FX

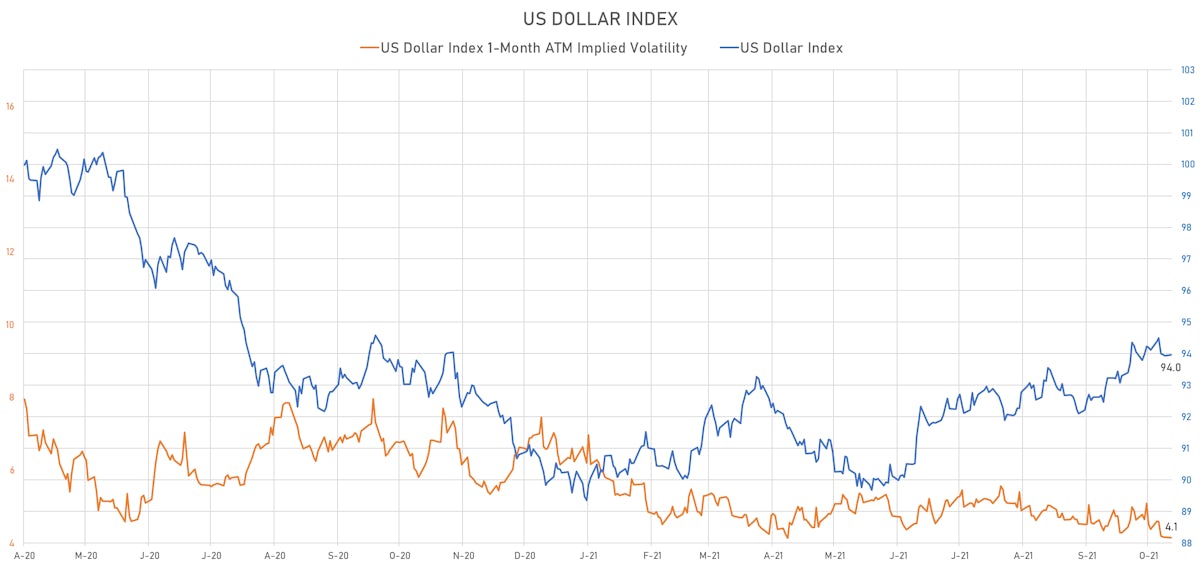

Pretty Quiet Day In FX, Implied Volatility On The US Dollar Index At Lowest Level In 6 Months

