FX

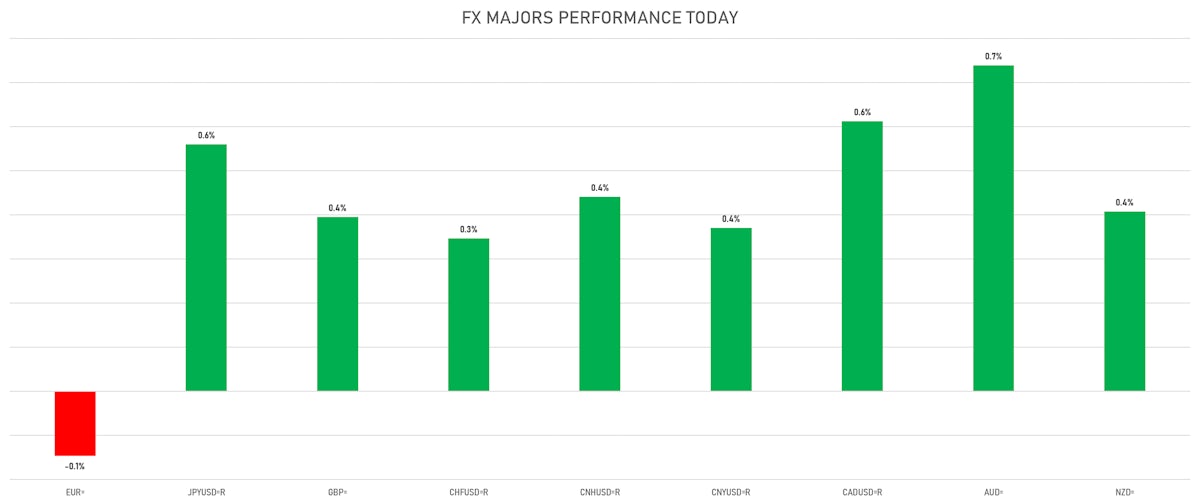

Broad Gains For Major Currencies Against The US Dollar, With Euro The Only Loser

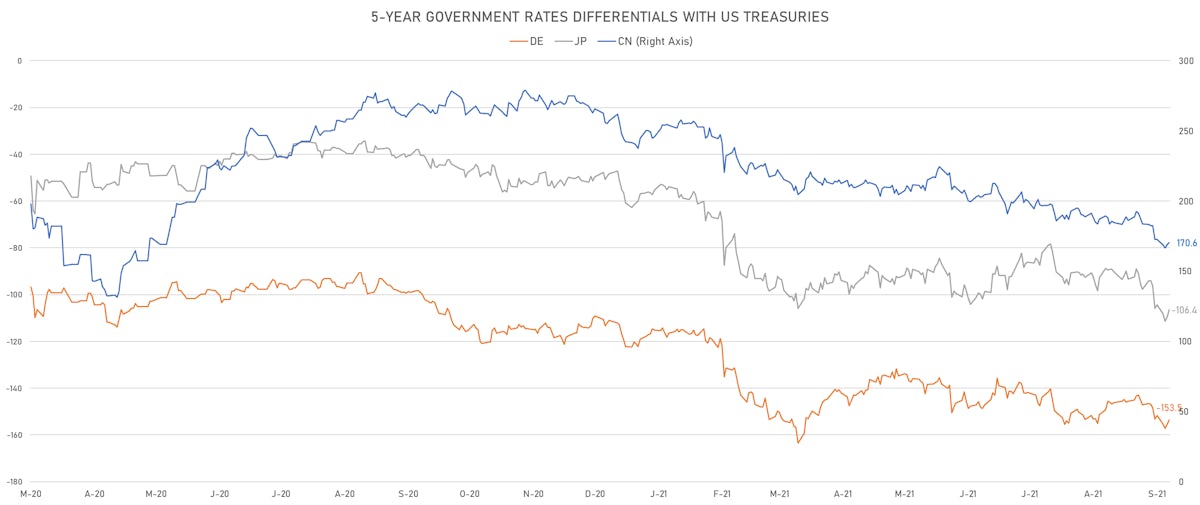

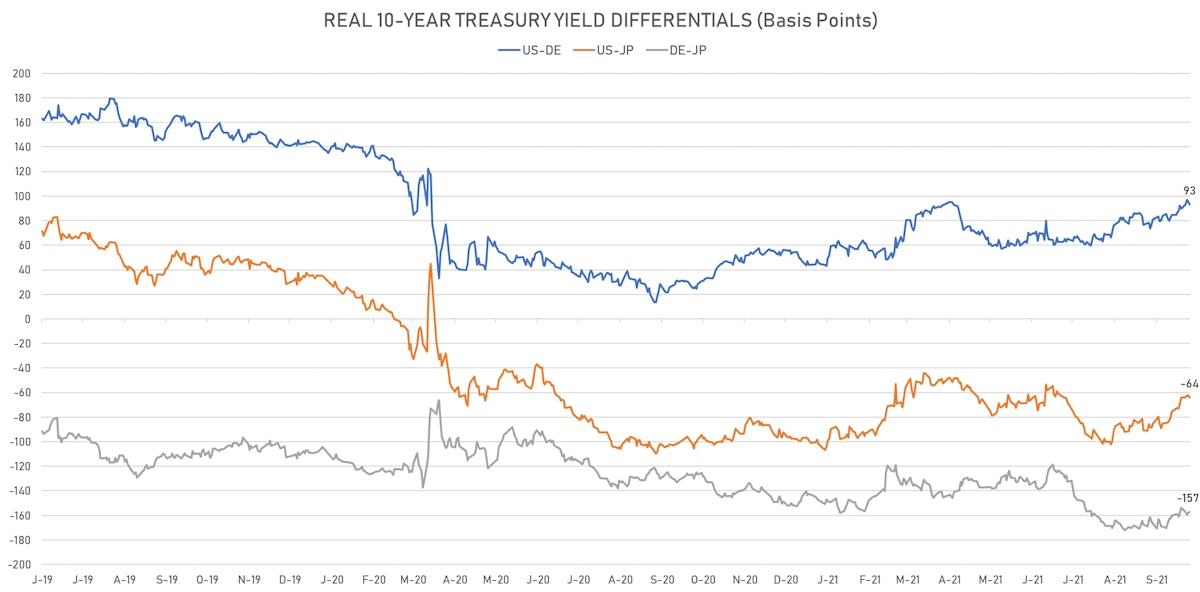

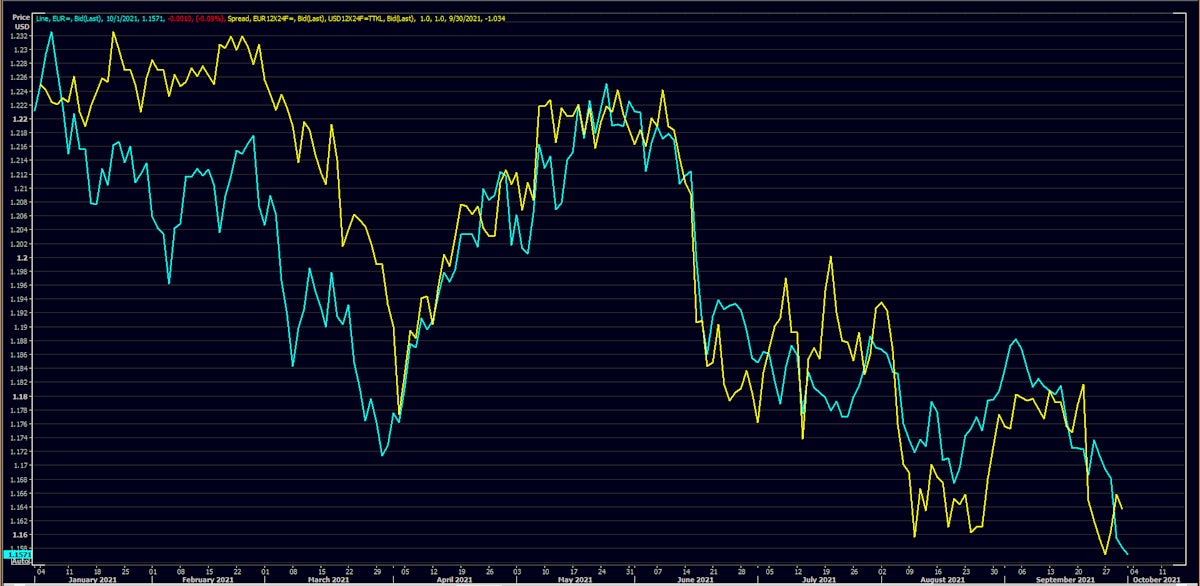

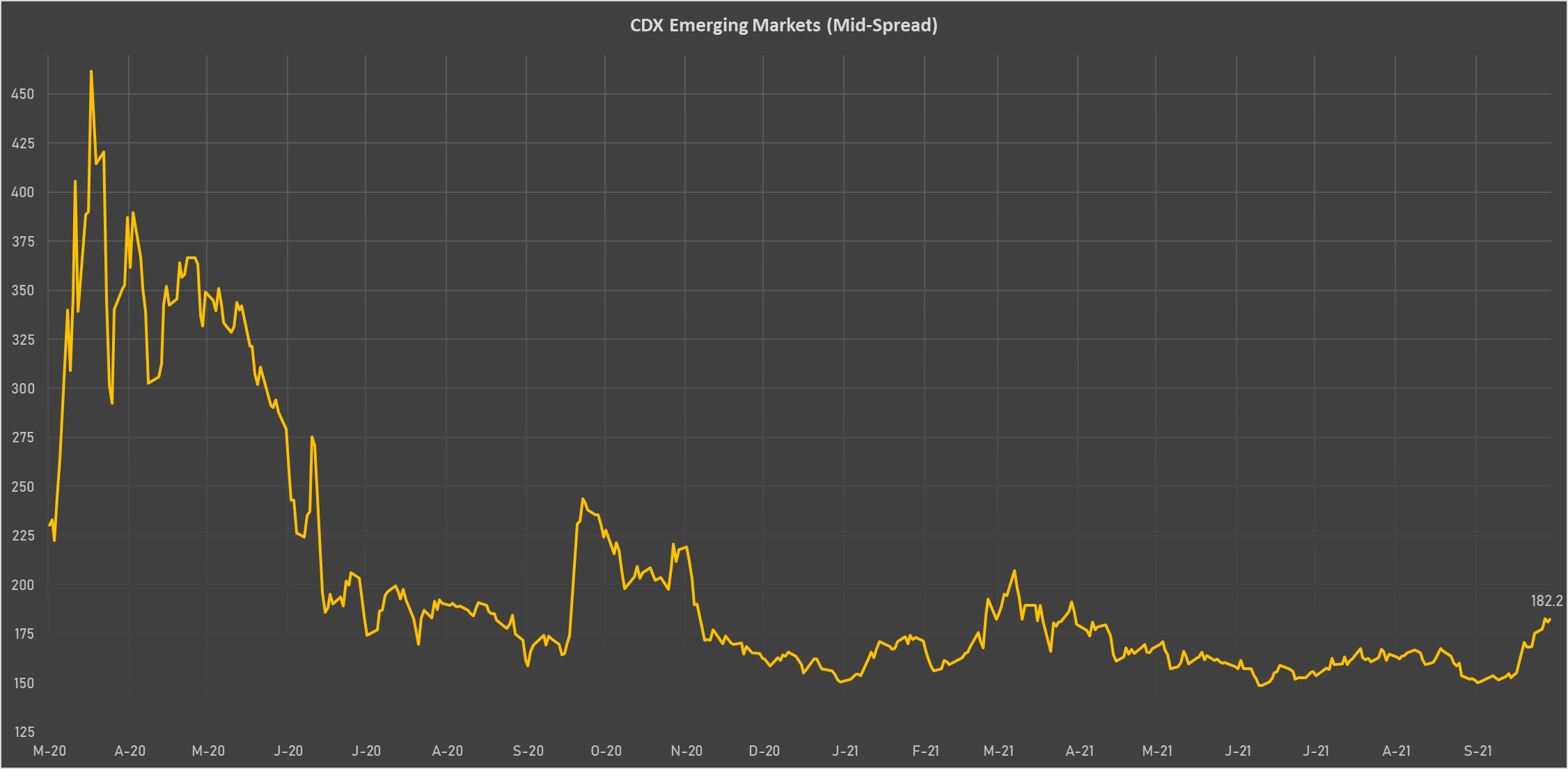

Rates differentials are driving the action in majors, though widening sovereign credit spreads more meaningful than carry for EM FX at the moment

Published ET

Euro spot rate vs 1Y Forward 1Y Rates differential | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is down -0.12% at 94.25 (YTD: +4.74%)

- Euro down 0.15% at 1.1578 (YTD: -5.2%)

- Yen up 0.56% at 111.34 (YTD: -7.2%)

- Onshore Yuan up 0.37% at 6.4452 (YTD: +1.2%)

