FX

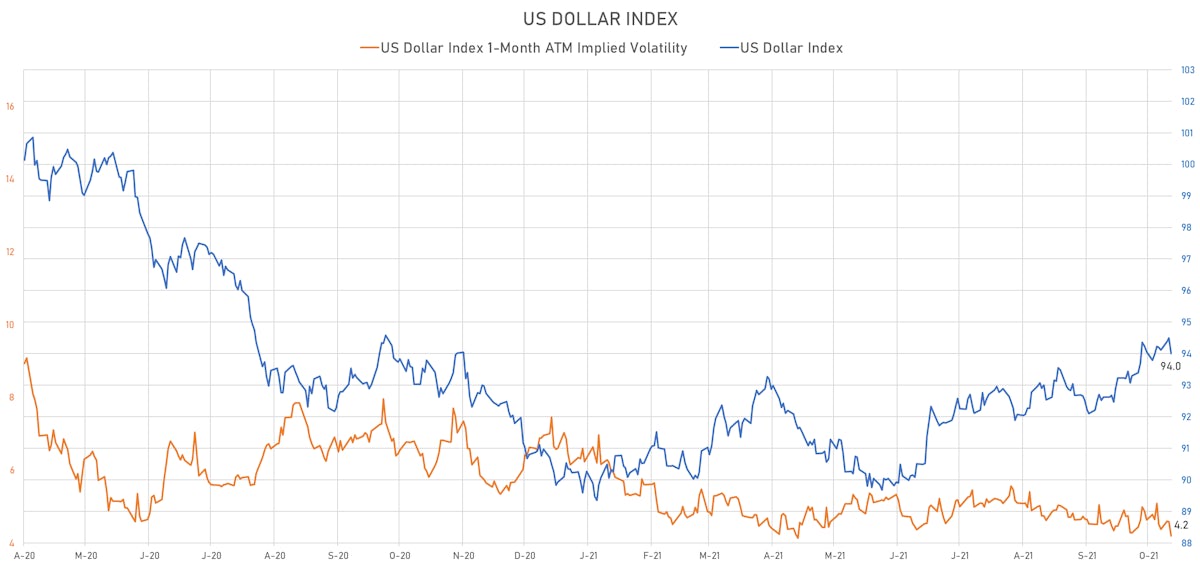

Broad Fall In The US Dollar, Though Likely A Temporary Consolidation Within Current Upward Move

The Chilean Central Bank surprised markets by raising rates 125bp to contain inflationary pressures, the latest example of rate setters actively fighting against a possible long-term anchoring of inflation expectations

