FX

Major Currencies Rebound On Friday On Falling US Rates, Most Still Down For Week

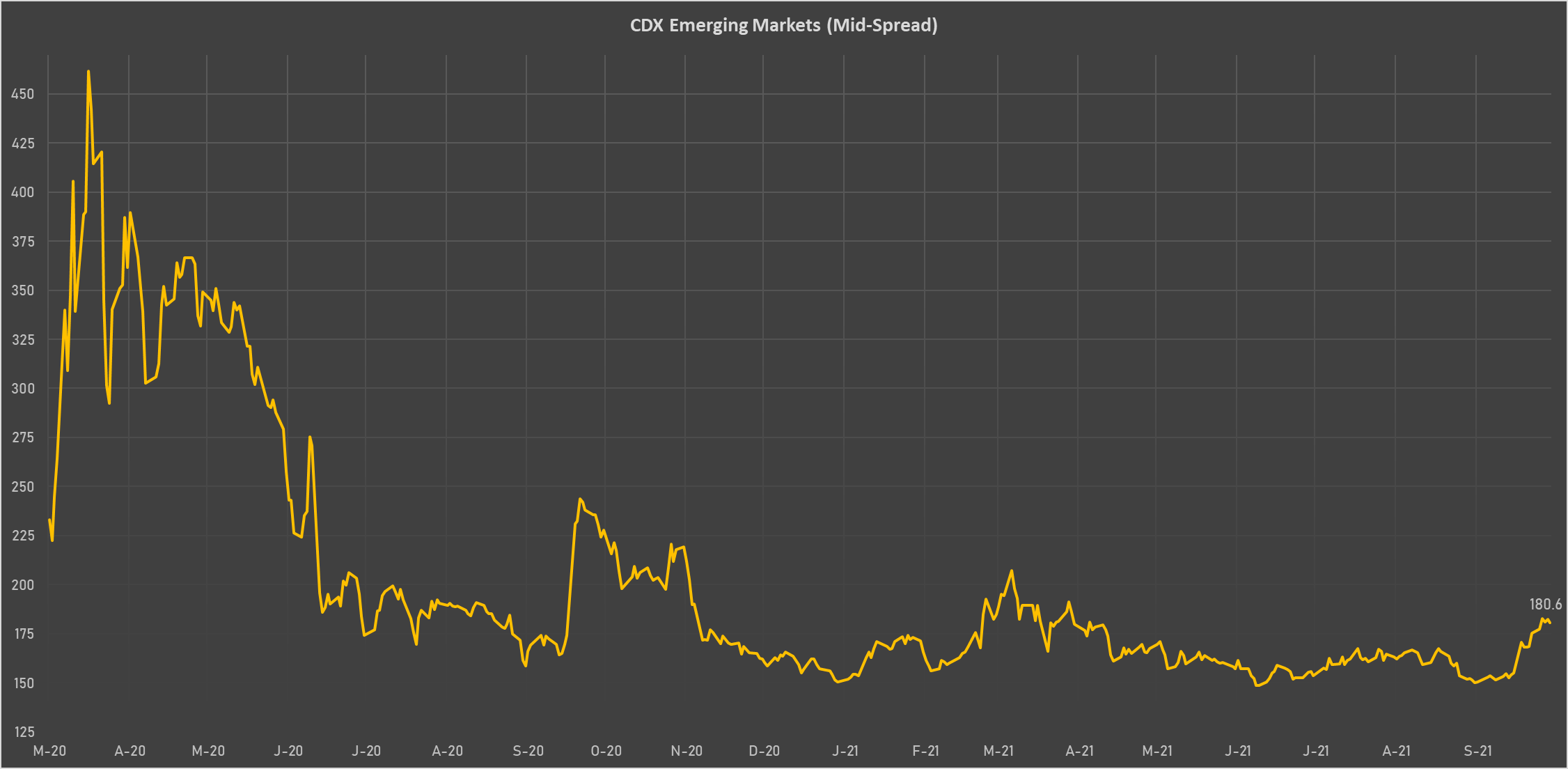

The Chinese Yuan has done the best this week among majors, with most investors realizing that an Evergrande default would not be a "Lehman moment"

