FX

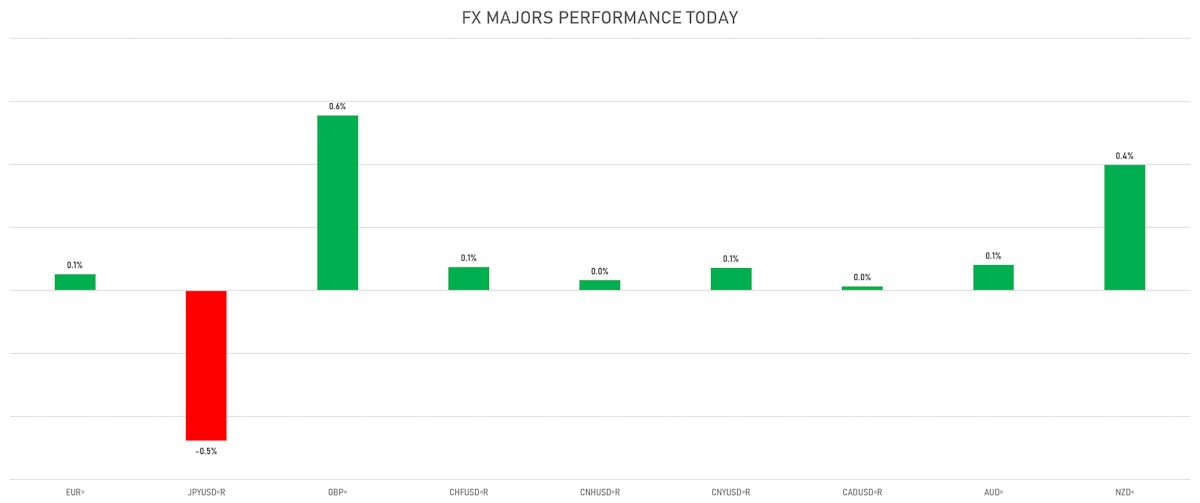

US Dollar Largely Unchanged, With Big Daily Rise In The GBP And Continued Weakness In The JPY

UK rates are increasingly pointing to a BOE policy error, with short-term forward rates now pricing in around 85bp of hikes by the end of 2022, followed by a policy reversal further down the curve

Published ET

Spreads Between 3-Month GBP LIBOR Futures Implied Yield And Spot 3-Month GBP LIBOR Rate | Source: Refinitiv

QUICK SUMMARY

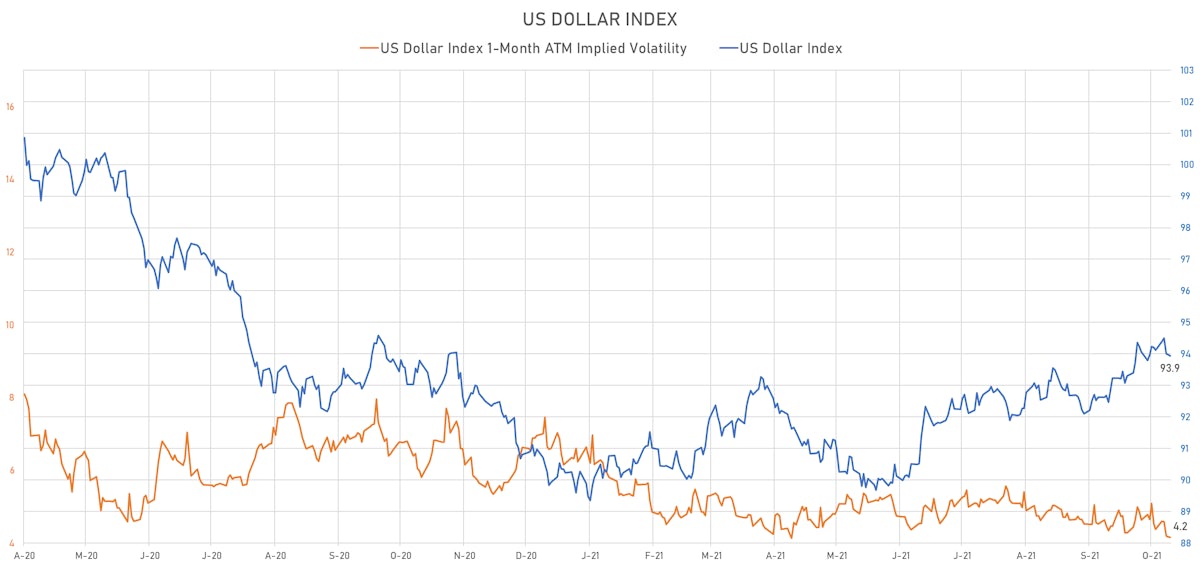

- The US Dollar Index is down -0.04% at 93.94 (YTD: +4.40%)

