FX

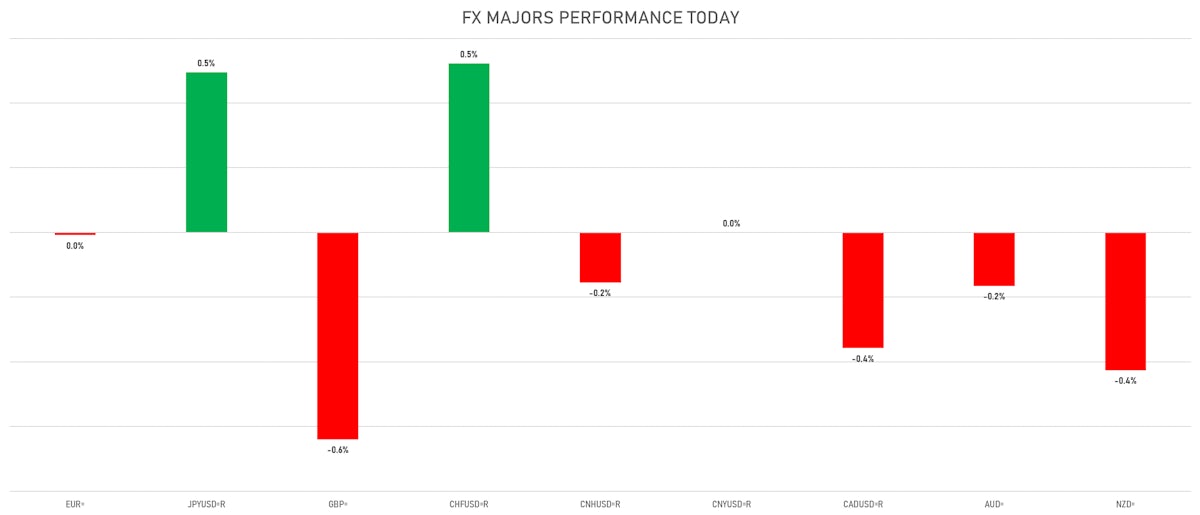

FX Majors Mixed Today: Euro Unchanged, JPY & CHF Up, GBP & CAD Down

One of the busiest macro weeks of the year with rates decisions coming up in the US, Japan, Norway, Switzerland, UK, Brazil, Hungary, Indonesia, South Africa, Taiwan, Turkey, Angola, Ghana

