FX

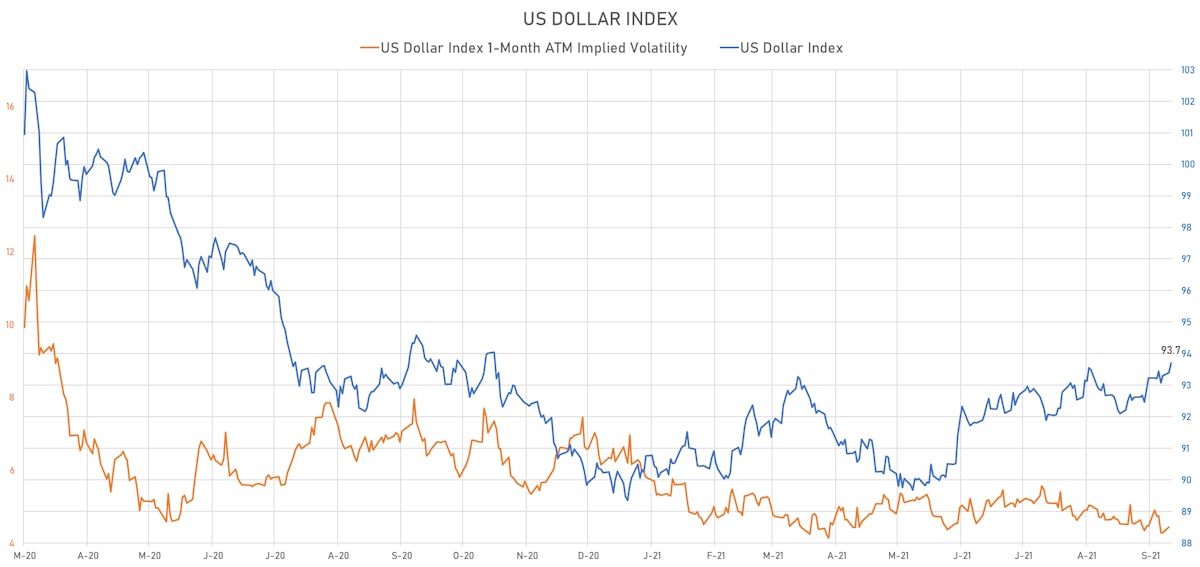

US Dollar Gets Stronger On The Back Of Favorable Moves In Rates Differentials

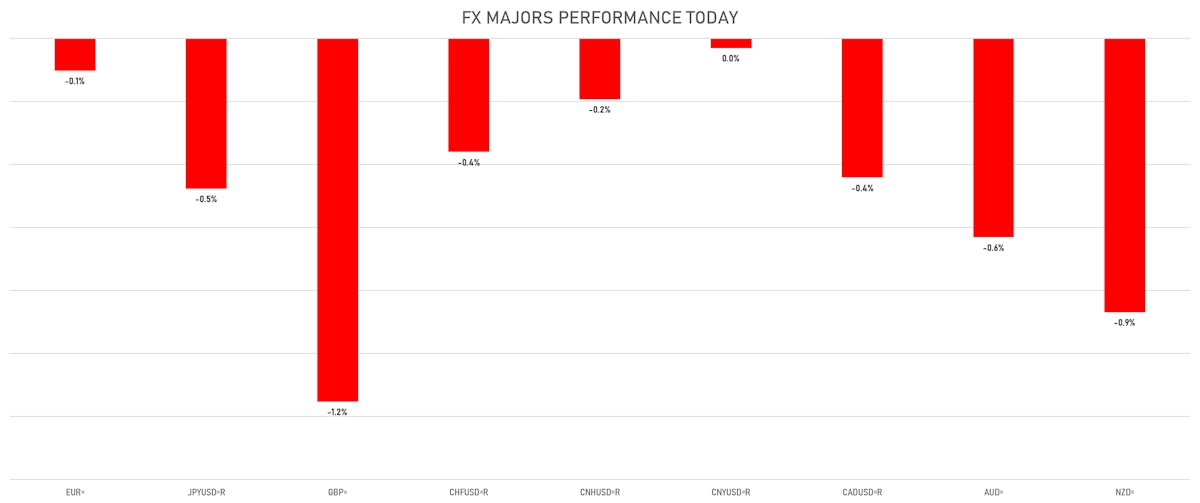

The British pound crashed through multiple technical support levels and was down 1.2% today, the worst performer among major currencies

