FX

Technical Rebound Leads To Counter-Intuitive Fall Of The US Dollar Despite Favorable Rates Differentials

A number of central banks made rates decisions today: the UK, Switzerland, South Africa, Taiwan and the Philippines kept their rates unchanged, Turkey cut by 100bp and Norway hiked by 25bp

Published ET

Euro spot vs 1Y Forward 1Y EUR-US Rates Differentials | Source: Refinitiv

QUICK SUMMARY

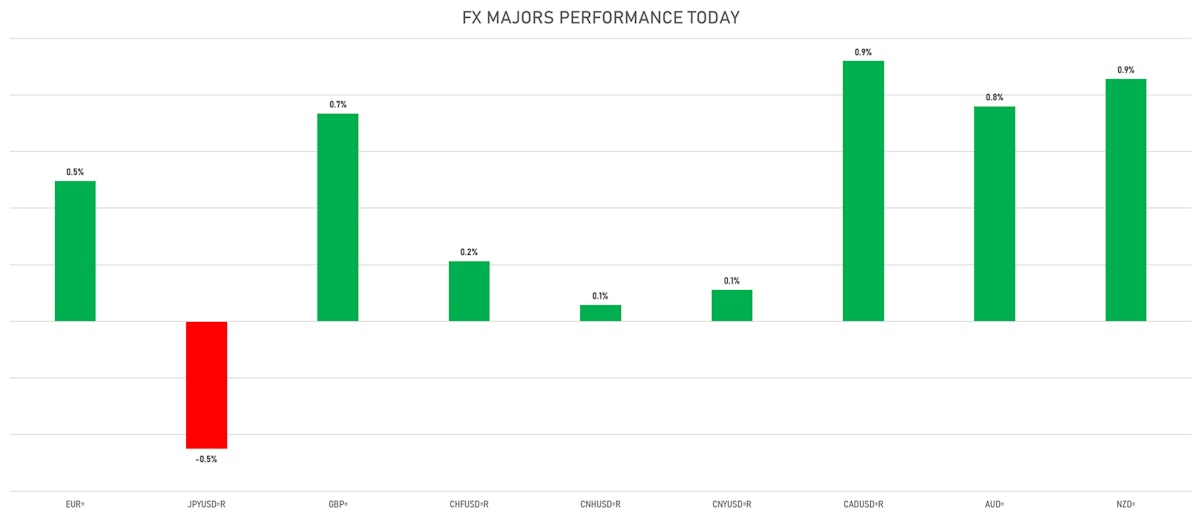

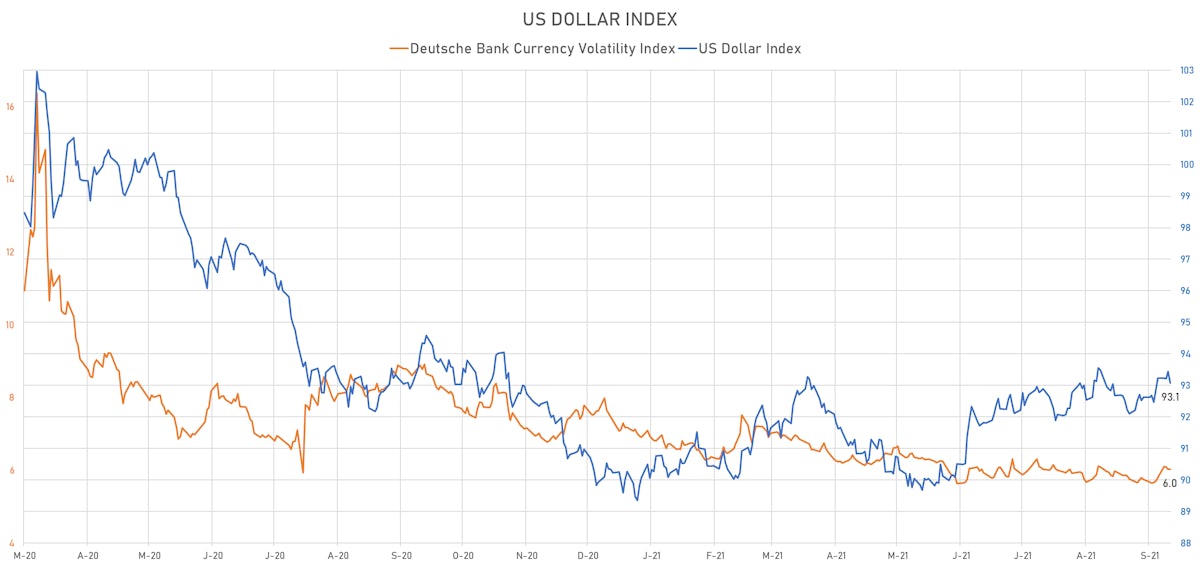

- The US Dollar Index is down -0.40% at 93.07 (YTD: +3.43%)

- Euro up 0.50% at 1.1744 (YTD: -3.8%)

- Yen down 0.45% at 110.27 (YTD: -6.4%)

- Onshore Yuan up 0.11% at 6.4590 (YTD: +1.1%)

- Swiss franc up 0.21% at 0.9241 (YTD: -4.2%)

- Sterling up 0.73% at 1.3725 (YTD: +0.4%)

- Canadian dollar up 0.92% at 1.2655 (YTD: +0.6%)

- Australian dollar up 0.76% at 0.7300 (YTD: -5.1%)

- NZ dollar up 0.86% at 0.7069 (YTD: -1.6%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Jul 2021 (CANSIM, Canada) at -0.60 % (vs 4.20 % prior), above consensus estimate of -1.20 %

- Canada, Retail Sales, Retail Sales Ex-Autos MM, Change P/P for Jul 2021 (CANSIM, Canada) at -1.00 % (vs 4.70 % prior), above consensus estimate of -1.50 %

- Euro Zone, PMI, Composite, Output, Flash for Sep 2021 (Markit Economics) at 56.10 (vs 59.00 prior), below consensus estimate of 58.50

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Sep 2021 (Markit Economics) at 58.70 (vs 61.40 prior), below consensus estimate of 60.30

