FX

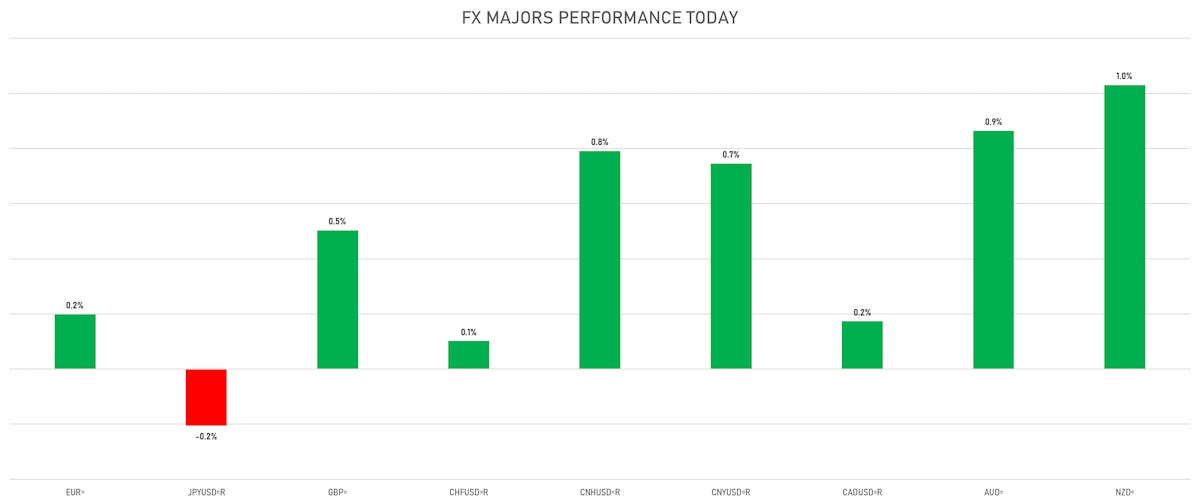

Slight Drop In The US Dollar Index As Risky Assets Rebound, With Big Gains In The Yuan