- Swiss franc up 0.35% at 0.9317 (YTD: -5.0%)

- Sterling up 0.39% at 1.3475 (YTD: -1.4%)

- Canadian dollar up 0.61% at 1.2677 (YTD: +0.4%)

- Australian dollar up 0.74% at 0.7228 (YTD: -6.1%)

- NZ dollar up 0.41% at 0.6898 (YTD: -4.0%)

MACRO DATA RELEASES

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Aug 2021 (AU Bureau of Stat) at 6.80 % (vs -8.60 % prior), above consensus estimate of -5.00 %

- China (Mainland), PMI, Manufacturing Sector for Sep 2021 (NBS, China) at 49.60 (vs 50.10 prior), below consensus estimate of 50.10

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Sep 2021 (Markit Economics) at 50.00 (vs 49.20 prior), above consensus estimate of 49.50

- Colombia, Policy Rates, Intervention Rate for Aug 2021 (Cent Bank, Colombia) at 2.00 % (vs 1.75 % prior), in line with Reuters consensus estimate

- Czech Republic, Policy Rates, Repo Rate (2 Week) for 01 Oct (Czech National Bank) at 1.50 % (vs 0.75 % prior), above consensus estimate of 1.25 %

- Denmark, GDP, Total, chain linked, Change P/P for Q2 2021 (statbank.dk) at 2.80 % (vs 2.30 % prior)

- Denmark, GDP, Total, chain linked, Change Y/Y for Q2 2021 (statbank.dk) at 9.80 % (vs 8.50 % prior)

- Denmark, Unemployment, Rate, Net for Aug 2021 (statbank.dk) at 3.10 % (vs 3.30 % prior)

- Euro Zone, Unemployment, Rate for Aug 2021 (Eurostat) at 7.50 % (vs 7.60 % prior), in line with Reuters consensus estimate

- France, HICP, Flash, Change Y/Y, Price Index for Sep 2021 (INSEE, France) at 2.70 % (vs 2.40 % prior), below consensus estimate of 2.80 %

- Germany, CPI, Flash, Change Y/Y, Price Index for Sep 2021 (Destatis) at 4.10 % (vs 3.90 % prior), below consensus estimate of 4.20 %

- Germany, HICP, Flash, Change Y/Y, Price Index for Sep 2021 (Destatis) at 4.10 % (vs 3.40 % prior), above consensus estimate of 4.00 %

- Germany, Unemployment, Change, Absolute change for Sep 2021 (Deutsche Bundesbank) at -30.00 k (vs -53.00 k prior), above consensus estimate of -33.00 k

- Germany, Unemployment, Rate, Registered for Sep 2021 (Deutsche Bundesbank) at 5.50 % (vs 5.50 % prior), above consensus estimate of 5.40 %

