FX

Yen Drops 1% Against The US Dollar, As Inflationary Fears Push Up Forward Rates Differentials

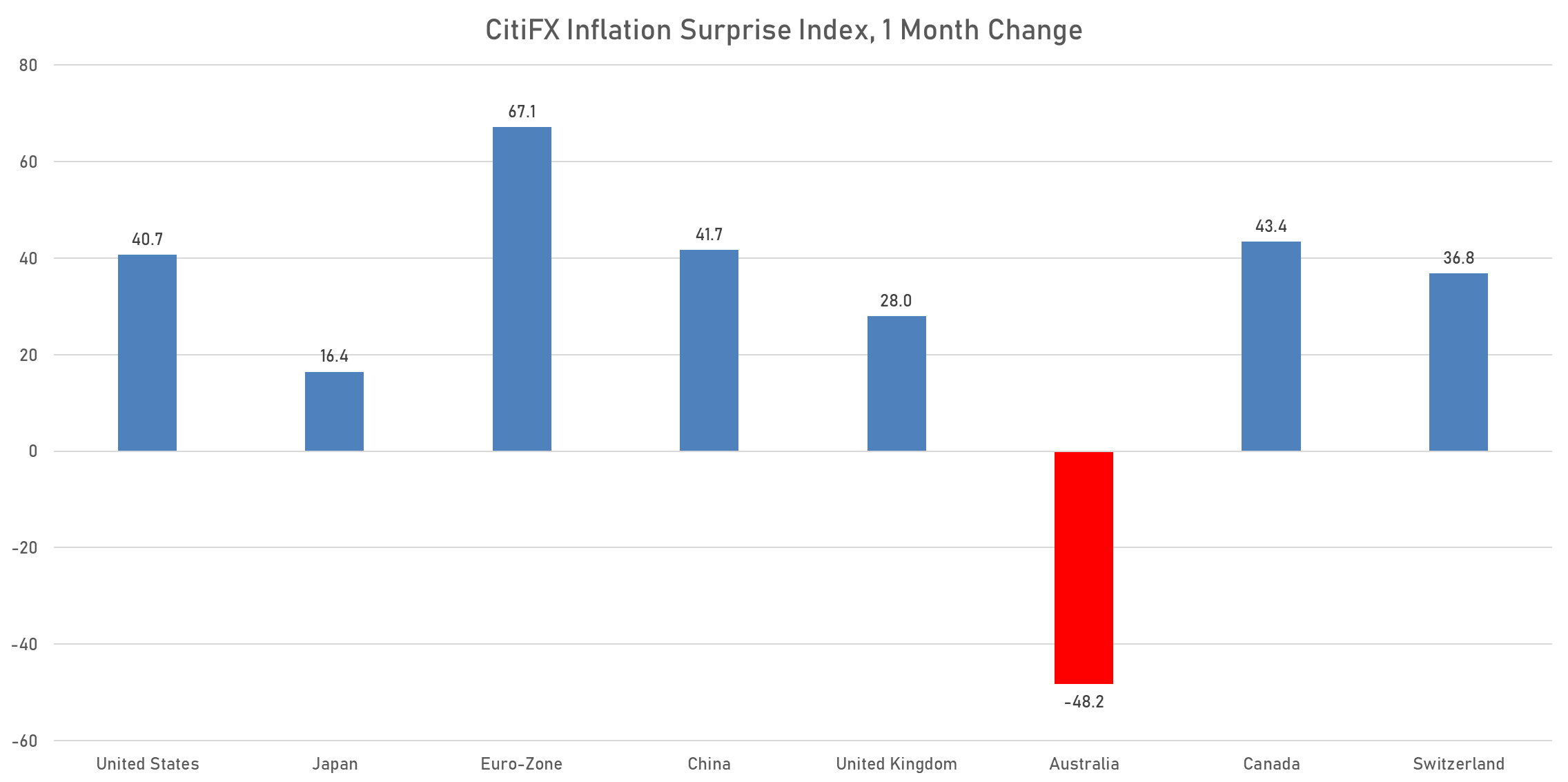

Central European countries like Poland and Romania have already raised rates to contain inflation, and the Czech Republic will likely follow soon after the higher than expected inflation data published today