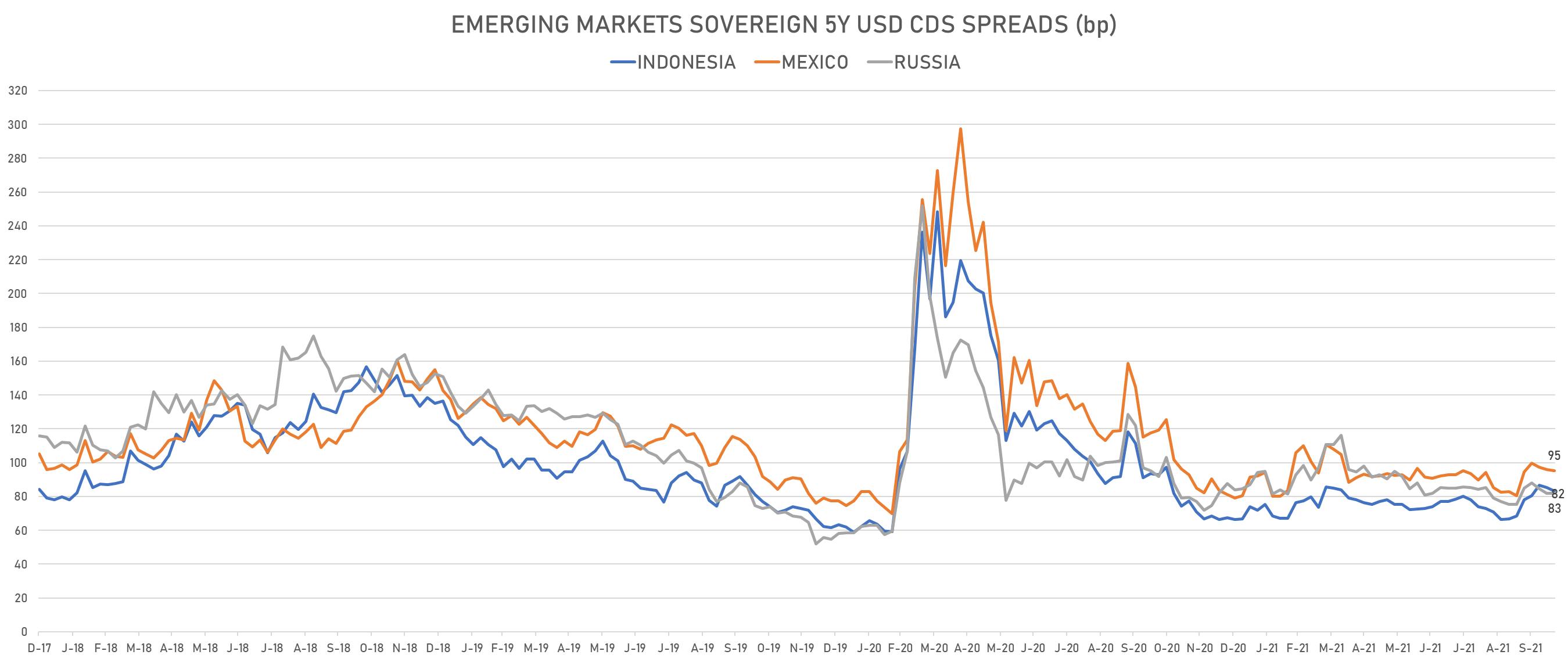

Emerging markets sovereign credit spreads were mostly tighter today, with the notable exception of Brazil, where the government is planning to get around the constitutionally-imposed spending cap in order to increase social programs

Published ET

CDX EM 5Y USD Sovereign Credit Spread vs Brazilian Government 5Y USD CDS Spread | Source: Refinitiv

QUICK SUMMARY

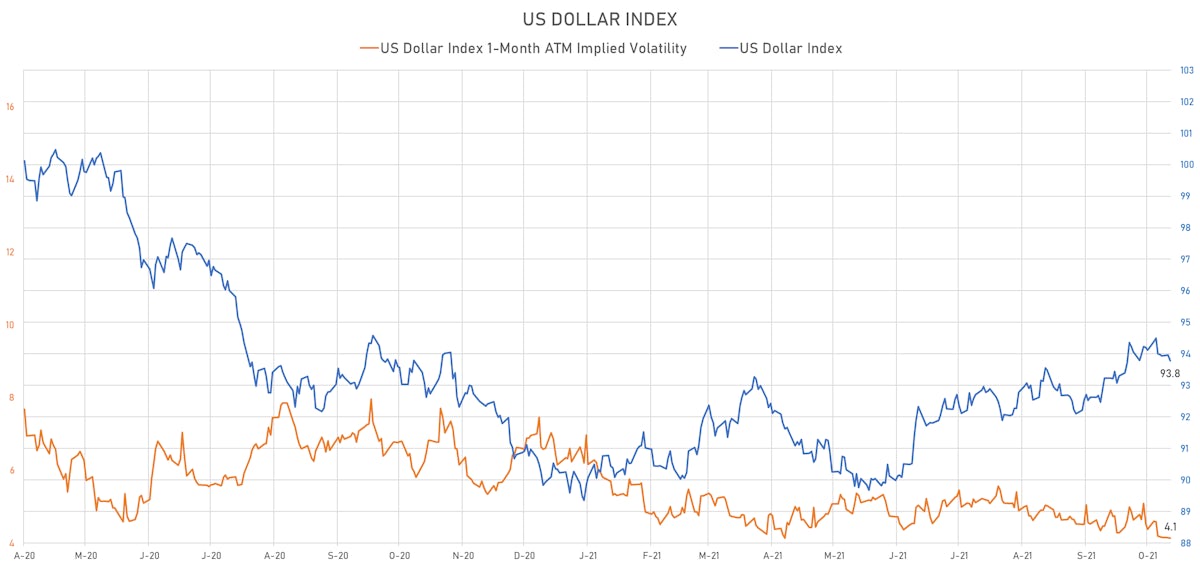

- The US Dollar Index is down -0.19% at 93.78 (YTD: +4.22%)