Published ET

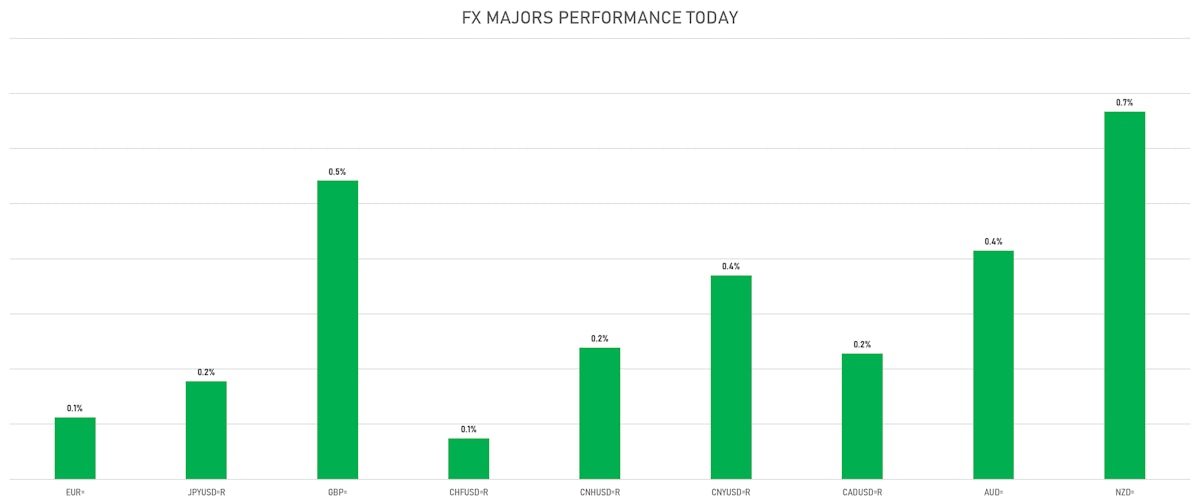

FX Majors Performance This Week | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.20% at 94.06 (YTD: +4.54%)

- Euro up 0.11% at 1.1594 (YTD: -5.1%)

- Yen up 0.18% at 111.05 (YTD: -7.0%)

- Onshore Yuan up 0.37% at 6.4452 (YTD: +1.2%)

- Swiss franc up 0.07% at 0.9309 (YTD: -4.9%)

- Sterling up 0.54% at 1.3545 (YTD: -0.9%)

- Canadian dollar up 0.23% at 1.2649 (YTD: +0.7%)

- Australian dollar up 0.42% at 0.7256 (YTD: -5.7%)

- NZ dollar up 0.67% at 0.6943 (YTD: -3.4%)

WEEKLY IMM DATA: NET SPEC POSITIONING

- All Currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

MACRO DATA RELEASES

- Angola, Policy Rates, BNA Basic Reference Rate for 30 Sep (Central Bank, Angola) at 20.00 % (vs 20.00 % prior)

- Brazil, PMI, Manufacturing Sector for Sep 2021 (Markit Economics) at 54.40 (vs 53.60 prior)

- Canada, GDP, All industries, Change P/P for Jul 2021 (CANSIM, Canada) at -0.10 % (vs 0.70 % prior), above consensus estimate of -0.20 %

- Canada, PMI, Manufacturing Sector, Markit Mfg PMI SA for Sep 2021 (Markit Economics) at 57.00 (vs 57.20 prior)

- Euro Zone, CPI, Change Y/Y for Sep 2021 (Eurostat) at 3.40 % (vs 3.00 % prior), above consensus estimate of 3.30 %

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Sep 2021 (Eurostat) at 1.90 % (vs 1.60 % prior), in line with Refinitiv consensus

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Sep 2021 (Markit Economics) at 58.60 (vs 58.70 prior), below consensus estimate of 58.70

- France, PMI, Manufacturing Sector, Total, Final for Sep 2021 (Markit Economics) at 55.00 (vs 55.20 prior), below consensus estimate of 55.20

- Germany, PMI, Manufacturing Sector, Total, Final for Sep 2021 (Markit Economics) at 58.40 (vs 58.50 prior), below consensus estimate of 58.50

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Sep 2021 (Markit Economics) at 53.70 (vs 52.30 prior), above consensus estimate of 51.80

- Indonesia, CPI, Change Y/Y for Sep 2021 (Statistics Indonesia) at 1.60 % (vs 1.59 % prior), below consensus estimate of 1.69 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Sep 2021 (Markit Economics) at 52.20 (vs 43.70 prior)

- Italy, PMI, Manufacturing Sector for Sep 2021 (Markit Economics) at 59.70 (vs 60.90 prior), above consensus estimate of 59.40

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Sep 2021 (Markit Economics) at 51.50 (vs 51.20 prior)

- Mexico, PMI, Manufacturing Sector for Sep 2021 (Markit Economics) at 48.60 (vs 47.10 prior)

