FX

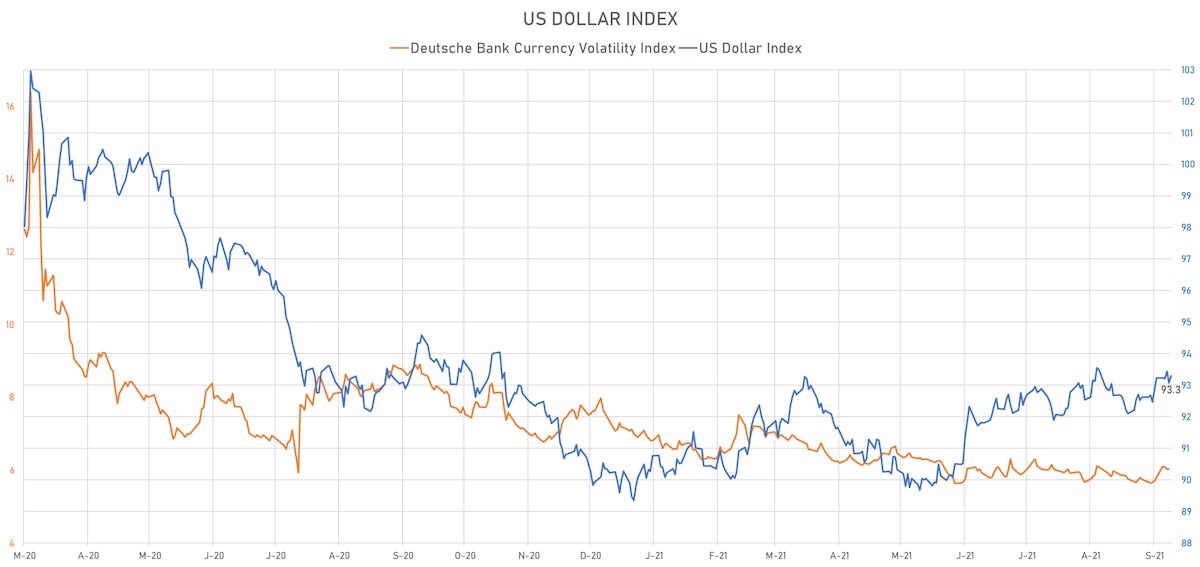

The US Dollar Index Follows The Yield Curve Up, Ends The Week With Gains

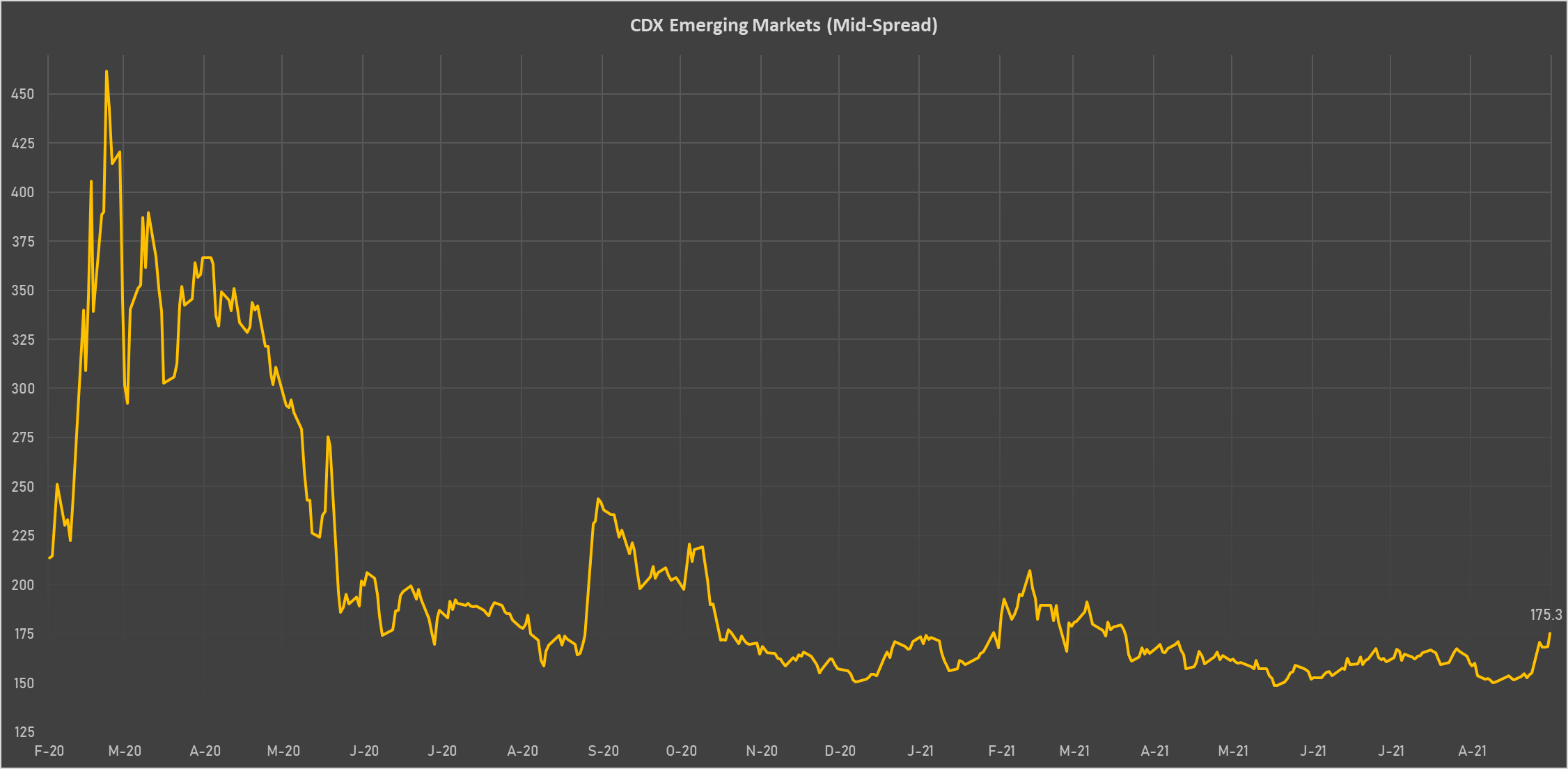

Emerging markets currencies like the Brazilian real have been struggling this week, with