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Sep 2021 (Markit Economics) at 56.30 (vs 59.00 prior), below consensus estimate of 58.50

- France, Business Sentiment, Composite business climate, manufacturing industry for Sep 2021 (INSEE, France) at 106.00 (vs 110.00 prior), below consensus estimate of 109.00

- France, PMI, Composite, Output, Flash for Sep 2021 (Markit Economics) at 55.10 (vs 55.90 prior), below consensus estimate of 55.80

- France, PMI, Manufacturing Sector, Total, Flash for Sep 2021 (Markit/CDAF, France) at 55.20 (vs 57.50 prior), below consensus estimate of 57.00

- France, PMI, Services Sector, Business Activity, Flash for Sep 2021 (Markit/CDAF, France) at 56.00 (vs 56.30 prior), in line with consensus estimate

- Germany, PMI, Composite, Output, Flash for Sep 2021 (Markit Economics) at 55.30 (vs 60.00 prior), below consensus estimate of 59.20

- Germany, PMI, Manufacturing Sector, Total, Flash for Sep 2021 (Markit Economics) at 58.50 (vs 62.60 prior), below consensus estimate of 61.50

- Germany, PMI, Services Sector, Business Activity, Flash for Sep 2021 (Markit Economics) at 56.00 (vs 60.80 prior), below consensus estimate of 60.20

- Japan, CPI, Nationwide, All Items, Change Y/Y for Aug 2021 (MIC, Japan) at -0.40 % (vs -0.30 % prior)

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Aug 2021 (MIC, Japan) at 0.00 % (vs -0.20 % prior), in line with consensus estimate

- Mexico, CPI, Core CPI, First half of month, Change P/P, Price Index for Sep 2021 (INEGI, Mexico) at 0.31 % (vs 0.28 % prior), above consensus estimate of 0.24 %

