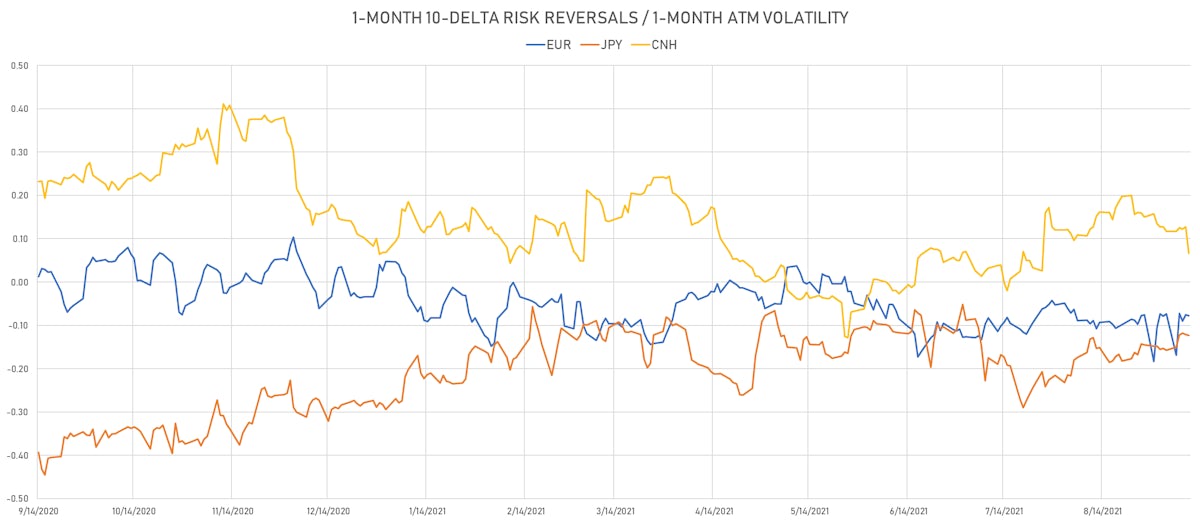

Options markets still project a balanced outlook, with very little skew in implied volatilities; only the yen is showing a modestly negative bias