- Euro up 0.20% at 1.1632 (YTD: -4.8%)

- Yen down 0.21% at 114.56 (YTD: -9.9%)

- Onshore Yuan up 0.75% at 6.3822 (YTD: +2.3%)

- Swiss franc up 0.10% at 0.9231 (YTD: -4.1%)

- Sterling up 0.50% at 1.3794 (YTD: +0.9%)

- Canadian dollar up 0.17% at 1.2356 (YTD: +3.1%)

- Australian dollar up 0.86% at 0.7474 (YTD: -2.9%)

- NZ dollar up 1.03% at 0.7156 (YTD: -0.4%)

MACRO DATA RELEASES

- Hungary, Policy Rates, Base Rate for Oct 2021 (Cent. Bank, Hungary) at 1.80 % (vs 1.65 % prior), in line with consensus estimate

- Hungary, Policy Rates, Overnight Deposit Rate for Oct 2021 (Cent. Bank, Hungary) at 0.85 % (vs 0.70 % prior), in line with consensus estimate

- Indonesia, Policy Rates, 7-Day Reverse Repo for Oct 2021 (Bank Indonesia) at 3.50 % (vs 3.50 % prior), in line with consensus estimate

- Indonesia, Policy Rates, Deposit Facility Rate for Oct 2021 (Bank Indonesia) at 2.75 % (vs 2.75 % prior), in line with consensus estimate

- Indonesia, Policy Rates, Lending Facility Rate for Oct 2021 (Bank Indonesia) at 4.25 % (vs 4.25 % prior), in line with consensus estimate

- Japan, Exports, Change Y/Y for Sep 2021 (MoF, Japan) at 13.00 % (vs 26.20 % prior), above consensus estimate of 11.00 %

- Japan, Imports, Change Y/Y for Sep 2021 (MoF, Japan) at 38.60 % (vs 44.70 % prior), above consensus estimate of 34.40 %

- Japan, Trade Balance, Current Prices for Sep 2021 (MoF, Japan) at -622.80 Bln JPY (vs -635.40 Bln JPY prior), below consensus estimate of -519.20 Bln JPY

- New Zealand, Milk Auction, Average Price, Constant Prices for W 19 Oct (Global Dairy Trade) at 4,061.00 USD (vs 3,977.00 USD prior)

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Sep 2021 (CSO, Poland) at 0.60 % (vs 0.90 % prior), in line with consensus estimate

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Sep 2021 (CSO, Poland) at 8.70 % (vs 9.50 % prior), in line with consensus estimate

- United States, Building Permits for Sep 2021 (U.S. Census Bureau) at 1.59 Mln (vs 1.72 Mln prior), below consensus estimate of 1.68 Mln

- United States, Housing Starts for Sep 2021 (U.S. Census Bureau) at 1.56 Mln (vs 1.62 Mln prior), below consensus estimate of 1.62 Mln

