FX

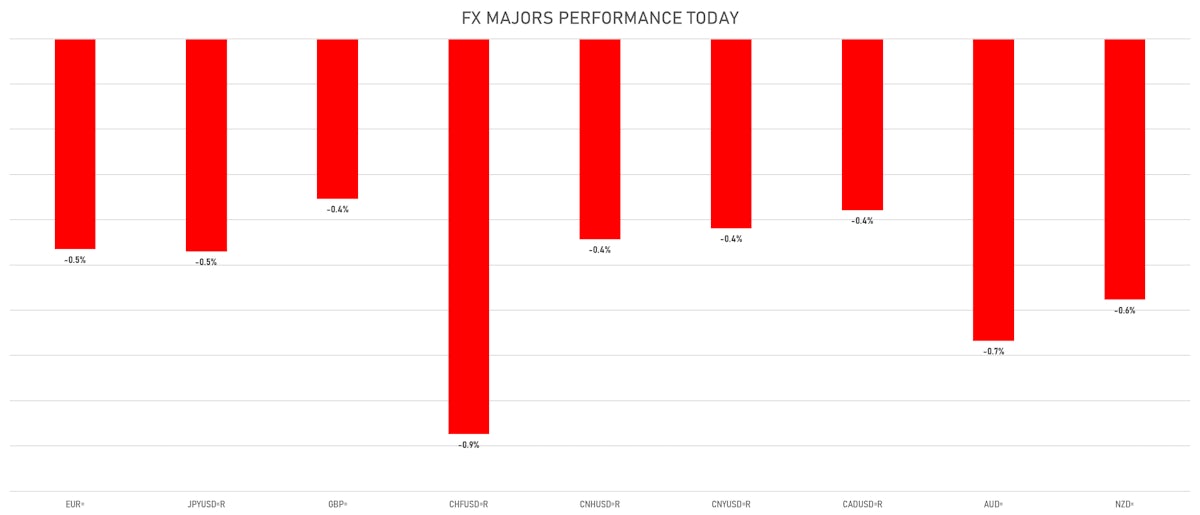

Broad Rise For The US Dollar Against Major Currencies, Boosted By Positive Macro Data

