FX

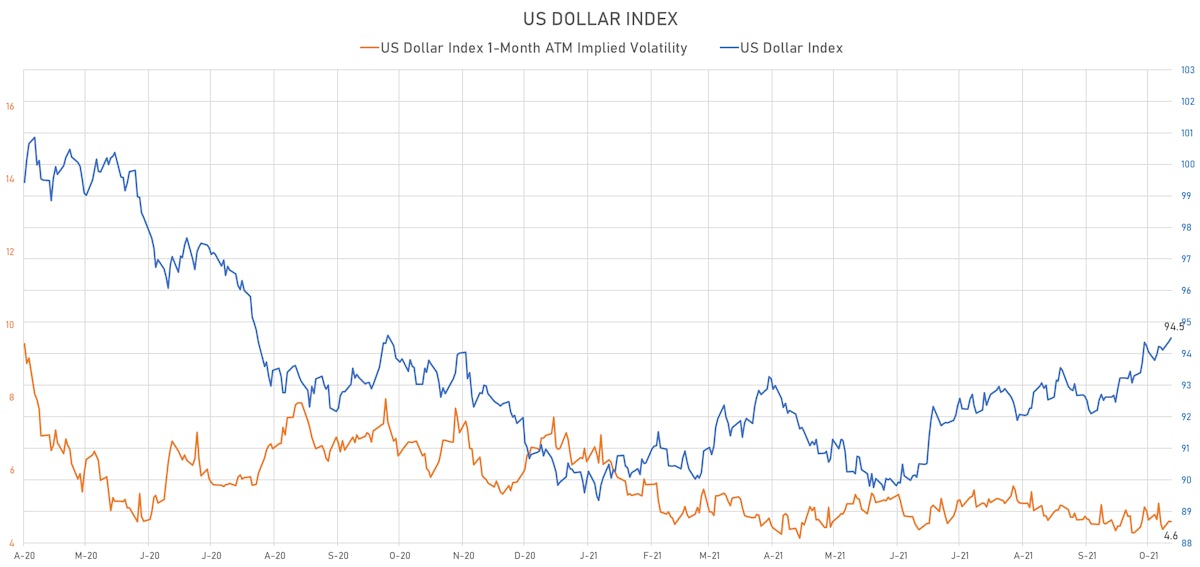

The US Dollar Makes Small Further Gains, Though Real Rates Differentials Were Less Favorable Today