- Italy, HICP, Preliminary, Change P/P, Price Index for Sep 2021 (ISTAT, Italy) at 1.40 % (vs 0.20 % prior), below consensus estimate of 1.60 %

- Italy, HICP, Preliminary, Change Y/Y, Price Index for Sep 2021 (ISTAT, Italy) at 3.00 % (vs 2.50 % prior), in line with Reuters consensus estimate

- Japan, Labor Market n.i.e, Active opening rate for Aug 2021 () at 1.14 (vs 1.15 prior), in line with Reuters consensus estimate

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, manufacturing, actual, Price Index for Q3 2021 (Bank of Japan) at 18.00 (vs 14.00 prior), above consensus estimate of 13.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, manufacturing, forecast, Price Index for Q3 2021 (Bank of Japan) at 14.00 (vs 13.00 prior), below consensus estimate of 15.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Large enterprises, nonmanufacturing, actual, Price Index for Q3 2021 (Bank of Japan) at 2.00 (vs 1.00 prior), above consensus estimate of 0.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, manufacturing, actual, Price Index for Q3 2021 (Bank of Japan) at -3.00 (vs -7.00 prior), above consensus estimate of -9.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, manufacturing, forecast, Price Index for Q3 2021 (Bank of Japan) at -4.00 (vs -6.00 prior), above consensus estimate of -6.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, non-manufacturing, actual, Price Index for Q3 2021 (Bank of Japan) at -10.00 (vs -9.00 prior), above consensus estimate of -11.00

- Japan, TANKAN, Business Conditions, Diffusion Index, Small enterprises, nonmanufacturing, forecast, Price Index for Q3 2021 (Bank of Japan) at -13.00 (vs -12.00 prior), below consensus estimate of -9.00

- Japan, TANKAN, Fixed Investment, Large enterprises, all industries, forecast for current Fiscal Year, Change Y/Y for Q3 2021 (Bank of Japan) at 10.10 % (vs 9.60 % prior), above consensus estimate of 9.10 %

- Japan, TANKAN, Fixed Investment, Small enterprises, all industries, forecast for current Fiscal Year, Change Y/Y for Q3 2021 (Bank of Japan) at 4.70 % (vs 0.90 % prior), above consensus estimate of 1.60 %

- Japan, Unemployment, Rate for Aug 2021 (MIC, Japan) at 2.80 % (vs 2.80 % prior), below consensus estimate of 2.90 %

- Mexico, Policy Rates, Reference Rate (Overnight Lending Rate) for Sep 2021 (Banco de Mexico) at 4.75 % (vs 4.50 % prior), in line with Reuters consensus estimate

- Switzerland, KOF composite leading indicator for Sep 2021 (KOF, Switzerland) at 110.60 (vs 113.50 prior), above consensus estimate of 110.00

- Switzerland, Reserves, Official reserve assets, Current Prices for Aug 2021 (Swiss National Bank) at 998,469.13 Mln CHF (vs 984,002.78 Mln CHF prior)

- United Kingdom, GDP, Total, at market prices, Change P/P for Q2 2021 (ONS, United Kingdom) at 5.50 % (vs 4.80 % prior), above consensus estimate of 4.80 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Sep 2021 (Nationwide, UK) at 0.10 % (vs 2.10 % prior), below consensus estimate of 0.60 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Sep 2021 (Nationwide, UK) at 10.00 % (vs 11.00 % prior), below consensus estimate of 10.70 %

- United Kingdom, Total, Final, Change Y/Y for Q2 2021 (ONS, United Kingdom) at 23.60 % (vs 22.20 % prior), above consensus estimate of 22.20 %

- United States, GDP, Total-final (Unrevised), Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.70 % (vs 6.60 % prior), above consensus estimate of 6.60 %

- United States, Jobless Claims, National, Initial for W 25 Sep (U.S. Dept. of Labor) at 362.00 k (vs 351.00 k prior), above consensus estimate of 335.00 k