sovereign spreads widening again

Published ET

Brazilian real vs Brazilian Government 5Y USD CDS Spread | Source: Refinitiv

QUICK SUMMARY

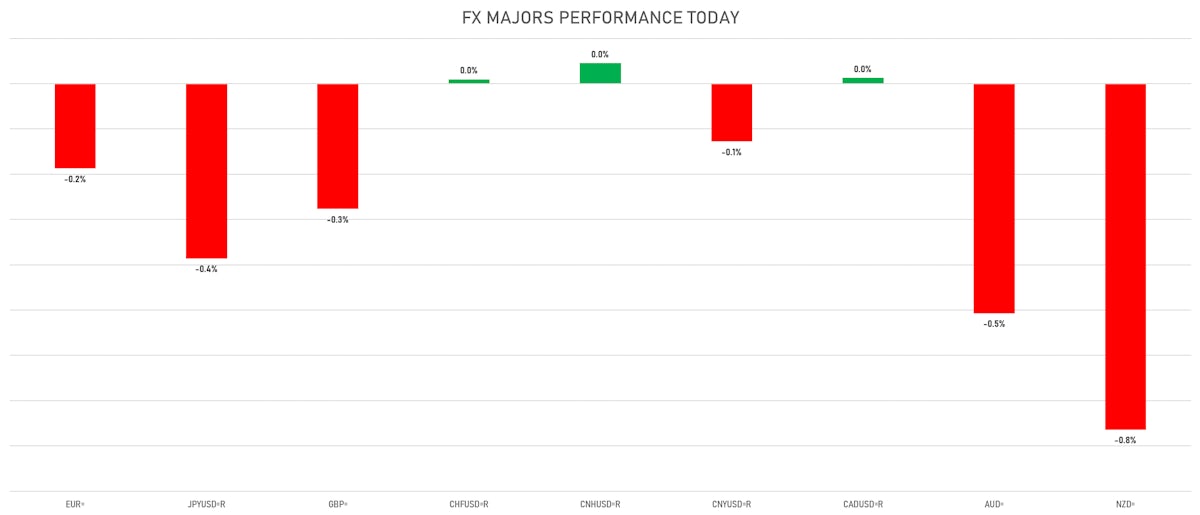

- The US Dollar Index is up 0.24% at 93.29 (YTD: +3.68%)