Published ET

GBP intraday spot prices | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is up 0.33% at 93.71 (YTD: +4.14%)

- Euro down 0.10% at 1.1682 (YTD: -4.3%)

- Yen down 0.48% at 111.54 (YTD: -7.4%)

- Onshore Yuan down 0.03% at 6.4595 (YTD: +1.1%)

- Swiss franc down 0.36% at 0.9293 (YTD: -4.7%)

- Sterling down 1.15% at 1.3537 (YTD: -1.0%)

- Canadian dollar down 0.44% at 1.2681 (YTD: +0.4%)

- Australian dollar down 0.63% at 0.7240 (YTD: -5.9%)

- NZ dollar down 0.87% at 0.6955 (YTD: -3.2%)

MACRO DATA RELEASES

- Argentina, Monthly Economic Activity Estimator, Change Y/Y for Jul 2021 (INDEC, Argentina) at 11.70 % (vs 10.80 % prior), above consensus estimate of 8.70 %

- Australia, Retail Sales, Total, Final, Change P/P for Aug 2021 (AU Bureau of Stat) at -1.70 % (vs 0.00 % prior), above consensus estimate of -2.50 %

- Austria, Markit PMI, Business Surveys, PMI, Manufacturing Sector, Total for Sep 2021 (Markit Economics) at 62.80 (vs 61.80 prior)

- France, Consumer confidence, overall for Sep 2021 (INSEE, France) at 102.00 (vs 99.00 prior), above consensus estimate of 100.00

- Germany, GfK Consumer climate indicator for Oct 2021 (GfK Group) at 0.30 (vs -1.20 prior), above consensus estimate of -1.60

- Kenya, Policy Rates, Central Bank Rate for Sep 2021 (Central Bank, Kenya) at 7.00 % (vs 7.00 % prior), in line with the consensus estimate

- Malaysia, Exports, Total, free on board, Change Y/Y for Aug 2021 (Statistics, Malaysia) at 18.40 % (vs 5.00 % prior), above consensus estimate of 14.60 %

- Malaysia, Imports, Total, cost insurance freight, Change Y/Y for Aug 2021 (Statistics, Malaysia) at 12.50 % (vs 24.00 % prior), below consensus estimate of 24.50 %

- Norway, Retail Sales, Change P/P for Aug 2021 (Statistics Norway) at -3.80 % (vs -3.10 % prior)

- Sweden, Retail Sales, Total excluding petrol stations, Change P/P for Aug 2021 (SCB, Sweden) at 0.70 % (vs -1.20 % prior)

- Sweden, Retail Sales, Total excluding petrol stations, Change Y/Y for Aug 2021 (SCB, Sweden) at 6.60 % (vs 5.40 % prior)

- United States, Conference Board, Consumer confidence for Sep 2021 (The Conference Board) at 109.30 (vs 113.80 prior), below consensus estimate of 114.50

- United States, House Prices, S&P Case-Shiller, Composite-20, Change P/P for Jul 2021 (Standard & Poor's) at 1.50 % (vs 1.80 % prior), below consensus estimate of 1.70 %

- United States, House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Jul 2021 (Standard & Poor's) at 19.90 % (vs 19.10 % prior), below consensus estimate of 20.00 %