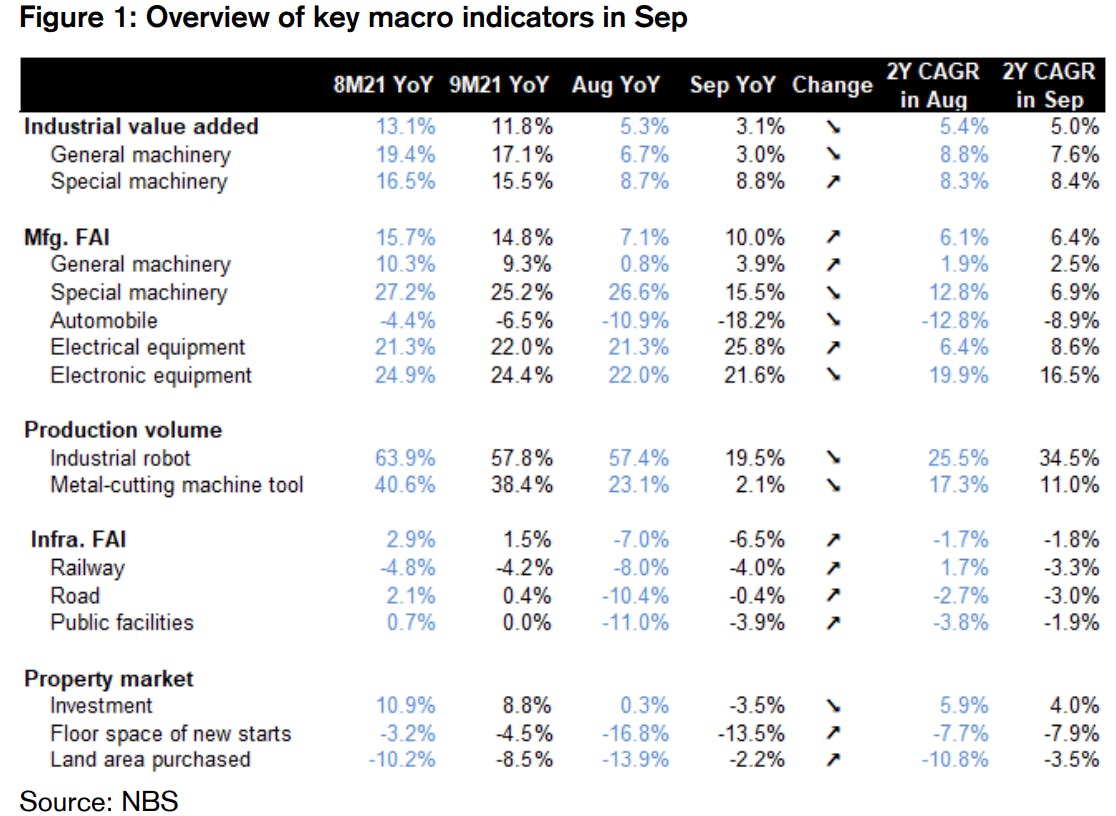

Chinese macro data for September came in mostly weaker, pushing economists to revise GDP growth forecasts for this year, with the Chinese government expected to provide extra fiscal and monetary stimulus if necessary

Published ET

CitiFX Economic Surprise Indices | Sources: ϕpost chart, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.02% at 93.96 (YTD: +4.42%)

- Euro up 0.16% at 1.1618 (YTD: -4.9%)

- Yen down 0.09% at 114.32 (YTD: -9.7%)

- Onshore Yuan up 0.10% at 6.4290 (YTD: +1.5%)

- Swiss franc down 0.06% at 0.9230 (YTD: -4.1%)

- Sterling down 0.04% at 1.3744 (YTD: +0.5%)

- Canadian dollar up 0.05% at 1.2365 (YTD: +3.0%)

- Australian dollar up 0.05% at 0.7425 (YTD: -3.5%)

- NZ dollar up 0.41% at 0.7092 (YTD: -1.3%)

DISAPPOINTING CHINESE SEPTEMBER MACRO DATA

DAILY MACRO RELEASES

- Canada, Housing Starts, All areas for Sep 2021 (CMHC, Canada) at 251.20 k (vs 260.20 k prior), below consensus estimate of 255.00 k

- China (Mainland), GDP, Change P/P for Q3 2021 (NBS, China) at 0.20 % (vs 1.30 % prior), below consensus estimate of 0.50 %

- China (Mainland), GDP, Change Y/Y for Q3 2021 (NBS, China) at 4.90 % (vs 7.90 % prior), below consensus estimate of 5.20 %

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Sep 2021 (NBS, China) at 7.30 % (vs 8.90 % prior), below consensus estimate of 7.90 %

- China (Mainland), Production, Value added, industry, Change Y/Y for Sep 2021 (NBS, China) at 3.10 % (vs 5.30 % prior), below consensus estimate of 4.50 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Sep 2021 (NBS, China) at 4.40 % (vs 2.50 % prior), above consensus estimate of 3.30 %

- Czech Republic, Producer Prices, Change P/P, Price Index for Sep 2021 (CSU, Czech Rep) at 0.70 % (vs 1.20 % prior), in line with consensus estimate

- Czech Republic, Producer Prices, Change Y/Y, Price Index for Sep 2021 (CSU, Czech Rep) at 9.90 % (vs 9.30 % prior), in line with consensus estimate

- Poland, Core CPI, Excluding food and energy prices, Change Y/Y, Price Index for Sep 2021 (Central Bank, Poland) at 4.20 % (vs 3.90 % prior), above consensus estimate of 4.00 %