- Mexico, CPI, INPC, First half of month, Change P/P, Price Index for Sep 2021 (INEGI, Mexico) at 0.42 % (vs -0.02 % prior), above consensus estimate of 0.28 %

- Netherlands, GDP, Total, Final, Change P/P for Q2 2021 (CBS - NL) at 3.80 % (vs 3.10 % prior), above consensus estimate of 3.10 %

- Netherlands, GDP, Total, Final, Change Y/Y for Q2 2021 (CBS - NL) at 10.40 % (vs 9.70 % prior), above consensus estimate of 9.70 %

- New Zealand, Exports, Total, FOB, Current Prices for Aug 2021 (Statistics, NZ) at 4.35 Bln NZD (vs 5.75 Bln NZD prior)

- New Zealand, Imports, Total, CIF, Current Prices for Aug 2021 (Statistics, NZ) at 6.49 Bln NZD (vs 6.16 Bln NZD prior)

- New Zealand, Trade Balance, Current Prices for Aug 2021 (Statistics, NZ) at -2.94 Bln NZD (vs -1.10 Bln NZD prior)

- New Zealand, Trade Balance, Current Prices for Aug 2021 (Statistics, NZ) at -2144.00 Mln NZD (vs -402.00 Mln NZD prior)

- Norway, Policy Rates, Central Bank Rate Decision for 24 Sep (Norges Bank) at 0.25 % (vs 0.00 % prior), in line with consensus estimate

- Norway, Unemployment, Rate, Total (LFS) for Jul 2021 (Statistics Norway) at 4.20 % (vs 4.80 % prior), below consensus estimate of 4.70 %

- Philippines, Policy Rates, Reverse Repo, O/N (Borrowing) Key Rate for 23 Sep (Bangko Sentral ng) at 2.00 % (vs 2.00 % prior), in line with consensus estimate

- Poland, Unemployment, Rate for Aug 2021 (CSO, Poland) at 5.80 % (vs 5.80 % prior), in line with consensus estimate

- Singapore, CPI, All items, Change Y/Y, Price Index for Aug 2021 (Statistics Singapore) at 2.40 % (vs 2.50 % prior), in line with consensus estimate

- South Africa, Policy Rates, Prime Overdraft Rate for Sep 2021 (SA Reserve Bank) at 7.00 % (vs 7.00 % prior)

- South Africa, Policy Rates, Repo Rate for Sep 2021 (SA Reserve Bank) at 3.50 % (vs 3.50 % prior), in line with consensus estimate

- Spain, GDP, Change P/P for Q2 2021 (INE, Spain) at 1.10 % (vs 2.80 % prior), below consensus estimate of 2.80 %

- Spain, GDP, Change Y/Y for Q2 2021 (INE, Spain) at 17.50 % (vs 19.80 % prior), below consensus estimate of 19.80 %

- Switzerland, Policy Rates, SNB Policy Rate for Q3 2021 (Swiss National Bank) at -0.75 % (vs -0.75 % prior), in line with consensus estimate

- Taiwan, Policy Rates, Discount Rate for Q3 2021 (CBC, Taiwan) at 1.13 % (vs 1.13 % prior), in line with consensus estimate

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Sep 2021 (Central Bank, Turkey) at 16.50 % (vs 17.50 % prior)

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Sep 2021 (Central Bank, Turkey) at 18.00 % (vs 19.00 % prior), below consensus estimate of 19.00 %

- Turkey, Policy Rates, Late Liquidity Window Rate for Sep 2021 (Central Bank, Turkey) at 22.50 % (vs 23.50 % prior)

- Turkey, Policy Rates, Overnight Lending Rate for Sep 2021 (Central Bank, Turkey) at 19.50 % (vs 20.50 % prior)

- United Kingdom, GfK Consumer confidence index for Sep 2021 (GfK Group) at -13.00 (vs -8.00 prior), below consensus estimate of -8.00

- United Kingdom, Markit/CIPS PMI, Composite, Flash for Sep 2021 (Markit Economics) at 54.10 (vs 54.80 prior), below consensus estimate of 54.50