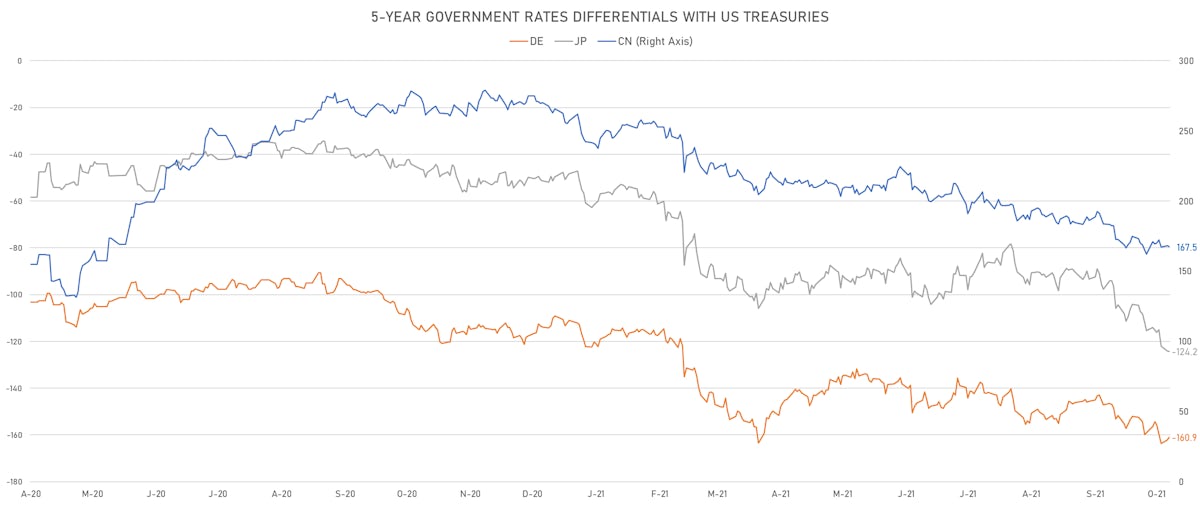

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.2 bp at 160.9 bp (YTD change: +49.8 bp)

- US-JAPAN: +0.1 bp at 124.2 bp (YTD change: +75.9 bp)

- US-CHINA: +0.7 bp at -167.5 bp (YTD change: +89.6 bp)

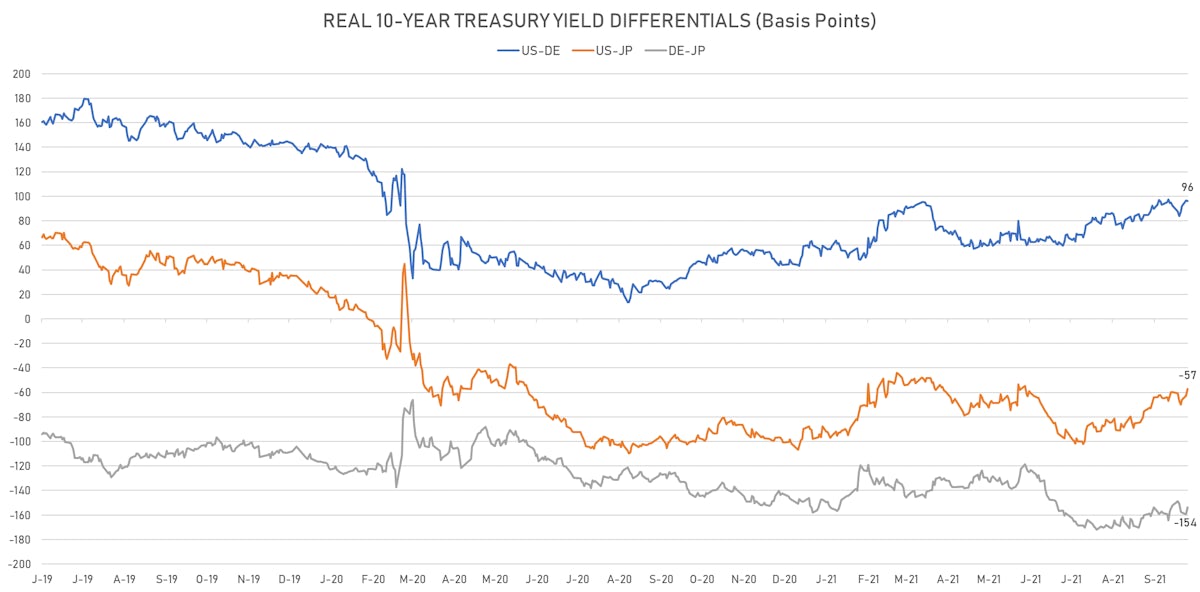

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.2 bp at 96.3 bp (YTD change: +50.2bp)

- US-JAPAN: +5.2 bp at -57.4 bp (YTD change: +44.1bp)

- JAPAN-GERMANY: -5.4 bp at 153.7 bp (YTD change: +6.1bp)