- Singapore, Exports, Domestic non-oil, Change Y/Y for Sep 2021 (Statistics Singapore) at 12.30 % (vs 2.70 % prior), above consensus estimate of 9.60 %

- Singapore, Exports, Non-oil domestic exports, Change P/P for Sep 2021 (Statistics Singapore) at 1.20 % (vs -3.60 % prior), below consensus estimate of 2.40 %

- United States, Capacity Utilization, Total index, Change M/M for Sep 2021 (FED, U.S.) at 75.20 % (vs 76.40 % prior), below consensus estimate of 76.50 %

- United States, NAHB/Wells Fargo Housing Market Index for Oct 2021 (NAHB, United States) at 80.00 (vs 76.00 prior), above consensus estimate of 76.00

- United States, Production, Change P/P for Sep 2021 (FED, U.S.) at -1.30 % (vs 0.40 % prior), below consensus estimate of 0.20 %

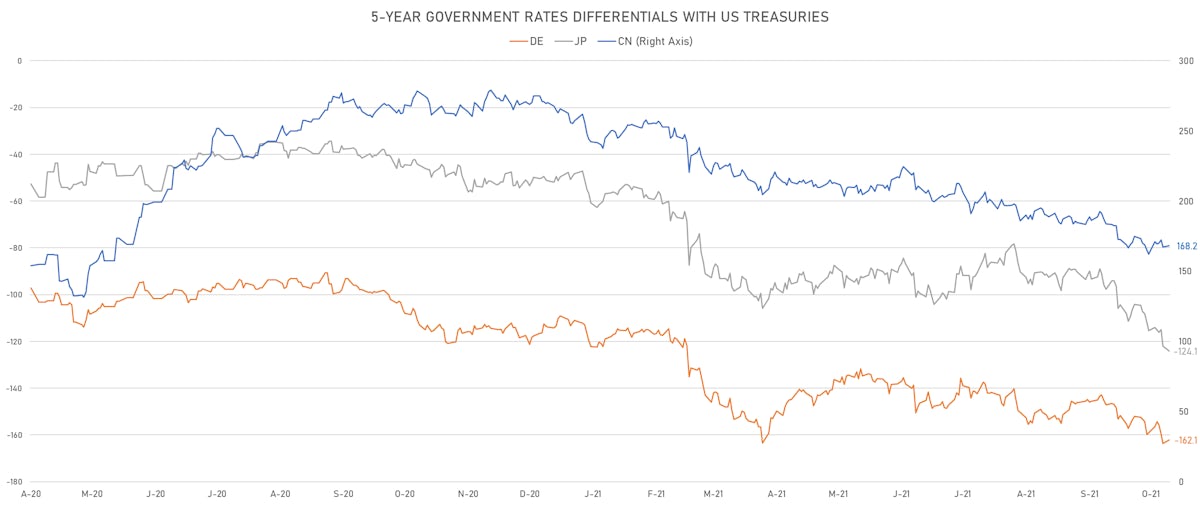

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.6 bp at 162.1 bp (YTD change: +51.0 bp)

- US-JAPAN: +2.0 bp at 124.1 bp (YTD change: +75.8 bp)

- US-CHINA: -1.1 bp at -168.2 bp (YTD change: +88.9 bp)

