FX

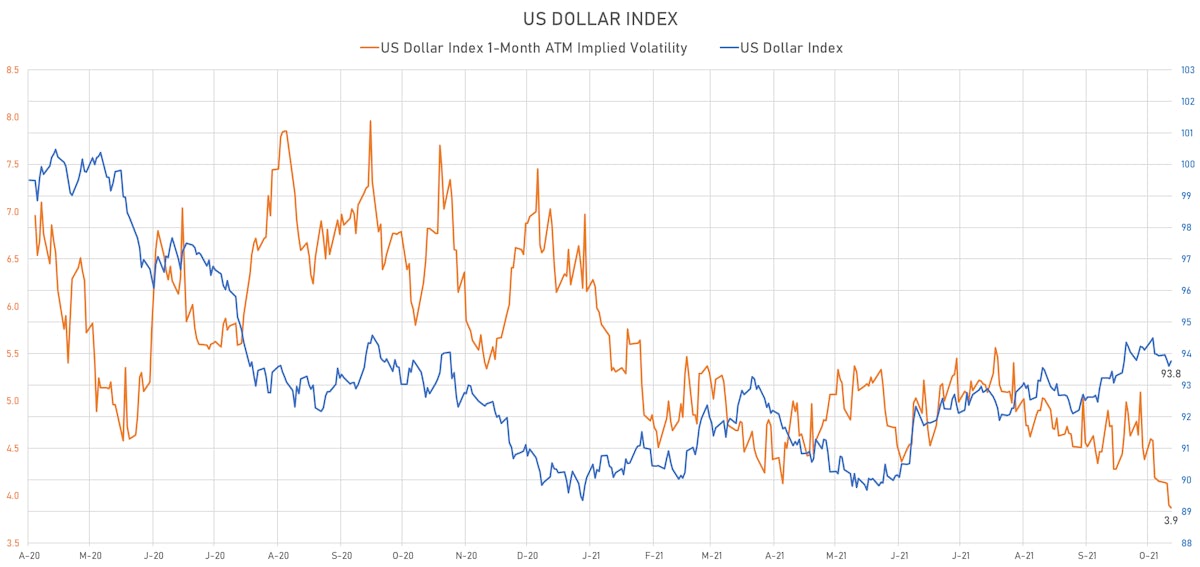

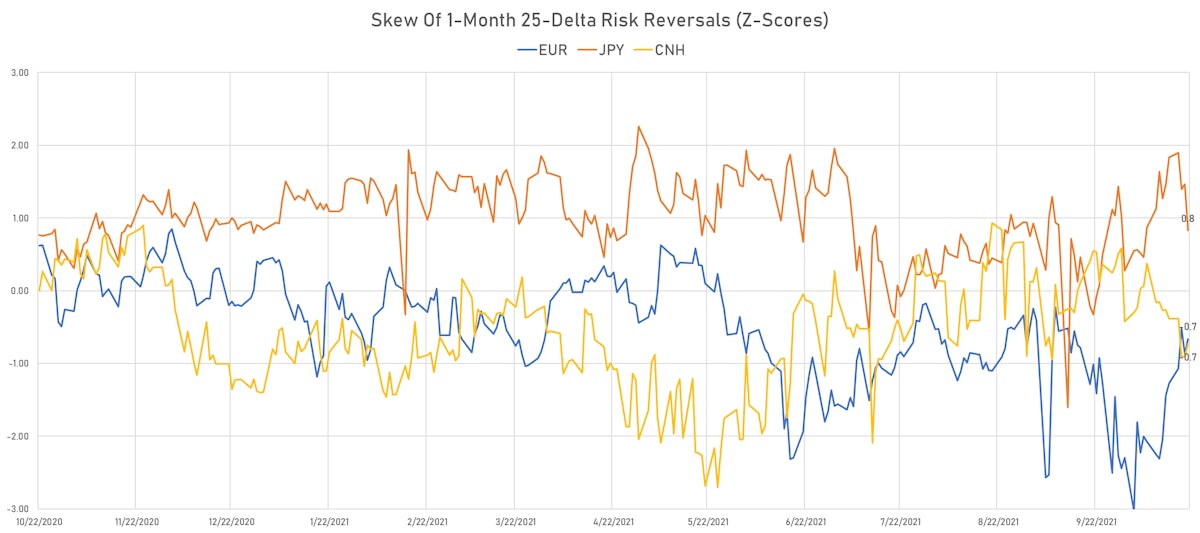

Rush To Safety For Currencies, With The CHF And JPY Both Rising Despite Unfavorable Moves In Rates Differentials