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.8 bp at 153.5 bp (YTD change: +42.5 bp)

- US-JAPAN: -2.8 bp at 106.4 bp (YTD change: +58.2 bp)

- US-CHINA: -1.3 bp at -170.6 bp (YTD change: +86.6 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.0 bp at 92.9 bp (YTD change: +46.8bp)

- US-JAPAN: -2.0 bp at -64.1 bp (YTD change: +37.4bp)

- JAPAN-GERMANY: -1.0 bp at 157.0 bp (YTD change: +9.4bp)

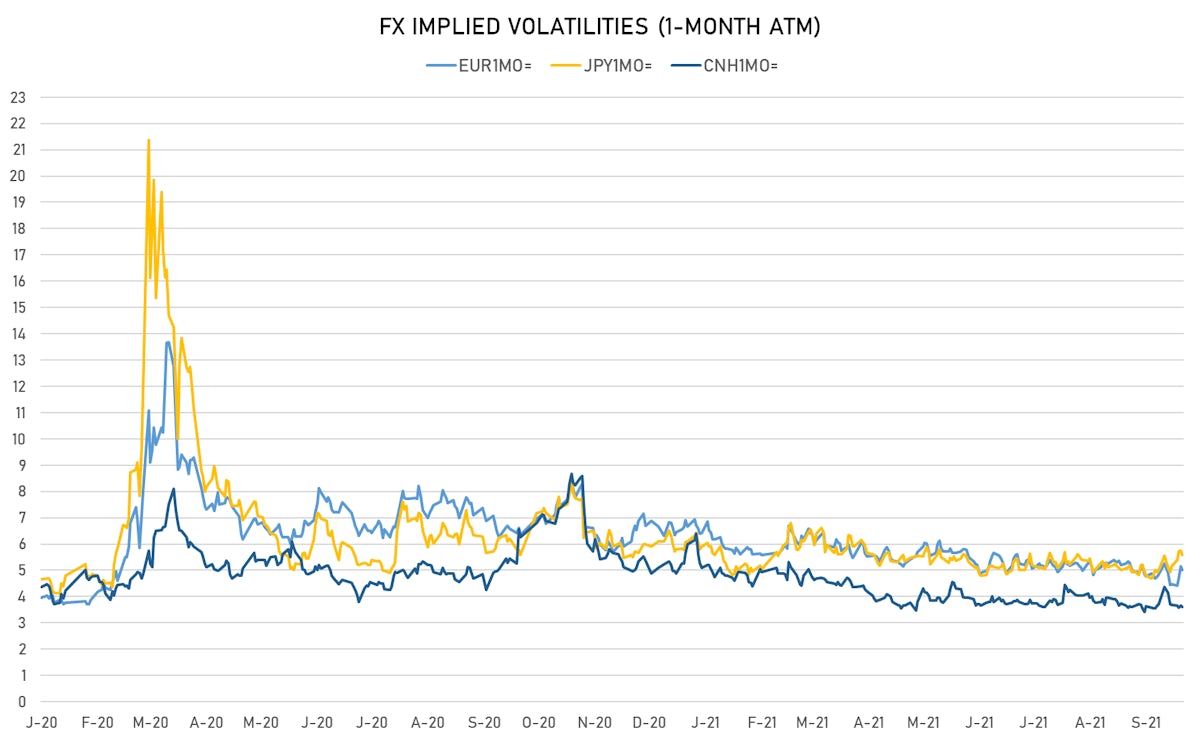

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.04, up 0.01 (YTD: -1.13)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.03, down -0.1 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 5.58, down -0.2 (YTD: -0.5)

- Offshore Yuan 1M ATM IV unchanged at 3.60 (YTD: -2.4)