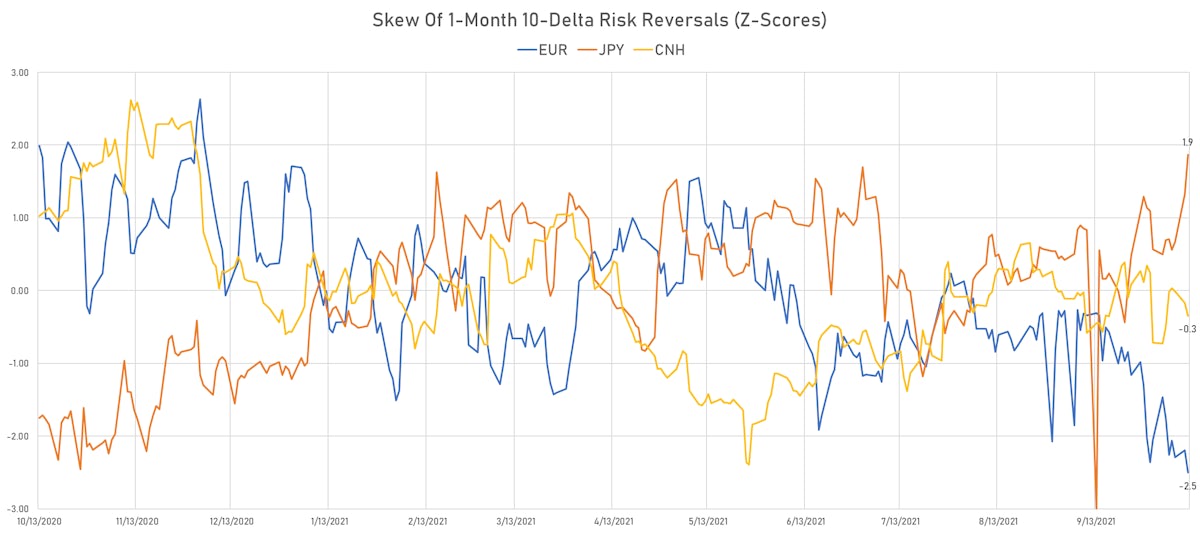

The volatility suppression of the PBOC is quite obvious at the moment, with yuan implied volatility falling while all other majors are seeing higher volatility, in line with the rise in rates volatility

Published ET

EUR, JPY, CNH 1-Month At-The-Money Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

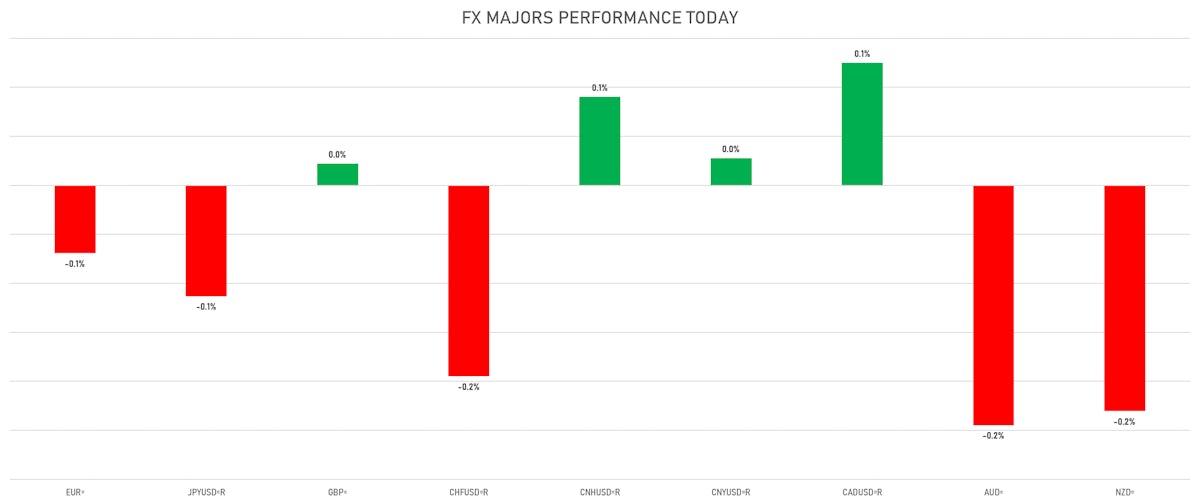

- The US Dollar Index is up 0.13% at 94.50 (YTD: +5.03%)

- Euro down 0.07% at 1.1543 (YTD: -5.5%)

- Yen down 0.11% at 113.44 (YTD: -9.0%)

- Onshore Yuan up 0.03% at 6.4485 (YTD: +1.2%)

- Swiss franc down 0.19% at 0.9296 (YTD: -4.8%)

- Sterling up 0.02% at 1.3598 (YTD: -0.5%)

- Canadian dollar up 0.12% at 1.2467 (YTD: +2.2%)

- Australian dollar down 0.24% at 0.7333 (YTD: -4.7%)

- NZ dollar down 0.23% at 0.6926 (YTD: -3.6%)

MACRO DATA RELEASES

- Germany, ZEW, Current Economic Situation, Germany, balance for Oct 2021 (ZEW, Germany) at 21.60 (vs 31.90 prior), below consensus estimate of 28.50

- Germany, ZEW, Economic Expectations, Germany, balance for Oct 2021 (ZEW, Germany) at 22.30 (vs 26.50 prior), below consensus estimate of 24.00