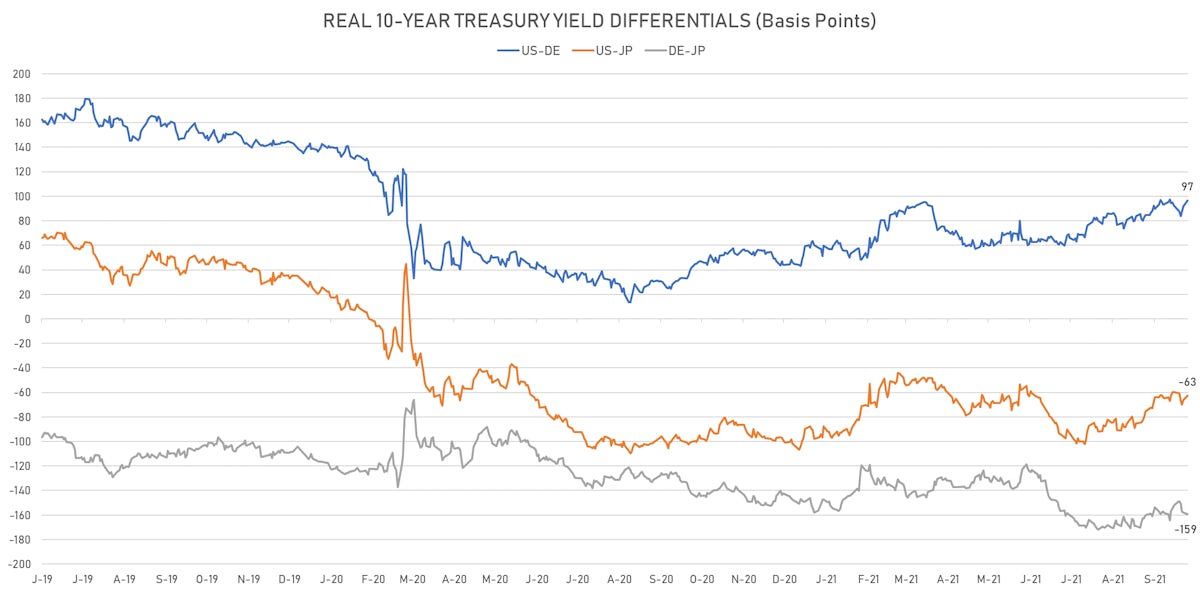

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.5 bp at 96.5 bp (YTD change: +50.4bp)

- US-JAPAN: +3.5 bp at -62.6 bp (YTD change: +38.9bp)

- JAPAN-GERMANY: +1.0 bp at 159.1 bp (YTD change: +11.5bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.16, down -0.05 (YTD: -1.01)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.99, up 0.1 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 6.43, down -0.1 (YTD: +0.3)

- Offshore Yuan 1M ATM IV unchanged at 3.65 (YTD: -2.3)