- Russia, PMI, Manufacturing Sector for Sep 2021 (Markit Economics) at 49.80 (vs 46.50 prior)

- Russia, Unemployment, Rate for Aug 2021 (RosStat, Russia) at 4.40 % (vs 4.50 % prior), below consensus estimate of 4.50 %

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Sep 2021 (Markit Economics) at 52.40 (vs 51.20 prior)

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Sep 2021 (Markit Economics) at 52.50 (vs 54.10 prior)

- United Kingdom, PMI, Manufacturing Sector for Sep 2021 (Markit Economics) at 57.10 (vs 56.30 prior), above consensus estimate of 56.30

- United States, ISM Manufacturing, PMI total for Sep 2021 (ISM, United States) at 61.10 (vs 59.90 prior), above consensus estimate of 59.60

- United States, PMI, Manufacturing Sector, Total, Final for Sep 2021 (Markit Economics) at 60.70 (vs 60.50 prior)

- United States, Personal Consumption Expenditure, Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.80 % (vs 0.30 % prior), above consensus estimate of 0.60 %

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Sep 2021 (UMICH, Survey) at 72.80 (vs 71.00 prior), above consensus estimate of 71.00

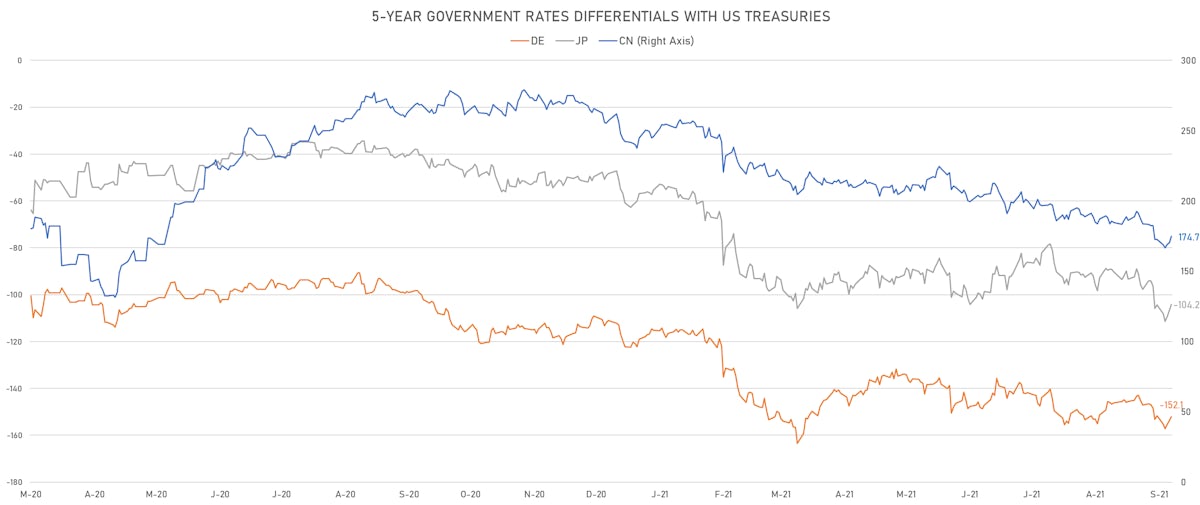

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.5 bp at 152.1 bp (YTD change: +41.0 bp)

- US-JAPAN: -2.3 bp at 104.2 bp (YTD change: +55.9 bp)

- US-CHINA: -4.2 bp at -174.7 bp (YTD change: +82.4 bp)