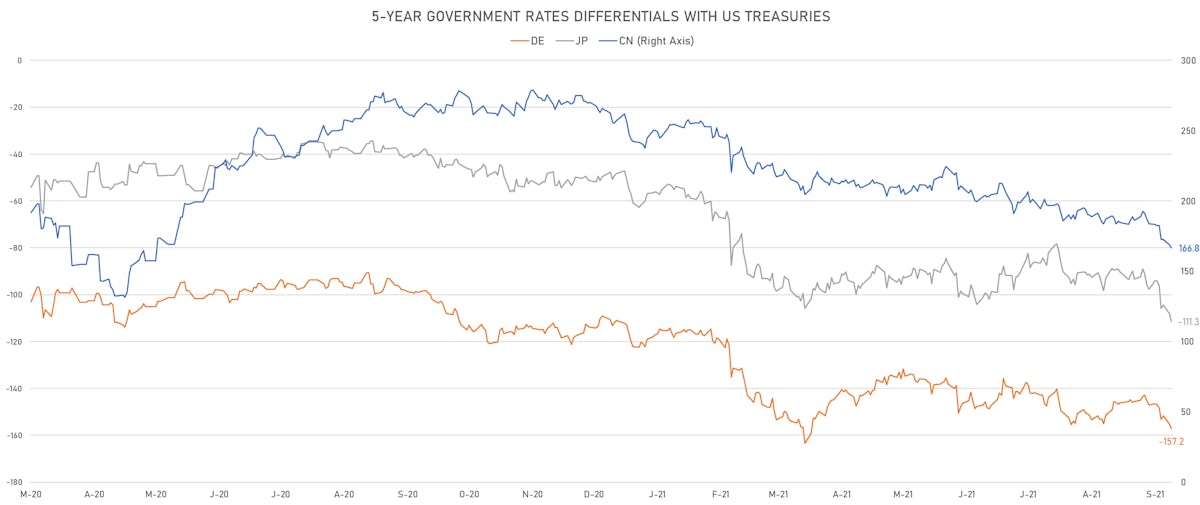

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.0 bp at 157.2 bp (YTD change: +46.2 bp)

- US-JAPAN: +3.2 bp at 111.3 bp (YTD change: +63.1 bp)

- US-CHINA: +2.1 bp at -166.8 bp (YTD change: +90.4 bp)

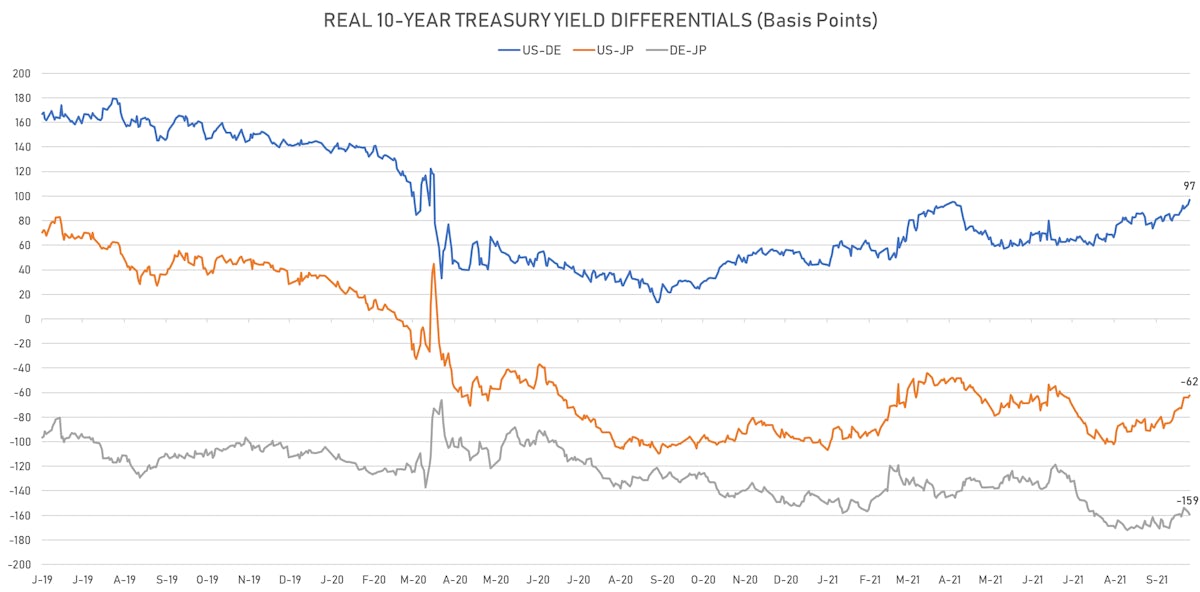

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.7 bp at 97.0 bp (YTD change: +50.9bp)