Published ET

US Dollar Index Intraday This Week | Source: Refinitiv

QUICK SUMMARY

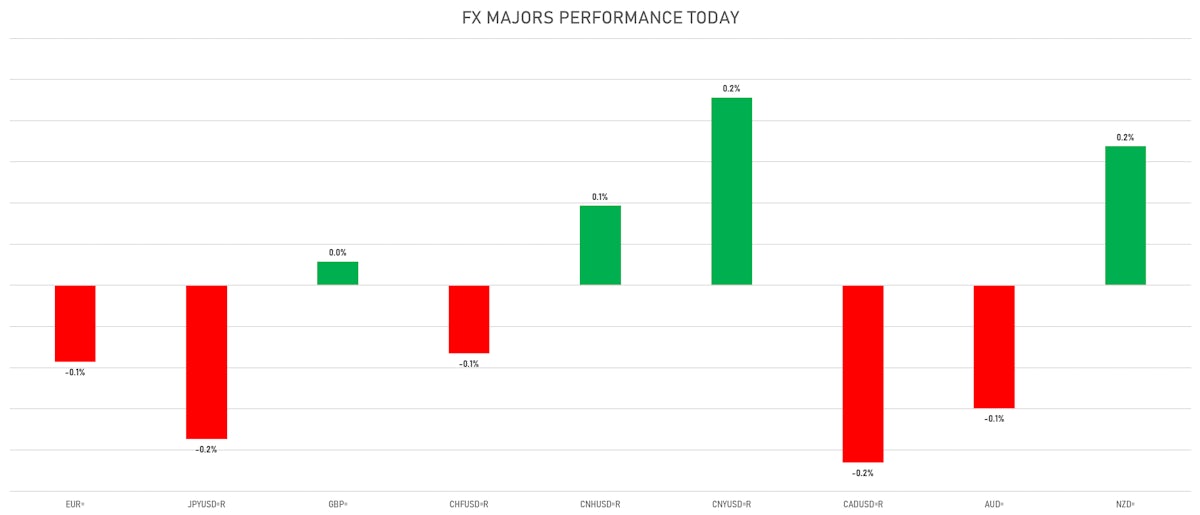

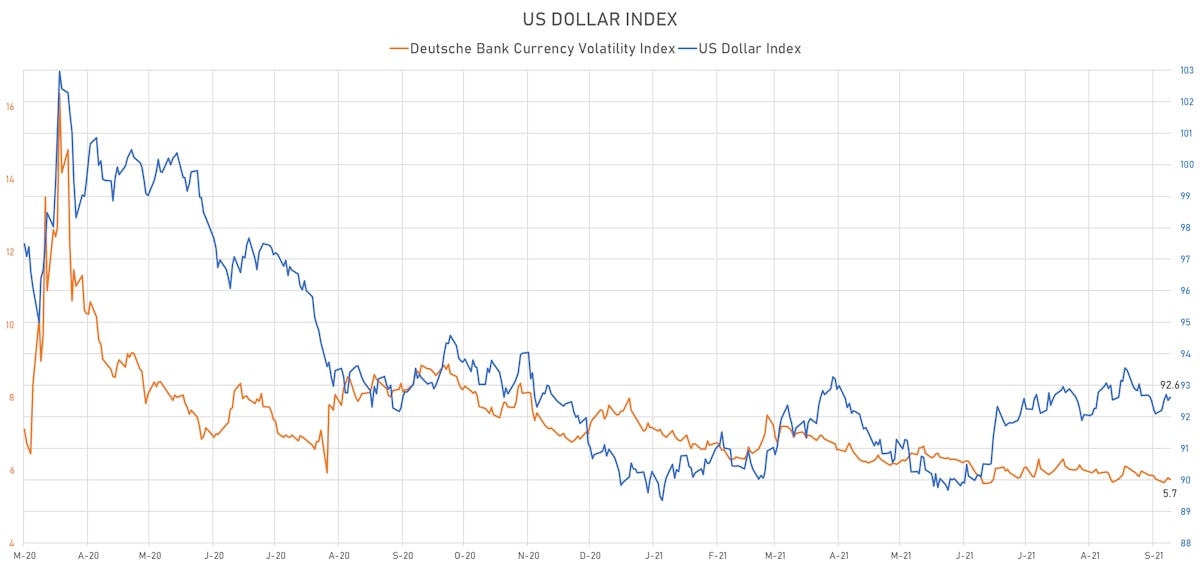

- The US Dollar Index is up 0.09% at 92.62 (YTD: +2.93%)

- Euro down 0.09% at 1.1814 (YTD: -3.3%)

- Yen down 0.19% at 109.93 (YTD: -6.1%)

- Onshore Yuan up 0.23% at 6.4440 (YTD: +1.3%)

- Swiss franc down 0.08% at 0.9176 (YTD: -3.5%)

- Sterling up 0.03% at 1.3839 (YTD: +1.2%)

- Canadian dollar down 0.22% at 1.2689 (YTD: +0.3%)

- Australian dollar down 0.15% at 0.7355 (YTD: -4.4%)

- NZ dollar up 0.17% at 0.7113 (YTD: -1.0%)

WEEKLY IMM MANAGED MONEY POSITIONING

- ALL CURRENCIES: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduced their net short US$ positioning

- Canadian Dollar: increase in net long US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

MACRO DATA RELEASES

- Brazil, Retail Sales, Change Y/Y for Jul 2021 (IBGE, Brazil) at 5.70 % (vs 6.30 % prior), above consensus estimate of 3.45 %

- Canada, Employment, Absolute change for Aug 2021 (CANSIM, Canada) at 90.20 k (vs 94.00 k prior), below consensus estimate of 100.00 k

- Canada, Unemployment, Rate for Aug 2021 (CANSIM, Canada) at 7.10 % (vs 7.50 % prior), below consensus estimate of 7.30 %

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Aug 2021 (PBC) at 2,960.00 Bln CNY (vs 1,060.00 Bln CNY prior), above consensus estimate of 2,750.00 Bln CNY

