FX

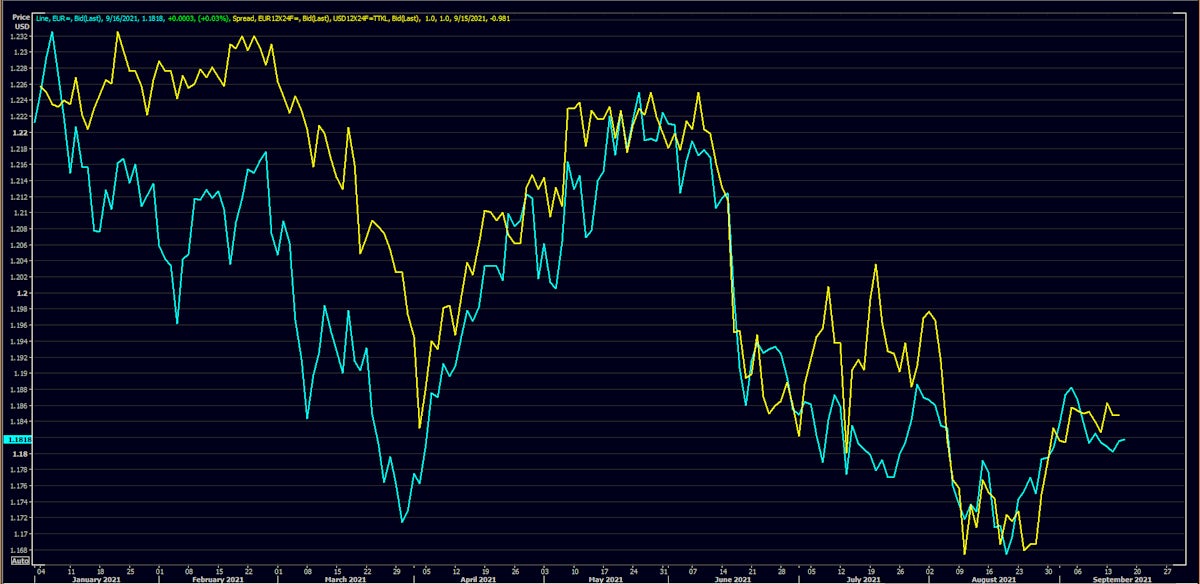

Euro Rises With Positive Move In Real Rates Differentials, US Dollar Index Falls

The Japanese Yen is rising against the US Dollar mostly on technical factors, as the close correlation with rates differentials has dropped significantly since the start of September

Published ET

JPY spot price vs US-JP Forward Rates Differential | Source: Refinitiv

QUICK SUMMARY

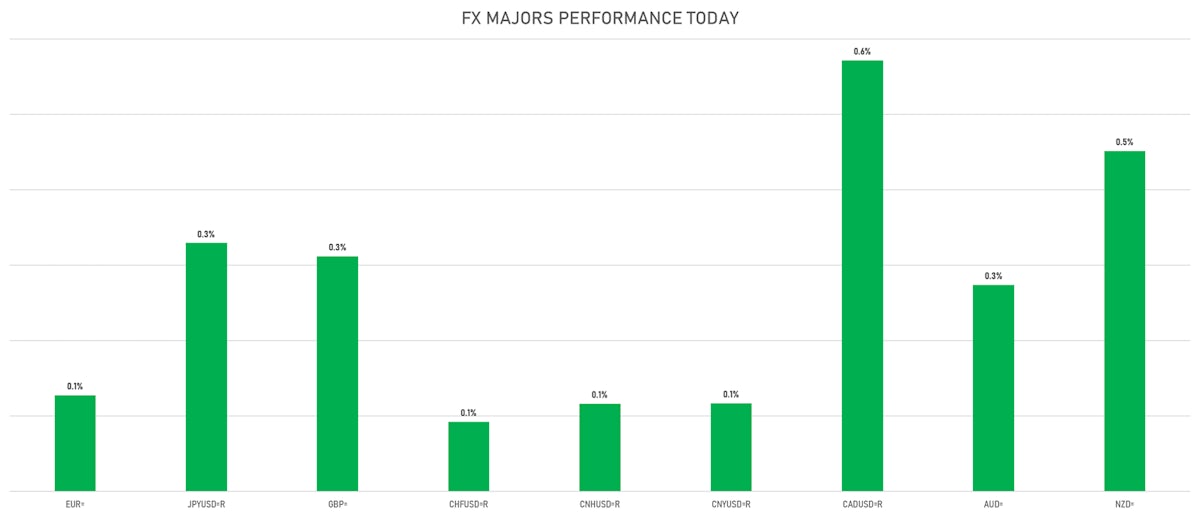

- The US Dollar Index is down -0.22% at 92.47 (YTD: +2.76%)