Published ET

CitiFX Macro Risk Long Term Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

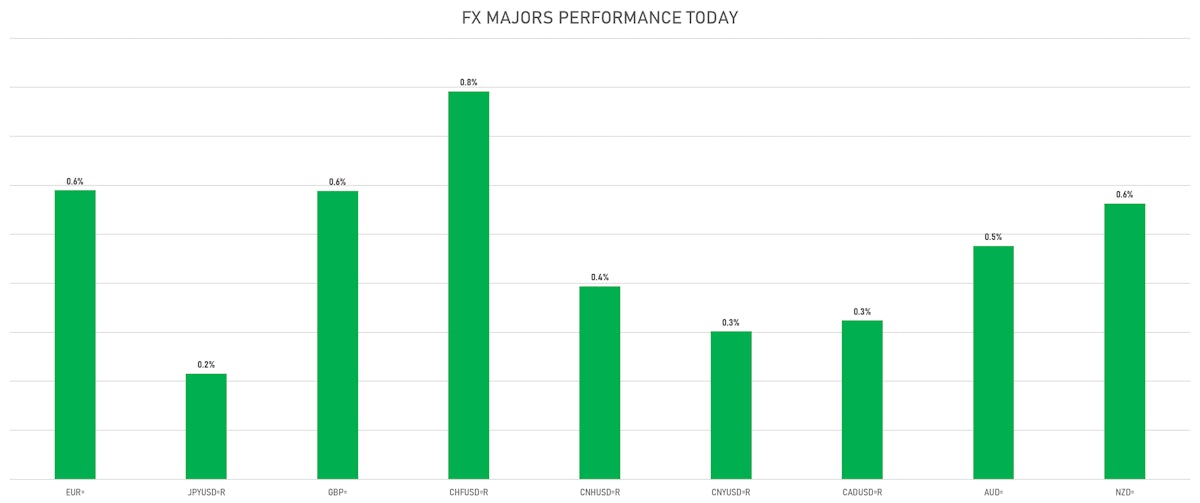

- The US Dollar Index is down -0.53% at 94.00 (YTD: +4.47%)

- Euro up 0.59% at 1.1595 (YTD: -5.1%)

- Yen up 0.22% at 113.38 (YTD: -8.9%)

- Onshore Yuan up 0.30% at 6.4262 (YTD: +1.5%)

- Swiss franc up 0.79% at 0.9236 (YTD: -4.1%)

- Sterling up 0.59% at 1.3665 (YTD: -0.1%)

- Canadian dollar up 0.32% at 1.2427 (YTD: +2.5%)

- Australian dollar up 0.48% at 0.7384 (YTD: -4.0%)

- NZ dollar up 0.56% at 0.6972 (YTD: -3.0%)

MACRO DATA RELEASES

- Chile, Policy Rates, Monetary Policy Interest Rate for Oct 2021 (Central Bank, Chile) at 2.75 % (vs 1.50 % prior), above consensus estimate of 2.50 %

- China (Mainland), Exports, Change Y/Y for Sep 2021 (China Customs) at 28.10 % (vs 25.60 % prior), above consensus estimate of 21.00 %

- China (Mainland), Imports, Change Y/Y for Sep 2021 (China Customs) at 17.60 % (vs 33.10 % prior), below consensus estimate of 20.00 %

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Sep 2021 (PBC) at 2,900.00 Bln CNY (vs 2960.00 Bln CNY prior), below consensus estimate of 3,105.00 Bln CNY

- China (Mainland), Monetary Financial Institutions, Uses of Funds, Loans, Change Y/Y for Sep 2021 (PBC) at 11.90 % (vs 12.10 % prior), below consensus estimate of 12.10 %

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Sep 2021 (PBC) at 1,660.00 Bln CNY (vs 1,220.00 Bln CNY prior), below consensus estimate of 1,850.00 Bln CNY

- China (Mainland), Money supply M2, Change Y/Y for Sep 2021 (PBC) at 8.30 % (vs 8.20 % prior), above consensus estimate of 8.10 %

- China (Mainland), Trade Balance, Current Prices for Sep 2021 (China Customs) at 66.76 Bln USD (vs 58.34 Bln USD prior), above consensus estimate of 46.80 Bln USD

- Euro Zone, Production, Total, excluding construction (EA19), Change P/P for Aug 2021 (Eurostat) at -1.60 % (vs 1.50 % prior), in line with Refinitiv consensus

- Euro Zone, Production, Total, excluding construction (EA19), Change Y/Y for Aug 2021 (Eurostat) at 5.10 % (vs 7.70 % prior), above consensus estimate of 4.70 %

- Germany, CPI, Final, Change P/P, Price Index for Sep 2021 (Destatis) at 0.00 % (vs 0.00 % prior), in line with Refinitiv consensus

- Germany, CPI, Final, Change Y/Y, Price Index for Sep 2021 (Destatis) at 4.10 % (vs 4.10 % prior), in line with Refinitiv consensus

- Germany, HICP, Final, Change P/P, Price Index for Sep 2021 (Destatis) at 0.30 % (vs 0.30 % prior), in line with Refinitiv consensus

- Germany, HICP, Final, Change Y/Y, Price Index for Sep 2021 (Destatis) at 4.10 % (vs 4.10 % prior), in line with Refinitiv consensus

- Portugal, CPI, All items, national, Change P/P, Price Index for Sep 2021 (INE, Portugal) at 0.90 % (vs 0.90 % prior)