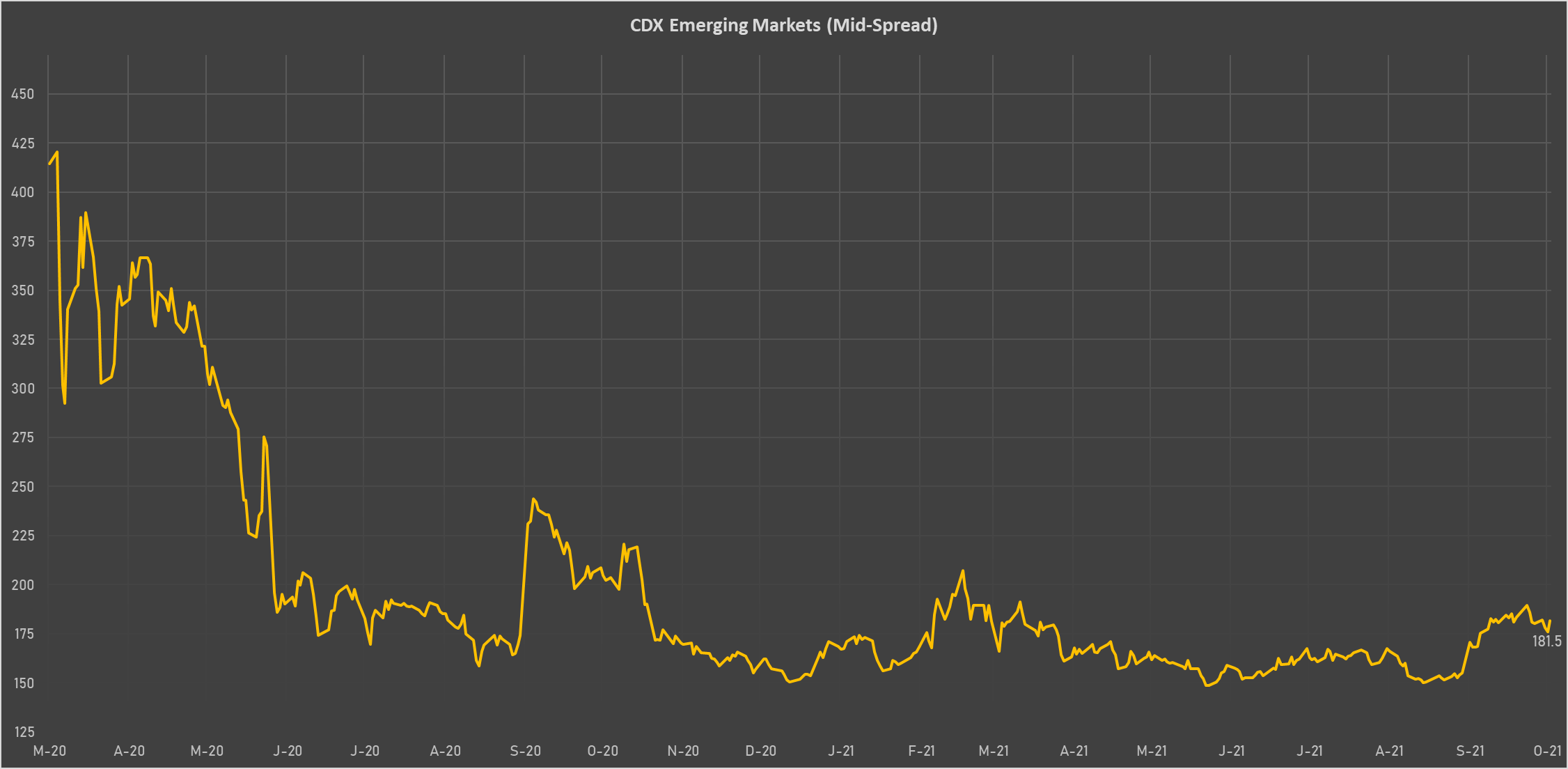

With higher rates volatility, emerging markets sovereign credit spreads are widening significantly, and EM currencies falling; the Turkish Lira was the worst performer today as the TCMB cut rates by 200 basis points (vs market expectation of 50 bp)