- Euro up 0.13% at 1.1817 (YTD: -3.2%)

- Yen up 0.33% at 109.33 (YTD: -5.5%)

- Onshore Yuan up 0.12% at 6.4320 (YTD: +1.5%)

- Swiss franc up 0.09% at 0.9197 (YTD: -3.7%)

- Sterling up 0.31% at 1.3849 (YTD: +1.3%)

- Canadian dollar up 0.57% at 1.2623 (YTD: +0.9%)

- Australian dollar up 0.27% at 0.7338 (YTD: -4.6%)

- NZ dollar up 0.45% at 0.7128 (YTD: -0.8%)

MACRO DATA RELEASES

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Aug 2021 (CANSIM, Canada) at 0.20 % (vs 0.60 % prior)

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Aug 2021 (CANSIM, Canada) at 3.50 % (vs 3.30 % prior)

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Aug 2021 (NBS, China) at 8.90 % (vs 10.30 % prior), below consensus estimate of 9.00 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Aug 2021 (NBS, China) at 2.50 % (vs 8.50 % prior), below consensus estimate of 7.00 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Aug 2021 (ECB) at 1,009.38 Bln EUR (vs 888.49 Bln EUR prior)

- Finland, Official reserve assets, Current Prices for Aug 2021 (Bank of Finland) at 14,180.00 Mln EUR (vs 11,415.00 Mln EUR prior)

- France, HICP, Change Y/Y, Price Index for Aug 2021 (INSEE, France) at 2.40 % (vs 2.40 % prior), in line with consensus estimate

- France, HICP, Final, Change P/P, Price Index for Aug 2021 (INSEE, France) at 0.70 % (vs 0.70 % prior), in line with consensus estimate

- Indonesia, Trade Balance, Current Prices for Aug 2021 (Statistics Indonesia) at 4.74 Bln USD (vs 2.59 Bln USD prior), above consensus estimate of 2.36 Bln USD

- Italy, HICP, Final, Change P/P, Price Index for Aug 2021 (ISTAT, Italy) at 0.20 % (vs 0.30 % prior), below consensus estimate of 0.30 %

- Italy, HICP, Final, Change Y/Y, Price Index for Aug 2021 (ISTAT, Italy) at 2.50 % (vs 2.60 % prior), below consensus estimate of 2.60 %

- Japan, Exports, Change Y/Y for Aug 2021 (MoF, Japan) at 26.20 % (vs 37.00 % prior), below consensus estimate of 34.00 %

- Japan, Imports, Change Y/Y for Aug 2021 (MoF, Japan) at 44.70 % (vs 28.50 % prior), above consensus estimate of 40.00 %

- Japan, Trade Balance, Current Prices for Aug 2021 (MoF, Japan) at -635.40 Bln JPY (vs 441.00 Bln JPY prior), below consensus estimate of -47.70 Bln JPY

- New Zealand, GDP, Change P/P for Q2 2021 (Statistics, NZ) at 2.60 % (vs 1.40 % prior), above consensus estimate of 1.40 %

- New Zealand, GDP, Change P/P for Q2 2021 (Statistics, NZ) at 2.80 % (vs 1.60 % prior), above consensus estimate of 1.30 %

- Poland, CPI, Change P/P, Price Index for Aug 2021 (CSO, Poland) at 0.30 % (vs 0.20 % prior)

- Poland, CPI, Change Y/Y, Price Index for Aug 2021 (CSO, Poland) at 5.50 % (vs 5.40 % prior)

- United Kingdom, CPI, All items (CPI), Change Y/Y for Aug 2021 (ONS, United Kingdom) at 3.20 % (vs 2.00 % prior), above consensus estimate of 2.90 %

- United States, Production, Change P/P for Aug 2021 (FED, U.S.) at 0.40 % (vs 0.90 % prior), in line with consensus estimate

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.3 bp at 143.0 bp (YTD change: +31.9 bp)

- US-JAPAN: +2.1 bp at 91.0 bp (YTD change: +42.7 bp)

- US-CHINA: +1.3 bp at -191.2 bp (YTD change: +65.9 bp)