Published ET

JPY Spot Rate vs 18-months forward 6-month US-JP rates differential | Source: Refinitiv

QUICK SUMMARY

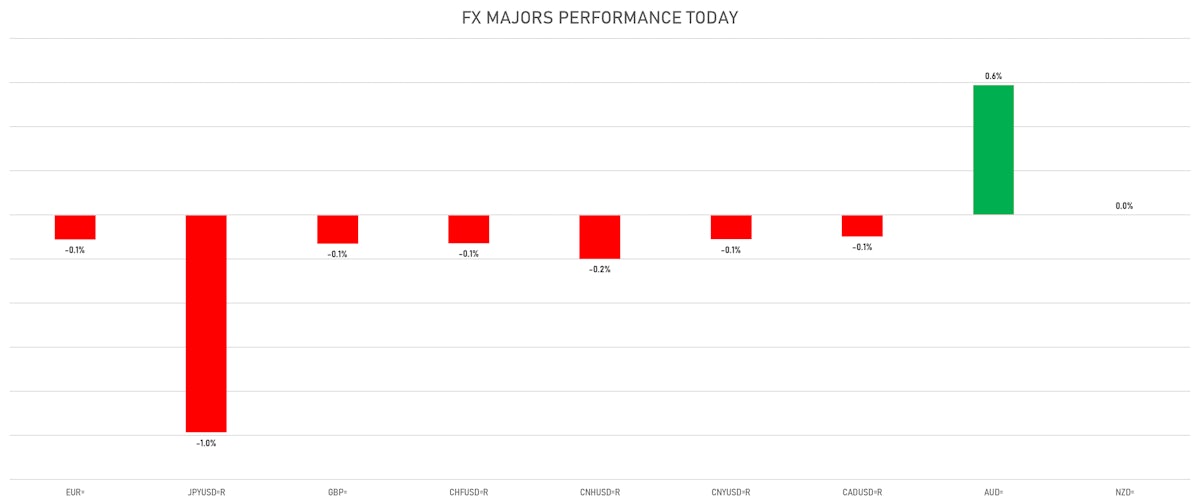

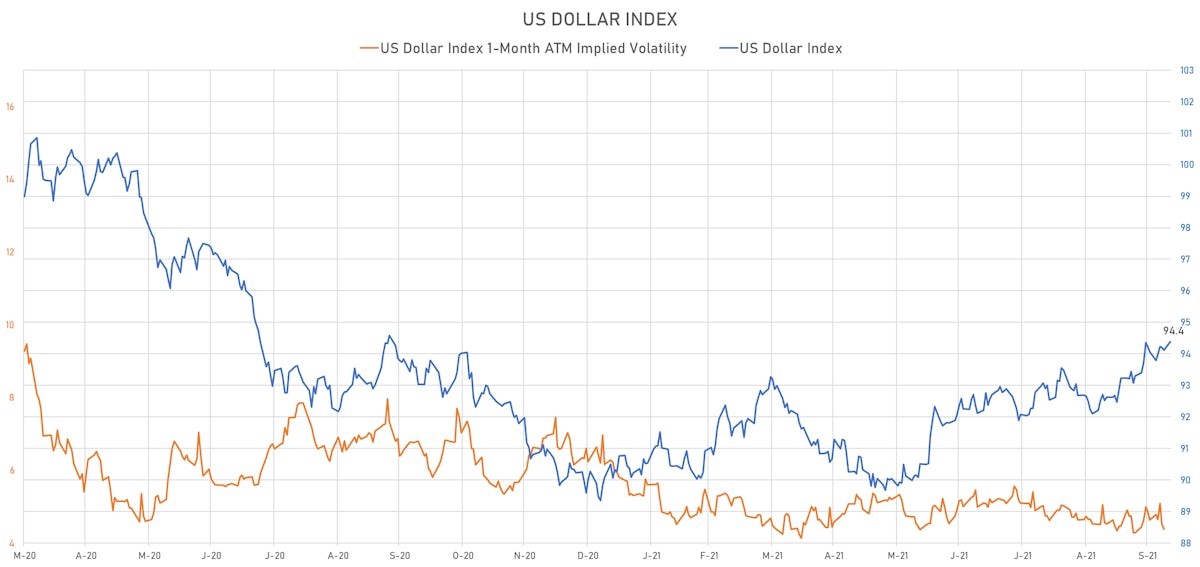

- The US Dollar Index is up 0.28% at 94.38 (YTD: +4.89%)

- Euro down 0.11% at 1.1554 (YTD: -5.4%)

- Yen down 0.99% at 113.35 (YTD: -8.9%)

- Onshore Yuan down 0.11% at 6.4501 (YTD: +1.2%)

- Swiss franc down 0.13% at 0.9277 (YTD: -4.6%)

- Sterling down 0.13% at 1.3593 (YTD: -0.6%)

- Canadian dollar down 0.10% at 1.2483 (YTD: +2.0%)

- Australian dollar up 0.59% at 0.7349 (YTD: -4.5%)

- NZ dollar up 0.00% at 0.6938 (YTD: -3.4%)

MACRO DATA RELEASES

- Czech Republic, CPI, Change P/P, Price Index for Sep 2021 (CSU, Czech Rep) at 0.20 % (vs 0.70 % prior), above consensus estimate of -0.20 %

- Czech Republic, CPI, Change Y/Y, Price Index for Sep 2021 (CSU, Czech Rep) at 4.90 % (vs 4.10 % prior), above consensus estimate of 4.50 %

- Denmark, CPI, All Items, Change Y/Y, Price Index for Sep 2021 (statbank.dk) at 2.20 % (vs 1.80 % prior)

- Italy, Production, Total industry excluding construction, Change P/P for Aug 2021 (ISTAT, Italy) at -0.20 % (vs 0.80 % prior), above consensus estimate of -0.30 %

- Italy, Production, Total industry excluding construction, Change Y/Y for Aug 2021 (ISTAT, Italy) at 0.00 % (vs 7.00 % prior), above consensus estimate of -0.70 %