Published ET

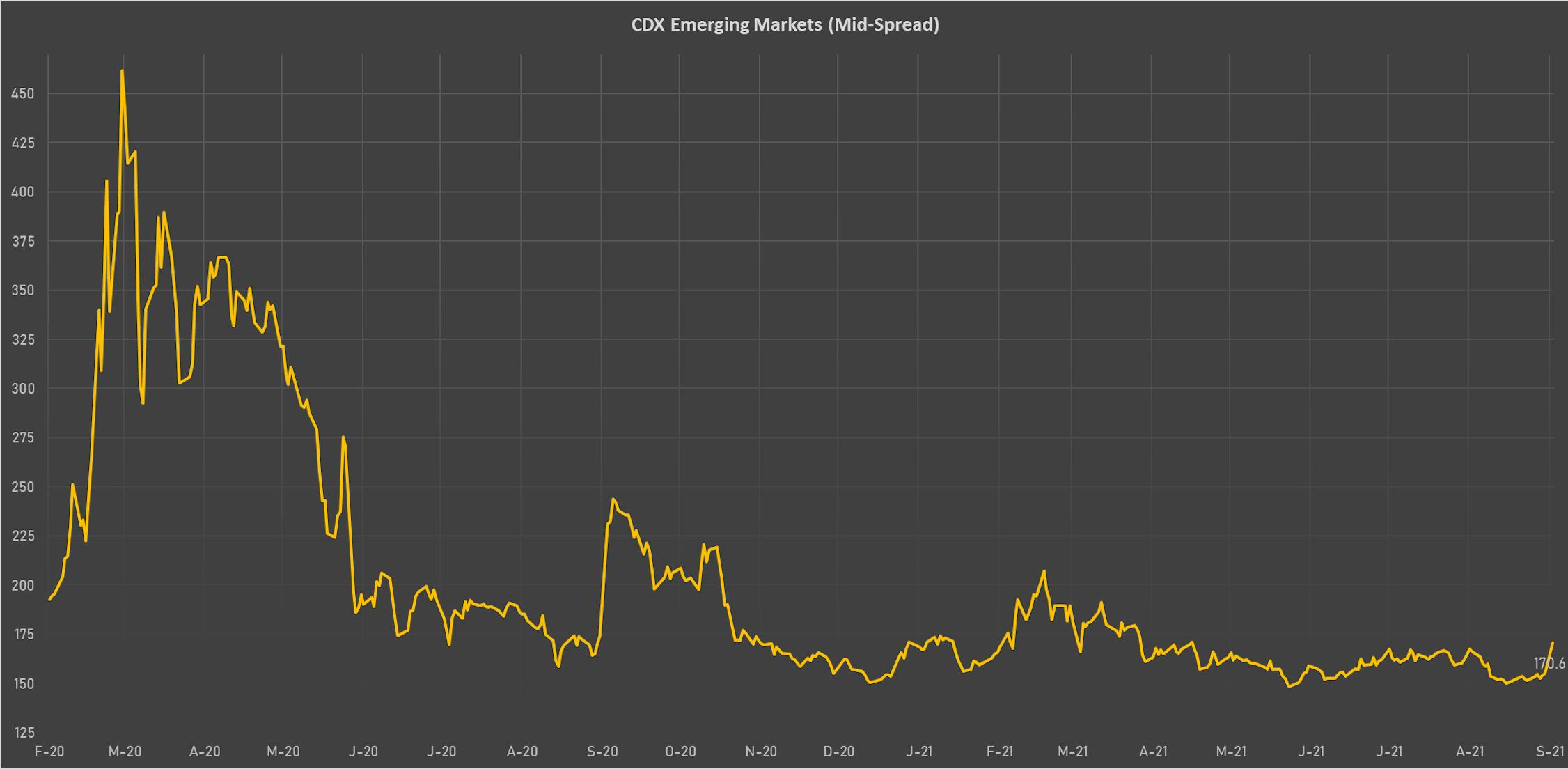

EM CDS Spreads Are Widening Again, And Their Currencies Weakening On The Bid To Quality | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