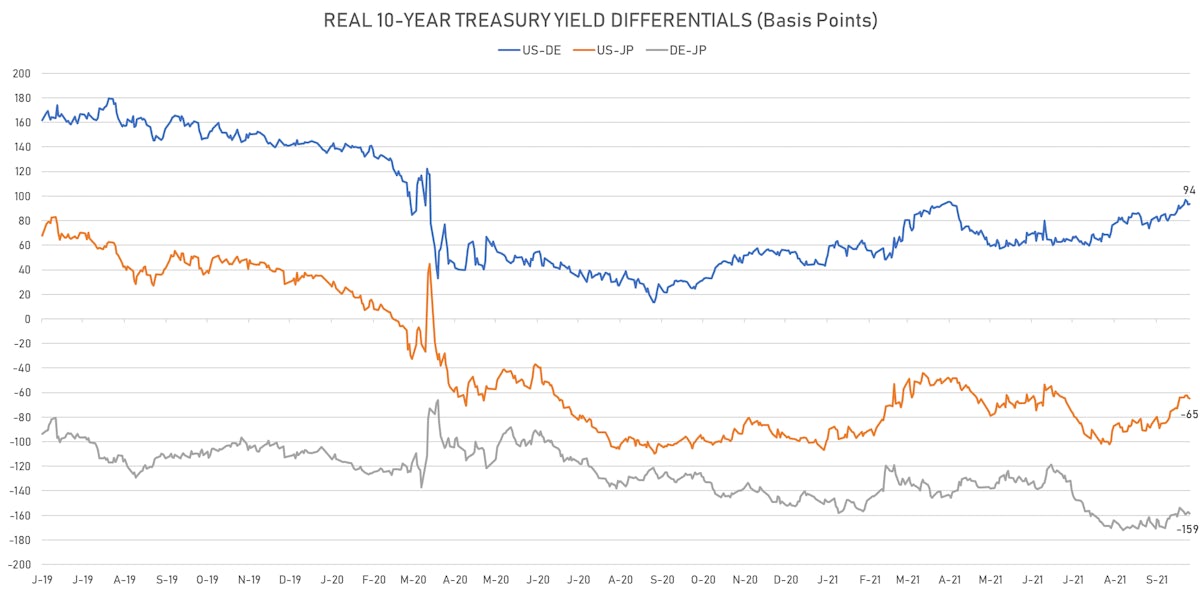

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.6 bp at 93.5 bp (YTD change: +47.4bp)

- US-JAPAN: -0.9 bp at -65.0 bp (YTD change: +36.5bp)

- JAPAN-GERMANY: +1.5 bp at 158.5 bp (YTD change: +10.9bp)