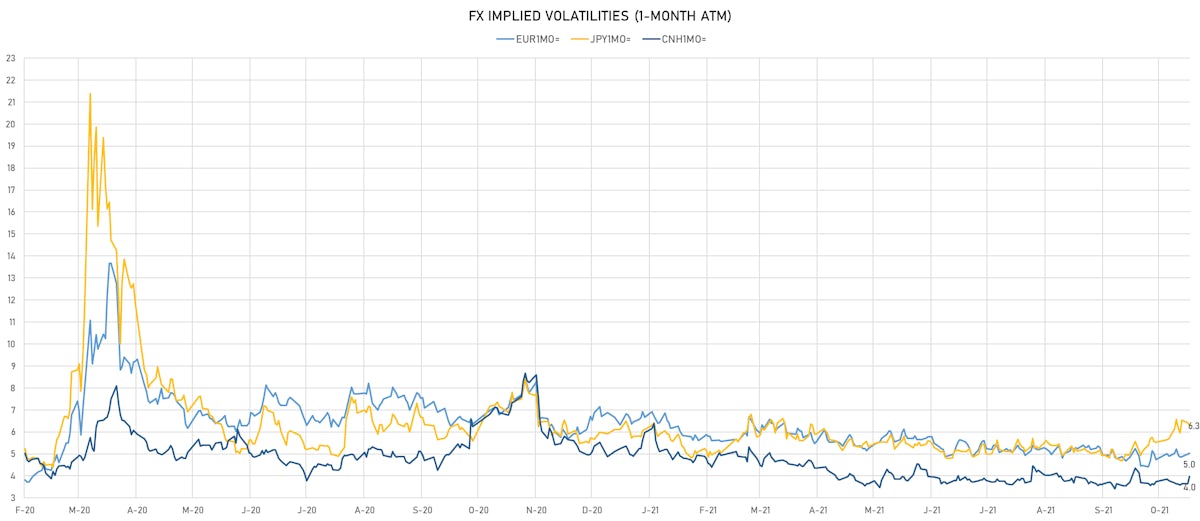

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.19, up 0.03 (YTD: -0.98)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.03 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 6.30, down -0.1 (YTD: +0.2)

- Offshore Yuan 1M ATM IV currently at 3.98, up 0.3 (YTD: -2.0)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Brazil (rated BB-): up 3.7 basis points to 208 bp (1Y range: 141-229bp)

- Malaysia (rated BBB+): down 1.1 basis points to 56 bp (1Y range: 33-64bp)

- Philippines (rated BBB): down 1.4 basis points to 57 bp (1Y range: 33-65bp)

- Panama (rated BBB-): down 2.4 basis points to 91 bp (1Y range: 44-93bp)

- South Africa (rated BB-): down 6.0 basis points to 206 bp (1Y range: 178-280bp)

- Mexico (rated BBB-): down 3.0 basis points to 95 bp (1Y range: 79-127bp)

- Colombia (rated BB+): down 5.2 basis points to 157 bp (1Y range: 83-175bp)

- Indonesia (rated BBB): down 3.1 basis points to 83 bp (1Y range: 66-97bp)

- Peru (rated BBB): down 3.1 basis points to 85 bp (1Y range: 52-105bp)

- Chile (rated A-): down 3.2 basis points to 85 bp (1Y range: 43-89bp)

LARGEST FX MOVES TODAY

- New Zambian kwacha up 3.0% (YTD: +24.6%)

- Congo Franc up 1.6% (YTD: -0.8%)

- North Antilles Guilder up 1.3% (YTD: +1.3%)

- South Africa Rand up 1.1% (YTD: +1.2%)

- Haiti Gourde up 1.0% (YTD: -26.8%)

- Tunisian Dinar up 1.0% (YTD: -4.4%)

- Honduras Lempira up 1.0% (YTD: 0.0%)

- New Zealand $ up 1.0% (YTD: -0.4%)

- Angolan Kwanza down 1.2% (YTD: +8.2%)

- Brazilian Real down 1.3% (YTD: -7.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 56.1%

- New Zambian kwacha up 24.6%

- Ethiopian Birr down 17.1%

- Turkish Lira down 20.1%

- Haiti Gourde down 26.8%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 73.3%

- Sudanese Pound down 87.5%