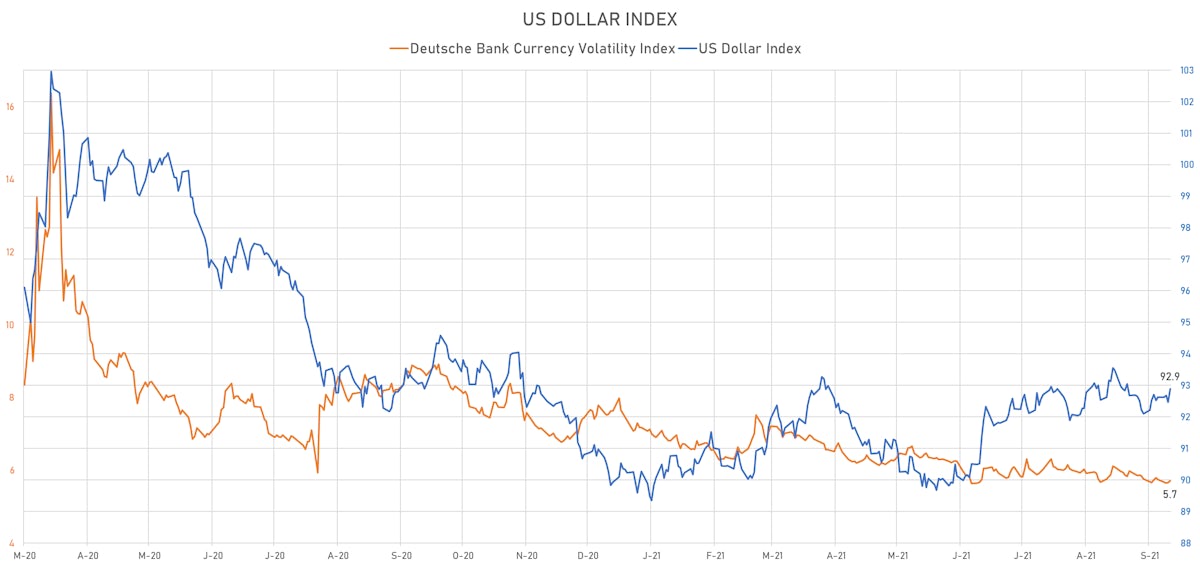

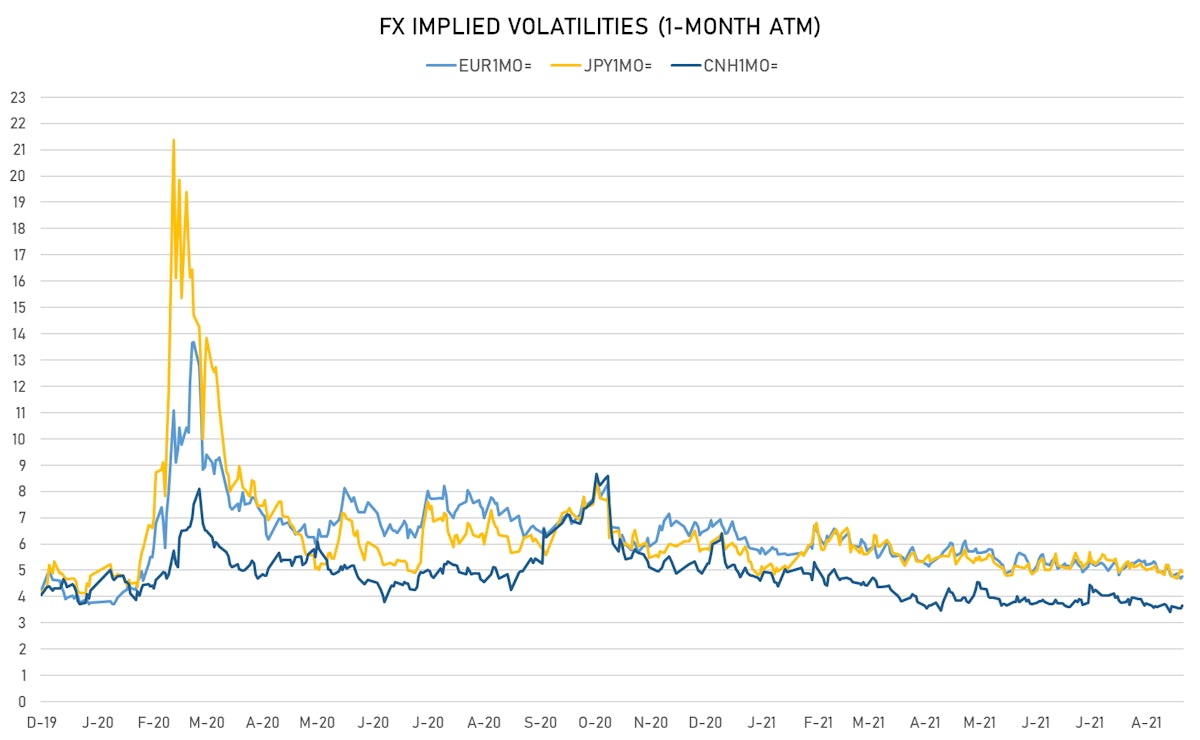

With US rates remaining rangebound and German rates likely to rise with inflation expectations, FX speculators aren't pushing strongly either way, showing low implied volatilities and little skew in option prices