- Japan, Producer Prices, Domestic, total, Change P/P, Price Index for Sep 2021 (Bank of Japan) at 0.30 % (vs 0.00 % prior), in line with consensus estimate

- Japan, Producer Prices, Domestic, total, Change Y/Y, Price Index for Sep 2021 (Bank of Japan) at 6.30 % (vs 5.50 % prior), above consensus estimate of 5.90 %

- New Zealand, Electronic card transactions, Retail industry, Change P/P for Sep 2021 (Statistics, NZ) at 0.90 % (vs -19.80 % prior)

- New Zealand, Electronic card transactions, Retail industry, Change Y/Y for Sep 2021 (Statistics, NZ) at -14.90 % (vs -11.40 % prior)

- Norway, CPI, All Items, Change P/P, Price Index for Sep 2021 (Statistics Norway) at 1.00 % (vs 0.00 % prior)

- Norway, CPI, All Items, Change Y/Y for Sep 2021 (Statistics Norway) at 4.10 % (vs 3.40 % prior), above consensus estimate of 4.00 %

- Norway, CPI, CPI-ATE, All items, Change P/P for Sep 2021 (Statistics Norway) at 0.40 % (vs -0.60 % prior)

- Norway, CPI, CPI-ATE, All items, Change Y/Y for Sep 2021 (Statistics Norway) at 1.20 % (vs 1.00 % prior), in line with consensus estimate

- Slovakia, Production, Change Y/Y for Aug 2021 (Stat Office of SR) at 0.80 % (vs 7.80 % prior), below consensus estimate of 4.90 %