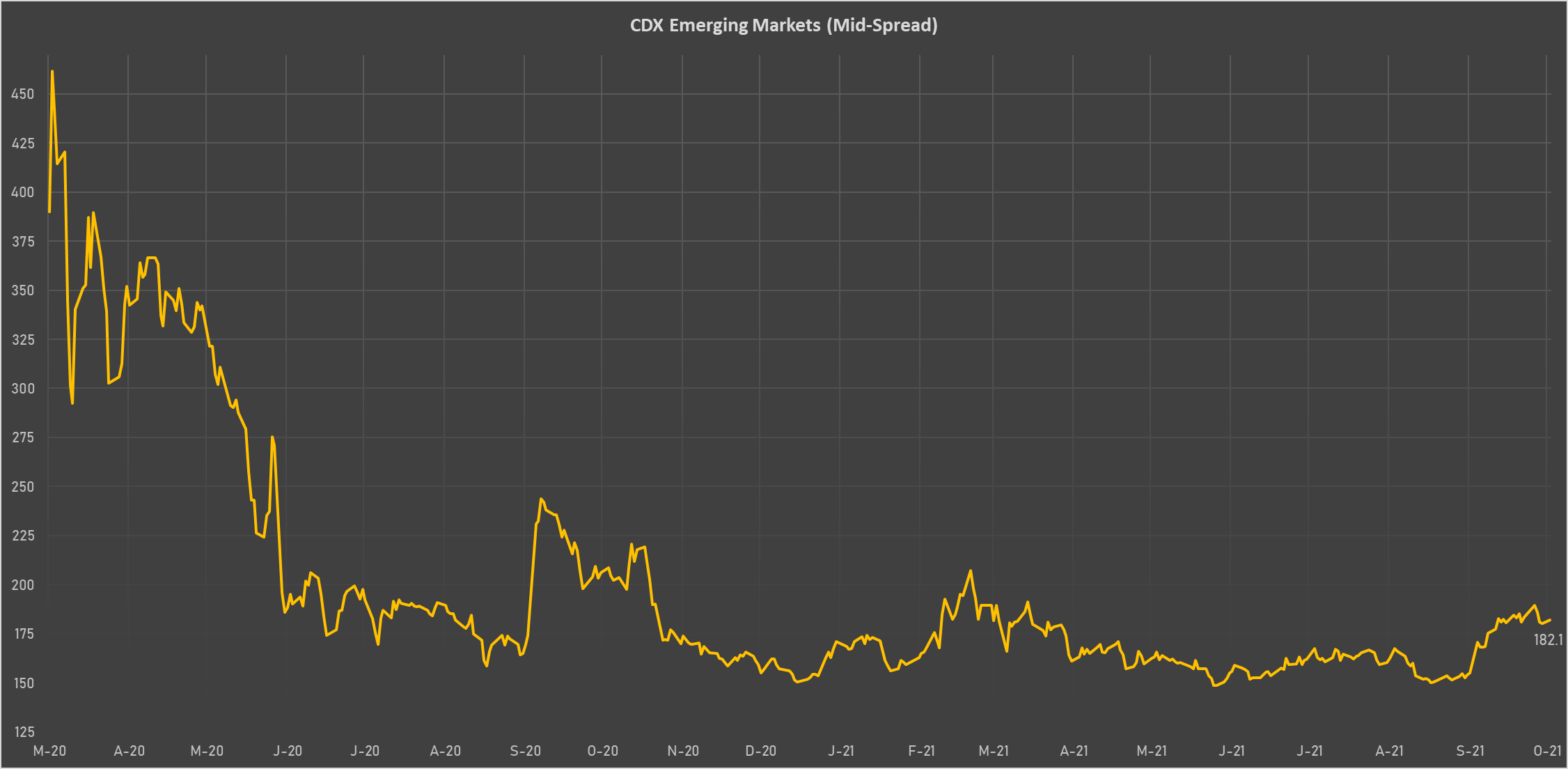

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Peru (rated BBB): up 3.8 basis points to 88 bp (1Y range: 52-105bp)

- Chile (rated A-): up 2.9 basis points to 88 bp (1Y range: 43-88bp)

- Argentina (rated CCC): up 56.6 basis points to 2,283 bp (1Y range: 1,071-2,253bp)

- Colombia (rated BB+): up 3.0 basis points to 162 bp (1Y range: 83-175bp)

- Mexico (rated BBB-): up 1.6 basis points to 98 bp (1Y range: 79-127bp)

- Morocco (rated BB+): down 2.7 basis points to 93 bp (1Y range: 84-108bp)

- Indonesia (rated BBB): down 2.9 basis points to 86 bp (1Y range: 66-97bp)

- Vietnam (rated BB): down 4.8 basis points to 105 bp (1Y range: 89-123bp)

- Philippines (rated BBB): down 4.4 basis points to 59 bp (1Y range: 33-65bp)

- Malaysia (rated BBB+): down 4.4 basis points to 57 bp (1Y range: 33-64bp)

LARGEST FX MOVES TODAY

- Myanmar Kyat up 2.0% (YTD: -32.0%)

- Liberian Dollar up 1.6% (YTD: +1.5%)

- Tonga Pa'Anga up 1.2% (YTD: +1.9%)

- Sri Lanka Rupee up 1.0% (YTD: -7.7%)

- Pakistani rupee down 0.9% (YTD: -6.9%)

- Brazilian Real down 0.9% (YTD: -5.8%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Tunisian Dinar down 1.8% (YTD: -4.6%)

- Congo Franc down 2.0% (YTD: -0.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 60.4%

- Ethiopian Birr down 17.1%

- Turkish Lira down 20.4%

- Haiti Gourde down 26.8%

- Myanmar Kyat down 32.0%

- Surinamese dollar down 33.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 73.2%

- Sudanese Pound down 87.5%