Published ET

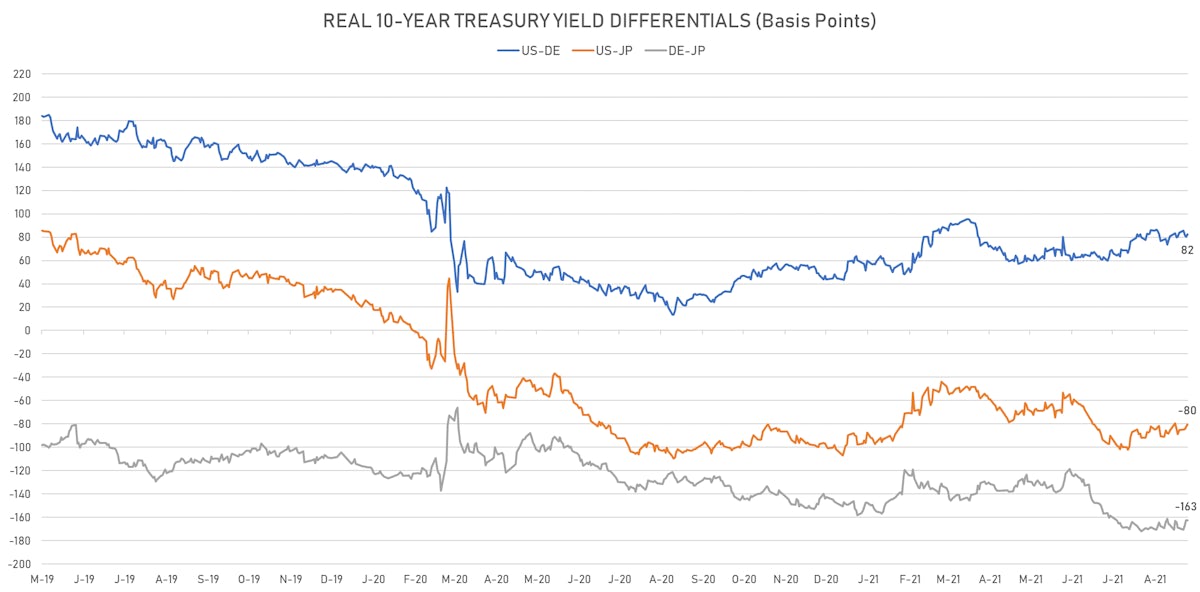

US DE JP 10Y Real Yields Differentials | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.45% at 92.88 (YTD: +3.22%)

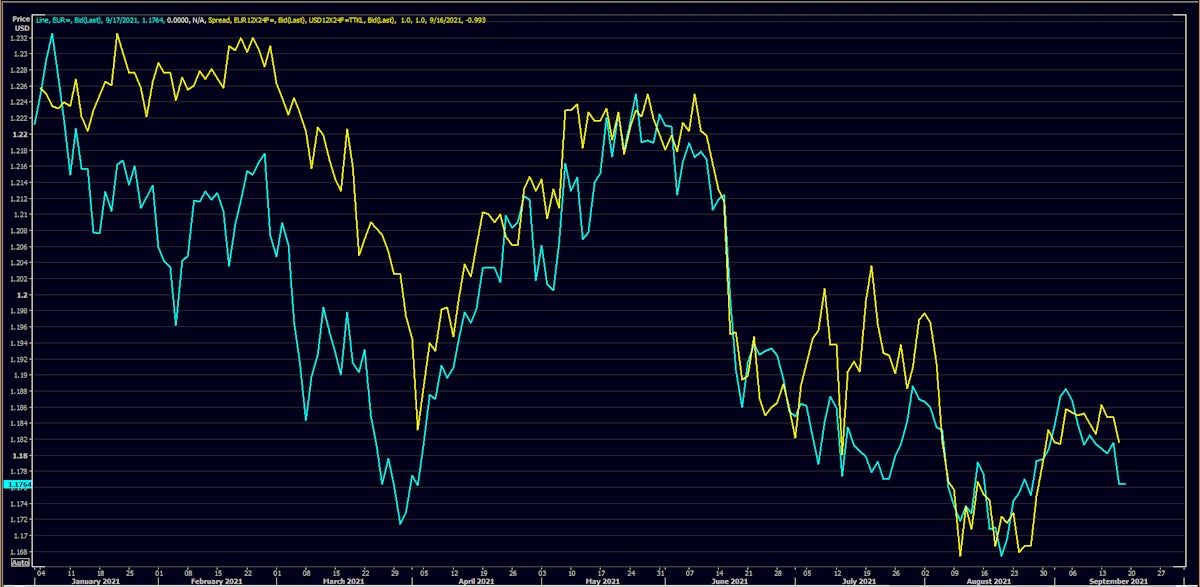

- Euro down 0.47% at 1.1760 (YTD: -3.7%)