Published ET

5-Year USD Credit Default Swap Spreads For Turkey, Brazil And South Africa | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

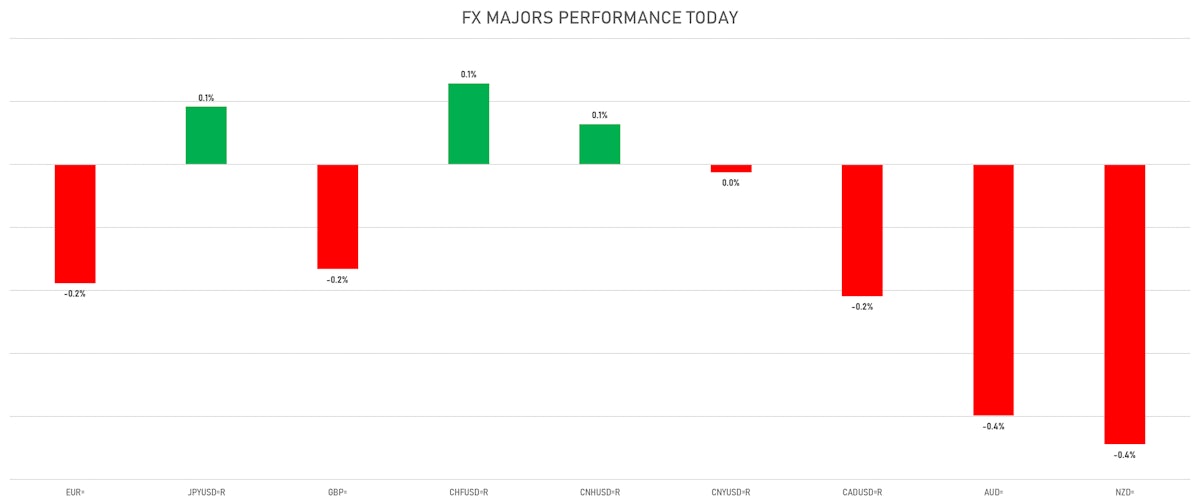

- The US Dollar Index is up 0.16% at 93.76 (YTD: +4.20%)

- Euro down 0.19% at 1.1627 (YTD: -4.8%)

- Yen up 0.09% at 114.15 (YTD: -9.6%)

- Onshore Yuan down 0.01% at 6.3954 (YTD: +2.1%)

- Swiss franc up 0.13% at 0.9179 (YTD: -3.5%)

- Sterling down 0.17% at 1.3801 (YTD: +0.9%)

- Canadian dollar down 0.21% at 1.2347 (YTD: +3.1%)

- Australian dollar down 0.40% at 0.7485 (YTD: -2.7%)

- NZ dollar down 0.44% at 0.7169 (YTD: -0.2%)

MACRO DATA RELEASES

- Argentina, Monthly Economic Activity Estimator, Change Y/Y for Aug 2021 (INDEC, Argentina) at 12.80 % (vs 11.70 % prior), above consensus estimate of 8.30 %

- Argentina, Trade Balance, Current Prices for Sep 2021 (INDEC, Argentina) at 1667.00 Mln USD (vs 2339.00 Mln USD prior), above consensus estimate of 1315.00 Mln USD

- Australia, Markit PMI, Composite for Oct 2021 (Markit Economics) at 52.20 (vs 46.00 prior)

- Australia, Markit PMI, Manufacturing for Oct 2021 (Markit Economics) at 57.30 (vs 56.80 prior)

- Australia, Markit PMI, Services for Oct 2021 (Markit Economics) at 52.00 (vs 45.50 prior)