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Aug 2021 (PBC) at 1,220.00 Bln CNY (vs 1,080.00 Bln CNY prior), below consensus estimate of 1,300.00 Bln CNY

- China (Mainland), Money supply M2, Change Y/Y for Aug 2021 (PBC) at 8.20 % (vs 8.30 % prior), below consensus estimate of 8.40 %

- Czech Republic, CPI, Change Y/Y, Price Index for Aug 2021 (CSU, Czech Rep) at 4.10 % (vs 3.40 % prior), above consensus estimate of 3.40 %

- Denmark, CPI, All Items, Change Y/Y, Price Index for Aug 2021 (statbank.dk) at 1.80 % (vs 1.60 % prior)

- Germany, HICP, Final, Change Y/Y, Price Index for Aug 2021 (Destatis) at 3.40 % (vs 3.40 % prior), in line with consensus estimate

- India, Production, Change Y/Y, Volume Index for Jul 2021 (MOSPI, India) at 11.50 % (vs 13.60 % prior), above consensus estimate of 10.70 %

- Norway, CPI, All Items, Change P/P, Price Index for Aug 2021 (Statistics Norway) at 0.00 % (vs 0.90 % prior), above consensus estimate of -0.30 %

- Norway, CPI, All Items, Change Y/Y for Aug 2021 (Statistics Norway) at 3.40 % (vs 3.00 % prior), above consensus estimate of 3.10 %

- Russia, GDP, Change Y/Y for Q2 2021 (RosStat, Russia) at 10.50 % (vs 10.30 % prior), above consensus estimate of 10.30 %

- Russia, Policy Rates, Central bank key rate for Sep 2021 (Central Bank, Russia) at 6.75 % (vs 6.50 % prior), below consensus estimate of 7.00 %

- United Kingdom, GDP Estimated YY, Change Y/Y for Jul 2021 (ONS, United Kingdom) at 7.50 % (vs 15.20 % prior), below consensus estimate of 8.00 %

- United Kingdom, GDP Estimated, Change M/M for Jul 2021 (ONS, United Kingdom) at 0.10 % (vs 1.00 % prior), below consensus estimate of 0.60 %

- United Kingdom, GDP estimate 3m/3m for Jul 2021 (ONS, United Kingdom) at 3.60 % (vs 4.80 % prior), below consensus estimate of 3.80 %

- United Kingdom, Production, Manufacturing, Change P/P for Jul 2021 (ONS, United Kingdom) at 0.00 % (vs 0.20 % prior), below consensus estimate of 0.10 %

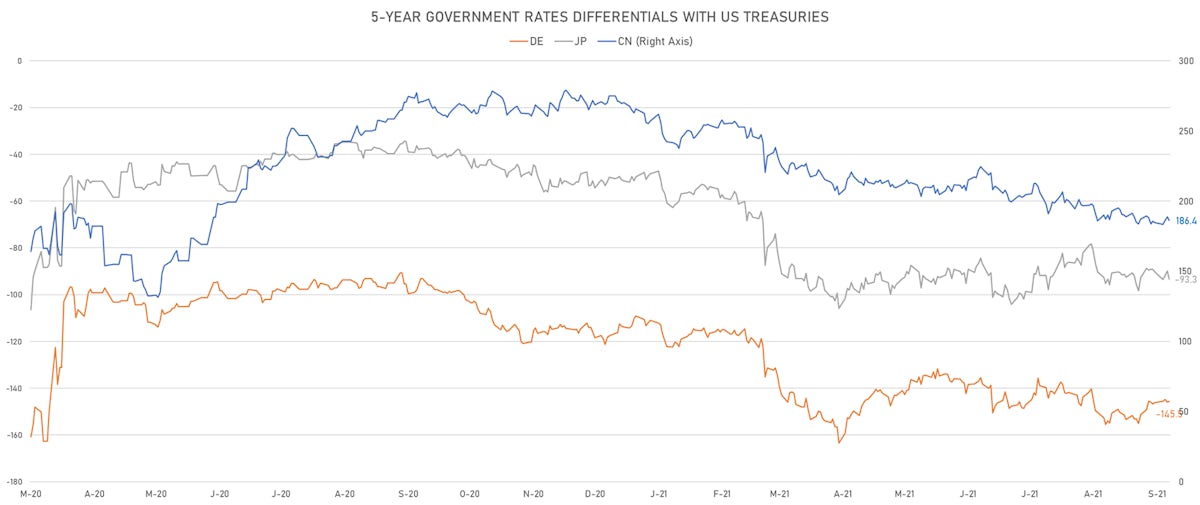

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.6 bp at 145.5 bp (YTD change: +34.4 bp)