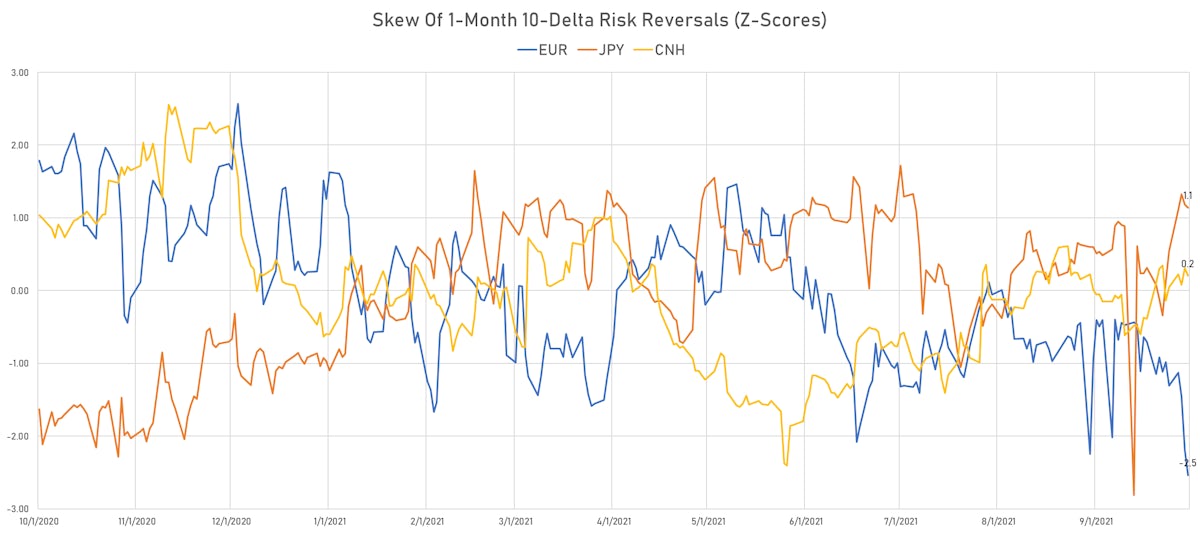

- Risk reversals are showing very negative speculative positioning on the Euro, as well as the Yen (to a much lesser degree)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): up 15.8 basis points to 444 bp (1Y range: 283-429bp)

- Colombia (rated BB+): up 5.1 basis points to 168 bp (1Y range: 83-163bp)

- Peru (rated BBB+): up 2.5 basis points to 105 bp (1Y range: 52-102bp)

- Panama (rated BBB-): up 1.5 basis points to 88 bp (1Y range: 44-86bp)

- Philippines (rated BBB): down 0.5 basis points to 51 bp (1Y range: 33-54bp)

- Bahrain (rated B+): down 2.7 basis points to 275 bp (1Y range: 159-330bp)

- Saudi Arabia (rated A): down 0.5 basis points to 52 bp (1Y range: 47-91bp)

- Oman (rated BB-): down 2.9 basis points to 264 bp (1Y range: 223-452bp)

- Indonesia (rated BBB): down 1.4 basis points to 80 bp (1Y range: 66-114bp)

- Vietnam (rated BB): down 2.0 basis points to 100 bp (1Y range: 89-137bp)

LARGEST FX MOVES TODAY

- Jamaican Dollar up 1.3% (YTD: -2.6%)

- Tunisian Dinar up 1.0% (YTD: -4.1%)

- Qatari Riyal up 0.9% (YTD: 0.0%)

- Moldovan Leu up 0.9% (YTD: -2.6%)

- South Africa Rand up 0.9% (YTD: -2.4%)

- Mauritius Rupee up 0.9% (YTD: -6.8%)

- Thai Baht up 0.9% (YTD: -10.7%)

- Ghanaian Cedi up 0.9% (YTD: -2.6%)

- Malawi Kwacha up 0.8% (YTD: -4.7%)

- Haiti Gourde down 1.0% (YTD: -26.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 65.5%

- New Zambian kwacha up 26.3%

- Mozambique metical up 15.4%

- Ethiopian Birr down 15.2%

- Turkish Lira down 16.4%

- Haiti Gourde down 26.1%

- Surinamese dollar down 33.6%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Sudanese Pound down 87.5%