- US-JAPAN: +1.7 bp at -62.3 bp (YTD change: +39.2bp)

- JAPAN-GERMANY: +2.0 bp at 159.3 bp (YTD change: +11.7bp)

VOLATILITIES TODAY

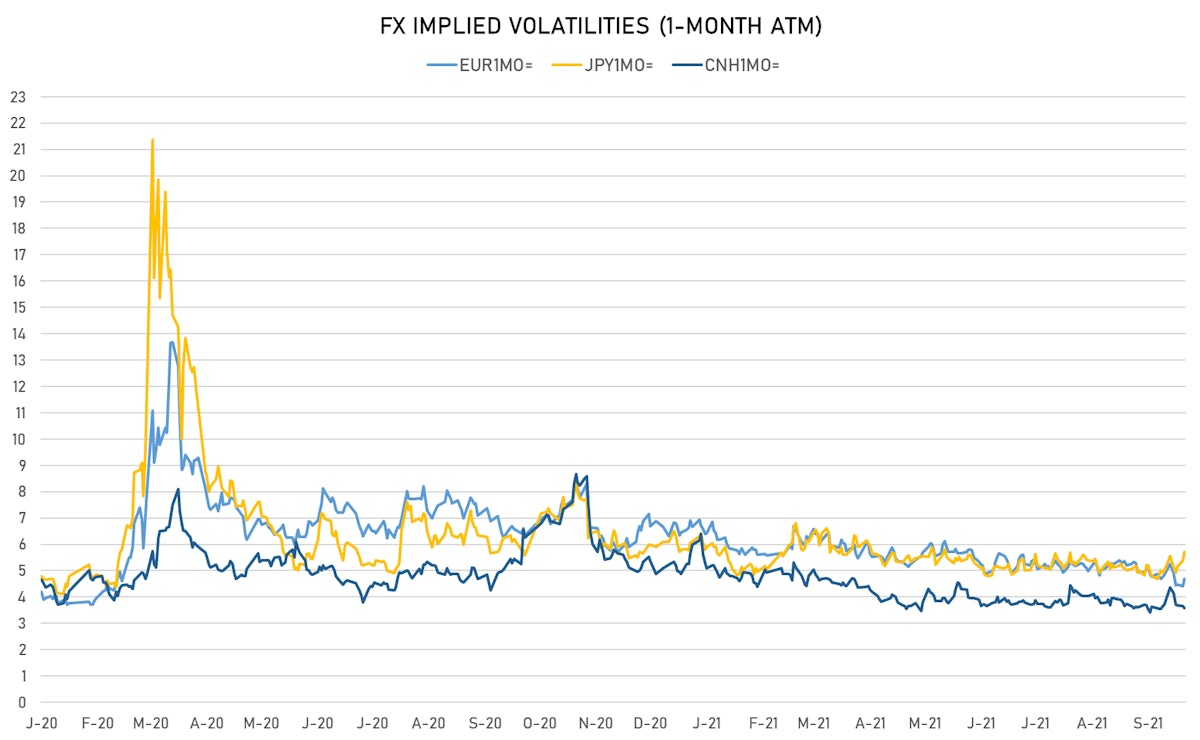

- Deutsche Bank USD Currency Volatility Index currently at 6.03, up 0.01 (YTD: -1.14)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.70, up 0.3 (YTD: -2.0)

- Japanese Yen 1M ATM IV currently at 5.71, up 0.3 (YTD: -0.4)

- Offshore Yuan 1M ATM IV currently at 3.58, down -0.1 (YTD: -2.4)