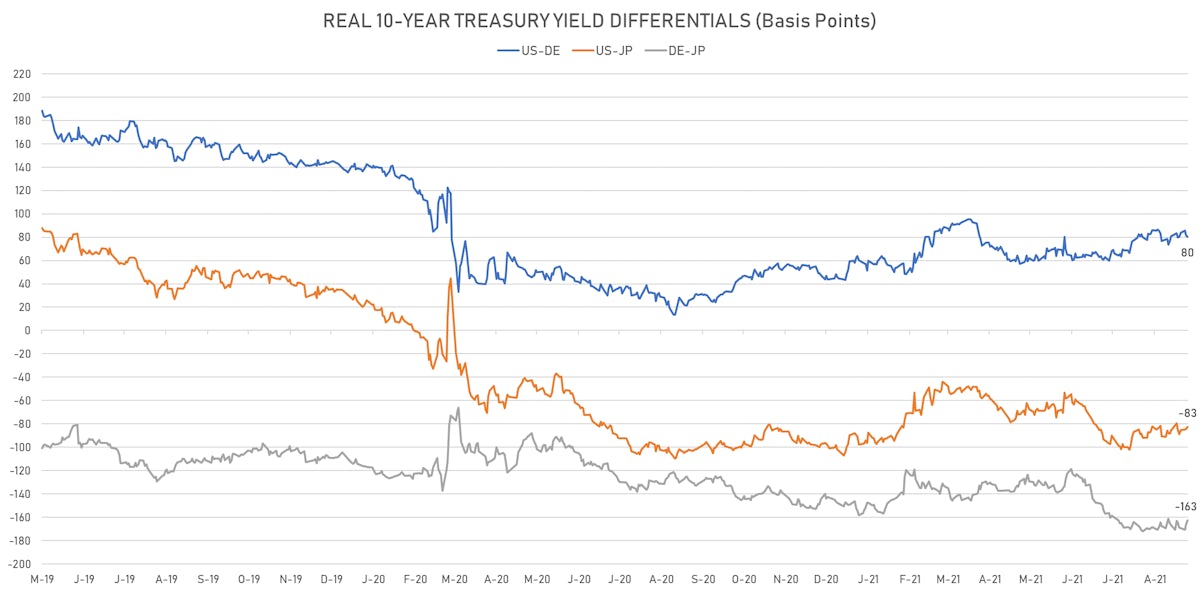

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.4 bp at 80.2 bp (YTD change: +34.1bp)

- US-JAPAN: +1.9 bp at -82.6 bp (YTD change: +18.9bp)

- JAPAN-GERMANY: -3.3 bp at 162.8 bp (YTD change: +15.2bp)