- Euro up 0.05% at 1.1600 (YTD: -5.0%)

- Yen down 0.48% at 114.20 (YTD: -9.6%)

- Onshore Yuan up 0.07% at 6.4340 (YTD: +1.4%)

- Swiss franc up 0.07% at 0.9226 (YTD: -4.1%)

- Sterling up 0.56% at 1.3749 (YTD: +0.6%)

- Canadian dollar up 0.01% at 1.2366 (YTD: +3.0%)

- Australian dollar up 0.08% at 0.7421 (YTD: -3.5%)

- NZ dollar up 0.40% at 0.7063 (YTD: -1.7%)

WEEKLY IMM MANAGED MONEY POSITIONING

- All Currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net long US$ positioning

- Euro: reduction in net long US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net long US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduction in net long US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

MACRO DATA RELEASES

- Brazil, Central Bank Economic Act Index (IBC-Br), Change P/P for Aug 2021 (Central Bank, Brazil) at -0.15 % (vs 0.60 % prior), below consensus estimate of -0.05 %

- Canada, Wholesale Trade, Sales, all trade groups, Change P/P for Aug 2021 (CANSIM, Canada) at 0.30 % (vs -2.10 % prior), below consensus estimate of 0.50 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Sep 2021 (ECB) at 1002.40 Bln EUR (vs 1009.38 Bln EUR prior)

- Finland, Official reserve assets, Current Prices for Sep 2021 (Bank of Finland) at 14,319.00 Mln EUR (vs 14,180.00 Mln EUR prior)

- France, HICP, Change Y/Y, Price Index for Sep 2021 (INSEE, France) at 2.70 % (vs 2.70 % prior), in line with consensus estimate

- France, HICP, Final, Change P/P, Price Index for Sep 2021 (INSEE, France) at -0.20 % (vs -0.20 % prior), in line with consensus estimate

- Indonesia, Exports, Change Y/Y for Sep 2021 (Statistics Indonesia) at 47.64 % (vs 64.10 % prior), below consensus estimate of 51.57 %

- Indonesia, Imports, Change Y/Y for Sep 2021 (Statistics Indonesia) at 40.31 % (vs 55.26 % prior), below consensus estimate of 50.00 %

- Indonesia, Trade Balance, Current Prices for Sep 2021 (Statistics Indonesia) at 4.37 Bln USD (vs 4.74 Bln USD prior), above consensus estimate of 3.84 Bln USD

- Israel, CPI, Change P/P, Price Index for Sep 2021 (Statistics, Israel) at 0.20 % (vs 0.30 % prior), in line with consensus estimate

- Israel, CPI, Change Y/Y, Price Index for Sep 2021 (Statistics, Israel) at 2.50 % (vs 2.20 % prior), below consensus estimate of 2.60 %

- Italy, CPI, Final, Change P/P, Price Index for Sep 2021 (ISTAT, Italy) at -0.20 % (vs -0.10 % prior), below consensus estimate of -0.10 %

- Italy, CPI, Final, Change Y/Y for Sep 2021 (ISTAT, Italy) at 2.50 % (vs 2.60 % prior), below consensus estimate of 2.60 %

- Italy, HICP, Final, Change P/P, Price Index for Sep 2021 (ISTAT, Italy) at 1.30 % (vs 1.40 % prior), below consensus estimate of 1.40 %

- Italy, HICP, Final, Change Y/Y, Price Index for Sep 2021 (ISTAT, Italy) at 2.90 % (vs 3.00 % prior), below consensus estimate of 3.00 %

- Nigeria, CPI, Change Y/Y for Sep 2021 (NBS, Nigeria) at 16.63 % (vs 17.01 % prior)