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for Sep 2021 (MOSPI, India) at 4.35 % (vs 5.30 % prior), below consensus estimate of 4.50 %

- India, Production, Change Y/Y, Volume Index for Aug 2021 (MOSPI, India) at 11.90 % (vs 11.50 % prior), below consensus estimate of 12.00 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Aug 2021 (Cabinet Office, JP) at -2.40 % (vs 0.90 % prior), below consensus estimate of 1.70 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Aug 2021 (Cabinet Office, JP) at 17.00 % (vs 11.10 % prior), above consensus estimate of 14.70 %

- Malaysia, Production, Total industry, Change Y/Y for Aug 2021 (Statistics, Malaysia) at -0.70 % (vs -5.20 % prior), below consensus estimate of 0.60 %

- Mexico, Production, Total industry, Change P/P for Aug 2021 (INEGI, Mexico) at 0.40 % (vs 1.10 % prior), above consensus estimate of -0.60 %

- Mexico, Production, Total industry, Change Y/Y for Aug 2021 (INEGI, Mexico) at 5.50 % (vs 7.30 % prior), above consensus estimate of 4.00 %

- Romania, CPI, All Items, Change Y/Y, Price Index for Sep 2021 (NIS, Romania) at 6.29 % (vs 5.25 % prior), above consensus estimate of 5.83 %

- Russia, Trade Balance, Total, Free On Board, Current Prices for Aug 2021 (Central Bank, Russia) at 17.11 Bln USD (vs 23.19 Bln USD prior)

- South Africa, Manufacturing Production MM, Change P/P for Aug 2021 (Statistics, SA) at 7.60 % (vs -8.00 % prior), above consensus estimate of 6.00 %

- South Africa, Mining Production YY, Change Y/Y for Aug 2021 (Statistics, SA) at 2.00 % (vs 10.30 % prior), below consensus estimate of 6.00 %

- South Korea, Policy Rates, Base Rate for Oct 2021 (The Bank of Korea) at 0.75 % (vs 0.75 % prior), in line with consensus estimate

- United Kingdom, Earnings, Average Weekly, Whole economy, regular pay, 3 month average, Change Y/Y for Aug 2021 (ONS, United Kingdom) at 6.00 % (vs 6.80 % prior), in line with consensus estimate

- United Kingdom, Earnings, Average Weekly, Whole economy, total pay, 3 month average, Change Y/Y for Aug 2021 (ONS, United Kingdom) at 7.20 % (vs 8.30 % prior), above consensus estimate of 7.00 %

- United Kingdom, Employed, Change in Level of Employment 3m/3m , Volume for Aug 2021 (ONS, United Kingdom) at 235.00 k (vs 183.00 k prior), below consensus estimate of 243.00 k

- United Kingdom, Unemployment, Claimant count, Absolute change for Sep 2021 (ONS, United Kingdom) at -51.10 k (vs -58.60 k prior)

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Aug 2021 (ONS, United Kingdom) at 4.50 % (vs 4.60 % prior), in line with consensus estimate

- United States, JOLTS Job Openings for Aug 2021 (BLS, U.S Dep. Of Lab) at 10.44 Mln (vs 10.93 Mln prior), below consensus estimate of 10.93 Mln