- Euro down 0.19% at 1.1714 (YTD: -4.1%)

- Yen down 0.39% at 110.72 (YTD: -6.8%)

- Onshore Yuan down 0.13% at 6.4660 (YTD: +0.9%)

- Swiss franc up 0.01% at 0.9239 (YTD: -4.2%)

- Sterling down 0.28% at 1.3678 (YTD: +0.0%)

- Canadian dollar up 0.01% at 1.2652 (YTD: +0.6%)

- Australian dollar down 0.51% at 0.7258 (YTD: -5.7%)

- NZ dollar down 0.76% at 0.7012 (YTD: -2.4%)

MACRO DATA RELEASES

- Belgium, All Sectors, Overall for Sep 2021 (NBB, Belgium) at 4.00 (vs 7.60 prior)

- Brazil, CPI, Broad National - 15 (IPCA-15), Change Y/Y for Sep 2021 (IBGE, Brazil) at 10.05 % (vs 9.30 % prior), above consensus estimate of 9.93 %

- Brazil, CPI, Broad national - 15 (IPCA-15), Change P/P for Sep 2021 (IBGE, Brazil) at 1.14 % (vs 0.89 % prior), above consensus estimate of 1.02 %

- Brazil, Current Account, Balance, Current Prices for Aug 2021 (Central Bank, Brazil) at 1.68 Bln USD (vs -1.58 Bln USD prior), above consensus estimate of 1.00 Bln USD

- Brazil, Financial Account, Direct Investment, In Reporting Economy, Net incurrence of liabilities, Current Prices for Aug 2021 (Central Bank, Brazil) at 4.45 Bln USD (vs 6.10 Bln USD prior), below consensus estimate of 6.00 Bln USD

- Germany, Climate Germany (Incl.Services), Volume Index for Sep 2021 (Ifo, Univ. of Munich) at 98.80 (vs 99.40 prior), below consensus estimate of 98.90

- Germany, Ifo Business Climate Germany Expectation (Incl.Services), Volume Index for Sep 2021 (Ifo, Univ. of Munich) at 97.30 (vs 97.50 prior), above consensus estimate of 96.50

- Germany, Ifo Business Climate Germany Situation (Incl. services), Volume Index for Sep 2021 (Ifo, Univ. of Munich) at 100.40 (vs 101.40 prior), below consensus estimate of 101.80

- Italy, Consumer confidence for Sep 2021 (ISTAT, Italy) at 119.60 (vs 116.20 prior), above consensus estimate of 115.80

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Flash for Sep 2021 (Markit Economics) at 51.20 (vs 52.70 prior)

- Singapore, Production, Change P/P for Aug 2021 (Statistics Singapore) at 5.70 % (vs -2.60 % prior), above consensus estimate of 3.10 %

- Singapore, Production, Change Y/Y for Aug 2021 (Statistics Singapore) at 11.20 % (vs 16.30 % prior), above consensus estimate of 8.80 %

- Taiwan, Export Orders Received, Change Y/Y for Aug 2021 (MoEA, Taiwan) at 17.60 % (vs 21.40 % prior), below consensus estimate of 20.70 %

- Thailand, Exports, Total, customs basis, Change Y/Y for Aug 2021 (Bank of Thailand) at 8.93 % (vs 20.27 % prior), below consensus estimate of 13.50 %

- Thailand, Imports, Total, customs basis, Change Y/Y for Aug 2021 (Bank of Thailand) at 47.92 % (vs 45.94 % prior), above consensus estimate of 40.35 %

- Thailand, Trade Balance, Total, customs basis (USD), Current Prices for Aug 2021 (Bank of Thailand) at -1.22 Bln USD (vs 0.18 Bln USD prior), below consensus estimate of 0.97 Bln USD