- Portugal, CPI, All items, national, Change Y/Y, Price Index for Sep 2021 (INE, Portugal) at 1.50 % (vs 1.50 % prior)

- South Africa, Retail Sales, Change Y/Y for Aug 2021 (Statistics, SA) at -1.30 % (vs -0.80 % prior), below consensus estimate of 2.60 %

- Sweden, Money Mkt CPIF Infl 5 Yrs, Change Y/Y for Oct 2021 () at 2.00 % (vs 1.90 % prior)

- United Kingdom, GDP Estimated YY, Change Y/Y for Aug 2021 (ONS, United Kingdom) at 6.90 % (vs 7.50 % prior), above consensus estimate of 6.70 %

- United Kingdom, GDP Estimated, Change M/M for Aug 2021 (ONS, United Kingdom) at 0.40 % (vs 0.10 % prior), below consensus estimate of 0.50 %

- United Kingdom, GDP estimate 3m/3m for Aug 2021 (ONS, United Kingdom) at 2.90 % (vs 3.60 % prior), below consensus estimate of 3.00 %

- United Kingdom, Production, Manufacturing, Change P/P for Aug 2021 (ONS, United Kingdom) at 0.50 % (vs 0.00 % prior), above consensus estimate of 0.00 %

- United Kingdom, Production, Manufacturing, Change Y/Y for Aug 2021 (ONS, United Kingdom) at 4.10 % (vs 6.00 % prior), in line with Refinitiv consensus

- United Kingdom, Production, Total, excluding construction, Change P/P for Aug 2021 (ONS, United Kingdom) at 0.80 % (vs 1.20 % prior), above consensus estimate of 0.20 %

- United Kingdom, Production, Total, excluding construction, Change Y/Y for Aug 2021 (ONS, United Kingdom) at 3.70 % (vs 3.80 % prior), above consensus estimate of 3.10 %

- United Kingdom, RICS Housing Market, Price, England and Wales for Sep 2021 (RICS, United Kingdom) at 68.00 (vs 73.00 prior), in line with Refinitiv consensus

- United Kingdom, Trade Balance, Goods for Aug 2021 (ONS, United Kingdom) at -14.93 Bln GBP (vs -12.71 Bln GBP prior), below consensus estimate of -12.00 Bln GBP

- United States, CPI - All Urban Samples: All Items, Change Y/Y for Sep 2021 (BLS, U.S Dep. Of Lab) at 5.40 % (vs 5.30 % prior), above consensus estimate of 5.30 %

- United States, CPI, All items less food and energy, Change Y/Y, Price Index for Sep 2021 (BLS, U.S Dep. Of Lab) at 4.00 % (vs 4.00 % prior), in line with Refinitiv consensus

- United States, CPI, All items, Change P/P for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.40 % (vs 0.30 % prior), above consensus estimate of 0.30 %