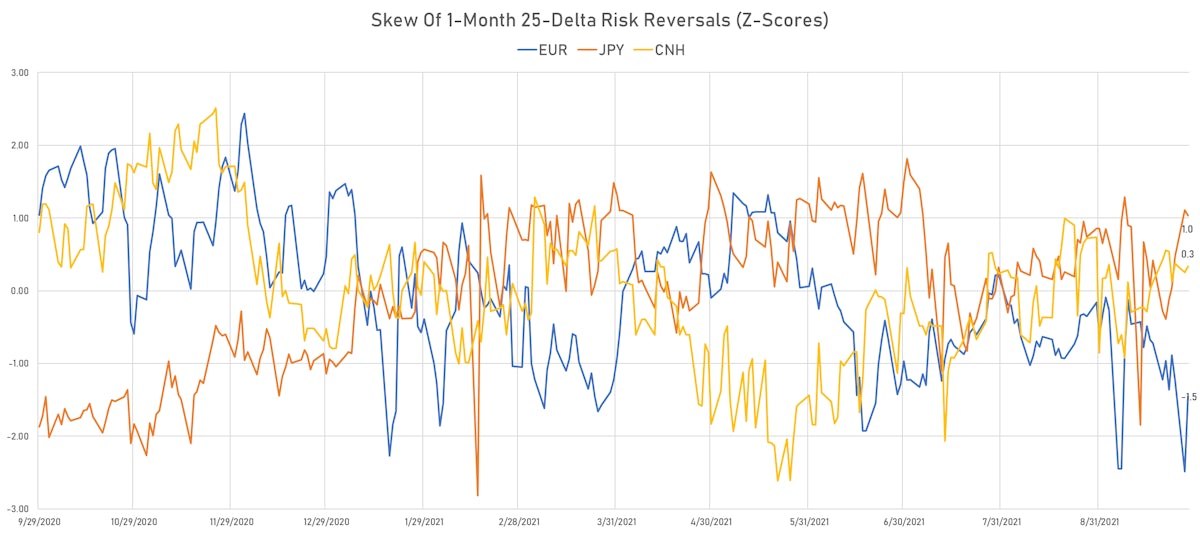

- Since the FOMC, prices of risk reversals have shown a clearer directional bias to the downside for the euro and yen