- United Kingdom, CBI Distributive Trades, Retailing, Volume of sales, balance for Sep 2021 (CBI, UK) at 11.00 (vs 60.00 prior), below consensus estimate of 35.00

- United States, New Home Sales for Aug 2021 (U.S. Census Bureau) at 0.74 Mln (vs 0.71 Mln prior), above consensus estimate of 0.71 Mln

WEEKLY IMM SPEC POSITIONING

- All Currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: increase in net long US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

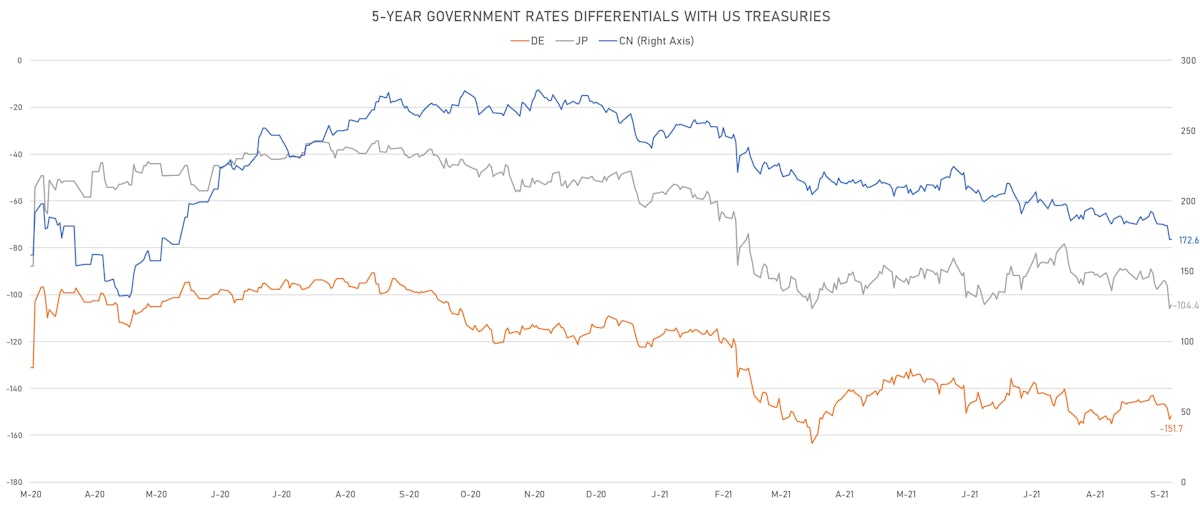

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.5 bp at 151.7 bp (YTD change: +40.6 bp)

- US-JAPAN: -1.5 bp at 104.4 bp (YTD change: +56.1 bp)

- US-CHINA: +0.0 bp at -172.6 bp (YTD change: +84.6 bp)