- United Kingdom, Markit/CIPS PMI, Manufacturing Flash for Sep 2021 (Markit Economics) at 56.30 (vs 60.30 prior), below consensus estimate of 59.00

- United Kingdom, Markit/CIPS PMI, Services, Flash for Sep 2021 (Markit Economics) at 54.60 (vs 55.00 prior), below consensus estimate of 55.00

- United Kingdom, Policy Rates, BOE MPC Vote Cut, Volume for Sep 2021 (Bank of England) at 0.00 (vs 0.00 prior), in line with consensus estimate

- United Kingdom, Policy Rates, BOE MPC Vote Hike, Volume for Sep 2021 (Bank of England) at 0.00 (vs 0.00 prior), in line with consensus estimate

- United Kingdom, Policy Rates, BOE MPC Vote Unchanged, Volume for Sep 2021 (Bank of England) at 9.00 (vs 8.00 prior), in line with consensus estimate

- United Kingdom, Policy Rates, Bank Rate for Sep 2021 (Bank of England) at 0.10 % (vs 0.10 % prior), in line with consensus estimate

- United Kingdom, Policy Rates, GB BOE QE Corporate Bond Purchases, Current Prices for Sep 2021 (Bank of England) at 20.00 Bln GBP (vs 20.00 Bln GBP prior), in line with consensus estimate

- United States, Jobless Claims, National, Continued for W 11 Sep (U.S. Dept. of Labor) at 2.85 Mln (vs 2.67 Mln prior), above consensus estimate of 2.65 Mln

- United States, Jobless Claims, National, Initial for W 18 Sep (U.S. Dept. of Labor) at 351.00 k (vs 332.00 k prior), above consensus estimate of 320.00 k

- United States, PMI, Composite, Output, Flash for Sep 2021 (Markit Economics) at 54.50 (vs 55.40 prior)

- United States, PMI, Manufacturing Sector, Total, Flash for Sep 2021 (Markit Economics) at 60.50 (vs 61.10 prior), below consensus estimate of 61.50

- United States, PMI, Services Sector, Business Activity, Flash for Sep 2021 (Markit Economics) at 54.40 (vs 55.10 prior), below consensus estimate of 55.00

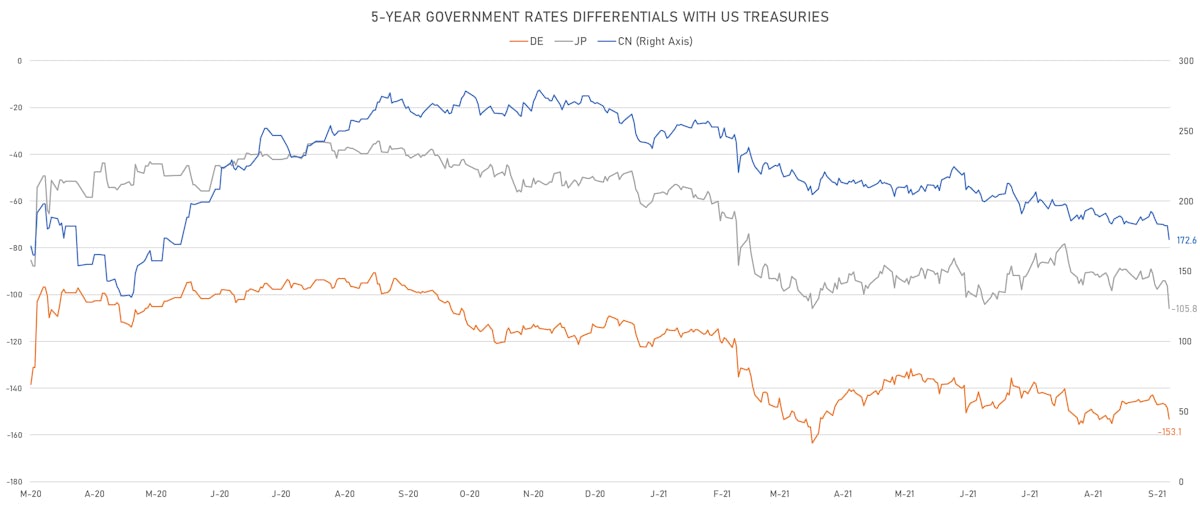

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.7 bp at 153.1 bp (YTD change: +42.0 bp)