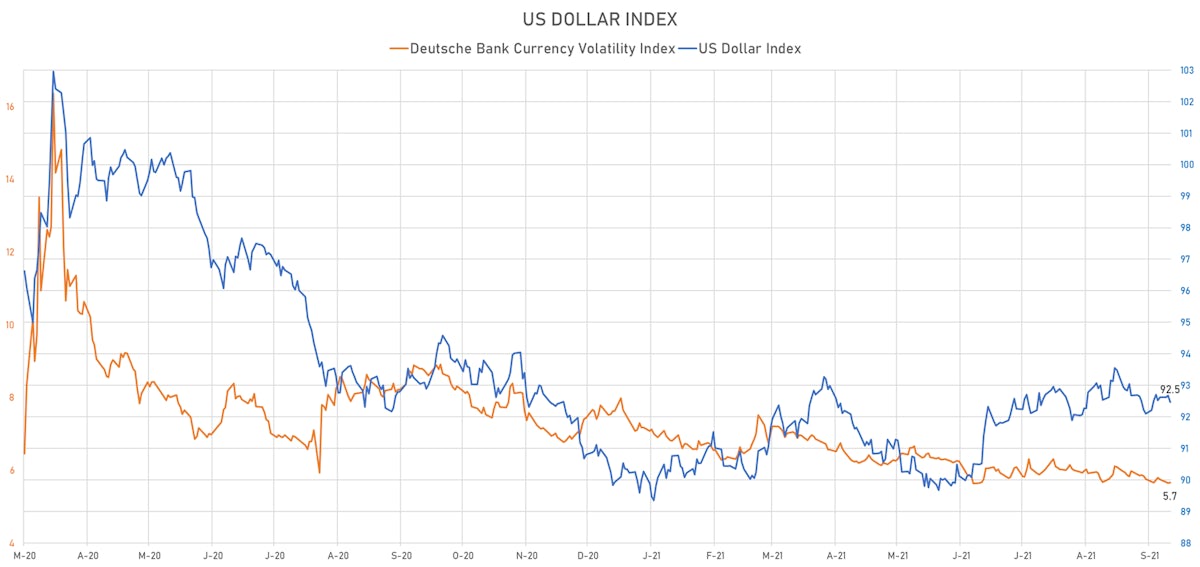

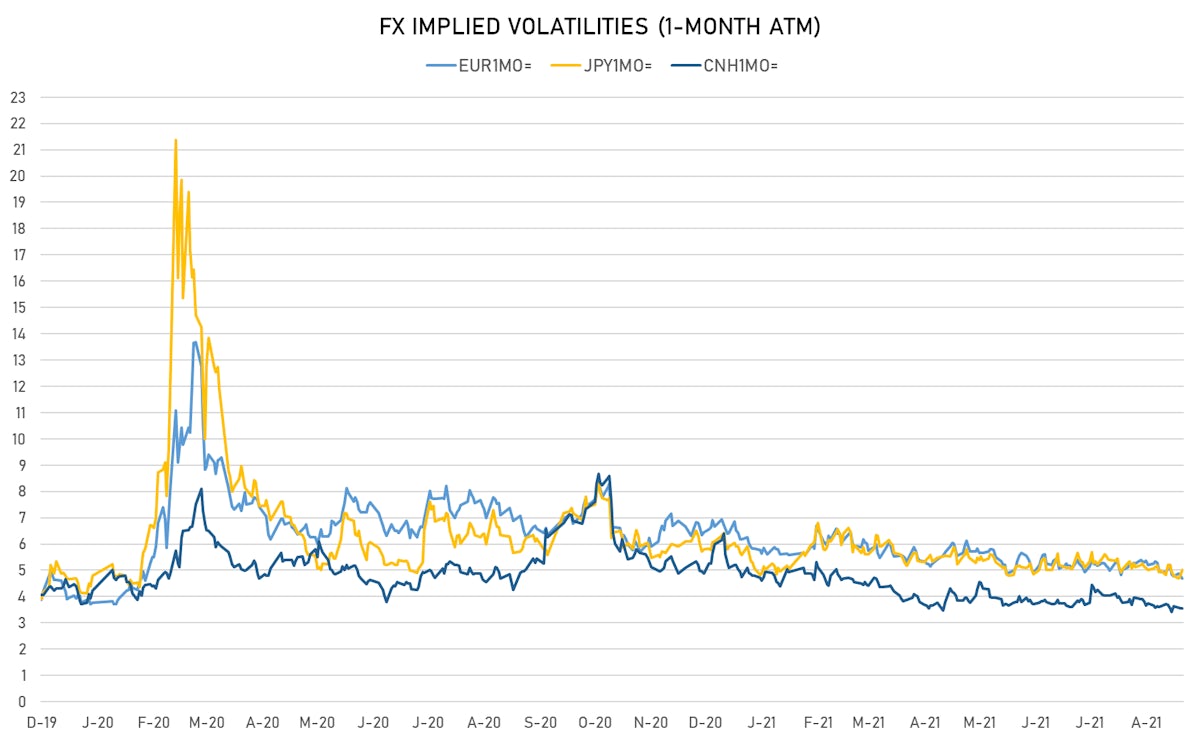

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.66, up 0.01 (YTD: -1.51)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.68, down -0.1 (YTD: -2.0)

- Japanese Yen 1M ATM IV currently at 5.00, up 0.2 (YTD: -1.1)

- Offshore Yuan 1M ATM IV unchanged at 3.55 (YTD: -2.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Indonesia (rated BBB): up 0.5 basis points to 67 bp (1Y range: 66-118bp)

- Egypt (rated B+): up 2.4 basis points to 348 bp (1Y range: 283-422bp)

- Bahrain (rated B+): down 2.2 basis points to 239 bp (1Y range: 159-330bp)

- Chile (rated A-): down 0.6 basis points to 66 bp (1Y range: 43-75bp)

- Brazil (rated BB-): down 1.9 basis points to 177 bp (1Y range: 141-252bp)

- Colombia (rated BB+): down 1.7 basis points to 132 bp (1Y range: 83-164bp)

- Russia (rated BBB): down 1.1 basis points to 75 bp (1Y range: 72-129bp)

- Peru (rated BBB+): down 1.3 basis points to 83 bp (1Y range: 52-101bp)

- Mexico (rated BBB-): down 1.9 basis points to 81 bp (1Y range: 79-164bp)

- Oman (rated BB-): down 6.7 basis points to 237 bp (1Y range: 223-452bp)

LARGEST FX MOVES TODAY

- Myanmar Kyat up 2.0% (YTD: -30.7%)

- Afghani up 1.0% (YTD: -9.4%)

- St Helena Pound up 0.6% (YTD: +1.3%)

- Russian Rouble down 0.5% (YTD: +2.6%)

- Australian Dollar down 0.7% (YTD: -4.6%)

- Angolan Kwanza down 0.8% (YTD: +3.9%)

- Ghanaian Cedi down 0.8% (YTD: -2.3%)

- Tonga Pa'anga down 0.9% (YTD: +1.8%)

- South Africa Rand down 1.3% (YTD: +2.0%)

- Venezuela Bolivar down 4.0% (YTD: -73.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.9%

- Mozambique metical up 15.4%

- Ethiopian Birr down 15.2%

- Haiti Gourde down 25.4%

- Myanmar Kyat down 30.7%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%