- Botswana, Policy Rates, Bank Rate for Oct 2021 (Bank of Botswana) at 3.75 % (vs 3.75 % prior)

- Denmark, Consumer confidence indicator for Oct 2021 (statbank.dk) at 3.30 (vs 8.20 prior)

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Oct 2021 (DG ECFIN, France) at -4.80 (vs -4.00 prior), above consensus estimate of -5.00

- France, Business Sentiment, Composite business climate, manufacturing industry for Oct 2021 (INSEE, France) at 107.00 (vs 106.00 prior), above consensus estimate of 105.00

- Japan, CPI, Nationwide, All Items, Change Y/Y for Sep 2021 (MIC, Japan) at 0.20 % (vs -0.40 % prior)

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Sep 2021 (MIC, Japan) at 0.10 % (vs 0.00 % prior), in line with the Refinitiv consensus

- Poland, Retail Sales, Change Y/Y, Price Index for Sep 2021 (CSO, Poland) at 11.10 % (vs 10.70 % prior), above consensus estimate of 10.40 %

- Sweden, Unemployment, Rate, Total (SCB), 15-74 years for Sep 2021 (SCB, Sweden) at 8.20 % (vs 8.50 % prior)

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Oct 2021 (Central Bank, Turkey) at 14.50 % (vs 16.50 % prior)

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Oct 2021 (Central Bank, Turkey) at 16.00 % (vs 18.00 % prior), below consensus estimate of 17.50 %

- Turkey, Policy Rates, Late Liquidity Window Rate for Oct 2021 (Central Bank, Turkey) at 20.50 % (vs 22.50 % prior)

- Turkey, Policy Rates, Overnight Lending Rate for Oct 2021 (Central Bank, Turkey) at 17.50 % (vs 19.50 % prior)

- Ukraine, Policy Rates, UA Central Bank Interest Rate for 21 Oct (NBU, Ukraine) at 8.50 % (vs 8.50 % prior), in line with the Refinitiv consensus

- United Kingdom, CBI Industrial Trends, Level of total order books, current situation for Oct 2021 (CBI, UK) at 9.00 (vs 22.00 prior), below consensus estimate of 18.00

- United Kingdom, GfK Consumer confidence index for Oct 2021 (GfK Group) at -17.00 (vs -13.00 prior), below consensus estimate of -16.00

- United States, Existing-Home Sales, Single-Family and Condos, total for Sep 2021 (NAR, United States) at 6.29 Mln (vs 5.88 Mln prior), above consensus estimate of 6.09 Mln

- United States, Existing-Home Sales, Single-Family and Condos, total, Change P/P for Sep 2021 (NAR, United States) at 7.00 % (vs -2.00 % prior)

- United States, Jobless Claims, National, Continued for W 09 Oct (U.S. Dept. of Labor) at 2.48 Mln (vs 2.59 Mln prior), below consensus estimate of 2.55 Mln

- United States, Jobless Claims, National, Initial for W 16 Oct (U.S. Dept. of Labor) at 290.00 k (vs 293.00 k prior), below consensus estimate of 300.00 k

- United States, Philadelphia Fed, General business activity for Oct 2021 (FED, Philadelphia) at 23.80 (vs 30.70 prior), below consensus estimate of 25.00