- US-JAPAN: +3.3 bp at 93.3 bp (YTD change: +45.0 bp)

- US-CHINA: +2.3 bp at -186.4 bp (YTD change: +70.7 bp)

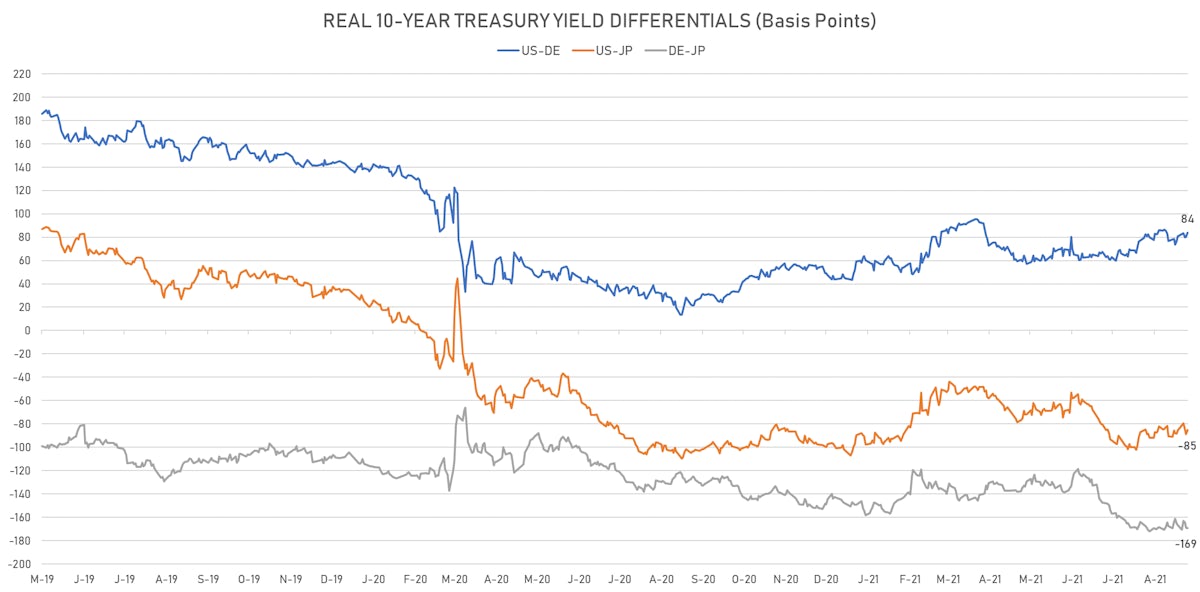

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.8 bp at 83.9 bp (YTD change: +37.8bp)

- US-JAPAN: +3.5 bp at -85.3 bp (YTD change: +16.2bp)

- JAPAN-GERMANY: +0.3 bp at 169.2 bp (YTD change: +21.6bp)