- Nigeria, CPI, Food, Change Y/Y, Price Index for Sep 2021 (NBS, Nigeria) at 19.57 % (vs 20.30 % prior)

- Peru, GDP, Change Y/Y for Aug 2021 (INEI, Peru) at 11.83 % (vs 12.94 % prior), above consensus estimate of 10.00 %

- Poland, CPI, Change P/P, Price Index for Sep 2021 (CSO, Poland) at 0.70 % (vs 0.60 % prior)

- Poland, CPI, Change Y/Y, Price Index for Sep 2021 (CSO, Poland) at 5.90 % (vs 5.80 % prior)

- United States, Import Prices, All commodities, Change P/P, Price Index for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.40 % (vs -0.30 % prior), below consensus estimate of 0.60 %

- United States, New York Fed, General Business Condition for Oct 2021 (FED, NY) at 19.80 (vs 34.30 prior), below consensus estimate of 27.00

- United States, Overall, Total business inventories, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.60 % (vs 0.50 % prior), in line with consensus estimate

- United States, Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.80 % (vs 2.50 % prior), above consensus estimate of 0.40 %

- United States, Retail Sales, Total including food services, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.70 % (vs 0.70 % prior), above consensus estimate of -0.20 %

- United States, Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.80 % (vs 1.80 % prior), above consensus estimate of 0.50 %

- United States, University of Michigan, Total-prelim, Volume Index for Oct 2021 (UMICH, Survey) at 71.40 (vs 72.80 prior), below consensus estimate of 73.10

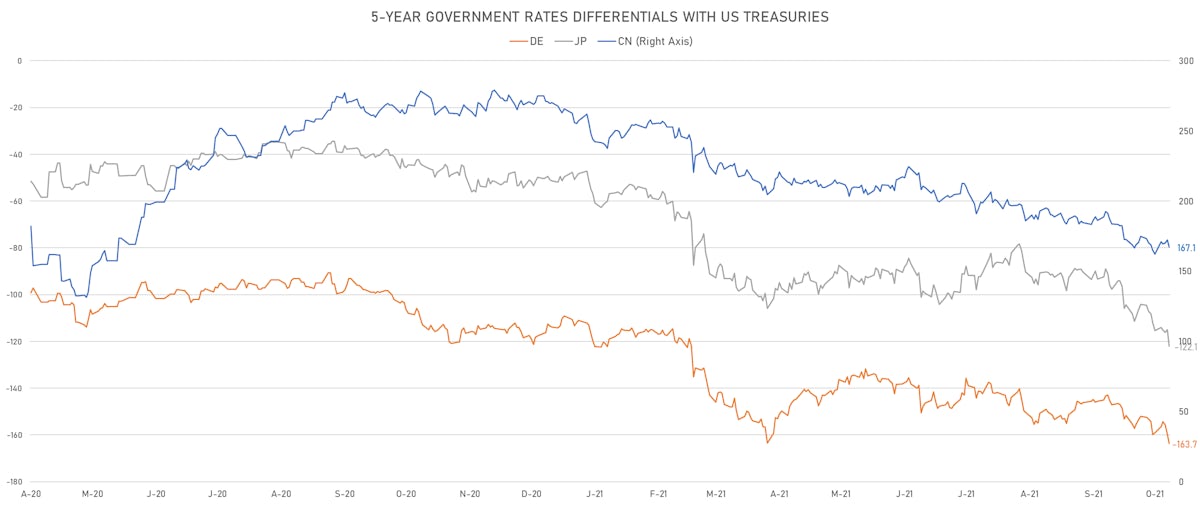

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.1 bp at 163.7 bp (YTD change: +52.6 bp)

- US-JAPAN: +7.1 bp at 122.1 bp (YTD change: +73.8 bp)

- US-CHINA: +5.4 bp at -167.1 bp (YTD change: +90.0 bp)