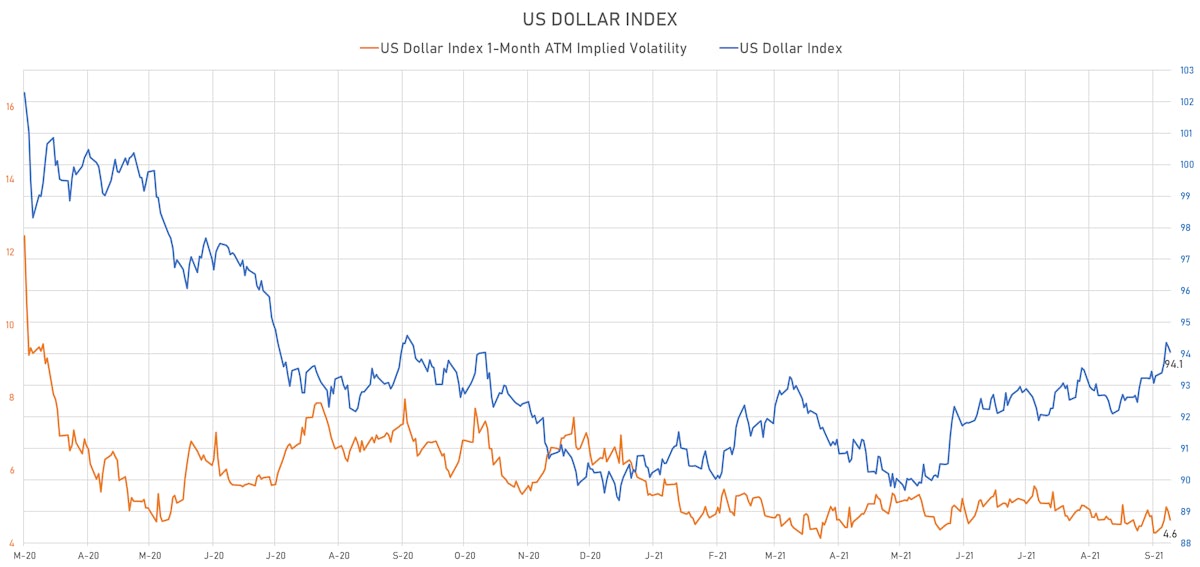

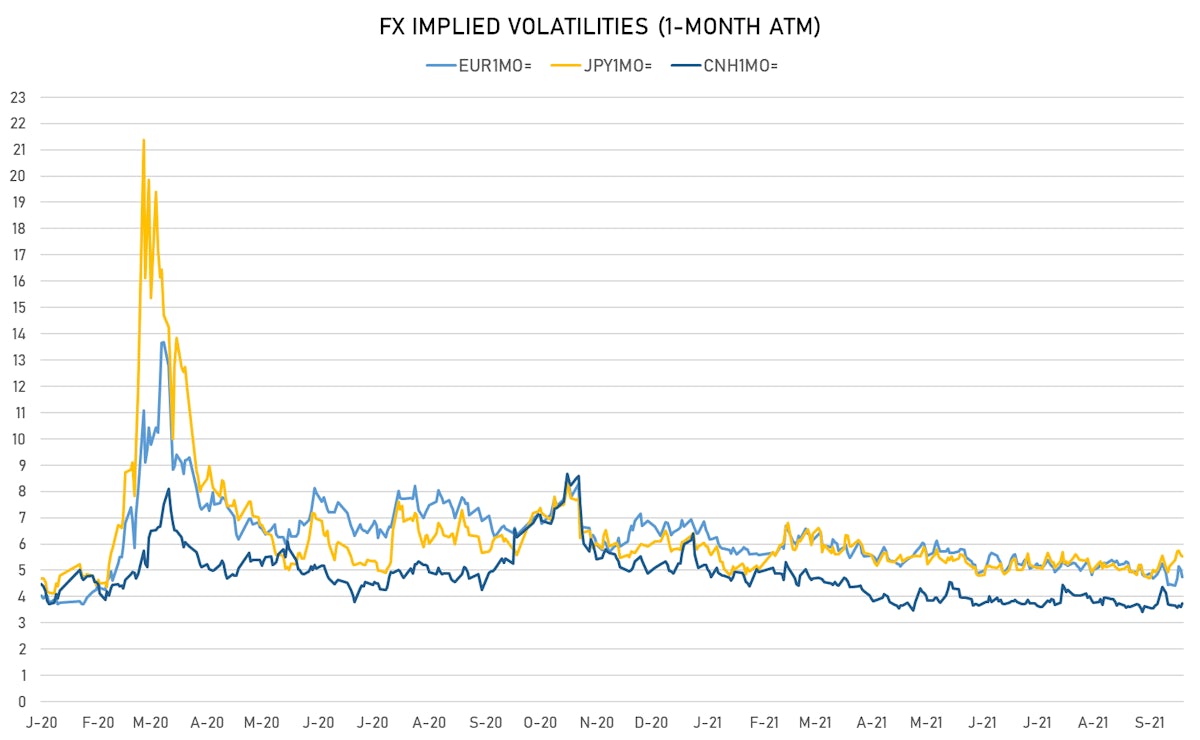

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.18, up 0.14 (YTD: -0.99)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.75, down -0.3 (YTD: -1.9)

- Japanese Yen 1M ATM IV unchanged at 5.53 (YTD: -0.6)

- Offshore Yuan 1M ATM IV currently at 3.75, up 0.1 (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): up 18.8 basis points to 463 bp (1Y range: 283-444bp)

- Bahrain (rated B+): up 8.0 basis points to 283 bp (1Y range: 159-330bp)

- Ethiopia (rated CCC): up 7.5 basis points to 426 bp (1Y range: 382-442bp)

- Nigeria (rated B): up 6.5 basis points to 369 bp (1Y range: 331-383bp)

- Ecuador (rated WD): up 3.0 basis points to 174 bp (1Y range: 156-181bp)

- Pakistan (rated B-): up 7.0 basis points to 406 bp (1Y range: 362-512bp)

- Lebanon (rated CC): up 61.0 basis points to 3,547 bp (1Y range: 3,179-3,683bp)

- Kenya (rated B+): up 7.5 basis points to 437 bp (1Y range: 392-454bp)

- Senegal (rated ): up 6.5 basis points to 394 bp (1Y range: 353-409bp)

- Vietnam (rated BB): up 1.5 basis points to 101 bp (1Y range: 89-137bp)

LARGEST FX MOVES TODAY

- Aruba florin up 2.2% (YTD: +2.2%)

- Gambian Dalasi up 2.1% (YTD: +2.1%)

- Haiti Gourde up 1.7% (YTD: -24.8%)

- Rwanda Franc up 1.5% (YTD: -1.0%)

- Brazilian Real up 1.5% (YTD: -3.2%)

- South Africa Rand up 1.4% (YTD: -1.3%)

- Malagasy Ariary up 1.4% (YTD: +1.4%)

- Mozambique metical up 1.3% (YTD: +16.9%)

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

- Nicaragua Cordoba down 2.6% (YTD: -3.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 44.0%

- New Zambian kwacha up 26.5%

- Mozambique metical up 16.9%

- Ethiopian Birr down 15.2%

- Turkish Lira down 16.1%

- Haiti Gourde down 24.8%

- Surinamese dollar down 34.1%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Sudanese Pound down 87.5%