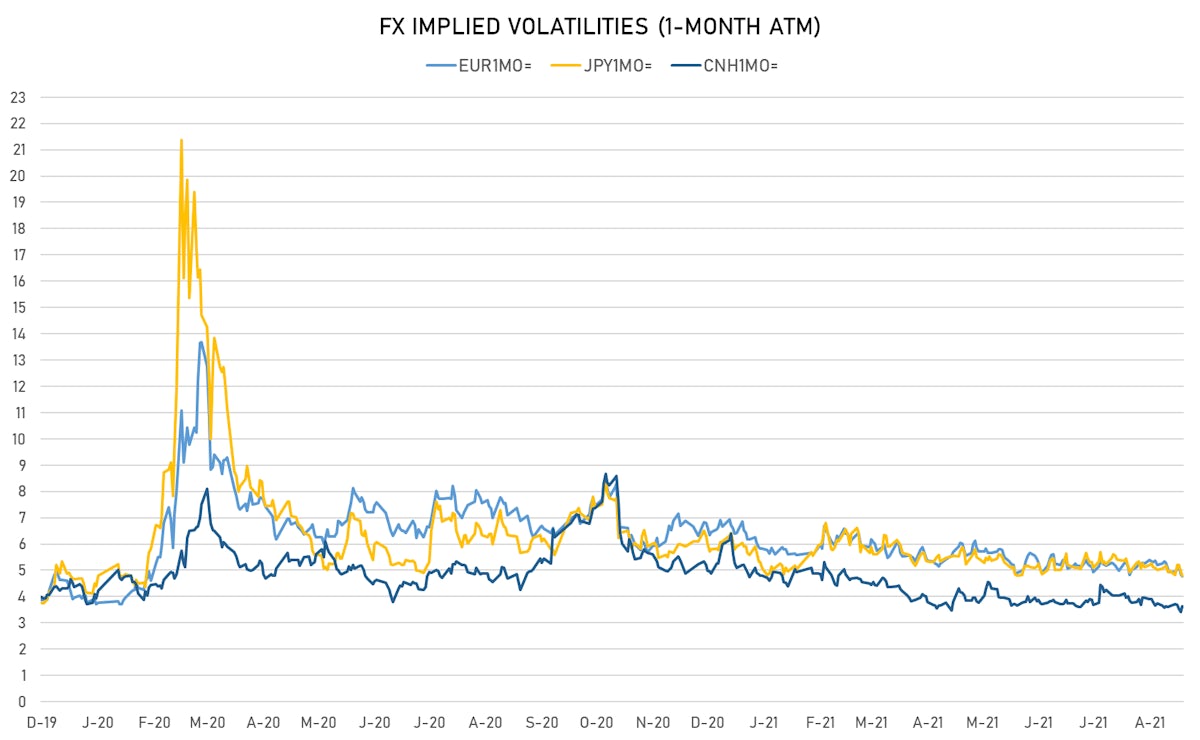

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.74, down -0.05 (YTD: -1.43)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.78, down -0.1 (YTD: -1.9)

- Japanese Yen 1M ATM IV currently at 4.80, down -0.2 (YTD: -1.3)

- Offshore Yuan 1M ATM IV currently at 3.64, up 0.2 (YTD: -2.3)