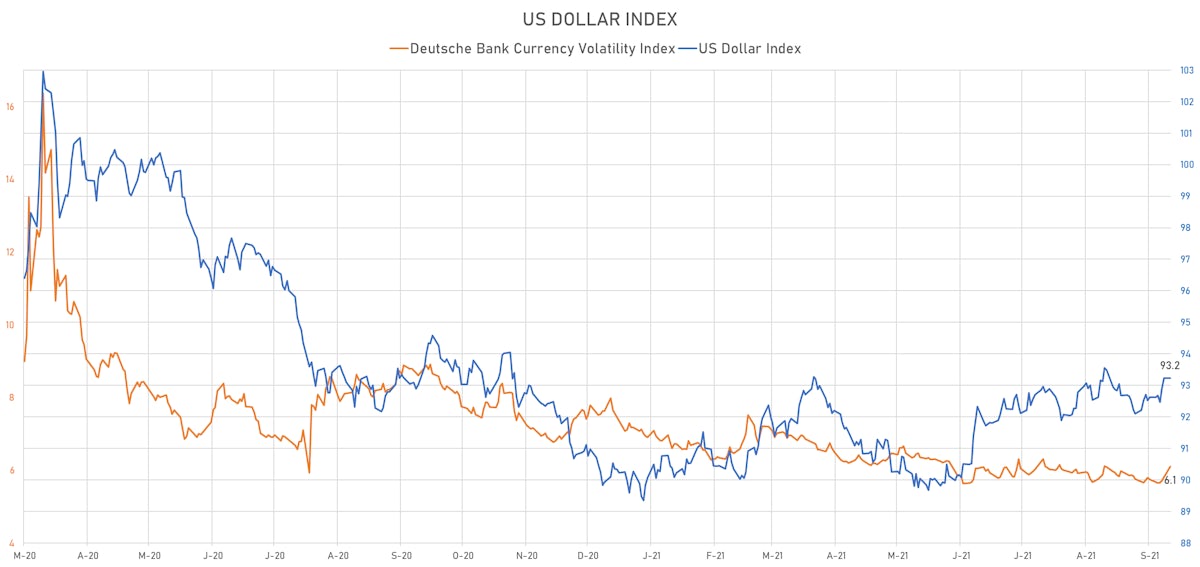

- The US Dollar Index is up 0.00% at 93.23 (YTD: +3.61%)

- Euro down 0.01% at 1.1724 (YTD: -4.0%)

- Yen up 0.49% at 109.41 (YTD: -5.6%)

- Onshore Yuan down 0.00% at 6.4655 (YTD: +0.9%)

- Swiss franc up 0.52% at 0.9276 (YTD: -4.6%)

- Sterling down 0.64% at 1.3654 (YTD: -0.1%)

- Canadian dollar down 0.36% at 1.2810 (YTD: -0.6%)

- Australian dollar down 0.17% at 0.7253 (YTD: -5.7%)

- NZ dollar down 0.43% at 0.7010 (YTD: -2.4%)

MACRO DATA RELEASES

- Germany, Producer Prices, Total industry, Change P/P, Price Index for Aug 2021 (Destatis) at 1.50 % (vs 1.90 % prior), above consensus estimate of 0.80 %

- Germany, Producer Prices, Total industry, Change Y/Y, Price Index for Aug 2021 (Destatis) at 12.00 % (vs 10.40 % prior), above consensus estimate of 11.40 %

- Hungary, Current Account, Balance, Current Prices for Q2 2021 (Cent. Bank, Hungary) at -0.78 Bln EUR (vs 0.54 Bln EUR prior), below consensus estimate of -0.47 Bln EUR

- Poland, Producer Prices, Total industry, Change Y/Y for Aug 2021 (CSO, Poland) at 9.50 % (vs 8.20 % prior), above consensus estimate of 9.20 %

- Poland, Production, Change Y/Y for Aug 2021 (CSO, Poland) at 13.20 % (vs 9.80 % prior), below consensus estimate of 13.70 %

- Slovakia, Unemployment, Rate, Total, registered for Aug 2021 (UPSVAR, Slovakia) at 7.40 % (vs 7.70 % prior), below consensus estimate of 7.53 %

- United States, NAHB/Wells Fargo Housing Market Index for Sep 2021 (NAHB, United States) at 76.00 (vs 75.00 prior), above consensus estimate of 74.00