- Yen down 0.47% at 109.89 (YTD: -6.0%)

- Onshore Yuan down 0.42% at 6.4598 (YTD: +1.1%)

- Swiss franc down 0.87% at 0.9280 (YTD: -4.6%)

- Sterling down 0.35% at 1.3788 (YTD: +0.8%)

- Canadian dollar down 0.38% at 1.2685 (YTD: +0.4%)

- Australian dollar down 0.67% at 0.7285 (YTD: -5.3%)

- NZ dollar down 0.58% at 0.7062 (YTD: -1.7%)

MACRO DATA RELEASES

- Australia, Activity, Participation Rate for Aug 2021 (AU Bureau of Stat) at 65.20 % (vs 66.00 % prior), below consensus estimate of 65.70 %

- Australia, Employment, Absolute change for Aug 2021 (AU Bureau of Stat) at -146.30 k (vs 2.20 k prior), below consensus estimate of -90.00 k

- Australia, Unemployment, Rate for Aug 2021 (AU Bureau of Stat) at 4.50 % (vs 4.60 % prior), below consensus estimate of 4.90 %

- Canada, Housing Starts, All areas for Aug 2021 (CMHC, Canada) at 260.20 k (vs 272.20 k prior), below consensus estimate of 268.00 k

- Canada, Wholesale Trade, Sales, all trade groups, Change P/P for Jul 2021 (CANSIM, Canada) at -2.10 % (vs -0.80 % prior), below consensus estimate of -2.00 %

- Czech Republic, Producer Prices, Change P/P, Price Index for Aug 2021 (CSU, Czech Rep) at 1.20 % (vs 1.60 % prior), above consensus estimate of 0.40 %

- Czech Republic, Producer Prices, Change Y/Y, Price Index for Aug 2021 (CSU, Czech Rep) at 9.30 % (vs 7.80 % prior), above consensus estimate of 8.60 %

- Egypt, Policy Rates, Overnight Deposit Rate for 20 Sep (Central Bank, Egypt) at 8.25 % (vs 8.25 % prior), in line with consensus estimate

- Egypt, Policy Rates, Overnight Lending Rate for 20 Sep (Central Bank, Egypt) at 9.25 % (vs 9.25 % prior), in line with consensus estimate

- New Zealand, PMI, Manufacturing Sector, Business NZ PMI for Aug 2021 (D.5824) at 40.10 (vs 62.60 prior)

- Poland, Core CPI, Excluding food and energy prices, Change Y/Y, Price Index for Aug 2021 (Central Bank, Poland) at 3.90 % (vs 3.70 % prior), in line with consensus estimate

- United States, Jobless Claims, National, Continued for W 04 Sep (U.S. Dept. of Labor) at 2.67 Mln (vs 2.78 Mln prior), below consensus estimate of 2.79 Mln

- United States, Jobless Claims, National, Initial for W 11 Sep (U.S. Dept. of Labor) at 332.00 k (vs 310.00 k prior), above consensus estimate of 330.00 k

- United States, Overall, Total business inventories, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.50 % (vs 0.80 % prior), in line with consensus estimate

- United States, Philadelphia Fed, General business activity for Sep 2021 (FED, Philadelphia) at 30.70 (vs 19.40 prior), above consensus estimate of 18.80

- United States, Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for Aug 2021 (U.S. Census Bureau) at 2.50 % (vs -1.00 % prior), above consensus estimate of -0.10 %

- United States, Retail Sales, Total including food services, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.70 % (vs -1.10 % prior), above consensus estimate of -0.80 %

- United States, Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.80 % (vs -0.40 % prior), above consensus estimate of -0.10 %