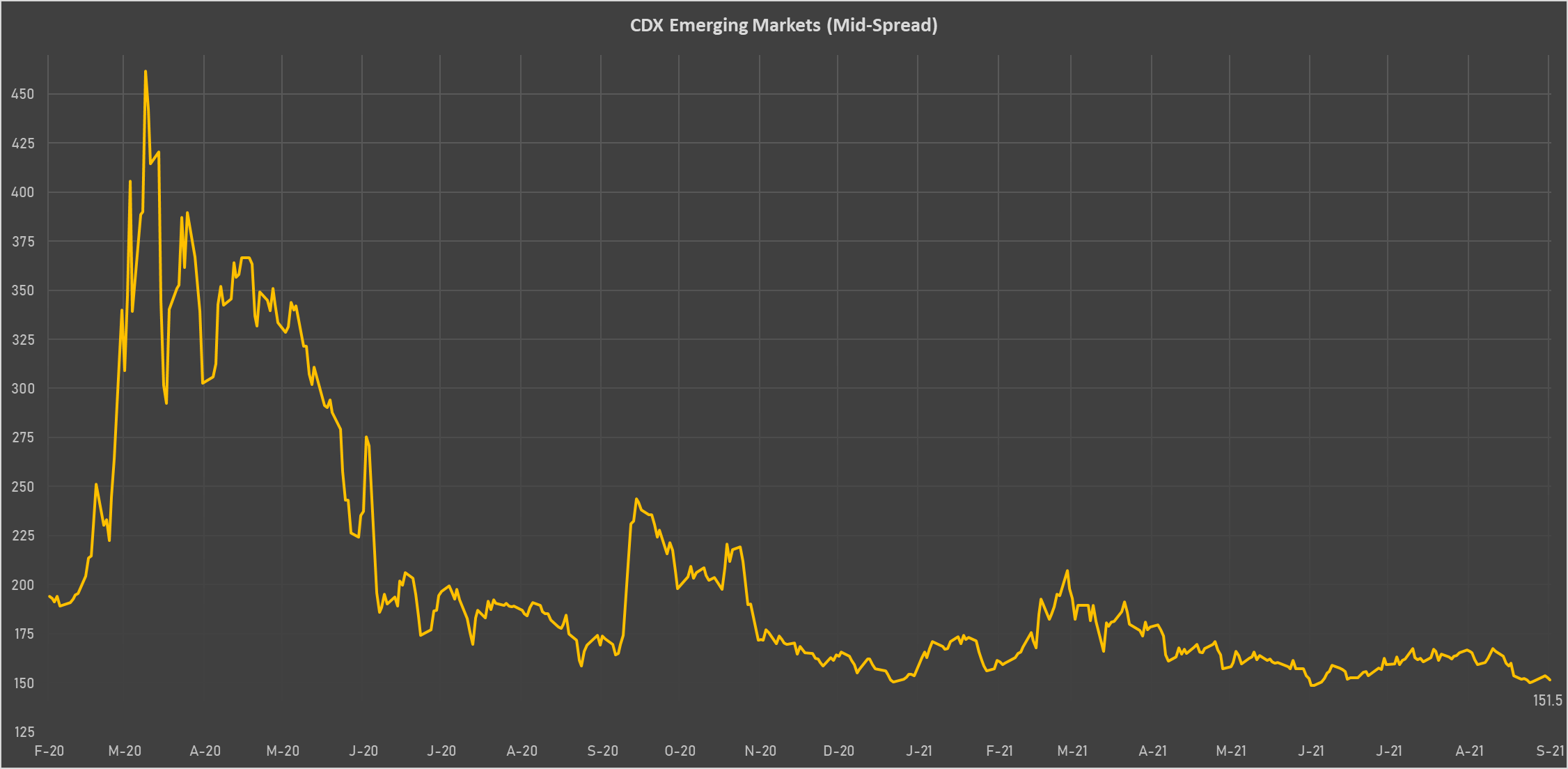

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 22.6 basis points to 1,860 bp (1Y range: 1,049-1,971bp)

- Ethiopia (rated CCC): down 2.5 basis points to 385 bp (1Y range: 382-442bp)

- Bahrain (rated B+): down 2.0 basis points to 240 bp (1Y range: 159-330bp)

- Indonesia (rated BBB): down 0.7 basis points to 66 bp (1Y range: 66-118bp)

- Colombia (rated BB+): down 1.5 basis points to 131 bp (1Y range: 83-164bp)

- South Africa (rated BB-): down 2.3 basis points to 180 bp (1Y range: 178-328bp)

- Mexico (rated BBB-): down 1.2 basis points to 83 bp (1Y range: 79-164bp)

- Vietnam (rated BB): down 1.7 basis points to 91 bp (1Y range: 90-137bp)

- Russia (rated BBB): down 1.5 basis points to 75 bp (1Y range: 72-129bp)

- Brazil (rated BB-): down 4.3 basis points to 176 bp (1Y range: 141-252bp)

LARGEST FX MOVES TODAY

- Afghani up 2.7% (YTD: -8.9%)

- Brazilian Real up 2.4% (YTD: -1.0%)

- Haiti Gourde up 1.7% (YTD: -25.2%)

- Tonga Pa'Anga up 1.2% (YTD: +1.2%)

- Moldovan Leu up 0.7% (YTD: -2.2%)

- Russian Rouble up 0.7% (YTD: +1.3%)

- Chilean Peso down 0.6% (YTD: -9.8%)

- Samoa Tala down 0.7% (YTD: -1.4%)

- Colombian Peso down 0.7% (YTD: -10.6%)

- Qatari Riyal down 1.2% (YTD: -1.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 47.7%

- Mozambique metical up 17.0%

- Ethiopian Birr down 15.2%

- Myanmar Kyat down 24.0%

- Haiti Gourde down 25.2%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%