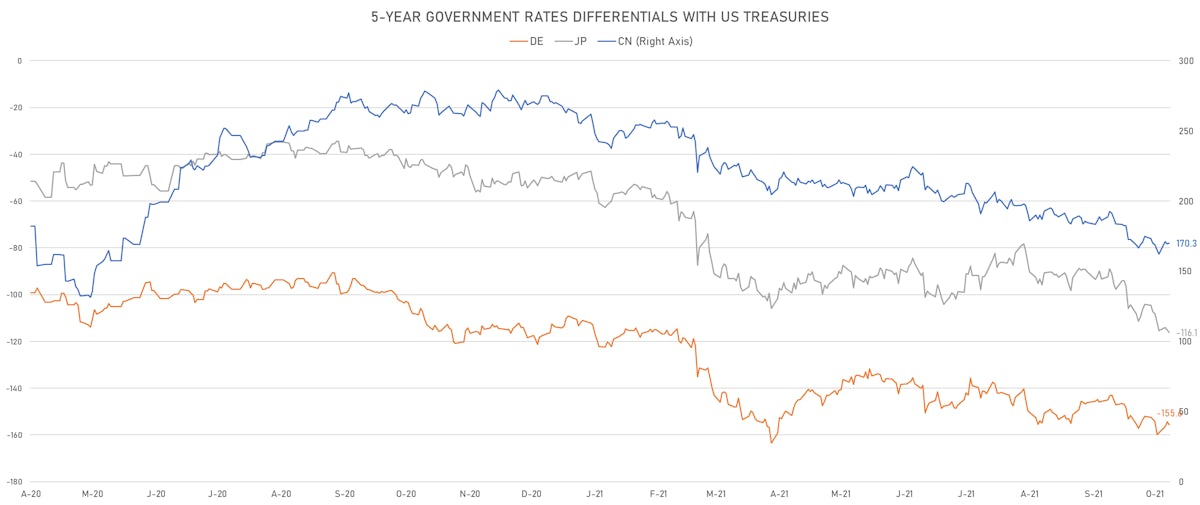

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.2 bp at 155.6 bp (YTD change: +44.6 bp)

- US-JAPAN: +0.9 bp at 116.1 bp (YTD change: +67.9 bp)

- US-CHINA: -0.7 bp at -170.3 bp (YTD change: +86.9 bp)

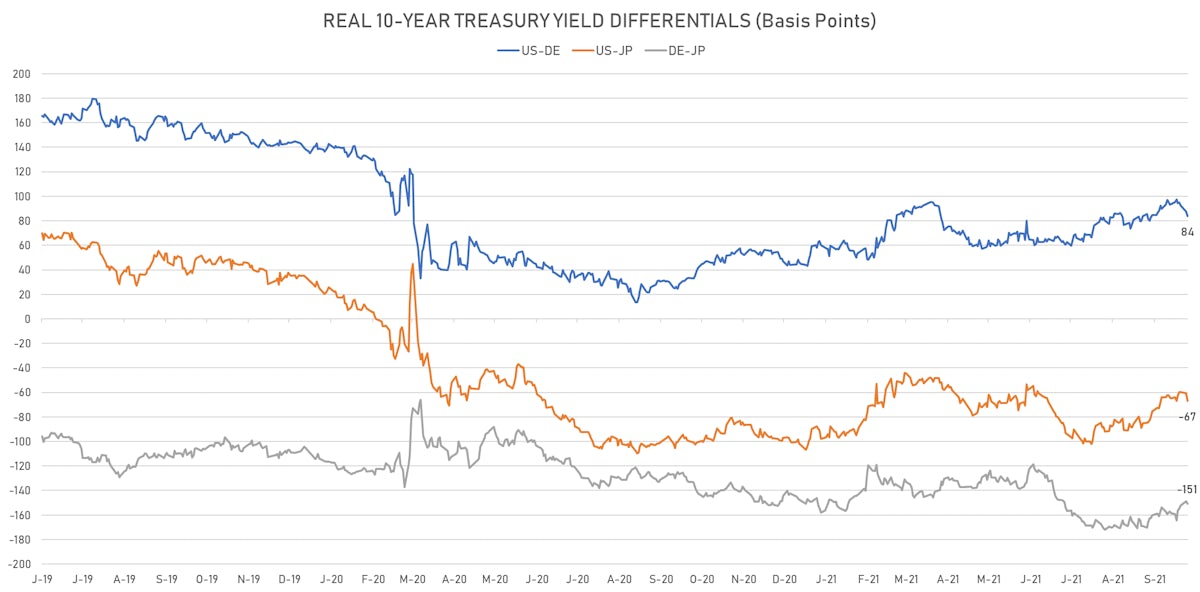

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.1 bp at 83.7 bp (YTD change: +37.6bp)

- US-JAPAN: -6.2 bp at -66.9 bp (YTD change: +34.6bp)

- JAPAN-GERMANY: +2.1 bp at 150.6 bp (YTD change: +3.0bp)