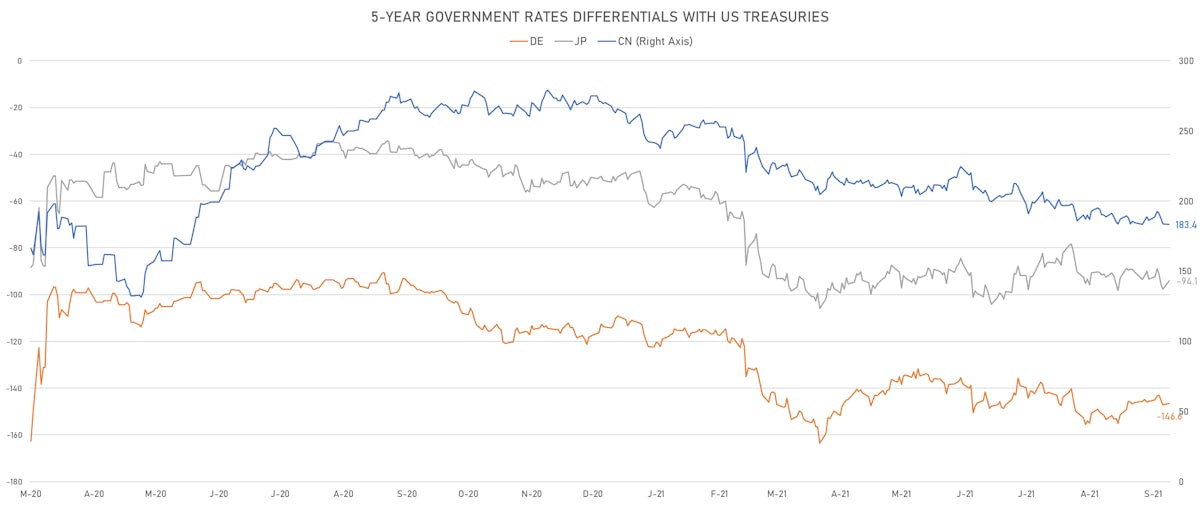

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.6 bp at 146.6 bp (YTD change: +35.5 bp)

- US-JAPAN: -3.6 bp at 94.1 bp (YTD change: +45.8 bp)

- US-CHINA: +0.4 bp at -183.4 bp (YTD change: +73.7 bp)

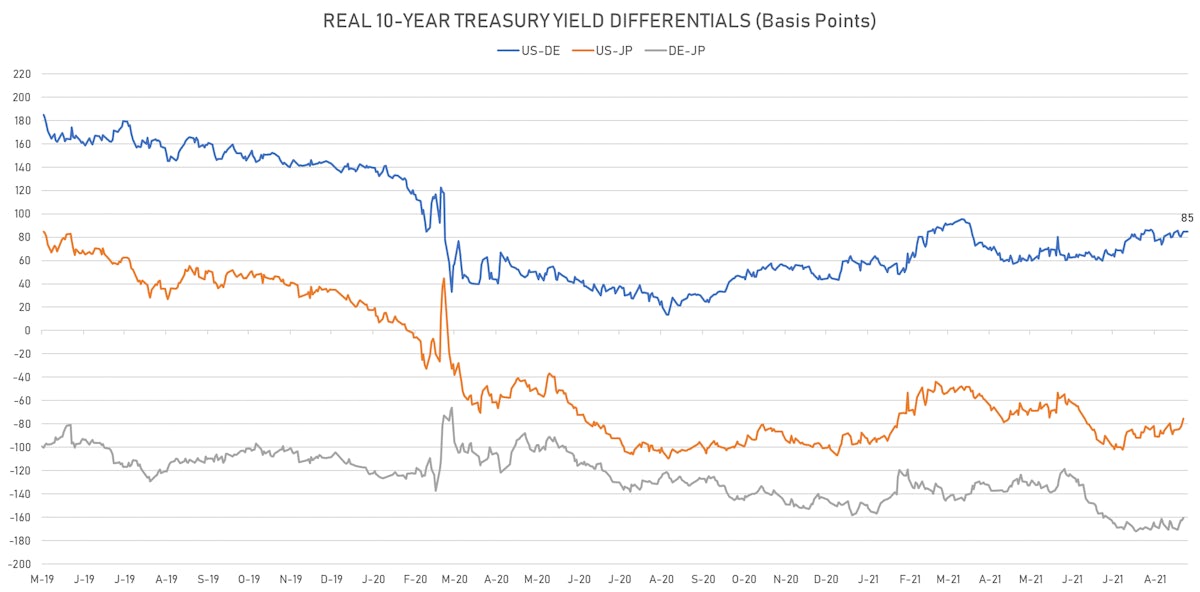

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.1 bp at 84.7 bp (YTD change: +38.6bp)

- US-JAPAN: +4.9 bp at -75.4 bp (YTD change: +26.1bp)

- JAPAN-GERMANY: -2.5 bp at 160.2 bp (YTD change: +12.6bp)