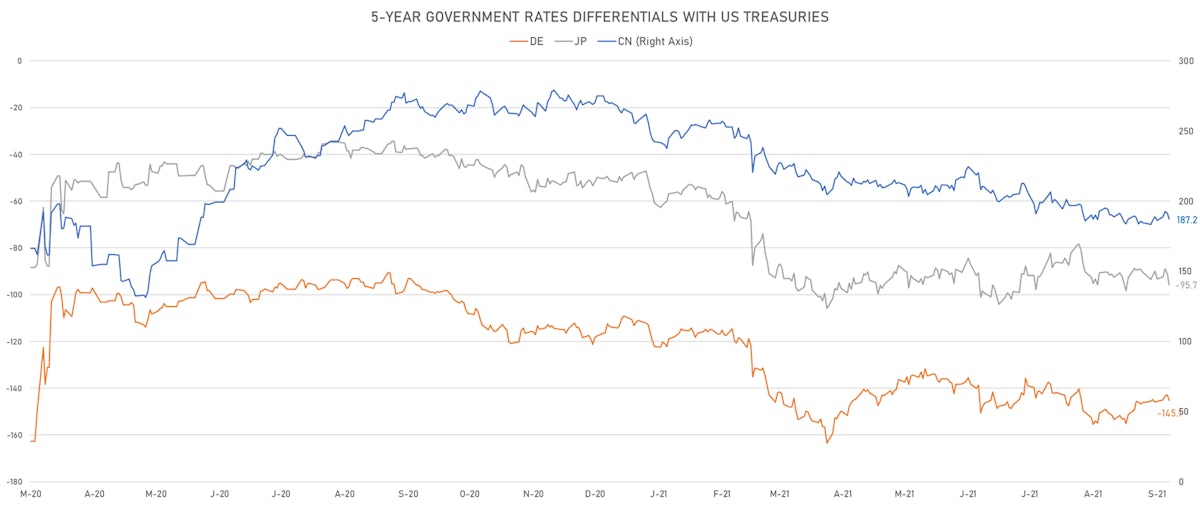

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.1 bp at 145.1 bp (YTD change: +34.1 bp)

- US-JAPAN: +4.8 bp at 95.7 bp (YTD change: +47.5 bp)

- US-CHINA: +4.1 bp at -187.2 bp (YTD change: +70.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.2 bp at 82.4 bp (YTD change: +36.3bp)

- US-JAPAN: +2.3 bp at -80.3 bp (YTD change: +21.2bp)

- JAPAN-GERMANY: -0.1 bp at 162.7 bp (YTD change: +15.1bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 5.71, up 0.05 (YTD: -1.46)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.78, up 0.1 (YTD: -1.9)

- Japanese Yen 1M ATM IV currently at 4.93, down -0.1 (YTD: -1.2)

- Offshore Yuan 1M ATM IV currently at 3.65, up 0.1 (YTD: -2.3)