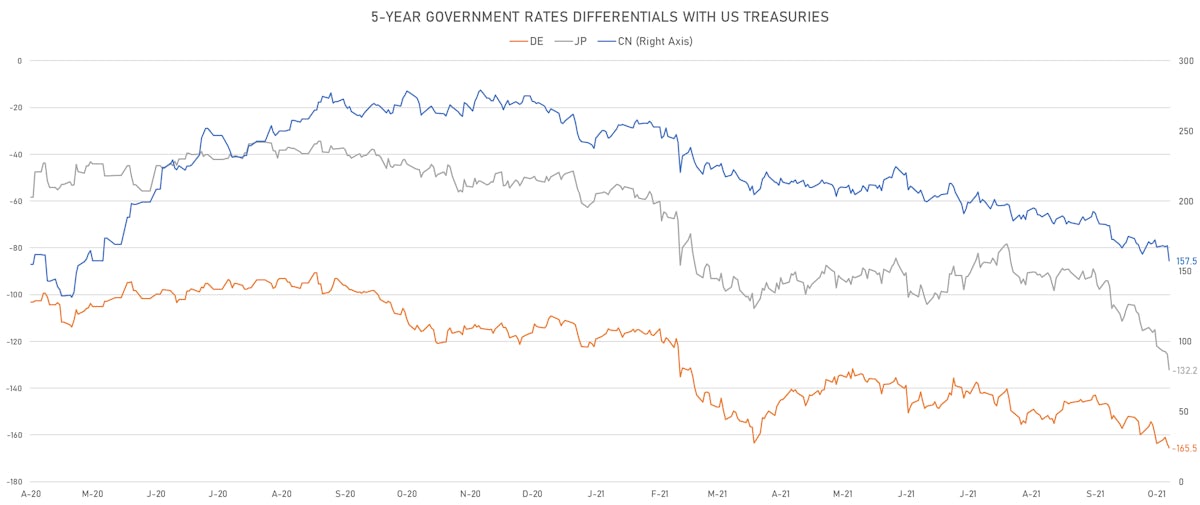

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.6 bp at 165.5 bp (YTD change: +54.4 bp)

- US-JAPAN: +6.8 bp at 132.2 bp (YTD change: +83.9 bp)

- US-CHINA: +10.7 bp at -157.5 bp (YTD change: +99.6 bp)

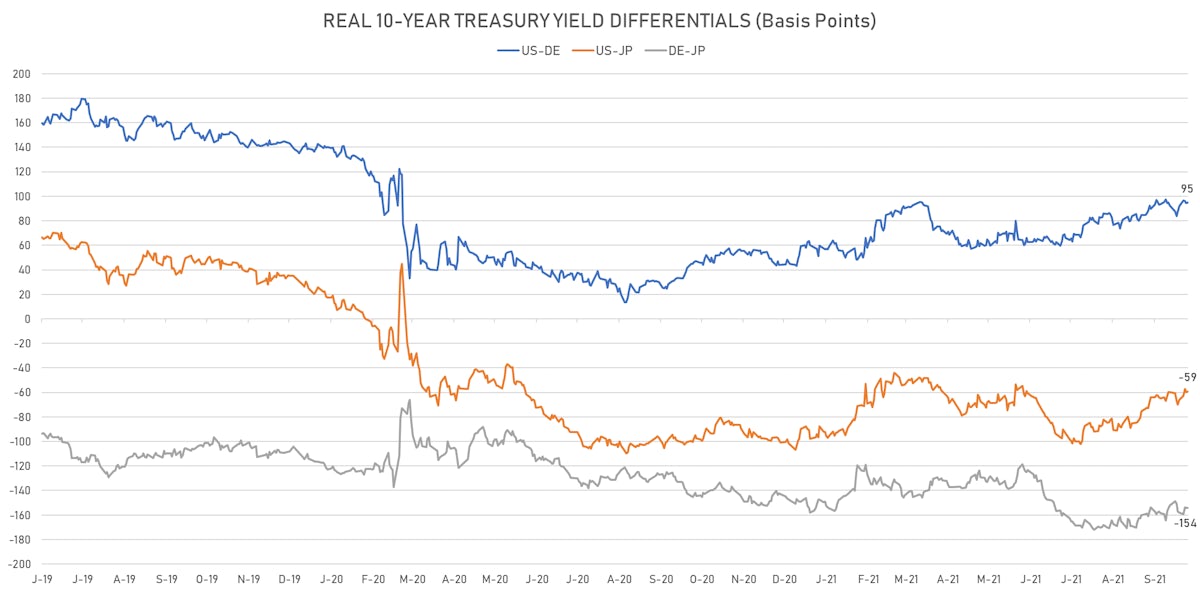

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.4 bp at 95.0 bp (YTD change: +48.9bp)

- US-JAPAN: +0.5 bp at -59.1 bp (YTD change: +42.4bp)

- JAPAN-GERMANY: -0.1 bp at 154.1 bp (YTD change: +6.5bp)