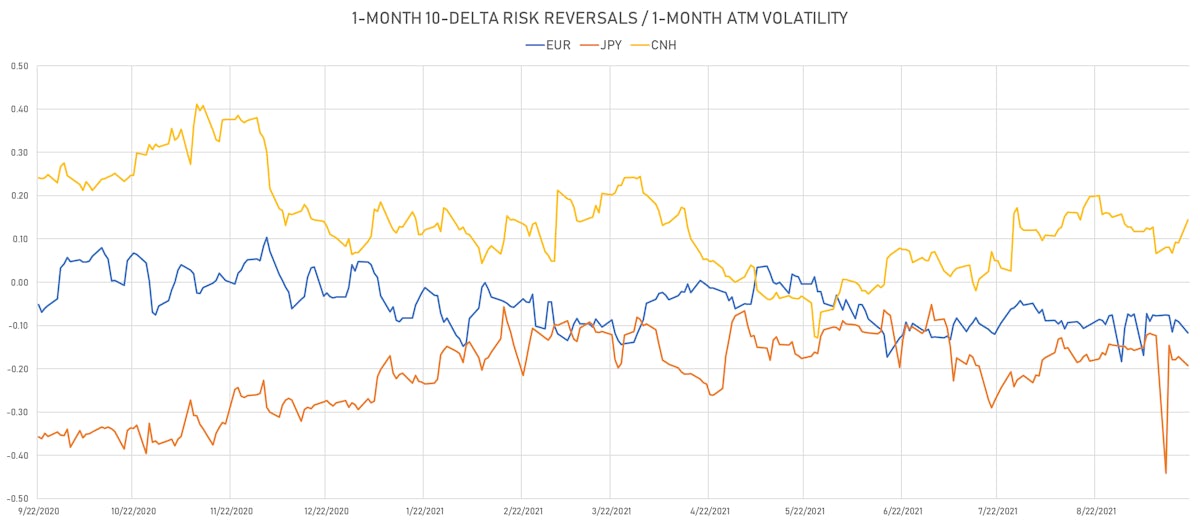

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.10, up 0.39 (YTD: -1.07)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.25, up 0.4 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 5.56, up 0.6 (YTD: -0.5)

- Offshore Yuan 1M ATM IV currently at 4.35, up 0.6 (YTD: -1.6)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Indonesia (rated BBB): up 18.1 basis points to 85 bp (1Y range: 66-118bp)

- Philippines (rated BBB): up 9.0 basis points to 51 bp (1Y range: 33-57bp)

- Malaysia (rated BBB+): up 9.0 basis points to 51 bp (1Y range: 33-57bp)

- Vietnam (rated BB): up 16.7 basis points to 106 bp (1Y range: 89-137bp)

- Panama (rated BBB-): up 11.7 basis points to 78 bp (1Y range: 44-95bp)

- Mexico (rated BBB-): up 14.1 basis points to 96 bp (1Y range: 79-164bp)

- Chile (rated A-): up 10.4 basis points to 76 bp (1Y range: 43-75bp)

- Saudi Arabia (rated A): up 7.2 basis points to 54 bp (1Y range: 47-101bp)

- Russia (rated BBB): up 10.3 basis points to 86 bp (1Y range: 72-129bp)

- Israel (rated A+): up 6.5 basis points to 54 bp (1Y range: 46-55bp)

LARGEST FX MOVES TODAY

- Armenian Dram up 1.5% (YTD: +7.8%)

- Barbados Dollar up 1.5% (YTD: 0.0%)

- Belize Dollar up 1.2% (YTD: 0.0%)

- Congo Franc up 1.0% (YTD: -0.8%)

- Mauritius Rupee up 0.9% (YTD: -6.4%)

- Russian Rouble down 0.8% (YTD: +0.9%)

- Ghanaian Cedi down 1.0% (YTD: -3.1%)

- Pakistani rupee down 1.0% (YTD: -5.3%)

- Afghani down 1.2% (YTD: -10.9%)

- Haiti Gourde down 3.0% (YTD: -26.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.0%

- Mozambique metical up 15.4%

- Argentine Peso down 14.5%

- Ethiopian Birr down 15.2%

- Haiti Gourde down 26.1%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%