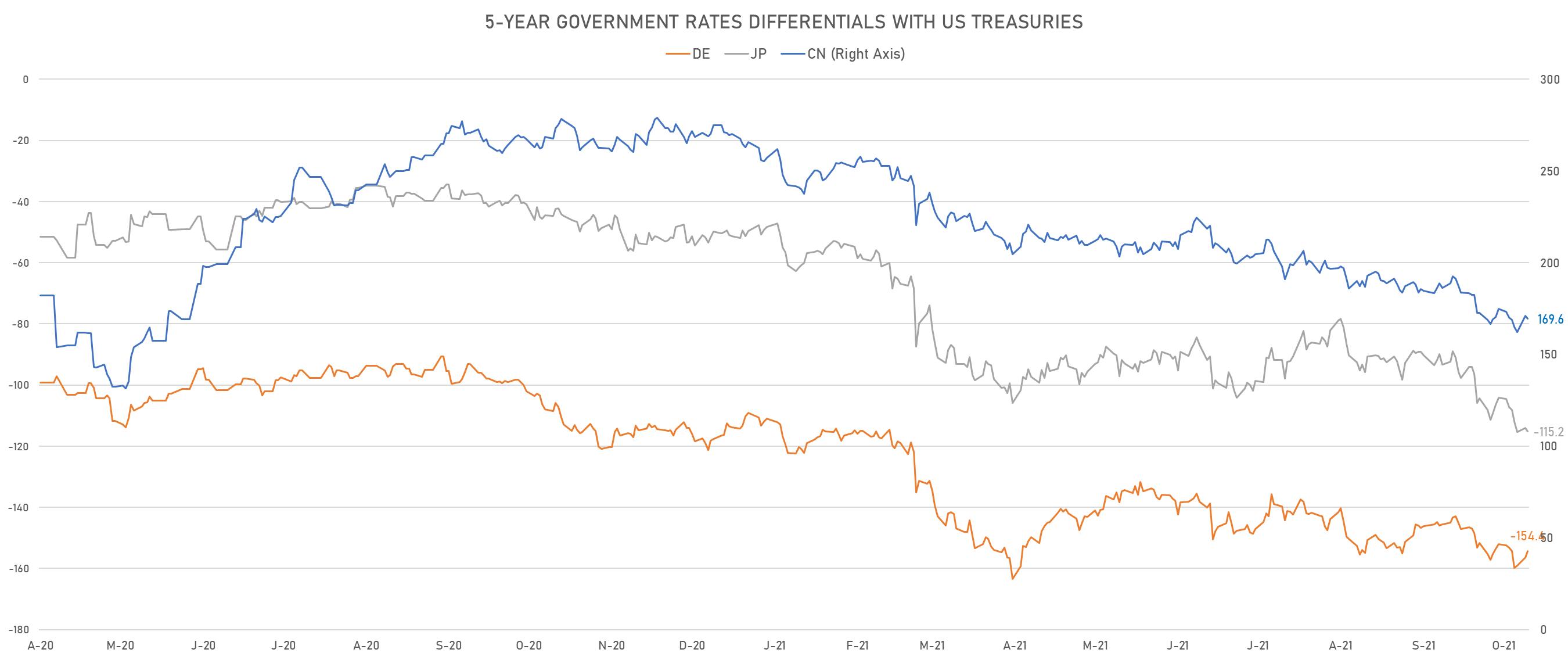

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.9 bp at 154.4 bp (YTD change: +43.3 bp)

- US-JAPAN: +1.1 bp at 115.2 bp (YTD change: +66.9 bp)

- US-CHINA: +1.5 bp at -169.6 bp (YTD change: +87.5 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.5 bp at 87.8 bp (YTD change: +41.7bp)

- US-JAPAN: -1.1 bp at -60.7 bp (YTD change: +40.8bp)

- JAPAN-GERMANY: -1.1 bp at 148.5 bp (YTD change: +0.9bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.14, up 0.13 (YTD: -1.03)