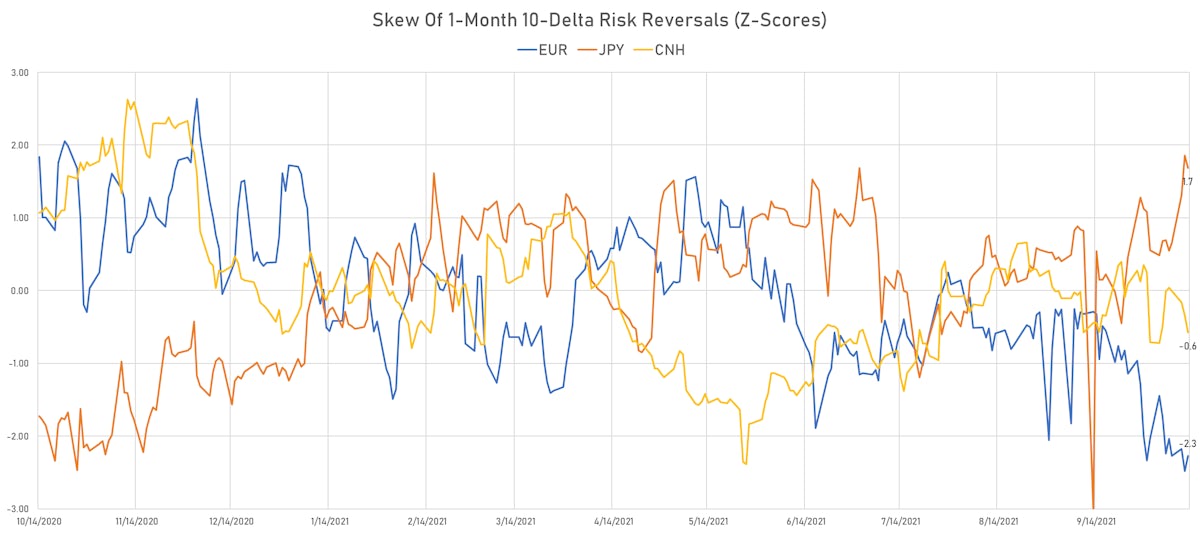

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.20, up 0.06 (YTD: -0.97)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.94, down -0.3 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 6.15, down -0.4 (YTD: +0.1)

- Offshore Yuan 1M ATM IV unchanged at 3.63 (YTD: -2.4)