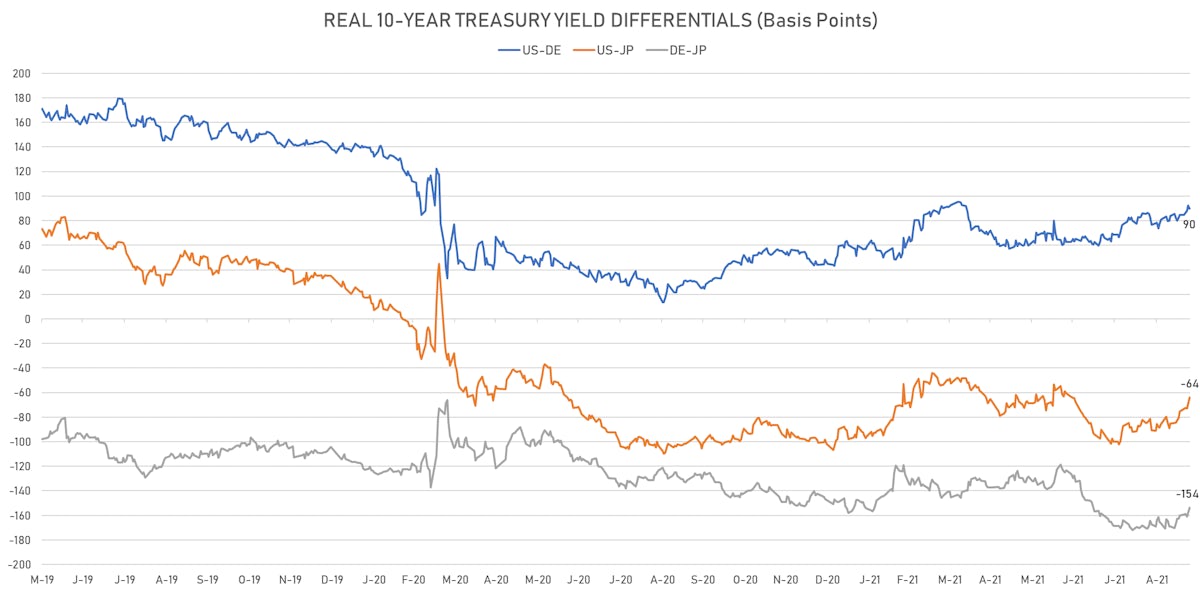

10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.8 bp at 89.7 bp (YTD change: +43.6bp)

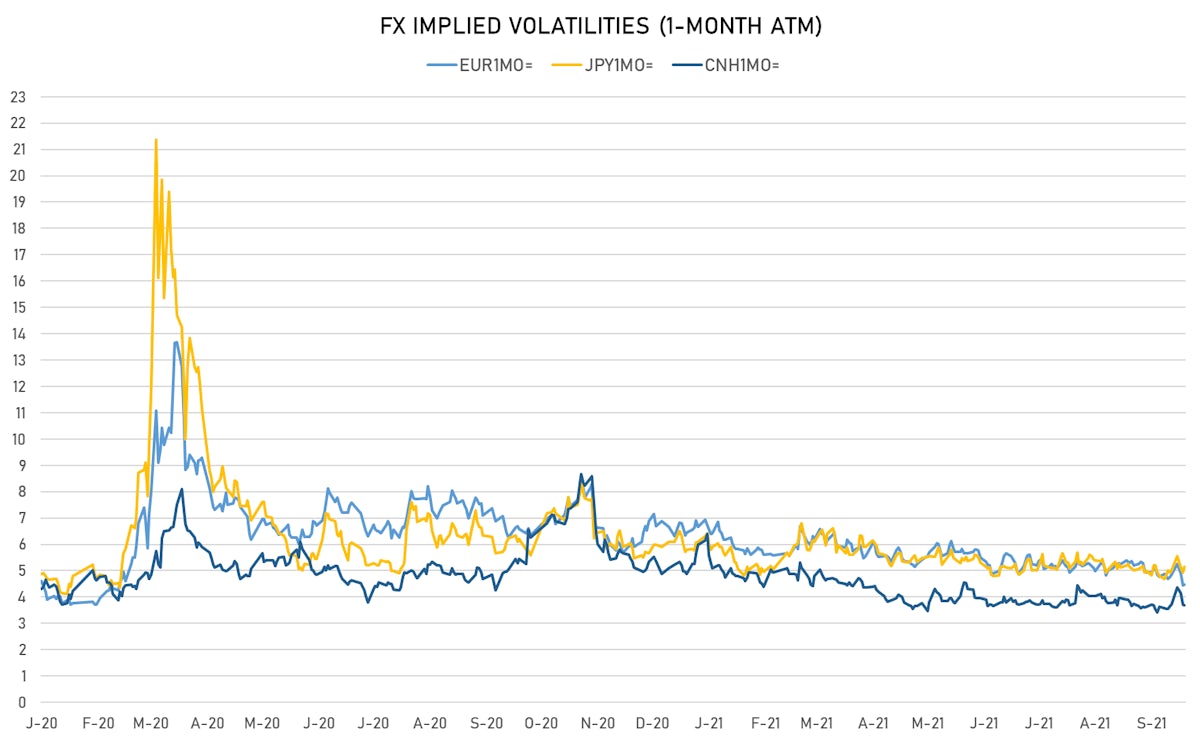

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.02, down -0.01 (YTD: -1.15)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 4.48 (YTD: -2.2)

- Japanese Yen 1M ATM IV currently at 5.14, up 0.2 (YTD: -1.0)