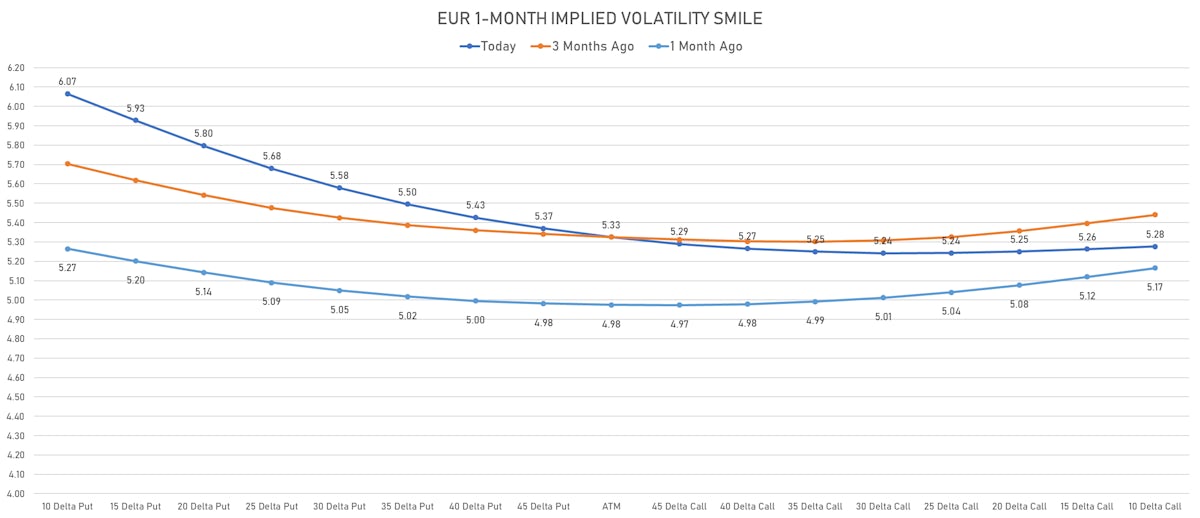

- Euro 1-Month At-The-Money Implied Volatility currently at 5.23, up 0.2 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 6.58, up 0.4 (YTD: +0.5)

- Offshore Yuan 1M ATM IV unchanged at 3.65 (YTD: -2.3)

- Euro and yen 1-Month 10-Delta risk reversals are now sitting at around 2 standard deviations from their 3-month averages, with heavy directional positioning in options markets