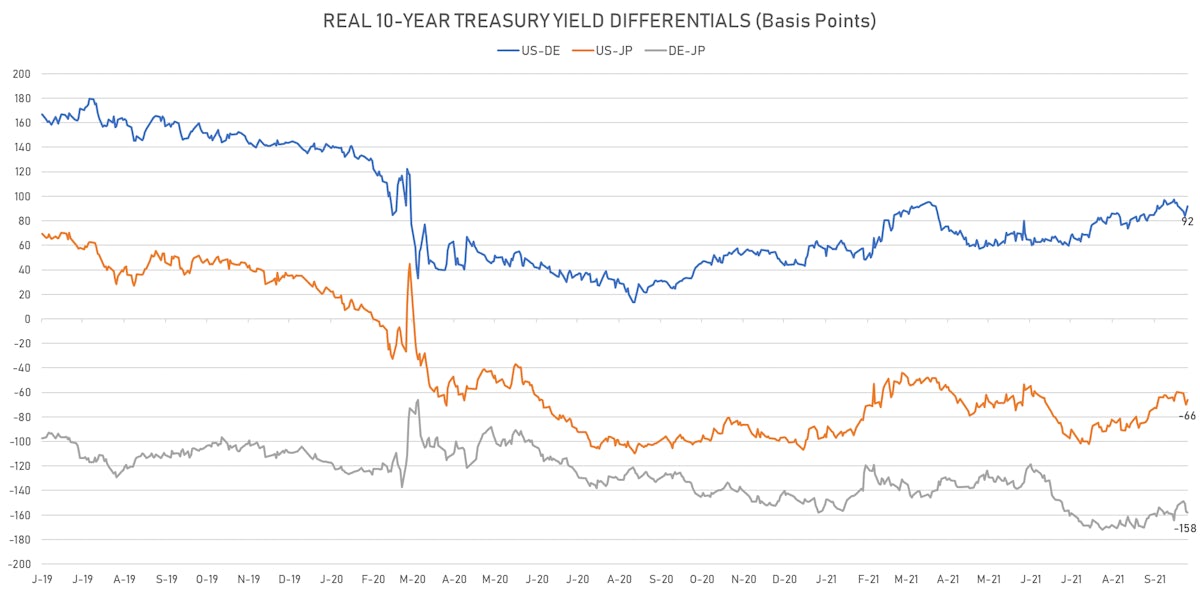

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.7 bp at 92.0 bp (YTD change: +45.9bp)

- US-JAPAN: +3.6 bp at -66.1 bp (YTD change: +35.4bp)

- JAPAN-GERMANY: +1.1 bp at 158.1 bp (YTD change: +10.5bp)

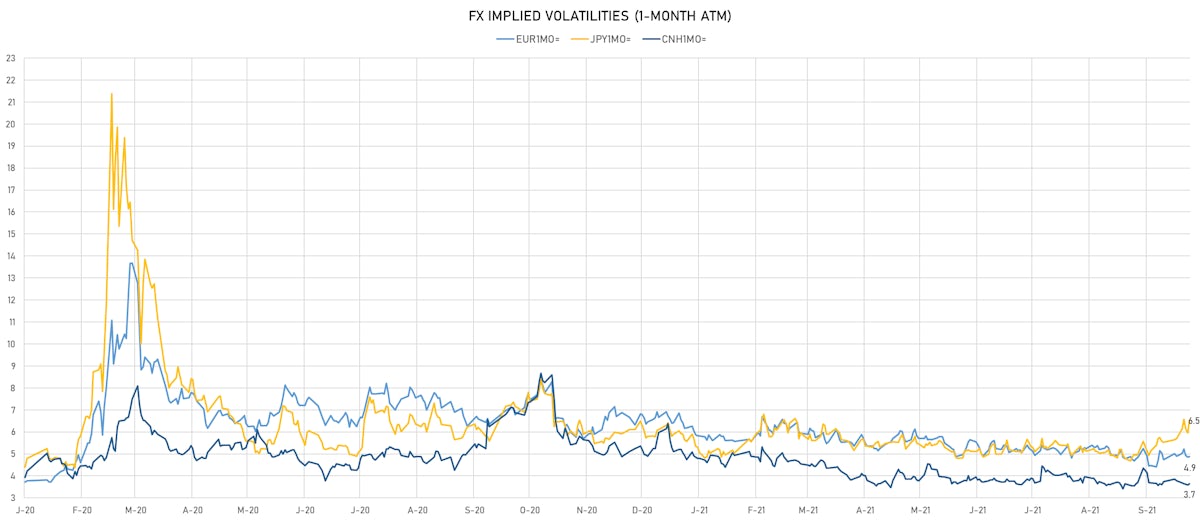

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.21, up 0.01 (YTD: -0.96)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 4.88 (YTD: -1.8)