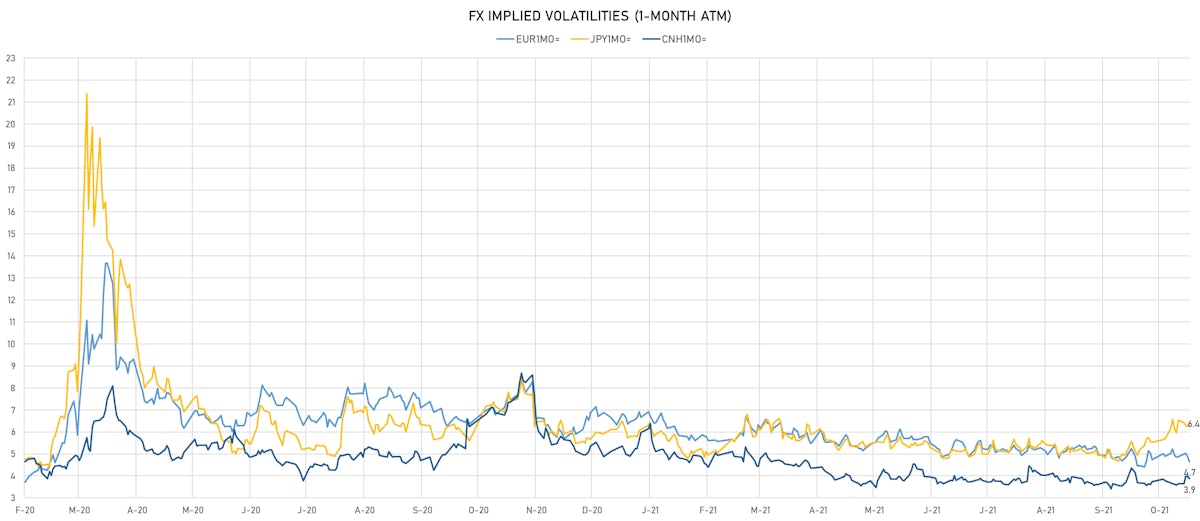

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.13, down -0.09 (YTD: -1.04)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.65, down -0.2 (YTD: -2.0)

- Japanese Yen 1M ATM IV currently at 6.40, up 0.2 (YTD: +0.3)

- Offshore Yuan 1M ATM IV currently at 3.88, down -0.1 (YTD: -2.1)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Brazil (rated BB-): up 14.3 basis points to 225 bp (1Y range: 141-229bp)

- Turkey (rated BB-): up 13.1 basis points to 452 bp (1Y range: 282-560bp)

- Mexico (rated BBB-): up 1.7 basis points to 96 bp (1Y range: 79-127bp)

- Russia (rated BBB): up 1.3 basis points to 81 bp (1Y range: 72-117bp)

- Philippines (rated BBB): up 0.9 basis points to 58 bp (1Y range: 33-65bp)

- Argentina (rated CCC): up 37.4 basis points to 2,332 bp (1Y range: 1,071-2,298bp)

- Chile (rated A-): up 1.3 basis points to 86 bp (1Y range: 43-89bp)

- South Africa (rated BB-): up 2.9 basis points to 208 bp (1Y range: 178-280bp)

- Malaysia (rated BBB+): up 0.6 basis points to 56 bp (1Y range: 33-64bp)

- Oman (rated BB-): down 5.3 basis points to 245 bp (1Y range: 223-452bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 1.0% (YTD: -25.4%)

- Venezuela Bolivar down 0.9% (YTD: -73.6%)

- Cape Verde Escudo down 1.0% (YTD: -0.9%)

- Moldovan Leu down 1.0% (YTD: -1.7%)

- Brazilian Real down 1.1% (YTD: -8.2%)

- Sierra Leon Leon down 1.3% (YTD: -4.6%)

- Ghanaian Cedi down 1.5% (YTD: -4.0%)

- South Africa Rand down 2.0% (YTD: +0.5%)

- Turkish Lira down 3.2% (YTD: -22.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 43.3%

- New Zambian kwacha up 23.7%

- Turkish Lira down 22.0%

- Haiti Gourde down 25.4%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.6%

- Venezuela Bolivar down 73.6%

- Sudanese Pound down 87.5%