- US-JAPAN: +9.5 bp at 105.8 bp (YTD change: +57.5 bp)

- US-CHINA: +9.8 bp at -172.6 bp (YTD change: +84.5 bp)

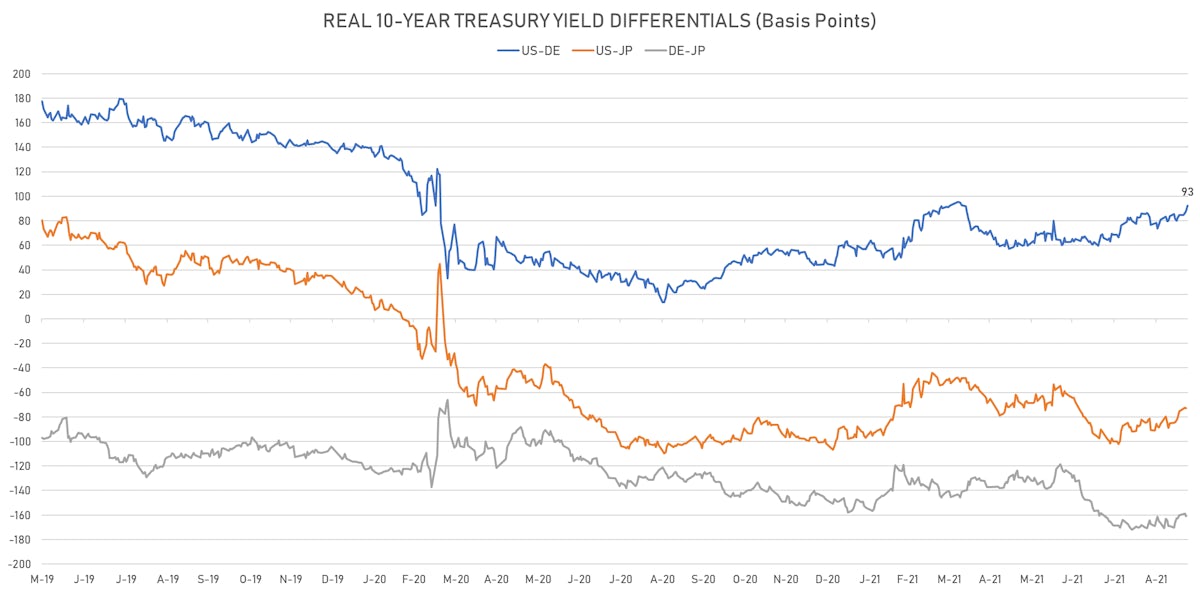

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.7 bp at 92.5 bp (YTD change: +46.4bp)