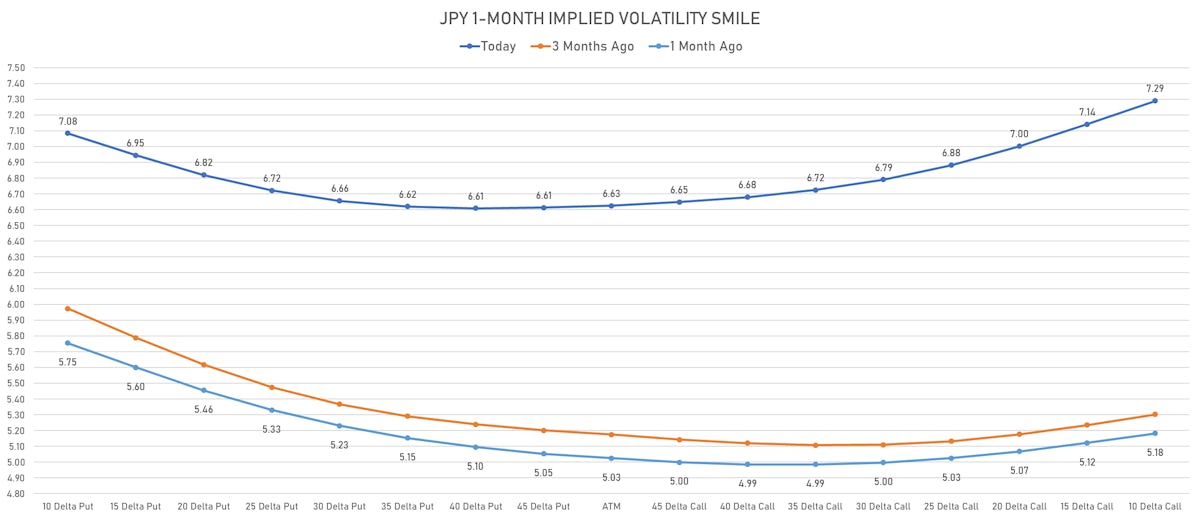

- Japanese Yen 1M ATM IV currently at 6.53, up 0.6 (YTD: +0.4)

- Offshore Yuan 1M ATM IV currently at 3.65, up 0.1 (YTD: -2.3)

- The skew in JPY 1-month risk reversals are at elevated levels, helped by the jump in ATM volatility, with positioning firmly on further yen weakness