- Turkey, Current Account, Balance, Current Prices for Aug 2021 (Central Bank, Turkey) at 0.53 Bln USD (vs -0.68 Bln USD prior), above consensus estimate of -0.10 Bln USD

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.8 bp at 156.3 bp (YTD change: +45.3 bp)

- US-JAPAN: -1.2 bp at 114.1 bp (YTD change: +65.9 bp)

- US-CHINA: -9.0 bp at -171.1 bp (YTD change: +86.1 bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.01, down -0.18 (YTD: -1.16)

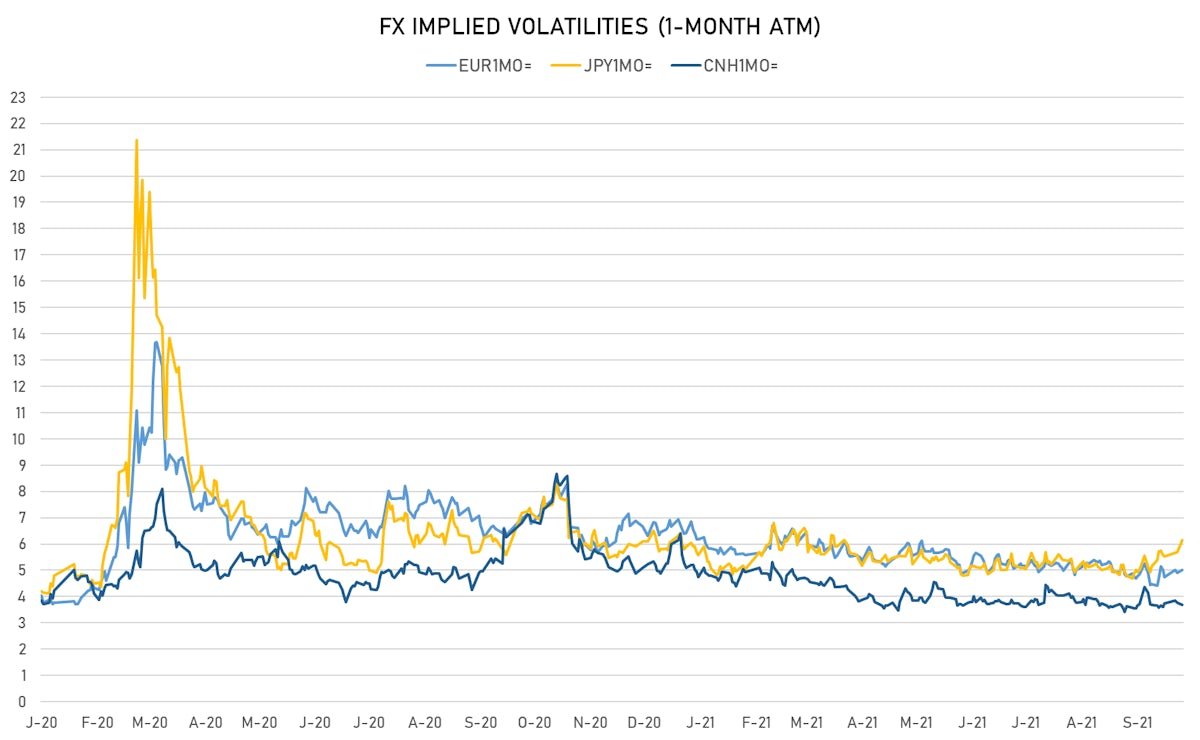

- Euro 1-Month At-The-Money Implied Volatility currently at 5.03, up 0.1 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 6.15, up 0.5 (YTD: +0.1)

- Offshore Yuan 1M ATM IV currently at 3.68, down -0.1 (YTD: -2.3)