- Offshore Yuan 1M ATM IV unchanged at 3.68 (YTD: -2.3)

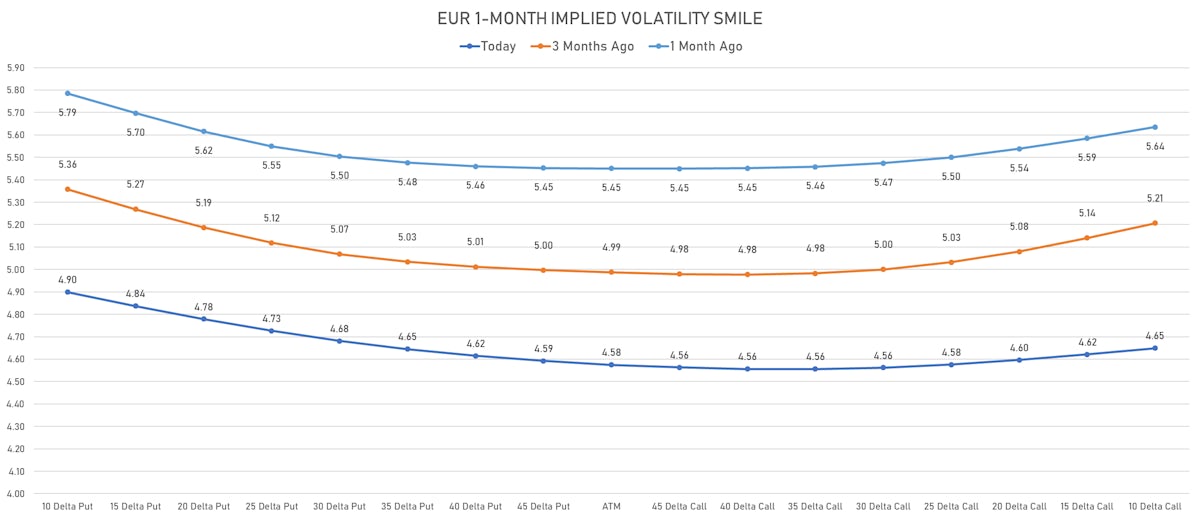

- ATM implied volatilities are lower and the Euro volatility smile is flatter, though still skewed to the downside

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 98.6 basis points to 2,127 bp (1Y range: 1,049-2,028bp)

- Chile (rated A-): up 2.7 basis points to 82 bp (1Y range: 43-79bp)

- South Africa (rated BB-): up 6.5 basis points to 203 bp (1Y range: 178-328bp)

- Mexico (rated BBB-): up 2.9 basis points to 95 bp (1Y range: 79-161bp)

- Oman (rated BB-): up 7.2 basis points to 253 bp (1Y range: 223-452bp)

- Peru (rated BBB+): up 2.6 basis points to 94 bp (1Y range: 52-101bp)

- Colombia (rated BB+): up 4.0 basis points to 153 bp (1Y range: 83-162bp)

- Turkey (rated BB-): up 10.8 basis points to 421 bp (1Y range: 282-560bp)

- Indonesia (rated BBB): up 1.9 basis points to 78 bp (1Y range: 66-118bp)

- Panama (rated BBB-): up 1.8 basis points to 79 bp (1Y range: 44-94bp)

LARGEST FX MOVES TODAY

- Angolan Kwanza up 2.4% (YTD: +8.5%)

- Jamaican Dollar up 1.5% (YTD: -2.9%)

- Ghanaian Cedi up 0.8% (YTD: -2.3%)

- Philippine Peso down 0.8% (YTD: -5.3%)

- Chilean Peso down 0.9% (YTD: -10.3%)

- Cape Verde Escudo down 0.9% (YTD: -0.9%)

- Honduras Lempira down 1.0% (YTD: -1.0%)

- Turkish Lira down 1.3% (YTD: -16.3%)

- South Africa Rand down 1.4% (YTD: -1.7%)

- Botswana Pula down 1.7% (YTD: -4.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 54.2%

- Mozambique metical up 15.4%

- Turkish Lira down 16.3%

- Haiti Gourde down 27.6%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.4%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%