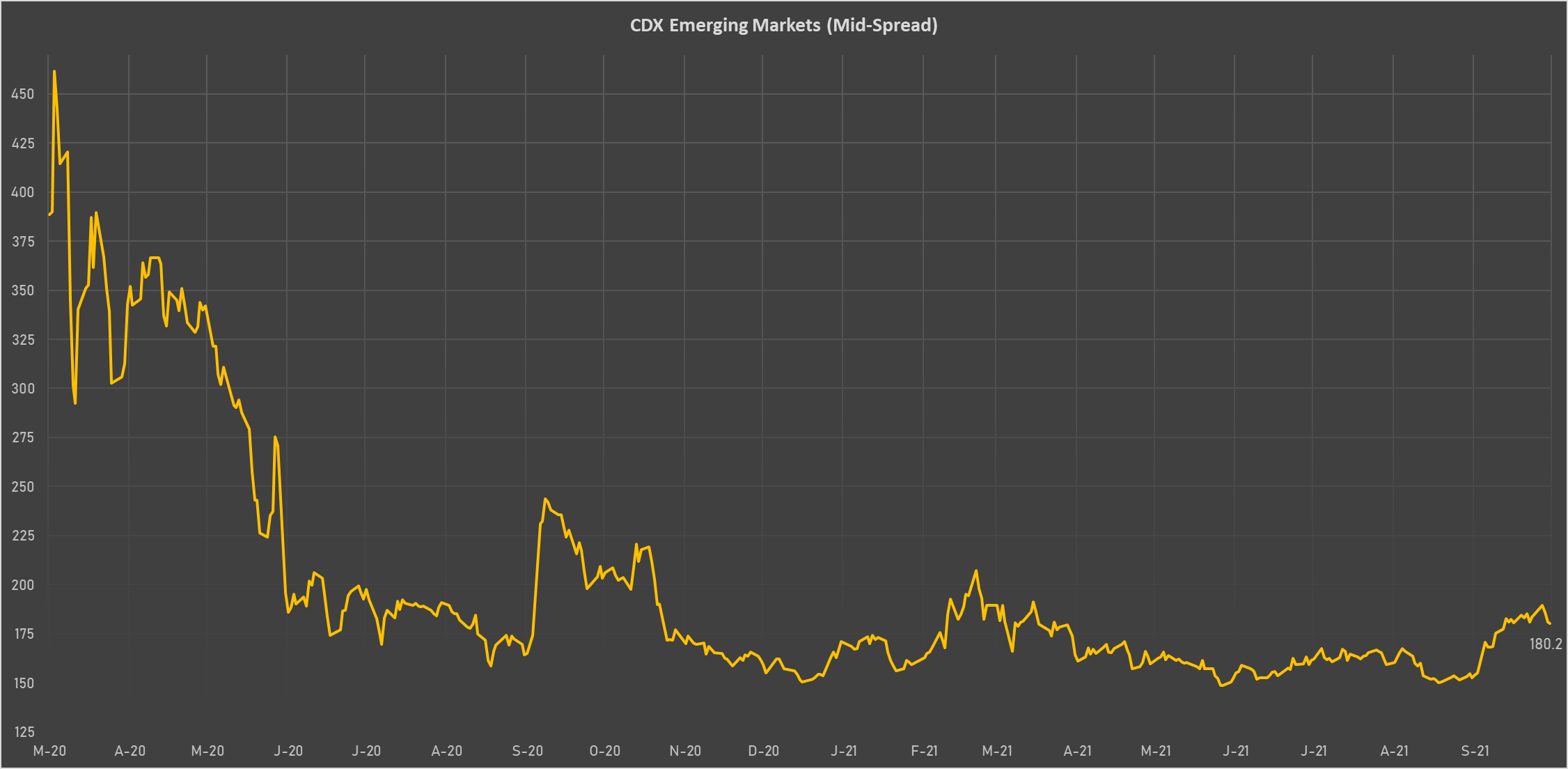

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Peru (rated BBB): up 2.7 basis points to 87 bp (1Y range: 52-105bp)

- Chile (rated A-): up 1.8 basis points to 88 bp (1Y range: 43-88bp)

- Nigeria (rated B): down 6.0 basis points to 377 bp (1Y range: 331-402bp)

- Russia (rated BBB): down 1.5 basis points to 82 bp (1Y range: 72-117bp)

- Morocco (rated BB+): down 2.2 basis points to 93 bp (1Y range: 84-108bp)

- Oman (rated BB-): down 8.7 basis points to 250 bp (1Y range: 223-452bp)

- Vietnam (rated BB): down 4.0 basis points to 106 bp (1Y range: 89-123bp)

- Indonesia (rated BBB): down 3.8 basis points to 85 bp (1Y range: 66-97bp)

- Malaysia (rated BBB+): down 3.2 basis points to 58 bp (1Y range: 33-64bp)

- Philippines (rated BBB): down 3.4 basis points to 60 bp (1Y range: 33-65bp)

LARGEST FX MOVES TODAY

- Barbados Dollar up 1.5% (YTD: +1.5%)

- Tunisian Dinar up 1.3% (YTD: -3.6%)

- South Africa Rand up 1.2% (YTD: +0.6%)

- Liberian Dollar up 1.2% (YTD: -0.1%)

- Mexican Peso up 1.1% (YTD: -2.1%)

- Guinea Franc up 1.0% (YTD: +3.0%)

- Brazilian Real up 1.0% (YTD: -4.9%)

- Turkish Lira down 0.9% (YTD: -19.9%)

- Haiti Gourde down 1.0% (YTD: -27.6%)

- Samoa Tala down 1.1% (YTD: -1.4%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 59.8%

- New Zambian kwacha up 21.0%

- Turkish Lira down 19.9%

- Haiti Gourde down 27.6%

- Myanmar Kyat down 33.3%

- Surinamese dollar down 33.5%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 73.2%

- Sudanese Pound down 87.5%