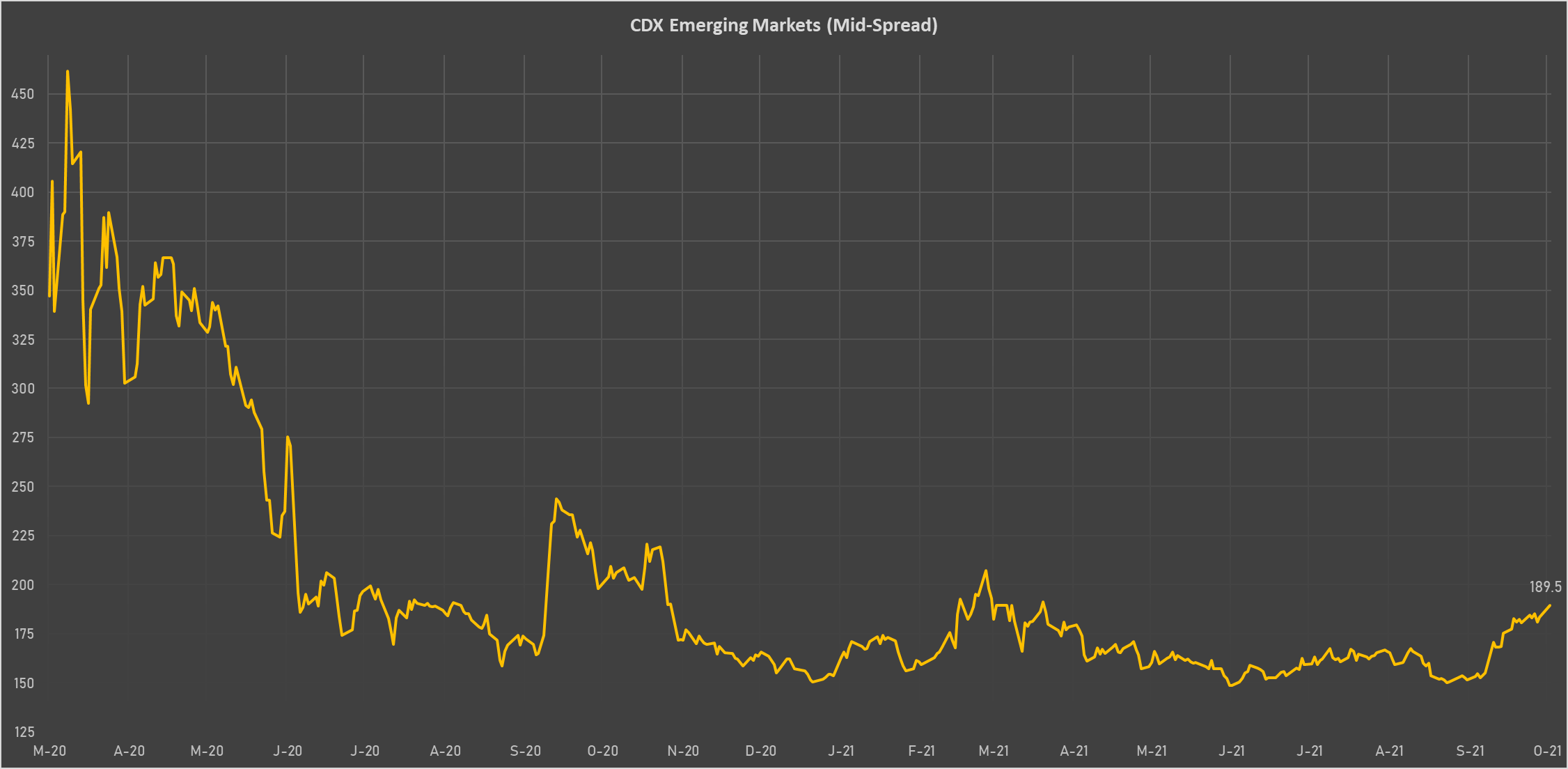

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Mexico (rated BBB-): up 5.3 basis points to 102 bp (1Y range: 79-127bp)

- Argentina (rated CCC): up 96.2 basis points to 2,226 bp (1Y range: 1,049-2,182bp)

- Panama (rated BBB-): up 3.4 basis points to 93 bp (1Y range: 44-91bp)

- Russia (rated BBB): up 3.3 basis points to 90 bp (1Y range: 72-117bp)

- Brazil (rated BB-): up 6.2 basis points to 209 bp (1Y range: 141-229bp)

- Bahrain (rated B+): up 7.6 basis points to 294 bp (1Y range: 159-330bp)

- Chile (rated A-): up 2.2 basis points to 88 bp (1Y range: 43-87bp)

- Colombia (rated BB+): up 4.2 basis points to 168 bp (1Y range: 83-175bp)

- United Arab Emirates (rated AA-): up 1.5 basis points to 65 bp (1Y range: 50-66bp)

- China (rated A+): down 3.1 basis points to 56 bp (1Y range: 27-58bp)

LARGEST FX MOVES TODAY

- Liberian Dollar up 2.5% (YTD: -1.2%)

- Armenian Dram up 2.2% (YTD: +10.1%)

- Samoa Tala up 1.1% (YTD: -1.6%)

- Thai Baht up 1.0% (YTD: -9.5%)

- Peru Sol up 0.9% (YTD: -10.7%)

- Colombian Peso up 0.8% (YTD: -7.9%)

- Angolan Kwanza down 0.5% (YTD: +8.6%)

- Tunisian Dinar down 0.8% (YTD: -4.9%)

- Haiti Gourde down 1.4% (YTD: -26.8%)

- Jamaican Dollar down 1.9% (YTD: -5.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 41.5%

- New Zambian kwacha up 25.0%

- Mozambique metical up 15.4%

- Turkish Lira down 17.7%

- Haiti Gourde down 26.8%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Sudanese Pound down 87.5%