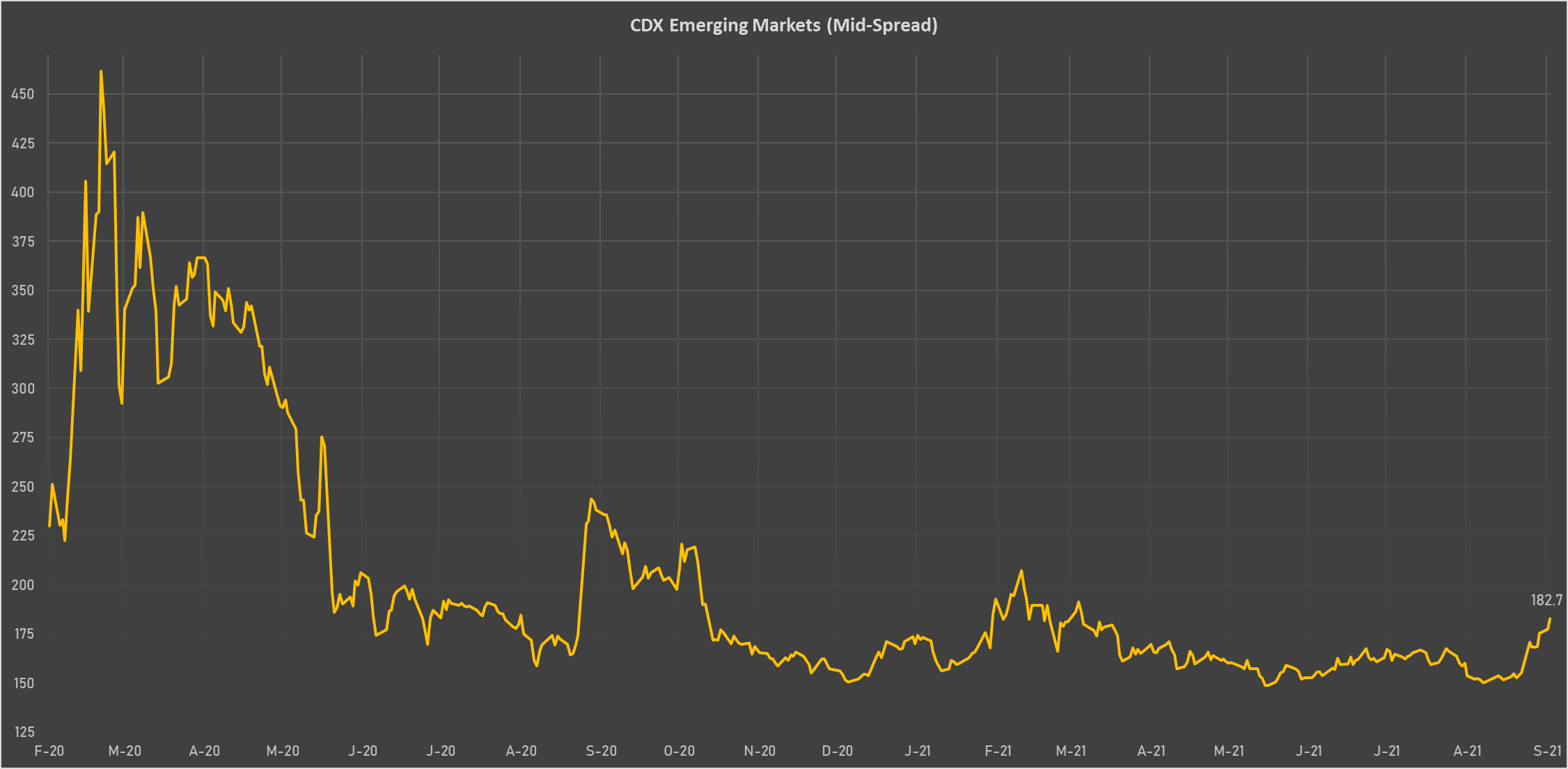

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): up 34.6 basis points to 429 bp (1Y range: 283-415bp)

- Malaysia (rated BBB+): up 3.1 basis points to 52 bp (1Y range: 33-55bp)

- Panama (rated BBB-): up 3.6 basis points to 86 bp (1Y range: 44-87bp)

- Mexico (rated BBB-): up 4.1 basis points to 101 bp (1Y range: 79-154bp)

- Philippines (rated BBB): up 2.0 basis points to 50 bp (1Y range: 33-55bp)

- Colombia (rated BB+): up 6.0 basis points to 162 bp (1Y range: 83-156bp)

- Russia (rated BBB): up 3.3 basis points to 90 bp (1Y range: 72-128bp)

- Peru (rated BBB+): up 3.5 basis points to 100 bp (1Y range: 52-101bp)

- South Africa (rated BB-): up 7.0 basis points to 214 bp (1Y range: 178-316bp)

- Saudi Arabia (rated A): up 1.6 basis points to 54 bp (1Y range: 47-92bp)

LARGEST FX MOVES TODAY

- Malawi Kwacha up 1.7% (YTD: -4.7%)

- Angolan Kwanza up 1.1% (YTD: +8.8%)

- Haiti Gourde up 1.0% (YTD: -25.4%)

- New Zealand $ down 0.9% (YTD: -3.2%)

- Polish Zloty down 0.9% (YTD: -5.8%)

- South Africa Rand down 1.0% (YTD: -2.7%)

- Mexican Peso down 1.1% (YTD: -2.2%)

- British Pound down 1.2% (YTD: -1.0%)

- St Helena Pound down 1.2% (YTD: -0.8%)

- Chilean Peso down 1.2% (YTD: -11.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 64.8%

- New Zambian kwacha up 26.7%

- Turkish Lira down 16.2%

- Haiti Gourde down 25.4%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.5%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%