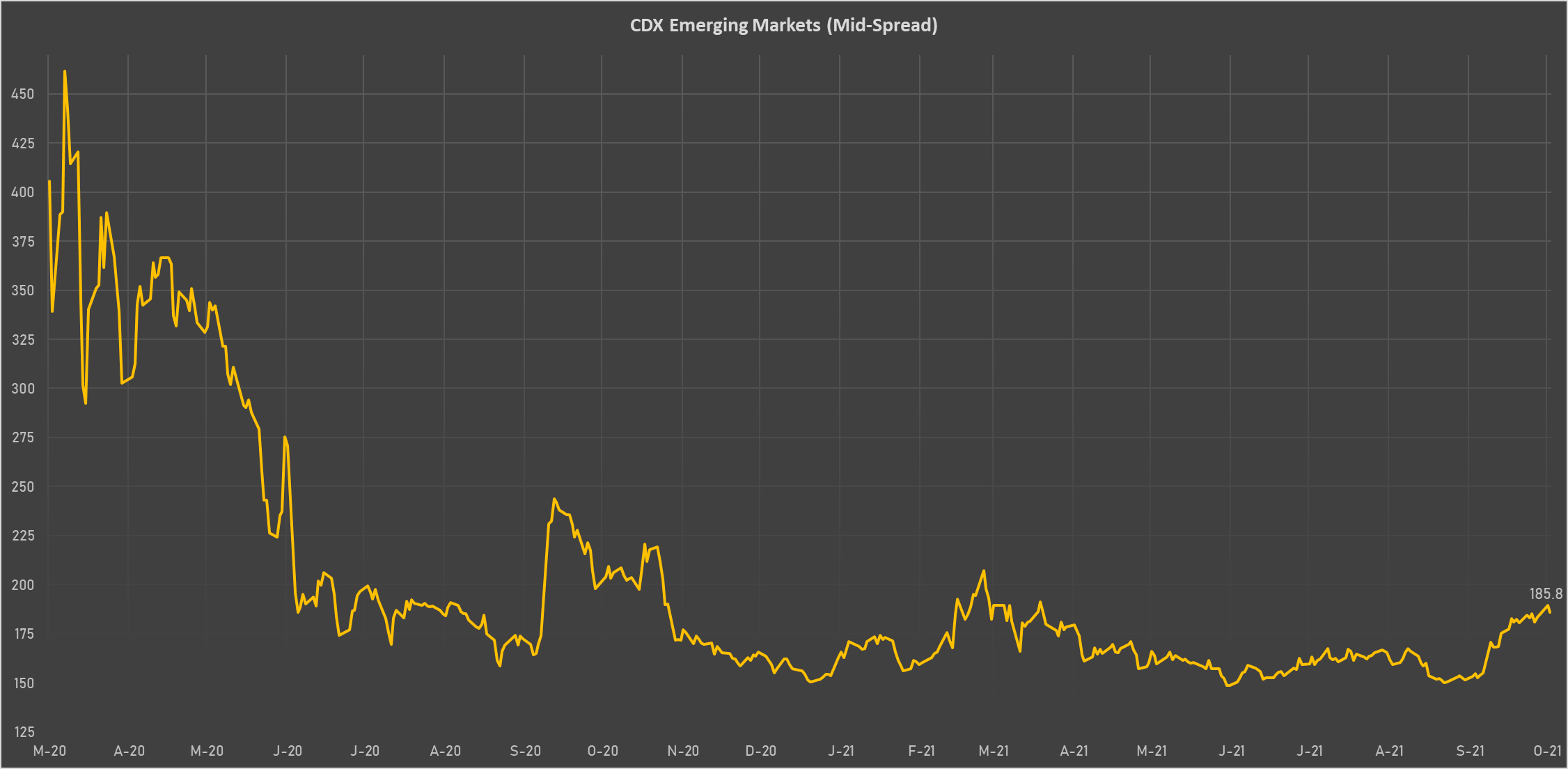

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- United Arab Emirates (rated AA-): down 1.5 basis points to 63 bp (1Y range: 50-66bp)

- Nigeria (rated B): down 12.5 basis points to 389 bp (1Y range: 331-402bp)

- Lebanon (rated CC): down 121.5 basis points to 3,737 bp (1Y range: 3,179-3,865bp)

- Senegal (rated ): down 13.5 basis points to 415 bp (1Y range: 353-429bp)

- Kenya (rated B+): down 15.0 basis points to 461 bp (1Y range: 392-476bp)

- Pakistan (rated B-): down 14.0 basis points to 428 bp (1Y range: 362-512bp)

- Ecuador (rated WD): down 6.0 basis points to 183 bp (1Y range: 156-189bp)

- Ethiopia (rated CCC): down 15.0 basis points to 448 bp (1Y range: 382-464bp)

- Peru (rated BBB+): down 3.2 basis points to 91 bp (1Y range: 52-105bp)

- Russia (rated BBB): down 3.8 basis points to 86 bp (1Y range: 72-117bp)

LARGEST FX MOVES TODAY

- Myanmar Kyat up 2.0% (YTD: -32.0%)

- Peru Sol up 1.7% (YTD: -9.1%)

- Zimbabwe Dollar up 1.7% (YTD: +10.1%)

- South Africa Rand up 1.2% (YTD: -0.6%)

- Swedish Krona up 1.1% (YTD: -5.1%)

- Mexican Peso up 1.1% (YTD: -3.2%)

- Chilean Peso up 1.0% (YTD: -12.8%)

- Iceland Krona up 1.0% (YTD: -0.8%)

- Tonga Pa'Anga down 0.9% (YTD: +0.6%)

- Samoa Tala down 1.2% (YTD: -2.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 60.8%

- New Zambian kwacha up 25.2%

- Turkish Lira down 18.7%

- Haiti Gourde down 26.8%

- Myanmar Kyat down 32.0%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 73.4%

- Sudanese Pound down 87.5%