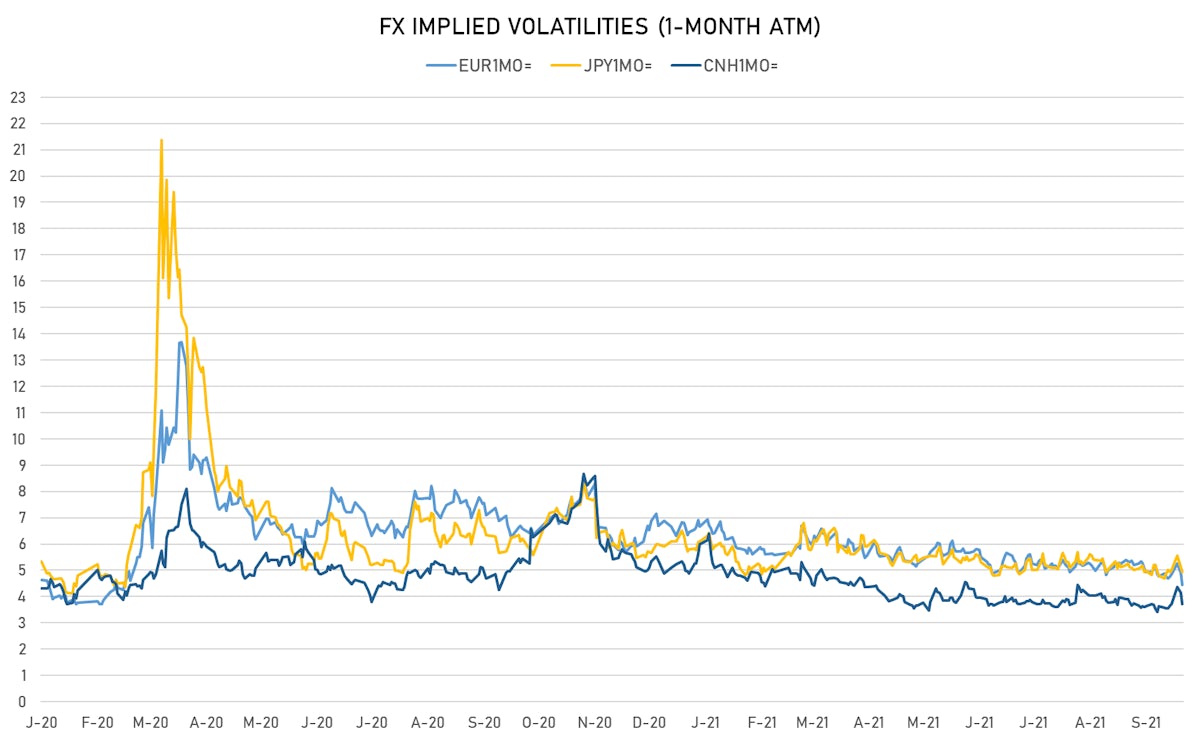

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.02, down -0.01 (YTD: -1.15)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.45, down -0.5 (YTD: -2.2)

- Japanese Yen 1M ATM IV currently at 4.93, down -0.2 (YTD: -1.2)

- Offshore Yuan 1M ATM IV currently at 3.70, down -0.4 (YTD: -2.3)