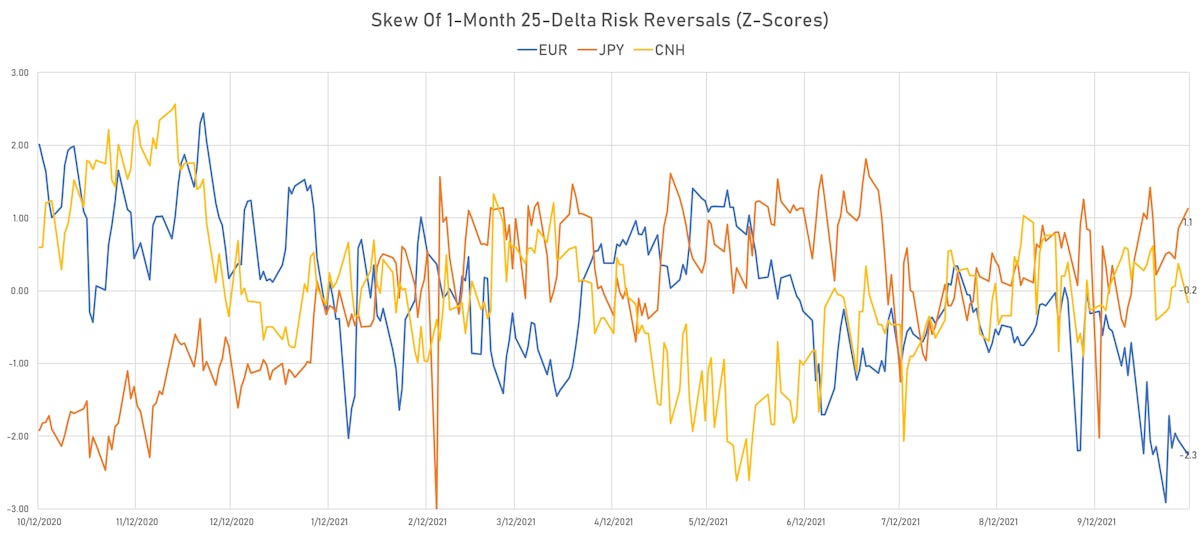

- Euro and yen risk reversals skewed towards weakening of the currencies

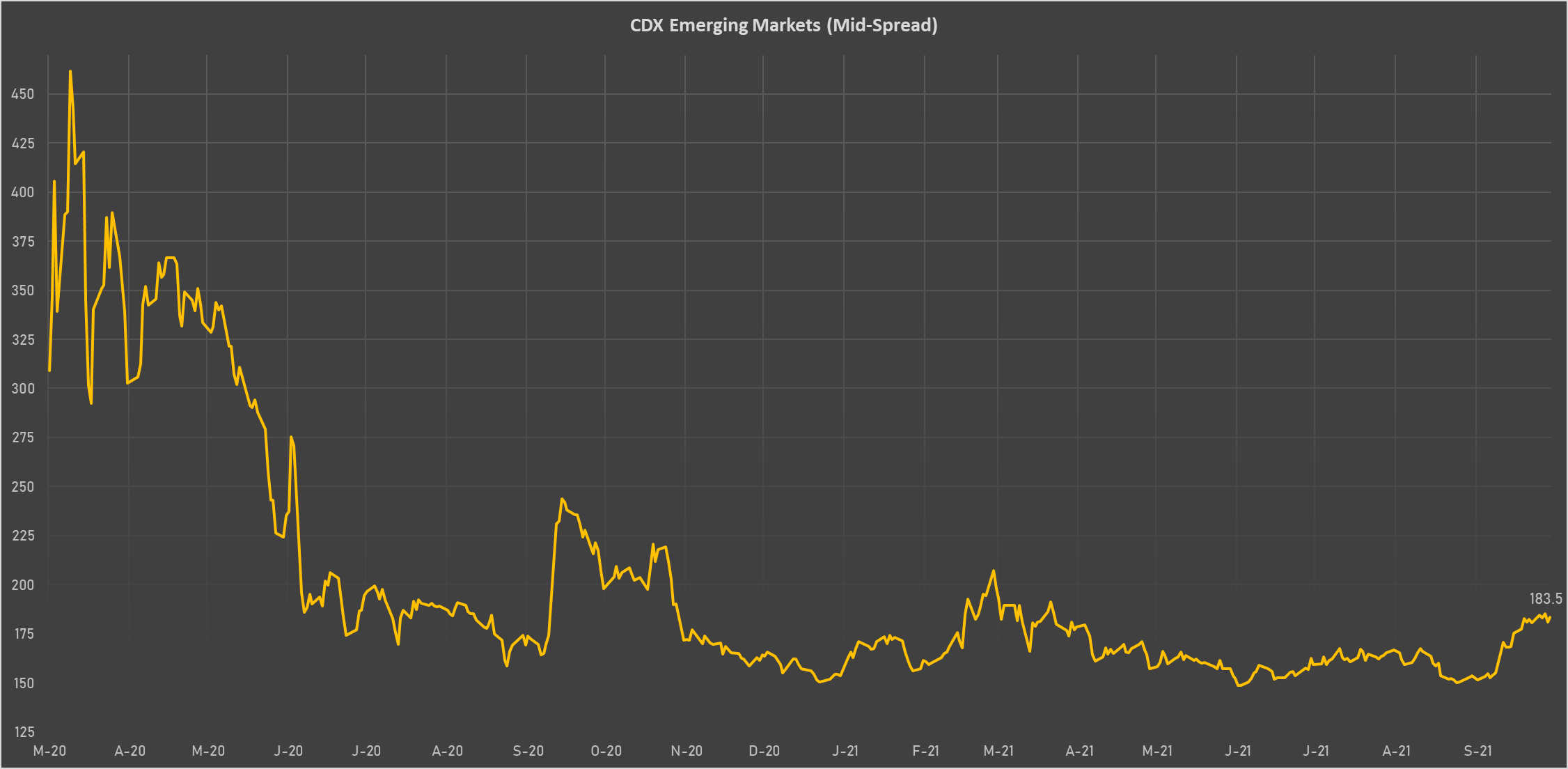

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- China (rated A+): up 10.6 basis points to 58 bp (1Y range: 27-51bp)

- Philippines (rated BBB): up 7.6 basis points to 65 bp (1Y range: 33-60bp)

- Malaysia (rated BBB+): up 7.3 basis points to 63 bp (1Y range: 33-58bp)

- Indonesia (rated BBB): up 8.7 basis points to 94 bp (1Y range: 66-97bp)

- Vietnam (rated BB): up 5.8 basis points to 111 bp (1Y range: 89-123bp)

- Saudi Arabia (rated A): up 2.3 basis points to 55 bp (1Y range: 47-87bp)

- Turkey (rated BB-): up 13.2 basis points to 440 bp (1Y range: 282-560bp)

- South Africa (rated BB-): up 5.5 basis points to 217 bp (1Y range: 178-287bp)

- Russia (rated BBB): up 2.1 basis points to 87 bp (1Y range: 72-117bp)

- Egypt (rated B+): up 11.0 basis points to 462 bp (1Y range: 283-463bp)

LARGEST FX MOVES TODAY

- Honduras Lempira up 1.0% (YTD: 0.0%)

- Vanuatu Vatu up 0.8% (YTD: -2.5%)

- Afghani up 0.8% (YTD: -14.3%)

- Tonga Pa'Anga up 0.8% (YTD: +1.2%)

- Uzbekistan Sum up 0.7% (YTD: -1.8%)

- New Zambian kwacha up 0.7% (YTD: +24.4%)

- Mexican Peso down 0.8% (YTD: -4.7%)

- Sierra Leon leon down 0.9% (YTD: -4.9%)

- Japanese Yen down 1.0% (YTD: -8.9%)

- Sri Lanka Rupee down 1.0% (YTD: -8.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 44.0%

- New Zambian kwacha up 24.4%

- Turkish Lira down 17.4%

- Haiti Gourde down 25.8%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%