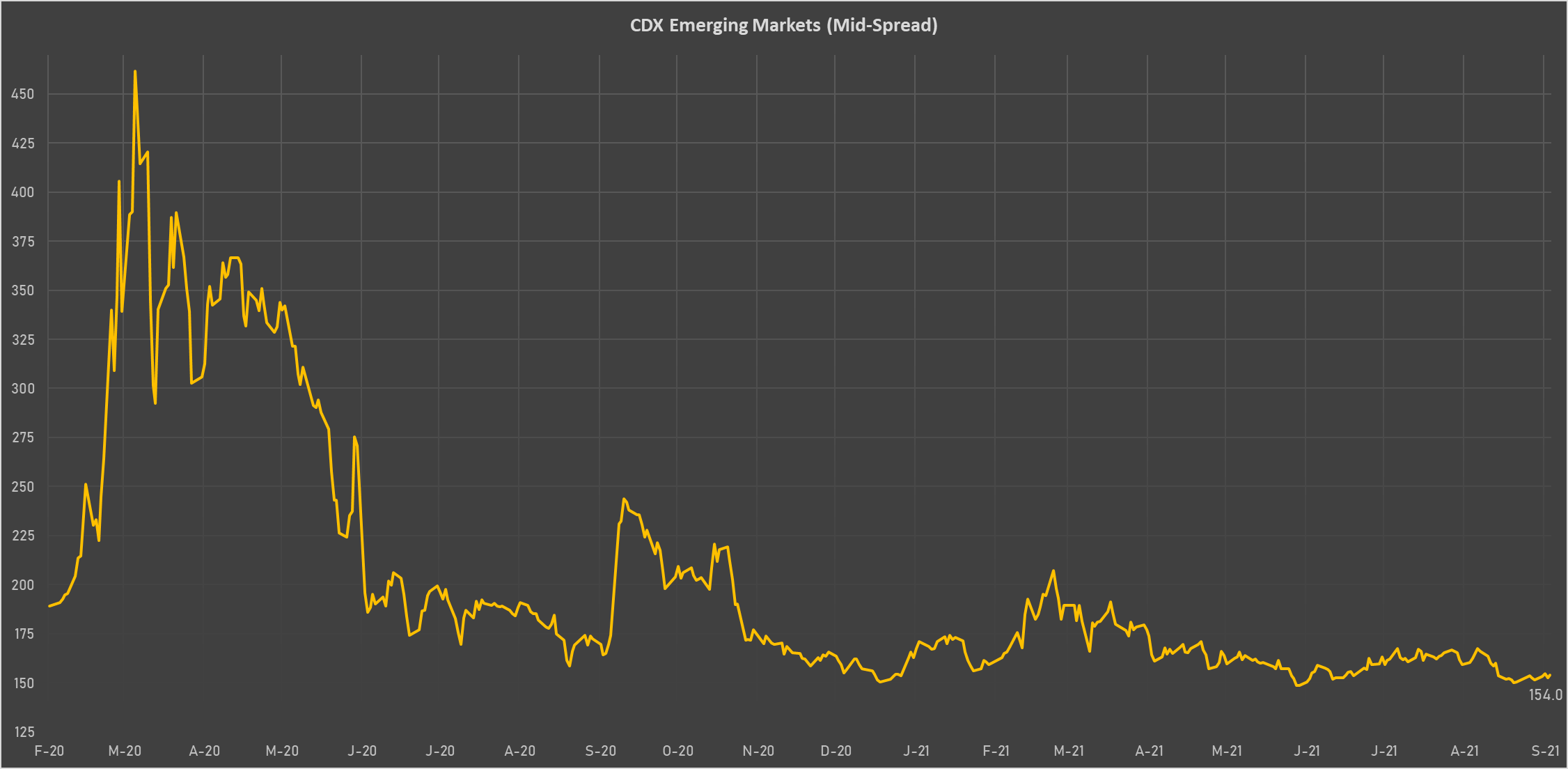

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): up 0.9 basis points to 75 bp (1Y range: 72-129bp)

- South Africa (rated BB-): up 1.8 basis points to 186 bp (1Y range: 178-328bp)

- Turkey (rated BB-): up 3.5 basis points to 376 bp (1Y range: 282-570bp)

- Peru (rated BBB+): up 0.7 basis points to 84 bp (1Y range: 52-101bp)

- Bahrain (rated B+): up 1.4 basis points to 240 bp (1Y range: 159-330bp)

- Morocco (rated BB+): up 0.5 basis points to 91 bp (1Y range: 84-127bp)

- Vietnam (rated BB): up 0.5 basis points to 90 bp (1Y range: 89-137bp)

- Brazil (rated BB-): up 0.8 basis points to 178 bp (1Y range: 141-252bp)

- Mexico (rated BBB-): up 0.3 basis points to 82 bp (1Y range: 79-164bp)

- Panama (rated BBB-): down 0.5 basis points to 67 bp (1Y range: 44-95bp)

LARGEST FX MOVES TODAY

- Angolan Kwanza up 1.6% (YTD: +5.5%)

- Pakistani rupee up 1.2% (YTD: -4.2%)

- Haiti Gourde up 1.0% (YTD: -24.6%)

- Cambodia Riel up 0.8% (YTD: -0.8%)

- Comoro Franc down 0.8% (YTD: -4.3%)

- Swiss Franc down 0.9% (YTD: -4.6%)

- Hungarian Forint down 1.0% (YTD: -0.4%)

- Turkish Lira down 1.1% (YTD: -12.9%)

- Iceland Krona down 1.2% (YTD: -0.5%)

- South Africa Rand down 1.3% (YTD: +0.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.0%

- Mozambique metical up 15.4%

- Ethiopian Birr down 15.2%

- Haiti Gourde down 24.6%

- Myanmar Kyat down 30.7%

- Surinamese dollar down 33.6%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.4%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%