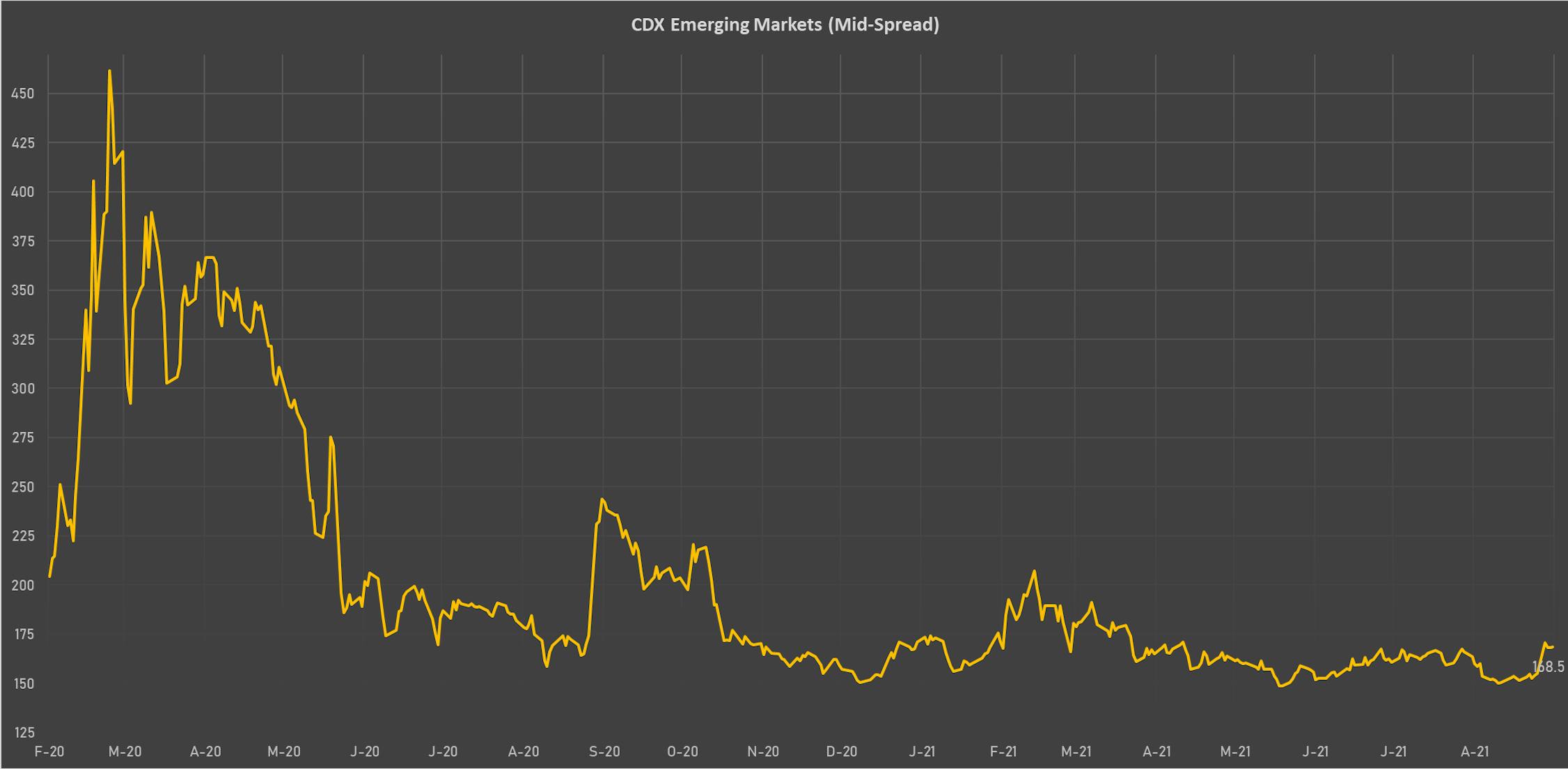

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Turkey (rated BB-): up 13.5 basis points to 410 bp (1Y range: 282-570bp)

- Chile (rated A-): up 2.2 basis points to 78 bp (1Y range: 43-77bp)

- Egypt (rated B+): up 6.9 basis points to 386 bp (1Y range: 283-422bp)

- Bahrain (rated B+): up 3.4 basis points to 258 bp (1Y range: 159-330bp)

- Senegal (rated ): down 4.0 basis points to 375 bp (1Y range: 353-409bp)

- Ecuador (rated WD): down 2.0 basis points to 165 bp (1Y range: 156-181bp)

- Saudi Arabia (rated A): down 1.0 basis points to 51 bp (1Y range: 47-101bp)

- South Africa (rated BB-): down 4.8 basis points to 197 bp (1Y range: 178-328bp)

- Indonesia (rated BBB): down 2.4 basis points to 76 bp (1Y range: 66-118bp)

- Vietnam (rated BB): down 4.0 basis points to 100 bp (1Y range: 89-137bp)

LARGEST FX MOVES TODAY

- Iceland Krona up 1.2% (YTD: -0.4%)

- CFA Franc BCEAO up 1.1% (YTD: -4.6%)

- Norwegian Krone up 1.0% (YTD: +0.0%)

- Cape Verde Escudo up 1.0% (YTD: 0.0%)

- Sierra Leone Leon down 1.0% (YTD: -4.3%)

- Ghanaian Cedi down 1.0% (YTD: -3.1%)

- Qatari Riyal down 1.0% (YTD: -1.0%)

- Turkish Lira down 1.1% (YTD: -15.3%)

- Haiti Gourde down 2.0% (YTD: -27.6%)

- Myanmar Kyat down 3.8% (YTD: -33.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 62.5%

- Mozambique metical up 15.4%

- Turkish Lira down 15.3%

- Haiti Gourde down 27.6%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%